Professional Documents

Culture Documents

Letter To BEZA For Duty Clarification

Uploaded by

Md SelimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter To BEZA For Duty Clarification

Uploaded by

Md SelimCopyright:

Available Formats

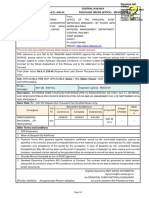

Ref.

Mango/BEZA/80

June 14, 2020

The Manager

One Stop Services (OSS)

Bangladesh Economic Zone Authority (BEZA)

Prime Minister’s Office

Government of the People’s Republic of Bangladesh

Monem Business District (Level-12)

111 CR Datta Road, Dhaka,Bangladesh

Subject: Request for issuing a guideline on custom charges on capital machineries.

Dear Sir,

We are thankful to you for allotting 100 acre land for implementing the first Electric Vehicle (EV) automobile

manufacturing project at Feni-Mirsorai Special Economic Zone (SEZ) of BEZA.

We have issued LC to import capital machineries. The shipment is expected to be arrived by July 2020. We

understand that there may not be custom duty (CD), regulatory duty (RD), supplementary duty (SD), VAT, AT,

AIT or any other charges on capital machinery. There are specific SROs by NBR and by BEZA too. (attached).

While going through all of the SROs, we became confused whether we won’t have to pay above mentioned

duty, vat & taxes or not. We are also unsure whether we need to apply to BEZA or NBR to get exemption

certificate.

In this context, we would like to request you to provide us a comprehensive guideline on;

1) Whether we need to pay CD, RD, SD, VAT, AT AIT or any other charges to custom while importing

capital machineries.

2) Whether we need to apply to BEZA or NBR or any specific authority to get exemption.

Thank you very much and appreciate your cooperation. We hope that with your cordial support we can

implement the project in shortest possible time and to add significant value in nation’s economic development.

Sincerely yours

A Mannan Khan

Chairman

Enclosure:

1) SRO no 209

2) SRO no 239

3) SRO no 210

4) SRO no 121

5) General order no 46/2020/Customs

6) SRO no 205

7) SRO no 257

8) SRO no 213

You might also like

- Aid for Trade in Asia and the Pacific: Leveraging Trade and Digital Agreements for Sustainable DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Leveraging Trade and Digital Agreements for Sustainable DevelopmentNo ratings yet

- CA Inter Taxation Question BankDocument425 pagesCA Inter Taxation Question BankvisshelpNo ratings yet

- CA Inter Tax RTP May22Document26 pagesCA Inter Tax RTP May22karnimasoni12No ratings yet

- Paper 4Document426 pagesPaper 4Henry RobinsonNo ratings yet

- Budget Analysis-2012 IndiaDocument27 pagesBudget Analysis-2012 IndiaDimple GohilNo ratings yet

- Other Prepaid Exepenses-31-12-2021Document6 pagesOther Prepaid Exepenses-31-12-2021Venkata Sivaram GM - Accounts & Finance - Kanakadurga FinanceNo ratings yet

- Proposal For Custom Clearance FOR ENERGAS LNG TERMINALDocument8 pagesProposal For Custom Clearance FOR ENERGAS LNG TERMINALAsadNo ratings yet

- 13 - 38223327102780 CR BhuswalDocument3 pages13 - 38223327102780 CR BhuswalAbhishek DahiyaNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- E-Way Bill System 02Document1 pageE-Way Bill System 02Krishna Nand SinghNo ratings yet

- TDS TRS GST (2) 20211228151919Document38 pagesTDS TRS GST (2) 20211228151919Rishi PriyadarshiNo ratings yet

- By Damodar Agrawal & Associates: Damodar06@yahoo - Co.inDocument374 pagesBy Damodar Agrawal & Associates: Damodar06@yahoo - Co.inNiteshNo ratings yet

- EPCES Mail - Inputs Revived From The EPCES Members For Amendment in Rules To Facilitate Integration of Customs Operation From SEZ PortalDocument2 pagesEPCES Mail - Inputs Revived From The EPCES Members For Amendment in Rules To Facilitate Integration of Customs Operation From SEZ Portalsuresh kumarNo ratings yet

- Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 160Document3 pagesMrunal's Economy Pillar#2B: Budget Revenue Part: Page 160Washim Alam50CNo ratings yet

- ICICI Bank - 1Document2 pagesICICI Bank - 1UmangNo ratings yet

- Endorsement For Policy Number: 5117904118 Vehicle Number: Fbb2261RDocument5 pagesEndorsement For Policy Number: 5117904118 Vehicle Number: Fbb2261RMohd IsaNo ratings yet

- Tax Card 2020-21 PDFDocument18 pagesTax Card 2020-21 PDFkashansajjadNo ratings yet

- Idt AacDocument177 pagesIdt AacVinay KumarNo ratings yet

- MSCPL Profile FinalDocument81 pagesMSCPL Profile FinalCA Ratan MoondraNo ratings yet

- Are You GST Ready WWW - SimpletaxindiaDocument140 pagesAre You GST Ready WWW - SimpletaxindiaJeethender Kummari KuntaNo ratings yet

- Tax May 22 RTPDocument26 pagesTax May 22 RTPShailjaNo ratings yet

- Research Paper On SEZDocument6 pagesResearch Paper On SEZyogeshshukla.ys14No ratings yet

- Costing G10 QuestionDocument6 pagesCosting G10 QuestionVishal Kumar 5504No ratings yet

- Nepal Budget Highlights - 79-80 - APM & AssociatesDocument89 pagesNepal Budget Highlights - 79-80 - APM & Associatesaasthapoddar155No ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaMayank GoelNo ratings yet

