Professional Documents

Culture Documents

Coulson Industries Sample Probs

Uploaded by

Arkei Fortaleza0 ratings0% found this document useful (0 votes)

27 views1 pageCoulson Industries, a defense contractor, is developing a cash budget for the last quarter of the year. They forecast sales of $400,000, $300,000, and $200,000 for October, November, and December respectively. They will also receive a $30,000 dividend in December. Purchases are estimated to be 70% of sales, with payment terms of 10% immediately, 70% the following month, and 20% in two months. Coulson has regular monthly expenses including $5,000 rent, $8,000 in salaries, and 10% of monthly sales in additional wages. They must pay $25,000 in taxes and $10,000 in interest in December,

Original Description:

Sample Problem

Original Title

COULSON-INDUSTRIES-SAMPLE-PROBS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCoulson Industries, a defense contractor, is developing a cash budget for the last quarter of the year. They forecast sales of $400,000, $300,000, and $200,000 for October, November, and December respectively. They will also receive a $30,000 dividend in December. Purchases are estimated to be 70% of sales, with payment terms of 10% immediately, 70% the following month, and 20% in two months. Coulson has regular monthly expenses including $5,000 rent, $8,000 in salaries, and 10% of monthly sales in additional wages. They must pay $25,000 in taxes and $10,000 in interest in December,

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views1 pageCoulson Industries Sample Probs

Uploaded by

Arkei FortalezaCoulson Industries, a defense contractor, is developing a cash budget for the last quarter of the year. They forecast sales of $400,000, $300,000, and $200,000 for October, November, and December respectively. They will also receive a $30,000 dividend in December. Purchases are estimated to be 70% of sales, with payment terms of 10% immediately, 70% the following month, and 20% in two months. Coulson has regular monthly expenses including $5,000 rent, $8,000 in salaries, and 10% of monthly sales in additional wages. They must pay $25,000 in taxes and $10,000 in interest in December,

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

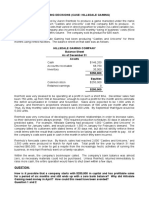

Cash Planning: Cash Budgets

An Example: Coulson Industries

CASH RECEIPTS: Coulson Industries, a defense contractor, is developing a cash

budget for October, November, and December. Coulson’s sales in August and

September were $100,000 and $200,000, respectively. Sales of $400,000,

$300,000, and $200,000 have been forecast for October, November, and

December, respectively. Historically, 20% of the firm’s sales have been for cash,

50% have generated accounts receivable collected after 1 month, and the

remaining 30% have generated accounts receivable collected after 2 months. Bad-

debt expenses (uncollectible accounts) have been negligible. In December, the firm

will receive a $30,000 dividend from stock in a subsidiary.

CASH DISBURSEMENTS: Coulson Company has also gathered the relevant

information for the development of a cash disbursement schedule. Purchases will

represent 70% of sales—10% will be paid immediately in cash, 70% is paid the

month following the purchase, and the remaining 20% is paid two months

following the purchase. The firm will also spend cash on rent, wages and salaries,

taxes, capital assets, interest, dividends, and a portion of the principal on its loans.

The resulting disbursement schedule thus follows.

Rent payments Rent of $5,000 will be paid each month.

Wages and salaries Fixed salaries for the year are $96,000, or $8,000 per month.

In addition, wages are estimated as 10% of monthly sales.

Tax payments Taxes of $25,000 must be paid in December.

Fixed-asset outlays New machinery costing $130,000 will be purchased and paid

for in November.

Interest payments An interest payment of $10,000 is due in December.

Cash dividend payments Cash dividends of $20,000 will be paid in October.

Principal payments (loans) A $20,000 principal payment is due in December.

