Professional Documents

Culture Documents

Indonesia Jakarta Retail Q1 2020 PDF

Indonesia Jakarta Retail Q1 2020 PDF

Uploaded by

panji_wijay4Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indonesia Jakarta Retail Q1 2020 PDF

Indonesia Jakarta Retail Q1 2020 PDF

Uploaded by

panji_wijay4Copyright:

Available Formats

M A R K E T B E AT

JAKARTA

Retail Q1 2020

SUPPLY: Delayed Opening of Some Retail Centers Due to COVID-19 Outbreak

YoY 12-Mo. Indonesia had reported its first two COVID-19 cases on 2nd March 2020, which negatively impacted the retail sector in Jakarta. To limit the spread of

Chg Forecast

COVID-19, Indonesia government had announced “social distancing” policy to be implemented strictly. As a result, shopping centers in Jakarta have

1.0% also shortened their operating hours or closed their premises (only essential retailers will remain open). One of shopping center owned by Lippo

Group, Lippo Plaza Mampang, even converted some of its spaces into Coronavirus Emergency Hospital to support the government’s effort to contain

Base Rent Growth

the coronavirus spread.

19.2% As a result of the outbreak, the progress of many under-construction developments are uncertain, with construction halted. Some projects such as

Vacancy Rate Green Sedayu Mall, Senayan Park which were initially scheduled for completion by the first quarter of 2020, have postponed their opening dates. Over

205,000 sqm of retail space is expected to enter the Jakarta market by 2020 but into the next few quarters, we do expect further project completion

0 sqm delays to occur.

YTD New Completions

DEMAND: Vacancy Rates to Increase in 2020

Source: Cushman & Wakefield Indonesia Research

Occupancy rate stayed relatively stable at 80.8%, a decline by only 0.3% since the last quarter. The COVID-19 outbreak has hardly hit retailers and

the aim for recovery of business by the upcoming Eid al-Fitr sales season may not happen this year. Near-term demand for retail market will be

ECONOMIC INDICATORS endured until COVID-19 contained. Retailers will be more discreet in terms of expansion and relocation and we may expect the overall vacancy rates

to increase in the next few quarters.

Q1 2020

YoY 12-Mo. Before the spread of COVID-19 in Jakarta, FLIX cinema has opened its third location in Mall of Indonesia, which is the biggest cinema with lifestyle

Chg Forecast and eco-friendly concept. KKV, a lifestyle collection store from China has also opened its first flagship store in Central Park Mall Jakarta.

2.3%

GDP Growth PRICING: Rents are Expected to Remain Unchanged in 2020

On a QoQ basis, no increment of the average rentals was seen within the Jakarta retail market, while Service Charge experienced an increase of 1.0%

in early 2020, landing itself at Rp 188,700/sqm/mo. F&B, Fashion, Entertainment, and Service Sectors have been particularly hardly hit by COVID-19

2.96% and have closed some stores temporarily and permanently. Tenants have requested rent relief to the landlord as they are struggling with their cash

flow. Landlords in Jakarta Shopping Centers are taking tenant’s request on a case-by-case basis based on industries they are in. Some of the policies

Inflation Rate

are: rental deferment for an agreed period and extend the existing lease term, rental or service charge abatement, etc. Following the COVID-19

outbreak, rents are expected to remain unchanged or experience only a slight decline in 2020.

4.5% RENT / VACANCY RATE AVAILABILITY BY PRODUCT TYPE

Central Bank Rate

Source: Central Bank and Census Bureau

M A R K E T B E AT

JAKARTA

Retail Q1 2020

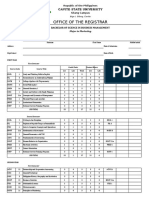

MARKET STATISTICS

PRIME RETAIL UNIT BASE RENT ARIEF RAHARDJO

INVENTORY VACANCY

SUBMARKET

(SQ.M.) RATE Director, Strategic Consulting

RP/SQM/MO US$/SF/MO EUR/SQM/MO

+62 21 2550 9500 / Arief.rahardjo@cushwake.com

Primary Location 1,310,000 18.1% Rp 984,500 US$ 5.61 € 54.82

Secondary Locations € 37.94

3,209,000 19.7% Rp 681,400 US$ 3.88 TANIA GUNAWAN

OVERALL JAKARTA RETAIL TOTAL 4,519,000 19.2% Rp 807,700 US$ 4.60 € 44.97 Analyst, Strategic Consulting

+62 21 2550 9500 / Tania.gunawan@cushwake.com

DEFINITIONS:

The primary retail location is defined as major retail precinct that includes Kota, Pasar Baru, Blok M and CBD area (capturing the areas of Sudirman, Thamrin, Rasuna Said and corridor of Jl. KH. cushmanwakefield.com

Mas Mansyur - Jl. Prof. Dr. Satrio). The secondary retail location covers all other areas outside the above retail areas in Jakarta.

