Professional Documents

Culture Documents

BPI Leasing Corporation v. CA

Uploaded by

Aila Amp100%(1)100% found this document useful (1 vote)

192 views2 pagesTax 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

192 views2 pagesBPI Leasing Corporation v. CA

Uploaded by

Aila AmpTax 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

BPI Leasing Corporation (BLC) v. CA, CTA, & 1.

Whether Revenue Regulation 19-86 is legislative or

CIR interpretative in character. – Legislative in character.

2003

2. Whether or not said revenue regulation should have

retroactive application. – NO.

Facts: BLC is a corporation engaged in the business of

leasing properties. Ruling:

[1]

For the calendar year 1986, BLC paid the CIR a total of The revenue regulation is legislative in nature.

P1,139,041.49 representing 4% "contractor’s percentage

tax" then imposed by Section 205 of the National Internal Administrative issuances may be distinguished according to

Revenue Code (NIRC), based on its gross rentals from their nature and substance: legislative and interpretative.

equipment leasing for the said year amounting to

P27,783,725.42.

Legislative rule Interpretative rule

is in the matter of is designed to provide

On November 10, 1986, the CIR issued Revenue Regulation

subordinate legislation, guidelines to the law which

19-86. Section 6.2 thereof provided that finance and

designed to implement a the administrative agency is

leasing companies registered under R.A. 5980 shall be

primary legislation by in charge of enforcing.

subject to gross receipt tax of 5%-3%-1% on actual

providing the details

income earned.

thereof.

This means that companies registered under R.A. 5980, such

In this case: The Court finds the questioned revenue

as BLC, are not liable for "contractor’s percentage tax"

regulation to be legislative in nature.

under Section 205 but are, instead, subject to "gross

receipts tax" under Section 260 (now Section 122) of the

Section 1 of Revenue Regulation 19-86 plainly states that it

NIRC.

was promulgated pursuant to Section 277 of the NIRC.

Since BLC had earlier paid the aforementioned "contractor’s

Section 277 (now Section 244) is an express grant of

percentage tax," it re-computed its tax liabilities under the

authority to the Secretary of Finance to promulgate all

"gross receipts tax" and arrived at the amount of

needful rules and regulations for the effective enforcement of

P361,924.44.

the provisions of the NIRC.

BLC filed a claim for a refund with the CIR for the amount of

In Paper Industries Corporation of the Philippines v. CA, the

P777,117.05, representing the difference between the

Court recognized that the application of Section 277 calls for

P1,139,041.49 it had paid as "contractor’s percentage tax"

none other than the exercise of quasi-legislative or rule-

and P361,924.44 it should have paid for "gross receipts tax."

making authority.

Four days later, to stop the running of the prescriptive period

for refunds, BLC filed a petition for review with the CTA.

It cannot be disputed that Revenue Regulation 19-86 was

issued pursuant to the rule-making power of the Secretary of

CTA: It dismissed the petition and denied BLC’s claim of

Finance, thus making it legislative, and not interpretative as

refund. It held that Revenue Regulation 19-86, as amended,

alleged by BLC.

may only be applied prospectively such that it only covers all

leases written on or after January 1, 1987, as stated under

Contention: BLC contends that assuming the revenue

Section 7 of said revenue regulation:

regulation is legislative in nature, it is invalid for want of

due process as no prior notice, publication and public

Section 7. Effectivity. – These regulations shall

hearing attended the issuance thereof. To support its view,

take effect on January 1, 1987 and shall be

BLC cited CIR v. Fortune Tobacco, et al., wherein the Court

applicable to all leases written on or after the said

nullified a revenue memorandum circular which reclassified

date.

certain cigarettes and subjected them to a higher tax rate,

holding it invalid for lack of notice, publication and public

It ruled that since BLC’s rental income was all received prior

hearing.

to 1986, it follows that this was derived from lease

transactions prior to January 1, 1987, and hence, not covered

Held: The doctrine enunciated in Fortune Tobacco, and

by the revenue regulation.

reiterated in CIR v. Michel J. Lhuillier Pawnshop, Inc., is that

when an administrative rule goes beyond merely providing

CA: It affirmed the decision of the CTA denying the claim for

for the means that can facilitate or render less cumbersome

tax refund by BLC.

the implementation of the law and substantially increases

the burden of those governed, it behooves the agency to

BLC’s contentions:

accord at least to those directly affected a chance to be heard

The CA and the CTA erred in not ruling that Revenue

and, thereafter, to be duly informed, before the issuance is

Regulation 19-86 may be applied retroactively so as to

given the force and effect of law.

allow BLC’s claim for a refund of P777,117.05.

