Professional Documents

Culture Documents

Financial Statement Analysis Quiz

Uploaded by

JoeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis Quiz

Uploaded by

JoeCopyright:

Available Formats

Financial Statement Analysis Quiz

Gray Corporation’s financial statements for the last year are shown below. All figures are in thousands (P000). The firm paid

a P1, 000 dividends to its stockholders during the year. Two million shares of stock are outstanding. The stock is currently

trading at a price of P50. There were no sales of new stock. Lease payments totaling P400 are included in cost and expense.

Balance Sheet

Assets Liabilities & Equity

Cash P2, 000 Accounts Payable P3, 000

A/R 12, 000 Tax Payable 1, 000

Inventory 14, 000 Long Term Debt 10, 000

Fixed Assets 27, 000 Equity 25, 000

Acc. Depreciation (16,000)

Total Assets P39, 00 Total Liabilities & Equity 39, 000

Income Statement Compute for the following:

1. Current Ratio 12. Return on Assets

Sales P100, 000 2. Quick Ratio 13. Return on Equity

Cost of Sales ( 80, 000) 3. Average Collection Period 14. Price Earnings Ratio

Gross Margin 20, 000 4. Inventory Turnover 15. Market to book value ratio

Expenses (8, 000) 5. Fixed Asset Turnover

Depreciation (1, 600) 6. Total Asset Turnover

EBIT 10, 400 7. Debt Ratio

Interest ( 800) 8. Debt to Equity Ratio

EBT 9, 600 9. Times Interest Earned

Tax ( 2, 600) 10. Return on Sales

Net Income P 7, 000 11. Return on Sales

Financial Statement Analysis Quiz

Gray Corporation’s financial statements for the last year are shown below. All figures are in thousands (P000). The firm paid

a P1, 000 dividends to its stockholders during the year. Two million shares of stock are outstanding. The stock is currently

trading at a price of P50. There were no sales of new stock. Lease payments totaling P400 are included in cost and expense.

Balance Sheet

Assets Liabilities & Equity

Cash P2, 000 Accounts Payable P3, 000

A/R 12, 000 Tax Payable 1, 000

Inventory 14, 000 Long Term Debt 10, 000

Fixed Assets 27, 000 Equity 25, 000

Acc. Depreciation (16,000)

Total Assets P39, 00 Total Liabilities & Equity 39, 000

Income Statement Compute for the following:

1. Current Ratio 12. Return on Assets

Sales P100, 000 2. Quick Ratio 13. Return on Equity

Cost of Sales ( 80, 000) 3. Average Collection Period 14. Price Earnings Ratio

Gross Margin 20, 000 4. Inventory Turnover 15. Market to book value ratio

Expenses (8, 000) 5. Fixed Asset Turnover

Depreciation (1, 600) 6. Total Asset Turnover

EBIT 10, 400 7. Debt Ratio

Interest ( 800) 8. Debt to Equity Ratio

EBT 9, 600 9. Times Interest Earned

Tax ( 2, 600) 10. Return on Sales

Net Income P 7, 000 11. Return on Sales

You might also like

- HO No. 1 - Financial Statements AnalysisDocument3 pagesHO No. 1 - Financial Statements AnalysisJOHANNANo ratings yet

- Bsa 2 - Finman - Group 8 - Lesson 2Document5 pagesBsa 2 - Finman - Group 8 - Lesson 2カイ みゆきNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Q3 Capital Gains TaxDocument7 pagesQ3 Capital Gains TaxNhajNo ratings yet

- Calculating Capital Gains and Losses for Individual and Corporate TaxpayersDocument5 pagesCalculating Capital Gains and Losses for Individual and Corporate TaxpayersNhajNo ratings yet

- Far ReviewerDocument21 pagesFar Reviewerbea kullinNo ratings yet

- Illustrative Problem - Sales Type Lease With Residual ValueDocument2 pagesIllustrative Problem - Sales Type Lease With Residual ValueQueen ValleNo ratings yet

- RFBT.04 Law On Credit TransactionDocument2 pagesRFBT.04 Law On Credit TransactionRhea Royce CabuhatNo ratings yet

- Understanding Taxes and Estate TaxesDocument56 pagesUnderstanding Taxes and Estate TaxesJewel Mae MercadoNo ratings yet

- Income Tax Expense CalculationDocument4 pagesIncome Tax Expense CalculationHana Grace MamangunNo ratings yet

- A. Condonation or Remission of A DebtDocument3 pagesA. Condonation or Remission of A DebtTk KimNo ratings yet

- Prelim Exam: Name: Date: Professor: Section: ScoreDocument13 pagesPrelim Exam: Name: Date: Professor: Section: ScoreJoyce LunaNo ratings yet

