Professional Documents

Culture Documents

IT - Learning Module - Tax Accounting Periods and Methods PDF

Uploaded by

Airon BendañaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT - Learning Module - Tax Accounting Periods and Methods PDF

Uploaded by

Airon BendañaCopyright:

Available Formats

LEARNING MODULE ON TAX ACCOUNTING PERIODS AND METHODS

I. Learning Objectives

A. Content Standards The students demonstrate an understanding on the tax accounting periods and methods

B. Performance Standards Prepare a comprehensive statement of income and expenses (generally the income tax return) for

an annual accounting period

C. Learning Competencies/Objectives Preparing a statement of income and expenses (generally the income tax return) for an annual

accounting period

Familiarize with the procedure of preparing a statement of income and expenses (generally

the income tax return) for an annual accounting period

II. Content Tax Accounting Periods and Methods

III. Learning Resources 1. Index for Income Tax

(https://www/bir.gov.ph/index.php/tax-information/income -tax-html)

2. 12 Reminders for Annual Income Tax Preparation in the Philippines

(https://dacpa.ph/?p=356)

IV. Learning Procedures/Activities Discussion (Online Reference/Resources)

V. Evaluation/Assessment Problem Sets

Discussion Problems/Written Works

Prepared:

ARJAY OCAMPO SERRANO, MBA

College Instructor

You might also like

- Income Tax LawDocument947 pagesIncome Tax LawHardik Chauhan100% (3)

- Financial Accounting and Reporting Learning ModulesDocument126 pagesFinancial Accounting and Reporting Learning ModulesLovelyn Joy Solutan100% (2)

- The Budget-Building Book for Nonprofits: A Step-by-Step Guide for Managers and BoardsFrom EverandThe Budget-Building Book for Nonprofits: A Step-by-Step Guide for Managers and BoardsNo ratings yet

- PSA - Financial AccountingDocument684 pagesPSA - Financial Accountingredwan99983% (6)

- Reaction Paper Panic: The Untold Story of 2008financial CrisisDocument1 pageReaction Paper Panic: The Untold Story of 2008financial CrisisAiron BendañaNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document19 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella67% (3)

- Adacuna DLP Fabm1 WK2 June 19, 2017 Branches of AccountingDocument4 pagesAdacuna DLP Fabm1 WK2 June 19, 2017 Branches of AccountingALMA ACUNANo ratings yet

- ELEMENTS OF BOOK-KEEPING II EditedDocument150 pagesELEMENTS OF BOOK-KEEPING II EditedGifty Asuquo100% (1)

- Lesson 1Document7 pagesLesson 1Dindin Oromedlav LoricaNo ratings yet

- Lesson Guide in Fundamentals of Accountancy, Business and Management June 19, 2019 I. ObjectivesDocument3 pagesLesson Guide in Fundamentals of Accountancy, Business and Management June 19, 2019 I. ObjectivesGlaiza Dalayoan FloresNo ratings yet

- Financial Accounting PDFDocument684 pagesFinancial Accounting PDFImtiaz Rashid91% (11)

- September 2 2019Document3 pagesSeptember 2 2019Vinza AcobNo ratings yet

- ACC 12 - Entrepreneurial Accounting Course Study GuideDocument66 pagesACC 12 - Entrepreneurial Accounting Course Study GuideHannah Jean MabunayNo ratings yet

- A Lesson Plan in BookkeepingDocument4 pagesA Lesson Plan in Bookkeepingdolores100% (9)

- Module 1 Packet: College OF CommerceDocument14 pagesModule 1 Packet: College OF CommerceCJ GranadaNo ratings yet

- F3 BPP NotesDocument476 pagesF3 BPP NotesMonique HoNo ratings yet

- Lesson PlanDocument4 pagesLesson PlanJhinete Rizada EstoyNo ratings yet

- Intermediate Course Study Material: TaxationDocument27 pagesIntermediate Course Study Material: TaxationBharath WajNo ratings yet

- BSC Accounting and Finance - Intermediate Financial AccountingDocument4 pagesBSC Accounting and Finance - Intermediate Financial AccountingEverjoice ChatoraNo ratings yet

- Principles of Financial Accounting 1Document6 pagesPrinciples of Financial Accounting 1Amonie ReidNo ratings yet

