Professional Documents

Culture Documents

Overview

Overview

Uploaded by

Allu Saiteja0 ratings0% found this document useful (0 votes)

5 views13 pagesuptothr mark

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentuptothr mark

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views13 pagesOverview

Overview

Uploaded by

Allu Saitejauptothr mark

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 13

<table border=0 cellpadding=0 cellspacing=0 align=center width=100%>

<tr><td colspan=10 align=center width=100% ><b><font size='2'>Steel Authority of

India Ltd<br>Industry : Steel - Large</font></b></td>

<table id="Finover" rules='all' border='1' style="width:100%;">

<tr>

<td><table width='100%' align='center' cellspacing='0' cellpadding='0'

border='0' bordercolorlight='#FFFFFF' bordercolordark='#D7D7E1'><tr><td

valign='top'><table width=100% class=tablelines cellpadding=2 cellspacing=1

border=0><tr><td CLASS='SubSbHdrLeft' colspan=12><b>Financial Overview

</b></td></tr><tr><td class=SubSbHdrLeft nowrap width=25%></td><td class=SubSbHdr

width=10%>Mar 10</td><td class=SubSbHdr width=10%>Mar 11</td><td class=SubSbHdr

width=10%>Mar 12</td><td class=SubSbHdr width=10%>Mar 13</td><td class=SubSbHdr

width=10%>Mar 14</td><td class=SubSbHdr width=10%>Mar 15</td><td class=SubSbHdr

width=10%>Mar 16</td><td class=SubSbHdr width=10%>Mar 17</td><td class=SubSbHdr

width=10%>Mar 18</td><td class=SubSbHdr width=10%>Mar 19</td></tr><tr><td nowrap

class=ColmElement width=25%>Year End</td><td class=ColmElementWht align='right'

width=10%>2,010,030.00</td><td class=ColmElementWht align='right'

width=10%>2,011,030.00</td><td class=ColmElementWht align='right'

width=10%>2,012,030.00</td><td class=ColmElementWht align='right'

width=10%>2,013,030.00</td><td class=ColmElementWht align='right'

width=10%>2,014,030.00</td><td class=ColmElementWht align='right'

width=10%>2,015,030.00</td><td class=ColmElementWht align='right'

width=10%>2,016,030.00</td><td class=ColmElementWht align='right'

width=10%>2,017,030.00</td><td class=ColmElementWht align='right'

width=10%>2,018,030.00</td><td class=ColmElementWht align='right'

width=10%>2,019,030.00</td></tr><tr><td nowrap class=ColmElement

width=25%>Networth</td><td class=ColmElementWht align='right'

width=10%>333,167.00</td><td class=ColmElementWht align='right'

width=10%>370,694.70</td><td class=ColmElementWht align='right'

width=10%>398,113.20</td><td class=ColmElementWht align='right'

width=10%>410,246.40</td><td class=ColmElementWht align='right'

width=10%>426,663.50</td><td class=ColmElementWht align='right'

width=10%>435,047.80</td><td class=ColmElementWht align='right'

width=10%>391,959.00</td><td class=ColmElementWht align='right'

width=10%>360,090.60</td><td class=ColmElementWht align='right'

width=10%>357,136.70</td><td class=ColmElementWht align='right'

width=10%>381,515.70</td></tr><tr><td nowrap class=ColmElement width=25%>Capital

Employed</td><td class=ColmElementWht align='right' width=10%>498,279.50</td><td

class=ColmElementWht align='right' width=10%>607,323.70</td><td

class=ColmElementWht align='right' width=10%>610,020.10</td><td

class=ColmElementWht align='right' width=10%>680,968.70</td><td

class=ColmElementWht align='right' width=10%>732,303.30</td><td

class=ColmElementWht align='right' width=10%>783,470.70</td><td

class=ColmElementWht align='right' width=10%>791,394.70</td><td

class=ColmElementWht align='right' width=10%>825,232.30</td><td

class=ColmElementWht align='right' width=10%>864,197.40</td><td

class=ColmElementWht align='right' width=10%>892,076.50</td></tr><tr><td nowrap

class=ColmElement width=25%>Gross Block</td><td class=ColmElementWht align='right'

width=10%>353,961.90</td><td class=ColmElementWht align='right'

width=10%>382,364.50</td><td class=ColmElementWht align='right'

width=10%>417,590.40</td><td class=ColmElementWht align='right'

width=10%>427,024.20</td><td class=ColmElementWht align='right'

width=10%>541,683.60</td><td class=ColmElementWht align='right'

width=10%>652,053.70</td><td class=ColmElementWht align='right'

width=10%>777,537.00</td><td class=ColmElementWht align='right'

width=10%>845,657.90</td><td class=ColmElementWht align='right'

width=10%>955,194.40</td><td class=ColmElementWht align='right'

width=10%>1,014,566.30</td></tr><tr><td nowrap class=ColmElement width=25%>Net

Working Capital ( Incl. Def. Tax)</td><td class=ColmElementWht align='right'

width=10%>205,907.10</td><td class=ColmElementWht align='right'

width=10%>211,930.30</td><td class=ColmElementWht align='right'

width=10%>124,172.20</td><td class=ColmElementWht align='right'

width=10%>109,648.40</td><td class=ColmElementWht align='right'

width=10%>81,379.80</td><td class=ColmElementWht align='right'

width=10%>75,024.90</td><td class=ColmElementWht align='right'

width=10%>47,976.50</td><td class=ColmElementWht align='right'

width=10%>55,230.80</td><td class=ColmElementWht align='right'

width=10%>59,364.90</td><td class=ColmElementWht align='right'

width=10%>78,350.70</td></tr><tr><td nowrap class=ColmElement width=25%>Current

Assets ( Incl. Def. Tax)</td><td class=ColmElementWht align='right'

width=10%>403,512.60</td><td class=ColmElementWht align='right'

width=10%>377,399.80</td><td class=ColmElementWht align='right'

width=10%>289,503.80</td><td class=ColmElementWht align='right'

width=10%>284,893.40</td><td class=ColmElementWht align='right'

width=10%>285,599.10</td><td class=ColmElementWht align='right'

width=10%>308,288.90</td><td class=ColmElementWht align='right'

width=10%>323,702.60</td><td class=ColmElementWht align='right'

width=10%>372,580.50</td><td class=ColmElementWht align='right'

width=10%>430,623.60</td><td class=ColmElementWht align='right'

width=10%>455,409.60</td></tr><tr><td nowrap class=ColmElement width=25%>Current

Liabilities and Provisions ( Incl. Def. Tax)</td><td class=ColmElementWht

align='right' width=10%>197,605.50</td><td class=ColmElementWht align='right'

width=10%>165,469.50</td><td class=ColmElementWht align='right'

width=10%>165,331.60</td><td class=ColmElementWht align='right'

width=10%>175,245.00</td><td class=ColmElementWht align='right'

width=10%>204,219.30</td><td class=ColmElementWht align='right'

width=10%>233,264.00</td><td class=ColmElementWht align='right'

width=10%>275,726.10</td><td class=ColmElementWht align='right'

width=10%>317,349.70</td><td class=ColmElementWht align='right'

width=10%>371,258.70</td><td class=ColmElementWht align='right'

width=10%>377,058.90</td></tr><tr><td nowrap class=ColmElement width=25%>Total

Assets/Liabilities (excl Reval & W.off)</td><td class=ColmElementWht align='right'

width=10%>695,885.00</td><td class=ColmElementWht align='right'

width=10%>772,793.20</td><td class=ColmElementWht align='right'

width=10%>775,351.70</td><td class=ColmElementWht align='right'

width=10%>856,213.70</td><td class=ColmElementWht align='right'

width=10%>936,522.60</td><td class=ColmElementWht align='right'

width=10%>1,016,734.70</td><td class=ColmElementWht align='right'

width=10%>1,067,120.80</td><td class=ColmElementWht align='right'

width=10%>1,142,582.00</td><td class=ColmElementWht align='right'

