Professional Documents

Culture Documents

Bad Bank Should India Have One - The Financial Express

Uploaded by

Sunny SahayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bad Bank Should India Have One - The Financial Express

Uploaded by

Sunny SahayCopyright:

Available Formats

Bad bank: Should India have one?

We have 29 ARCs buying bad assets, but the model has

not yielded desired results. Meanwhile, developed

nations have tasted success with bad banks

There is added urgency because the government has put on hold, rightly so, fresh reference to the

NCLT under the IBC for one year.

By Deepak Narang

The debate over a ‘bad bank’, keenly discussed in the official circles and the

media in FY17, has been in the focus once again after the IBA sent a proposal for

establishing a bad bank to the government and RBI. Earlier, RBI toyed with the

idea of a private asset management company and a national asset management

company for private and public sector banks, respectively.

Related News

Privacy VIOLATION: After Facebook, Google is now in a soup over user

privacy

Covid-19: Challenge Delhi’s testing rules in Supreme Court

At present, banks have NPAs of Rs 9.7 lakh crore (as of December 2019) with

estimates of fresh slippages of Rs 5.5 lakh crore primarily because of the Covid-

19 stress. We have to look for quick solutions. There is added urgency because

the government has put on hold, rightly so, fresh reference to the NCLT under

the IBC for one year.

A bad bank is established to buy toxic assets from a good bank at a price that is

determined by a bad bank. It is controlled by the government, and apart from

the government, other private players invest in its equity. It may raise loan from

other banks. These transactions happen at arm’s length and a bad bank is

managed by professionals with domain knowledge.

In India, a bad bank has not been set up; rather, private asset reconstruction

companies (ARCs) have been buying NPAs from various banks—and 29 ARCs

are in the business of buying bad assets but the model has not yielded desired

results. ARCs act merely as recovery agents because they lack the bandwidth

to reconstruct any company under stress which is sold as going concern. The

efficacy of the ARC model is under question. The CVC, some time ago,

submitted a report to the government after examining cases above Rs 50 crore

that were sold to ARCs between 2013-14 and 2017-18 by PSBs. The report

mentions that, in at least 48 cases, assets were sold to ARCs below the

realisable value of security. Besides the accounts which were sold as going

concern, the value of stocks and equipment were not factored in while fixing the

reserve price.

This has acted as a dampener and sale to ARCs is few and far between now.

Besides, ARCs have recovered roughly 9.5% of the security receipts that they

held at the end of FY18. We need to keep in mind that all PSBs have board-

approved policy for sale to ARCs and cases of Rs 50 crore should have been

placed before the board for sanction/approval.

If the economy has to come back on track, then lending has to resume in a big

way. As a rule of thumb, credit growth is roughly 2-2.5 times GDP growth.

Setting up a bad bank, undoubtedly, is a way forward. The case of Jhabua

power plant can be examined to understand the desirability of a bad bank.

Jhabua Power for resolution of insolvency was under the IBC on account of

shortage of working capital. Two bids were received—one from the NTPC,

which made the bid for the first time for Rs 1,900 crore at the rate of Rs 3.2 per

MW, and another from Adani Power, for Rs 750 crore at Rs 1.25 per MW. Had

the NTPC not entered the fray, the plant, in all probability, could have been

purchased by Adani Power may be after some increase of price post bargaining.

In this case, not only the price was higher, but profit, if any, will go to

government coffers. The cost to the exchequer will, therefore, be either nil or

minimal. Such deals may, subsequently, invite wrath of the CVC/CBI. A bad bank

can do this work as it will have the bandwidth to deal with such situations and

can rope in experts to manage units/plant till it finds a buyer. Besides, it may

share future profits with the bank that sold this asset.

Arguments against establishing bad banks are: (1) When there are no takers

for bad assets, so why have a bad bank; (2) Why waste government resources

when the Covid-19 crisis has put tremendous strain on resources; (3) The price

at which toxic assets will be transferred will not be market-determined and price

discovery will not happen; (4) ARCs are already there for the purpose.

