Professional Documents

Culture Documents

Sinosteel Luoyang Institute of Refractories Research Co., LTD

Sinosteel Luoyang Institute of Refractories Research Co., LTD

Uploaded by

venus gargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sinosteel Luoyang Institute of Refractories Research Co., LTD

Sinosteel Luoyang Institute of Refractories Research Co., LTD

Uploaded by

venus gargCopyright:

Available Formats

Sinosteel Luoyang Institute of Refractories Research Co., Ltd.

43# Xiyuan Road, Jianxi District, Luoyang, Henan, 471039, China

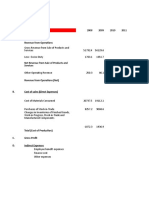

2018 (till May) INCOME STATEMENT

Sinosteel Luoyang Institute of Refractories Research Co.,

May-18 unit:RMB(Yuan)

Ltd

current month current year cumulative Same period last

Item No.

amount amount year

Ⅰ.Total sales from operations 1 38323797.53 270233869.9 221865708.4

Including: sales from operations 2 38323797.53 270233869.9 221865708.4

Ⅱ.Total operating costs 3 37647119.93 269233264.8 224229251.2

Including:operating costs 4 27373267.24 225275010.4 187482053.2

Tax and additions 5 510734.11 2552346.01 2278412.42

Selling expenses 6 4388623.08 15576846.07 16277984.74

General and administrative expense 7 3252790.91 16264904.28 14296119.29

Including: research and development costs 8 0 0 469845.48

Financial expense 9 2121704.59 9564158.09 3894681.57

Including:interest expenses 10 1440166.66 7315292.02 3935560.53

Interest income 11 5916.8 215990.42 75416.85

Net exchange losses(net income expressed with "-") 12 105328.86 1801375.37 -220787.88

Impairment loss on assets 13 0 0 0

Other 14 0 0

Plus:gain or loss from changes in fair values(loss expressed

15 0 0 0

with "-")

Investment income(loss expressed with "-") 16 0 0 0

Including:investment income from joint ventures and

17 0 0

affiliates

Income from disposal of assets(loss expressed with "-") 18 0 0 0

Including:the disposal is divided into the proceeds of

19 0 0 0

holding the non-current assets for sale or the disposal group

Disposal of fixed assets, construction in progress, productive

biological assets and intangible assets that are not classified as 20 0 0 0

held for sale

Income from debt restructuring 21 0 0 0

Non-monetary asset exchange profits 22 0 0 0

Other income 23 0 0

Ⅲ.Operating profit 24 676677.6 1000605.04 -2363542.83

Plus:non-operating income 25 0 833806.5 3003293.75

Including:government subsidies 26 0 0 3000000

Less: non-operating expenses 27 0 9000 31500

Ⅳ.Income before tax(total loss expressed with "-") 28 676677.6 1825411.54 608250.92

Less:income tax 29 119936.13 469946.95 521952.46

Ⅴ.Net income 30 556741.47 1355464.59 86298.46

Net income attributed to shareholders 31 864744.24 -406303.87 -1809201.49

*Minority interests 32 -308002.77 1761768.46 1895499.95

Ⅵ.Net of tax from other comprehensive income 33 0 0

34 0 0

1.Other comprehensive income cannot reclassified into the pr

ofit Including:

and loss ① .Remeasure the variation of net indebtedness

35 0 0

or net asset of defined benefit plans

② .Under the equity method in classification into the profits

and losses of the invested entity cannot the share of other 36 0 0

comprehensive income

2.Other comprehensive income that will be reclassified into the

37 0 0

profit and loss

Including: ①.share in other comprehensive income that will

38 0 0

be classified into profit and loss under equity method

②.Changes in fair value through profit and loss of available-

39 0 0

for-sale financial assets

③.Held to maturity investment reclassified into available-for

40 0 0

sale financial assets

④.Effective part of cash-flow hedge profit and loss 41 0 0

⑤ .Balance arising from the translation of foreign currency

42 0 0

financial statements

Ⅶ.Total comprehensive income 43 556741.47 1355464.59 86298.46

Total comprehensive income attributed to parent company

44 864744.24 -406303.87 -1809201.49

owners

*Total comprehensive income attributed to minority 45 -308002.77 1761768.46 1895499.95