KEY LEASE TRANSACTIONS 1Q 2020

PROPERTY DISTRICT TENANT SQM

Mall of Indonesia North Jakarta FLIX Cinema 7,500

Mall Kelapa Gading North Jakarta H&M 6,000

Central Park Mall West Jakarta KKV Store 3,100

Lippo Mall Puri West Jakarta Grebe Official Store 1,200

Senayan City Mall CBD Hype Branch (Bank Mandiri) 350

Central Park Mall West Jakarta Union 250

Pacific Place Mall CBD Harlan Holden 217

*Renewals not included in leasing statistics

KEY CONSTRUCTION COMPLETIONS DURING 1Q 2020

PROPERTY DISTRICT SIZE (SQM) OPENING DATE

A CUSHMAN & WAKEFIELD RESEARCH PUBLICATION

- - - -

Cushman & Wakefield (NYSE: CWK) is a leading global real

estate services firm that delivers exceptional value for real

estate occupiers and owners. Cushman & Wakefield is among

SIGNIFICANT UNDER-CONSTRUCTION PROJECT the largest real estate services firms with approximately

PROPERTY DISTRICT APPROX SIZE (SQM) COMPLETION DATE 51,000 employees in 400 offices and 70 countries. In 2018,

the firm had revenue of $8.2 billion across core services of

Senayan Park Central Jakarta 33,000 2020

property, facilities and project management, leasing, capital

Mall @ Green Sedayu West Jakarta 11,000 2020 markets, valuation and other services.

ASHTA @ District 8 CBD Jakarta 15,000 2020

Aeon Mall Southgate @ Tanjung Barat South Jakarta 35,000 2020 ©2020 Cushman & Wakefield. All rights reserved. The information

contained within this report is gathered from multiple sources believed

Lippo Mall East Side @ Holland Village Central Jakarta 50,000 2020 to be reliable. The information may contain errors or omissions and is

presented without any warranty or representations as to its accuracy.

Pondok Indah Mall 3 South Jakarta 55,000 2020

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample 25M LinkedinDocument6 pagesSample 25M LinkedinAakash MaratheNo ratings yet

- Dishwashing LiquidDocument13 pagesDishwashing LiquidJay Ar100% (1)

- MGT162 Group Report - NikeDocument13 pagesMGT162 Group Report - NikeIzzety EmylyaNo ratings yet

- Digital Marketing Employee ListDocument22 pagesDigital Marketing Employee ListPrabu KalivarathanNo ratings yet

- Chapter One Introduction and Overview of Organization: TH THDocument20 pagesChapter One Introduction and Overview of Organization: TH THAmar kumar NepalNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- "Commodity Derivative Future Contracts: A Rough Draft Made byDocument3 pages"Commodity Derivative Future Contracts: A Rough Draft Made byadarsh kumarNo ratings yet

- Isp A Company Built On Customer ServiceDocument3 pagesIsp A Company Built On Customer Serviceironmask20041047No ratings yet

- WR-2391 BPP GSS - DysonDocument22 pagesWR-2391 BPP GSS - DysonNobiaWahabNo ratings yet

- Accounting Hub Cloud - Adoption Trends and Best PracticesDocument15 pagesAccounting Hub Cloud - Adoption Trends and Best Practicesalicng360No ratings yet

- Supply Chain Design and PlanningDocument21 pagesSupply Chain Design and PlanningWaseem AbbasNo ratings yet

- Fusion Bpo Services LTD.: 507 Place D'armes Bureau 1000, Montreal, Quebec H2Y2W8Document4 pagesFusion Bpo Services LTD.: 507 Place D'armes Bureau 1000, Montreal, Quebec H2Y2W8Iffat JarinNo ratings yet

- Example Full Report Group AssignmentDocument36 pagesExample Full Report Group AssignmentRuzaini AhmadNo ratings yet

- Mutasi Statement BRImoDocument6 pagesMutasi Statement BRImoCeklis OkeNo ratings yet

- KP HW2 Chap4Document5 pagesKP HW2 Chap4Abdul RafehNo ratings yet

- Customer Case Study SodexoDocument12 pagesCustomer Case Study SodexoRick LowNo ratings yet

- CHECKLISTDocument14 pagesCHECKLISTAnnie ContranoNo ratings yet

- SolMan Chapter 4 (Partial)Document9 pagesSolMan Chapter 4 (Partial)zaounxosakubNo ratings yet

- Auditing in A CIS EnvironmentDocument11 pagesAuditing in A CIS EnvironmentPaul Anthony AspuriaNo ratings yet

- Marketing Essential - Assignment 1 - BTEC HND - Semester 2020/2021Document11 pagesMarketing Essential - Assignment 1 - BTEC HND - Semester 2020/2021tra nguyen thuNo ratings yet

- Writing A Cover Letter When You Have No ExperienceDocument9 pagesWriting A Cover Letter When You Have No Experiencef5d5wm52100% (1)

- MMTC Franchisee ApplnDocument3 pagesMMTC Franchisee ApplnrajatmaheshwariNo ratings yet

- Afzal 1511 3780 1 Lecture#5Document13 pagesAfzal 1511 3780 1 Lecture#5rabab balochNo ratings yet

- Economics Quiz 3Document3 pagesEconomics Quiz 3Pao EspiNo ratings yet

- Dissertation On Marketing ManagementDocument6 pagesDissertation On Marketing ManagementWhereCanIBuyResumePaperDesMoines100% (1)

- INV3703 Past Paper 3Document28 pagesINV3703 Past Paper 3SilenceNo ratings yet

- Chapter 16 Latihan Soal & SolusiDocument10 pagesChapter 16 Latihan Soal & Solusiandre suryantoNo ratings yet

- Real Estate Finance and Investments 15Th Edition Brueggeman Test Bank Full Chapter PDFDocument26 pagesReal Estate Finance and Investments 15Th Edition Brueggeman Test Bank Full Chapter PDFMichaelHughesafdmb100% (6)

- Priyanka Divecha Black BookDocument42 pagesPriyanka Divecha Black Bookyogesh DivechaNo ratings yet

- Freight Transport SystemsDocument34 pagesFreight Transport SystemspeanakyNo ratings yet