Let us provide a different perspective to these issues.

1. If there are no takers for the assets, then it makes sense to let domain experts

deal with toxic assets till these can be sold.

2. As in the case of Jhabua Power and in most cases of Rs 500 crore and above,

the government may suffer minimum loss.

3. Price discovery is an important component of the deal and a bad bank is best

suited for fixing price. A good bank should make additional provision in case the

discovered cost is less than the book value and they want to retain it on its

books.

4. ARCs have mostly not reconstructed assets as banks suffer loss on

investment in security receipts after five years. Instances are there when

defaulters have managed to reduce obligation to banks through purchase from

ARCs in the name of sister/connected concern as provisions like Section 29A of

the IBC are not included in the SARFAESI Act.

Selling stressed assets to a bad bank at a price determined by it will insulate

bankers from the purview of 3Cs (CBI, CVC, CAG), and encourage them to

offload these to a bad bank.

Countries like the UK, the US, Spain, Malaysia, France, Finland, Belgium,

Germany, Austria and Sweden have successfully experimented with bad asset

resolution through a bad bank. The earliest case was of the Mellon Bank in 1988

—to hold bad assets of $1.4 billion. The UK Asset Resolution (UKAR), a bad

bank, repaid 48.7 billion pound taxpayers’ loan that it had taken, and is close to

selling the last of its asset portfolio before winding down. International

experience should come handy for us to model our bad bank on.

Parliament may pass a legislation to set up a bad bank and empower it with the

heft for recovering from borrowers, with minimal legal hassles with respect to

acquisition/disposal of bank assets.

The author is former ED, UBI, and director (Rare ARC, Incred Finance and

Baroda Trustee India Pvt Ltd)

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of

Mutual Funds, calculate your tax by Income Tax Calculator, know market’s Top

Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on

Twitter.

Financial Express is now on Telegram. Click here to join our channel and stay

updated with the latest Biz news and updates.

You might also like

- Role of SEBI in Indian EconomyDocument7 pagesRole of SEBI in Indian EconomyAkhilesh Shukla100% (1)

- The Merger of Associate Banks With State Bank of India A Pre and Post Merger AnalysisDocument13 pagesThe Merger of Associate Banks With State Bank of India A Pre and Post Merger AnalysisRachit GoyalNo ratings yet

- Fund and Non Fund Based BankingDocument17 pagesFund and Non Fund Based BankingPrajakta SamantNo ratings yet

- A Case Study On Merger and Acquisition On Indian Bank Since 1991Document16 pagesA Case Study On Merger and Acquisition On Indian Bank Since 1991International Journal of Innovative Science and Research TechnologyNo ratings yet

- Management Education & Research Institute: INTERVIEW FOR MBA/PGDM 2013-15 (Marketing)Document2 pagesManagement Education & Research Institute: INTERVIEW FOR MBA/PGDM 2013-15 (Marketing)ankitverma9716No ratings yet

- Analysis of Merger of SBIDocument5 pagesAnalysis of Merger of SBIAnuja AmiditNo ratings yet

- Non Performing AssetsDocument15 pagesNon Performing AssetsChetanModiNo ratings yet

- Private and Public Sector Bank NPA ComparisonDocument14 pagesPrivate and Public Sector Bank NPA ComparisonSunny KhandelwalNo ratings yet

- Dana Packaging Company Is A Large Producer of Paper andDocument1 pageDana Packaging Company Is A Large Producer of Paper andAmit PandeyNo ratings yet

- Investment BankingDocument17 pagesInvestment BankingDhananjay BiyalaNo ratings yet

- Pine LabsDocument11 pagesPine LabsSandeep NashikarNo ratings yet

- Taxability of offshore share transactionsDocument5 pagesTaxability of offshore share transactionsNishit SaraiyaNo ratings yet

- Equity ValuationDocument10 pagesEquity ValuationJasmine NandaNo ratings yet

- Risk Management in Indian Banking SectorDocument3 pagesRisk Management in Indian Banking Sectorsplender2008No ratings yet

