Professional Documents

Culture Documents

5 Important Things Everyoneshouldknow About Retirement Income

5 Important Things Everyoneshouldknow About Retirement Income

Uploaded by

api-3543008880 ratings0% found this document useful (0 votes)

56 views1 page1) The traditional 4% withdrawal rule for retirement income no longer works due to low interest rates. A 2.8% withdrawal rate adjusted for 3% inflation provides a 90% chance of success.

2) Inflation is real and the Federal Reserve targets an inflation rate of 2% annually. A fixed level of income will not keep up with inflation over a long retirement.

3) The sequence of returns during retirement can significantly impact the longevity of savings. Withdrawing during market downturns can devastate retirement accounts. Careful planning of income withdrawals is important.

Original Description:

Original Title

5thingsyoushouldknowaboutretirementincome

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The traditional 4% withdrawal rule for retirement income no longer works due to low interest rates. A 2.8% withdrawal rate adjusted for 3% inflation provides a 90% chance of success.

2) Inflation is real and the Federal Reserve targets an inflation rate of 2% annually. A fixed level of income will not keep up with inflation over a long retirement.

3) The sequence of returns during retirement can significantly impact the longevity of savings. Withdrawing during market downturns can devastate retirement accounts. Careful planning of income withdrawals is important.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

56 views1 page5 Important Things Everyoneshouldknow About Retirement Income

5 Important Things Everyoneshouldknow About Retirement Income

Uploaded by

api-3543008881) The traditional 4% withdrawal rule for retirement income no longer works due to low interest rates. A 2.8% withdrawal rate adjusted for 3% inflation provides a 90% chance of success.

2) Inflation is real and the Federal Reserve targets an inflation rate of 2% annually. A fixed level of income will not keep up with inflation over a long retirement.

3) The sequence of returns during retirement can significantly impact the longevity of savings. Withdrawing during market downturns can devastate retirement accounts. Careful planning of income withdrawals is important.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

5 Im por t an t Th in gs

Ever yon e Sh ou ld Kn ow

Abou t Ret ir em en t In com e

1) 4% Ru le No Lon ger Wor k s

The experts at Morningstar now say:

2.8% withdrawal rate, adjusted for 3% inflation, can provide a 90% success in achieving their

retirement goal. With interest rates at historic lows, it is vital to review the level of income you

currently receive to protect your future income needs.

2) In f lat ion is Real

Inflation Is Part of the Federal Reserve?s Monetary Policy A January 25, 2012 press release from the

Board of Governors of the Federal Reserve stated:

?The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in

the price index for personal consumption expenditures, is most consistent over the longer run with

the Federal Reserve?s statutory mandate. Communicating this inflation goal clearly to the public

helps keep longer-term inflation expectations firmly anchored.?

Side note: A level income that never changes over time may not meet your needs in the future.

3) Sequ en ce of Ret u r n s Can Be a Killer

Five years of positive market returns and five years of negative returns will have the same outcome

if you reverse the numbers. However, if there is income being withdrawn, the results can be

devastating. Planning when to take income could be the most important decision of your retirement.

Taking income during a negative market correction could devastate your retirement nest egg.

4) Plan f or Lon gevit y

Thanks to a number of factors, people are living longer. In 1935 average life expectancy was 61.7

years today?s average life expectancy is 78.7 years. Those statics are based on life expectancy at

birth. What if you?re already 65? Did you know a 65 year old male today has an average life

expectancy 83? 65 year old females today have it even better with an average life expectancy of 85?

Planning for the long term is a crucial part of retirement planning. Retirement is a 20- to 30-year

marathon, not a 5-year sprint.

5) Addin g An An n u it y t o You r Por t f olio Can Lead t o Gr eat er Su ccess

By integrating an annuity to a portfolio can yield a 23% higher chance of maintaining retirement

distributions than using a traditional 50% equity 50% bond allocation. Not having a diverse portfolio

provides higher risk and is not suggested by experts.

Any one of the above mentioned retirement vehicles can serve as pitfalls and jeopardize your ability

to retire the way you expect. While they may not make you rich, our solutions can help maintain

your wealth.

Contact Us Today For Successful Retirement Income Planning.

You might also like

- Report - 9 Risks To RetirementDocument16 pagesReport - 9 Risks To RetirementSameer Rastogi100% (1)

- How Much Annual Income Can Your Retirement Portfolio Provide?Document4 pagesHow Much Annual Income Can Your Retirement Portfolio Provide?gvandykeNo ratings yet

- How Much Annual Income Can Your Retirement Portfolio Provide?Document4 pagesHow Much Annual Income Can Your Retirement Portfolio Provide?gvandykeNo ratings yet

- Date-5817046d152c43 42467409 PDFDocument13 pagesDate-5817046d152c43 42467409 PDFlowlyorphan7594No ratings yet

- Investing Conservatively in Retirement: Make Your Money Work for You (For the Middle Class)From EverandInvesting Conservatively in Retirement: Make Your Money Work for You (For the Middle Class)No ratings yet

