Professional Documents

Culture Documents

Chapter 33 PFRS 5 Discontinued Operations

Chapter 33 PFRS 5 Discontinued Operations

Uploaded by

studentoneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 33 PFRS 5 Discontinued Operations

Chapter 33 PFRS 5 Discontinued Operations

Uploaded by

studentoneCopyright:

Available Formats

Problem 33-1 (IFRS)

On September 30, 2020 when the carrying amount of the net assets of a business

segment was P70,000,000, Young Company signed a legally binding contract to sell the

business segment. The sale is expected to be completed by January 31, 2021 at a sale

price of P60,000,000. In addition, prior to January 31, 2021, the sale Contract obliged

Young Company to terminate the employment of certain employees of the business

segment incurring an expected termination cost of P2, 000, 000 to be paid on June 30,

2021.The segment revenue and expenses for 2020 were P40,000,000 and P45,000,000

respectively.

What amount should be reported as pretax loss from discontinued operation for 2020?

a. 17, 000, 000

b. 12, 000, 000

c. 15, 000, 000

d. 7, 000, 000

Problem 33-2 (IAA)

Booker Company committed to sell the comic book division, a component of the

business, on September 1, 2020. The carrying amount of the division was P4,000,000

and the fair value was P3,500,000. The disposal date is expected on June 1, 2021. The

division reported an operating loss of P200, 000 for the year ended December 31, 2020.

What amount should be reported as pretax loss from discontinued operation in 2020?

a. 500, 000

b. 200, 000

c. 700, 000

d. 0

Problem 33-3 (IFRS)

Zebra Company is a diversified entity with nationwide interests in commercial real

estate development, banking, mining and food distribution. The food distribution

division\'was deemed to be inconsistent with the long-term direction of the entity. On

October 1, 2020 the board of directors voted to approve the disposal of this division.

The sale is expected to occur in August 2021. The food distribution had revenue of P35,

000, 000 and expenses of P27, 000, 000 for the period January 1 to September 30, and

revenue of P15, 000, 000 and expenses of P10, 000, 000 for the period October 1 to

December 31. The carrying amount of the division’s net assets on December 31, 2020

was P55, 000, 000 and the fair value less cost of disposal was P60, 000, 000. The sale

contract required Zebra to terminate certain employees incurring an expected

termination cost of P4, 000, 000 to be paid by December 15, 2021. The income tax rate

is 30%.

What amount should be reported as income from discontinued operation for 2020?

a. 7,700,000

b. 8,300,000

c. 9,000,000

d. 6,300,000

Problem 334 (IAA)

Enron Company decided on August 1, 2020 to dispose of a component of business.

The component was sold on November 30, 2020. the net income for the current year

included income of P5, 000, 000 from operating the discontinued segment from January

to the date of disposal. The entity incurred a loss on the November 30, sale of

P1,000,000

What amount should be reported as pretax income or loss from discontinued operation

for 2020?

a. 1,000,000 loss

b. 5,000,000 income

c. 4,000,000 loss

d. 4,000,000 income

You might also like

- Problem #6 A Sole Proprietorship and An Individual With No Business Form A PartnershipDocument1 pageProblem #6 A Sole Proprietorship and An Individual With No Business Form A Partnershipstudentone93% (15)

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A Partnershipstudentone60% (15)

- Problem #8 Two Sole Proprietors Form A PartnershipDocument2 pagesProblem #8 Two Sole Proprietors Form A Partnershipstudentone87% (15)

- Problem #8 Two Sole Proprietors Form A PartnershipDocument2 pagesProblem #8 Two Sole Proprietors Form A Partnershipstudentone87% (15)

- A Handbook On Supply Chain ManagementDocument89 pagesA Handbook On Supply Chain ManagementSimejNo ratings yet

- Chapter 13 SolutionsDocument8 pagesChapter 13 Solutionsflyerfan3767% (3)

- Lesson 2. Sustainability and Strategic AuditDocument14 pagesLesson 2. Sustainability and Strategic AuditstudentoneNo ratings yet

- NPO-Multiple Choice Questions PART VIDocument3 pagesNPO-Multiple Choice Questions PART VILorraineMartinNo ratings yet

- IKEA's Strategic ManagementDocument38 pagesIKEA's Strategic ManagementJobeer Dahman93% (45)

- Audit Working Papers: By: Tariq MahmoodDocument38 pagesAudit Working Papers: By: Tariq MahmoodMazhar Hussain Ch.No ratings yet