width=10%>1,235,456.10</td><td class=ColmElementWht align='right'

width=10%>1,269,135.40</td></tr><tr><td nowrap class=ColmElement width=25%>Gross

Sales</td><td class=ColmElementWht align='right' width=10%>439,035.60</td><td

class=ColmElementWht align='right' width=10%>476,291.50</td><td

class=ColmElementWht align='right' width=10%>510,294.90</td><td

class=ColmElementWht align='right' width=10%>498,292.20</td><td

class=ColmElementWht align='right' width=10%>523,198.50</td><td

class=ColmElementWht align='right' width=10%>511,489.60</td><td

class=ColmElementWht align='right' width=10%>438,751.70</td><td

class=ColmElementWht align='right' width=10%>497,671.00</td><td

class=ColmElementWht align='right' width=10%>589,623.60</td><td

class=ColmElementWht align='right' width=10%>669,673.10</td></tr><tr><td nowrap

class=ColmElement width=25%>Net Sales</td><td class=ColmElementWht align='right'

width=10%>405,202.40</td><td class=ColmElementWht align='right'

width=10%>433,073.60</td><td class=ColmElementWht align='right'

width=10%>463,351.20</td><td class=ColmElementWht align='right'

width=10%>444,405.80</td><td class=ColmElementWht align='right'

width=10%>466,425.60</td><td class=ColmElementWht align='right'

width=10%>457,303.60</td><td class=ColmElementWht align='right'

width=10%>387,464.80</td><td class=ColmElementWht align='right'

width=10%>444,524.10</td><td class=ColmElementWht align='right'

width=10%>575,584.60</td><td class=ColmElementWht align='right'

width=10%>669,673.10</td></tr><tr><td nowrap class=ColmElement width=25%>Other

Income</td><td class=ColmElementWht align='right' width=10%>28,225.90</td><td

class=ColmElementWht align='right' width=10%>17,150.10</td><td

class=ColmElementWht align='right' width=10%>21,406.50</td><td

class=ColmElementWht align='right' width=10%>11,555.20</td><td

class=ColmElementWht align='right' width=10%>20,215.00</td><td

class=ColmElementWht align='right' width=10%>9,985.90</td><td class=ColmElementWht

align='right' width=10%>5,946.70</td><td class=ColmElementWht align='right'

width=10%>5,356.10</td><td class=ColmElementWht align='right'

width=10%>13,151.90</td><td class=ColmElementWht align='right'

width=10%>5,328.20</td></tr><tr><td nowrap class=ColmElement width=25%>Value Of

Output</td><td class=ColmElementWht align='right' width=10%>393,592.30</td><td

class=ColmElementWht align='right' width=10%>446,600.30</td><td

class=ColmElementWht align='right' width=10%>477,036.30</td><td

class=ColmElementWht align='right' width=10%>464,566.70</td><td

class=ColmElementWht align='right' width=10%>457,479.30</td><td

class=ColmElementWht align='right' width=10%>471,384.80</td><td

class=ColmElementWht align='right' width=10%>382,058.70</td><td

class=ColmElementWht align='right' width=10%>443,317.80</td><td

class=ColmElementWht align='right' width=10%>564,229.70</td><td

class=ColmElementWht align='right' width=10%>696,839.30</td></tr><tr><td nowrap

class=ColmElement width=25%>Cost of Production</td><td class=ColmElementWht

align='right' width=10%>319,148.20</td><td class=ColmElementWht align='right'

width=10%>382,805.90</td><td class=ColmElementWht align='right'

width=10%>420,820.70</td><td class=ColmElementWht align='right'

width=10%>404,173.20</td><td class=ColmElementWht align='right'

width=10%>397,520.30</td><td class=ColmElementWht align='right'

width=10%>398,524.00</td><td class=ColmElementWht align='right'

width=10%>377,549.60</td><td class=ColmElementWht align='right'

width=10%>437,401.80</td><td class=ColmElementWht align='right'

width=10%>504,848.90</td><td class=ColmElementWht align='right'

width=10%>563,784.50</td></tr><tr><td nowrap class=ColmElement width=25%>Selling

Cost</td><td class=ColmElementWht align='right' width=10%>6,931.10</td><td

class=ColmElementWht align='right' width=10%>7,265.10</td><td class=ColmElementWht

align='right' width=10%>7,267.60</td><td class=ColmElementWht align='right'

width=10%>10,959.90</td><td class=ColmElementWht align='right'

width=10%>11,031.10</td><td class=ColmElementWht align='right'

width=10%>11,226.50</td><td class=ColmElementWht align='right'

width=10%>11,468.30</td><td class=ColmElementWht align='right'

width=10%>12,457.10</td><td class=ColmElementWht align='right'

width=10%>23,343.10</td><td class=ColmElementWht align='right'

width=10%>27,120.90</td></tr><tr><td nowrap class=ColmElement

width=25%>PBIDT</td><td class=ColmElementWht align='right'

width=10%>118,712.80</td><td class=ColmElementWht align='right'

width=10%>91,548.80</td><td class=ColmElementWht align='right'

width=10%>77,018.90</td><td class=ColmElementWht align='right'

width=10%>53,913.00</td><td class=ColmElementWht align='right'

width=10%>59,088.80</td><td class=ColmElementWht align='right'

width=10%>55,864.20</td><td class=ColmElementWht align='right' width=10%>-

23,047.00</td><td class=ColmElementWht align='right' width=10%>3,569.10</td><td

class=ColmElementWht align='right' width=10%>51,287.30</td><td

class=ColmElementWht align='right' width=10%>98,775.30</td></tr><tr><td nowrap

class=ColmElement width=25%>PBDT</td><td class=ColmElementWht align='right'

width=10%>114,692.70</td><td class=ColmElementWht align='right'

width=10%>86,801.10</td><td class=ColmElementWht align='right'

width=10%>67,179.00</td><td class=ColmElementWht align='right'

width=10%>46,436.40</td><td class=ColmElementWht align='right'

width=10%>49,412.40</td><td class=ColmElementWht align='right'

width=10%>41,321.90</td><td class=ColmElementWht align='right' width=10%>-

46,051.50</td><td class=ColmElementWht align='right' width=10%>-21,709.10</td><td

class=ColmElementWht align='right' width=10%>23,059.80</td><td

class=ColmElementWht align='right' width=10%>67,226.10</td></tr><tr><td nowrap

class=ColmElement width=25%>PBIT</td><td class=ColmElementWht align='right'

width=10%>105,340.40</td><td class=ColmElementWht align='right'

width=10%>76,690.80</td><td class=ColmElementWht align='right'

width=10%>61,348.60</td><td class=ColmElementWht align='right'

width=10%>39,883.20</td><td class=ColmElementWht align='right'

width=10%>41,921.90</td><td class=ColmElementWht align='right'

width=10%>38,131.40</td><td class=ColmElementWht align='right' width=10%>-

47,070.50</td><td class=ColmElementWht align='right' width=10%>-23,230.40</td><td

class=ColmElementWht align='right' width=10%>20,638.10</td><td

class=ColmElementWht align='right' width=10%>64,928.10</td></tr><tr><td nowrap

class=ColmElement width=25%>PBT</td><td class=ColmElementWht align='right'

width=10%>101,320.30</td><td class=ColmElementWht align='right'

width=10%>71,943.10</td><td class=ColmElementWht align='right'

width=10%>51,508.70</td><td class=ColmElementWht align='right'

width=10%>32,406.60</td><td class=ColmElementWht align='right'

width=10%>32,245.50</td><td class=ColmElementWht align='right'

width=10%>23,589.10</td><td class=ColmElementWht align='right' width=10%>-

70,075.00</td><td class=ColmElementWht align='right' width=10%>-48,508.60</td><td

class=ColmElementWht align='right' width=10%>-7,589.40</td><td

class=ColmElementWht align='right' width=10%>33,378.90</td></tr><tr><td nowrap

class=ColmElement width=25%>PAT</td><td class=ColmElementWht align='right'

