Professional Documents

Culture Documents

Basics of Financial Management: Birla Institute of Technology

Uploaded by

Nilesh kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basics of Financial Management: Birla Institute of Technology

Uploaded by

Nilesh kumarCopyright:

Available Formats

BASICS OF FINANCIAL

MANAGEMENT

ASSIGNMENT

SUBMITTED BY:

SUBMITTED TO: AYUSH RAJ

Dr. SUSHIL KUMAR BBA/15009/19

BIRLA INSTITUTE OF TECHNOLOGY

1. Discuss following methods of evaluating investment projects.

i. Pay Back Period Method: It represents the period in which the total

investments in permanent assets pay backs itself. This method is based on

the principal that every capital expenditures pays itself back within a

certain period out of the additional earnings generated from the capital

assets thus it measures the period of time for the original cost of a project to

be recovered from the additional earnings of the project itself.

In case of evaluation of a single project, it is adopted if it pays back itself

within a period specified by the management and if the project does not pay

back itself within the period.

Where the annual cash inflows are equal, Divide the initial outlay (cost)

of the project by annual cash flows, where the project generates constant

annual cash inflows.

Where the annual cash inflows are unequal, the pat back period can be

found by adding up the cash inflows until the total is equal to the initial

cash outlay of project or original cost of the asset.

Payback period = Cash outlay of the project or original cost of the

asset\

Annual cash Inflows

ii. Average rate of return method (ARR): Under this method average

profit after tax and deprecation is calculated and then it is divided by the

total capital outlay or total investment in the project.

ARR= Total Profits (after dep. & taxes) X 100

Net Investment in project x No. Of years of profits

Or

Average annual profit X 100

Net investment in the Project

iii. Internal Rate of Return Method: It is a modern technique of capital

budgeting that take into account the time value of money. It is also known

as “time adjusted rate of return discounted cash flows” “yield method”

“trial and error yield method”

Under this method, the cash flows of the project are discounted at a suitable

rate by hit and trial method, which equates the net present value so

calculated to the amount of the investment. Under this method, since the

discount rate is determined internally, this method is called as the internal

rate of return method. It can be defined as the rate of discount at which the

present value

of cash inflows is equal to the present value of cash outflows.

When the annual net cash flows are equal over the life of the assets.

Present Value Factor = Initial Outlay

Annual Cash Flows

iv. Net Present Value Method: This method is the modern method of

evaluating the investment proposals. This method takes into consideration

the time value of money and attempts to calculate the return in investments

by introducing the factor of time element. It recognizes the fact that a rupee

earned today is more valuable earned tomorrow. The net present value of

all inflows and outflows of cash occurring during the entire life of the

project is determined separately for each year by discounting these flows

by the firm’s cost of capital.

v. Profitability Index or PI: This is also known as benefit cost ratio. This

is similar to the NPV method. The major drawback of NPV method that

does not give satisfactory results while evaluating the projects requiring

different initial investments. PI method provides solution to this.

PI is calculated as:

PI = Present value of cash Inflows

Present value of cash outflows

2. Explain factors affecting capital structure decisions.

Ans. The factors affecting capital structure decisions are as follows:

i. Financial Leverage: The use of long term fixed interest bearing debt and

preference share capital along with equity share capital is called financial

leverage. The use of long term debt magnifies the earning per share if the

firm yields a return higher than the cost of debt. The earning per share also

increases with use of preference share capital but due to the fact that

interest is allowed to be deducted while computing tax, the leverage impact

of debt is more.

ii. Growth and Stability of Sales: The capital structure of a firm is highly

influenced by the growth and stability of its sales. If the sales are expected

to remain fairly stable, it can raise a higher level of debt. Stability of sales

ensures that the firm will not face any difficulty in meeting its fixed

commitments of interest payment and repayments of debts.

iii. Cost of Capital: Cost of capital refers to the minimum rate of return

expected by its suppliers. The capital structure should also provide for the

minimum cost of capital. Usually, debt is cheaper source of finance

compared to preference and equity.

