Professional Documents

Culture Documents

Rizal Technological University: Actual Cost Std. Cost Actual Cost STD, Cost

Uploaded by

Andrew Miguel SantosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rizal Technological University: Actual Cost Std. Cost Actual Cost STD, Cost

Uploaded by

Andrew Miguel SantosCopyright:

Available Formats

RIZAL TECHNOLOGICAL UNIVERSITY

Boni Ave., Mandaluyong City

College of Business and Entrepreneurial Technology

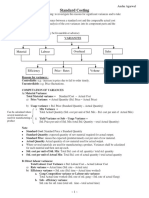

STRATEGIC COST ACCOUNTING Variance Analysis – is the difference between the

standard cost and actual cost.

Name: Santos, Andrew Miguel L.

Section: CBET-01-401A Actual cost > Std. Cost Actual Cost < Std, Cost

Date: June 13, 2020

Unfavorable (debit Favorable (credit var.)

var.)

STANDARD COSTING AND VARIANCE Added to the COGS Deducted to COGS

ANALYSIS

Actions to DIRECT MATERIAL VARIANCES

Plan implement Results

plan Case 1: where actual qty.purchased = actual qty. used

Actual Standard

Comparison AQ x AP AQ x SP SQ x SP

of actual and

Evaluation planned

results

DM price variance DM qty. variance

Figure 1.1

SQ can be computed as = actual production x std.

Planning Stage – connotes the starting point of qty. per unit.

setting standard costs.

- Therefore, what is Standard costs?

Case 2: where actual qty. purchased. ≠ actual qty

Standard costs – is a predetermined costs of used

production that should be attained under

condition. Actual Standard

AQ x AP AQ(P) x SP AQ(U)xSP SQ x SP

Comparison of planned and actual results – this

phase results to variance.

- Why there is a variance? DM price variance DM qty. variance

Because there is a concept about

MANAGEMENT BY EXCEPTION where the

DIRECT LABOR VARIANCES

management is giving attention only to those

situations in which LARGE VARIANCES - It is the same template for CASE 1 but change the

occur. (Whether favorable or unfavorable) AQ with AH (Actual Hour), AP to AR (Actual Rate),

SQ to SH (Standard Hour) and SP to SR (Standard

Rate). The difference between ACTUAL and (AH x

(The said topic will focus merely in Variance SR) is called DL Rate Variance. The difference

Analysis because it is the core of this topic.) between STANDARD and (AH x SR) is DL

Efficiency Variance.

RIZAL TECHNOLOGICAL UNIVERSITY

Boni Ave., Mandaluyong City

College of Business and Entrepreneurial Technology

MIX AND YIELD VARIANCES

Sub variances of DM qty. variances and DL Std. Hrs = Actual production x Std. hr. per unit

efficiency var.

Actual

3 Way Analysis

AQ x AP

DM price

variance Actual

AQ x SP AH x AR

DM mix

variance BAAH (Budgeted Spending

AQ x WASP DM qty. variance Allowed for Actual Hrs. Variance

DM yield

Standard variance Budgeted Fixed OH (NC x SR)

SQ x SP Variable OH (AH x Std. VOH Rate)

BASH (Budgeted Efficiency

WASP (Weighted Average Std. Price) Allowed for Std. Hrs. Variance

- Total Std. Cost / Total Std. Qty Budgeted Fixed OH (NC x SR)

OVERHEAD VARIANCES Variable OH (SH x Std. VOH Rate)

Volume

There is 2 way, 3 way and 4 way to account overhead Standard Variance

variances. The reason for that said ways to account SH x SR

overhead variances is because of UNSATISFIED

MANAGEMENT without comparison.