You might also like

- Should My Asset Allocation Include My Pension and Social Security?From EverandShould My Asset Allocation Include My Pension and Social Security?No ratings yet

- Prepare Cash BudgetDocument1 pagePrepare Cash BudgetHassan ShahidNo ratings yet

- Cash BudgetDocument1 pageCash BudgetRizzalyn EstrellaNo ratings yet

- Lahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18Document2 pagesLahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18SinpaoNo ratings yet

- Af 311 Exam ReviewDocument10 pagesAf 311 Exam ReviewTedy MuliyaNo ratings yet

- Managing Tools ActivityDocument3 pagesManaging Tools ActivityCristelyn TomasNo ratings yet

- Cash Planning ExerciseDocument2 pagesCash Planning ExerciseRaniel PamatmatNo ratings yet

- Cash BudgetDocument17 pagesCash BudgetElle RaineNo ratings yet

- CH 11 - Smartbook Accounting 201Document6 pagesCH 11 - Smartbook Accounting 201Gene'sNo ratings yet

- BudgetingDocument9 pagesBudgetingshobi_300033% (3)

- Answer The Following Questions Very CarefullyDocument2 pagesAnswer The Following Questions Very CarefullyMaham ImtiazNo ratings yet

- AccountingDocument14 pagesAccountingDavid DavidNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- As A Preliminary To Requesting Budget Estimates of SalesDocument4 pagesAs A Preliminary To Requesting Budget Estimates of SalesChiodos OliverNo ratings yet

- Cash BudetDocument1 pageCash BudetHasan JamilNo ratings yet

- Cost and Management Accounting II AssignmentDocument8 pagesCost and Management Accounting II AssignmentbetsegawabebeaNo ratings yet

- Cash BudgetDocument3 pagesCash BudgetJann Kerky0% (1)

- Study Guide Chap 10Document33 pagesStudy Guide Chap 10taimoormalikNo ratings yet

- ExercisesDocument2 pagesExercisesMuhammad Aiman Md NorNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash Equivalentsiraleigh17No ratings yet

- Semi Detailed Lesson Plan For Grade 12 StudentsDocument4 pagesSemi Detailed Lesson Plan For Grade 12 StudentsPrecious Grace Vecina50% (2)

- Ch15 Managing Current Assets - Part2Document38 pagesCh15 Managing Current Assets - Part2Khalil AbdoNo ratings yet

- Cost II Chap3Document11 pagesCost II Chap3abelNo ratings yet

- 6e Brewer CH07 B EOCDocument20 pages6e Brewer CH07 B EOCLiyanCenNo ratings yet

- F3 Final Mock 2Document8 pagesF3 Final Mock 2Nicat IsmayıloffNo ratings yet

- Chapter 4 Payroll StudentDocument12 pagesChapter 4 Payroll StudentAmaa AmaaNo ratings yet

- ACC300 Principles of AccountingDocument11 pagesACC300 Principles of AccountingG JhaNo ratings yet

- Asignación 4 LSFPDocument3 pagesAsignación 4 LSFPElia SantanaNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- Chapter 07 1a EocDocument11 pagesChapter 07 1a EocAshish BhallaNo ratings yet

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesNo ratings yet

- Cash Flows, Financial Planning and BudgetingDocument34 pagesCash Flows, Financial Planning and BudgetingKarl LuzungNo ratings yet

- Acc102 W4Document26 pagesAcc102 W4Moheb RefaatNo ratings yet

- Loblaw Manufacturing Has Asked You To Create A Cash BudgetDocument1 pageLoblaw Manufacturing Has Asked You To Create A Cash BudgetLet's Talk With HassanNo ratings yet

- Chapter08 ProblemDocument12 pagesChapter08 ProblemArjit AgarwalNo ratings yet

- Cash BudgetingDocument14 pagesCash BudgetingJo Ryl100% (1)

- Accmana Exercise Master Budget AY 2016Document2 pagesAccmana Exercise Master Budget AY 2016NaomiGeronimoNo ratings yet

- Kelifa CH 3Document16 pagesKelifa CH 3yoftahe habtamuNo ratings yet

- Lab-Current LiabilitiesDocument5 pagesLab-Current LiabilitiesPatrick HarponNo ratings yet

- Working Capital Management Part 2Document23 pagesWorking Capital Management Part 2Phill SamonteNo ratings yet

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNo ratings yet

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- Chapter 3 - ProblemsDocument2 pagesChapter 3 - ProblemsLayla MainNo ratings yet

- Cash Budgeting TutorialDocument4 pagesCash Budgeting Tutorialmichellebaileylindsa100% (1)