iv. Nature and Size of Firm: Nature and size of firm also influences the

capital structure. A public utility concern has different capital structure as

compared to manufacturing concern. Public utility concern may employ

more of debt because of stability and regularity of their earnings. Small

companies have to depend upon owned capital, as it is very difficult for

them to raise ling term loans on reasonable terms.

v. Flexibility: Capital structure of the firm should be flexible. I.e. it should be

capable of the being adjusted according top the needs of changing

conditions. A firm should arrange its capital structure in such a way that it

can substitute one form of financing by other.

vi. Capital Market Conditions: The choice of securities is also influenced by

the market conditions. If share market is depressed the company should not

issue equity share capital.

3. Discuss determinants of dividend policy along with different

forms of dividends.

Ans. The determinants of dividend policy are as follows:

I. Legal Restrictions: Legal provisions relating to dividends in the

Companies Act, 1956 lay down a framework within which dividend policy

is formulated. These provisions require that:

Dividend can be paid only out of current profits or past profits after

providing for depreciation or out of the moneys provided by Government

for the payment of dividends in pursuance of a guarantee given by the

Government.

A company providing more than ten per cent dividend is required to

transfer certain percentage of the current year's profits to reserves.

The dividends cannot be paid out of capital because it will amount to

reduction of capital adversely affecting the security of its creditors.

II. Desire and Type of Shareholders: Desires of shareholders for dividends

depend upon their economic status. Investors, such as retired persons,

widows and other economically weaker persons view dividends as a source

of funds to meet their day-to-day living expenses. To benefit such

investors, the companies should pay regular dividends.

III. Magnitude and Trend of Earnings: As dividends can be paid only out of

present or past year's profits, earnings of a company fix the upper limits on

dividends. The dividends should, generally, be paid out of current year's

earnings only as the retained earnings of the previous years become more

or less a part of permanent investment in the business to earn current

profits. The past trend of the company's earnings should also be kept in

consideration while making the dividend decision.

IV. Age of the Company: The age of the company also influences the dividend

decision of a company. A newly established concern has to limit payment

of dividend and retain substantial part of earnings for financing its future

growth and development, while older companies which have established

sufficient reserves can afford to pay liberal dividends.

V. Inflation: Inflation acts as a constraint in the payment of dividends. when

prices rise, funds generated by depreciation would not be adequate to

replace fixed assets, and hence to maintain the same assets and capital

intact, substantial part of the current earnings would be retained.

VI. Control Objectives: As in case of a high dividend pay-out ratio, the

retained earnings are insignificant, and the company will have to issue new

shares to raise funds to finance its future requirements. The control of the

existing shareholders will be diluted if they cannot buy the additional

shares issued by the company.

The types of dividend policy are as follows:

I. Regular Dividend Policy: Payment of dividend at the usual rate is termed

as regular dividend. The investors such as retired persons, widows and other

economically weaker persons prefer to get regular dividends.

II. Stable Dividend Policy: The term 'stability of dividends' means consistency

in the stream of dividend payments. In more precise terms, it means payment

of certain minimum amount of dividend regularly. A stable dividend policy

may be established in any of the following three forms:

a. Constant dividend per share

b. Constant payout ratio

c. Stable rupee dividend plus extra dividend

III. Irregular Dividend Policy: Some companies follow irregular dividend

payments on account of the following: (i) Uncertainty of earnings(ii)

Unsuccessful business operations(iii) Lack of liquid resources

IV. No Dividend Policy: A company can follow a policy of paying no dividends

presently because of its unfavorable working capital position or on account

of requirements of funds for future expansion and growth.

