Professional Documents

Culture Documents

Terms

Terms

Uploaded by

Laskar REAZ0 ratings0% found this document useful (0 votes)

7 views2 pagesThe circular outlines guidelines for insurance company bank accounts, including:

1) Companies must have separate bank accounts for premium deposits at a maximum of 3 banks, and close other accounts by July 31st.

2) They must have one bank account for capital reserves and one for other income deposits.

3) They need one bank account for expenses and one for management expenses.

4) No cash payments are allowed for claims, commissions, salaries or other allowances.

Original Description:

IDRA RULES

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe circular outlines guidelines for insurance company bank accounts, including:

1) Companies must have separate bank accounts for premium deposits at a maximum of 3 banks, and close other accounts by July 31st.

2) They must have one bank account for capital reserves and one for other income deposits.

3) They need one bank account for expenses and one for management expenses.

4) No cash payments are allowed for claims, commissions, salaries or other allowances.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesTerms

Terms

Uploaded by

Laskar REAZThe circular outlines guidelines for insurance company bank accounts, including:

1) Companies must have separate bank accounts for premium deposits at a maximum of 3 banks, and close other accounts by July 31st.

2) They must have one bank account for capital reserves and one for other income deposits.

3) They need one bank account for expenses and one for management expenses.

4) No cash payments are allowed for claims, commissions, salaries or other allowances.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

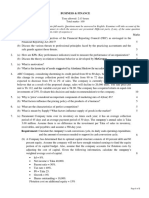

IDRA Circular

Circular nonlife 62/2019: (1-10), Date: 3 June, 2019

1. Bank A/C for premium deposit

Need separate 3 Banks

Each separate banks should have one Bank A/C

Maximum bank a/c should not exceed 3 Bank A/C

Other bank account (except 3 separate Bank A/C) should be shut down within

31.7.2019.

2. Bank A/C for capital reserve + other income deposit

For capital reserve – there should be one Bank A/C

For other income deposit – there should be one Bank A/C

3. Bank A/C for expense

For expense claim – One Bank A/C

For management expense – One Bank A/C

4. No cash payment for claims, commission, salary and other allowances

5. Branch Office Banking rules

For Branch office expenses – Each branch should have one Bank A/C

Fund transfer from Central premium deposit bank A/C to Branch A/C – Crossed

cheque or Fund transfer

6. In case of income, commission return related to Branch, amount should be deposit to

the Bank notified at 2(B).

7. Withdrawal + Expenses

Transaction should be made by crossed cheque

Maximum withdrawal for special administrative special needs = 10,000 BDT

Cash payment allowable for expenses – related to Company Directors’ meeting

honorarium + other related expenses

8. Based on the above directions, classification of Bank A/C should be notified to the

authority within 12.8.2019.

9. Approvals

FDR related to investment – No need for approval of the authority

IPO, right issue, dividend payment

Need director’s approval

Bank A/C + its details should be submitted to the authority

Other company matters – Pre approval needed from the authority

10. Insurance stump due on policy amount >20,000 BDT, payment made through pay

order/cross cheque with separate Challan.

11. Circular Nonlife 66/2019, Date: 24 July, 2019, 64/2019, Date: 2 July, 2019: Commission

to insurance agent = 15%

12. Circular Nonlife 75/2019: Agent commission = 14.25% (after deducting advance tax 5%)

should be given to agent under IDRA license.

You might also like

- Mitc Smart EmicardDocument5 pagesMitc Smart Emicardmoviejunk97No ratings yet

- Instruction On Petty Cash and Cash Advance HandlingDocument4 pagesInstruction On Petty Cash and Cash Advance HandlingSuranga Fernando100% (1)

- Guidelines Stock Audit - Drawing PowerDocument4 pagesGuidelines Stock Audit - Drawing PowerHimanshu Aggarwal50% (4)

- Pcdagri TODINNOFRILLDocument3 pagesPcdagri TODINNOFRILLANBUNo ratings yet

- Bank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Document16 pagesBank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Arun CHNo ratings yet

- Accounts Receivable PolicyDocument7 pagesAccounts Receivable PolicyJSNo ratings yet

