Professional Documents

Culture Documents

Cash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business Income

Uploaded by

neha0 ratings0% found this document useful (0 votes)

15 views19 pagesOriginal Title

Chemlite-B.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views19 pagesCash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business Income

Uploaded by

nehaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 19

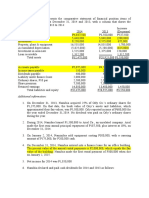

Cash Flow Statement (In Direct Method)

Net Income 118,995

Adjustments:

To reconcile net income to net cash provided

by operating activities

Add: Non-Cash Charges and Non-Business Exp

Less: Non-Business Income

Depreciation 61,625

Amortization of patents 25,000

Gain on sale of equipment -24,250

Deferred Taxes (Refer Note 2) 26730

Int Expenses 58750

147,855

Net changes in Working Capital

Add: Decrease in CA and Inc in CL

Less: Increase in CA and Dec in CL

Accounts receivable -70,030

Inventories:

Raw materials -20,450

Finished Goods -99,680

Prepaid insurance -65,000

Taxes payable -950

-256,110

Net cash from operating activities (A) 10,740

Cash flows from investing activities

Capital expenditures for P & E (520+425) -945,000

Proceeds from sale of equipment 215,500

Net cash used in investing activities (B) -729,500

Cash flows from financing activities

Proceeds from issuance of long term debt 510,000

Proceeds from issuance of short term debt 200,000

Dividends paid -10,000

Purchase of treasury stock -26,000

Int Expenses -58750

Net cash provided by financing activities (C) 615,250

Net decrease in cash (A)+(B)+(C) -103,510

Cash at beginning of the year 113,000

Cash at the end of the year 9,490

Note: 1. purchase of land (2.5) and a building (6) for

$850,000. These investments were partly

(8.5*50%=4.25) financed by the issue of a Notes

Payable to the seller of the land and building, there is

no cash involved in this transaction

Note:2. Deferred tax is a non-cash item

You might also like

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Chema LiteDocument8 pagesChema LiteHàMềmNo ratings yet

- Chemalite - A - en - BDocument12 pagesChemalite - A - en - BAimane Beggar100% (1)

- Audit of Financial StatementsDocument4 pagesAudit of Financial StatementsMark Anthony TibuleNo ratings yet

- Cash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business IncomeDocument19 pagesCash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business IncomemishikaNo ratings yet

- Cash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business IncomeDocument19 pagesCash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business IncomeAniket DubeyNo ratings yet

- Cash Flow Statement: Operating Profit Before Working Capital ChangesDocument1 pageCash Flow Statement: Operating Profit Before Working Capital ChangesnehaNo ratings yet

- Assignment 6 SolutionsDocument4 pagesAssignment 6 SolutionsjoanNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Chemalite (B)Document1 pageChemalite (B)Aimane BeggarNo ratings yet

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- Salditos, Ericca P.Document7 pagesSalditos, Ericca P.Ericca SalditosNo ratings yet

- Acctg5 - Quiz 1 DIODocument1 pageAcctg5 - Quiz 1 DIODante Nas JocomNo ratings yet

- 648235Document5 pages648235mohitgaba19No ratings yet

- ASS SoCFDocument2 pagesASS SoCFpau mejaresNo ratings yet

- HI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsDocument24 pagesHI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsFeku RamNo ratings yet

- Chemalite Statement of CFsDocument1 pageChemalite Statement of CFsacct634100% (1)

- Llagas 01 eLMS Activity 3Document3 pagesLlagas 01 eLMS Activity 3Angela Fye LlagasNo ratings yet

- Case StudyDocument2 pagesCase Studyの変化 ナザレNo ratings yet

- In Philippine PesoDocument4 pagesIn Philippine PesoAitanna Sophia LagunaNo ratings yet

- Cash Flow Direct IndirectDocument18 pagesCash Flow Direct IndirectTalha HassanNo ratings yet

- Marcus AgDocument4 pagesMarcus AgMosesNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Cashflow (Direct Method)Document7 pagesCashflow (Direct Method)Umair ShahzadNo ratings yet

- Lite Inc. (B)Document22 pagesLite Inc. (B)sankalp_iimNo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- B2 2022 May AnsDocument15 pagesB2 2022 May AnsRashid AbeidNo ratings yet

- MAY 2016 SkillsDocument188 pagesMAY 2016 SkillsOnaderu Oluwagbenga EnochNo ratings yet

- Practice Problems, CH 5 SolutionDocument6 pagesPractice Problems, CH 5 SolutionscridNo ratings yet

- FS 2022 2CM - 100905Document10 pagesFS 2022 2CM - 100905Bennur Rajib Arajam BarraquiasNo ratings yet

- Working: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000Document8 pagesWorking: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000kudkhanNo ratings yet

- Individual Performance Task #3 - Part 2 - Functional Form Income StatementDocument2 pagesIndividual Performance Task #3 - Part 2 - Functional Form Income StatementArver Gabriel QuiambaoNo ratings yet

- Chemalite B - BDocument1 pageChemalite B - BadityaNo ratings yet

- Cash Flow StatementDocument18 pagesCash Flow Statementriya SharmaNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- A221 MC 2 - StudentDocument7 pagesA221 MC 2 - StudentNajihah RazakNo ratings yet

- Mirri TaxDocument10 pagesMirri TaxMandanda LovemoreNo ratings yet

- Tugas Cash Flow (Kel 4) KelarDocument23 pagesTugas Cash Flow (Kel 4) KelarRamaNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Long+Quiz+6 Dec2019 KeyDocument6 pagesLong+Quiz+6 Dec2019 KeySheikh Sahil MobinNo ratings yet

- Comprehensive Problem 1Document3 pagesComprehensive Problem 1Heaven WincletNo ratings yet

- Cash Flow Statement With Solution 5Document12 pagesCash Flow Statement With Solution 5Kaytise profNo ratings yet

- Solutions Chapter 23Document11 pagesSolutions Chapter 23Avi SeligNo ratings yet

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Document5 pagesJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezNo ratings yet

- Apple Inc Com in Dollar US in ThousandsDocument6 pagesApple Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Section B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?Document11 pagesSection B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?18071369 Nguyễn ThànhNo ratings yet

- Quiz 2. MIDTERM (Cash Flow Statement)Document3 pagesQuiz 2. MIDTERM (Cash Flow Statement)Gila AbrazaldoNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Sales Revenue: 5 Finance CostDocument2 pagesSales Revenue: 5 Finance Costbalqis izaziNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Cash ExampleDocument1 pageCash ExampleFRANCIS IAN ALBARACIN IINo ratings yet

- Cash Flow Statement For The Period: EntityDocument3 pagesCash Flow Statement For The Period: EntityJanmejay MinaNo ratings yet

- Kosofe Consolidated GPFS 2020Document6 pagesKosofe Consolidated GPFS 2020Oluranti SijuwolaNo ratings yet

- CPA 13 - Public Financial ManagementDocument15 pagesCPA 13 - Public Financial ManagementManit MehtaNo ratings yet

- ACCT101 9n10 SCFDocument17 pagesACCT101 9n10 SCFVedanshi BihaniNo ratings yet