You might also like

- Accounting AssignmentDocument16 pagesAccounting AssignmentMIKASANo ratings yet

- Why Groups Struggle To Solve Problems TogetherDocument7 pagesWhy Groups Struggle To Solve Problems TogetherNilesh kumarNo ratings yet

- CSEC POA June 2003 P1 PDFDocument10 pagesCSEC POA June 2003 P1 PDFVernon White0% (1)

- David Wessels - Corporate Strategy and ValuationDocument26 pagesDavid Wessels - Corporate Strategy and Valuationesjacobsen100% (1)

- Foreign Currency ValuationDocument12 pagesForeign Currency ValuationAhmed ElhawaryNo ratings yet

- What Is Weighted Average Cost of CapitalDocument12 pagesWhat Is Weighted Average Cost of CapitalVïñü MNNo ratings yet

- Financial StatementDocument13 pagesFinancial StatementkeyurNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Building Brand Architecture AssignmentDocument3 pagesBuilding Brand Architecture AssignmentNilesh kumarNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Quiz - iCPADocument33 pagesQuiz - iCPAGizelle TaguasNo ratings yet

- Decathlon Sports India Pvt. Ltd. Proline India FILA IndiaDocument2 pagesDecathlon Sports India Pvt. Ltd. Proline India FILA IndiaNilesh kumarNo ratings yet

- Castrol India Limited An Innovative Distribution Channel: Submitted by Group 1, Section BDocument15 pagesCastrol India Limited An Innovative Distribution Channel: Submitted by Group 1, Section BNilesh kumarNo ratings yet

- Statement of Changes in EquityDocument24 pagesStatement of Changes in EquityChristine SalvadorNo ratings yet

- The cost of unused capacity is $10,000 (50,000 - 40,000 units x $2 POHRDocument80 pagesThe cost of unused capacity is $10,000 (50,000 - 40,000 units x $2 POHRCaila Joice FavorNo ratings yet

- Business Communication: AssignmentDocument21 pagesBusiness Communication: AssignmentNilesh kumarNo ratings yet

- Finance Management Notes MbaDocument12 pagesFinance Management Notes MbaSandeep Kumar SahaNo ratings yet

- Functions of Financial ManagementDocument5 pagesFunctions of Financial ManagementAthar KhanNo ratings yet

- Understanding Depreciation Expense and MethodsDocument52 pagesUnderstanding Depreciation Expense and MethodsPiyush Malhotra50% (2)

- Basics of Financial Management: Birla Institute of TechnologyDocument6 pagesBasics of Financial Management: Birla Institute of TechnologyNilesh kumarNo ratings yet

- Basics of Financial Management: Birla Institute of TechnologyDocument6 pagesBasics of Financial Management: Birla Institute of TechnologyNilesh kumarNo ratings yet

- Evaluate investment projects using IRR, NPV, payback periodDocument5 pagesEvaluate investment projects using IRR, NPV, payback periodNilesh kumarNo ratings yet

- DJMD SjdnajkDocument14 pagesDJMD Sjdnajksuhaib shaikhNo ratings yet

- Ais Bis C Is The Total Cash Flow During The Period After ADocument41 pagesAis Bis C Is The Total Cash Flow During The Period After AMamtaSharmaNo ratings yet

- Financial Management EssentialsDocument5 pagesFinancial Management EssentialsGaming with AyushNo ratings yet

- Chapter 9 Financial ManagementDocument29 pagesChapter 9 Financial ManagementAjay pandeyNo ratings yet

- Financial Management DPSDocument19 pagesFinancial Management DPSYashasviNo ratings yet

- MB0045 Financial Management: C C C CDocument10 pagesMB0045 Financial Management: C C C CDinesh Reghunath RNo ratings yet

- Financial Management: Investment, Financing and Dividend DecisionsDocument7 pagesFinancial Management: Investment, Financing and Dividend Decisionssonal2901No ratings yet

- MB0045 - Mba 2 SemDocument19 pagesMB0045 - Mba 2 SemacorneleoNo ratings yet

- Optimal Capital Structure Decisions for Maximizing Firm ValueDocument29 pagesOptimal Capital Structure Decisions for Maximizing Firm ValuesaravmbaNo ratings yet

