Professional Documents

Culture Documents

Administration Charter Amendment - Problems and Solution - 7-2-2020

Uploaded by

David LublinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Administration Charter Amendment - Problems and Solution - 7-2-2020

Uploaded by

David LublinCopyright:

Available Formats

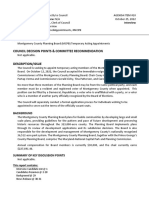

Problems with current charter amendment and proposed changes

Current charter amendment

Does not capture growth in the tax base except for new construction (not even full value there).

Disconnect between economic growth and tax revenue growth

Hypothetical example of overall: Assume no new construction in this example

Year 1 With charter cap Without

Assessable base $100 billion $100 billion

Tax rate 1.00% 1.00%

Revenue $1 billion $1 billion

Assume 2% inflation and 10% growth in property values

Charter limits overall revenue to $1.02 billion (previous year’s revenue plus 2% inflation)

Year 2 With charter cap Without

Assessable base $110 billion $110 billion

Tax rate .93% 1.00%

Revenue $1.02 billion* $1.1 billion

* Assume no new construction in this year.

Increased occupancy in commercial building does not add to the taxable base.

Commercial assessments have the same rate as for residential but commercial assessments are based on vacancies

and the income that the commercial property generates. Even when commercial buildings fill up and no longer have

vacancies and reassessment increases their taxes, the county does not realize new revenue because the property tax

revenue is still subject to the cap based on inflation. It is all relative.

Example –

A building has a 20% vacancy rate and pays property taxes relative to the building’s income. A new business

comes to the county rents out the vacant space, and the building is now fully occupied. At the time of the

new assessment, the property owner’s taxes go up, but the additional new taxes from the new business

occupying the building cannot exceed the revenue cap – someone else’s taxes will go down as a result.

Underestimates affect the base forever.

Because forecasts are (understandably) cautious, the forecast of revenues (which is needed to set the tax rate each

year) may underestimate actual revenues available from the assessable base, which results in setting the revenue

base lower than the limit. That lower limit cannot be adjusted in future years. In FY19, a cautious estimate resulted in

$40 million less than actual revenues available.

Charter limit does not cap individual taxes at rate of inflation.

Taxes for individual properties taxes may go up or down, and by different amounts (even if the tax rate stays the same

or goes down slightly. Some property owners see tax increases; others see tax decreases. A homeowner with a

modestly priced house ($400,000) may see their assessment increase by up to 10% and their taxes will go up; another

homeowner with a $2 million home may see a decrease. Below are actual property tax changes for different sample

properties (changes from 2018 to 2019).

Property type Location Assessed value increase/decrease

Residential Silver Spring $640,000 11%

Residential Potomac $2,147,800 (.21%)

Residential Silver Spring $540,000 2.49%

Commercial Rockville $371,183,600 (.2%)

Commercial Friendship $91,000,000 2.28%

Heights

Revenue cap keeps the tax rate artificially low

- Charter amendment forces County to raise tax rate simply to spend at same rate; it gives Montgomery County

the reputation of tax and spend without actually getting the revenue

-

Expected 0% inflation means no additional revenues regardless of economic growth.

- The charter amendment added by Council in 1990 occurred during a period of relatively high inflation and

large increases in property values.

- It is possible that inflation will be close to 0% next year; if so, property tax revenues will be the same as this

year; in additionincome taxes are likely to be flat or go down. Council may have to vote to lower the tax rate

to stay under the revenue cap – cutting taxes during a pandemic and time of great demand. Additionally re-

assessments may go down from COVID – when they do, the decreases are immediate and don’t change for 3

years and when the assessments increase again – phased in, the total taxes collected do not go above the

previous year’s revenue cap + inflation.

We’re in a fiscal death spiral - simply defeating the proposed charter amendment leaves us in the ICU ward.

Who gets high increases during under charter cap?

- Residential property owners in houses that are increasing in value – biggest demand is moderately priced

houses – those are going up in value NEED EXAMPLES – Aspen Hill, Forest Glen…..