- Course Guide For Simplified Accounting For Entrepreneurs & Professionals (Safe&P)Document7 pagesCourse Guide For Simplified Accounting For Entrepreneurs & Professionals (Safe&P)Darwin Dionisio ClementeNo ratings yet

- Fabm1 - DLLDocument7 pagesFabm1 - DLLAmur Jessica FuentesNo ratings yet

- Course Handout: Reference Books Author /publication Edition &yearDocument6 pagesCourse Handout: Reference Books Author /publication Edition &yearBALRAJ ARORANo ratings yet

- RPS - Akuntansi International - Id.enDocument9 pagesRPS - Akuntansi International - Id.enVanilla ClairNo ratings yet

- 1.IT - Learning Module - Inclusions and Exclusions of Gross IncomeDocument1 page1.IT - Learning Module - Inclusions and Exclusions of Gross IncomeAiron BendañaNo ratings yet

- Intermediate Course Study Material: TaxationDocument31 pagesIntermediate Course Study Material: Taxationtauseefalam917No ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document20 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Blecemie MonteraNo ratings yet

- October 16,2017Document3 pagesOctober 16,2017April Joy Lascuña - CailoNo ratings yet

- 46430bosinter p4 Seca Mod1initDocument24 pages46430bosinter p4 Seca Mod1initbahubali jainNo ratings yet

- Intermediate Course Study Material: TaxationDocument34 pagesIntermediate Course Study Material: TaxationMd IbrarNo ratings yet

- Toaz - Info Ae 17 m8 Cash Amp Accrual Basis PRDocument15 pagesToaz - Info Ae 17 m8 Cash Amp Accrual Basis PRloyd smithNo ratings yet

- Lesson Plan FABMDocument2 pagesLesson Plan FABMAaron Christian San JoseNo ratings yet

- Financial Accounting: Instructor: Sílvia CortêsDocument4 pagesFinancial Accounting: Instructor: Sílvia CortêsJose RodriguesNo ratings yet

- ACC203Document7 pagesACC203waheedahmedarainNo ratings yet

- Financial ReportingDocument3 pagesFinancial Reportinggembel mlithiNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeDocument16 pagesFundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeGladys Angela ValdemoroNo ratings yet

- Module 1 ICT 141 Module 1: Definition of AccountingDocument4 pagesModule 1 ICT 141 Module 1: Definition of AccountingJanice SeterraNo ratings yet

- Atg Acctg 2Document8 pagesAtg Acctg 2Christine Marie ViscaynoNo ratings yet

- DCP Financial AccountingDocument9 pagesDCP Financial AccountingIntekhab AslamNo ratings yet

- City University of Hong Kong Course Syllabus Offered by Department of Accountancy With Effect From Semester A 2017/18Document5 pagesCity University of Hong Kong Course Syllabus Offered by Department of Accountancy With Effect From Semester A 2017/18aaaNo ratings yet

- DLP Entrep Jan 15Document1 pageDLP Entrep Jan 15Anna Liza LimNo ratings yet

- Week 15 LC 14Document4 pagesWeek 15 LC 14Jemar AlipioNo ratings yet

- Module 4 Packet: College OF CommerceDocument18 pagesModule 4 Packet: College OF CommerceCJ GranadaNo ratings yet

- Outline 2021Document2 pagesOutline 2021clementNo ratings yet

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- I208 GP235 Financial ManagmentDocument3 pagesI208 GP235 Financial Managmentleo rojasNo ratings yet

- Next Page - Next Page - Next PageDocument3 pagesNext Page - Next Page - Next PageHannah AdellitNo ratings yet

- Course OutlineDocument16 pagesCourse OutlinereaderNo ratings yet

- Acct 462 ComDocument265 pagesAcct 462 ComdemolaojaomoNo ratings yet

- MC Course Guide OBE Basic AccountingDocument4 pagesMC Course Guide OBE Basic AccountingJoanna Rose ParaisoNo ratings yet

- Syllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021Document10 pagesSyllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021SYED HUSSAINNo ratings yet

- K17405ca CĐTT Phan Nguyen Tường VyDocument31 pagesK17405ca CĐTT Phan Nguyen Tường VyPhước NguyễnNo ratings yet

- Poa Scheme of Work - September To December 2020 (Form 4)Document8 pagesPoa Scheme of Work - September To December 2020 (Form 4)pratibha jaggan martinNo ratings yet