Ⅷ.Earnings per share 46 0 0 0

Basic EPS 47 0 0 0

Diluted EPS 48 0 0 0

You might also like

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- ACCO 400 Weeks 5 and 6 Discussion Questions and AnswersDocument4 pagesACCO 400 Weeks 5 and 6 Discussion Questions and AnswersWasif SethNo ratings yet

- Chapter 5 - Preparation of Master Budget: Learning ObjectivesDocument5 pagesChapter 5 - Preparation of Master Budget: Learning ObjectivesLysss Epssss100% (1)

- Apics CSCP - 1a SccdiDocument44 pagesApics CSCP - 1a Sccdiainne42No ratings yet

- Sinosteel Luoyang Institute of Refractories Research Co., LTDDocument3 pagesSinosteel Luoyang Institute of Refractories Research Co., LTDvenus gargNo ratings yet

- Profit and Loss Statement (2015-2017)Document2 pagesProfit and Loss Statement (2015-2017)venus gargNo ratings yet

- Reformulated Comprehensive Income StatementDocument5 pagesReformulated Comprehensive Income StatementXyzNo ratings yet

- Live Project Presentation On: An Analysis Study of Annual Report of The Company ONGC''Document16 pagesLive Project Presentation On: An Analysis Study of Annual Report of The Company ONGC''Dipankar SâháNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Profit and LossDocument1 pageProfit and LossYagika Jagnani100% (1)

- AFM Project Sec J Group 10Document32 pagesAFM Project Sec J Group 10J40Santhosh KrishnaNo ratings yet

- Accounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)Document12 pagesAccounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)RISHIKESH DHIR 1923649No ratings yet

- Godrej Agrovet Ratio Analysis 17-18Document16 pagesGodrej Agrovet Ratio Analysis 17-18arpitNo ratings yet

- InfoEdge Annual Report 2023 1Document1 pageInfoEdge Annual Report 2023 1Aditya RoyNo ratings yet

- Sinosteel Luoyang Institute of Refractories Research Co., LTDDocument2 pagesSinosteel Luoyang Institute of Refractories Research Co., LTDvenus gargNo ratings yet

- Dreddy FinalDocument11 pagesDreddy FinalNavneet SharmaNo ratings yet

- Taller OficialDocument74 pagesTaller OficialDENNIS DEPITA MORONNo ratings yet

- Bata India Limited: Statement of Profit and Loss For The Fifteen Month Period Ended 31St March, 2015Document1 pageBata India Limited: Statement of Profit and Loss For The Fifteen Month Period Ended 31St March, 2015Viswateja KrottapalliNo ratings yet

- Navana CNG Limited IncomeDocument4 pagesNavana CNG Limited IncomeHridoyNo ratings yet

- Assignment-2 FA PDFDocument3 pagesAssignment-2 FA PDFrajNo ratings yet

- EV Annual Report 2021 22Document69 pagesEV Annual Report 2021 22deepakturi2002No ratings yet

- Group ProjectDocument9 pagesGroup ProjectsnsahaNo ratings yet

- Bajaj Aut1Document2 pagesBajaj Aut1Rinku RajpootNo ratings yet

- Extracted Pages From PVR LTD - 20Document1 pageExtracted Pages From PVR LTD - 20jadgugNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- 4 Years of Financial Data - v4Document25 pages4 Years of Financial Data - v4khusus downloadNo ratings yet

- Statements of Comprehensive Income: For The Financial Year Ended 31 December 2020Document5 pagesStatements of Comprehensive Income: For The Financial Year Ended 31 December 2020nfarzana.jefriNo ratings yet

- Annual Report 2019 3Document77 pagesAnnual Report 2019 3andreileonard.asigurariNo ratings yet