- Cost of Capital NotesDocument9 pagesCost of Capital NotesSoumendra RoyNo ratings yet

- BITTTTDocument12 pagesBITTTTMohamed RaaziqNo ratings yet

- 12 Business Studies CH 09 Financial ManagementDocument6 pages12 Business Studies CH 09 Financial ManagementMeera TalrejaNo ratings yet

- Meaning of Financial ManagementDocument6 pagesMeaning of Financial ManagementMar JinitaNo ratings yet

- Cost of CapitalDocument12 pagesCost of CapitalMohamed RaaziqNo ratings yet

- Financial ManagementDocument49 pagesFinancial ManagementsatyavaniNo ratings yet

- Capital Structure Theories Explained in 40 CharactersDocument23 pagesCapital Structure Theories Explained in 40 CharactersAshutosh MohantyNo ratings yet

- Capital Budgeting Decisions ExplainedDocument9 pagesCapital Budgeting Decisions Explainedkurtieee21No ratings yet

- Financial ManagmentDocument34 pagesFinancial ManagmentDarsh AroraNo ratings yet

- Capital StructureDocument8 pagesCapital StructureAnanthakrishnan KNo ratings yet

- MB0045Document10 pagesMB0045Dinesh Reghunath RNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingTyjon RaaghavNo ratings yet

- FM Theory Meaning of Financial ManagementDocument10 pagesFM Theory Meaning of Financial ManagementDarshan MoreNo ratings yet

- Cash Flow of The Project: Whenever A Company Is Investing Huge Funds in An InvestmentDocument4 pagesCash Flow of The Project: Whenever A Company Is Investing Huge Funds in An InvestmentkeshavNo ratings yet

- Unit 5 Financial Management Complete NotesDocument17 pagesUnit 5 Financial Management Complete Notesvaibhav shuklaNo ratings yet

- MB20202 Corporate Finance Unit IV Study MaterialsDocument21 pagesMB20202 Corporate Finance Unit IV Study MaterialsSarath kumar CNo ratings yet

- Estimating Capital RequirementDocument7 pagesEstimating Capital RequirementVishwo ShresthaNo ratings yet

- Assignment On: Submitted ToDocument23 pagesAssignment On: Submitted ToMahmudul HasanNo ratings yet

- chp1 Financial ManagementDocument14 pageschp1 Financial ManagementHuda ShahNo ratings yet

- MB0045 - Financial ManagementDocument36 pagesMB0045 - Financial ManagementsatishdasariNo ratings yet

- Meaning of Financial ManagementDocument4 pagesMeaning of Financial ManagementchantieeeNo ratings yet

- Chapter 9 Financial ManagementDocument18 pagesChapter 9 Financial ManagementAshish GangwalNo ratings yet

- Nature and Scope of FinanceDocument52 pagesNature and Scope of FinanceangaNo ratings yet

- Name Harsha Registration / Roll No. Course Master of Business Administration (MBA) Subject Semester Semester 2 Subject NumberDocument20 pagesName Harsha Registration / Roll No. Course Master of Business Administration (MBA) Subject Semester Semester 2 Subject NumberKumar GauravNo ratings yet

- Mba Corporate FinanceDocument13 pagesMba Corporate FinanceAbhishek chandegraNo ratings yet

- Financial Management Guide: Investment, Financing and Dividend DecisionsDocument34 pagesFinancial Management Guide: Investment, Financing and Dividend DecisionsLatha VarugheseNo ratings yet

- Financial Management FundamentalsDocument14 pagesFinancial Management FundamentalsMuscle mindNo ratings yet

- NIBM ExamDocument9 pagesNIBM ExamRavi GurungNo ratings yet

- Assignment On: Submitted ToDocument22 pagesAssignment On: Submitted ToMahmudul HasanNo ratings yet

- FM Sheet 4 (JUHI RAJWANI)Document8 pagesFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNo ratings yet

- FM Material UNIT-IIDocument5 pagesFM Material UNIT-IIananthineevs7btsNo ratings yet