Revenue Regulation 19-86 is legislative rather than

In Lhuillier and Fortune Tobacco, the Court invalidated the

interpretative in character and hence, should

revenue memoranda concerned because the same increased

retroact to the date of effectivity of the law it seeks

the tax liabilities of the affected taxpayers without affording

to interpret.

them due process.

Respondents’ contention: The provision on the date of

In this case: Revenue Regulation 19-86 would be beneficial

effectivity of Revenue Regulation 19-86 is clear and

to the taxpayers as they are subjected to lesser taxes.

unequivocal, leaving no room for interpretation on its

Petitioner, in fact, is invoking Revenue Regulation 19-86 as

prospective application.

the very basis of its claim for refund. If it were invalid, then

petitioner all the more has no right to a refund.

Issues:

The Court upholds the validity of Revenue Regulation 19-86.

[2]

There is no indication that the revenue regulation may

operate retroactively.

Rule: The principle is well entrenched that statutes, including

administrative rules and regulations, operate prospectively

only, unless the legislative intent to the contrary is manifest

by express terms or by necessary implication.

In this case: There is no indication that the revenue

regulation may operate retroactively.

Furthermore, there is an express provision stating that it

"shall take effect on January 1, 1987," and that it "shall be

applicable to all leases written on or after the said date."

Being clear on its prospective application, it must be given its

literal meaning and applied without further interpretation.

Thus, BLC is not in a position to invoke the provisions of

Revenue Regulation 19-86 for lease rentals it received prior to

January 1, 1987.

Rule: It is also apt to add that tax refunds are in the nature

of tax exemptions. As such, these are regarded as in

derogation of sovereign authority and are to be strictly

construed against the person or entity claiming the

exemption.

The burden of proof is upon him who claims the exemption

and he must be able to justify his claim by the clearest grant

under Constitutional or statutory law, and he cannot be

permitted to rely upon vague implications.

In this case: Nothing that BLC has raised justifies a tax

refund.

You might also like

- Hibberd v. RohdeDocument2 pagesHibberd v. RohdeMarion KhoNo ratings yet

- American Tobacco Co V Director of PatentsDocument2 pagesAmerican Tobacco Co V Director of PatentsJoshua Langit CustodioNo ratings yet

- Lao Brothers v. Lao (Gador) Stock Ownership DisputeDocument1 pageLao Brothers v. Lao (Gador) Stock Ownership DisputeKen Reyes GadorNo ratings yet

- Lirag V SSS (Art. 1956) - RevisedDocument3 pagesLirag V SSS (Art. 1956) - RevisedMitchell YumulNo ratings yet

- EditedMacailing vs. AndradaDocument2 pagesEditedMacailing vs. AndradaReth GuevarraNo ratings yet

- Local Autonomy PowersDocument2 pagesLocal Autonomy PowersJohn Lester LantinNo ratings yet

- BPI Leasing Corp vs. CA, Et Al.Document2 pagesBPI Leasing Corp vs. CA, Et Al.Laila R. AntonioNo ratings yet

- Stockholder's Right to Inspect Corporate Records UpheldDocument1 pageStockholder's Right to Inspect Corporate Records Upheldmimiyuki_No ratings yet

- Topic: SPA, Written/oral AgencyDocument3 pagesTopic: SPA, Written/oral AgencydelayinggratificationNo ratings yet

- Buklod NG Kawaning EIIB vs. Zamora, G.R. No. 142801-802Document3 pagesBuklod NG Kawaning EIIB vs. Zamora, G.R. No. 142801-802Roward100% (1)

- ROGELIO Florete Vs MARCELINO FloreteDocument4 pagesROGELIO Florete Vs MARCELINO FloreteMaeNo ratings yet

- Dissolution of de facto corporation by stockholdersDocument2 pagesDissolution of de facto corporation by stockholdersSamii JoNo ratings yet