- Chapter 4 Receivables and Related RevenuesDocument12 pagesChapter 4 Receivables and Related Revenuesjohn condesNo ratings yet

- Chapter 3 MultiDocument3 pagesChapter 3 MultiJose Mari M. NavaseroNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- (CB MODULE) Module 3 - Problem 3.1 To 3.20 Answer Keys (Pages 156 To 167)Document29 pages(CB MODULE) Module 3 - Problem 3.1 To 3.20 Answer Keys (Pages 156 To 167)Grace Alipoyo Fortuito-tanNo ratings yet

- Pre-Test 5Document3 pagesPre-Test 5BLACKPINKLisaRoseJisooJennieNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- Answer The Following With Speed and Accuracy. Solutions Must Be DisclosedDocument4 pagesAnswer The Following With Speed and Accuracy. Solutions Must Be DisclosedUNKNOWNNNo ratings yet

- Audit of Liabiities and She-1Document9 pagesAudit of Liabiities and She-1Yaj CruzadaNo ratings yet

- AP AnswerKeyDocument6 pagesAP AnswerKeyRosalie E. Balhag100% (2)

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Financial Management - FSADocument6 pagesFinancial Management - FSAAbby EsculturaNo ratings yet

- Quiz in ELEC 01 (Inventory Estimation)Document3 pagesQuiz in ELEC 01 (Inventory Estimation)djanine cardinalesNo ratings yet

- Special Transact - Almario Quiz 1Document4 pagesSpecial Transact - Almario Quiz 1Es ToryahieeNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Document7 pagesRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNo ratings yet

- Answers To MCQ BookDocument2 pagesAnswers To MCQ BookFernando III Perez0% (1)

- CosAcc Unit 1 Introduction PDFDocument13 pagesCosAcc Unit 1 Introduction PDFKrisha NicoleNo ratings yet

- Final PreboardsDocument14 pagesFinal Preboardsrandomlungs121223No ratings yet

- p1 Midterm 2012Document8 pagesp1 Midterm 2012marygraceomacNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- 12Document12 pages12mariyha Palanggana0% (2)

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- Midterm Exam AST With AnswersDocument15 pagesMidterm Exam AST With AnswersJames CantorneNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- سناء انتر5 PDFDocument40 pagesسناء انتر5 PDFMohammed Isa HomidatNo ratings yet

- AP Ist Quiz 6419Document11 pagesAP Ist Quiz 6419Veron Briones50% (2)

- 5134649879operating Segment FinalDocument8 pages5134649879operating Segment FinalGlen JavellanaNo ratings yet

- Intangible Assets Assignment - No Answers - For PostingDocument2 pagesIntangible Assets Assignment - No Answers - For Postingemman neriNo ratings yet

- Auditing ProblemsDocument17 pagesAuditing ProblemsKathleenCusipagNo ratings yet

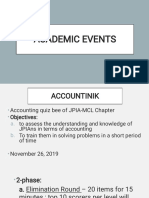

- JPIA-MCL Academic-EventsDocument17 pagesJPIA-MCL Academic-EventsJana BercasioNo ratings yet

- Sample Problems INTACC-3 - PART-2Document6 pagesSample Problems INTACC-3 - PART-2Angela AlarconNo ratings yet

- ExamDocument7 pagesExamKristen WalshNo ratings yet

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logeneNo ratings yet

- Problem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Document6 pagesProblem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Actg SolmanNo ratings yet

- Review Questions For Chapter 6 (Statement ofDocument19 pagesReview Questions For Chapter 6 (Statement ofNick Corrosivesnare40% (5)

- AP-5906 ReceivablesDocument5 pagesAP-5906 ReceivablesAngelieNo ratings yet

- 1234449Document19 pages1234449Jade MarkNo ratings yet

- This Study Resource Was: Saint Paul School of Business and LawDocument4 pagesThis Study Resource Was: Saint Paul School of Business and LawKim FloresNo ratings yet

- Finals Manaco2Document6 pagesFinals Manaco2Kenneth Bryan Tegerero Tegio100% (1)

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Answer - ELEC 001Document2 pagesAnswer - ELEC 001Kris Van HalenNo ratings yet

- Easy 1. Which Is The Correct Accounting For A Finance Lease in The AccountsDocument4 pagesEasy 1. Which Is The Correct Accounting For A Finance Lease in The AccountsQueen ValleNo ratings yet