- Advance Taxation Chp. 5Document6 pagesAdvance Taxation Chp. 5Rohan ThakkarNo ratings yet

- KYC Circular For CA Opening - 05032019Document2 pagesKYC Circular For CA Opening - 05032019jeevithaNo ratings yet

- 47-Corporate Salary Package - CSPDocument3 pages47-Corporate Salary Package - CSPmevrick_guyNo ratings yet

- भारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -Document6 pagesभारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -praveen chokhaniNo ratings yet

- भारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -Document6 pagesभारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -praveen chokhaniNo ratings yet

- भारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -Document6 pagesभारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -praveen chokhaniNo ratings yet

- CC Common MitcDocument6 pagesCC Common Mitcsandhyakasturi123No ratings yet

- Government Accounting FINALS 2s Sy 22 23Document8 pagesGovernment Accounting FINALS 2s Sy 22 23ssabinaNo ratings yet

- Sub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptDocument20 pagesSub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptAmitKumarNo ratings yet

- Schedule of Bank Charges (Exclusive of FED) Effective From January 01, 2012 International Banking NoDocument26 pagesSchedule of Bank Charges (Exclusive of FED) Effective From January 01, 2012 International Banking Norizviabbas2012No ratings yet

- A Guide To Your Personal Income TaxDocument7 pagesA Guide To Your Personal Income TaxRekha SinghNo ratings yet

- AcknoedgmentDocument2 pagesAcknoedgmentsanket shahNo ratings yet

- PettyCash Policy 2022Document4 pagesPettyCash Policy 2022oasisNo ratings yet

- Latest NRB CircularsDocument20 pagesLatest NRB CircularsNista ShresthaNo ratings yet

- 25981advisor or Associate Advisor For ProjectsDocument5 pages25981advisor or Associate Advisor For ProjectsArjun KoduriNo ratings yet

- HBL Schedule of Bank ChargesDocument25 pagesHBL Schedule of Bank ChargesJohn Wick60% (5)

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNo ratings yet

- Fa Q Son RestructuringDocument4 pagesFa Q Son RestructuringSoma ShekharNo ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument20 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬No ratings yet

- Cash Lite Pds enDocument7 pagesCash Lite Pds enSyarmimi LiyanaNo ratings yet

- ECS Direct Debit Mandate FormDocument3 pagesECS Direct Debit Mandate FormManish KumarNo ratings yet

- Balance Transfer AttachmentDocument8 pagesBalance Transfer AttachmentNg Han GuanNo ratings yet

- RBI GUIDELINES ON Working CapitalDocument57 pagesRBI GUIDELINES ON Working Capitalashwini.krs80No ratings yet

- GCC 2013-14Document7 pagesGCC 2013-14Noble MeshakNo ratings yet

- Compensation Policy 28 03 2019Document10 pagesCompensation Policy 28 03 2019Arnab MitraNo ratings yet

- Standard Covenant CCDocument3 pagesStandard Covenant CCPriyam MrigNo ratings yet

- Schedule of ChargesDocument45 pagesSchedule of ChargeslehmanwolfNo ratings yet

- HPCL Super Saver Credit Card TNCDocument8 pagesHPCL Super Saver Credit Card TNCNagaraj VukkadapuNo ratings yet

- PNB MITC ConditionsDocument38 pagesPNB MITC Conditionswestm4248No ratings yet

- Grace PeriodDocument2 pagesGrace PeriodHaider UsmanNo ratings yet

- PDS PF-i PrivateDocument8 pagesPDS PF-i PrivateMuhammad FawwazNo ratings yet

- PH Gam - DisbursementsDocument6 pagesPH Gam - DisbursementsNabelah OdalNo ratings yet

- Most Important Terms & Conditions: 1. Fees and Charges A. Fees Payable On The Credit Card by The CardmemberDocument6 pagesMost Important Terms & Conditions: 1. Fees and Charges A. Fees Payable On The Credit Card by The Cardmembermoives pointNo ratings yet

- Avant Gard Hospitality PVT LTDDocument50 pagesAvant Gard Hospitality PVT LTDSony Jacob50% (2)

