Professional Documents

Culture Documents

In Executive Pay, A Rich Game of Thrones: Avenues

In Executive Pay, A Rich Game of Thrones: Avenues

Uploaded by

Rajesh K SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Executive Pay, A Rich Game of Thrones: Avenues

In Executive Pay, A Rich Game of Thrones: Avenues

Uploaded by

Rajesh K SinghCopyright:

Available Formats

2 DECCANHERALD ***123 Wednesday, June 13, 2012

Avenues For in-depth analysis of business news,

read Economy & Business on Monday »

In executive pay, a rich game of thrones

Natasha Singer cording to a recent study from cent captured 93 per cent of stock awards and a grant of op-

Georgetown University. the income gains, while the in- tions to purchase 1.9 million

I

s any CEO worth $1 million Data on CEO compensation comes of the 99 per cent essen- shares of HP stock.

a day? That’s roughly in 2011, albeit preliminary, con- tially remained flat, according Although that amounted to

$42,000 an hour. Or $700 firm what many of us already to a study by Emmanuel Saez, compensation of about $16.5

a minute. Or $12 a second. know: the top brass generally an economics professor at the million, ranking Ms. Whitman

do much, much better than the University of California, Berke- 35th on the Equilar list, she will

Think of it this way: In the rest of us, whether times are ley. have to meet certain conditions

time it took to read those good or bad. After the ups and In 2011, the median weekly for all of the stock to vest. If she

words, you could’ve pocketed downs of the recent boom-bust earnings for full-time wage and remains employed at H.P., she

$100. Finish this article and, years, pay among the 100 best- salary workers in the United can exercise her option to buy

well, you do the math. paid chief executives at big States rose only about 1 per 100,000 shares each year for

At Apple, the answer to that American corporations held cent, to $756, from $747 in the next three years. In addi-

question is an emphatic yes, fairly steady in 2011, according 2010, according to data from tion, 800,000 shares will vest

and then some. Not since Steve toEquilar, which reviewed the Bureau of Labour Statis- if HP’s share price increases by

Jobs has a chief executive at CEO compensation for The tics. In constant dollars, wages 20 per cent under her steward-

Apple, or any other public New York Times. Here are fell a little more than 2 per cent. ship, and another 800,000 will

American corporation, for that some numbers worth knowing: The C-suite and the shop vest if the stock increases by 40

matter, been as richly reward- • Among the 100 top-paid floor have never been further per cent.

ed in stock as Timothy D Cook, CEOs, overall pay last year rose apart, said Brandon Rees, the The rest of the top earners

who succeeded Jobs as chief a scant 2 per cent from 2010. deputy director of the AFL- list reads like an A-list of cor-

executive last August, a few • The median chief executive CIO office of investment. porate titans, from Robert A.

months before the latter died. in this group took home $14.4 “American workers are hav- Iger of Walt Disney, ranked sev-

Cook was paid a cash salary million, compared with theav- ing to make do with less,” Rees enth, with pay of $31.4 million,

of roughly $900,000 in 2011. erage annual American salary said, “while CEOs have never to William C Weldon of John-

On its own, that would have of $45,230. had it better.” son & Johnson, ranked 13th,

been a ho-hum paycheck for a • In all, the combined com- Equilar analysed base with $23.4 million. (Weldon

top American CEO in recent pensation of these 100 CEOs salaries, cash bonuses, perks, plans to step down as chief later

years. totaled $2.1 billion, the rough stock awards and options for this month; he will stay on as

But then came a wild extra, equivalent of the estimated an- the 100 most highly compen- chairman.)

a one-time award, in the form nual economic output of Sierra sated executives at public com- Rupert Murdoch of the

of Apple stock. It was initially Leone. panies that had revenue of News Corporation took 10th

worth a staggering $376.2 mil- The full picture won’t be- more than $5 billion and had place, with compensation of

lion. As of the end of last week, come clear until June or so, filed their proxy statements by $29.4 million, a 75 per cent in-

it was valued at roughly $634 when corporate proxy state- March 30. One standout on crease from 2010. In a year

million, reflecting Apple’s soar- ments will detail the full range the list was Vikram S Pandit, when the News Corporation

ing share price. of executive compensation. But the chief executive of Citi- and Murdoch’s son James were