- Decision Areas in Financial ManagementDocument15 pagesDecision Areas in Financial ManagementSana Moid100% (3)

- Capital Budgeting TechniquesDocument11 pagesCapital Budgeting Techniquesnaqibrehman59No ratings yet

- Financial Management KangraDocument12 pagesFinancial Management Kangramanik_chand_patnaikNo ratings yet

- FM Reading MaterialDocument12 pagesFM Reading MaterialTaransh ANo ratings yet

- Every Company Is Required To Take Three Main Financial Decisions, They AreDocument5 pagesEvery Company Is Required To Take Three Main Financial Decisions, They Areroyette ladicaNo ratings yet

- Objectives of Financial PlanningDocument9 pagesObjectives of Financial Planning220479No ratings yet

- Master of Business Administration-MBA Semester 2 MB 0045/MBF 201 - FINANCIAL MANAGEMENT - 4 Credits (Book ID:B1628) Assignment Set - 1 (60 Marks)Document7 pagesMaster of Business Administration-MBA Semester 2 MB 0045/MBF 201 - FINANCIAL MANAGEMENT - 4 Credits (Book ID:B1628) Assignment Set - 1 (60 Marks)Vikas WaliaNo ratings yet

- Business Studies Class 12 Study Material Chapter 9Document17 pagesBusiness Studies Class 12 Study Material Chapter 9YashNo ratings yet

- Financial Management - Meaning, Objectives and Functions Meaning of Financial ManagementDocument6 pagesFinancial Management - Meaning, Objectives and Functions Meaning of Financial ManagementsupriyaswainNo ratings yet

- ECO Assignment - 1Document10 pagesECO Assignment - 1Nilesh kumarNo ratings yet

- ECO Assignment - 1Document10 pagesECO Assignment - 1Nilesh kumarNo ratings yet

- Applications of Inferential Statistics in Marketing ResearchDocument3 pagesApplications of Inferential Statistics in Marketing ResearchNilesh kumarNo ratings yet

- Where Do You See Yourself in 2 YearsDocument1 pageWhere Do You See Yourself in 2 YearsNilesh kumarNo ratings yet

- BC2 - AyushDocument2 pagesBC2 - AyushNilesh kumarNo ratings yet

- Business Communication: AssignmentDocument17 pagesBusiness Communication: AssignmentNilesh kumarNo ratings yet

- Organizational capabilities, competitive advantage, business strategiesDocument3 pagesOrganizational capabilities, competitive advantage, business strategiesNilesh kumarNo ratings yet

- Brand-PyramidDocument1 pageBrand-PyramidNilesh kumarNo ratings yet

- Affordable Sports Brands in India Focus on Quality, Comfort & StyleDocument2 pagesAffordable Sports Brands in India Focus on Quality, Comfort & StyleNilesh kumarNo ratings yet

- Understanding the law of supply and factors affecting supply curveDocument9 pagesUnderstanding the law of supply and factors affecting supply curveNilesh kumarNo ratings yet

- IntroductionDocument1 pageIntroductionNilesh kumarNo ratings yet

- Expressing Interest in a Job OpeningDocument1 pageExpressing Interest in a Job OpeningNilesh kumarNo ratings yet

- Tech MahindraDocument5 pagesTech MahindraNilesh kumarNo ratings yet

- Interpretations For RegressionDocument1 pageInterpretations For RegressionNilesh kumarNo ratings yet

- Organizational capabilities, competitive advantage, business strategiesDocument3 pagesOrganizational capabilities, competitive advantage, business strategiesNilesh kumarNo ratings yet

- Segmentation, Targeting and Positioning (STP) Model of ActivewearDocument1 pageSegmentation, Targeting and Positioning (STP) Model of ActivewearNilesh kumarNo ratings yet

- Case Material For The Mid-Term - To Be Shared With StudentsDocument6 pagesCase Material For The Mid-Term - To Be Shared With StudentsNilesh kumarNo ratings yet