- Petty Cash Fund Guidelines and ProceduresDocument2 pagesPetty Cash Fund Guidelines and ProceduresIrish VargasNo ratings yet

- Sobc Ib English-2016Document28 pagesSobc Ib English-2016faisal_ahsan7919No ratings yet

- MicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Document6 pagesMicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Jan RootsNo ratings yet

- ACCTG304 FinalDocument19 pagesACCTG304 FinalChristine Sondon100% (1)

- Staffod PDFDocument2 pagesStaffod PDFMithun SinghNo ratings yet

- Module 2Document57 pagesModule 2Tejaswini TejuNo ratings yet

- DiviDocument6 pagesDiviDeena dayalanNo ratings yet

- Reserve Bank of IndiaDocument6 pagesReserve Bank of IndiaVasu Ram JayanthNo ratings yet

- Financial Statements of Banking CompaniesDocument20 pagesFinancial Statements of Banking CompaniesBashu GuragainNo ratings yet

- Car Loan ProposalDocument6 pagesCar Loan ProposalRolly Acuna100% (3)

- BA 114.1 - Quiz 1 SamplexDocument12 pagesBA 114.1 - Quiz 1 SamplexPamela May NavarreteNo ratings yet

- 7.20200707 - Updates - CAIIB Cooperative BankingDocument27 pages7.20200707 - Updates - CAIIB Cooperative BankingKolhapur ANANo ratings yet

- PNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Document8 pagesPNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Anil DhankharNo ratings yet

- Accounting For CashDocument10 pagesAccounting For CashjoannaberroNo ratings yet

- Kisan DBT Swap Scheme 373Document12 pagesKisan DBT Swap Scheme 373khetaramNo ratings yet

- CC Common MITCDocument6 pagesCC Common MITCSharadNo ratings yet

- 1st Issue E-Gyan, July-2013Document13 pages1st Issue E-Gyan, July-2013mevrick_guyNo ratings yet

- RandDocument16 pagesRandMmNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Note 3Document2 pagesNote 3Laskar REAZNo ratings yet

- AS Case Study May Jun 2014Document17 pagesAS Case Study May Jun 2014Laskar REAZNo ratings yet

- Case Study 2012Document16 pagesCase Study 2012Laskar REAZNo ratings yet

- Financial & Corporate Reporting Time Allowed - 3 Hours Total Marks - 100Document5 pagesFinancial & Corporate Reporting Time Allowed - 3 Hours Total Marks - 100Laskar REAZNo ratings yet

- 7 IT Governance ND2020Document2 pages7 IT Governance ND2020Laskar REAZNo ratings yet

- Corporate Reporting 2012Document4 pagesCorporate Reporting 2012Laskar REAZNo ratings yet

- AS Advanced Audit Assurance May June 2012Document4 pagesAS Advanced Audit Assurance May June 2012Laskar REAZNo ratings yet

- Business & Finance: Time Allowed-2:15 Hours Total Marks - 100Document2 pagesBusiness & Finance: Time Allowed-2:15 Hours Total Marks - 100Laskar REAZNo ratings yet

- KL Management Information May Jun 2017Document3 pagesKL Management Information May Jun 2017Laskar REAZNo ratings yet

- It Knowledge Time Allowed - 2 Hours Total Marks - 100Document1 pageIt Knowledge Time Allowed - 2 Hours Total Marks - 100Laskar REAZNo ratings yet

- Accounting: Page 1 of 3Document3 pagesAccounting: Page 1 of 3Laskar REAZNo ratings yet

- Management Information June-2012Document2 pagesManagement Information June-2012Laskar REAZNo ratings yet

- Business & Commercial Law: Time Allowed - 2 Hours Total Marks - 100Document1 pageBusiness & Commercial Law: Time Allowed - 2 Hours Total Marks - 100Laskar REAZNo ratings yet

- Assurance Time Allowed - 2 Hours Total Marks - 100Document1 pageAssurance Time Allowed - 2 Hours Total Marks - 100Laskar REAZNo ratings yet

- Knowledge Level Business Finance May Jun 2014Document2 pagesKnowledge Level Business Finance May Jun 2014Laskar REAZNo ratings yet