Professional Documents

Culture Documents

Tally Batch

Tally Batch

Uploaded by

Madhuri KashyapOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tally Batch

Tally Batch

Uploaded by

Madhuri KashyapCopyright:

Available Formats

26

Lesson no-21

Batch-wise Details in tally erp9

Getwell traders

Plot no-5 , Ganga vihar , Delhi

GST no-07AAFFR9383Q1Z7

st

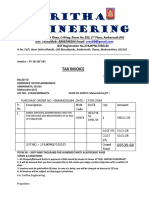

Q1. On 1 Jan 2018 purchased Medicine -500 pcs from national pharmacy @ Rs.10 each

with batch number TR/201, having manufacturing date as 01/12/2017 and expiry date as

01/01/2019.

Charge GST@5% and invoice no-GST/09/2017-18.

(address – vijay nagar , Ghaziabad UP , GSTno- 09DQTPK9758M1ZF)

nd

Q2. On 2 Jan 2018 raise cash sales invoice no-TI/01/2017-18 for 200 pcs of medicine of

Rs.10.50 each from the above batch no-TR/201 and charge GST@5%.

nd

Q3. On 2 Jan 2018 purchased kissan ketchup -100 bottles from Kissan Ketchup

Industries @82/bottle with batch no-RK/501, having manufacturing date as 02/12/2017

and expiry date as 01/10/2018.

Charge GST@12% and invoice no-09/2017-18

(address – new park , Delhi , GST no-07BVPPR5391L1ZM )

nd

Q.4 on 2 Jan 2018 raise cash sales invoice no-TI/02/2017-18 of 2 bottles of ketchup of

Rs.90 each from the above batch no-RK/501 and charges GST@12% .

How to solve it Please watch video

Link—https://www.youtube.com/watch?v=6t_RQE5dorQ

E-mail ID-rtsprofessionalstudies@gmail.com, Follow us On Youtube– www.youtube/ RTS Professional Studies

You might also like

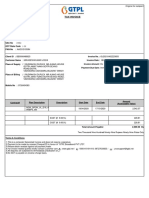

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDocument1 pageBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsRajeev SinghNo ratings yet

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDocument1 pageTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- Additional Costs in Tally Erp9: LinkDocument1 pageAdditional Costs in Tally Erp9: LinkMaheshNo ratings yet

- Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageQty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDEEPAK CHANDELNo ratings yet

- Invoice 1Document1 pageInvoice 1Anupam PriyamNo ratings yet

- Before The National Anti-Profiteering Authority Under The Central Goods & Services Tax ACT, 2017Document12 pagesBefore The National Anti-Profiteering Authority Under The Central Goods & Services Tax ACT, 2017kalyan sundarNo ratings yet

- Sant AluminiumDocument5 pagesSant AluminiumUtkarsh KhandelwalNo ratings yet

- Category: B Intelligence Report: (Department of Commercial Taxes)Document2 pagesCategory: B Intelligence Report: (Department of Commercial Taxes)SeemaNaikNo ratings yet

- VinayDocument1 pageVinayalok singhNo ratings yet

- ConsolidatedCustomerInvoice 59974308 BQ5 1651645728Document3 pagesConsolidatedCustomerInvoice 59974308 BQ5 1651645728mthara7No ratings yet

- 2 Addressed Letterhead SarithaDocument20 pages2 Addressed Letterhead SarithaRaju NairNo ratings yet

- GTA Entry in Tally Erp 9 Release 6.4: P.T EnterprisesDocument1 pageGTA Entry in Tally Erp 9 Release 6.4: P.T EnterprisesIndrajit DebnathNo ratings yet

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDocument1 pageBiller Details GTPL Broadband PVT LTD.: Terms & Conditionsketulraval2013No ratings yet

- New One.Document4 pagesNew One.vikaskfeaindia15No ratings yet

- Store Details: Glass SutraDocument2 pagesStore Details: Glass SutraglasssutrateamNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)KamakshiNo ratings yet

- 1031 AmmarDocument2 pages1031 AmmarAbhimanyu SutharNo ratings yet

- PO Format UltratechDocument2 pagesPO Format UltratechGoutam DasNo ratings yet

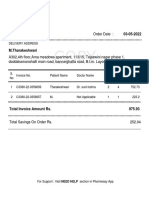

- Medicine BillDocument1 pageMedicine BillShivam VermaNo ratings yet

- Dizo Watch D2 With 1.91 Inch Super Big Display, BT Calling (By Realme Techlife)Document2 pagesDizo Watch D2 With 1.91 Inch Super Big Display, BT Calling (By Realme Techlife)Prateek PalNo ratings yet

- Mamatha Traders Adjuducation Order Us 73 - CompressedDocument31 pagesMamatha Traders Adjuducation Order Us 73 - Compressedurmilachoudhary1999No ratings yet

- Chandra Enterprises-085Document4 pagesChandra Enterprises-085Aarvee FoodNo ratings yet