4 Way Analysis

2 Way Analysis

Variable Overhead

Actual

AH x AR Actual Budgeted Standard

AH x AR AH x S.(VOH)Rate SH x Std.(VOH)Rate

BASH (Budgeted Controllable

Allowance Std. Hrs) Variance

Spending Efficiency

Budgeted Fixed OH (NC x SR) Variance Variance

Variable (SH x Std. (VOH) rate)

Volume

Standard Variance Fixed Overhead

SH x SR Actual Budgeted Standard

AH x AR NC x S.(Fixed)Rate SH x Std.(F)Rate

Where:

Spending Volume

NC= is NORMAL CAPACITY

Variance Variance

Actual – fixed and variable is combined

You might also like

- Pantene Case StudyDocument21 pagesPantene Case StudyMuhammad AreebNo ratings yet

- IM Test-BankDocument20 pagesIM Test-BankHoàng TrâmNo ratings yet

- MS 8904 - Standard Costing Variance AnalysisDocument7 pagesMS 8904 - Standard Costing Variance Analysisxara mizpahNo ratings yet

- MAS-04 Standard Costing and Variance Analysis - 1Document11 pagesMAS-04 Standard Costing and Variance Analysis - 1Krizza MaeNo ratings yet

- Chapter 9 Standard Costing - SynopsisDocument8 pagesChapter 9 Standard Costing - SynopsissajedulNo ratings yet

- VADILAL Marketing Report1Document56 pagesVADILAL Marketing Report1shobhit0% (2)

- Financial Accounting Script PDFDocument82 pagesFinancial Accounting Script PDFQ YvonneNo ratings yet

- 9004 - HandoutsDocument7 pages9004 - HandoutsSirNo ratings yet

- MAS-42G (Standard Costing With GP Variance Analysis)Document14 pagesMAS-42G (Standard Costing With GP Variance Analysis)Bernadette PanicanNo ratings yet

- Mas 1.2.3 Assessment For-PostingDocument7 pagesMas 1.2.3 Assessment For-PostingJustine CruzNo ratings yet

- Afm102 Exam Aid FinalDocument128 pagesAfm102 Exam Aid FinalFernando III PerezNo ratings yet

- Mas 07Document14 pagesMas 07Christine Jane AbangNo ratings yet

- STCM06 Standard CostingDocument31 pagesSTCM06 Standard Costingdin matanguihanNo ratings yet

- Standard Costing & VariancesDocument3 pagesStandard Costing & VariancesKristel Faye CruzNo ratings yet

- Lecture Notes - Chapter 6Document3 pagesLecture Notes - Chapter 6Saint BakemonoNo ratings yet

- 5-Standard Costing and GP Variance AnalysisDocument16 pages5-Standard Costing and GP Variance AnalysisMelybelle LaurelNo ratings yet

- Summary Standard CostingDocument2 pagesSummary Standard CostingMaria Callista LovinaNo ratings yet

- Chapter - 12 Advanced VariancesDocument27 pagesChapter - 12 Advanced Variancesthakkert25No ratings yet

- Standard Costs and VariancesDocument41 pagesStandard Costs and VariancesnathalieroseNo ratings yet

- CH 10 and 10C - CLASS NOTES - MOS 3370 - KINGS - FALL 2023-2Document32 pagesCH 10 and 10C - CLASS NOTES - MOS 3370 - KINGS - FALL 2023-2niweisheng28No ratings yet

- 3-Variance Analysis & Performance MeasurementsDocument1 page3-Variance Analysis & Performance MeasurementsDana Beatrice RoqueNo ratings yet

- Standard Costs1 - 220421 - 150152Document3 pagesStandard Costs1 - 220421 - 150152Joesan GonzalesNo ratings yet

- Module 005 Standard CostingDocument12 pagesModule 005 Standard CostinggagahejuniorNo ratings yet

- CH 10 NotesDocument13 pagesCH 10 NotesmohamedNo ratings yet

- 06 Standard Costing PDFDocument5 pages06 Standard Costing PDFMarielle CastañedaNo ratings yet

- Standard Costing and Variance Analysis As Applied ToDocument39 pagesStandard Costing and Variance Analysis As Applied TorhearomefranciscoNo ratings yet

- ACCT 2200 - Chapter 9Document26 pagesACCT 2200 - Chapter 9afsdasdf3qf4341f4asDNo ratings yet

- Variance Analysis - Basic Formulas: 1) Material, Labour, Variable Overhead VariancesDocument3 pagesVariance Analysis - Basic Formulas: 1) Material, Labour, Variable Overhead VariancesAslam SiddiqNo ratings yet