- Digest - G.R. No. L-4043 Cervantes Vs Auditor General (Separation of Powers, Non-Delegability of Legislative Powers, Completeness and Sufficient Standard Tests) PDFDocument2 pagesDigest - G.R. No. L-4043 Cervantes Vs Auditor General (Separation of Powers, Non-Delegability of Legislative Powers, Completeness and Sufficient Standard Tests) PDFMarkNo ratings yet

- Judge Torres' invalid assignment of shares and electionDocument1 pageJudge Torres' invalid assignment of shares and electionAbhor Tyranny100% (2)

- Parsicha Vs Don LuisDocument2 pagesParsicha Vs Don LuisRichie SalubreNo ratings yet

- Gimeno V Atty. ZaideDocument2 pagesGimeno V Atty. ZaideMariz EnocNo ratings yet

- Gavieres Vs Tavera - MEMORACIONDocument2 pagesGavieres Vs Tavera - MEMORACIONMichael Angelo MemoracionNo ratings yet

- Afisco Insurance Corporation v. CA 302 SCRA 1Document2 pagesAfisco Insurance Corporation v. CA 302 SCRA 1Kayee KatNo ratings yet

- Expert Travel vs. CA DigestDocument4 pagesExpert Travel vs. CA DigestPaolo AdalemNo ratings yet

- Martinez v. CADocument2 pagesMartinez v. CAJun RiveraNo ratings yet

- Avon vs. Court of Appeals Et. AlDocument3 pagesAvon vs. Court of Appeals Et. AlWhere Did Macky GallegoNo ratings yet

- GR No. 173082 (2014) - Rep. of The Phil. v. SandiganbayanDocument2 pagesGR No. 173082 (2014) - Rep. of The Phil. v. SandiganbayanNikki Estores GonzalesNo ratings yet

- Bagaoisan v. National Tobacco AuthorityDocument2 pagesBagaoisan v. National Tobacco AuthorityJude Raphael CollantesNo ratings yet

- Koji v. YasumaDocument8 pagesKoji v. YasumadingNo ratings yet

- Radio Corp v. ROADocument3 pagesRadio Corp v. ROAVictor RamirezNo ratings yet

- 139 - The Board of Liquidators Vs Heirs of Maximo M. KalawDocument2 pages139 - The Board of Liquidators Vs Heirs of Maximo M. KalawJoannah GamboaNo ratings yet

- Edward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineDocument11 pagesEdward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineGrey WolffeNo ratings yet

- 1) SEC V GMA Network, GR No.164026Document1 page1) SEC V GMA Network, GR No.164026gel94100% (1)

- Salazar v. CFIDocument2 pagesSalazar v. CFILouie BruanNo ratings yet

- Machetti v. Hospicio de San JoseDocument1 pageMachetti v. Hospicio de San JoseAices SalvadorNo ratings yet

- Ang Pue v. Sec. of Commerce and Industry, 5 SCRA 645Document1 pageAng Pue v. Sec. of Commerce and Industry, 5 SCRA 645Aphrobit CloNo ratings yet

- 033 - Villa Rey Transit v. Ferrer (1968) - DacilloDocument3 pages033 - Villa Rey Transit v. Ferrer (1968) - DacilloAmber AncaNo ratings yet

- Labor dispute over corporate officer statusDocument9 pagesLabor dispute over corporate officer statusReginald Matt Aquino SantiagoNo ratings yet

- Manzano vs. Perez Dispute Over Ownership of House and LotDocument2 pagesManzano vs. Perez Dispute Over Ownership of House and LotGeorge JerusalemNo ratings yet

- G.R. No. 187262, January 10, 2019 - Engineering Geoscience, Inc., Petitioner vs. Philippine Savings Bank, Respondent.Document2 pagesG.R. No. 187262, January 10, 2019 - Engineering Geoscience, Inc., Petitioner vs. Philippine Savings Bank, Respondent.Francis Coronel Jr.No ratings yet

- 009 Board of Trustees of GSIS V VelascoDocument3 pages009 Board of Trustees of GSIS V VelascoWD NNo ratings yet

- IX. Q. B. DBP vs. Licuanan (Duron)Document2 pagesIX. Q. B. DBP vs. Licuanan (Duron)Krizea Marie Duron100% (1)