Many credit Cook, along data available as of March 30 group. After the company was embroiled in a scandal over

with Jobs, for Apple’s recent suggests that a new elite is bailed out by taxpayers in phone hacking, the elder Mur-

success. And the company is emerging in corporate Ameri- 2009, Pandit pledged to work doch earned a cash bonus of

quick to note that Cook’s pay ca: CEOs who make more than for $1 a year until the bank re- $12.5 million. That is because

package extends over 10 years. $10 million a year. turned to profitability. the company did well financial-

One-half of his stock is sched- Granted, these are chief ex- Citigroup has since repaid ly, analysts said, even if its rep-

uled to vest in 2016, and the ecutives of publicly traded its bailout money, and the utation plummeted.

other in 2021, provided that companies, the kind of busi- board has restored Pandit’s “Financially, they exceeded

Cook still works for Apple. And, nesses anyone can buy into on pay. It amounted to $14.9 mil- their target,” said Boyd of Equi-

at a time when some investors the stock market. Next to pay lion last year, putting Pandit in lar. “But from a publicity stand-

seethe over far smaller pay- in the rarefied realms of private 45th place on Equilar’s list. Cit- point, News Corporation has

checks, a mere eight figures is American capitalism, the mul- igroup’s longtime shareholders taken a hit over the last year

relatively commonplace for top titrillion-dollar world of hedge are still waiting for their pay- and a half.”

chief executives these days, Ap- funds, private equity and the day: while the company’s net Also among the top 10,

ple’s shareholders are hardly like, these CEOs might seem income rose 3 per cent last David M Cote, the chief execu-

up in arms over the magnitude like pikers. Top hedge fund - that can turn dull proxy state- nine CEOs combined. Those utive compensation trends an- times ahead. “On average, pay year, Equilar said; its share tive of Honeywell, received to-

of Cook’s reward. To the con- managers collectively earned ments into page-turners. nine included Lawrence J Elli- nually for Sunday Business, levels have moderated,” said price fell 44 per cent. tal compensation of $35.3 mil-

trary, a vast majority voted in $14.4 billion last year. Cook is an extreme example son of Oracle, at $77.6 million, said Cook’s pay was unique. Doug Friske, the global head New “say on pay” votes, lion, putting him in fifth place.

favour of it. But the Equilar figures also of this phenomenon. He is, ex- a perennial on the best-paid “The amount he got was his- of executive compensation con- though non-binding, have Honeywell tends to dole out a

Of course, most of us can’t hint at the myriad ways execu- perts agree, an outlier, the only list, and Philippe P Dauman, of toric to such a degree that it sulting at Towers Watson, a hu- caused some companies to huge bonus every other year.

begin to wrap our heads tive compensation is as tailored chief executive on the Equilar Viacom, at $43.1 million. skews the numbers,” Boyd said. man resource consulting firm make a greater proportion of Last year, Cote’s bonus was

around pay figures like these. as a bespoke suit. It is those cus- list to pull down a nine-figure Aaron Boyd, the director of But Apple was not the only in New York. “Now we are see- pay contingent on chief execu- $23.3 million.

An American with a bachelor’s tom details - the one-off huge paycheck. His stock award was research at Equilar, the execu- special case. Consider J C Pen- ing normalisation.” tives’ achievement of rigorous Clarence P Cazalot Jr, the

degree, after all, typically stock grants, in Cook’s case, the so valuable, even at its initial tive compensation data firm ney, whose new chief executive, Corporate boards also seem performance goals. Some com- chief executive of Marathon

makes $2.3 million, not in a token $1 annual salaries or price, that his total compensa- based in Redwood City, Cali- Ronald B Johnson, came in to be acknowledging criticism panies have even eliminated Oil, received $29.9 million, an

year, but over a lifetime, ac- evaporating bonuses in others tion eclipsed that of the next fornia, that has reviewed exec- third on the top 100 list, with of executive pay from share- stock option awards — the increase of 239 per cent from

total compensation of $53.3 holders and the public. Some grants of stock that executives the previous year. That put him

million. companies have reduced dis- are able to buy at a fixed price in eighth place. Cazalot re-