width=10%>67,543.70</td><td class=ColmElementWht align='right'

width=10%>49,047.40</td><td class=ColmElementWht align='right'

width=10%>35,427.20</td><td class=ColmElementWht align='right'

width=10%>21,703.50</td><td class=ColmElementWht align='right'

width=10%>26,164.80</td><td class=ColmElementWht align='right'

width=10%>20,926.80</td><td class=ColmElementWht align='right' width=10%>-

40,214.40</td><td class=ColmElementWht align='right' width=10%>-28,332.40</td><td

class=ColmElementWht align='right' width=10%>-4,817.10</td><td

class=ColmElementWht align='right' width=10%>21,788.20</td></tr><tr><td nowrap

class=ColmElement width=25%>CP</td><td class=ColmElementWht align='right'

width=10%>80,916.10</td><td class=ColmElementWht align='right'

width=10%>63,905.40</td><td class=ColmElementWht align='right'

width=10%>51,097.50</td><td class=ColmElementWht align='right'

width=10%>35,733.30</td><td class=ColmElementWht align='right'

width=10%>43,331.70</td><td class=ColmElementWht align='right'

width=10%>38,659.60</td><td class=ColmElementWht align='right' width=10%>-

16,190.90</td><td class=ColmElementWht align='right' width=10%>-1,532.90</td><td

class=ColmElementWht align='right' width=10%>25,832.10</td><td

class=ColmElementWht align='right' width=10%>55,635.40</td></tr><tr><td nowrap

class=ColmElement width=25%>Revenue earnings in forex</td><td class=ColmElementWht

align='right' width=10%>7,830.00</td><td class=ColmElementWht align='right'

width=10%>9,804.60</td><td class=ColmElementWht align='right'

width=10%>12,300.10</td><td class=ColmElementWht align='right'

width=10%>11,579.50</td><td class=ColmElementWht align='right'

width=10%>25,532.20</td><td class=ColmElementWht align='right'

width=10%>15,677.10</td><td class=ColmElementWht align='right'

width=10%>5,571.30</td><td class=ColmElementWht align='right'

width=10%>17,297.30</td><td class=ColmElementWht align='right'

width=10%>22,437.00</td><td class=ColmElementWht align='right'

width=10%>28,726.40</td></tr><tr><td nowrap class=ColmElement width=25%>Revenue

expenses in forex</td><td class=ColmElementWht align='right'

width=10%>107,526.90</td><td class=ColmElementWht align='right'

width=10%>132,637.40</td><td class=ColmElementWht align='right'

width=10%>166,604.10</td><td class=ColmElementWht align='right'

width=10%>137,191.00</td><td class=ColmElementWht align='right'

width=10%>143,492.80</td><td class=ColmElementWht align='right'

width=10%>129,996.80</td><td class=ColmElementWht align='right'

width=10%>109,768.20</td><td class=ColmElementWht align='right'

width=10%>148,647.50</td><td class=ColmElementWht align='right'

width=10%>39,518.40</td><td class=ColmElementWht align='right'

width=10%>261,167.40</td></tr><tr><td nowrap class=ColmElement width=25%>Capital

earnings in forex</td><td class=ColmElementWht align='right'

width=10%>0.00</td><td class=ColmElementWht align='right' width=10%>0.00</td><td

class=ColmElementWht align='right' width=10%>0.00</td><td class=ColmElementWht

align='right' width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>0.00</td><td class=ColmElementWht align='right' width=10%>0.00</td><td

class=ColmElementWht align='right' width=10%>0.00</td><td class=ColmElementWht

align='right' width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>0.00</td></tr><tr><td nowrap class=ColmElement width=25%>Capital

expenses in forex</td><td class=ColmElementWht align='right'

width=10%>33,893.30</td><td class=ColmElementWht align='right'

width=10%>23,520.20</td><td class=ColmElementWht align='right'

width=10%>12,269.60</td><td class=ColmElementWht align='right'

width=10%>13,692.20</td><td class=ColmElementWht align='right'

width=10%>17,068.00</td><td class=ColmElementWht align='right'

width=10%>5,843.90</td><td class=ColmElementWht align='right'

width=10%>7,030.40</td><td class=ColmElementWht align='right'

width=10%>0.00</td><td class=ColmElementWht align='right' width=10%>0.00</td><td

class=ColmElementWht align='right' width=10%>0.00</td></tr><tr><td nowrap

class=ColmElement width=25%>Book Value (Unit Curr)</td><td class=ColmElementWht

align='right' width=10%>80.66</td><td class=ColmElementWht align='right'

width=10%>89.75</td><td class=ColmElementWht align='right' width=10%>96.38</td><td

class=ColmElementWht align='right' width=10%>99.32</td><td class=ColmElementWht

align='right' width=10%>103.30</td><td class=ColmElementWht align='right'

width=10%>105.32</td><td class=ColmElementWht align='right'

width=10%>94.89</td><td class=ColmElementWht align='right' width=10%>87.18</td><td

class=ColmElementWht align='right' width=10%>86.46</td><td class=ColmElementWht

align='right' width=10%>92.36</td></tr><tr><td nowrap class=ColmElement

width=25%>Market Capitalisation</td><td class=ColmElementWht align='right'

width=10%>1,040,034.70</td><td class=ColmElementWht align='right'

width=10%>701,135.40</td><td class=ColmElementWht align='right'

width=10%>388,475.90</td><td class=ColmElementWht align='right'

width=10%>257,538.30</td><td class=ColmElementWht align='right'

width=10%>294,919.50</td><td class=ColmElementWht align='right'

width=10%>282,321.40</td><td class=ColmElementWht align='right'

width=10%>177,612.60</td><td class=ColmElementWht align='right'

width=10%>252,788.10</td><td class=ColmElementWht align='right'

width=10%>289,962.90</td><td class=ColmElementWht align='right'

width=10%>221,809.20</td></tr><tr><td bgcolor='#ffffff' colspan='101'

width=25%><b>Financial Years High & Low Prices</b></td></tr><tr><td nowrap

class=ColmElement width=25%>High Date (BSE)</td><td class=ColmElementWht

align='right' width=10%>06 Jan 2010</td><td class=ColmElementWht align='right'

width=10%>06 Apr 2010</td><td class=ColmElementWht align='right' width=10%>06 Apr

2011</td><td class=ColmElementWht align='right' width=10%>25 Apr 2012</td><td

class=ColmElementWht align='right' width=10%>02 Jan 2014</td><td

class=ColmElementWht align='right' width=10%>09 Jun 2014</td><td

class=ColmElementWht align='right' width=10%>17 Apr 2015</td><td

class=ColmElementWht align='right' width=10%>08 Feb 2017</td><td

class=ColmElementWht align='right' width=10%>08 Jan 2018</td><td

class=ColmElementWht align='right' width=10%>13 Jun 2018</td></tr><tr><td nowrap

class=ColmElement width=25%>High Price (BSE)</td><td class=ColmElementWht

align='right' width=10%>258.30</td><td class=ColmElementWht align='right'

width=10%>258.55</td><td class=ColmElementWht align='right'

width=10%>177.30</td><td class=ColmElementWht align='right'

width=10%>101.75</td><td class=ColmElementWht align='right'

width=10%>74.80</td><td class=ColmElementWht align='right'

width=10%>112.90</td><td class=ColmElementWht align='right'

width=10%>78.95</td><td class=ColmElementWht align='right' width=10%>68.15</td><td

class=ColmElementWht align='right' width=10%>101.40</td><td class=ColmElementWht

align='right' width=10%>91.10</td></tr><tr><td nowrap class=ColmElement

width=25%>Low Date (BSE)</td><td class=ColmElementWht align='right' width=10%>01

Apr 2009</td><td class=ColmElementWht align='right' width=10%>07 Mar 2011</td><td