- FRA Group 10Document25 pagesFRA Group 10sovinahalli 1234No ratings yet

- Financial Report For The Year 2020-21-DDocument74 pagesFinancial Report For The Year 2020-21-DAmanuel TewoldeNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- LUPIN Is A Leading Global Pharmaceuticals CompanyDocument7 pagesLUPIN Is A Leading Global Pharmaceuticals CompanyVandita RannsinghNo ratings yet

- Fusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司Document22 pagesFusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司in resNo ratings yet

- Statement of Profit and LossDocument1 pageStatement of Profit and LossAjit singhNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- NRG AUTO LIMITED-5-Year-Financial-PlanDocument21 pagesNRG AUTO LIMITED-5-Year-Financial-Plandariaivanov25No ratings yet

- Statement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020Document11 pagesStatement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020dineshkumar1234No ratings yet

- Account Cca (AutoRecovered) 1Document13 pagesAccount Cca (AutoRecovered) 1Saloni BaisNo ratings yet

- Wema-Bank-Financial Statement-2019Document33 pagesWema-Bank-Financial Statement-2019john stonesNo ratings yet

- ITC-Profit-Loss 2017 PDFDocument1 pageITC-Profit-Loss 2017 PDFShristi GutgutiaNo ratings yet

- Havells Income STMT 2009-2013Document11 pagesHavells Income STMT 2009-2013K.GayathiriNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- Financial ModelingDocument10 pagesFinancial Modelingjokers0143No ratings yet

- 2021 Con Quarter04 SoiDocument2 pages2021 Con Quarter04 SoiMohammadNo ratings yet

- Financial Analysis DataSheet KECDocument22 pagesFinancial Analysis DataSheet KECSuraj DasNo ratings yet

- Unless Otherwise Specified, All Monetary Values Are in Millions of INRDocument7 pagesUnless Otherwise Specified, All Monetary Values Are in Millions of INRRanjith Ǝ LuidinNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- Greenko Investment Company - Financial Statements 2017-18Document93 pagesGreenko Investment Company - Financial Statements 2017-18DSddsNo ratings yet

- Financials & Feasibility InformationDocument10 pagesFinancials & Feasibility InformationTP FavsNo ratings yet

- Half Year Financial Statement and Dividend AnnouncementDocument16 pagesHalf Year Financial Statement and Dividend AnnouncementKennardNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Greenko - Dutch - Audited - Combined - Financial - Statements - FY 2018 - 19Document1 pageGreenko - Dutch - Audited - Combined - Financial - Statements - FY 2018 - 19hNo ratings yet

- Finance Department Analysis of Dabur LimitedDocument15 pagesFinance Department Analysis of Dabur LimitedradhikaNo ratings yet

- FM Project Report I H09 2876Document7 pagesFM Project Report I H09 2876az-waniey sempoyNo ratings yet

- Balaji Enterprises CMA (Praveen Kumar) - 2016PROVDocument13 pagesBalaji Enterprises CMA (Praveen Kumar) - 2016PROVGEETHA PNo ratings yet

- Annex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1Document81 pagesAnnex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1psevangelioNo ratings yet

- FIN 422-Midterm AssDocument43 pagesFIN 422-Midterm AssTakibul HasanNo ratings yet

- Bursa Q1 2015v6Document19 pagesBursa Q1 2015v6Fakhrul Azman NawiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sinosteel Luoyang Institute of Refractories Research Co., LTDDocument2 pagesSinosteel Luoyang Institute of Refractories Research Co., LTDvenus gargNo ratings yet

- IPMS of SH - Darbara Singh, DE (NWO) Panipat (HRMS 199802763) For The Period 1.4.2018 To 31.3.2019Document4 pagesIPMS of SH - Darbara Singh, DE (NWO) Panipat (HRMS 199802763) For The Period 1.4.2018 To 31.3.2019venus gargNo ratings yet

- Sinosteel Luoyang Institute of Refractories Research Co., LTDDocument3 pagesSinosteel Luoyang Institute of Refractories Research Co., LTDvenus gargNo ratings yet

- Profit and Loss Statement (2015-2017)Document2 pagesProfit and Loss Statement (2015-2017)venus gargNo ratings yet