- Chapter 4 and Other Questions Chapters 1 To 5Document8 pagesChapter 4 and Other Questions Chapters 1 To 5Beatrice BallabioNo ratings yet

- Current LiabilityDocument38 pagesCurrent LiabilityRamadhani FirmansyahNo ratings yet

- 2008-11-06 154427 Marsh CompanyDocument8 pages2008-11-06 154427 Marsh CompanyDavid David100% (1)

- 6 BudgetingDocument2 pages6 BudgetingClyette Anne Flores BorjaNo ratings yet

- Hillsdale Gaming Case AnalysisDocument2 pagesHillsdale Gaming Case AnalysisIan Grey100% (7)

- Cash BudgetDocument3 pagesCash Budgetmanoj kumarNo ratings yet

- CH 3 Current - Liabilities - & - PayrollDocument17 pagesCH 3 Current - Liabilities - & - Payrolladdisyawkal18No ratings yet

- 2019 June 23 ACT 701 Chapter 3 Problems and SolutionDocument21 pages2019 June 23 ACT 701 Chapter 3 Problems and SolutionZisanNo ratings yet

- Hampton Machine Tool CoDocument13 pagesHampton Machine Tool CoArdi del Rosario100% (12)

- CMA MCQ Self Entrance-1Document2 pagesCMA MCQ Self Entrance-1Ava DasNo ratings yet

- Cases For Session 11 & 12Document8 pagesCases For Session 11 & 12Kevin Mclean0% (2)

- ARP New FormatDocument1 pageARP New FormatArkei FortalezaNo ratings yet

- Profile ResultsDocument2 pagesProfile ResultsArkei FortalezaNo ratings yet

- Call Numbers Format NewDocument2 pagesCall Numbers Format NewArkei FortalezaNo ratings yet

- Concepcion: THE SPANISH PERIOD (1605 - 1892)Document15 pagesConcepcion: THE SPANISH PERIOD (1605 - 1892)Arkei FortalezaNo ratings yet

- Plant Nutrition Is The Study of The: Emanuel EpsteinDocument24 pagesPlant Nutrition Is The Study of The: Emanuel EpsteinArkei FortalezaNo ratings yet

- Assessment of CSR DELA CRUZ GILDADocument2 pagesAssessment of CSR DELA CRUZ GILDAArkei FortalezaNo ratings yet

- Customer Satisfaction: Submitted To: Jasper YauderDocument10 pagesCustomer Satisfaction: Submitted To: Jasper YauderArkei FortalezaNo ratings yet

- Ways and Means of Promoting Ethical Behavior Within The Organization in Relation To The Outside WorldDocument2 pagesWays and Means of Promoting Ethical Behavior Within The Organization in Relation To The Outside WorldArkei FortalezaNo ratings yet

- Corporate Social Responsibility (CSR) Can Be Described As Embracing Responsibility andDocument2 pagesCorporate Social Responsibility (CSR) Can Be Described As Embracing Responsibility andArkei FortalezaNo ratings yet

- What Are The Main Types of Depreciation Methods?Document8 pagesWhat Are The Main Types of Depreciation Methods?Arkei Fortaleza100% (1)

- Concepts of Corporate Social ResponsibilityDocument1 pageConcepts of Corporate Social ResponsibilityArkei FortalezaNo ratings yet

- Narrative Report Mas 4 Group 4Document9 pagesNarrative Report Mas 4 Group 4Arkei FortalezaNo ratings yet

- Appendix A Letter of PermissionDocument9 pagesAppendix A Letter of PermissionArkei Fortaleza0% (2)

- ReferencesDocument3 pagesReferencesArkei Fortaleza100% (1)

- Advanced Accounting Baker Test Bank - Chap019Document82 pagesAdvanced Accounting Baker Test Bank - Chap019donkazotey100% (2)

- Your Enemy Has Been Slain: The Effects of Playing Mobile Legends To The Behavior of Junior High School StudentsDocument11 pagesYour Enemy Has Been Slain: The Effects of Playing Mobile Legends To The Behavior of Junior High School StudentsArkei Fortaleza100% (1)

- Letter of PermissionDocument4 pagesLetter of PermissionArkei FortalezaNo ratings yet