Professional Documents

Culture Documents

Buyer's Loan Application Sheet

Uploaded by

Jerico NaypaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buyer's Loan Application Sheet

Uploaded by

Jerico NaypaCopyright:

Available Formats

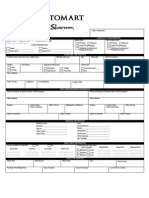

BUYER’S LOAN APPLICATION SHEET

Project Name Bldg./Blk Unit/Lot

UDHM 1 281

GENERAL INFORMATION CONTACTS

Surname First Name Middle Name TIN Buyer’s Mobile No.

LOYZAGA MARIGRACE BUQUID 450-340-717-000 0945-402-8401

Sex Date of Birth Civil Status Citizenship Buyer’s Res. No.

Male Female 7/29/67 SINGLE FILIPINO N/A

Present Home Address SPOUSE INFORMATION Buyer’s Email Address

gbh_clinic2003@yahoo.com

920 INCENCIO ST SAN ROQUE CAVITE CITY

Employer/Business Name Surname First Name Middle Name Parent’s Res No.

GBH LYING INN & FAMILY MED CLINIC N/A n/a

Employer/Business Address Date of Birth Citizenship Parent’s Mobile No.

GUERAY BLDG LOPEZ JAENA ST CARIDAD CAVITE N/A N/A

CITY

Position and Department Employer/Business Name Employer’s Contact No

SENIOR MIDWIFE N/A (046)4359863

Nature of Business Employer/Business Address Spouse Mobile No.

MEDICAL N/A N/A

Parents/Provincial Address Other Contact Person & Contact No. Employer’s Contact No

(Spouse)

CAVITE JOSEPH AQUINO

N/A

EDUCATIONAL ATTAINMENT

College Graduate: (YES/NO) ____YES___________ License Professional: (YES/NO) ____YES______

PACKAGE PRICE AFFORDABILITY

Type of Purchase Gross Salary ___65,500____

Spot Cash CTS2018

Less:

Gross Deduction ____________

Deferred Cash CTS-HDMF Net Take Home Pay ____________

Loan Term/Interest Rate

Less:

______12 YRS_____ Living Expenses ____________ TOTAL AMOUNT FOR HOUSING

Less:

Contract Price (Net of Discount.) ________________ Debt Payments Amount

Add: 12% VAT ________________ 65,500

Total Contract Price ________________ ________________

Add: Processing Cost 1 ________________

Processing Cost 2 ________________ Add:

Total Outstanding

Other sources of Amount

Obligation ________________

income

Less: Equity Paid ________________

Amount for Financing _________________

Less: Reservation Fee _________________

Equity for Payment _________________

Loan Amount _________________

Reference: REMARKS

35% BGMI for Income Requirement

Formula: MA = BGMI

35% BGMI

BANK ACCOUNT (Indicate your 3 most active)

TYPE OF

BANK BRANCH/ADDRESS ACCOUNT NO. DATE OPENED AVE. BALANCE

ACCOUNT

V.7.23.2019

CREDIT CARDS OWNED (Indicate your 3 most active)

CARD TYPE CARD EXPIRY

ISSUER NAME CREDIT LIMIT

(e.g. Visa/Mastercard) (mm/yyyy)

REAL ESTATE OWNED

TYPE OF ACQUISITION MARKET MORTGAGE RENTAL

LOCATION TCT NO.

PROPERTY COST VALUE BALANCE INCOME

OUTSTANDING CREDITS/LOAN AVAILMENTS

Security Type Maturity Date

Amount/Balance Mo. Amortization

Creditor & Address Security Type Maturity Date

Amount/Balance Mo. Amortization

Creditor & Address Security Type Maturity Date

Amount/Balance Mo. Amortization

MISCELLANEOUS

(Answer the following questions with YES or NO. If your answer is YES, please elaborate on the details as required)

Are there past or pending cases against you? Yes No

If Yes, please indicate the nature, plaintiff, amount involved and the status.

Do you have past due obligations? If yes, please indicate the creditor’s name, nature, amount involved and due date.

Yes No

Was your bank account ever closed because of mishandling or issuance of bouncing checks? Yes No

If yes, please indicate the bank’s name, nature amount and date.