- Practice SetDocument39 pagesPractice SetDionico O. Payo Jr.No ratings yet

- Midterm Exam With Answer Keydocx PDF FreeDocument10 pagesMidterm Exam With Answer Keydocx PDF FreeKryzzel Anne JonNo ratings yet

- Summary - IntAcc 3 Theories - Valix - OtherDocument13 pagesSummary - IntAcc 3 Theories - Valix - OtherChristopher VicenteNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- InTax Quiz 2 Real Estate Gain LossDocument2 pagesInTax Quiz 2 Real Estate Gain LossBLACKPINKLisaRoseJisooJennie100% (1)

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Local Government Code Concept MapDocument3 pagesLocal Government Code Concept MapBon Jovi RosarioNo ratings yet

- Value Added Tax (VAT) : Transfer and Business TaxDocument58 pagesValue Added Tax (VAT) : Transfer and Business TaxRizzle RabadillaNo ratings yet

- 6978 - Government Grant and Borrowing CostDocument2 pages6978 - Government Grant and Borrowing CostRaquel Villar DayaoNo ratings yet

- Compilation of MCQDocument34 pagesCompilation of MCQDaphnie Bolo100% (1)

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- Intermediate Accounting 3 - January 24, 2023, F2F DiscussionDocument8 pagesIntermediate Accounting 3 - January 24, 2023, F2F DiscussionZhaira Kim CantosNo ratings yet

- Exercises Budgeting and Responsibility Problems W - Solutions 1Document10 pagesExercises Budgeting and Responsibility Problems W - Solutions 1Kristine NunagNo ratings yet

- Real Estate Taxation - 12.11.15 (Wo Answers)Document7 pagesReal Estate Taxation - 12.11.15 (Wo Answers)Juan FrivaldoNo ratings yet

- M Idterm Activity - Donor 'S TaxDocument3 pagesM Idterm Activity - Donor 'S TaxMary DenizeNo ratings yet

- Problem 14-5: Kayla Cruz & Gabriel TekikoDocument7 pagesProblem 14-5: Kayla Cruz & Gabriel TekikoNURHAM SUMLAYNo ratings yet

- Set A Leases Problem SERANADocument6 pagesSet A Leases Problem SERANASherri BonquinNo ratings yet

- Week 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGDocument23 pagesWeek 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGfernan opeliñaNo ratings yet

- 1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)Document5 pages1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)James ScoldNo ratings yet

- RR 6-08Document19 pagesRR 6-08matinikkiNo ratings yet

- INSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetDocument13 pagesINSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetMac Ferds100% (2)

- TRANSFER AND BUSINESS TAXATIONDocument26 pagesTRANSFER AND BUSINESS TAXATIONRichelle PilapilNo ratings yet

- Taxa2 Quiz3Document14 pagesTaxa2 Quiz3ishinoya keishiNo ratings yet

- Tax Term Quiz TheoriesDocument6 pagesTax Term Quiz TheoriesRena Jocelle NalzaroNo ratings yet

- Assignment NegoDocument10 pagesAssignment Negomelbertgutzby vivasNo ratings yet

- Property, Plant and Equipment AccountingDocument10 pagesProperty, Plant and Equipment Accountingbhettyna noayNo ratings yet

- Investing ActivitiesDocument7 pagesInvesting ActivitiesMs. ArianaNo ratings yet

- C8 Statement of Financial PositionDocument14 pagesC8 Statement of Financial PositionAllaine ElfaNo ratings yet

- Money Markets ReviewerDocument4 pagesMoney Markets ReviewerHazel Jane EsclamadaNo ratings yet

- Fin Mar 2.1 Determinants of Int RatesDocument3 pagesFin Mar 2.1 Determinants of Int RatesMadelyn EspirituNo ratings yet

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Exam - Taxation MSA 206Document4 pagesExam - Taxation MSA 206Juan FrivaldoNo ratings yet

- Chapter 1 Succession and Transfer Taxes Part 3Document2 pagesChapter 1 Succession and Transfer Taxes Part 3AngieNo ratings yet

- PRESENTATION OF FS Problems Answer KeyDocument20 pagesPRESENTATION OF FS Problems Answer KeyJazie CadelinaNo ratings yet

- Maris CorporationDocument2 pagesMaris CorporationmageNo ratings yet

- Value Added TaxDocument8 pagesValue Added TaxErica VillaruelNo ratings yet

- Session 1 Exercise DrillDocument5 pagesSession 1 Exercise DrillABBIE GRACE DELA CRUZNo ratings yet

- Mansci - Chapter 3Document2 pagesMansci - Chapter 3Rae WorksNo ratings yet

- Investment in Equity Securities - SeatworkDocument2 pagesInvestment in Equity Securities - SeatworkLester ColladosNo ratings yet