class=ColmElementWht align='right' width=10%>19 Dec 2011</td><td

class=ColmElementWht align='right' width=10%>28 Mar 2013</td><td

class=ColmElementWht align='right' width=10%>07 Aug 2013</td><td

class=ColmElementWht align='right' width=10%>30 Apr 2014</td><td

class=ColmElementWht align='right' width=10%>12 Feb 2016</td><td

class=ColmElementWht align='right' width=10%>24 May 2016</td><td

class=ColmElementWht align='right' width=10%>28 Sep 2017</td><td

class=ColmElementWht align='right' width=10%>11 Feb 2019</td></tr><tr><td nowrap

class=ColmElement width=25%>Low Price (BSE)</td><td class=ColmElementWht

align='right' width=10%>93.80</td><td class=ColmElementWht align='right'

width=10%>150.20</td><td class=ColmElementWht align='right'

width=10%>73.00</td><td class=ColmElementWht align='right' width=10%>60.00</td><td

class=ColmElementWht align='right' width=10%>37.65</td><td class=ColmElementWht

align='right' width=10%>65.20</td><td class=ColmElementWht align='right'

width=10%>33.50</td><td class=ColmElementWht align='right' width=10%>38.45</td><td

class=ColmElementWht align='right' width=10%>53.00</td><td class=ColmElementWht

align='right' width=10%>44.10</td></tr><tr><td nowrap class=ColmElement

width=25%>High Date (NSE)</td><td class=ColmElementWht align='right' width=10%>06

Jan 2010</td><td class=ColmElementWht align='right' width=10%>06 Apr 2010</td><td

class=ColmElementWht align='right' width=10%>06 Apr 2011</td><td

class=ColmElementWht align='right' width=10%>25 Apr 2012</td><td

class=ColmElementWht align='right' width=10%>02 Jan 2014</td><td

class=ColmElementWht align='right' width=10%>09 Jun 2014</td><td

class=ColmElementWht align='right' width=10%>17 Apr 2015</td><td

class=ColmElementWht align='right' width=10%>08 Feb 2017</td><td

class=ColmElementWht align='right' width=10%>08 Jan 2018</td><td

class=ColmElementWht align='right' width=10%>13 Jun 2018</td></tr><tr><td nowrap

class=ColmElement width=25%>High Price (NSE)</td><td class=ColmElementWht

align='right' width=10%>267.00</td><td class=ColmElementWht align='right'

width=10%>258.45</td><td class=ColmElementWht align='right'

width=10%>177.30</td><td class=ColmElementWht align='right'

width=10%>101.75</td><td class=ColmElementWht align='right'

width=10%>74.90</td><td class=ColmElementWht align='right'

width=10%>112.95</td><td class=ColmElementWht align='right'

width=10%>79.00</td><td class=ColmElementWht align='right' width=10%>68.15</td><td

class=ColmElementWht align='right' width=10%>101.45</td><td class=ColmElementWht

align='right' width=10%>91.10</td></tr><tr><td nowrap class=ColmElement

width=25%>Low Date (NSE)</td><td class=ColmElementWht align='right' width=10%>01

Apr 2009</td><td class=ColmElementWht align='right' width=10%>07 Mar 2011</td><td

class=ColmElementWht align='right' width=10%>19 Dec 2011</td><td

class=ColmElementWht align='right' width=10%>28 Mar 2013</td><td

class=ColmElementWht align='right' width=10%>07 Aug 2013</td><td

class=ColmElementWht align='right' width=10%>30 Apr 2014</td><td

class=ColmElementWht align='right' width=10%>12 Feb 2016</td><td

class=ColmElementWht align='right' width=10%>24 May 2016</td><td

class=ColmElementWht align='right' width=10%>28 Sep 2017</td><td

class=ColmElementWht align='right' width=10%>08 Feb 2019</td></tr><tr><td nowrap

class=ColmElement width=25%>Low Price (NSE)</td><td class=ColmElementWht

align='right' width=10%>93.75</td><td class=ColmElementWht align='right'

width=10%>150.00</td><td class=ColmElementWht align='right'

width=10%>73.20</td><td class=ColmElementWht align='right' width=10%>60.00</td><td

class=ColmElementWht align='right' width=10%>37.60</td><td class=ColmElementWht

align='right' width=10%>65.10</td><td class=ColmElementWht align='right'

width=10%>33.50</td><td class=ColmElementWht align='right' width=10%>38.45</td><td

class=ColmElementWht align='right' width=10%>52.85</td><td class=ColmElementWht

align='right' width=10%>44.00</td></tr><tr><td nowrap class=ColmElement

width=25%>CEPS (annualised) (Unit Curr)</td><td class=ColmElementWht align='right'

width=10%>19.04</td><td class=ColmElementWht align='right' width=10%>15.08</td><td

class=ColmElementWht align='right' width=10%>12.05</td><td class=ColmElementWht

align='right' width=10%>8.32</td><td class=ColmElementWht align='right'

width=10%>10.15</td><td class=ColmElementWht align='right' width=10%>8.96</td><td

class=ColmElementWht align='right' width=10%>-3.92</td><td class=ColmElementWht

align='right' width=10%>-0.37</td><td class=ColmElementWht align='right'

width=10%>6.25</td><td class=ColmElementWht align='right'

width=10%>13.47</td></tr><tr><td nowrap class=ColmElement width=25%>EPS

(annualised) (Unit Curr)</td><td class=ColmElementWht align='right'

width=10%>15.80</td><td class=ColmElementWht align='right' width=10%>11.48</td><td

class=ColmElementWht align='right' width=10%>8.25</td><td class=ColmElementWht

align='right' width=10%>4.93</td><td class=ColmElementWht align='right'

width=10%>5.99</td><td class=ColmElementWht align='right' width=10%>4.67</td><td

class=ColmElementWht align='right' width=10%>0.00</td><td class=ColmElementWht

align='right' width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>5.27</td></tr><tr><td nowrap class=ColmElement width=25%>Dividend

(annualised%)</td><td class=ColmElementWht align='right' width=10%>33.00</td><td

class=ColmElementWht align='right' width=10%>24.00</td><td class=ColmElementWht

align='right' width=10%>20.00</td><td class=ColmElementWht align='right'

width=10%>20.00</td><td class=ColmElementWht align='right' width=10%>20.20</td><td

class=ColmElementWht align='right' width=10%>20.00</td><td class=ColmElementWht

align='right' width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>0.00</td><td class=ColmElementWht align='right' width=10%>0.00</td><td

class=ColmElementWht align='right' width=10%>5.00</td></tr><tr><td nowrap

class=ColmElement width=25%>Payout (%)</td><td class=ColmElementWht align='right'

width=10%>20.88</td><td class=ColmElementWht align='right' width=10%>20.90</td><td

class=ColmElementWht align='right' width=10%>24.24</td><td class=ColmElementWht

align='right' width=10%>40.59</td><td class=ColmElementWht align='right'

width=10%>33.71</td><td class=ColmElementWht align='right' width=10%>42.85</td><td

class=ColmElementWht align='right' width=10%>0.00</td><td class=ColmElementWht

align='right' width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>0.00</td><td class=ColmElementWht align='right'

width=10%>0.00</td></tr><tr><td nowrap class=ColmElement width=25%>Cash Flow From

Operating Activities</td><td class=ColmElementWht align='right'

width=10%>48,004.80</td><td class=ColmElementWht align='right'

width=10%>21,572.50</td><td class=ColmElementWht align='right'

width=10%>10,418.30</td><td class=ColmElementWht align='right'

width=10%>24,044.80</td><td class=ColmElementWht align='right'

width=10%>58,830.90</td><td class=ColmElementWht align='right'

width=10%>27,441.20</td><td class=ColmElementWht align='right'

width=10%>37,997.10</td><td class=ColmElementWht align='right'

width=10%>21,250.30</td><td class=ColmElementWht align='right'

width=10%>61,578.10</td><td class=ColmElementWht align='right'

width=10%>73,015.70</td></tr><tr><td nowrap class=ColmElement width=25%>Cash Flow