- C0482-01 - Inv PROSPEIRTY SIC 96 PDFDocument1 pageC0482-01 - Inv PROSPEIRTY SIC 96 PDFvenus gargNo ratings yet

- C0482-01 - BL Prospeirty Sic 96Document1 pageC0482-01 - BL Prospeirty Sic 96venus gargNo ratings yet

- C0482 - So Prospeirty Sic 96Document1 pageC0482 - So Prospeirty Sic 96venus gargNo ratings yet

- A Study of E-Filling of Income Tax Return in IndiaDocument5 pagesA Study of E-Filling of Income Tax Return in IndiaVijay ChalwadiNo ratings yet

- Ces Report in BusinessDocument54 pagesCes Report in Businessnicole alcantaraNo ratings yet

- Question - Chapter 6. Basis of AssessmentDocument5 pagesQuestion - Chapter 6. Basis of AssessmentTâm TốngNo ratings yet

- BOP SlideDocument19 pagesBOP SlidePrajesh CalicutNo ratings yet

- The Institute of Chartered Accountants of Pakistan Introduction To Financial AccountingDocument4 pagesThe Institute of Chartered Accountants of Pakistan Introduction To Financial AccountingadnanNo ratings yet

- Lecture 3BDocument33 pagesLecture 3Bsamuel.sjhNo ratings yet

- Filipino Sa Piling Larangan (Feasibility Study)Document9 pagesFilipino Sa Piling Larangan (Feasibility Study)AGLDNo ratings yet

- Act102 Assessment2Document4 pagesAct102 Assessment2MohammadNo ratings yet

- Chapter 1 Class ExerciseDocument5 pagesChapter 1 Class ExerciseBigAsianPapiNo ratings yet

- 7 CIR V PhoenixDocument1 page7 CIR V PhoenixFrancesca Isabel MontenegroNo ratings yet

- Cost Systems and Cost AccumulationDocument25 pagesCost Systems and Cost AccumulationPrima Warta SanthaliaNo ratings yet

- Individual Inc Tax BUHA CH3Document23 pagesIndividual Inc Tax BUHA CH3Mary TolNo ratings yet

- Annual Report 2021-22Document216 pagesAnnual Report 2021-22Dheeraj GuptaNo ratings yet

- Tax SparingDocument5 pagesTax Sparingfrancis_asd2003No ratings yet

- Acctg11e - SM - CH03 For 25 - 29 Sept 2017Document114 pagesAcctg11e - SM - CH03 For 25 - 29 Sept 2017Dylan Rabin Pereira100% (1)

- Sales Literature iSelect+PlanDocument14 pagesSales Literature iSelect+PlanABDUL SAMADNo ratings yet

- Financial Prospects: TABLE 2.3 Monthly Income Statement of Mang Juan's ManufacturingDocument4 pagesFinancial Prospects: TABLE 2.3 Monthly Income Statement of Mang Juan's ManufacturingTrisha EcleoNo ratings yet

- Consolidated Financial Statement ExerciseDocument4 pagesConsolidated Financial Statement ExerciseAnonymous OzWtUONo ratings yet

- Lufthansa Interim Q1 2010Document44 pagesLufthansa Interim Q1 2010riverofgiraffesNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamMikaela SalvadorNo ratings yet

- Annual Report With Cover Photo (Timeless Design)Document8 pagesAnnual Report With Cover Photo (Timeless Design)Huu Thanh TranNo ratings yet

- Salary Slip For The Month - Feb 2018: Earnings Amt. (INR) Deductions Amt. (INR)Document1 pageSalary Slip For The Month - Feb 2018: Earnings Amt. (INR) Deductions Amt. (INR)ROHIT RANJAN33% (3)

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument15 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced Levelrahat879No ratings yet

- OverheadsDocument38 pagesOverheadsHebaNo ratings yet

- CMA 2013 SampleEntranceExam Revised May 15 2013Document77 pagesCMA 2013 SampleEntranceExam Revised May 15 2013Ava DasNo ratings yet

- Ae23 Capital Budgeting 2Document2 pagesAe23 Capital Budgeting 2Hanielyn TagupaNo ratings yet