- Standard Costing Standard Costing: A Managerial Control ToolDocument8 pagesStandard Costing Standard Costing: A Managerial Control ToolTrine De LeonNo ratings yet

- MAS 2 - Standard CostingDocument13 pagesMAS 2 - Standard CostingLovely Mae Lariosa100% (1)

- Standard CostingDocument10 pagesStandard Costingdharmendraparwar24No ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija Talipan100% (1)

- Handout SCM 2305Document10 pagesHandout SCM 2305Carl Felix Sumalinog NaynayNo ratings yet

- Standard CostingDocument99 pagesStandard CostingcaironsalamNo ratings yet

- Standard Costing & Variance AnalysisDocument10 pagesStandard Costing & Variance AnalysisMariella Antonio-NarsicoNo ratings yet

- File To MailDocument9 pagesFile To MailPrateek SaxenaNo ratings yet

- Standard CostingDocument12 pagesStandard CostingJana Trina LibatiqueNo ratings yet

- Advanced VariancesDocument7 pagesAdvanced Variancesthakkert25No ratings yet

- Standard CostingDocument15 pagesStandard CostingPADMAVATHI UNo ratings yet

- 09 Standard CostingDocument5 pages09 Standard CostingabcdefgNo ratings yet

- Chapter 6 (Standard Cost)Document98 pagesChapter 6 (Standard Cost)annur azalillahNo ratings yet

- Standard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eDocument46 pagesStandard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eEinstein SalcedoNo ratings yet

- Chap 10Document4 pagesChap 10Thuỳ Tiên NguyễnNo ratings yet

- Cost Variance FormulasDocument1 pageCost Variance FormulasESTALLO JENICA MAENo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- Formula List of Basic Variance PDFDocument4 pagesFormula List of Basic Variance PDFShi Yan LNo ratings yet

- MGMT 027 Chapter 10Document99 pagesMGMT 027 Chapter 10Ramil ElambayoNo ratings yet

- 02 Abdul Qodir Standart1Document27 pages02 Abdul Qodir Standart1abdul qodirNo ratings yet

- Formulas in CostDocument3 pagesFormulas in CostHappyPurpleNo ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija TalipanNo ratings yet

- Standard Costs and VariancesDocument86 pagesStandard Costs and Variancesmohamed el kadyNo ratings yet

- STANDARD COSTING - Cost AccountingDocument3 pagesSTANDARD COSTING - Cost AccountingDarwin DionisioNo ratings yet

- Flexible Budgets, Overhead Cost Variances, and Management ControlDocument19 pagesFlexible Budgets, Overhead Cost Variances, and Management ControlSubha ManNo ratings yet

- Disposition of VariancesDocument12 pagesDisposition of VariancesNors PataytayNo ratings yet

- Standard Costing: 1. Material Variances (AAS)Document2 pagesStandard Costing: 1. Material Variances (AAS)Douzo playsNo ratings yet

- Gino Miguel M. Enso Strategic Cost Management - BSA 2B - B48 Standard CostingDocument5 pagesGino Miguel M. Enso Strategic Cost Management - BSA 2B - B48 Standard CostingMr. XenonNo ratings yet

- Chapter 10 Standard Costs and VariancesDocument24 pagesChapter 10 Standard Costs and VariancesKimberly BanaagNo ratings yet

- Handout-3 MASDocument6 pagesHandout-3 MASJung JeonNo ratings yet

- Standart Costing PDFDocument3 pagesStandart Costing PDFVIHARI DNo ratings yet

- SPPTChap 010Document19 pagesSPPTChap 010Farhan RabbehNo ratings yet

- Standard Costs and VariancesDocument19 pagesStandard Costs and VariancesFarhan RabbehNo ratings yet

- Standard CostingDocument11 pagesStandard CostinganishaNo ratings yet

- Sample Size for Analytical Surveys, Using a Pretest-Posttest-Comparison-Group DesignFrom EverandSample Size for Analytical Surveys, Using a Pretest-Posttest-Comparison-Group DesignNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument5 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETAndrew Miguel SantosNo ratings yet

- Chapter 1 Nature and Form of The ContractDocument12 pagesChapter 1 Nature and Form of The ContractAndrew Miguel SantosNo ratings yet

