Professional Documents

Culture Documents

Notifying Us of Changes To A VAT Registered Business

Uploaded by

Ravindra PallOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notifying Us of Changes To A VAT Registered Business

Uploaded by

Ravindra PallCopyright:

Available Formats

Notifying us of changes to a

VAT registered business

You may use this form to tell us of any changes to your

VAT registered business. VAT Registration Number

If you have ceased trading or transferred the business

to a new owner, complete form VAT7 Application to cancel

your VAT Registration. Your full name

If you have changed your legal entity, for example, from sole

trader to limited company but would like to retain the same

VAT Registration Number complete forms VAT1 and VAT68.

If you are registering a change in Partner(s), complete form Your position within the company

VAT2 Partnership details. For example, Proprietor, Partner, Director

These forms are available from our website, go to

www.hmrc.gov.uk from the home page select ‘quick links’

and then ‘Find a Form’.

What do you want to tell us about?

Tick all boxes that apply

Changes to business contact details complete section 1 Change VAT Return dates complete section 3

Change bank details complete section 2 Transfer of the business complete section 4

1 Changes to business contact details

For Partnership/Sole traders only If you have changed the address of the principal place of

business, what is the new address?

New name(s)

We do not accept an accountant’s address, director’s

If you are changing your own name provide a copy of your

home address, PO Box address or c/o address

marriage, divorce or deed poll certificate

For Incorporated companies only

New company name

Postcode

Provide the Certificate of Incorporation for change of

name from Companies House Contact numbers

Phone

Fax

New trading name Business email and website addresses

Website

2 Change bank details Account name

The bank account must be in the name of the registered

person or company and must be held in the UK.

These bank details are used by HMRC to make any Sort code

repayments of VAT to your business. If you pay your VAT — —

by Direct Debit, we record those bank account details

separately. You will need to log in to HMRC Online Account number

Services to keep those up-to-date.

VAT484 Page 1 HMRC 11/09

VAT Registration Number

3 Change VAT Returns dates

I wish my VAT returns to end on the last days of:

March, June, September and December I wish to apply for monthly returns

April, July, October and January Note: Monthly returns are only allowed if a business

is in a regular repayment position

May, August, November and February

4 Transfer of the business

If you have transferred your business to a new owner, give the details of the new owner

Name The new owner is

An individual A company

Address Date of transfer DD MM YYYY

Does the new owner wish to apply to keep the existing

VAT Registration Number?

No Yes

Postcode

If ‘Yes’ you will both need to complete form VAT68

Any other changes

It is important that the changes are authorised by the appropriate person. The details can only be amended with the written

authority of the registered person.

Acceptable signatories are as follows:

• Incorporated Company – a Director or Company Secretary

• Limited Liability Partnership – a member of the LLP

• Partnership – any one of the listed Partners

• Sole Proprietor – him or herself

• Non-Profit Making Body – Chairperson, Treasurer, Trustee or Secretary

• Local Authority – Town Clerk, Head of Finance or Treasurer

Other signatories such as accountants, solicitors will only be accepted after an original form 64-8 Authorising your agent

has been completed. This form is available from our website.

Declaration

I declare that the information I have given on this form is true and complete

Signed Full name

Date DD MM YYYY Capacity in which signed

For example, Proprietor, Partner, Director

Return the completed form to: Grimsby National Registration Service, HM Revenue & Customs, Imperial House,

77 Victoria Street, Grimsby DN31 1DB

Page 2

You might also like

- Application Form FA10MST New Multi-Site Template Food Control Plan Under Food Act 2014Document6 pagesApplication Form FA10MST New Multi-Site Template Food Control Plan Under Food Act 2014Fatemeh ArefianNo ratings yet

- Applying to register for VAT - additional infoDocument10 pagesApplying to register for VAT - additional infothangam27No ratings yet

- Customer Requested Billing Account Name Update 2.2021Document2 pagesCustomer Requested Billing Account Name Update 2.2021MariuszNo ratings yet

- MERCHANT REQUEST FORM - Paydee SDN BHDDocument2 pagesMERCHANT REQUEST FORM - Paydee SDN BHDKeerthiga ManoharanNo ratings yet

- ReGo Trading - New Customer ApplicationDocument1 pageReGo Trading - New Customer ApplicationShahid RazaNo ratings yet

- Shared Services Division: Purchasing DepartmentDocument2 pagesShared Services Division: Purchasing DepartmentNyl Gabriel BandalanNo ratings yet