- Satyam Computer Services Case StudyDocument45 pagesSatyam Computer Services Case StudyLokeshwar PawarNo ratings yet

- Merger of SBI and Their Associate BanksDocument16 pagesMerger of SBI and Their Associate BanksVipulNo ratings yet

- DHFL Bank ScamDocument7 pagesDHFL Bank ScamPrasannaNo ratings yet

- Legal & Regulatory Framework of M&ADocument7 pagesLegal & Regulatory Framework of M&AabdullahshamimNo ratings yet

- Financial Inclusion in India - A Review of InitiatDocument11 pagesFinancial Inclusion in India - A Review of InitiatEshan BedagkarNo ratings yet

- Tata Corporate Governance Issues Highlight India-Specific ConcernsDocument5 pagesTata Corporate Governance Issues Highlight India-Specific ConcernsPGDM IMSNo ratings yet

- Impact of Recent Mergers in Public Sector BanksDocument18 pagesImpact of Recent Mergers in Public Sector BanksAnkita Das100% (3)

- Consumer Behaviour in Post-Covid EraDocument1 pageConsumer Behaviour in Post-Covid EraAkash DhimanNo ratings yet

- CASE STUDY ON Mergers & AcquisitionDocument32 pagesCASE STUDY ON Mergers & AcquisitionPrernaNo ratings yet

- Harshad Mehta ScamDocument20 pagesHarshad Mehta ScamVinay Singh0% (1)

- Valuation Models for M&A DealsDocument21 pagesValuation Models for M&A DealsAnna Paula GallemitNo ratings yet

- Digitalisation in The Banking SectorDocument10 pagesDigitalisation in The Banking SectorEditor IJTSRD100% (1)

- Deposit InsuranceDocument14 pagesDeposit InsuranceHarshdeep SinghNo ratings yet

- Reserve Bank of IndiaDocument17 pagesReserve Bank of IndiaShivamPandeyNo ratings yet

- STM Asian Paints Group 6 SectionBDocument64 pagesSTM Asian Paints Group 6 SectionBSiddharth Sharma80% (5)

- A Submitted ON: "Infrastructure Leasing & Financial Services"Document16 pagesA Submitted ON: "Infrastructure Leasing & Financial Services"Apurva GuptaNo ratings yet

- History of IDBIDocument43 pagesHistory of IDBIanuragchandrajhaNo ratings yet

- IDFC BankDocument12 pagesIDFC Bankdrmadmax1963No ratings yet

- Amalgamation of Banking CompaniesDocument17 pagesAmalgamation of Banking CompaniesShivali Dubey67% (3)

- Bmt5121 Corporate Goverance and Ethics Digital Assignment 3Document17 pagesBmt5121 Corporate Goverance and Ethics Digital Assignment 3Barani Kumar NNo ratings yet

- Merger and Acquisition of BankDocument14 pagesMerger and Acquisition of Bankimsong 07No ratings yet

- DISSERTATION RE NikhilDocument37 pagesDISSERTATION RE NikhilNikhil Ranjan50% (2)

- Banking Sector Reforms in India Some ReflectionsDocument14 pagesBanking Sector Reforms in India Some ReflectionsAustin OliverNo ratings yet

- Indian Banking StructureDocument5 pagesIndian Banking StructureKarthik NadarNo ratings yet

- Satyam Computer Fraud Case StudyDocument27 pagesSatyam Computer Fraud Case StudySalahuddinsaiyed50% (2)

- Satyam ScamDocument41 pagesSatyam ScamRajasree VarmaNo ratings yet

- Consortium BankingDocument4 pagesConsortium BankingSnigdha DasNo ratings yet

- Section 1: Case Study Topic: Merger of Flipkart and Myntra Strategy: Merger and AcquisitionDocument8 pagesSection 1: Case Study Topic: Merger of Flipkart and Myntra Strategy: Merger and AcquisitionMuskan MannNo ratings yet

