Professional Documents

Culture Documents

Fin 103 Quiz 1

Uploaded by

Nicole AnditCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin 103 Quiz 1

Uploaded by

Nicole AnditCopyright:

Available Formats

Republic of the Philippines

BATANGAS STATE UNIVERSITY

COLLEGE OF ACCOUNTANCY BUSINESS ECONOMICS AND

INTERNATIONAL HOSPITALITY MANAGEMENT

CITE Building, Pablo Borbon Main 1, Rizal Avenue, Batangas City

QUIZ 1

FIN 103 – FINANCIAL MANAGEMENT 2

General Direction: Box your final answers. Make sure your final answers are written in ink.

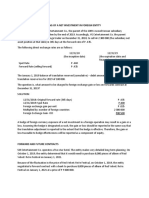

Question 1:

As Chief Financial Officer of the Uptown Service Corporation (USC), you are considering a

recapitalization plan that would convert USC from its current all-equity capital structure to one including

substantial financial leverage. USC now has 150,000 shares of common stock outstanding, which are

selling for ₱80.00 each, and the recapitalization proposal is to issue ₱6,000,000 worth of long-term debt

at an interest rate of 7.0 percent and use the proceeds to repurchase 75,000 shares of common stock worth

₱6,000,000. USC’s earnings next year will depend on the state of the economy. If there is normal growth,

EBIT will be ₱1,200,000. EBIT will be ₱600,000 if there is a recession and EBIT will be ₱1,800,000 if

there is an economic boom. You believe that each economic outcome is equally likely. Assume there are

no market frictions such as corporate or personal income taxes.

a. Calculate the number of shares outstanding and per-share for USC if the proposed recapitalization

is adopted.

b. Calculate the earnings per share (EPS) and return on equity for USC shareholders under all three

economic outcomes (recession, normal growth and boom), for both the current all-equity

capitalization and the proposed mixed debt/equity capital structure.

c. Calculate the break-even level of EBIT where earnings per share for USC stockholders are the

same under the current and proposed capital structures.

d. At what level of EBIT will USC shareholders earn zero EPS under the current and the proposed

capital structures?

Question 2:

An unlevered company operates in perfect markets and has net operating income (EBIT) of ₱2,000,000.

Assume that the required return on assets for firms in this industry is 8 percent and that the firm issues

₱10 million worth of debt with a required return of 6.5 percent and uses the proceeds to repurchase

outstanding stock. There are no corporate or personal taxes.

a. What is the market value and required return of this firm’s stock before the repurchase

transaction, according to M&M Proposition I?

b. What is the market value and required return of this firm’s remaining stock after the repurchase

transaction according to M&M Proposition II?

Question 3:

You are the manager of a financially distressed corporation with ₱10 million in debt outstanding that will

mature in one month. Your firm currently has ₱7 million cash on hand. Assume that you are offered the

opportunity to invest in either of the two projects described below.

Project 1: the opportunity to invest ₱7 million in risk-free Treasury bills, with a 4 percent annual interest

rate (or a 0.333% per month interest rate)

Project 2: a high-risk gamble, which will pay off ₱12 million in one month if successful (probability =

0.25), but will only pay ₱4,000,000 if unsuccessful (probability = 0.75)

a. Compute the expected payoff for each project, and state which one you would adopt if you were

operating the firm in the shareholders’ best interests? Why?

b. Which project would you accept if the firm was unlevered? Why?

c. Which project would you accept if the company was organized as a partnership rather than a

corporation? Why?

You might also like

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- FM 2 - Midterm ExamDocument5 pagesFM 2 - Midterm ExamNANNo ratings yet

- HO No. 3 - Working Capital ManagementDocument2 pagesHO No. 3 - Working Capital ManagementGrace Chavez ManaliliNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementSanna KazmiNo ratings yet

- Homework Exercises - 9 AnswersDocument9 pagesHomework Exercises - 9 AnswersLương Thế CườngNo ratings yet

- Part 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyDocument22 pagesPart 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyDanna Karen MallariNo ratings yet