Why? Last year, Johnson left cretionary bonuses and linked — in favor of full-value stock ceived a cash bonus of $21.8

his position as Senior Vice- executive pay more closely to awards that vest only if execu- million, the second-highest

President of retail at Apple, performance metrics like rev- tives meet specified goals, said cash bonus, a majority of which

along with Apple stock worth enue and share price. Last year, Carol Bowie, head of Americas came from accelerated payouts

$101 million at the time that companies also began to hold research at Institutional Share- for spinning off a company

had not yet vested. So, as part shareholder votes on executive holder Services, a proxy con- unit, the Marathon Petroleum

of his pay package, J C Penney pay packages, so-called “say on sulting firm for institutional in- Corporation.

gave Johnson a one-time stock pay” polls required by Dodd- vestors. Next, Alan R Mulally, who

award worth $52.6 million. (As Frank, the Wall Street reform “We are definitely seeing a helped turn around Ford, took

of the end of last week, his Ap- law. trend toward more perform- ninth place, with compensation

ple stock would have been Corporate America hasn’t ance-based pay,” Bowie said. “It of $29.5 million. Although

worth about $159 million. His entirely embraced reform. remains to be seen if perform- Ford’s share price fell nearly

Penney stock was worth $58 Some companies and industry ance follows.” 36 per cent last year, its net in-

million.) groups have asked the Securi- At Hewlett-Packard, for in- come increased 208 per cent.

Last year’s other top earners ties and Exchange Commission stance, shareholders voted in Elsewhere, Fabrizio Freda,

included Stephen I Chazen to jettison, or at least delay put- March 2011 to reject the com- the chief executive of the Estee

($31.7 million) of Occidental ting in place, a provision in the pany’s executive compensation Lauder Companies, made a big

Petroleum; Gregory Q Brown Dodd-Frank law that would re- plan. The board eventually re- leap.

($29.3 million) of Motorola So- quire companies to disclose the sponded to criticism over the He ranked 18th on the Equi-

lutions, and Howard D Schultz ratio of CEO pay to median em- company’s multimillion-dollar lar list, up from 54th place on

($16.1 million) of Starbucks. ployee pay, the kind of statistic executive severance packages. a comparable list in 2010. He

Analysts say the uptick in that could grab headlines in The departure last year of Léo received compensation of near-

CEO pay is a sign that corpo- this era of the 1 per cent. Apotheker, who had served as ly $21 million in 2011, a 51 per

rations are returning to busi- The 100 highest earners of CEO for 11 months, for exam- cent increase. Freda is the first

ness as usual after the last re- 2011 have one thing in com- ple, cost HP shareholders real outsider, and only the sec-

cession. When the economy mon, however. Although they about $30 million, according ond person outside the Lauder

soured, executive pay fell could all rank among the 1 per to a report from ISS. family, to run the beauty prod-

sharply at many companies, cent - households that bring in When HP’s board subse- ucts empire. Under his stew-

though not as much as many $380,000 or more - they actu- quently chose Meg Whitman ardship last year, Lauder’s net

ordinary Americans might ally belong in a more exclusive as the new CEO, it took some income increased 47 per cent,

have hoped. With the recovery bracket: people with more than steps to mollify shareholders while its total shareholder re-

in 2010, pay then skyrocketed. $10 million in pay. by giving her a performance- turn, the change in share price

Now it’s stabilising, suggesting, But the CEO wealth is hardly based compensation package. plus dividends paid, increased

perhaps, that corporate boards trickling down. During the The board offered her a base 90 per cent.

see more predictable economic 2010 recovery, the top 1 per salary of $1, no cash bonus, no The New York Times

IT sector slows down hiring to cut costs

I

nformation technology (IT) Major reason behind this is

sector in the country wit- companies are going to reduce

nessed steep decline in hir- the bench size and award more

ing activities as most compa- jobs on contact basis to save

nies embraced cost cutting costs for future inflation,” he

measures to tide over uncer- added. In terms of geographi-

tain economic conditions, say cal analysis, Bangalore has

experts. seen a slump of 31 per cent in

“Hiring activities have seen hiring from previous month

a dip of 29 per cent in IT and and a decline of 18 per cent

ITeS sectors in May 2012 from from the year-ago period.

the preceding month,” MyHir- Besides, Delhi has witnessed

ingClub.com CEO Rajesh Ku- a drop of 16 per cent last month

mar said. compared to April followed by

However, he said that other Chennai (17 per cent), Mumbai

industries have increased re- (14 per cent) and Hyderabad

cruitment activities by 13-15 per (12 per cent).

cent in May as compared to “As we had expected in be-

April. HR experts attributed ginning of this financial year

the sluggish job scenario in the hiring is not on the same pace.