- IpoDocument13 pagesIpoalan ruzarioNo ratings yet

- Axis Bank's Acquisition of FreeCharge Expands Digital Payments ReachDocument14 pagesAxis Bank's Acquisition of FreeCharge Expands Digital Payments ReachAmartya Choubey100% (1)

- # 722798 - Apple Internal AnalysisDocument13 pages# 722798 - Apple Internal AnalysisXueyingying JiangNo ratings yet

- Strategic and Ethical Failure of Kingfisher Airlines: by Satyakama Das (19PGPMWE49) Sudhansu Sekhar Mishra (19PGPMWE58)Document16 pagesStrategic and Ethical Failure of Kingfisher Airlines: by Satyakama Das (19PGPMWE49) Sudhansu Sekhar Mishra (19PGPMWE58)Satyakam DasNo ratings yet

- Case Study Vijay Mallya - Another Big NaDocument10 pagesCase Study Vijay Mallya - Another Big Najai sri ram groupNo ratings yet

- PRINCIPLES AND PRACTICES OF BANKINGDocument63 pagesPRINCIPLES AND PRACTICES OF BANKINGbasuNo ratings yet

- Topic:-Green Bonds in India-Performance, Scope and Future Scenario in The CountryDocument5 pagesTopic:-Green Bonds in India-Performance, Scope and Future Scenario in The Countryrishav tiwaryNo ratings yet

- The Role of Whistleblowers in Detecting and Preventing Employee Fraud in Licensed Commercial Banks in Sri Lanka: A Qualitative StudyDocument7 pagesThe Role of Whistleblowers in Detecting and Preventing Employee Fraud in Licensed Commercial Banks in Sri Lanka: A Qualitative StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Importance of Documents in Incorporation of CompanyDocument34 pagesImportance of Documents in Incorporation of CompanyNandini TarwayNo ratings yet

- RBI Regulates Financial System & Maintains Monetary StabilityDocument66 pagesRBI Regulates Financial System & Maintains Monetary StabilitysejalNo ratings yet

- Analysis of the PNB Scam Using 5W2H and Its ImplicationsDocument14 pagesAnalysis of the PNB Scam Using 5W2H and Its ImplicationsSachin PimpalkhuteNo ratings yet

- PESTEL ANALYSIS OF BANKING AND INSURANCEDocument10 pagesPESTEL ANALYSIS OF BANKING AND INSURANCEDhananjayrao mhatreNo ratings yet

- Basel Norms For BankingDocument5 pagesBasel Norms For BankingAkshat PrakashNo ratings yet

- Indian Financial System - An OverviewDocument33 pagesIndian Financial System - An OverviewShilpiVaishkiyar0% (1)

- Banking and Insurance Law - Abstract and Synopsis!Document4 pagesBanking and Insurance Law - Abstract and Synopsis!Anonymous 6oIohENx0% (1)

- Title ProposalDocument7 pagesTitle ProposalkanishkajaishihaNo ratings yet

- Bad BankDocument7 pagesBad Bankkartikbot79No ratings yet

- PSB Reforms Key for Bad Bank SuccessDocument12 pagesPSB Reforms Key for Bad Bank SuccessVn KulkarniNo ratings yet

- Civil Services MarksheetDocument1 pageCivil Services MarksheetSunny SahayNo ratings yet

- Civil Services MarksheetDocument1 pageCivil Services MarksheetSunny SahayNo ratings yet

- Untitled: General MetricsDocument5 pagesUntitled: General MetricsSunny SahayNo ratings yet

- Opqrstuv Ÿ Xpyuz V R: Cdde F Ghijÿ LMJHF E NDocument6 pagesOpqrstuv Ÿ Xpyuz V R: Cdde F Ghijÿ LMJHF E NSunny SahayNo ratings yet

- Mechanical-Engineering Gate2016.InfoDocument3 pagesMechanical-Engineering Gate2016.InfoHenryNo ratings yet

- Productions & Operations Management PDFDocument164 pagesProductions & Operations Management PDFDuma DumaiNo ratings yet