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- Which Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in AssociatesDocument1 pageWhich Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in Associatesjahnhannalei marticio0% (1)

- Modes of Acquiring Ownership & Estate TaxesDocument11 pagesModes of Acquiring Ownership & Estate TaxesMarko JerichoNo ratings yet

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument3 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- SOREV Income Approach DiagnosticDocument4 pagesSOREV Income Approach DiagnosticReyn شكرا100% (1)

- Business Law Chapter-4Document3 pagesBusiness Law Chapter-4Gita KnowledgeNo ratings yet

- UNDERSTANDING INTERCOMPANY TRANSACTIONSDocument2 pagesUNDERSTANDING INTERCOMPANY TRANSACTIONSMark Lyndon YmataNo ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- Activity 1 - FS Analysis AnswerDocument6 pagesActivity 1 - FS Analysis AnswerMelvert Alvarez MacaranasNo ratings yet

- External Auditor Independence StandardsDocument1 pageExternal Auditor Independence StandardsJoeNo ratings yet

- When a Mentor Becomes a ThiefDocument10 pagesWhen a Mentor Becomes a ThiefJoeNo ratings yet

- 1.1 Technical Writing IntroDocument43 pages1.1 Technical Writing IntroMeleen TadenaNo ratings yet

- Test I. Choose The Best AnswerDocument3 pagesTest I. Choose The Best AnswerJoeNo ratings yet

- 1.1 Technical Writing IntroDocument43 pages1.1 Technical Writing IntroMeleen TadenaNo ratings yet

- Sales Dialogue: Creating and Communicating ValueDocument17 pagesSales Dialogue: Creating and Communicating ValueJoeNo ratings yet

- ACCBP 100 – Accounting Plus ULOa. Discuss the nature of business and its relationship in managementDocument31 pagesACCBP 100 – Accounting Plus ULOa. Discuss the nature of business and its relationship in managementJoeNo ratings yet

- Performance Task Practice Set: Accountancy, Business and Management 1Document2 pagesPerformance Task Practice Set: Accountancy, Business and Management 1JoeNo ratings yet

- Transparency PDFDocument9 pagesTransparency PDFJoeNo ratings yet

- Demand, Supply and Equilibrium Analysis: Chapters 4,5 & 6Document49 pagesDemand, Supply and Equilibrium Analysis: Chapters 4,5 & 6JoeNo ratings yet

- ABM Corp Trial Balance WorksheetDocument1 pageABM Corp Trial Balance WorksheetJoeNo ratings yet

- Table of Specifications (TOS) : Course: Date Completed: College: Term: Sem: SY: Exam Date: Total PointsDocument1 pageTable of Specifications (TOS) : Course: Date Completed: College: Term: Sem: SY: Exam Date: Total PointsJoeNo ratings yet

- Concept of Demand: Willing AbleDocument13 pagesConcept of Demand: Willing AbleHarish Lodhi100% (1)

- Building Customer RelationshipDocument21 pagesBuilding Customer RelationshipJoeNo ratings yet

- Chapter 15: Partnerships - Formation, Operations, and Changes in Ownership InterestsDocument43 pagesChapter 15: Partnerships - Formation, Operations, and Changes in Ownership InterestsMona A Al NabahinNo ratings yet

- Chapter 2 Strategic Dimensions To QualityDocument20 pagesChapter 2 Strategic Dimensions To QualityJoe100% (1)

- ACCBP 100 – Accounting Plus ULOa. Discuss the nature of business and its relationship in managementDocument31 pagesACCBP 100 – Accounting Plus ULOa. Discuss the nature of business and its relationship in managementJoeNo ratings yet

- The Functions of Financial Management The Functions of Financial ManagementDocument9 pagesThe Functions of Financial Management The Functions of Financial ManagementJoeNo ratings yet

- Market StructureDocument18 pagesMarket StructureAnonymous xOqiXnW9No ratings yet

- Forms of Business OrganizationDocument26 pagesForms of Business OrganizationJoeNo ratings yet

- Practice S and D, Market Structures - Day 4Document21 pagesPractice S and D, Market Structures - Day 4JoeNo ratings yet

- Sales Agency: UM Tagum College Arellano Street, Tagum City, 8100 Philippines Home Office and Branch AccountingDocument1 pageSales Agency: UM Tagum College Arellano Street, Tagum City, 8100 Philippines Home Office and Branch AccountingJoeNo ratings yet

- Forms of Business OrganizationDocument26 pagesForms of Business OrganizationJoeNo ratings yet

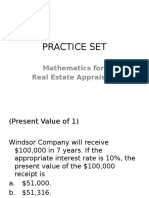

- Time Value of Money & FS Analysis QuizDocument2 pagesTime Value of Money & FS Analysis QuizJoeNo ratings yet