- BCIF - Ver9 With DPA and Bill Delivery Agreement - 02022022Document1 pageBCIF - Ver9 With DPA and Bill Delivery Agreement - 02022022Tegnap NehjNo ratings yet

- Vat1 07 22Document14 pagesVat1 07 22Hadi GhamarzadehNo ratings yet

- AL RAFEE Credit Application FormDocument3 pagesAL RAFEE Credit Application FormNithin M NambiarNo ratings yet

- Application Form FA10C New Custom Food Control Plan Under Food Act 2014Document7 pagesApplication Form FA10C New Custom Food Control Plan Under Food Act 2014Fatemeh ArefianNo ratings yet

- SM-03-Tenant Billing Refund Infomation.v2Document2 pagesSM-03-Tenant Billing Refund Infomation.v2Achik IeraNo ratings yet

- Banking Application FormDocument12 pagesBanking Application FormCassiane OgliariNo ratings yet

- City of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDocument1 pageCity of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDexter Q. JaducanaNo ratings yet

- Business Permit App FormDocument1 pageBusiness Permit App FormcheansiaNo ratings yet

- Account Opening Form For Company: Section IDocument9 pagesAccount Opening Form For Company: Section ISiddharth KumarNo ratings yet

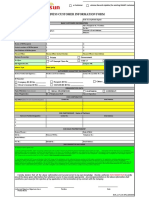

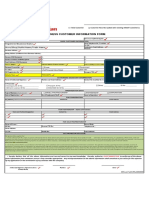

- Business Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameDocument3 pagesBusiness Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameRodelLaborNo ratings yet

- Credit Account ApplicationDocument1 pageCredit Account Applicationanon-996739100% (2)

- Form FA10MSNP2 2Document6 pagesForm FA10MSNP2 2Fatemeh ArefianNo ratings yet

- Business Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameDocument2 pagesBusiness Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade Namelhuk banaag100% (2)

- Bcif Front PartnershipDocument1 pageBcif Front PartnershipASDFNo ratings yet

- Customer Records UpdateDocument4 pagesCustomer Records UpdateRgen Al VillNo ratings yet

- Unified FormDocument1 pageUnified FormRobert V. AbrasaldoNo ratings yet

- My Republic Application FormDocument3 pagesMy Republic Application FormCheng ClNo ratings yet

- Account Opening Application UPDATED (1) (1)Document17 pagesAccount Opening Application UPDATED (1) (1)Shoaib A. KaziNo ratings yet

- BCIF - Ver7 With DPA - 02052018 PDFDocument1 pageBCIF - Ver7 With DPA - 02052018 PDFJon Colinares50% (2)

- Investor Information KitDocument27 pagesInvestor Information KitIyyappadasan SubramanianNo ratings yet

- New I-Bank Applicant Add A Business Account Business Mobile CaptureDocument3 pagesNew I-Bank Applicant Add A Business Account Business Mobile Captureswift adminNo ratings yet

- BCIF Version 7Document1 pageBCIF Version 7Denise RadomesNo ratings yet

- Business Customer Information FormDocument2 pagesBusiness Customer Information FormWalter O BrianNo ratings yet

- Meldingsformulier Voor Wijzigingen Met Betrekking Tot de Erkend ReferentDocument10 pagesMeldingsformulier Voor Wijzigingen Met Betrekking Tot de Erkend ReferentBasharNo ratings yet

- Letter of Intent - NV To V PDFDocument1 pageLetter of Intent - NV To V PDFAlyssa Kaye Talledo67% (3)

- New Customer Records UpdateDocument3 pagesNew Customer Records Updatepretty mangayNo ratings yet

- Mechelec Credit Application2Document3 pagesMechelec Credit Application2Nithin M NambiarNo ratings yet

- Business Permit ApplicationDocument2 pagesBusiness Permit Applicationjohnsspliff anime X gamerNo ratings yet

- Chown Consumer FormDocument11 pagesChown Consumer FormRazana AqilaNo ratings yet

- Account Details Addition / Modification Request Form (KRA / Trading / DP A/c)Document1 pageAccount Details Addition / Modification Request Form (KRA / Trading / DP A/c)Pankaj AgarwalNo ratings yet

- Customer Information SheetDocument3 pagesCustomer Information SheetMcAsia Foodtrade CorpNo ratings yet

- 64-8 Form (Másolat)Document2 pages64-8 Form (Másolat)Molnar FerencneNo ratings yet