- Boost rural healthcare spending, strengthen NRHMDocument1 pageBoost rural healthcare spending, strengthen NRHMSunny SahayNo ratings yet

- Safari - 06-Jun-2020 at 9:34 PM PDFDocument1 pageSafari - 06-Jun-2020 at 9:34 PM PDFSunny SahayNo ratings yet

- Online Duplicate Bill: Electricity Bill For LT ConsumerDocument1 pageOnline Duplicate Bill: Electricity Bill For LT ConsumerSunny SahayNo ratings yet

- China Now Has The Military Power To Alter Territorial Status QuoDocument1 pageChina Now Has The Military Power To Alter Territorial Status QuoSunny SahayNo ratings yet

- 21 THEORY OF METAL MACHINING SolutionsDocument7 pages21 THEORY OF METAL MACHINING SolutionsTiyaniNo ratings yet

- 21 THEORY OF METAL MACHINING SolutionsDocument7 pages21 THEORY OF METAL MACHINING SolutionsTiyaniNo ratings yet

- ARC Capacity Building For Conflict Resolution 1Document55 pagesARC Capacity Building For Conflict Resolution 1Kamalesh 14No ratings yet

- Local Govt Role in COVID ResponseDocument1 pageLocal Govt Role in COVID ResponseSunny SahayNo ratings yet

- NepalDocument1 pageNepalSunny SahayNo ratings yet

- History, The Stand-Off, and Policy Worth RereadingDocument1 pageHistory, The Stand-Off, and Policy Worth RereadingSunny SahayNo ratings yet

- In Persian Gulf Littoral, Cooperative Security Is KeyDocument1 pageIn Persian Gulf Littoral, Cooperative Security Is KeySunny SahayNo ratings yet

- Hints - Basics of Society GovernanceDocument51 pagesHints - Basics of Society GovernanceSunny SahayNo ratings yet

- TextDocument2 pagesTextSunny SahayNo ratings yet

- 2021 Metal Cutting, Metrology, Forming, Automation, Rootics by S K Mondal PDFDocument276 pages2021 Metal Cutting, Metrology, Forming, Automation, Rootics by S K Mondal PDFYour Study Related100% (2)

- Alternate UrbanizationDocument1 pageAlternate UrbanizationSunny SahayNo ratings yet

- GFDocument448 pagesGFShivran RoyNo ratings yet

- Evernote Export PDFDocument267 pagesEvernote Export PDFSunny SahayNo ratings yet

- Module 5 Extrusion Lecture 1 PDFDocument10 pagesModule 5 Extrusion Lecture 1 PDFaditya sharma100% (1)

- All India GS Mains Test Series-2019: (Module-3)Document4 pagesAll India GS Mains Test Series-2019: (Module-3)Sunny SahayNo ratings yet

- ForestryDocument194 pagesForestrySourabh JakharNo ratings yet

- Gray Cast Iron, The Least Expensive andDocument3 pagesGray Cast Iron, The Least Expensive andSunny SahayNo ratings yet

- NC - CNC NotesDocument7 pagesNC - CNC NotesAmandeep SinghNo ratings yet

- Safari - 12-Dec-2018 at 21:27 PDFDocument1 pageSafari - 12-Dec-2018 at 21:27 PDFSunny SahayNo ratings yet

- Intermodal Transportation System in An Evolving Economy: Research PaperDocument7 pagesIntermodal Transportation System in An Evolving Economy: Research PaperUsiwo FranklinNo ratings yet

- Bsa - Finman - SyllabusDocument13 pagesBsa - Finman - SyllabusAbdulmajed Unda MimbantasNo ratings yet

- Sample Copy - Mphasis &finsource PDFDocument2 pagesSample Copy - Mphasis &finsource PDFSameer ShaikhNo ratings yet

- Online Tutorial 8 Audit of Human Resources and Payment CycleDocument3 pagesOnline Tutorial 8 Audit of Human Resources and Payment CycleleiannetumamaoNo ratings yet