- FMA - Tute 3 - Interest RateDocument3 pagesFMA - Tute 3 - Interest RateHà ĐàoNo ratings yet

- The Retirement Report October 2022Document9 pagesThe Retirement Report October 2022anna nerissa ayrosoNo ratings yet

- Retirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessFrom EverandRetirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessNo ratings yet

- 15-Minute Retirement Plan FINALDocument23 pages15-Minute Retirement Plan FINALUmar FarooqNo ratings yet

- Retirement Planning Basics: (Page 1 of 24)Document24 pagesRetirement Planning Basics: (Page 1 of 24)Goutam ReddyNo ratings yet

- Agile Portfolio 2Document9 pagesAgile Portfolio 2quantextNo ratings yet

- The Role of Inflation Linked Bonds in A Post Retirement SolutionDocument15 pagesThe Role of Inflation Linked Bonds in A Post Retirement SolutionnoisomeNo ratings yet

- BE Report - Ankita GuptaDocument2 pagesBE Report - Ankita GuptaVikas SumanNo ratings yet

- Can Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?From EverandCan Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?No ratings yet

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsFrom EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsNo ratings yet

- Summary of Charles Goodhart & Manoj Pradhan's The Great Demographic ReversalFrom EverandSummary of Charles Goodhart & Manoj Pradhan's The Great Demographic ReversalNo ratings yet

- Dr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryFrom EverandDr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryRating: 4 out of 5 stars4/5 (1)

- Finance and Investing for the Long Run: Investing for Young Adults to Make the Most of Their MoneyFrom EverandFinance and Investing for the Long Run: Investing for Young Adults to Make the Most of Their MoneyNo ratings yet

- Guide to Personal Financial Planning for the Armed ForcesFrom EverandGuide to Personal Financial Planning for the Armed ForcesNo ratings yet

- Standard of Living: Explain The Benefits of Financial Education?Document9 pagesStandard of Living: Explain The Benefits of Financial Education?NoreenNo ratings yet

- Series 4 5Document7 pagesSeries 4 5Jessica ClareNo ratings yet

- Mamas, Don't Let Your Babies Grow Up To Be Pension Fund ManagersDocument12 pagesMamas, Don't Let Your Babies Grow Up To Be Pension Fund Managersrichardck61No ratings yet

- National Retirement Risk IndexDocument7 pagesNational Retirement Risk IndexWBURNo ratings yet

- Applied Financial Macroeconomics and Investment Strategy: A Practitioner’s Guide to Tactical Asset AllocationFrom EverandApplied Financial Macroeconomics and Investment Strategy: A Practitioner’s Guide to Tactical Asset AllocationNo ratings yet

- Common Sense Retirement Planning: Home, Savings and InvestmentFrom EverandCommon Sense Retirement Planning: Home, Savings and InvestmentNo ratings yet

- IV Report For June 2015Document8 pagesIV Report For June 2015api-263983134No ratings yet

- Retirement Planning BasicsDocument24 pagesRetirement Planning BasicsJakeWillNo ratings yet

- How to Survive the Coming Retirement Storm: A Five-Step Process for Success in Volatile TimesFrom EverandHow to Survive the Coming Retirement Storm: A Five-Step Process for Success in Volatile TimesNo ratings yet

- Risk Less and Prosper: Your Guide to Safer InvestingFrom EverandRisk Less and Prosper: Your Guide to Safer InvestingRating: 3 out of 5 stars3/5 (4)

- ch4 5Document37 pagesch4 5BobNo ratings yet

- Ifp 22 Basics of Retirement PlanningDocument7 pagesIfp 22 Basics of Retirement Planningsachin_chawlaNo ratings yet

- How To Invest $100,000 Today - 5 Strategies Including The Near-Perfect Portfolio Strategy - Seeking AlphaDocument32 pagesHow To Invest $100,000 Today - 5 Strategies Including The Near-Perfect Portfolio Strategy - Seeking Alphanavpar21No ratings yet

- Handy Financial Tips Ebook EnglishDocument24 pagesHandy Financial Tips Ebook EnglishJPNo ratings yet

- Retirement PlanningDocument11 pagesRetirement PlanningIan Miles TakawiraNo ratings yet

- Five Debates Over Macroeconomic PolicyDocument27 pagesFive Debates Over Macroeconomic Policyayushmehar22No ratings yet

- Retirement PlanDocument96 pagesRetirement PlanAmrin ChaudharyNo ratings yet

- The World Needs Further Monetary Ease, Not An Early ExitDocument38 pagesThe World Needs Further Monetary Ease, Not An Early ExitZerohedgeNo ratings yet

- Retirement Planning Month at Investment-Mantra - In: Best Pension Plans 1 Crore Life InsuranceDocument6 pagesRetirement Planning Month at Investment-Mantra - In: Best Pension Plans 1 Crore Life InsuranceMansoor AhmedNo ratings yet

- Should My Asset Allocation Include My Pension and Social Security?From EverandShould My Asset Allocation Include My Pension and Social Security?No ratings yet