From Investing Activities</td><td class=ColmElementWht align='right' width=10%>-

80,211.50</td><td class=ColmElementWht align='right' width=10%>-89,332.80</td><td

class=ColmElementWht align='right' width=10%>33,256.00</td><td

class=ColmElementWht align='right' width=10%>-57,051.30</td><td

class=ColmElementWht align='right' width=10%>-71,921.20</td><td

class=ColmElementWht align='right' width=10%>-51,605.00</td><td

class=ColmElementWht align='right' width=10%>-45,581.70</td><td

class=ColmElementWht align='right' width=10%>-54,386.70</td><td

class=ColmElementWht align='right' width=10%>-64,687.10</td><td

class=ColmElementWht align='right' width=10%>-37,556.60</td></tr><tr><td nowrap

class=ColmElement width=25%>Cash Flow From Financing Activities</td><td

class=ColmElementWht align='right' width=10%>73,950.00</td><td

class=ColmElementWht align='right' width=10%>18,175.20</td><td

class=ColmElementWht align='right' width=10%>-46,991.50</td><td

class=ColmElementWht align='right' width=10%>32,475.30</td><td

class=ColmElementWht align='right' width=10%>12,467.10</td><td

class=ColmElementWht align='right' width=10%>23,615.10</td><td

class=ColmElementWht align='right' width=10%>7,427.30</td><td class=ColmElementWht

align='right' width=10%>33,021.30</td><td class=ColmElementWht align='right'

width=10%>2,694.20</td><td class=ColmElementWht align='right' width=10%>-

35,907.70</td></tr><tr><td bgcolor='#ffffff' colspan='101'

width=25%><b></b></td></tr><tr><td bgcolor='#ffffff' colspan='101'

width=25%><b>Rate of Growth (%)</b></td></tr><tr><td nowrap class=ColmElement

width=25%>ROG-Net Worth (%)</td><td class=ColmElementWht align='right'

width=10%>18.36</td><td class=ColmElementWht align='right' width=10%>11.26</td><td

class=ColmElementWht align='right' width=10%>7.40</td><td class=ColmElementWht

align='right' width=10%>3.05</td><td class=ColmElementWht align='right'

width=10%>4.00</td><td class=ColmElementWht align='right' width=10%>1.97</td><td

class=ColmElementWht align='right' width=10%>-9.90</td><td class=ColmElementWht

align='right' width=10%>-8.13</td><td class=ColmElementWht align='right'

width=10%>-0.82</td><td class=ColmElementWht align='right'

width=10%>6.83</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-Capital

Employed (%)</td><td class=ColmElementWht align='right' width=10%>39.53</td><td

class=ColmElementWht align='right' width=10%>21.88</td><td class=ColmElementWht

align='right' width=10%>0.44</td><td class=ColmElementWht align='right'

width=10%>11.63</td><td class=ColmElementWht align='right' width=10%>7.54</td><td

class=ColmElementWht align='right' width=10%>6.99</td><td class=ColmElementWht

align='right' width=10%>1.01</td><td class=ColmElementWht align='right'

width=10%>4.28</td><td class=ColmElementWht align='right' width=10%>4.72</td><td

class=ColmElementWht align='right' width=10%>3.23</td></tr><tr><td nowrap

class=ColmElement width=25%>ROG-Gross Block (%)</td><td class=ColmElementWht

align='right' width=10%>7.74</td><td class=ColmElementWht align='right'

width=10%>8.02</td><td class=ColmElementWht align='right' width=10%>9.21</td><td

class=ColmElementWht align='right' width=10%>2.26</td><td class=ColmElementWht

align='right' width=10%>26.85</td><td class=ColmElementWht align='right'

width=10%>20.38</td><td class=ColmElementWht align='right' width=10%>19.24</td><td

class=ColmElementWht align='right' width=10%>8.76</td><td class=ColmElementWht

align='right' width=10%>12.95</td><td class=ColmElementWht align='right'

width=10%>6.22</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-Gross Sales

(%)</td><td class=ColmElementWht align='right' width=10%>-9.89</td><td

class=ColmElementWht align='right' width=10%>8.49</td><td class=ColmElementWht

align='right' width=10%>7.14</td><td class=ColmElementWht align='right'

width=10%>-2.35</td><td class=ColmElementWht align='right' width=10%>5.00</td><td

class=ColmElementWht align='right' width=10%>-2.24</td><td class=ColmElementWht

align='right' width=10%>-14.22</td><td class=ColmElementWht align='right'

width=10%>13.43</td><td class=ColmElementWht align='right' width=10%>18.48</td><td

class=ColmElementWht align='right' width=10%>13.58</td></tr><tr><td nowrap

class=ColmElement width=25%>ROG-Net Sales (%)</td><td class=ColmElementWht

align='right' width=10%>-6.18</td><td class=ColmElementWht align='right'

width=10%>6.88</td><td class=ColmElementWht align='right' width=10%>6.99</td><td

class=ColmElementWht align='right' width=10%>-4.09</td><td class=ColmElementWht

align='right' width=10%>4.95</td><td class=ColmElementWht align='right'

width=10%>-1.96</td><td class=ColmElementWht align='right' width=10%>-

15.27</td><td class=ColmElementWht align='right' width=10%>14.73</td><td

class=ColmElementWht align='right' width=10%>29.48</td><td class=ColmElementWht

align='right' width=10%>16.35</td></tr><tr><td nowrap class=ColmElement

width=25%>ROG-Cost of Production (%)</td><td class=ColmElementWht align='right'

width=10%>-15.96</td><td class=ColmElementWht align='right'

width=10%>19.10</td><td class=ColmElementWht align='right' width=10%>13.83</td><td

class=ColmElementWht align='right' width=10%>-7.01</td><td class=ColmElementWht

align='right' width=10%>0.07</td><td class=ColmElementWht align='right'

width=10%>1.27</td><td class=ColmElementWht align='right' width=10%>-4.49</td><td

class=ColmElementWht align='right' width=10%>11.12</td><td class=ColmElementWht

align='right' width=10%>14.47</td><td class=ColmElementWht align='right'

width=10%>13.83</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-Total

Assets (%)</td><td class=ColmElementWht align='right' width=10%>25.37</td><td

class=ColmElementWht align='right' width=10%>11.05</td><td class=ColmElementWht

align='right' width=10%>0.33</td><td class=ColmElementWht align='right'

width=10%>10.43</td><td class=ColmElementWht align='right' width=10%>9.38</td><td

class=ColmElementWht align='right' width=10%>8.56</td><td class=ColmElementWht

align='right' width=10%>4.96</td><td class=ColmElementWht align='right'

width=10%>7.07</td><td class=ColmElementWht align='right' width=10%>8.13</td><td

class=ColmElementWht align='right' width=10%>2.73</td></tr><tr><td nowrap

class=ColmElement width=25%>ROG-PBIDT (%)</td><td class=ColmElementWht

align='right' width=10%>8.45</td><td class=ColmElementWht align='right'

width=10%>-22.88</td><td class=ColmElementWht align='right' width=10%>-

15.87</td><td class=ColmElementWht align='right' width=10%>-30.00</td><td

class=ColmElementWht align='right' width=10%>9.60</td><td class=ColmElementWht

align='right' width=10%>-5.46</td><td class=ColmElementWht align='right'

width=10%>-141.26</td><td class=ColmElementWht align='right'

width=10%>115.49</td><td class=ColmElementWht align='right'

width=10%>1,336.98</td><td class=ColmElementWht align='right'

width=10%>92.59</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-PBDT

(%)</td><td class=ColmElementWht align='right' width=10%>7.32</td><td

class=ColmElementWht align='right' width=10%>-24.32</td><td class=ColmElementWht

align='right' width=10%>-22.61</td><td class=ColmElementWht align='right'

width=10%>-30.88</td><td class=ColmElementWht align='right' width=10%>6.41</td><td

class=ColmElementWht align='right' width=10%>-16.37</td><td class=ColmElementWht

align='right' width=10%>-211.45</td><td class=ColmElementWht align='right'