- Homework 1Document3 pagesHomework 1lizhikunNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsDocument7 pagesACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsRiri FahraniNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela: Activity #6Document2 pagesPamantasan NG Lungsod NG Valenzuela: Activity #6VickyNo ratings yet

- ACF 103 Exam Revision Qns 20151Document5 pagesACF 103 Exam Revision Qns 20151Riri FahraniNo ratings yet

- Multiple-Choice Quiz: Chapter 1: The Role of Financial ManagementDocument26 pagesMultiple-Choice Quiz: Chapter 1: The Role of Financial ManagementSindo Jack100% (1)

- File MB0045 Financial Management SolvedDocument28 pagesFile MB0045 Financial Management SolvedSebastian TaraoNo ratings yet

- Capital Structure: Questions and ExercisesDocument4 pagesCapital Structure: Questions and ExercisesLinh HoangNo ratings yet

- Tche 303 - Money and Banking Tutorial Assignment 6Document3 pagesTche 303 - Money and Banking Tutorial Assignment 6Tường ThuậtNo ratings yet

- U7 Case Analysis A8Document3 pagesU7 Case Analysis A8ScribdTranslationsNo ratings yet

- Managerial Economics 3rd Assignment Bratu Carina Maria WORDDocument5 pagesManagerial Economics 3rd Assignment Bratu Carina Maria WORDCarina MariaNo ratings yet

- Chapter OneDocument5 pagesChapter OneHazraphine LinsoNo ratings yet

- CH17Document7 pagesCH17mnbzxcpoiqweNo ratings yet

- Financial Management ExerciseDocument2 pagesFinancial Management ExerciseGede Tristan Desirata RamaNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementellaNo ratings yet

- 61Fin2Fim - Financial Management Tutorial 9 - Capital BudgetingDocument7 pages61Fin2Fim - Financial Management Tutorial 9 - Capital BudgetingThuỳ PhạmNo ratings yet

- Theory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™Document6 pagesTheory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™jezNo ratings yet

- Tutorial Questions Spring 2014Document13 pagesTutorial Questions Spring 2014lalaran123No ratings yet

- CF Week9 Seminar3Document4 pagesCF Week9 Seminar3KesyadwikaNo ratings yet

- AFM (NEW) Fall. 2013Document3 pagesAFM (NEW) Fall. 2013Muhammad KhanNo ratings yet

- Accounting Textbook Solutions - 39Document19 pagesAccounting Textbook Solutions - 39acc-expert0% (1)

- Problems and QuestionsDocument5 pagesProblems and Questionsmashta04No ratings yet

- Review Questions - 1Document3 pagesReview Questions - 1nlNo ratings yet

- FMA - Tute 10 - Dividend PolicyDocument3 pagesFMA - Tute 10 - Dividend PolicyPhuong VuongNo ratings yet

- MAS2 - 08 Capital Structure and Long-Term Financial DecisionsDocument3 pagesMAS2 - 08 Capital Structure and Long-Term Financial DecisionsBianca IyiyiNo ratings yet

- Answer The Following QuestionsDocument8 pagesAnswer The Following QuestionsTaha Wael QandeelNo ratings yet

- 4 - 16 - Capital StructureDocument2 pages4 - 16 - Capital StructurePham Ngoc VanNo ratings yet

- INTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterDocument12 pagesINTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterRenalyn ParasNo ratings yet

- MBA Exam 1 Spring 2009Document12 pagesMBA Exam 1 Spring 2009Kamal AssafNo ratings yet

- Iefinmt Reviewer For Quiz (#2) : I. IdentificationDocument9 pagesIefinmt Reviewer For Quiz (#2) : I. IdentificationpppppNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Finman CH 18 SolmanDocument32 pagesFinman CH 18 SolmanJoselle Jan Claudio100% (1)

- Q & A (Acca Certifr) Mohammd MagdyDocument49 pagesQ & A (Acca Certifr) Mohammd MagdyalshmymrynayfNo ratings yet

- Tutorial 8Document2 pagesTutorial 8Sean AustinNo ratings yet

- Tute 10 PDFDocument3 pagesTute 10 PDFRony RahmanNo ratings yet

- Coursework 2-Corporate FinanceDocument4 pagesCoursework 2-Corporate Financeyitong zhangNo ratings yet