Billing Address: _________________________________________________________________________

Sketch:

CERTIFICATION

I/We certify that the foregoing information/statement are to the best of my/our knowledge; true, correct and complete; and I/We hereby agree that any

misrepresentation of a material fact is a ground for cancellation of the transaction, or payment of penalties as the case may be. I/We agree to notify 8990 HDC of any

material change affecting the information contain herein. I/We agree that all information obtained by 8990 HDC shall remain its property whether or not the purchase of

the house and lot is consummated. This signature(s) appearing below is genuine.

Upon your application with DECA HOMES, you automatically agree to receive SMS messages from the developer.

_______MARIGRACE B. LOYZAGA______ _______________N/A_______________________

PRINTED NAME AND SIGNATURE OF BUYER PRINTED NAME AND SIGNATURE OF SPOUSE

6/18/20

_________________________________ _________________________________

DATE DATE

FOR 8990 USE ONLY

Approved by:

6/18/20

JENNY BINAS BEN JAMES SIGUAN

8990 REPRESENTATIVE AGENT UNIT MANAGER DATE RECEIVED

V.7.23.209

DECA HOMES GUIDELINES

1. Reservation Fee P5,000.00 for socialized at least P10, 000.00 for economic

2. Equity Payment - After the payment of reservation fee, the minimum equity is ____________________________ PESOS (P______________) per

month payable via PDC (see Section 6 on Postdated Checks).

2.1 The payment of equity installment shall commence 30 days after reservation date and every 30 days thereafter.

2.2 If the unit is not yet ready for delivery after the buyer had already paid the equity schedule, he may continue paying the installments of

P10,000.00 per month until the unit is delivered. In which case, the total amount paid prior to the delivery of the unit shall be considered

equity payment and shall be deducted from the Package Price to determine the amount subject to the Deferred Payment Plan (see Section

5 on Deferred Payment Plan).

2.3 If the buyer’s GMI requires him to pay an equity greater than P10,000.00, the said equity shall be payable over a maximum period of 6

monthly installments. However, in no case shall the monthly equity installment amount to less than P10,000.00.

2.4 Delay in the payment of equity installment shall be charged forty percent (40%) of the amount due which shall immediately be effective

after the lapse of the due date until full settlement thereof

2.5 The buyer may opt, at any time, to advance the payment of equity.

3. If the buyer fails to pay any installment on the equity for three cumulative monthly installments, the Option Agreement and all other contracts shall

be considered as automatically cancelled and all previous payments shall be forfeited in favor of the developer.

4. Should the buyer wish to extend the terms of the equity payment and the developer approves the same in writing, the buyer agrees to pay 21%

interest per annum for the entire remaining unpaid balance until the same is fully paid.

5. The initial basis of computation on equity stated above is the selling price.

6. Postdated Checks - Equity installments, monthly amortization, and the CLI/FI premiums shall be covered by PDC, which shall be submitted by the

buyer upon reservation as follows:

(a) All required PDC’s for the equity. (at least three)

(b) 46 PDCs for the next 46 monthly amortizations, inclusive of the monthly SRI/FI premiums for the next 46 months.

(c) One (1) guarantee check representing one year of advance monthly amortization.

6.1 Failure to issue the required postdated checks within the prescribed period shall automatically cancel the Option Agreement and all

appurtenant contracts without further need of notice to the buyer.

8. Payment should be made directly by the buyer to 8990’s cashier so that he/she may be issued an official receipt. Payment entrusted to agents/Unit

Managers, shall be the sole responsibility and risk of the buyer. It shall not be construed as effective payment to the company but rather only a private

transaction between the buyer and the agent/Unit Manager, of which the Developer shall not be liable in case the payment is not remitted by the

agent/Unit Manager.

9. Complete requirements should be submitted upon reservation; otherwise, the developer may cancel the account due to non-compliance of

requirements.

10. 8990 Housing Development Corporation reserves the right to rectify the figures appearing herein or on the Official Price List and brochures in the

event of typographical error, changes in lot area or any unintentional error that may occur. The developer also reserves the right to change the prices

without prior public notice.

11. Reservation fee and equity payments are non-transferable and non-withdrawable.

12. The buyer cannot sell, transfer or assign any of his rights under the contracts and agreements executed with the developer to another third party

without the prior written notice and consent of the developer. However, the buyer agrees that the developer, without need of further notice and

consent from the buyer, may sell, transfer, convey, hypothecate, mortgage, sublet, license, encumber or otherwise merge, consolidate or pool said

contracts and agreements with the buyer with any other financial instruments and assets for securitization, whether absolute or limited, and assign

them to any of the developer’s assignee/transferee or its successor-in-interest at any time during the term of agreements. To this end, the buyer

agrees to perform such acts and execute such documents as may be necessary to implement such assignment/transfer.