width=10%>52.86</td><td class=ColmElementWht align='right'

width=10%>206.22</td><td class=ColmElementWht align='right'

width=10%>191.53</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-PBIT

(%)</td><td class=ColmElementWht align='right' width=10%>9.07</td><td

class=ColmElementWht align='right' width=10%>-27.20</td><td class=ColmElementWht

align='right' width=10%>-20.01</td><td class=ColmElementWht align='right'

width=10%>-34.99</td><td class=ColmElementWht align='right' width=10%>5.11</td><td

class=ColmElementWht align='right' width=10%>-9.04</td><td class=ColmElementWht

align='right' width=10%>-223.44</td><td class=ColmElementWht align='right'

width=10%>50.65</td><td class=ColmElementWht align='right'

width=10%>188.84</td><td class=ColmElementWht align='right'

width=10%>214.60</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-PBT

(%)</td><td class=ColmElementWht align='right' width=10%>7.80</td><td

class=ColmElementWht align='right' width=10%>-28.99</td><td class=ColmElementWht

align='right' width=10%>-28.40</td><td class=ColmElementWht align='right'

width=10%>-37.09</td><td class=ColmElementWht align='right' width=10%>-

0.50</td><td class=ColmElementWht align='right' width=10%>-26.85</td><td

class=ColmElementWht align='right' width=10%>-397.07</td><td class=ColmElementWht

align='right' width=10%>30.78</td><td class=ColmElementWht align='right'

width=10%>84.35</td><td class=ColmElementWht align='right'

width=10%>539.81</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-PAT

(%)</td><td class=ColmElementWht align='right' width=10%>9.46</td><td

class=ColmElementWht align='right' width=10%>-27.38</td><td class=ColmElementWht

align='right' width=10%>-27.77</td><td class=ColmElementWht align='right'

width=10%>-38.74</td><td class=ColmElementWht align='right'

width=10%>20.56</td><td class=ColmElementWht align='right' width=10%>-

20.02</td><td class=ColmElementWht align='right' width=10%>-292.17</td><td

class=ColmElementWht align='right' width=10%>29.55</td><td class=ColmElementWht

align='right' width=10%>83.00</td><td class=ColmElementWht align='right'

width=10%>552.31</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-CP

(%)</td><td class=ColmElementWht align='right' width=10%>8.49</td><td

class=ColmElementWht align='right' width=10%>-21.02</td><td class=ColmElementWht

align='right' width=10%>-20.04</td><td class=ColmElementWht align='right'

width=10%>-30.07</td><td class=ColmElementWht align='right'

width=10%>21.26</td><td class=ColmElementWht align='right' width=10%>-

10.78</td><td class=ColmElementWht align='right' width=10%>-141.88</td><td

class=ColmElementWht align='right' width=10%>90.53</td><td class=ColmElementWht

align='right' width=10%>1,785.18</td><td class=ColmElementWht align='right'

width=10%>115.37</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-Revenue

earnings in forex (%)</td><td class=ColmElementWht align='right' width=10%>-

3.04</td><td class=ColmElementWht align='right' width=10%>25.22</td><td

class=ColmElementWht align='right' width=10%>25.45</td><td class=ColmElementWht

align='right' width=10%>-5.86</td><td class=ColmElementWht align='right'

width=10%>120.49</td><td class=ColmElementWht align='right' width=10%>-

38.60</td><td class=ColmElementWht align='right' width=10%>-64.46</td><td

class=ColmElementWht align='right' width=10%>210.47</td><td class=ColmElementWht

align='right' width=10%>29.71</td><td class=ColmElementWht align='right'

width=10%>28.03</td></tr><tr><td nowrap class=ColmElement width=25%>ROG-Revenue

expenses in forex (%)</td><td class=ColmElementWht align='right' width=10%>-

16.69</td><td class=ColmElementWht

align='right' width=10%>23.35</td><td class=ColmElementWht align='right'

width=10%>25.61</td><td class=ColmElementWht align='right' width=10%>-

17.65</td><td class=ColmElementWht align='right' width=10%>4.59</td><td

class=ColmElementWht align='right' width=10%>-9.41</td><td class=ColmElementWht

align='right' width=10%>-15.56</td><td class=ColmElementWht align='right'

width=10%>35.42</td><td class=ColmElementWht align='right' width=10%>-

73.41</td><td class=ColmElementWht align='right' width=10%>560.88</td></tr><tr><td

nowrap class=ColmElement width=25%>ROG-Market Capitalisation (%)</td><td

class=ColmElementWht align='right' width=10%>161.07</td><td class=ColmElementWht

align='right' width=10%>-32.59</td><td class=ColmElementWht align='right'

width=10%>-44.59</td><td class=ColmElementWht align='right' width=10%>-

33.71</td><td class=ColmElementWht align='right' width=10%>14.51</td><td

class=ColmElementWht align='right' width=10%>-4.27</td><td class=ColmElementWht

align='right' width=10%>-37.09</td><td class=ColmElementWht align='right'

width=10%>42.33</td><td class=ColmElementWht align='right' width=10%>14.71</td><td

class=ColmElementWht align='right' width=10%>-23.50</td></tr><tr><td

bgcolor='#ffffff' colspan='101' width=25%><b></b></td></tr><tr><td

bgcolor='#ffffff' colspan='101' width=25%><b>Key Ratios</b></td></tr><tr><td

nowrap class=ColmElement width=25%>Debt-Equity Ratio</td><td class=ColmElementWht

align='right' width=10%>0.39</td><td class=ColmElementWht align='right'

width=10%>0.51</td><td class=ColmElementWht align='right' width=10%>0.46</td><td

class=ColmElementWht align='right' width=10%>0.47</td><td class=ColmElementWht

align='right' width=10%>0.56</td><td class=ColmElementWht align='right'

width=10%>0.64</td><td class=ColmElementWht align='right' width=10%>0.78</td><td

class=ColmElementWht align='right' width=10%>1.02</td><td class=ColmElementWht

align='right' width=10%>1.21</td><td class=ColmElementWht align='right'

width=10%>1.23</td></tr><tr><td nowrap class=ColmElement width=25%>Long Term Debt-

Equity Ratio</td><td class=ColmElementWht align='right' width=10%>0.34</td><td

class=ColmElementWht align='right' width=10%>0.33</td><td class=ColmElementWht

align='right' width=10%>0.27</td><td class=ColmElementWht align='right'

width=10%>0.31</td><td class=ColmElementWht align='right' width=10%>0.32</td><td

class=ColmElementWht align='right' width=10%>0.32</td><td class=ColmElementWht

align='right' width=10%>0.38</td><td class=ColmElementWht align='right'

width=10%>0.49</td><td class=ColmElementWht align='right' width=10%>0.68</td><td

class=ColmElementWht align='right' width=10%>0.82</td></tr><tr><td nowrap

class=ColmElement width=25%>Current Ratio</td><td class=ColmElementWht

align='right' width=10%>1.77</td><td class=ColmElementWht align='right'

width=10%>1.59</td><td class=ColmElementWht align='right' width=10%>1.39</td><td

class=ColmElementWht align='right' width=10%>1.22</td><td class=ColmElementWht

align='right' width=10%>0.99</td><td class=ColmElementWht align='right'

width=10%>0.83</td><td class=ColmElementWht align='right' width=10%>0.75</td><td

class=ColmElementWht align='right' width=10%>0.70</td><td class=ColmElementWht

align='right' width=10%>0.75</td><td class=ColmElementWht align='right'

width=10%>0.85</td></tr><tr><td bgcolor='#ffffff' colspan='101'

width=25%><b>Turnover Ratios</b></td></tr><tr><td nowrap class=ColmElement

width=25%>Fixed Assets Ratio</td><td class=ColmElementWht align='right'

width=10%>1.29</td><td class=ColmElementWht align='right' width=10%>1.29</td><td

class=ColmElementWht align='right' width=10%>1.28</td><td class=ColmElementWht

align='right' width=10%>1.18</td><td class=ColmElementWht align='right'