- Aratuc VS ComelecDocument1 pageAratuc VS ComelecJ. LapidNo ratings yet

- BPI v. FMICDocument4 pagesBPI v. FMICfjl_302711100% (1)

- Lups-Montelibano Vs Bacolod Murcia MillingDocument2 pagesLups-Montelibano Vs Bacolod Murcia MillingAllenNo ratings yet

- MARK San Juan Structural Vs CaDocument2 pagesMARK San Juan Structural Vs CaAllenNo ratings yet

- Atlas Farms V NLRCDocument2 pagesAtlas Farms V NLRCCecil LosteNo ratings yet

- PPA employee suspension caseDocument6 pagesPPA employee suspension caseLizzy WayNo ratings yet

- Leslie's DigestsDocument4 pagesLeslie's DigestsNolas Jay100% (2)

- Valle Verde Country Club v. AfricaDocument2 pagesValle Verde Country Club v. AfricaRap Santos100% (1)

- 2 - Mateo V DARDocument2 pages2 - Mateo V DARKrisel0% (2)

- PNB Vs AznarDocument4 pagesPNB Vs AznarAthena SantosNo ratings yet

- Villa Rey Transit vs. FerrerDocument2 pagesVilla Rey Transit vs. FerrerJolas E. Brutas0% (1)

- EDITO GULFO and EMMANUELA GULFO, Petitioners, vs. JOSE P. ANCHETA, RespondentDocument3 pagesEDITO GULFO and EMMANUELA GULFO, Petitioners, vs. JOSE P. ANCHETA, RespondentJaylordPataotaoNo ratings yet

- Guidelines on jurisdiction over labor disputesDocument3 pagesGuidelines on jurisdiction over labor disputesCourtney TirolNo ratings yet

- Chee Kiong Yam Vs Hon. Malik, G.R. No. L-50550-52 October 31, 1979Document2 pagesChee Kiong Yam Vs Hon. Malik, G.R. No. L-50550-52 October 31, 1979Rizchelle Sampang-ManaogNo ratings yet

- SMART COMMUNICATIONS, INC. ET AL. v. NTC - DigestDocument2 pagesSMART COMMUNICATIONS, INC. ET AL. v. NTC - DigestMark Genesis Rojas100% (1)

- Domingo v. DomingoDocument10 pagesDomingo v. DomingoR. BonitaNo ratings yet

- Will Probate Dispute in AlbayDocument1 pageWill Probate Dispute in AlbayMacrino Cahulogan100% (1)

- Tio vs. Videogram Regulatory BoardDocument2 pagesTio vs. Videogram Regulatory BoardAnge DinoNo ratings yet

- BATELEC I General Manager's Dismissal Deemed Intra-Corporate ControversyDocument2 pagesBATELEC I General Manager's Dismissal Deemed Intra-Corporate Controversychris0% (1)

- People v. Tan Boon KongDocument2 pagesPeople v. Tan Boon KongJustin MoretoNo ratings yet

- 23 ST Mary Crusade Foundation, Inc V Riel PDFDocument1 page23 ST Mary Crusade Foundation, Inc V Riel PDFTon Ton CananeaNo ratings yet

- Santamaria v HKSB Banking Corp Case DigestDocument1 pageSantamaria v HKSB Banking Corp Case Digesticeiceice023No ratings yet

- BPI Leasing Corp V CA Admin Digest G R No 127624 November 18 2003Document2 pagesBPI Leasing Corp V CA Admin Digest G R No 127624 November 18 2003Samiha TorrecampoNo ratings yet

- UST GN 2011 - Remedial Law ProperDocument386 pagesUST GN 2011 - Remedial Law ProperGhost100% (11)

- Wine Brenner v. CIRDocument4 pagesWine Brenner v. CIRAila AmpNo ratings yet

- Plaridel Security v. CIRDocument2 pagesPlaridel Security v. CIRAila AmpNo ratings yet

- Zamora v. CIR (1963) (Depreciation)Document1 pageZamora v. CIR (1963) (Depreciation)Aila AmpNo ratings yet

- Commisioner v. Duberstein (1960)Document1 pageCommisioner v. Duberstein (1960)Aila AmpNo ratings yet

- UP Bar Reviewer 2013 - Legal and Judicial EthicsDocument71 pagesUP Bar Reviewer 2013 - Legal and Judicial EthicsPJGalera100% (38)