- Dividends and Other PayoutsDocument3 pagesDividends and Other PayoutsLinh HoangNo ratings yet

- FM2 Câu hỏi ôn tậpDocument7 pagesFM2 Câu hỏi ôn tậpĐoàn Trần Ngọc AnhNo ratings yet

- Chapter 3 Financial AnalysisDocument58 pagesChapter 3 Financial Analysismarjorie acibar0% (1)

- 06 Current Assets ManagementDocument2 pages06 Current Assets ManagementQamber AbbasNo ratings yet

- Wiley - Practice Exam 1 With SolutionsDocument10 pagesWiley - Practice Exam 1 With SolutionsIvan Bliminse80% (5)

- Chapter 3 Financial AnalysisDocument59 pagesChapter 3 Financial AnalysisRegina De LunaNo ratings yet

- 11 MODULE 3 For AE 19Document26 pages11 MODULE 3 For AE 19Yvonne Marie DavilaNo ratings yet

- MAN 321 Corporate Finance Final Examination: Fall 2001Document8 pagesMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNo ratings yet

- FalseDocument13 pagesFalseJoel Christian MascariñaNo ratings yet

- FINC 302 Assignment 3 FinalDocument4 pagesFINC 302 Assignment 3 FinalMary AmoNo ratings yet

- Financial Management AssignmentDocument3 pagesFinancial Management AssignmentHamza FayyazNo ratings yet

- FM Assignment1 - Vikin Jain - EPGP-15A-100Document4 pagesFM Assignment1 - Vikin Jain - EPGP-15A-100Vikin JainNo ratings yet

- Financial Management McqsDocument17 pagesFinancial Management McqsKofi AsaaseNo ratings yet

- Workshop2 SEOsDocument5 pagesWorkshop2 SEOsriyat0601No ratings yet

- Solutions Corporate FinanceDocument28 pagesSolutions Corporate FinanceUsman UddinNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and Exercisesmin - radiseNo ratings yet

- Finance Chapter 15Document34 pagesFinance Chapter 15courtdubs100% (1)

- Distributions To Shareholders: Dividends and Repurchases: Batangas State UniversityDocument41 pagesDistributions To Shareholders: Dividends and Repurchases: Batangas State UniversityNicole AnditNo ratings yet

- Review Critics About The International Trade of The Philippines-2019Document3 pagesReview Critics About The International Trade of The Philippines-2019Nicole AnditNo ratings yet

- Fin 103 Quiz 1Document1 pageFin 103 Quiz 1Nicole AnditNo ratings yet

- Capital Structure.1Document95 pagesCapital Structure.1Nicole AnditNo ratings yet

- Assign 1Document1 pageAssign 1Nicole AnditNo ratings yet

- Audit Prob ReceivablesDocument30 pagesAudit Prob ReceivablesMagnana Kaw81% (21)

- ACC514 Long Quiz 1Document1 pageACC514 Long Quiz 1Nicole AnditNo ratings yet

- Financial Management 102Document3 pagesFinancial Management 102Nicole AnditNo ratings yet

- Financial Management 102Document3 pagesFinancial Management 102Nicole AnditNo ratings yet

- Distributions To Shareholders: Dividends and Repurchases: Batangas State UniversityDocument41 pagesDistributions To Shareholders: Dividends and Repurchases: Batangas State UniversityNicole AnditNo ratings yet

- AISDocument3 pagesAISNicole AnditNo ratings yet

- Capital Structure.1Document95 pagesCapital Structure.1Nicole AnditNo ratings yet

- Audit Prob ReceivablesDocument30 pagesAudit Prob ReceivablesMagnana Kaw81% (21)

- Audit Prob ReceivablesDocument30 pagesAudit Prob ReceivablesMagnana Kaw81% (21)

- Assign 1Document1 pageAssign 1Nicole AnditNo ratings yet

- Statement of Management'S Responsibility For Financial StatementsDocument2 pagesStatement of Management'S Responsibility For Financial StatementsNicole AnditNo ratings yet

- J.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页Document85 pagesJ.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页HungNo ratings yet