- Finance Bill 2012 - Major Issues and ChallengesDocument8 pagesFinance Bill 2012 - Major Issues and ChallengesNehaNo ratings yet

- GST Times - Vol.1, Issue-3Document22 pagesGST Times - Vol.1, Issue-3Milna JosephNo ratings yet

- A Govt CompanyDocument6 pagesA Govt Companyabhiramreddy3No ratings yet

- CBDT Issued Revised TDS Rate Chart As Applicable For F.Y. 2020-21 W.E.F May 14, 2020 - A2Z Taxcorp LLPDocument11 pagesCBDT Issued Revised TDS Rate Chart As Applicable For F.Y. 2020-21 W.E.F May 14, 2020 - A2Z Taxcorp LLPpriserve acc4No ratings yet

- GST Chart Book by CA Pranav ChandakDocument54 pagesGST Chart Book by CA Pranav ChandakAman AhujaNo ratings yet

- Memo On Sticker System 2020Document1 pageMemo On Sticker System 2020Anonymous yisZNKXNo ratings yet

- Government of Pakistan Revenue Division Federal Board of Revenue Inland RevenueDocument1 pageGovernment of Pakistan Revenue Division Federal Board of Revenue Inland RevenueAbdul HafeezNo ratings yet

- FAQ's On TCS For Outbound Tour Packages - February'23Document9 pagesFAQ's On TCS For Outbound Tour Packages - February'23Vinay KumarNo ratings yet

- Zanzibar Connections Co. LTD: Invoice Summary For TRA PurposeDocument1 pageZanzibar Connections Co. LTD: Invoice Summary For TRA PurposemaibackupimaliNo ratings yet

- Exemption Certificate Top Link Upto Dec 2020Document1 pageExemption Certificate Top Link Upto Dec 2020khawarNo ratings yet

- Intouch Issue 3 2022Document21 pagesIntouch Issue 3 2022Shermadurai VNo ratings yet

- PC Chart Book + Revision Videos On Youtube Guaranteed SuccessDocument48 pagesPC Chart Book + Revision Videos On Youtube Guaranteed SuccessPallab BaruahNo ratings yet

- 1BZA - How To Set Up CargoWise For Customs Messaging in South AfricaDocument13 pages1BZA - How To Set Up CargoWise For Customs Messaging in South AfricaThabo KholoaneNo ratings yet

- Taxes Relevant To TransportationDocument15 pagesTaxes Relevant To TransportationPrateek AggarwalNo ratings yet

- Statement of Account 259440729204Document5 pagesStatement of Account 259440729204Gangadhar GujjalapudiNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaNanduri RamaraoNo ratings yet

- Presentation+ +Manish+ShahDocument106 pagesPresentation+ +Manish+ShahAtul PatelNo ratings yet

- E-Way Bill System Eway Bill No 8213 9518 9383Document2 pagesE-Way Bill System Eway Bill No 8213 9518 9383abhishek.sharma120000No ratings yet

- Consoritum Opinion T.ALAMDocument9 pagesConsoritum Opinion T.ALAMSaiefAhmadNo ratings yet

- Tax Laws Indirect Taxes For December 2020 ExamDocument54 pagesTax Laws Indirect Taxes For December 2020 ExamHasnainNo ratings yet

- Taxation in SA 2009 2008 - 09pdfDocument132 pagesTaxation in SA 2009 2008 - 09pdfvikramaditya_n84No ratings yet

- GST FrameworkDocument21 pagesGST FrameworkExecutive EngineerNo ratings yet

- Budget 19-20 - ARU Advisers PDFDocument3 pagesBudget 19-20 - ARU Advisers PDFDevil KingNo ratings yet

- Paper-2 International Tax Practice-NOV 20Document22 pagesPaper-2 International Tax Practice-NOV 20dhawaljaniNo ratings yet

- IT Return Extension Expected Till 15 DecemberDocument8 pagesIT Return Extension Expected Till 15 DecemberMuhammad Wisal AhmedNo ratings yet

- 01 Circuler Round Up For January 2020Document8 pages01 Circuler Round Up For January 2020Rabab RazaNo ratings yet

- Information in Respect of Central Excise (Petroleum)Document4 pagesInformation in Respect of Central Excise (Petroleum)Bbc1994216No ratings yet

- 08 - LH221098100573 SCR SecundrabadDocument2 pages08 - LH221098100573 SCR SecundrabadAbhishek DahiyaNo ratings yet

- F6 Tech Bid Final TRSDocument119 pagesF6 Tech Bid Final TRSindramaniNo ratings yet

- Foreign Trade Policy: A Brief UnderstandingDocument76 pagesForeign Trade Policy: A Brief UnderstandingMilna JosephNo ratings yet

- Siam Indian Auto IndustryDocument40 pagesSiam Indian Auto IndustryAtul BansalNo ratings yet

- Flash NewsDocument3 pagesFlash Newslingesh1892No ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiahhhhhhhuuuuuyyuyyyyyNo ratings yet

- Inter GST Chart Book Nov2022Document41 pagesInter GST Chart Book Nov2022Aastha ChauhanNo ratings yet

- BD Finance Act 2022 Key SummariesDocument29 pagesBD Finance Act 2022 Key SummariesMd SelimNo ratings yet

- Evsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document15 pagesEvsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Md SelimNo ratings yet

- CL Suggested Ans - Nov Dec 2019 PDFDocument63 pagesCL Suggested Ans - Nov Dec 2019 PDFMd SelimNo ratings yet

- Handbook of VATDocument66 pagesHandbook of VATMd SelimNo ratings yet