- Civil Law Reviewer (Part 2)Document172 pagesCivil Law Reviewer (Part 2)sweetcop100% (1)

- UP Bar Reviewer 2013 - Civil LawDocument406 pagesUP Bar Reviewer 2013 - Civil LawPJGalera100% (37)

- G.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Document2 pagesG.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Aila AmpNo ratings yet

- Labor UP Law 2013 ReviewerDocument108 pagesLabor UP Law 2013 Reviewersweetcop94% (17)

- Taxation Memaid (Beda)Document132 pagesTaxation Memaid (Beda)Maria Jennifer Yumul BorbonNo ratings yet

- UP Bar Reviewer 2013 - Mercantile LawDocument184 pagesUP Bar Reviewer 2013 - Mercantile LawPJGalera89% (18)

- Consti Case DigestsDocument172 pagesConsti Case DigestsPaolo Antonio Escalona100% (3)

- UP Crim Law Reviwer 2013Document258 pagesUP Crim Law Reviwer 2013Chase DaclanNo ratings yet

- 3D 2009 Torts DigestDocument536 pages3D 2009 Torts Digestjinx114788% (17)

- Transpo Digests Pt. 1 (Hojilla)Document13 pagesTranspo Digests Pt. 1 (Hojilla)James Ibrahim AlihNo ratings yet

- En Banc: CIR v. Philippine Ace Lines, IncDocument2 pagesEn Banc: CIR v. Philippine Ace Lines, IncAila AmpNo ratings yet

- Up Tax Reviewer 2014 PDFDocument257 pagesUp Tax Reviewer 2014 PDFJoseph Rinoza PlazoNo ratings yet

- Transpo Digests Pt. 2 (Hojilla) PDFDocument15 pagesTranspo Digests Pt. 2 (Hojilla) PDFFrank Johnley DuldulaoNo ratings yet

- Busorg Digests (2S, 2012)Document56 pagesBusorg Digests (2S, 2012)Gabby PundavelaNo ratings yet

- Transpo Digests Pt. 3 (Hojilla) PDFDocument5 pagesTranspo Digests Pt. 3 (Hojilla) PDFAlex GraciaNo ratings yet

- Commissioner of Internal Revenue v. CA, CTA, YMCA (1998)Document3 pagesCommissioner of Internal Revenue v. CA, CTA, YMCA (1998)Aila AmpNo ratings yet

- Law On TransportationDocument115 pagesLaw On Transportationrunawaybride85No ratings yet

- CIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRDocument3 pagesCIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRAila Amp100% (1)

- Philex Mining tax refund disputeDocument3 pagesPhilex Mining tax refund disputeAila AmpNo ratings yet

- Cir V. Philippine Airlines, Inc. (2009) : PartiesDocument3 pagesCir V. Philippine Airlines, Inc. (2009) : PartiesAila AmpNo ratings yet

- SC upholds hierarchy of courts in dismissing directly filed certiorari petitionDocument277 pagesSC upholds hierarchy of courts in dismissing directly filed certiorari petitionKris NageraNo ratings yet

- (En Banc) : Lutz vs. Araneta Plaintiff's Contention: He Alleges That SuchDocument2 pages(En Banc) : Lutz vs. Araneta Plaintiff's Contention: He Alleges That SuchAila AmpNo ratings yet

- Tio v. Videogram Regulatory BoardDocument3 pagesTio v. Videogram Regulatory BoardAila AmpNo ratings yet

- SPEC PRO Case AssignmentDocument5 pagesSPEC PRO Case AssignmentTeoti Navarro ReyesNo ratings yet

- 11 - DOTC v. Sps. AbecinaDocument10 pages11 - DOTC v. Sps. AbecinaMelfay ErminoNo ratings yet

- Felling of Trees Vis-A-Vis Widening of Road Cases: 1Document1 pageFelling of Trees Vis-A-Vis Widening of Road Cases: 1Arpit GoyalNo ratings yet

- Court Doc in Rutling Brothers Gun Trafficking ChargesDocument13 pagesCourt Doc in Rutling Brothers Gun Trafficking ChargesGuns.comNo ratings yet