- The 4% Rule and Safe Withdrawal Rates in Retirement: Financial Freedom for Smart PeopleFrom EverandThe 4% Rule and Safe Withdrawal Rates in Retirement: Financial Freedom for Smart PeopleRating: 5 out of 5 stars5/5 (5)

- ANALYZEDocument3 pagesANALYZEPeng GuinNo ratings yet

- Gaurav Sharma: Curriculum VitaeDocument2 pagesGaurav Sharma: Curriculum Vitaejassi7nishadNo ratings yet

- Activity 1.1 The Twin ParadoxDocument1 pageActivity 1.1 The Twin ParadoxBlessed May PastranaNo ratings yet

- Ay - 2022-2023 Constitution and BylawsDocument14 pagesAy - 2022-2023 Constitution and BylawsThe Voice of the SierraNo ratings yet

- Bilingual Education in The 21thDocument5 pagesBilingual Education in The 21thToni SoaresNo ratings yet

- Investments and Risks For Sustainable Development - Curs ASEDocument280 pagesInvestments and Risks For Sustainable Development - Curs ASEluiza StefNo ratings yet

- The Prophetic Speculations of DG and OthersDocument119 pagesThe Prophetic Speculations of DG and OthersJuan P. QuirósNo ratings yet

- SnehatanishkapaperDocument6 pagesSnehatanishkapaperbooklifenyNo ratings yet

- BASF Senergy System Overview Platinum Ci Stucco PlusDocument4 pagesBASF Senergy System Overview Platinum Ci Stucco Plusjohn fontillasNo ratings yet

- Ingress Protection - IP Ratings - Fans & MotorsDocument6 pagesIngress Protection - IP Ratings - Fans & MotorsAmirmasoudNo ratings yet

- Comparative Superlative Reading ActivityDocument2 pagesComparative Superlative Reading ActivityAnonymous cHvjDH0ONo ratings yet

- De Dap An HSG Tieng Anh Hai DuongDocument7 pagesDe Dap An HSG Tieng Anh Hai DuongLan PhạmNo ratings yet

- Dell™ Latitude™ D600 Service Manual: Notes, Notices, and CautionsDocument43 pagesDell™ Latitude™ D600 Service Manual: Notes, Notices, and Cautionspuppix 4uNo ratings yet

- Alan Kay - How To Invent The Future PDFDocument76 pagesAlan Kay - How To Invent The Future PDFVladNo ratings yet

- Differentiation ToolboxDocument9 pagesDifferentiation Toolboxapi-247367783No ratings yet

- Test Bank For Experiencing Intercultural Communication An Introduction 7th Edition Judith Martin Thomas Nakayama Full DownloadDocument19 pagesTest Bank For Experiencing Intercultural Communication An Introduction 7th Edition Judith Martin Thomas Nakayama Full Downloadaaronwarrenpgozeainyq100% (18)

- Primer On Probation Parole and Exec Clemency ApprovedDocument2 pagesPrimer On Probation Parole and Exec Clemency ApprovedMinerva LopezNo ratings yet

- Nclex RN ResearchDocument24 pagesNclex RN ResearchGloria JaisonNo ratings yet

- Harden, 2004Document5 pagesHarden, 2004DanielNo ratings yet

- A Beginner To SchoologyDocument17 pagesA Beginner To Schoologynuar65No ratings yet

- Chapter 16 Polynomial RingsDocument8 pagesChapter 16 Polynomial RingsWinda DwiNo ratings yet

- Good Design and Bad Design (Software Engeneering)Document5 pagesGood Design and Bad Design (Software Engeneering)ozila jazzNo ratings yet

- 10 Oraciones AfirmativasDocument5 pages10 Oraciones AfirmativasBrenda GonzalezNo ratings yet

- HJR 192Document2 pagesHJR 192Sue Rhoades100% (14)

- Information Systems Page 2Document39 pagesInformation Systems Page 2Maria Fatima AlambraNo ratings yet

- Opinion Essay: Paragraph 1 Paragraph 2 Paragraph 3 Paragraph 4Document2 pagesOpinion Essay: Paragraph 1 Paragraph 2 Paragraph 3 Paragraph 4Andrea RubioNo ratings yet

- Study Material 12TH Biology 2023-24Document90 pagesStudy Material 12TH Biology 2023-24Ayush Sharma100% (1)

- 1k Manual PDFDocument33 pages1k Manual PDFJamal Omar100% (2)

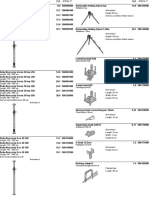

- Manitou Mi 15 18 20 25 30 35 Series Repair Manual - 647364enDocument23 pagesManitou Mi 15 18 20 25 30 35 Series Repair Manual - 647364entinatrujillo250186xtn100% (69)

- Dokaflex 1-2-4Document3 pagesDokaflex 1-2-4minagf2007No ratings yet

- El Chapo Sidebar Conference About Juror Issue 01Document10 pagesEl Chapo Sidebar Conference About Juror Issue 01Conrado Gonzalo Garcia JaminNo ratings yet