IT and ITeS space to cost cut- Last month was not overall

ting move and expects that the good for hiring activity in the

same trend would continue for IT sector as the industry is

few months. more scared about their prof-

“Recruitment activity in IT itability in this financial year.

decline, but some skills still in “They had started doing cost

big demand. Cost cutting and control via several activities

project outsourcing is one of ty in economic scenario and po- would help the Indian software and that the reason several or-

the reason for decline in hiring litical conditions have also af- exporters with higher repatri- ganisations from this industry

activity in this sector,” Sat-n- fected hiring activities. We are ated earnings, as the largest had put their openings on hold

Merc Manpower Consultant expecting the same trend will proportion of their revenues till further notice. Might be this

Director Prachi Kumar said continue for few more comes from the US. will be continue for some more

about the job prospects in the months.” “But still IT companies had period,” Psyche Panacea Direc-

IT sector. Echoing the view, Rajesh Ku- slow down their hiring activi- tor Vikas Vats said.

She further said, “Uncertain- mar said, “A weaker rupee ties in the month of May 2012. PTI

You might also like

- Phone #Document669 pagesPhone #Rajesh K Singh33% (3)

- HR Predictions For 2023: CompanyDocument28 pagesHR Predictions For 2023: CompanyTriadiNo ratings yet

- Route To The TopDocument32 pagesRoute To The TopSandeep NaikNo ratings yet

- BSBMGT616 Assessment 1 - HUGO LIMA BRASILINO - #1Document7 pagesBSBMGT616 Assessment 1 - HUGO LIMA BRASILINO - #1Hugo Brasilino100% (2)

- Cool Japan InitiativeDocument30 pagesCool Japan InitiativeAndrewKazNo ratings yet

- Rollercoaster ReturnsDocument4 pagesRollercoaster ReturnsFormulaMoneyNo ratings yet

- 5 - Feats - 3.18 2Document1 page5 - Feats - 3.18 2tamccuneNo ratings yet

- USA TODAY Collegiate Case Study: Business LeadersDocument13 pagesUSA TODAY Collegiate Case Study: Business LeadersUSA TODAY EducationNo ratings yet

- Enron 101 PDFDocument4 pagesEnron 101 PDFYeminá Camacho YacariniNo ratings yet

- AnswersDocument56 pagesAnswers郭家豪No ratings yet

- Changing Jobs or Retiring?: 4 AT&T Employees Honored For Community Commitment, Duncan Has HonoreeDocument1 pageChanging Jobs or Retiring?: 4 AT&T Employees Honored For Community Commitment, Duncan Has HonoreePrice LangNo ratings yet

- Case General Dollar Solution Abdul Majeed MBA-CS 3Document5 pagesCase General Dollar Solution Abdul Majeed MBA-CS 3Sufi MajeedNo ratings yet

- The Wall Street Journal 20171223 B005 3Document1 pageThe Wall Street Journal 20171223 B005 3dst JakeNo ratings yet

- Who Rules AmericaDocument23 pagesWho Rules Americadelaney_sanders_2No ratings yet

- News Herald 20190608 A04 2 PDFDocument1 pageNews Herald 20190608 A04 2 PDFAnonymous etXfLqdHcNo ratings yet

- Bridges - Winter 2004Document12 pagesBridges - Winter 2004Federal Reserve Bank of St. LouisNo ratings yet

- Profiles in Investing - Leon Cooperman (Bottom Line 2004)Document1 pageProfiles in Investing - Leon Cooperman (Bottom Line 2004)tatsrus1No ratings yet

- Unit 5Document2 pagesUnit 5HuysymNo ratings yet

- Tahitian Noni Times June 2008Document4 pagesTahitian Noni Times June 2008EdNo ratings yet

- Emc/Age: Money and Muscle Coming To Efficiency and SafetyDocument4 pagesEmc/Age: Money and Muscle Coming To Efficiency and SafetyEMCAGENo ratings yet