- In The Court of 2nd Artha Rin Adalat Ain1Document4 pagesIn The Court of 2nd Artha Rin Adalat Ain1Moniruzzaman Juror100% (2)

- From The Words of Abdullah Azzam PDFDocument103 pagesFrom The Words of Abdullah Azzam PDFHajra Binte AdamNo ratings yet

- Actividad Integradora 2 Modulo 7Document2 pagesActividad Integradora 2 Modulo 7ghostcity180405No ratings yet

- Nigerian Constitutional Development PaperDocument9 pagesNigerian Constitutional Development PaperAdesewa OladapoNo ratings yet

- Monthly DO From DoPTDocument4 pagesMonthly DO From DoPTMayankSahuNo ratings yet

- Abraham Lincoln: From Log Cabin to White HouseDocument2 pagesAbraham Lincoln: From Log Cabin to White HouseCard ElecNo ratings yet

- Vending Machine AgreementDocument8 pagesVending Machine AgreementAtiqah Adena Mutiara100% (2)

- Unit 1 Self TestDocument2 pagesUnit 1 Self Testjose100% (2)

- Cases 2 - Ordinary Land Reg Steps6-7, Cadastral ProceedDocument24 pagesCases 2 - Ordinary Land Reg Steps6-7, Cadastral ProceedLiz ZieNo ratings yet

- Tyrone Goodwin Vs HUD, Eta. Civil Action #2:17-CV-01537 IN THE U.S. DISTRICT COURT FOR THE WESTERN DISTRICT OF PENNSYLVANIADocument18 pagesTyrone Goodwin Vs HUD, Eta. Civil Action #2:17-CV-01537 IN THE U.S. DISTRICT COURT FOR THE WESTERN DISTRICT OF PENNSYLVANIATyrone GoodwinNo ratings yet

- British Intelligence On China in TibetDocument31 pagesBritish Intelligence On China in TibetnorbuaNo ratings yet

- Bryan Scott Storer Boise Idaho Attorney Amended Complaint FC 10-04 Filed May 17 2011 by The Professional Conduct Board Idaho State BarDocument42 pagesBryan Scott Storer Boise Idaho Attorney Amended Complaint FC 10-04 Filed May 17 2011 by The Professional Conduct Board Idaho State Barnewyorknewyork2011No ratings yet

- A Hero Journey Film ReviewDocument4 pagesA Hero Journey Film ReviewKym MumfordNo ratings yet

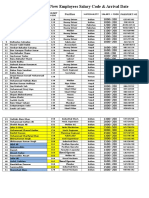

- New Employees Salary Code & Arrival Date: Passport NoDocument6 pagesNew Employees Salary Code & Arrival Date: Passport NoHaleem Ur Rashid BangashNo ratings yet

- 132947Document4 pages132947adriana lopez chivataNo ratings yet

- Hindu Law Right of Daughter in PropertyDocument77 pagesHindu Law Right of Daughter in PropertyGANESH MANJHINo ratings yet

- Quasi-Delict v. Breach of ContractDocument10 pagesQuasi-Delict v. Breach of ContractMJ AroNo ratings yet

- DIVINA V CADocument1 pageDIVINA V CAAliw del RosarioNo ratings yet

- Little Flowers EM Blaiklock AC KeysDocument190 pagesLittle Flowers EM Blaiklock AC KeysAngela Frances100% (1)

- Legal Counseling and Social ResponsibilityDocument10 pagesLegal Counseling and Social ResponsibilityMaddy LeeNo ratings yet

- Mini Quest Double Feature Revenge of The Kobold KingDocument4 pagesMini Quest Double Feature Revenge of The Kobold KingYanhuNo ratings yet

- Falklands Peace Treaty Settled Sovereignty DisputeDocument4 pagesFalklands Peace Treaty Settled Sovereignty DisputeOfeliaNo ratings yet

- Short History-Sulu SultanateDocument31 pagesShort History-Sulu SultanateIcas Phils100% (1)

- Img PDFDocument1 pageImg PDFAnonymous AXVJSR8CA7No ratings yet

- NEF LAW COLLEGE, Guwahati Intra Moot ProblemDocument2 pagesNEF LAW COLLEGE, Guwahati Intra Moot ProblemTrishna Devi100% (2)

- Native American HeaddressesDocument5 pagesNative American Headdressesneil07No ratings yet