- Nature, Purpose and Scope of Financial ManagementDocument7 pagesNature, Purpose and Scope of Financial ManagementJoeNo ratings yet

- Relationship of Financial Objectives to Organizational StrategyDocument11 pagesRelationship of Financial Objectives to Organizational StrategyJoeNo ratings yet

- Pfizer SWOT AnalysisDocument3 pagesPfizer SWOT AnalysisJoeNo ratings yet

- Sales Agency: UM Tagum College Arellano Street, Tagum City, 8100 Philippines Home Office and Branch AccountingDocument1 pageSales Agency: UM Tagum College Arellano Street, Tagum City, 8100 Philippines Home Office and Branch AccountingJoeNo ratings yet

- Accounting exam questionsDocument3 pagesAccounting exam questionsJoeNo ratings yet

- Chap 019Document45 pagesChap 019ducacapupuNo ratings yet

- Business TerminologyDocument5 pagesBusiness TerminologyPap KitcharoenkankulNo ratings yet

- Books for Physicians to Read for Personal Finance and InvestingDocument8 pagesBooks for Physicians to Read for Personal Finance and Investingmchallis100% (1)

- Assign 2 CLO 3Document3 pagesAssign 2 CLO 3DIVA RTHININo ratings yet

- Study of Tstockmantra Investment - Offered Services, Risk & GainsDocument47 pagesStudy of Tstockmantra Investment - Offered Services, Risk & GainsBHUPENDRANo ratings yet

- Himilo University Principle of Accounting II AssignmentDocument2 pagesHimilo University Principle of Accounting II AssignmentSabina MaxamedNo ratings yet

- Absolute Return: The Way To Make Money in Emerging Markets?Document26 pagesAbsolute Return: The Way To Make Money in Emerging Markets?Stelu OlarNo ratings yet

- Cash FlowDocument6 pagesCash Flowsilvia indahsariNo ratings yet

- Disadvantage 0f CAPMDocument4 pagesDisadvantage 0f CAPMromanaNo ratings yet

- Equity Shares-1Document98 pagesEquity Shares-1Mayur MankarNo ratings yet

- Agency Problems and Accountability of Corporate ManagersDocument38 pagesAgency Problems and Accountability of Corporate ManagersLovely PasatiempoNo ratings yet

- Week 1FDocument23 pagesWeek 1FJessicaNo ratings yet

- Test Bank For Microeconomics and Behavior 10th Edition Robert FrankDocument23 pagesTest Bank For Microeconomics and Behavior 10th Edition Robert Frankmichaelmckayksacoxebfi95% (21)

- Creighton Value Investing PanelDocument9 pagesCreighton Value Investing PanelbenclaremonNo ratings yet

- Activity Partnership Formation and OperationDocument8 pagesActivity Partnership Formation and OperationSharon AnchetaNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial ReportingNhel AlvaroNo ratings yet

- ICICI Prudential Equity & Debt FundDocument3 pagesICICI Prudential Equity & Debt FundSabyasachi ChatterjeeNo ratings yet

- Aramit Limited 2010Document46 pagesAramit Limited 2010Sadia ChowdhuryNo ratings yet

- Soal Latihan Penilaian SahamDocument6 pagesSoal Latihan Penilaian SahamAchmad Syafi'iNo ratings yet

- Session 1 Part 0 Private Equity Class InstructionsDocument12 pagesSession 1 Part 0 Private Equity Class InstructionseruditeaviatorNo ratings yet

- Sample3-351, Online - Sfsu.edu Quiz and SolutionDocument5 pagesSample3-351, Online - Sfsu.edu Quiz and SolutionBikal MagarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Stoploss MethodsDocument6 pagesStoploss MethodsKrishnamoorthy Subramaniam100% (1)

- Activity 1 Finman 1Document6 pagesActivity 1 Finman 1lykaNo ratings yet

- Month End Activities.Document10 pagesMonth End Activities.The survivorNo ratings yet

- Coca-Cola Working-From Sagar - PGPFIN StudentDocument23 pagesCoca-Cola Working-From Sagar - PGPFIN StudentAshutosh TulsyanNo ratings yet

- Statement of Cash Flows MCQsDocument7 pagesStatement of Cash Flows MCQsSamsung AccountNo ratings yet

- Understanding The Myths of Market Trends and PatternsDocument32 pagesUnderstanding The Myths of Market Trends and PatternsbayaBiH100% (2)

- Advanced Financial Accounting Course OutlineDocument5 pagesAdvanced Financial Accounting Course OutlineEriqNo ratings yet

- Kiểm tra LMS - lần 2Document17 pagesKiểm tra LMS - lần 2Kotoru HanoelNo ratings yet