- Salaries and Side Hustles British English StudentDocument7 pagesSalaries and Side Hustles British English StudentManuella EphyahNo ratings yet

- When It Comes To The Key Factor in Choosing A Job, It's Compensation All The WayDocument6 pagesWhen It Comes To The Key Factor in Choosing A Job, It's Compensation All The Waysteven25musNo ratings yet

- PDFDocument7 pagesPDFBhavani ShankarNo ratings yet

- Compiled Micro-Economics NotesDocument111 pagesCompiled Micro-Economics Notesqtj8v7dy7wNo ratings yet

- The Persuasive Power of Opportunity CostDocument2 pagesThe Persuasive Power of Opportunity Costelver.ramos2No ratings yet

- The Triple Bottom LineDocument2 pagesThe Triple Bottom LineCard CardNo ratings yet

- APT Morgans 5 Apr 2018 PDFDocument30 pagesAPT Morgans 5 Apr 2018 PDFNikhil JoyNo ratings yet

- Full Case Study - WeWorkDocument16 pagesFull Case Study - WeWorkVanshika SharmaNo ratings yet

- Full Download Foundations of Economics 8th Edition Bade Solutions ManualDocument35 pagesFull Download Foundations of Economics 8th Edition Bade Solutions Manualexonfleeting.r8cj3t100% (38)

- Farragut Newsletter June2009Document2 pagesFarragut Newsletter June2009FruffingNo ratings yet

- Skills ExerciseDocument6 pagesSkills ExerciseOzcan OzturkNo ratings yet

- Technology Capital Markets:: ResilientDocument3 pagesTechnology Capital Markets:: ResilientAlwaysOnNo ratings yet

- Salaries and Side Hustles British English StudentDocument7 pagesSalaries and Side Hustles British English StudentМилана АлексинаNo ratings yet

- An Actuarial Audit: ContingenciesDocument5 pagesAn Actuarial Audit: ContingenciesPrachi AryaNo ratings yet

- INTERBRAND - Best - Global - Brands 2020-Technology-DesktopDocument25 pagesINTERBRAND - Best - Global - Brands 2020-Technology-DesktopNaveed AhmedNo ratings yet

- Chapter 3: Market Integration Semi-FinalDocument8 pagesChapter 3: Market Integration Semi-FinalKenneth SuarezNo ratings yet

- Chapter 12 Inclass CopiesDocument3 pagesChapter 12 Inclass CopiesCarlosNo ratings yet

- Accounts Payable in Tough TimesDocument2 pagesAccounts Payable in Tough TimesAccounts Payable Now and Tomorrow50% (2)

- Eco 2Document1 pageEco 2NISHANTH P CHOYAL 2228512No ratings yet

- Spotlight On Spending #12: Taxpayers Tab For DCEODocument2 pagesSpotlight On Spending #12: Taxpayers Tab For DCEOIllinois PolicyNo ratings yet

- Adobe Scan 11 Feb 2023Document25 pagesAdobe Scan 11 Feb 2023Jack ConroyNo ratings yet

- Salaries and Side Hustles British English StudentDocument7 pagesSalaries and Side Hustles British English StudentAnca StanNo ratings yet

- America's Bailout BaronsDocument36 pagesAmerica's Bailout Baronsapi-25941405No ratings yet

- Ma RioDocument1 pageMa RioJanet LowNo ratings yet

- GPTW Fortune 100best Report 2016Document10 pagesGPTW Fortune 100best Report 2016Tushar PatilNo ratings yet

- 10.features 4-8Document1 page10.features 4-8lindsey_arynNo ratings yet

- 21 12 07 Tastytrade ResearchDocument6 pages21 12 07 Tastytrade ResearchCSNo ratings yet

- High CEO CompensationDocument2 pagesHigh CEO CompensationKamalavalli SethuramanNo ratings yet

- Lecture 3 PDFDocument66 pagesLecture 3 PDFJohanna Torres ReinaNo ratings yet

- Why Do We Like To Listen New Opportunities?Document62 pagesWhy Do We Like To Listen New Opportunities?api-27095887No ratings yet