- Due Diligence Questionnaire (DDQDocument8 pagesDue Diligence Questionnaire (DDQIrelena RomeroNo ratings yet

- Claim FormsDocument4 pagesClaim FormsThaworn ThaweeaphiradeemaitreeNo ratings yet

- Registration of Business Names Act: Form BN 5Document3 pagesRegistration of Business Names Act: Form BN 5Jasmine JacksonNo ratings yet

- Jebe Engagement Letter PDFDocument2 pagesJebe Engagement Letter PDFHiro SebastianNo ratings yet

- Application For VAT Annaul AccountingDocument1 pageApplication For VAT Annaul AccountingKeyconsulting UKNo ratings yet

- DCN1302008 Q SD 402 A7 - Customer - Information - DCN1302008okDocument1 pageDCN1302008 Q SD 402 A7 - Customer - Information - DCN1302008okjorgealfonsoortizcNo ratings yet

- Form 1594777111Document1 pageForm 1594777111Evcillove Mangubat100% (1)

- DownloadDocument2 pagesDownloadabothuashok99No ratings yet

- Supplier Accredit AppDocument1 pageSupplier Accredit AppAndrew CamposanoNo ratings yet

- Business App FormDocument1 pageBusiness App FormUnistar RochgeneNo ratings yet

- Retailer Supplier Registration FormDocument3 pagesRetailer Supplier Registration FormConan McClellandNo ratings yet

- MSA FormDocument1 pageMSA FormKaela LinNo ratings yet

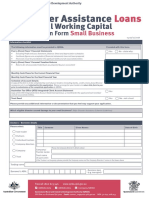

- QRIDA Rural Disaster Assistance LoansDocument9 pagesQRIDA Rural Disaster Assistance LoansMichael MckeownNo ratings yet

- BCIF - Ver9 With DPA and Bill Delivery Agreement - 02022022Document3 pagesBCIF - Ver9 With DPA and Bill Delivery Agreement - 02022022Marilyn DelacruzNo ratings yet

- Account details update requestDocument1 pageAccount details update requestvickyNo ratings yet

- Motis Ireland Limited Account Application FormDocument3 pagesMotis Ireland Limited Account Application FormAlexandru DragosNo ratings yet

- Bplo Unified Form PDFDocument2 pagesBplo Unified Form PDFTristan Lindsey Kaamiño AresNo ratings yet

- Angel Broking Pvt. Ltd. Angel Commodities Broking Pvt. LTDDocument2 pagesAngel Broking Pvt. Ltd. Angel Commodities Broking Pvt. LTDManishSankrityayanNo ratings yet

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- LOG BOOK UV20442 ThreadingL-2Document16 pagesLOG BOOK UV20442 ThreadingL-2Ravindra Pall100% (1)

- LOGBOOK UV20437 Make-upL-2Document20 pagesLOGBOOK UV20437 Make-upL-2Ravindra Pall100% (1)

- Sample Copy Application Form 150116Document2 pagesSample Copy Application Form 150116Mihalis AristidouNo ratings yet

- SELT Preparation Activities - GESE Grade 5Document4 pagesSELT Preparation Activities - GESE Grade 5Salvador SánchezNo ratings yet

- Visa DeclarationDocument1 pageVisa DeclarationLenvion LNo ratings yet

- Application Form For Mining Lease (Form-1) : Annexure-VIIDocument6 pagesApplication Form For Mining Lease (Form-1) : Annexure-VIIRavindra PallNo ratings yet

- Import of Waste Tyres for Production of Tyre Pyrolysis OilDocument5 pagesImport of Waste Tyres for Production of Tyre Pyrolysis OilRavindra PallNo ratings yet

- GESE Grade 5 Guide For CandidatesDocument20 pagesGESE Grade 5 Guide For CandidatesManuel PérezNo ratings yet

- Affidavit of Undertaking APORDocument1 pageAffidavit of Undertaking APORJoemar Emil Bareng100% (2)

- Judgment for Carmen in nullity caseDocument54 pagesJudgment for Carmen in nullity caseKevin MarkNo ratings yet

- Yujuico vs. AtienzaDocument2 pagesYujuico vs. AtienzaRenzoSantosNo ratings yet

- 24 Laperal v. Solid HomesDocument2 pages24 Laperal v. Solid HomesnoonalawNo ratings yet

- Form 1023 For CWCLA 6.11.12Document746 pagesForm 1023 For CWCLA 6.11.12Williamsburg Greenpoint100% (1)