width=10%>1.08</td><td class=ColmElementWht align='right' width=10%>0.86</td><td

class=ColmElementWht align='right' width=10%>0.61</td><td class=ColmElementWht

align='right' width=10%>0.61</td><td class=ColmElementWht align='right'

width=10%>0.65</td><td class=ColmElementWht align='right'

width=10%>0.68</td></tr><tr><td nowrap class=ColmElement width=25%>Inventory

Ratio</td><td class=ColmElementWht align='right' width=10%>4.50</td><td

class=ColmElementWht align='right' width=10%>4.61</td><td class=ColmElementWht

align='right' width=10%>4.02</td><td class=ColmElementWht align='right'

width=10%>3.31</td><td class=ColmElementWht align='right' width=10%>3.31</td><td

class=ColmElementWht align='right' width=10%>3.07</td><td class=ColmElementWht

align='right' width=10%>2.67</td><td class=ColmElementWht align='right'

width=10%>3.23</td><td class=ColmElementWht align='right' width=10%>3.55</td><td

class=ColmElementWht align='right' width=10%>3.63</td></tr><tr><td nowrap

class=ColmElement width=25%>Debtors Ratio</td><td class=ColmElementWht

align='right' width=10%>13.46</td><td class=ColmElementWht align='right'

width=10%>12.49</td><td class=ColmElementWht align='right' width=10%>11.49</td><td

class=ColmElementWht align='right' width=10%>10.86</td><td class=ColmElementWht

align='right' width=10%>10.56</td><td class=ColmElementWht align='right'

width=10%>11.79</td><td class=ColmElementWht align='right' width=10%>13.85</td><td

class=ColmElementWht align='right' width=10%>16.41</td><td class=ColmElementWht

align='right' width=10%>17.36</td><td class=ColmElementWht align='right'

width=10%>16.01</td></tr><tr><td nowrap class=ColmElement width=25%>Interest Cover

Ratio</td><td class=ColmElementWht align='right' width=10%>26.20</td><td

class=ColmElementWht align='right' width=10%>16.15</td><td class=ColmElementWht

align='right' width=10%>6.23</td><td class=ColmElementWht align='right'

width=10%>5.33</td><td class=ColmElementWht align='right' width=10%>3.23</td><td

class=ColmElementWht align='right' width=10%>2.62</td><td class=ColmElementWht

align='right' width=10%>-2.05</td><td class=ColmElementWht align='right'

width=10%>-0.92</td><td class=ColmElementWht align='right' width=10%>0.73</td><td

class=ColmElementWht align='right' width=10%>2.20</td></tr><tr><td nowrap

class=ColmElement width=25%>PBIDTM (%)</td><td class=ColmElementWht align='right'

width=10%>27.04</td><td class=ColmElementWht align='right' width=10%>19.22</td><td

class=ColmElementWht align='right' width=10%>15.09</td><td class=ColmElementWht

align='right' width=10%>10.82</td><td class=ColmElementWht align='right'

width=10%>9.26</td><td class=ColmElementWht align='right' width=10%>10.92</td><td

class=ColmElementWht align='right' width=10%>-5.25</td><td class=ColmElementWht

align='right' width=10%>0.72</td><td class=ColmElementWht align='right'

width=10%>8.70</td><td class=ColmElementWht align='right'

width=10%>15.40</td></tr><tr><td nowrap class=ColmElement width=25%>PBITM

(%)</td><td class=ColmElementWht align='right' width=10%>23.99</td><td

class=ColmElementWht align='right' width=10%>16.10</td><td class=ColmElementWht

align='right' width=10%>12.02</td><td class=ColmElementWht align='right'

width=10%>8.00</td><td class=ColmElementWht align='right' width=10%>5.98</td><td

class=ColmElementWht align='right' width=10%>7.45</td><td class=ColmElementWht

align='right' width=10%>-10.73</td><td class=ColmElementWht align='right'

width=10%>-4.67</td><td class=ColmElementWht align='right' width=10%>3.50</td><td

class=ColmElementWht align='right' width=10%>10.34</td></tr><tr><td nowrap

class=ColmElement width=25%>PBDTM (%)</td><td class=ColmElementWht align='right'

width=10%>26.12</td><td class=ColmElementWht align='right' width=10%>18.22</td><td

class=ColmElementWht align='right' width=10%>13.16</td><td class=ColmElementWht

align='right' width=10%>9.32</td><td class=ColmElementWht align='right'

width=10%>7.41</td><td class=ColmElementWht align='right' width=10%>8.08</td><td

class=ColmElementWht align='right' width=10%>-10.50</td><td class=ColmElementWht

align='right' width=10%>-4.36</td><td class=ColmElementWht align='right'

width=10%>3.91</td><td class=ColmElementWht align='right'

width=10%>10.69</td></tr><tr><td nowrap class=ColmElement width=25%>CPM

(%)</td><td class=ColmElementWht align='right' width=10%>18.43</td><td

class=ColmElementWht align='right' width=10%>13.42</td><td class=ColmElementWht

align='right' width=10%>10.01</td><td class=ColmElementWht align='right'

width=10%>7.17</td><td class=ColmElementWht align='right' width=10%>6.89</td><td

class=ColmElementWht align='right' width=10%>7.56</td><td class=ColmElementWht

align='right' width=10%>-3.69</td><td class=ColmElementWht align='right'

width=10%>-0.31</td><td class=ColmElementWht align='right' width=10%>4.38</td><td

class=ColmElementWht align='right' width=10%>8.73</td></tr><tr><td nowrap

class=ColmElement width=25%>APATM (%)</td><td class=ColmElementWht align='right'

width=10%>15.38</td><td class=ColmElementWht align='right' width=10%>10.30</td><td

class=ColmElementWht align='right' width=10%>6.94</td><td class=ColmElementWht

align='right' width=10%>4.36</td><td class=ColmElementWht align='right'

width=10%>3.61</td><td class=ColmElementWht align='right' width=10%>4.09</td><td

class=ColmElementWht align='right' width=10%>-9.17</td><td class=ColmElementWht

align='right' width=10%>-5.69</td><td class=ColmElementWht align='right'

width=10%>-0.82</td><td class=ColmElementWht align='right'

width=10%>3.68</td></tr><tr><td nowrap class=ColmElement width=25%>ROCE

(%)</td><td class=ColmElementWht align='right' width=10%>24.63</td><td

class=ColmElementWht align='right' width=10%>13.87</td><td class=ColmElementWht

align='right' width=10%>10.08</td><td class=ColmElementWht align='right'

width=10%>6.18</td><td class=ColmElementWht align='right' width=10%>4.43</td><td

class=ColmElementWht align='right' width=10%>5.03</td><td class=ColmElementWht

align='right' width=10%>-5.98</td><td class=ColmElementWht align='right'

width=10%>-2.87</td><td

class=ColmElementWht align='right' width=10%>2.44</td><td class=ColmElementWht

align='right' width=10%>7.89</td></tr><tr><td nowrap class=ColmElement

width=25%>RONW (%)</td><td class=ColmElementWht align='right'

width=10%>21.98</td><td class=ColmElementWht align='right' width=10%>13.94</td><td

class=ColmElementWht align='right' width=10%>9.22</td><td class=ColmElementWht

align='right' width=10%>5.37</td><td class=ColmElementWht align='right'

width=10%>4.51</td><td class=ColmElementWht align='right' width=10%>4.86</td><td

class=ColmElementWht align='right' width=10%>-9.73</td><td class=ColmElementWht

align='right' width=10%>-7.53</td><td class=ColmElementWht align='right'

width=10%>-1.34</td><td class=ColmElementWht align='right'

width=10%>6.67</td></tr><tr><td nowrap class=ColmElement width=25%>Debtors

Velocity (Days)</td><td class=ColmElementWht align='right' width=10%>27.00</td><td

class=ColmElementWht align='right' width=10%>29.00</td><td class=ColmElementWht

align='right' width=10%>32.00</td><td class=ColmElementWht align='right'

