Professional Documents

Culture Documents

Additional Costs in Tally Erp9: Link

Uploaded by

MaheshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Costs in Tally Erp9: Link

Uploaded by

MaheshCopyright:

Available Formats

24

Lesson no-19

Additional costs in tally erp9

Getwell traders

Plot no-5 , Ganga vihar , Delhi

GST no-07AAFFR9383Q1Z7

Q1. On 01-01-2018 purchased 500 nos office file @Rs.30 each from the Stationery House

with the invoice no-GST/05/2017-18 and paid GST@12%, GST no-09DQTPK9758M1ZG.

Additional cost details are as follows:

Packing charges on purchase = Rs.110

Cartage charges = Rs.180

Note: use only voucher mode for purchase entry

Q2. On 02-01-2018 purchased 100 pcs of stapler @ Rs.20 each from stationery House

with the invoice no-GST/09/2017-18 and paid GST@18%.

Additional cost details are as follow:

Packing charges on purchase = 90

Cartage charges = 120

Note: use only invoice mode for purchase entry

Additional cost after purchase

Q3. On 01-01-2018 purchased 200 nos of Markers @ Rs.35 each from stationery House

with the invoice no-GST/352/2017-18 and paid GST@18%. And on 02-1-2018 pay

cartage expenses of Rs.200 by cash.

How to solve it Please watch video

Link—https://www.youtube.com/watch?v=DOZKoi_Eo3Y&t=2s

E-mail ID-rtsprofessionalstudies@gmail.com, Follow us On Youtube– www.youtube/ RTS Professional Studies

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Tally BatchDocument1 pageTally BatchMadhuri KashyapNo ratings yet

- Tally Erp 9 Practise Set 1Document28 pagesTally Erp 9 Practise Set 1Anusha ShettyNo ratings yet

- Tech Connect Retail Private Limited,: Grand TotalDocument1 pageTech Connect Retail Private Limited,: Grand TotalKaranPadhaNo ratings yet

- InvoiceDocument2 pagesInvoiceLET'S MAKE IT SIMPLENo ratings yet

- AaDocument1 pageAaJaswant Singh0% (1)

- New One.Document4 pagesNew One.vikaskfeaindia15No ratings yet

- Invoice RG6197 FEBRUARY 2020Document1 pageInvoice RG6197 FEBRUARY 2020Ram KumarNo ratings yet

- WS Retail Services Pvt. LTD.Document1 pageWS Retail Services Pvt. LTD.Joydev GangulyNo ratings yet

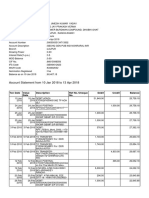

- Account Statement From 10 Jan 2018 To 13 Apr 2018Document3 pagesAccount Statement From 10 Jan 2018 To 13 Apr 2018UMESH KUMAR YadavNo ratings yet

- Invoice RG6197 AUGUST 2020Document1 pageInvoice RG6197 AUGUST 2020Ram KumarNo ratings yet

- BookbillDocument1 pageBookbillkshitijaNo ratings yet

- WS Retail Services Pvt. LTD.,: Grand TotalDocument1 pageWS Retail Services Pvt. LTD.,: Grand TotalMaximNo ratings yet

- Invoice - HEMA 18-19Document1 pageInvoice - HEMA 18-19Utkarsh KhandelwalNo ratings yet

- Invoice - HEMADocument1 pageInvoice - HEMAUtkarsh KhandelwalNo ratings yet

- TL 240302 ZZ 005449Document1 pageTL 240302 ZZ 005449madanthehunkNo ratings yet

- Invoice OD109087115300276000Document1 pageInvoice OD109087115300276000Sumana DuttaNo ratings yet

- WS Retail Services Pvt. LTD.,: Grand TotalDocument1 pageWS Retail Services Pvt. LTD.,: Grand TotalDeepanshu GuptaNo ratings yet

- Detail of Pamint 2019Document41 pagesDetail of Pamint 2019Mohd HaneefNo ratings yet

- MM TicketsDocument8 pagesMM Ticketspiyush thokeNo ratings yet

- Invoice OD408210370507558000Document2 pagesInvoice OD408210370507558000VinitSinhaNo ratings yet

- InvoiceDocument1 pageInvoiceHitesh GuptaNo ratings yet

- Sane Retail Private Limited,: Grand TotalDocument1 pageSane Retail Private Limited,: Grand TotalBhaskarNo ratings yet

- GTA Entry in Tally Erp 9 Release 6.4: P.T EnterprisesDocument1 pageGTA Entry in Tally Erp 9 Release 6.4: P.T EnterprisesIndrajit DebnathNo ratings yet

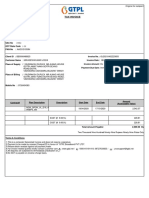

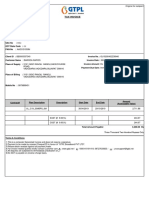

- GTPL Tax Invoice 5299Document1 pageGTPL Tax Invoice 5299Indresh Kumar ShahNo ratings yet

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDocument1 pageBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsAnmol KingNo ratings yet

- Sinvoice 4000025727 9394530Document2 pagesSinvoice 4000025727 9394530ajit23nayakNo ratings yet

- Ir 77-2022-GSTDocument2 pagesIr 77-2022-GSTAnshu MoryaNo ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- Nikki Di Moto GDocument1 pageNikki Di Moto GHarsh Vardhan JhaNo ratings yet