Montgomery County does not have high rates compared to neighboring jurisdictions

Commercial Tax rates NEED A YEAR

Proposed change:

Keep existing language (red):

By June 30 each year, the Council shall make tax levies deemed necessary to finance the

budgets. Unless approved by an affirmative vote of all current Councilmembers, the Council

shall not levy an ad valorem tax on real property to finance the budgets that will produce

total revenue that exceeds the total revenue produced by the tax on real property in the

preceding fiscal year plus a percentage of the previous year’s real property tax revenues that

equals any increase in the Consumer Price Index as computed under this section. This limit

does not apply to revenue from: (1) newly constructed property, (2) newly rezoned property,

(3) property that, because of a change in state law, is assessed differently than it was

assessed in the previous tax year, (4) property that has undergone a change in use, and (5)

any development district tax used to fund capital improvement projects.

Proposal would replace the deleted language above with language below (blue):

UNLESS APPROVED BY AN AFFIRMATIVE VOTE OF SIX COUNCILMEMBERS, THE COUNCIL MAY NOT LEVY

AN AD VALOREM TAX RATE ON REAL PROPERTY GREATER THAN THE AD VALOREM TAX RATE ON REAL

PROPERTY IN THE PRIOR FISCAL YEAR.

FOR EACH TAXABLE YEAR, THE TAXABLE VALUE OF AN OWNER-OCCUPIED RESIDENTIAL PROPERTY

SUBJECT TO AN AD VALOREM REAL PROPERTY TAX MAY NOT INCREASE BY MORE THAN THREE PERCENT.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Planning Board NomineesDocument33 pagesPlanning Board NomineesDavid LublinNo ratings yet

- Latest Planning Board Open Meetings ViolationDocument23 pagesLatest Planning Board Open Meetings ViolationDavid Lublin100% (1)

- Applicant ListDocument3 pagesApplicant ListDavid LublinNo ratings yet

- MCPG105-23 - LR547 WRDocument14 pagesMCPG105-23 - LR547 WRDavid LublinNo ratings yet

- Pause Thrive LetterDocument7 pagesPause Thrive LetterDavid LublinNo ratings yet

- OLO RESJ Review of Thrive 2.9.22 RevisedDocument6 pagesOLO RESJ Review of Thrive 2.9.22 RevisedDavid Lublin100% (2)

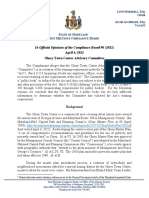

- Open Meetings Compliance Board OpinionDocument7 pagesOpen Meetings Compliance Board OpinionDavid Lublin100% (1)

- De XXX - 2020.10.28 Motion For Temporary Retraining Order and Memorandum of LawDocument17 pagesDe XXX - 2020.10.28 Motion For Temporary Retraining Order and Memorandum of LawDavid LublinNo ratings yet

- Complaint Against Marylin PierreDocument22 pagesComplaint Against Marylin PierreDavid LublinNo ratings yet

- GSSCC County Council Candidate QuestionnaireDocument2 pagesGSSCC County Council Candidate QuestionnaireDavid LublinNo ratings yet

- Lobbying Compliance Assessment and PolicyDocument22 pagesLobbying Compliance Assessment and PolicyDavid LublinNo ratings yet

- Economic Impact Statement - Bill 52-20 Rent ControlDocument17 pagesEconomic Impact Statement - Bill 52-20 Rent ControlDavid LublinNo ratings yet

- Lierman Kick-Off Host CommitteeDocument1 pageLierman Kick-Off Host CommitteeDavid LublinNo ratings yet

- De XXX - 2020.10.28 Verified ComplaintDocument33 pagesDe XXX - 2020.10.28 Verified ComplaintDavid LublinNo ratings yet

- SB226 Prohibition of Signs Expressways Veto PDFDocument1 pageSB226 Prohibition of Signs Expressways Veto PDFDavid LublinNo ratings yet

- Exec Reg 9-20t Phegprogram v10.4 - 041420-Final - CleanDocument8 pagesExec Reg 9-20t Phegprogram v10.4 - 041420-Final - CleanDavid LublinNo ratings yet

- NABET-CWA Local 31 ULP Position Statement (Signed)Document13 pagesNABET-CWA Local 31 ULP Position Statement (Signed)David LublinNo ratings yet

- Ethics Report Re Jay JalisiDocument24 pagesEthics Report Re Jay JalisiDavid LublinNo ratings yet

- ADUs-Current Zoning, ZTA 19-01 and DC RulesDocument2 pagesADUs-Current Zoning, ZTA 19-01 and DC RulesDavid LublinNo ratings yet