- InvoiceDocument1 pageInvoiceHitesh GuptaNo ratings yet

- OD108961172825005000 InvoiceDocument1 pageOD108961172825005000 InvoiceAnonymous DbgdDfj3gQNo ratings yet

- OD124187887711925000Document3 pagesOD124187887711925000Durga Prasad PesaramelliNo ratings yet

- Invoice 13dec2023 VIE1LBOV108085 1702457835Document1 pageInvoice 13dec2023 VIE1LBOV108085 1702457835dileep.jcmNo ratings yet

- VvinaDocument1 pageVvinaalok singhNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amountfaizan ganiNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amountfaizan ganiNo ratings yet

- Sri Vasavi Medical Agencies Invoice Rpaug002Document1 pageSri Vasavi Medical Agencies Invoice Rpaug002amareshNo ratings yet

- Chennnur Bharath UpdatedDocument1 pageChennnur Bharath UpdatedSaroja Murali GokulaNo ratings yet

- Tax Invoice: Sri Kakatiya Industries (India) Private Limited - 2023-24Document2 pagesTax Invoice: Sri Kakatiya Industries (India) Private Limited - 2023-24BJRUSS PKG-2No ratings yet

- Tally Erp 9 Practise Set 1Document28 pagesTally Erp 9 Practise Set 1Anusha ShettyNo ratings yet

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDocument1 pageBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsAnmol KingNo ratings yet

- M/S Keshavlal Mohanlal Patel - Visnagar: GSTIN: 24ABVPP0986A1ZGDocument4 pagesM/S Keshavlal Mohanlal Patel - Visnagar: GSTIN: 24ABVPP0986A1ZGharshadvsn50No ratings yet

- Boat Rockerz 370 Bluetooth Headset: Grand Total 1048.00Document2 pagesBoat Rockerz 370 Bluetooth Headset: Grand Total 1048.00KHAMMAM BidPayable OfficeNo ratings yet

- OD113626379364628000Document3 pagesOD113626379364628000Some Famous FactsNo ratings yet

- Arora 17-18 BillDocument2 pagesArora 17-18 Billanyakhanna.khannaNo ratings yet

- Chandra Enterprises-059Document4 pagesChandra Enterprises-059Aarvee FoodNo ratings yet

- POCO X3 (Cobalt Blue, 128 GB) : Grand Total 17999.00Document6 pagesPOCO X3 (Cobalt Blue, 128 GB) : Grand Total 17999.00Arbaz khanNo ratings yet

- Print Invoice DetailsDocument1 pagePrint Invoice Detailskrishna kanthNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderAmit SharmaNo ratings yet

- HPCL Rti LPG Refill LimitsDocument3 pagesHPCL Rti LPG Refill LimitsMoneylife Foundation100% (1)

- Sub Order LabelsDocument7 pagesSub Order LabelsDharani KumarNo ratings yet

- Excise Invoice 213Document4 pagesExcise Invoice 213Anonymous rNqW9p3No ratings yet

- Sep 22 1Document2 pagesSep 22 1Mohammed AbdulNo ratings yet

- WS Retail Services Pvt. LTD.,: Grand TotalDocument1 pageWS Retail Services Pvt. LTD.,: Grand TotalDeepanshu GuptaNo ratings yet

- IPR Service BillDocument1 pageIPR Service BillUtkarsh KhandelwalNo ratings yet

- Invoice RG6197 AUGUST 2020Document1 pageInvoice RG6197 AUGUST 2020Ram KumarNo ratings yet

- ForwardInvoice ORD468822086Document2 pagesForwardInvoice ORD468822086Vinay GautamNo ratings yet

- 20180523153227XXXXXXX3302 PDFDocument1 page20180523153227XXXXXXX3302 PDFUMESH KUMAR YadavNo ratings yet

- OD126279138480165000Document3 pagesOD126279138480165000rakeshsingh0897383No ratings yet

- ForwardInvoice ORD541737227Document2 pagesForwardInvoice ORD541737227GaRvIt ShArMaNo ratings yet

- Tax Invoice: Jagdamba Indane Gas Agency (0000177454)Document1 pageTax Invoice: Jagdamba Indane Gas Agency (0000177454)Vedang KulkarniNo ratings yet

- OD430708073377616100Document2 pagesOD430708073377616100RAJ GONDALIYANo ratings yet

- GST Invoice: New Santosh Tyre NST/1288/23-24 18-Sep-23Document1 pageGST Invoice: New Santosh Tyre NST/1288/23-24 18-Sep-23kabirfarm786No ratings yet

- 770 Kinetic ImpexDocument6 pages770 Kinetic ImpexMangeshNo ratings yet

- DR R K Sharma 13 FebDocument1 pageDR R K Sharma 13 FebVinay SharmaNo ratings yet

- Mogli Labs (India) PVT LTD: Tax InvoiceDocument4 pagesMogli Labs (India) PVT LTD: Tax Invoicelucky sharmaNo ratings yet