- High Low MethodDocument4 pagesHigh Low MethodSamreen LodhiNo ratings yet

- UPDATE ON KEY INFRASTRUCTURE PROJECTSDocument5 pagesUPDATE ON KEY INFRASTRUCTURE PROJECTSJayson RubioNo ratings yet

- Chapter-5 A Comparative AnalysisDocument5 pagesChapter-5 A Comparative Analysisshoyeb1204No ratings yet

- Financial Statement Analysis ReportDocument47 pagesFinancial Statement Analysis Reportgaurang90% (80)

- BMOA DAYS GENERAL GUIDELINES FinalDocument26 pagesBMOA DAYS GENERAL GUIDELINES FinalCharlotte Balladares LarideNo ratings yet

- Data Warehousing: A Strategic Tool for Business InsightsDocument30 pagesData Warehousing: A Strategic Tool for Business InsightsMrudul BhattNo ratings yet

- Basics of Business Mathematics in 40 CharactersDocument17 pagesBasics of Business Mathematics in 40 CharactersAbhishek JainNo ratings yet

- Class 7 - Spring 2021 - TopostDocument24 pagesClass 7 - Spring 2021 - TopostMahin AliNo ratings yet

- Internationalization CanvasDocument1 pageInternationalization CanvasRomulo Alexandre Soares - RASNo ratings yet

- Marketing Notes-2020Document118 pagesMarketing Notes-2020mukesh100% (1)

- A Study On Traditional Market Decline and Revitalization in Korea Improving The Iksan Jungang Traditional MarketDocument9 pagesA Study On Traditional Market Decline and Revitalization in Korea Improving The Iksan Jungang Traditional MarketMUHAMAD AGUNG PARENRENGINo ratings yet

- Indonesian Outlook 2024-2029 - March 13th 2024Document10 pagesIndonesian Outlook 2024-2029 - March 13th 2024Saefuddin SaefuddinNo ratings yet

- CV of Asabea Tannor.Document2 pagesCV of Asabea Tannor.Naana TannorNo ratings yet

- Medina Foundation College: Sapang Dalaga, Misamis OccidentalDocument18 pagesMedina Foundation College: Sapang Dalaga, Misamis OccidentalDELPGENMAR FRAYNANo ratings yet

- Duality Theory - Assignment A) Primal ProblemDocument5 pagesDuality Theory - Assignment A) Primal ProblemSohaib ArifNo ratings yet

- PEPSI COLA vs. MolonDocument28 pagesPEPSI COLA vs. MolonChristle CorpuzNo ratings yet

- Arts3 q1 Mod1 Aralin1-4 v5Document27 pagesArts3 q1 Mod1 Aralin1-4 v5Edward TarucNo ratings yet

- Commercial Law Case Digest: List of CasesDocument57 pagesCommercial Law Case Digest: List of CasesJean Mary AutoNo ratings yet

- Tyco fraud investigation timelineDocument12 pagesTyco fraud investigation timelineSumit Sharma100% (1)

- Mam Realty Development Corp. Vs NLRCDocument3 pagesMam Realty Development Corp. Vs NLRCbenNo ratings yet

- 773531Document38 pages773531Mohammed Khaja MohinuddinNo ratings yet

- Access Data: Statistic As Excel Data FileDocument5 pagesAccess Data: Statistic As Excel Data FileAKSHAT MITTALNo ratings yet

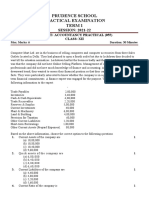

- Prudence School Accountancy Practical ExamDocument2 pagesPrudence School Accountancy Practical Examicarus fallsNo ratings yet

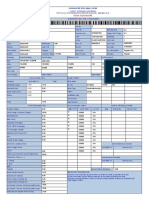

- UD BUANA Trial BalanceDocument1 pageUD BUANA Trial Balancerasaz deviNo ratings yet

- Capital BudgetingDocument87 pagesCapital BudgetingCBSE UGC NET EXAMNo ratings yet

- Irrevocable Letter of CreditDocument1 pageIrrevocable Letter of CreditJunvy AbordoNo ratings yet