- Multiple Regression Results in 40 CharactersDocument14 pagesMultiple Regression Results in 40 CharactersNilesh kumarNo ratings yet

- Multiple Regression Results in 40 CharactersDocument14 pagesMultiple Regression Results in 40 CharactersNilesh kumarNo ratings yet

- Interpretations For AnovaDocument1 pageInterpretations For AnovaNilesh kumarNo ratings yet

- Organizational Behaviour: AssignmentDocument14 pagesOrganizational Behaviour: AssignmentNilesh kumarNo ratings yet

- Multiple Regression Results in 40 CharactersDocument14 pagesMultiple Regression Results in 40 CharactersNilesh kumarNo ratings yet

- Business Communication: AssignmentDocument17 pagesBusiness Communication: AssignmentNilesh kumarNo ratings yet

- Understanding the law of supply and factors affecting supply curveDocument9 pagesUnderstanding the law of supply and factors affecting supply curveNilesh kumarNo ratings yet

- Chap 1-Cost Concepts, Cost Behaviour and Cost EstimationDocument38 pagesChap 1-Cost Concepts, Cost Behaviour and Cost EstimationAyeNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisyukiNo ratings yet

- BSBFIM601 Full Learner ResourceDocument130 pagesBSBFIM601 Full Learner ResourceJazz100% (1)

- Libby 10e Chap002 PPT AccessibleDocument47 pagesLibby 10e Chap002 PPT Accessible許妤君No ratings yet

- Statement of Financial Position GuideDocument8 pagesStatement of Financial Position GuideHLeigh Nietes-Gabutan100% (1)

- Business Math Unit 4Document16 pagesBusiness Math Unit 4allysaallysaNo ratings yet

- Chapter 1 Homework Assignment Fall 2018Document8 pagesChapter 1 Homework Assignment Fall 2018Marouf AlhndiNo ratings yet

- Statement of Cash Flow - OnlineDocument36 pagesStatement of Cash Flow - OnlineEvans Galista AHNo ratings yet

- Q Mar22Document9 pagesQ Mar22user mrmysteryNo ratings yet

- Catherine-: Thank You Miss Christal. So What Is Net Present ValueDocument4 pagesCatherine-: Thank You Miss Christal. So What Is Net Present Valueenircm etsomalNo ratings yet

- Financial Management - Exam 1Document7 pagesFinancial Management - Exam 1jozetteypilNo ratings yet

- Long Run Cost Output RelationsDocument19 pagesLong Run Cost Output Relationschadaram_hemchandNo ratings yet

- Conceptual Framework For Financial ReportingDocument2 pagesConceptual Framework For Financial Reportingangelinamaye99No ratings yet

- Brief Equity Research BurneaDocument14 pagesBrief Equity Research BurneaAlthea Louise PalacNo ratings yet

- Purchase Consideration - SolutionDocument16 pagesPurchase Consideration - Solutionsarthak mendirattaNo ratings yet

- Revista Economica Vol 4 2012Document677 pagesRevista Economica Vol 4 2012lucia_balanoiuNo ratings yet

- Excel File For Financial Ratio Activities UpdatedDocument4 pagesExcel File For Financial Ratio Activities Updated0a0lvbht4No ratings yet

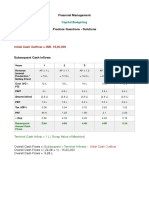

- Financial Management Capital Budgeting Practice Questions SolutionsDocument5 pagesFinancial Management Capital Budgeting Practice Questions SolutionsAnchit JassalNo ratings yet

- ch08 SolDocument18 pagesch08 SolJohn Nigz Payee50% (2)

- Consolidation Summary P&LDocument3 pagesConsolidation Summary P&LRah EelNo ratings yet

- 1.5.1 Productivity and Costs Practice ActivityDocument5 pages1.5.1 Productivity and Costs Practice ActivitystjepanNo ratings yet