- Far NosolnDocument11 pagesFar NosolnStela Marie CarandangNo ratings yet

- Module 4 Post TaskDocument9 pagesModule 4 Post TaskTHEA BEATRICE GARCIA100% (1)

- ELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityDocument1 pageELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityRyoma EchizenNo ratings yet

- ACCO 20063 Homework 3 Review of Conceptual FrameworkDocument8 pagesACCO 20063 Homework 3 Review of Conceptual FrameworkVincent Luigil AlceraNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Joana MagtuboNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- AIS Tut 1Document3 pagesAIS Tut 1HagarMahmoud0% (1)

- Great DepressionDocument5 pagesGreat DepressionDarrelNo ratings yet

- MAS First Prebrd SOL FEBRUARY 2024 95th Batch SOLUTIONSDocument4 pagesMAS First Prebrd SOL FEBRUARY 2024 95th Batch SOLUTIONSMikee LabadaNo ratings yet

- ACC 139 SAS Day 17 EXAM JLDDocument20 pagesACC 139 SAS Day 17 EXAM JLDmarili ZarateNo ratings yet

- AccountingDocument3 pagesAccountingrenoNo ratings yet

- Answers - Chapter 5 Vol 2Document5 pagesAnswers - Chapter 5 Vol 2jamfloxNo ratings yet

- Assignment 1 - Discontinued Operation Test 10 ItemsDocument4 pagesAssignment 1 - Discontinued Operation Test 10 ItemsJeane Mae BooNo ratings yet

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- Comprehensive QuizDocument4 pagesComprehensive QuizBea LadaoNo ratings yet

- Quiz Discontinued OperationsDocument2 pagesQuiz Discontinued OperationsMENDOZA, GLENDA S.No ratings yet

- Updates in MA - Prelim ReviewerDocument5 pagesUpdates in MA - Prelim ReviewerstudentoneNo ratings yet

- DocxDocument8 pagesDocxstudentoneNo ratings yet

- C094 - IAP107 - Sustainability and Strategic AuditDocument5 pagesC094 - IAP107 - Sustainability and Strategic AuditstudentoneNo ratings yet

- Updates in Managerial AccountingDocument15 pagesUpdates in Managerial Accountingstudentone50% (2)

- Responsibility Acctg Transfer Pricing GP AnalysisDocument21 pagesResponsibility Acctg Transfer Pricing GP AnalysisstudentoneNo ratings yet

- Mas Notes Reviewer PDFDocument91 pagesMas Notes Reviewer PDFstudentoneNo ratings yet

- Break Even AnalysisDocument20 pagesBreak Even AnalysisstudentoneNo ratings yet

- Updates in Managerial AccountingDocument32 pagesUpdates in Managerial Accountingstudentone100% (2)

- Session 02 CH 2 Introduction To Transaction ProcessingDocument41 pagesSession 02 CH 2 Introduction To Transaction ProcessingstudentoneNo ratings yet

- A. Steps in Queuing Analysis Queuing Process Refers To The NumberDocument7 pagesA. Steps in Queuing Analysis Queuing Process Refers To The NumberstudentoneNo ratings yet

- Chapter 1Document2 pagesChapter 1studentoneNo ratings yet

- Of Fiscal Policy:: I. Full EmploymentDocument2 pagesOf Fiscal Policy:: I. Full EmploymentstudentoneNo ratings yet

- Definition of Terms: Basket of Goods: Consumer Price IndexDocument6 pagesDefinition of Terms: Basket of Goods: Consumer Price IndexstudentoneNo ratings yet

- A. Steps in Queuing AnalysisDocument10 pagesA. Steps in Queuing AnalysisstudentoneNo ratings yet

- Decision Theory - Sheet1Document2 pagesDecision Theory - Sheet1studentoneNo ratings yet

- Prob 3 Ch. 1 ParcorDocument2 pagesProb 3 Ch. 1 Parcorstudentone100% (1)

- Problem #10 Two Sole Proprietorship Form A PartnershipDocument2 pagesProblem #10 Two Sole Proprietorship Form A Partnershipstudentone83% (6)

- Problem 11 - 1 CfasDocument1 pageProblem 11 - 1 CfasstudentoneNo ratings yet

- Chapter 1 Multiple Choice PGDocument1 pageChapter 1 Multiple Choice PGstudentone50% (2)