- Invoice - 282 EnHDocument4 pagesInvoice - 282 EnHPriyank PawarNo ratings yet

- Tax Invoice: JATIN GAS SERVICE (0000107209)Document4 pagesTax Invoice: JATIN GAS SERVICE (0000107209)RiseNo ratings yet

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDocument1 pageTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- OD108961172825005000 InvoiceDocument1 pageOD108961172825005000 InvoiceAnonymous DbgdDfj3gQNo ratings yet

- Samsung 275 L Frost Free Double Door 3 Star 2020 Convertible RefrigeratorDocument1 pageSamsung 275 L Frost Free Double Door 3 Star 2020 Convertible RefrigeratorHarish Kr SinghNo ratings yet

- 20180523153227XXXXXXX3302 PDFDocument1 page20180523153227XXXXXXX3302 PDFUMESH KUMAR YadavNo ratings yet

- Invoices DaburDocument1 pageInvoices Daburaamir aliNo ratings yet

- Invoice OD304071431053480000Document1 pageInvoice OD304071431053480000Er Ravi Kant MishraNo ratings yet

- Invoice: Invoice From Invoice To Customer InformationDocument1 pageInvoice: Invoice From Invoice To Customer InformationZeeshan FirdousNo ratings yet

- OD125916074925876000Document2 pagesOD125916074925876000Rahul KamtiNo ratings yet

- QR-JMI/20/21/0434: Kind Attn-MrDocument1 pageQR-JMI/20/21/0434: Kind Attn-Mrnnetaji.r147No ratings yet

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDocument1 pageTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJinfo NitinNo ratings yet

- 08 Eldeco HermanDocument1 page08 Eldeco HermanpreritNo ratings yet

- GST Impact On Distribution Companies and DealersDocument3 pagesGST Impact On Distribution Companies and DealersMahaveer DhelariyaNo ratings yet

- Invoice OD104230895412862000Document1 pageInvoice OD104230895412862000Pranab KumarNo ratings yet

- 14 TechDocument1 page14 Tech11rj.thakurNo ratings yet

- IR DashmeshDocument2 pagesIR DashmeshAnshu MoryaNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- WFH Table and ChairDocument1 pageWFH Table and ChairawesumaditisinghalNo ratings yet

- Bill SepDocument2 pagesBill SepAbhishek GorisariaNo ratings yet

- In Voice Red TapeDocument1 pageIn Voice Red TapeRAJU GUPTANo ratings yet

- WS Retail Services Pvt. LTD.,: Grand TotalDocument1 pageWS Retail Services Pvt. LTD.,: Grand TotalAbhinav MehraNo ratings yet

- CARRIER Dual Filtration With HD & PM2.5 Filter 2 Ton 5 Star Split AI Flexicool Inverter With Auto Cleanser AC - WhiteDocument8 pagesCARRIER Dual Filtration With HD & PM2.5 Filter 2 Ton 5 Star Split AI Flexicool Inverter With Auto Cleanser AC - Whitethe.chotraniNo ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- GST-II Problems and SolutionDocument112 pagesGST-II Problems and SolutionSukruth SNo ratings yet

- Savvy StudiozDocument4 pagesSavvy Studioza1amarpatelNo ratings yet

- Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageQty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDEEPAK CHANDELNo ratings yet

- Piped Natural Gas Invoice DomesticDocument2 pagesPiped Natural Gas Invoice DomesticBalasubramanian GurunathanNo ratings yet

- Gas BillDocument2 pagesGas BillNavneetNo ratings yet

- Zing Resume BuilderResume PDFDocument1 pageZing Resume BuilderResume PDFMaheshNo ratings yet

- Application PDFDocument1 pageApplication PDFMaheshNo ratings yet

- List of Names of Flowers in MarathiDocument3 pagesList of Names of Flowers in MarathiMahesh100% (1)

- List of Vegetable Names in Marathi PDFDocument4 pagesList of Vegetable Names in Marathi PDFMaheshNo ratings yet

- Mahesh Suresh Khairnar: Job Title: Data Entry OperatorDocument2 pagesMahesh Suresh Khairnar: Job Title: Data Entry OperatorMaheshNo ratings yet

- Rapidex English Speaking Course MarathiDocument2 pagesRapidex English Speaking Course MarathiMahesh100% (2)

- List of Names of Birds in MarathiDocument2 pagesList of Names of Birds in MarathiMaheshNo ratings yet

- Mahesh S. Khairnar: FresherDocument2 pagesMahesh S. Khairnar: FresherMaheshNo ratings yet

- Extending Capabilities of English To Marathi Machi PDFDocument8 pagesExtending Capabilities of English To Marathi Machi PDFMaheshNo ratings yet

- List of Names of Animals in MarathiDocument2 pagesList of Names of Animals in MarathiMaheshNo ratings yet

- Abuse Cursing Swear-Words in MarathiDocument3 pagesAbuse Cursing Swear-Words in MarathiMahesh67% (3)

- Relations in Marathi PDFDocument5 pagesRelations in Marathi PDFMahesh100% (1)

- Extending Capabilities of English To Marathi Machine TranslatorDocument8 pagesExtending Capabilities of English To Marathi Machine TranslatorMaheshNo ratings yet

- Export Under GST in Tally Erp 9: Monu Home AppliancesDocument1 pageExport Under GST in Tally Erp 9: Monu Home AppliancesMaheshNo ratings yet

- Mahesh Khairnar: EducationDocument2 pagesMahesh Khairnar: EducationMaheshNo ratings yet