Professional Documents

Culture Documents

It 000087777830 2020 09 PDF

It 000087777830 2020 09 PDF

Uploaded by

naeem1990Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

It 000087777830 2020 09 PDF

It 000087777830 2020 09 PDF

Uploaded by

naeem1990Copyright:

Available Formats

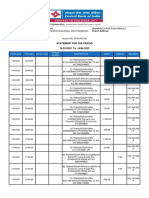

INCOME TAX PAYMENT CHALLAN

PSID # : 135424259

Corporate RTO Lahore 5 7 2020

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year 09 19

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 153(1)(a) Payment for Goods u/s 153(1)(a) (ATL @ 4% Payment Section Code 64060058

/ Non-ATL @ 8%)

(Section) (Description of Payment Section) Account Head (NAM) B01105

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

CNIC/Reg./Inc. No.

Taxpayer's Name Status

Business Name

Address

FOR WITHHOLDING TAXES ONLY

CNIC/Reg./Inc. No. 3509/20062007

Name of withholding agent MODERNO FABRICS

Total no. of Taxpayers 2 Total Tax Deducted 109,037

Amount of tax in words: One Hundred Nine Thousand Thirty Seven Rupees And No Paisas Rs. 109,037

Only

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 ADC (e- 109,037 No Branch

payment)

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor 3509/20062007

Name of Depositor MODERNO FABRICS

Date

Stamp & Signature

PSID-IT-000087777830-092020

Prepared By : MODERNOFAB - MODERNO FABRICS Date: 23-Oct-2019 10:54 AM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fund Formation Attracting Global InvestorsDocument82 pagesFund Formation Attracting Global InvestorssandipktNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corality ModelOff Sample Answer Hard TimesDocument81 pagesCorality ModelOff Sample Answer Hard TimesserpepeNo ratings yet

- MERCHANDISINGDocument21 pagesMERCHANDISINGlorraine85% (13)

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition Statemented redfNo ratings yet

- One SiteDocument2 pagesOne SiteVanessa Burbano AyalaNo ratings yet

- Agreement SaleDocument4 pagesAgreement SaleAmitKumarNo ratings yet

- Nextrans Startup Industry Report 2022Document65 pagesNextrans Startup Industry Report 2022Phương Thùy Nguyễn ThịNo ratings yet

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- ScribdDocument1 pageScribdnaeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document3 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Certificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding AgentDocument9 pagesCertificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding Agentnaeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document3 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Title: Firstname LastnameDocument8 pagesTitle: Firstname Lastnamenaeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document2 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document2 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- 149-Article Text-274-1-10-20200228 PDFDocument12 pages149-Article Text-274-1-10-20200228 PDFnaeem1990No ratings yet

- 001 200358166 CR8 117 5 PDFDocument1 page001 200358166 CR8 117 5 PDFnaeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138458893Document1 pageIncome Tax Payment Challan: PSID #: 138458893naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990No ratings yet

- Basu1977 PDFDocument20 pagesBasu1977 PDFnaeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138384574Document1 pageIncome Tax Payment Challan: PSID #: 138384574naeem1990No ratings yet

- Borges2010 PDFDocument17 pagesBorges2010 PDFnaeem1990No ratings yet

- Insurance Final ExaminationsDocument4 pagesInsurance Final ExaminationsKarl Jason JosolNo ratings yet

- XBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDocument359 pagesXBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardbhalakankshaNo ratings yet

- Acct L-2 TVET BestDocument91 pagesAcct L-2 TVET BestFelekePhiliphosNo ratings yet

- Chapter 16: Capital Structure: Basic Concepts: Answers To End-of-Chapter Problems BDocument10 pagesChapter 16: Capital Structure: Basic Concepts: Answers To End-of-Chapter Problems BAshish BhallaNo ratings yet

- Josh Tan Course-NotesDocument7 pagesJosh Tan Course-NotesTan YongshanNo ratings yet

- Cost of Capital Module 7 (Class 27)Document16 pagesCost of Capital Module 7 (Class 27)Vineet AgarwalNo ratings yet

- Question PDFDocument2 pagesQuestion PDFISLAM KHALED ZSCNo ratings yet

- Weekender - GEI Industrial Systems - 05-08-11 PDFDocument5 pagesWeekender - GEI Industrial Systems - 05-08-11 PDFSwarupa DateNo ratings yet

- Statement For The Period 14/03/2023 To 14/04/2023Document6 pagesStatement For The Period 14/03/2023 To 14/04/2023Adrian LamoNo ratings yet

- Annual Report 2021 22Document132 pagesAnnual Report 2021 22Paromita SharmaNo ratings yet

- Interim Order in The Matter of Sarada Pleasure and Adventure LimitedDocument13 pagesInterim Order in The Matter of Sarada Pleasure and Adventure LimitedShyam SunderNo ratings yet

- CHAPTER 2 - Financial Reporting and Analysis-1Document16 pagesCHAPTER 2 - Financial Reporting and Analysis-1Mohammed HassanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Bula DuttaNo ratings yet

- 2022-06-15-62a964b6e7bd4-3 Accounts Executive 14.06.2022Document4 pages2022-06-15-62a964b6e7bd4-3 Accounts Executive 14.06.2022ShibinNo ratings yet

- Infographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityDocument1 pageInfographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityBen TorejaNo ratings yet

- TB12Document9 pagesTB12afrgod20No ratings yet

- Fundamentals of Engineering EconomicsDocument138 pagesFundamentals of Engineering EconomicsAmna JabbarNo ratings yet

- TVM TablesDocument21 pagesTVM Tablesanamika prasadNo ratings yet

- Excel Files For Case 12 - Value PublishinDocument12 pagesExcel Files For Case 12 - Value PublishinGerry RuntukahuNo ratings yet

- Daily Sales Report Daily Sales ReportDocument3 pagesDaily Sales Report Daily Sales Reportromeo maribbayNo ratings yet

- NIR AP NetworkDocument711 pagesNIR AP NetworkmalumaatNo ratings yet

- BSG Guide How To WinDocument14 pagesBSG Guide How To Winjack stauberNo ratings yet