- Chapter 1 QuestionsDocument2 pagesChapter 1 QuestionsstudentoneNo ratings yet

- Prob 3 Ch. 1 ParcorDocument2 pagesProb 3 Ch. 1 Parcorstudentone100% (1)

- (Sabio) : Equipment 400,000 Accounts Receivable 360,000 Allowance For Doubtful Accounts 54,000 Sabio, Captial 706,000Document2 pages(Sabio) : Equipment 400,000 Accounts Receivable 360,000 Allowance For Doubtful Accounts 54,000 Sabio, Captial 706,000studentoneNo ratings yet

- ANSWER KEY - MULTIPLE CHOICE - THEORIES & PROBLEMSDocument4 pagesANSWER KEY - MULTIPLE CHOICE - THEORIES & PROBLEMSstudentone100% (1)

- TMF Group-Country-Profile-Luxembourg-PRINTDocument32 pagesTMF Group-Country-Profile-Luxembourg-PRINTRicardo FerreiraNo ratings yet

- Income Tax Vol-2 48th EditionDocument540 pagesIncome Tax Vol-2 48th EditionVipul VatsNo ratings yet

- Gebeyehu Final ResearchDocument43 pagesGebeyehu Final ResearchyusufNo ratings yet

- Rc-upload-1666858542586-3-Bank Details LOA (MST) - Version 092022Document2 pagesRc-upload-1666858542586-3-Bank Details LOA (MST) - Version 092022Noor HerziantiNo ratings yet

- SMAC - Social, Mobile, Analytics, CloudDocument12 pagesSMAC - Social, Mobile, Analytics, CloudtechnetNo ratings yet

- Global BlueDocument2 pagesGlobal BlueAKSHAYNo ratings yet

- Project Human Resource Development: "Apple"Document16 pagesProject Human Resource Development: "Apple"cjksdbvjkcsbNo ratings yet

- Code of Conduct TrainingDocument2 pagesCode of Conduct TrainingtmaulanaNo ratings yet

- P2 Joint Arrangements - GuerreroDocument17 pagesP2 Joint Arrangements - GuerreroCelen OchocoNo ratings yet

- Tool Emerging Techn 765549 NDXDocument4 pagesTool Emerging Techn 765549 NDXAarzoo DewanNo ratings yet

- How To Create A Data CultureDocument9 pagesHow To Create A Data CultureCognizantNo ratings yet

- CH11Document31 pagesCH11Marwa HassanNo ratings yet

- SM 06 NewDocument25 pagesSM 06 NewWita WhdNo ratings yet

- KPMG - SprocketDocument1 pageKPMG - SprocketAtulNo ratings yet

- Volume V, Issue 11 - November 2016 - Project Management World JDocument3 pagesVolume V, Issue 11 - November 2016 - Project Management World JMiguel Comino LópezNo ratings yet

- Instance ShreeDocument131 pagesInstance ShreesandyNo ratings yet

- For Examiner's UseDocument16 pagesFor Examiner's UseAung Zaw HtweNo ratings yet

- ISO/TS 22163: Railway Applications - Quality Management System - Business Management System Requirements For Rail OrganizationsDocument2 pagesISO/TS 22163: Railway Applications - Quality Management System - Business Management System Requirements For Rail OrganizationsRagul VinothNo ratings yet

- W8 Instructions PDFDocument15 pagesW8 Instructions PDFKrisdenNo ratings yet

- Product Life Cycle - IIPSDocument61 pagesProduct Life Cycle - IIPSsomyabhargava100% (4)

- Add-Course ReportDocument93 pagesAdd-Course Reportmaltemayur37No ratings yet

- Nissan Case Study of Haward Business SchoolDocument14 pagesNissan Case Study of Haward Business SchoolKAPIL VARSHNEYNo ratings yet

- Home Business Magazine October 2009Document84 pagesHome Business Magazine October 2009Home Business Magazine100% (16)

- Internal Auditors Guide To Blockchain - 1554497668 PDFDocument8 pagesInternal Auditors Guide To Blockchain - 1554497668 PDFSatyam KesharwaniNo ratings yet

- 2017-10 - Council Minutes October 2017Document58 pages2017-10 - Council Minutes October 2017The ExaminerNo ratings yet

- Ai - PPT 7 (Internal Control)Document30 pagesAi - PPT 7 (Internal Control)diana_busrizalti100% (1)