- Activity 2 - Partnership OperationsDocument1 pageActivity 2 - Partnership OperationsEunji eunNo ratings yet

- 502A-SPA-Santos, Andrew Miguel L.Document2 pages502A-SPA-Santos, Andrew Miguel L.Andrew Miguel SantosNo ratings yet

- Solution To Activity 1 - Partnership FormationDocument8 pagesSolution To Activity 1 - Partnership FormationAndrew Miguel SantosNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument7 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETAndrew Miguel SantosNo ratings yet

- Rizal Technological University: Boni Ave., Mandaluyong City College of Business and Entrepreneurial TechnologyDocument5 pagesRizal Technological University: Boni Ave., Mandaluyong City College of Business and Entrepreneurial TechnologyAndrew Miguel SantosNo ratings yet

- Rizal Technological University: Boni Ave., Mandaluyong City College of Business and Entrepreneurial TechnologyDocument4 pagesRizal Technological University: Boni Ave., Mandaluyong City College of Business and Entrepreneurial TechnologyAndrew Miguel SantosNo ratings yet

- Boys Over Flower: Altejos, Laurente, Santos: MethodologyDocument4 pagesBoys Over Flower: Altejos, Laurente, Santos: MethodologyAndrew Miguel SantosNo ratings yet

- Activity Sheet 1 Research Interests: Name of Group: Rturesearch1-Cbet-01-502A-Boysoverflower Members of The GroupDocument7 pagesActivity Sheet 1 Research Interests: Name of Group: Rturesearch1-Cbet-01-502A-Boysoverflower Members of The GroupAndrew Miguel SantosNo ratings yet

- RTU Research 1 Thesis Outline For Quantitative ResearchDocument2 pagesRTU Research 1 Thesis Outline For Quantitative ResearchAndrew Miguel SantosNo ratings yet

- RTU Research AS3 Chapter One GuidelinesDocument7 pagesRTU Research AS3 Chapter One GuidelinesAndrew Miguel SantosNo ratings yet

- Financial Analysis: Impact On Investment Decisions: Group Name: Boysoverflowers Section: Cbet-01-502A MembersDocument4 pagesFinancial Analysis: Impact On Investment Decisions: Group Name: Boysoverflowers Section: Cbet-01-502A MembersAndrew Miguel SantosNo ratings yet

- Activity Sheet 2 Proposed Title and JustificationsDocument2 pagesActivity Sheet 2 Proposed Title and JustificationsAndrew Miguel SantosNo ratings yet

- Rizal Technological University: Reflection (Assignment) Chapter 9 & 10Document2 pagesRizal Technological University: Reflection (Assignment) Chapter 9 & 10Andrew Miguel SantosNo ratings yet

- Chapter 1 DraftDocument10 pagesChapter 1 DraftAndrew Miguel SantosNo ratings yet

- 502a Sales Quiz 2 Set BDocument2 pages502a Sales Quiz 2 Set BAndrew Miguel SantosNo ratings yet

- Winnie MDocument2 pagesWinnie MAndrew Miguel SantosNo ratings yet

- Report Summary CHAPTER 14 - (Survival and Growth of The Enterprise) Group 12Document3 pagesReport Summary CHAPTER 14 - (Survival and Growth of The Enterprise) Group 12Andrew Miguel SantosNo ratings yet

- Garry L. Santos: Employment HistoryDocument3 pagesGarry L. Santos: Employment HistoryAndrew Miguel SantosNo ratings yet

- Winnie MDocument2 pagesWinnie MAndrew Miguel SantosNo ratings yet

- Strategic Cost ManagementDocument4 pagesStrategic Cost ManagementAndrew Miguel Santos100% (1)

- Topic: The Life of RizalDocument6 pagesTopic: The Life of RizalAndrew Miguel SantosNo ratings yet

- Rizal Technological University: Reflection (Assignment) Chapter 9 & 10Document2 pagesRizal Technological University: Reflection (Assignment) Chapter 9 & 10Andrew Miguel SantosNo ratings yet

- Report Summary CHAPTER 14 - (Survival and Growth of The Enterprise) Group 12Document3 pagesReport Summary CHAPTER 14 - (Survival and Growth of The Enterprise) Group 12Andrew Miguel SantosNo ratings yet