- Edgardo Dolar vs. Brgy. Lublub, Municipality of Dumangas, Iloilo, 475 SCRA 458Document7 pagesEdgardo Dolar vs. Brgy. Lublub, Municipality of Dumangas, Iloilo, 475 SCRA 458FranzMordenoNo ratings yet

- Transfer of Property To Unborn Under TPADocument14 pagesTransfer of Property To Unborn Under TPAmonali raiNo ratings yet

- Articles of IncorporationDocument13 pagesArticles of IncorporationJaysel BaggayNo ratings yet

- William Burl Roudybush and Ruth J. Roudybush v. Ralph W. Zabel, Zabel Ltd. and First National Bank in Lenox, 813 F.2d 173, 1st Cir. (1987)Document8 pagesWilliam Burl Roudybush and Ruth J. Roudybush v. Ralph W. Zabel, Zabel Ltd. and First National Bank in Lenox, 813 F.2d 173, 1st Cir. (1987)Scribd Government DocsNo ratings yet

- Agrarian ReformDocument18 pagesAgrarian ReformNori Lola100% (1)

- DAR v. Trinidad Valley Realty & Development Corporation - Prohibition Against Injunction in Agrarian Reform CasesDocument6 pagesDAR v. Trinidad Valley Realty & Development Corporation - Prohibition Against Injunction in Agrarian Reform CasesCourtney TirolNo ratings yet

- Implied trust over agricultural lot ruled void for failure to comply with formalities of donationDocument3 pagesImplied trust over agricultural lot ruled void for failure to comply with formalities of donationjenizacallejaNo ratings yet

- DOAS Dumptruck UHR492Document2 pagesDOAS Dumptruck UHR492anamarie de la cruz100% (1)

- Part PerformanceDocument15 pagesPart PerformanceS M Pizuar HossainNo ratings yet

- MIAA Vs CADocument2 pagesMIAA Vs CAMil RamosNo ratings yet

- 2019 Specpro Case Digests Ver. 6.5 PDFDocument15 pages2019 Specpro Case Digests Ver. 6.5 PDFMaloy Prado EdnalagaNo ratings yet

- United Merchants vs. Country Bankers InsuranceDocument2 pagesUnited Merchants vs. Country Bankers InsurancePaolo AlarillaNo ratings yet

- Proforma of Undertaking Is Available On RBI WebsiteDocument2 pagesProforma of Undertaking Is Available On RBI WebsiteRx GaNiNo ratings yet

- Application Form (AGRI) CERT. TO AFFIDAVITDocument4 pagesApplication Form (AGRI) CERT. TO AFFIDAVITLorna U. Fernandez-EspinozaNo ratings yet

- Facto Convert It Into Patrimonial Property. While A Prior Declaration That TheDocument17 pagesFacto Convert It Into Patrimonial Property. While A Prior Declaration That TheThereseVilogNo ratings yet

- Final Law Report 1876-1879Document11 pagesFinal Law Report 1876-1879Rae Anne ÜNo ratings yet

- 12 Advocates For Truth in Lending V Bangko Sentral Monetary BoardDocument23 pages12 Advocates For Truth in Lending V Bangko Sentral Monetary BoardLeyCodes LeyCodesNo ratings yet

- GilgameshDocument33 pagesGilgameshgauchaoNo ratings yet

- Robles V Lizarraga HermanosDocument4 pagesRobles V Lizarraga HermanosjoygmailNo ratings yet

- Affidavit of Loss - Bir.or - Car.1.2020Document1 pageAffidavit of Loss - Bir.or - Car.1.2020black stalkerNo ratings yet

- BCI v. UOI Case Analysis on Constitutionality of Sections 22A-E of Legal Services ActDocument8 pagesBCI v. UOI Case Analysis on Constitutionality of Sections 22A-E of Legal Services ActAbhishekKuleshNo ratings yet

- Abellana V CADocument2 pagesAbellana V CANikki Estores GonzalesNo ratings yet

- Gotesco Properties v. Go G.R. No. 201167 February 27 2013Document2 pagesGotesco Properties v. Go G.R. No. 201167 February 27 2013Hurjae Soriano Lubag100% (2)

- Chua Yek Hong Vs IacDocument1 pageChua Yek Hong Vs IacFrancise Mae Montilla MordenoNo ratings yet

- Section 5.: Divisible and Indivisible ObligationsDocument54 pagesSection 5.: Divisible and Indivisible ObligationsJennica Gyrl G. DelfinNo ratings yet