- County Executive Marc Elrich's Budget Message For FY21Document10 pagesCounty Executive Marc Elrich's Budget Message For FY21David LublinNo ratings yet

- SBE LetterDocument2 pagesSBE LetterRyan MinerNo ratings yet

- Jealous Gave Speeches To Universities While They Were Raising TuitionDocument23 pagesJealous Gave Speeches To Universities While They Were Raising TuitionDavid LublinNo ratings yet

- SAGE Policy Report January 2019Document45 pagesSAGE Policy Report January 2019David Lublin100% (1)

- ZTA 19-01 TestimonyDocument2 pagesZTA 19-01 TestimonyDavid Lublin0% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- H. Family IncomeDocument29 pagesH. Family IncomeFahad AkmadNo ratings yet

- MIS PresentationDocument11 pagesMIS PresentationAman Singh RajputNo ratings yet

- Millennium Company - Projected Financial StatementDocument2 pagesMillennium Company - Projected Financial StatementKathleenCusipagNo ratings yet

- Life Cycle CostingDocument4 pagesLife Cycle CostingSanjay Kumar SinghNo ratings yet

- Britannia Industry AnalysisDocument27 pagesBritannia Industry AnalysisVickeySumitDebbarmaNo ratings yet

- CADBURYDocument25 pagesCADBURYRkenterprise0% (1)

- Fin611 Solved Online QuizzesDocument7 pagesFin611 Solved Online QuizzesFarhan Bajwa100% (1)

- PNC INFRATECH - ASM ProjectDocument11 pagesPNC INFRATECH - ASM ProjectAbhijeet kohatNo ratings yet

- Life Insurance in IndiaDocument27 pagesLife Insurance in Indiasoorbhiee100% (1)

- Resume - Un Economic Affairs Officer PDFDocument2 pagesResume - Un Economic Affairs Officer PDFJustin RobertNo ratings yet

- ACC 202 - Financial Accounting IIDocument6 pagesACC 202 - Financial Accounting IIRahul raj SahNo ratings yet

- BBB Policy ResearchDocument11 pagesBBB Policy ResearchMeeraNatasyaNo ratings yet

- CeraDocument32 pagesCeraRohit ThapliyalNo ratings yet

- 10 Budget Word Problems To Practice in ClassDocument2 pages10 Budget Word Problems To Practice in ClasshellkatNo ratings yet

- EBITDA CheatsheetDocument1 pageEBITDA Cheatsheetyanfong1003No ratings yet

- Mgac AnsDocument23 pagesMgac AnsMark Ivan JagodillaNo ratings yet

- Aditya: ForgeDocument17 pagesAditya: ForgeanupNo ratings yet

- Heritage Foods Discounted Cash Flow Valuation CaseDocument9 pagesHeritage Foods Discounted Cash Flow Valuation CasePriya DurejaNo ratings yet

- Monmouth Student Template UpdatedDocument14 pagesMonmouth Student Template Updatedhao pengNo ratings yet

- Role of Board of DirectorsDocument3 pagesRole of Board of DirectorsFarhan JawedNo ratings yet

- Diskusi 7 Bahasa Inggris NiagaDocument2 pagesDiskusi 7 Bahasa Inggris NiagaRamdhaniNo ratings yet

- Exam 1 AmDocument51 pagesExam 1 AmShanzah SaNo ratings yet

- Compensation Strategy For The Knowledge WorkersDocument5 pagesCompensation Strategy For The Knowledge WorkersKK SharmaNo ratings yet

- Practical Oriented Questions and AnswersDocument11 pagesPractical Oriented Questions and AnswersAshok dore Ashok doreNo ratings yet

- Summary Regulation CPA NotesDocument2 pagesSummary Regulation CPA Notesjklein2588100% (1)

- CIR Vs General FoodsDocument12 pagesCIR Vs General FoodsVictor LimNo ratings yet

- Lecture 08 - Relative Valuation - Using Market ComparablesDocument76 pagesLecture 08 - Relative Valuation - Using Market ComparablesDanila GallaratoNo ratings yet

- Budgeting For Planning and ControlDocument23 pagesBudgeting For Planning and ControlMuhammad AbrarNo ratings yet

- ICBC Presentation 09Document24 pagesICBC Presentation 09AhmadNo ratings yet

- Skema Audit InternalDocument4 pagesSkema Audit InternaligoeneezmNo ratings yet