- Syllabus Mba Accounting 2012Document4 pagesSyllabus Mba Accounting 2012Marko RisticNo ratings yet

- 01 Inetial PagesDocument33 pages01 Inetial PagesTushar RathiNo ratings yet

- Bos 41987 in It PagesDocument17 pagesBos 41987 in It PagesAnju TresaNo ratings yet

- Accounting Manual and Computerised 5 N1348Document15 pagesAccounting Manual and Computerised 5 N1348RichardNo ratings yet

- MBA4807 Module Overview 2024 FinalDocument20 pagesMBA4807 Module Overview 2024 FinalKatlego MonyaeNo ratings yet

- MIT SW No. 5Document4 pagesMIT SW No. 5Airon BendañaNo ratings yet

- ISOMPDFDocument7 pagesISOMPDFAiron BendañaNo ratings yet

- Scheduling Information System OperationsDocument3 pagesScheduling Information System OperationsAiron BendañaNo ratings yet

- Information Systems HardwareDocument3 pagesInformation Systems HardwareAiron BendañaNo ratings yet

- Information Systems HardwareDocument3 pagesInformation Systems HardwareAiron BendañaNo ratings yet

- Mit Quiz#123Document2 pagesMit Quiz#123Airon BendañaNo ratings yet

- Question N AreDocument6 pagesQuestion N AreAiron BendañaNo ratings yet

- Scheduling Information System OperationsDocument3 pagesScheduling Information System OperationsAiron BendañaNo ratings yet

- Question N AreDocument6 pagesQuestion N AreAiron BendañaNo ratings yet

- MIT SW No. 5Document4 pagesMIT SW No. 5Airon BendañaNo ratings yet

- Information Systems HardwareDocument3 pagesInformation Systems HardwareAiron BendañaNo ratings yet

- Mit Quiz#123Document2 pagesMit Quiz#123Airon BendañaNo ratings yet

- Information Systems HardwareDocument3 pagesInformation Systems HardwareAiron BendañaNo ratings yet

- ISOMPDFDocument7 pagesISOMPDFAiron BendañaNo ratings yet

- Diluted-Earnings-Per-Share-Intermediate Accounting 3 ValixDocument1 pageDiluted-Earnings-Per-Share-Intermediate Accounting 3 ValixAiron Bendaña0% (1)

- Information Systems HardwareDocument3 pagesInformation Systems HardwareAiron BendañaNo ratings yet

- Scheduling Information System OperationsDocument3 pagesScheduling Information System OperationsAiron BendañaNo ratings yet

- NOTESPROJMANDocument2 pagesNOTESPROJMANAiron BendañaNo ratings yet

- Information Systems HardwareDocument3 pagesInformation Systems HardwareAiron BendañaNo ratings yet

- Financial Crisis PDFDocument5 pagesFinancial Crisis PDFAiron BendañaNo ratings yet

- Diluted-Earnings-Per-Share-Intermediate Accounting 3 ValixDocument1 pageDiluted-Earnings-Per-Share-Intermediate Accounting 3 ValixAiron Bendaña0% (1)

- Intermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11Document1 pageIntermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11Airon BendañaNo ratings yet

- Project AccloudtantDocument5 pagesProject AccloudtantAiron BendañaNo ratings yet

- Pigeon InfoDocument2 pagesPigeon InfoAiron BendañaNo ratings yet

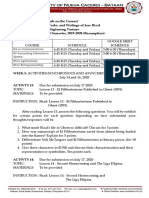

- El Filibusterismo Published in Ghent (1891) : The Life, Works, and Writings of Jose Rizal Activity 13Document3 pagesEl Filibusterismo Published in Ghent (1891) : The Life, Works, and Writings of Jose Rizal Activity 13Airon BendañaNo ratings yet

- University of Nueva Caceres-Bataan: 19 Century Philippines As Rizal's ContextDocument23 pagesUniversity of Nueva Caceres-Bataan: 19 Century Philippines As Rizal's ContextAiron BendañaNo ratings yet

- Personal Vision StatementDocument2 pagesPersonal Vision StatementAiron BendañaNo ratings yet

- Introduction To Management: UNIT-1Document5 pagesIntroduction To Management: UNIT-1Airon BendañaNo ratings yet

- WEEK 5 ACTIVITY July 14 & 16, 2020Document2 pagesWEEK 5 ACTIVITY July 14 & 16, 2020Airon BendañaNo ratings yet