- Hi ThereDocument1 pageHi ThereAndrew Miguel SantosNo ratings yet

- The Life and Works of Rizal: (Final Examination)Document4 pagesThe Life and Works of Rizal: (Final Examination)Andrew Miguel SantosNo ratings yet

- Project Impact of Online AdvertisingDocument41 pagesProject Impact of Online AdvertisingAbhay KumarNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument4 pagesUniversity of Mauritius: Faculty of Law and ManagementAyush GowriahNo ratings yet

- Managerial Economics FinalDocument35 pagesManagerial Economics FinalMisfit Safique Amethyst100% (1)

- Algorithmic Trading Directory 2010Document100 pagesAlgorithmic Trading Directory 201017524100% (4)

- Aircraft ValuationDocument4 pagesAircraft Valuationdjagger1No ratings yet

- How To Solve Business CasesDocument22 pagesHow To Solve Business CasesTrà Giang NguyễnNo ratings yet

- The Study of Cash Flow Statement of Axis Bank For Period 2017-21Document11 pagesThe Study of Cash Flow Statement of Axis Bank For Period 2017-21Dnyandeep ManwarNo ratings yet

- Materials Procurement, Use and ControlDocument15 pagesMaterials Procurement, Use and ControlNah HamzaNo ratings yet

- Ijcrt 192976Document17 pagesIjcrt 192976Kshitiz BhardwajNo ratings yet

- TFM Session Five FX ManagementDocument64 pagesTFM Session Five FX ManagementmankeraNo ratings yet

- Inventories: © 2008-16 Nelson Lam and Peter Lau Intermediate Financial Reporting: An IFRS Perspective (Chapter 9) - 1Document42 pagesInventories: © 2008-16 Nelson Lam and Peter Lau Intermediate Financial Reporting: An IFRS Perspective (Chapter 9) - 1林義哲No ratings yet

- Fabm 1 - Week 5 - 6Document3 pagesFabm 1 - Week 5 - 6FERNANDO TAMZ2003No ratings yet

- Income Statement 1Document4 pagesIncome Statement 1Mhaye Aguinaldo0% (1)

- Prospectus: El Tucuche Fixed Income FundDocument34 pagesProspectus: El Tucuche Fixed Income FundDillonNo ratings yet

- Intermediate Accounting 2 Millan 2019 Answer KeyDocument5 pagesIntermediate Accounting 2 Millan 2019 Answer KeyMaureen SanchezNo ratings yet

- IAS 16 PPE Lecture Slides (Updated)Document39 pagesIAS 16 PPE Lecture Slides (Updated)Ndila mangalisoNo ratings yet

- Santoor Marketing Project PDFDocument47 pagesSantoor Marketing Project PDFshubhi abrol100% (2)

- Ogl 355-Leading Organizational Innovation and Change-Module 3-Team Assignment-RingleadersDocument8 pagesOgl 355-Leading Organizational Innovation and Change-Module 3-Team Assignment-Ringleadersapi-486398978No ratings yet

- HE9091 - Principles of Economics NotesDocument65 pagesHE9091 - Principles of Economics Noteschia.chia1999No ratings yet

- WARC Reveals Effective Social Strategy TrendsDocument1 pageWARC Reveals Effective Social Strategy TrendsDesiCreativeNo ratings yet

- THC 110 LessonsDocument6 pagesTHC 110 LessonsAnalyn CabilloNo ratings yet

- Valuation & Case AnalysisDocument38 pagesValuation & Case AnalysisShaheen RahmanNo ratings yet

- Akash Britannia Final ProjectDocument42 pagesAkash Britannia Final ProjectSaravanakumar SaravanaNo ratings yet

- Strategic ManagementDocument22 pagesStrategic ManagementAnnie MacqueNo ratings yet

- Flexible Budgets and Performance Analysis: Key Terms and Concepts To KnowDocument15 pagesFlexible Budgets and Performance Analysis: Key Terms and Concepts To KnowRachel YangNo ratings yet

- MEGA MGT301 Searching FileDocument647 pagesMEGA MGT301 Searching FileMehak SherNo ratings yet