width=10%>34.00</td><td class=ColmElementWht align='right' width=10%>35.00</td><td

class=ColmElementWht align='right' width=10%>31.00</td><td class=ColmElementWht

align='right' width=10%>26.00</td><td class=ColmElementWht align='right'

width=10%>22.00</td><td class=ColmElementWht align='right' width=10%>21.00</td><td

class=ColmElementWht align='right' width=10%>23.00</td></tr><tr><td nowrap

class=ColmElement width=25%>Creditors Velocity (Days)</td><td class=ColmElementWht

align='right' width=10%>60.00</td><td class=ColmElementWht align='right'

width=10%>50.00</td><td class=ColmElementWht align='right' width=10%>34.00</td><td

class=ColmElementWht align='right' width=10%>33.00</td><td class=ColmElementWht

align='right' width=10%>43.00</td><td class=ColmElementWht align='right'

width=10%>46.00</td><td class=ColmElementWht align='right' width=10%>59.00</td><td

class=ColmElementWht align='right' width=10%>56.00</td><td class=ColmElementWht

align='right' width=10%>67.00</td><td class=ColmElementWht align='right'

width=10%>65.00</td></tr><tr><td bgcolor='#ffffff' colspan='101'

width=25%><b>Assets Utilisation Ratio (times)</b></td></tr><tr><td nowrap

class=ColmElement width=25%>Value of Output/Total Assets</td><td

class=ColmElementWht align='right' width=10%>0.76</td><td class=ColmElementWht

align='right' width=10%>0.71</td><td class=ColmElementWht align='right'

width=10%>0.68</td><td class=ColmElementWht align='right' width=10%>0.68</td><td

class=ColmElementWht align='right' width=10%>0.66</td><td class=ColmElementWht

align='right' width=10%>0.63</td><td class=ColmElementWht align='right'

width=10%>0.61</td><td class=ColmElementWht align='right' width=10%>0.60</td><td

class=ColmElementWht align='right' width=10%>0.58</td><td class=ColmElementWht

align='right' width=10%>0.56</td></tr><tr><td nowrap class=ColmElement

width=25%>Value of Output/Gross Block</td><td class=ColmElementWht align='right'

width=10%>1.04</td><td class=ColmElementWht align='right' width=10%>1.02</td><td

class=ColmElementWht align='right' width=10%>1.00</td><td class=ColmElementWht

align='right' width=10%>0.97</td><td class=ColmElementWht align='right'

width=10%>0.97</td><td class=ColmElementWht align='right' width=10%>0.90</td><td

class=ColmElementWht align='right' width=10%>0.84</td><td class=ColmElementWht

align='right' width=10%>0.78</td><td class=ColmElementWht align='right'

width=10%>0.75</td><td class=ColmElementWht align='right'

width=10%>0.71</td></tr></TABLE></td></tr></TABLE></td>

</tr>

</table></tr>

<tr><td align=left><font face=Verdana

size='2'><b>https://www.capitaline.com</b></font></td></tr>

</table>

</form>

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Tutorial QuestionsDocument19 pagesTutorial QuestionsTan Ngoc TranNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Activity 2 Investments in Equity SecuritiesDocument4 pagesActivity 2 Investments in Equity SecuritiesVi Vid100% (5)

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisDocument2 pagesUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBANo ratings yet

- Course Outline - Investment Analysis and Portfolio ManagementDocument4 pagesCourse Outline - Investment Analysis and Portfolio ManagementMadihaBhatti100% (1)

- Main Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementDocument22 pagesMain Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementSnehaVohra100% (1)

- Multifactor Models QuestionsDocument5 pagesMultifactor Models QuestionsJosh Brodsky0% (1)

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- Historical Income Statement and Balance Sheets For Vitex Corp. Income Statement ($ Million)Document4 pagesHistorical Income Statement and Balance Sheets For Vitex Corp. Income Statement ($ Million)ShilpaNo ratings yet

- Books of Prime EntryDocument22 pagesBooks of Prime EntryRakiya ZainabNo ratings yet

- Krakatau Steel (B)Document13 pagesKrakatau Steel (B)Fadhila HanifNo ratings yet

- Maths CH-4 PPT-1Document31 pagesMaths CH-4 PPT-1newaybeyene5No ratings yet

- Session 13 Conjoint Analysis Group 5Document19 pagesSession 13 Conjoint Analysis Group 5Ngan Tran Ha HanhNo ratings yet

- Master Thesis Topics in Finance and BankingDocument8 pagesMaster Thesis Topics in Finance and Bankingangeladominguezaurora100% (1)

- Hull OFOD10e Multiple Choice Questions and Answers Ch03 Hull OFOD10e Multiple Choice Questions and Answers Ch03Document8 pagesHull OFOD10e Multiple Choice Questions and Answers Ch03 Hull OFOD10e Multiple Choice Questions and Answers Ch03Đặng Lê Thanh TràNo ratings yet

- Apznzabaqearpefkn Hcmj5ev6iwe5rx70g7mkdovnxe3pa7ta Twqnbcpgkx4b8dlsvvuwlxldgtqnnnqekvmueiigzpewgmueffbhywd04ecgaai7ix5awzmbplwwtae0rnugdk8gtkxol Nklc3ed2ezepg8ddmblahyt Wjxrwsqgbuaesk6c0cejurkay6 Ukwgyls DnuqhpzDocument2 pagesApznzabaqearpefkn Hcmj5ev6iwe5rx70g7mkdovnxe3pa7ta Twqnbcpgkx4b8dlsvvuwlxldgtqnnnqekvmueiigzpewgmueffbhywd04ecgaai7ix5awzmbplwwtae0rnugdk8gtkxol Nklc3ed2ezepg8ddmblahyt Wjxrwsqgbuaesk6c0cejurkay6 Ukwgyls DnuqhpzHaise SasakiNo ratings yet

- 3 HW On PPE Answer KeyDocument5 pages3 HW On PPE Answer KeyHannah Jane ToribioNo ratings yet

- Calculation My DollDocument2 pagesCalculation My Dollfitri0% (1)

- Grinold - Factor ModelsDocument22 pagesGrinold - Factor ModelssnazxNo ratings yet

- Expmonthly Vol2no8 Oct 1Document23 pagesExpmonthly Vol2no8 Oct 1stepchoi35No ratings yet

- Cash Flow Estimation MbaDocument27 pagesCash Flow Estimation MbaViolets n' DaisiesNo ratings yet

- Stock Market IntroductionDocument3 pagesStock Market IntroductionVishalsinh VaghelaNo ratings yet

- Axis Mutual Fund Project ReportDocument37 pagesAxis Mutual Fund Project ReportVikas PabaleNo ratings yet

- Transfer Pricing and Responsibility AccountingDocument2 pagesTransfer Pricing and Responsibility AccountingMadiha JamalNo ratings yet

- ACCS+111 Study GuideDocument2 pagesACCS+111 Study GuideAsiphe Biyo IINo ratings yet

- First Semester Business English Exams Agenla 2016-2017 Level II AccountingDocument2 pagesFirst Semester Business English Exams Agenla 2016-2017 Level II AccountingLysongo OruNo ratings yet

- Examples of Customized Charts of AccountsDocument33 pagesExamples of Customized Charts of AccountsDennis lugodNo ratings yet

- Law Final Exam 1 100Document24 pagesLaw Final Exam 1 100Dan Edriel RonabioNo ratings yet

- Chap 015Document21 pagesChap 015Zaid Osama AldwekNo ratings yet

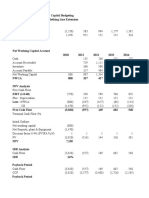

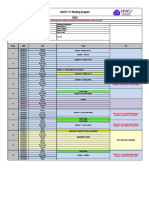

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNo ratings yet

- 17 International Capital Structure and The Cost of CapitalDocument29 pages17 International Capital Structure and The Cost of CapitalOnkar Singh AulakhNo ratings yet