13. Violation of any provision mentioned herein is a ground for a cancellation of reservation and forfeiture of all payments made.

_______________________

8990 Representative

CONFORME:

This certifies that I have completely read the guidelines, understood fully their meaning and freely agreed with the contents stipulated

herein.

_______________________

BUYER

Witness:

BEN JAMES SIGUAN

Marketing Unit Manager Buyer’s Spouse

V.7.23.2019

You might also like

- Denr EmbDocument2 pagesDenr EmbELben RescoberNo ratings yet

- Loan Form 2021 PDFDocument5 pagesLoan Form 2021 PDFClaribelle MaquilavaNo ratings yet

- NPC Motor Vehicle Loan FormDocument2 pagesNPC Motor Vehicle Loan FormPhoebe Grace LopezNo ratings yet

- Small Business Loan Application Form For Individual - Sole - BDODocument2 pagesSmall Business Loan Application Form For Individual - Sole - BDOjunco111222No ratings yet

- Pilar Sorsogon Bpls-FormDocument4 pagesPilar Sorsogon Bpls-FormKevin Albert Dela CruzNo ratings yet

- Application For Membership: Insert CCT MBA Logo Here 6/F Joshua Center, Taft Ave, Ermita, Metro ManilaDocument2 pagesApplication For Membership: Insert CCT MBA Logo Here 6/F Joshua Center, Taft Ave, Ermita, Metro ManilaAnne florNo ratings yet

- AIKODocument9 pagesAIKOJessel Andria CañebaNo ratings yet

- BOHOL DIOCESAN MULTI-PURPOSE COOPERATIVE LOAN APPLICATIONDocument4 pagesBOHOL DIOCESAN MULTI-PURPOSE COOPERATIVE LOAN APPLICATIONIBP Bohol ChapterNo ratings yet

- Personal Information: Loan Application For Individual and Sole ProprietorshipDocument2 pagesPersonal Information: Loan Application For Individual and Sole Proprietorshipmakzsy sharief saripadaNo ratings yet

- Form-Loan Express March 2015 PDFDocument3 pagesForm-Loan Express March 2015 PDFJesse Carredo0% (1)

- LOAN FORM AND PN 2021Document2 pagesLOAN FORM AND PN 2021tom10carandangNo ratings yet

- HTTPS:::WWW - Pagibigfund.gov - ph:document:pdf:dlforms:providentrelated:PFF285 ApplicationProvidentBenefitsClaim V07Document2 pagesHTTPS:::WWW - Pagibigfund.gov - ph:document:pdf:dlforms:providentrelated:PFF285 ApplicationProvidentBenefitsClaim V07Zyreen Kate CataquisNo ratings yet

- PNP Nup Loan Application Form and Promissory NoteDocument2 pagesPNP Nup Loan Application Form and Promissory NoteEnteng Teng TengitsNo ratings yet

- Philippine Business Permit Application FormDocument1 pagePhilippine Business Permit Application FormJESSA VILLEGAS TALINGTINGNo ratings yet

- Gsis Lease With Option To Buy (Lwob) : Application InformationDocument2 pagesGsis Lease With Option To Buy (Lwob) : Application InformationOlivia Abac100% (1)

- Application Form Enwealth new AccountDocument2 pagesApplication Form Enwealth new AccounticttumainiNo ratings yet

- Introductory Credit Card Application InsightsDocument2 pagesIntroductory Credit Card Application Insightsace majestixxNo ratings yet

- Cambridge Village ID FormDocument1 pageCambridge Village ID FormRamiro RamirezNo ratings yet

- Credit Application Form for Motorcycle/E-Bike FinancingDocument2 pagesCredit Application Form for Motorcycle/E-Bike FinancingProff Yues100% (1)

- 719112E3E843Document1 page719112E3E843Ma. Teresita OnateNo ratings yet

- PL App FormDocument2 pagesPL App Formsabefoy840No ratings yet

- Application FormDocument1 pageApplication FormpinoyautomartNo ratings yet

- Application FormDocument1 pageApplication FormArabea KateNo ratings yet

- Application For Provident Benefits (Apb) ClaimDocument2 pagesApplication For Provident Benefits (Apb) ClaimJoey Singson100% (1)

- RHED Financing Application Form 1Document2 pagesRHED Financing Application Form 1Kenneth InuiNo ratings yet