- A Na A 8: Has OPEC Greed Finally TriggeredDocument1 pageA Na A 8: Has OPEC Greed Finally TriggeredCopy JunkieNo ratings yet

- 2022 06 01fortuneDocument212 pages2022 06 01fortunesarah123No ratings yet

- Exec Pay VV ImpDocument15 pagesExec Pay VV ImpSheharyar HamidNo ratings yet

- Empirical Finance Newsletter, September 2009 (Plus Stock Screen Results)Document4 pagesEmpirical Finance Newsletter, September 2009 (Plus Stock Screen Results)The Manual of IdeasNo ratings yet

- The Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersFrom EverandThe Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersNo ratings yet

- Summary of Scott Davis, Carter Copeland & Rob Wertheimer's Lessons from the TitansFrom EverandSummary of Scott Davis, Carter Copeland & Rob Wertheimer's Lessons from the TitansNo ratings yet

- ED200623Document1 pageED200623Rajesh K SinghNo ratings yet

- ED230623Document1 pageED230623Rajesh K SinghNo ratings yet

- 2023 06 07result - 03 30 PM - 2Document1 page2023 06 07result - 03 30 PM - 2Rajesh K SinghNo ratings yet

- 2023 06 07result - 05 40 PMDocument1 page2023 06 07result - 05 40 PMRajesh K SinghNo ratings yet

- Syllabus and Datesheet For Short Assessment 2020 2021 For Classes IIIVDocument6 pagesSyllabus and Datesheet For Short Assessment 2020 2021 For Classes IIIVRajesh K SinghNo ratings yet

- 2666 GMVN Gsa PolicyDocument3 pages2666 GMVN Gsa PolicyRajesh K SinghNo ratings yet

- Samavana Brochure FinalDocument19 pagesSamavana Brochure FinalRajesh K SinghNo ratings yet

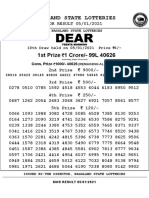

- Nagaland State Lotteries: 1st Prize 1 Crore/-55L 05591Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-55L 05591Rajesh K SinghNo ratings yet

- Most Scoring Concepts: For Neet 2022Document48 pagesMost Scoring Concepts: For Neet 2022Rajesh K Singh0% (1)

- Nagaland State Lotteries: 1st Prize 1 Crore/-56A 21449Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-56A 21449Rajesh K SinghNo ratings yet

- Achievements: Delhi Public School, Sushant LokDocument14 pagesAchievements: Delhi Public School, Sushant LokRajesh K SinghNo ratings yet

- Combo Items - 1Document3 pagesCombo Items - 1Rajesh K SinghNo ratings yet

- Hero Heroine Bollywood Actors Actress Directory 2021Document4 pagesHero Heroine Bollywood Actors Actress Directory 2021Rajesh K SinghNo ratings yet

- Nagaland State Lotteries: 1st Prize 1 Crore/-52L 22173Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-52L 22173Rajesh K SinghNo ratings yet

- DL281220Document1 pageDL281220Rajesh K SinghNo ratings yet

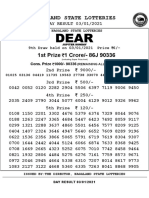

- Nagaland State Lotteries: 1st Prize 1 Crore/-86J 90336Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-86J 90336Rajesh K SinghNo ratings yet

- 2019 Nace Job Outlook Survey PDFDocument48 pages2019 Nace Job Outlook Survey PDFRajesh K SinghNo ratings yet

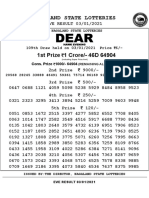

- Nagaland State Lotteries: 1st Prize 1 Crore/-46D 64904Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-46D 64904Rajesh K SinghNo ratings yet

- Nagaland State Lotteries: 1st Prize 1 Crore/-95L 89664Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-95L 89664Rajesh K SinghNo ratings yet

- EL281220Document1 pageEL281220Rajesh K SinghNo ratings yet

- Nagaland State Lotteries: 1st Prize 1 Crore/-99L 40626Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-99L 40626Rajesh K SinghNo ratings yet

- Nagaland State Lotteries: 1st Prize 1 Crore/-37L 69740Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-37L 69740Rajesh K SinghNo ratings yet