- S&P Global-Long-Road-To-Recovery-Coronavirus-Lessons-From-Supply-Chain-And-Financial-Data PDFDocument30 pagesS&P Global-Long-Road-To-Recovery-Coronavirus-Lessons-From-Supply-Chain-And-Financial-Data PDFturbbbNo ratings yet

- Ch. 14 Payout PolicyDocument68 pagesCh. 14 Payout PolicyRiyan DarmawanNo ratings yet

- CASE 17: Dell's Working Capital: Financial Management AssignmentDocument8 pagesCASE 17: Dell's Working Capital: Financial Management AssignmentAamir KhanNo ratings yet

- TN40 MoGen IncDocument29 pagesTN40 MoGen Inc__myself50% (4)

- Corporate Governance MBA (1.5) EDocument2 pagesCorporate Governance MBA (1.5) EshafiqkhanNo ratings yet

- MaDocument7 pagesMaamitdharamsiNo ratings yet

- Bed Bath Beyond The Capital Structure Decision PDFDocument14 pagesBed Bath Beyond The Capital Structure Decision PDFDaniel MedeirosNo ratings yet

- CF Chap 4 MultipleDocument22 pagesCF Chap 4 MultipleĐào Thị Thùy TrangNo ratings yet

- Chapter 3 - ĐTTCDocument22 pagesChapter 3 - ĐTTCvân huỳnhNo ratings yet

- 2022 Full Annual ReportDocument234 pages2022 Full Annual ReportJ Pierre RicherNo ratings yet

- TCS Financial AnalysisDocument5 pagesTCS Financial AnalysisREVATHI NAIRNo ratings yet

- Boyar's Intrinsic Value Research Forgotten FourtyDocument49 pagesBoyar's Intrinsic Value Research Forgotten FourtyValueWalk100% (1)

- SFM Theorey Notes by Ankur MittalDocument73 pagesSFM Theorey Notes by Ankur MittalAnkur MittalNo ratings yet

- Alluvial Capital Management Q4 2022 Letter To PartnersDocument9 pagesAlluvial Capital Management Q4 2022 Letter To PartnersChristopher CardonaNo ratings yet

- Ey Capital Allocation StrategyDocument16 pagesEy Capital Allocation StrategyNicolás Galavis VelandiaNo ratings yet

- Apple: Corporate Governance and Stock Buyback: Company OverviewDocument11 pagesApple: Corporate Governance and Stock Buyback: Company OverviewKania BilaNo ratings yet

- RIL Annual Report 2013Document228 pagesRIL Annual Report 2013Amar ItagiNo ratings yet

- Dividends and Other PayoutsDocument26 pagesDividends and Other Payoutsmger2000No ratings yet

- Introduction To Valuation: Case: Liston Mechanics CorporationDocument9 pagesIntroduction To Valuation: Case: Liston Mechanics CorporationKunal MehtaNo ratings yet

- Advanced Corporate Finance Chapter 19Document35 pagesAdvanced Corporate Finance Chapter 19laurenNo ratings yet

- Warren E Buffett 2008 CaseDocument9 pagesWarren E Buffett 2008 CaseAnuj Kumar GuptaNo ratings yet

- Chapter 4 Share CapitalDocument208 pagesChapter 4 Share CapitalAkash MalikNo ratings yet

- Assignment 7 FinanceDocument3 pagesAssignment 7 FinanceAhmedNo ratings yet

- Phan Tich Tai ChinhDocument16 pagesPhan Tich Tai Chinhbo noloveNo ratings yet

- Accounting Worksheet 2Document34 pagesAccounting Worksheet 2Roseline SibekoNo ratings yet

- Full Collection Nomad LettersDocument225 pagesFull Collection Nomad Letterstanmay100% (1)

- Analysis of Dividend PolicyDocument33 pagesAnalysis of Dividend Policytaijulshadin100% (3)

- The NSE RuleBook 2015Document400 pagesThe NSE RuleBook 2015Johnson OdoNo ratings yet

- OS Report On Caterpillar - IncDocument40 pagesOS Report On Caterpillar - IncAkshay BondNo ratings yet