- Application Form For Business Permit Office of The City Mayor Business Permit & Licensing DivisionDocument2 pagesApplication Form For Business Permit Office of The City Mayor Business Permit & Licensing Divisionvivian deocampoNo ratings yet

- SET 2 TCAA 2021 DepEd Forms Above P500K and Autonomous v1.0Document14 pagesSET 2 TCAA 2021 DepEd Forms Above P500K and Autonomous v1.0Aynrand SalvadorNo ratings yet

- Pre-Mature Exit Form Jan 19Document2 pagesPre-Mature Exit Form Jan 19antriksh82No ratings yet

- Life Membership FormDocument1 pageLife Membership FormSheila Marie OmegaNo ratings yet

- Unified FormDocument1 pageUnified FormRobert V. AbrasaldoNo ratings yet

- Anggo Toyota Application FormDocument1 pageAnggo Toyota Application FormTempwell company Naga BranchNo ratings yet

- Membership Application Form Fillable 1Document3 pagesMembership Application Form Fillable 1peaky1115No ratings yet

- Payout Request FormDocument2 pagesPayout Request FormKANGSA banikNo ratings yet

- Bank of Commerce - Customer Information SheetDocument4 pagesBank of Commerce - Customer Information SheetElaine Joyce BayaniNo ratings yet

- SALN TemplateDocument2 pagesSALN Templatemevah espinaNo ratings yet

- Apply for Moratorium on Pag-IBIG STL PaymentsDocument2 pagesApply for Moratorium on Pag-IBIG STL PaymentsJhonson MedranoNo ratings yet

- Enhanced FMS FormsDocument18 pagesEnhanced FMS FormsAmyfe AdapNo ratings yet

- PFF285 ApplicationProvidentBenefitsClaim V08Document5 pagesPFF285 ApplicationProvidentBenefitsClaim V08Trisha ApalisNo ratings yet

- Dok Alternatibo Brotherhood With Inventors Guild CooperativeDocument2 pagesDok Alternatibo Brotherhood With Inventors Guild CooperativeStaff Coo Dok AlternatiboNo ratings yet

- InvoiceDocument4 pagesInvoicealexNo ratings yet

- Customer Info Sheet PDFDocument3 pagesCustomer Info Sheet PDFMcAsia Foodtrade CorpNo ratings yet

- Loan Modification Package Empire MSDocument14 pagesLoan Modification Package Empire MSjeff499No ratings yet

- Mechelec Credit Application2Document3 pagesMechelec Credit Application2Nithin M NambiarNo ratings yet

- Complete Merchant Application DocumentsDocument1 pageComplete Merchant Application DocumentsHeaven HawkinsNo ratings yet

- PNB Aplication FormDocument2 pagesPNB Aplication Formrodrigo p. kito100% (1)

- Account Opening Form For Resident Individuals (Single/Joint) (SF/CA/FD/RD/OD/CC)Document4 pagesAccount Opening Form For Resident Individuals (Single/Joint) (SF/CA/FD/RD/OD/CC)Jyothi Pradeep KumarNo ratings yet

- Joint Filing Separately Filing Not Applicable: Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesJoint Filing Separately Filing Not Applicable: Sworn Statement of Assets, Liabilities and Net WorthArman BentainNo ratings yet

- No. of Years: For Individuals and Sole ProprietorshipsDocument2 pagesNo. of Years: For Individuals and Sole Proprietorshipsjunil rejanoNo ratings yet

- Official Receipt 2 Types RemovedDocument2 pagesOfficial Receipt 2 Types Removedbktsuna0201100% (1)

- Additional Request Form (ARF) - FDocument2 pagesAdditional Request Form (ARF) - FAtif SyedNo ratings yet

- BOSA Loan FormDocument2 pagesBOSA Loan FormIsaac OkotNo ratings yet

- Customer Information Sheet: Please Fill Out All Information BelowDocument1 pageCustomer Information Sheet: Please Fill Out All Information BelowEarl JustinNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticenielNo ratings yet

- Medical in Voice Template 1Document7 pagesMedical in Voice Template 1joel sabastin dassNo ratings yet

- Disbursement VoucherDocument87 pagesDisbursement VoucherchatNo ratings yet

- Credit Application FormDocument4 pagesCredit Application FormJefferson MercadoNo ratings yet

- Application Form AlterationsDocument2 pagesApplication Form AlterationsSonu SinghNo ratings yet

- Minor Alteration Form - Client PDFDocument2 pagesMinor Alteration Form - Client PDFSonu SinghNo ratings yet