- Nagaland State Lotteries: 1st Prize 1 Crore/-92K 88458Document1 pageNagaland State Lotteries: 1st Prize 1 Crore/-92K 88458Rajesh K SinghNo ratings yet

- Project OverviewDocument6 pagesProject OverviewshirishpatelNo ratings yet

- Great Place To Work - 2010 UK ReportDocument33 pagesGreat Place To Work - 2010 UK ReportGreat Place To Work (UK)No ratings yet

- ICFAI University MBA Business Ethics and Corporate Governance (MB321) Sample Paper 2Document29 pagesICFAI University MBA Business Ethics and Corporate Governance (MB321) Sample Paper 2swati82No ratings yet

- Good Intentions and Failed Implementations-DanismanDocument12 pagesGood Intentions and Failed Implementations-Danismanandreeutzavl24No ratings yet

- Internal Vs External CeoDocument6 pagesInternal Vs External CeowaqaslbNo ratings yet

- Lebenslauf Klaus DittrichDocument2 pagesLebenslauf Klaus DittricherwrwerweNo ratings yet

- Minimum Standard For Specialized Orthpedic Hospital Dec 16 09Document157 pagesMinimum Standard For Specialized Orthpedic Hospital Dec 16 09Gudegna GemechuNo ratings yet

- The Dark Side of The Third SectorDocument2 pagesThe Dark Side of The Third Sectortrevorskingle100% (1)

- GT 2018 Russell 2000 SurveyDocument161 pagesGT 2018 Russell 2000 SurveyKaleab SeleshiNo ratings yet

- How Strategic Is Your BoardDocument7 pagesHow Strategic Is Your BoardAlberto RemolifNo ratings yet

- Renu Sud KarnadDocument1 pageRenu Sud KarnadAman BhartiyaNo ratings yet

- PressReleaseMDAL ENGDocument1 pagePressReleaseMDAL ENGPM SUSBANDONONo ratings yet

- Chapter 19 Lecture NotesDocument33 pagesChapter 19 Lecture Notesstacysha13No ratings yet

- An Analysis of Corporate Governance in Islamic and Western PerspectivesDocument6 pagesAn Analysis of Corporate Governance in Islamic and Western PerspectivesAzzam FaizulNo ratings yet

- Function, Roles, and Skills of A Manager: Lesson 3Document12 pagesFunction, Roles, and Skills of A Manager: Lesson 3Christine Joy ResponteNo ratings yet

- Fact Book 2019 - Final PDFDocument205 pagesFact Book 2019 - Final PDFpriteshpatel103100% (1)

- Public Procurement Act 2011Document98 pagesPublic Procurement Act 2011Vencheslaus Kaguo100% (1)

- Key Managerial Personnel (Note)Document4 pagesKey Managerial Personnel (Note)Shriyani DattaNo ratings yet

- Free Research Papers On Banking and FinanceDocument8 pagesFree Research Papers On Banking and Financeaflbvmogk100% (1)

- Zald Berger 1978Document40 pagesZald Berger 1978Rajiv Krishnan KozhikodeNo ratings yet

- CIO or CTO or VP IT or Director ITDocument4 pagesCIO or CTO or VP IT or Director ITapi-121338291No ratings yet

- Implementing Corporate Environmental StrategiesDocument37 pagesImplementing Corporate Environmental StrategiesDavid BoyerNo ratings yet

- UXC Annual Report To ShareholdersDocument89 pagesUXC Annual Report To ShareholdersTrevor Wood100% (1)

- Best Buy - Final Report 5-14-121Document4 pagesBest Buy - Final Report 5-14-121Forbes100% (1)

- CPCL Annual Report 2007Document96 pagesCPCL Annual Report 2007Subbu SureshNo ratings yet

- Ernst Young Guide To The IPO Value Journey by Ernst Young, Stephen C. Blowers, Peter H. Griffith, Thomas L. MilanDocument306 pagesErnst Young Guide To The IPO Value Journey by Ernst Young, Stephen C. Blowers, Peter H. Griffith, Thomas L. MilanAbhishek GuptaNo ratings yet

- Executive Order No. 648 Reorganizing The Human Settlements Regulatory CommissionDocument7 pagesExecutive Order No. 648 Reorganizing The Human Settlements Regulatory CommissionJom MariaNo ratings yet