- Credit Restore Secrets They Never Wanted You to KnowFrom EverandCredit Restore Secrets They Never Wanted You to KnowRating: 4 out of 5 stars4/5 (3)

- Trade Rutes of EuropeDocument1 pageTrade Rutes of EuropeNico BelloNo ratings yet

- Secondary School Voluntary Secondary SchoolDocument1 pageSecondary School Voluntary Secondary SchoolvinayakNo ratings yet

- Principles of Accounting IIDocument10 pagesPrinciples of Accounting IIEnusah AbdulaiNo ratings yet

- Avarice Sheet PDFDocument1 pageAvarice Sheet PDFNainoa NaffNo ratings yet

- TCS Configuration PDFDocument20 pagesTCS Configuration PDFrishisap2No ratings yet

- 10 Basics of Ethical CommunicationDocument8 pages10 Basics of Ethical CommunicationsujzNo ratings yet

- Moore Hunt - Illuminating The Borders. of Northern French and Flemish Manuscripts PDFDocument264 pagesMoore Hunt - Illuminating The Borders. of Northern French and Flemish Manuscripts PDFpablo puche100% (2)

- Memorandum Order No. 2016-003 - PEZADocument19 pagesMemorandum Order No. 2016-003 - PEZAYee BeringuelaNo ratings yet

- Requirements For Marriage Licenses in El Paso County, Texas: Section 2.005. See Subsections (B 1-19)Document2 pagesRequirements For Marriage Licenses in El Paso County, Texas: Section 2.005. See Subsections (B 1-19)Edgar vallesNo ratings yet

- Project Report Dcc50232 p4-2Document5 pagesProject Report Dcc50232 p4-2syahirah jarkasiNo ratings yet

- Coleridge's Gothic Style Revealed in PoemsDocument2 pagesColeridge's Gothic Style Revealed in PoemsarushiNo ratings yet

- Mona Mohamed, Menna Selem, Mariam, ManalDocument8 pagesMona Mohamed, Menna Selem, Mariam, ManalMenna HamoudaNo ratings yet

- Achieving Competitive Advantage Through Location StrategyDocument4 pagesAchieving Competitive Advantage Through Location StrategyAboi Boboi33% (3)

- CH 1 - TemplatesDocument7 pagesCH 1 - TemplatesadibbahNo ratings yet

- Global Business Strategy ChallengesDocument11 pagesGlobal Business Strategy ChallengesDAVIDNo ratings yet

- Shiela V. SiarDocument35 pagesShiela V. SiarCrimson BirdNo ratings yet

- Main Suggestions With MCQ Gaps AnswersDocument4 pagesMain Suggestions With MCQ Gaps Answersapi-275444989No ratings yet

- Muh351 ProjeDocument2 pagesMuh351 Projesudanlı kara hakıNo ratings yet

- Arvin Lloyd D. SuniegaDocument3 pagesArvin Lloyd D. SuniegaApril Joy Sumagit HidalgoNo ratings yet

- External Influences On Business Activity YR 13Document82 pagesExternal Influences On Business Activity YR 13David KariukiNo ratings yet

- Auditing Subsequent Events ProceduresDocument8 pagesAuditing Subsequent Events ProceduresMark Kenneth ParagasNo ratings yet

- Mendoza V CADocument2 pagesMendoza V CAranNo ratings yet

- The 1987 Constitution of The Republic of The Philippines - Article Ix Article IxDocument5 pagesThe 1987 Constitution of The Republic of The Philippines - Article Ix Article IxLiz LorenzoNo ratings yet

- Sykes v. Wilkes - Document No. 4Document3 pagesSykes v. Wilkes - Document No. 4Justia.comNo ratings yet

- Asobi CoinDocument37 pagesAsobi CoinVankokhNo ratings yet

- Assignment On Procurement and Contract AdministrationDocument5 pagesAssignment On Procurement and Contract Administrationasterayemetsihet87No ratings yet

- Colors For Trombone PDF AppermontDocument2 pagesColors For Trombone PDF AppermontJames0% (7)

- Wipro Limited-An Overview: Deck Expiry by 05/15/2014Document72 pagesWipro Limited-An Overview: Deck Expiry by 05/15/2014compangelNo ratings yet

- Chapter Iv Research PaperDocument6 pagesChapter Iv Research PaperMae DeloriaNo ratings yet

- Trash Essay Emma LindheDocument2 pagesTrash Essay Emma Lindheapi-283879651No ratings yet