Professional Documents

Culture Documents

PEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, Editor

Uploaded by

Brittany EtheridgeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, Editor

Uploaded by

Brittany EtheridgeCopyright:

Available Formats

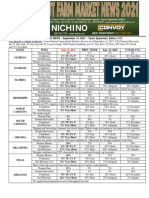

PEANUT MARKETING NEWS – August 17, 2020 – Tyron Spearman, Editor (110)

PEANUT SPECIALIST REPORT ON U.S. CROP – At the virtual meeting of the peanut shellers and buying points, Kris Balkcom

reported from state peanut specialist about crop problems and potential. Here is a summary of Southeast:

GEORGIA – Scott Monfort, UGA –Updated acreage est. 750K, (Actual – 789 K, Mainly O6G, O9B, 12Y, 16HO, FloRun331,

Ga18RU). Variety issues: Disease with O9B and germ with O6G, Skippy stands and increased TSWV have been the main

issues this growing season. Harvest should start 1st September, Yield Potential: The dry land crop is struggling in many areas.

Irrigated looks good except for fields with stand issues and virus. Yield should be down overall this year unless the rain

situation changes.

FLORIDA - David Wright, UFL, 170 K (actual, 159K) Acreage may be slightly more as it was dry at the end of cotton planting

season. O6G main variety with 331 and GA 12Y continues to grow in popularity due to yield in stress situations. Both 331 and

12Y do well in stress situations since they produce a lot of vine and have high yield capability. Many people are learning how

to manage 12Y plus it can be planted early due to the disease resistance. Crop condition: Been good growing season overall so

far. There are some spots that have been a little too dry and some too wet but overall a good season to this point. Harvest is

starting in Levy county area and Ocala. Most of the panhandle will be in September. Yield potential: Could make a near record

yield, if weather holds.

ALABAMA – Kris Balkcom, Auburn, (actual 160K)173 K, Still feel our acreage will be in the 170’s. Still mainly O6G’s but some

acres of many others. Concerned with TSWV in 331 and many growers have issues with increased lsk’s with 12Y. AUNPL17

can perform well in a high disease environment due to its disease package. Lots of seed issues with marginal stands scattered

across the state resulting in TSW issues. Too early to tell how bad that will hurt us. Overall crop looked pretty good, but the

dry weather and heat has taken its toll for the past 10-14 days. Harvest should start early September. I feel like due to some of

the stand issues, pockets of dry weather, and extreme heat that we will not break any yield records this year. However, August

will help determine the size of our crop.

SOUTH CAROLINA - Dan Anco, Clemson ,70 K increased to 75K (Actual 81K) Bailey, Sullivan, O9B, O6G, 297, 33, and some

Emery. Some runner cultivar seed quality was suboptimal following the 2019 season. Stand issues, TSW in places, erratic

weather has affected planting and management timing. Rain is needed to reduce stress and help pod fill. Harvest should start

first week of September. Yield Potential: Some areas have been more fortunate with rainfall, overall, still good potential, but

need good weather to finish out and harvest. Concerns: Adverse weather during harvest would add challenges.

HEARD AT THE PRE-HARVEST VIRTUAL MEETING

Rep. Austin Scott, (R), Hope that consumers realize the importance of the food supply chain as shelves were empty during the

pandemic. We’ve got to get more revenue to the farmer. I am worried about China’s influence on agriculture, especially

production of agricultural chemicals. Rural areas need to report on the census or we will lose more seats and funding.

Rep. Drew Ferguson (R), Excited about the economy and the especially the Mexico/Canada Trade agreement, It is a blueprint

for other nations. Now we will know the MC rules and implement them fairly. Committed to challenging China in trade

agreements as they have been unfair in how they have operated.

Karl Zimmer, Premium Peanut, Reminded the industry that aflatoxin is the single largest risk for the peanut industry. He

noted that 37% of the 2019 crop failed the minimum standards. Estimated that the $120 million economic impact or $84 per

acre. Committee is taking action as a diverse Taskforce of 22 members from all segments of the peanut supply chain have been

selected to tackle the problem.

CHINA IMPORTING U.S. PEANUTS - China peanut imports will reach a record high in MY 2019/20, rising to nearly 1.4

million tons and one-third of global trade in peanuts. For the first time, China will be the largest import market, surpassing the

next-largest market (the European Union) by more than 40 percent. MY 2019/20 will also be the first year China is a net

importer of peanuts.

China’s imports in 2020/21 will remain high but are forecast to fall year-on-year due to lower exportable supplies. China is

the world’s largest producer and consumer of peanuts. Prior to 2014/15, China’s domestic production was largely sufficient to

meet steadily rising local demand. In the past 5 years, China has begun importing larger quantities of peanuts, mostly for

crushing into meal for feed and oil for food use.

While China’s 2019/20 imports are a record high, they will only represent 7 percent of its domestic consumption. China’s

breakneck peanut imports are driven by slow domestic production growth and record-high global beginning stocks in 2019/20

that made imports more attractive. Chinese importers took advantage of all-time-high stocks in Senegal and Sudan as well as

large U.S. stocks. Together these three countries account for nearly 90 percent of China’s imports in 2019/20 as of June.

You might also like

- PEANUT MARKETING NEWS - April 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 13, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets. November 2017From EverandFood Outlook: Biannual Report on Global Food Markets. November 2017No ratings yet

- GPW International Peanut Forum April 28-30 2021Document15 pagesGPW International Peanut Forum April 28-30 2021sb AgrocropsNo ratings yet

- China, Peoples Republic of Frozen Potato Products China Situation 2003Document14 pagesChina, Peoples Republic of Frozen Potato Products China Situation 2003TrilceNo ratings yet

- Body". The Session Generated Plenty of Questions and Anyone Interested in More Information Can Tune Into Her Monthly PodcastDocument1 pageBody". The Session Generated Plenty of Questions and Anyone Interested in More Information Can Tune Into Her Monthly PodcastBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - September 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - September 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- CQ Perspectives Jan 2005Document4 pagesCQ Perspectives Jan 2005Crop QuestNo ratings yet

- PEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Global Feed Markets: November - December 2012Document10 pagesGlobal Feed Markets: November - December 2012Milling and Grain magazineNo ratings yet

- Doane Ag Insights WeeklyDocument7 pagesDoane Ag Insights WeeklydoaneadvisoryNo ratings yet

- PEANUT MARKETING NEWS - August 24, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - August 24, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Global Feed Markets: November - December 2011Document6 pagesGlobal Feed Markets: November - December 2011Milling and Grain magazineNo ratings yet

- Northwest Berry Foundation's: Oda Recruiting For 12 Open Commissioner Positions On 3 Berry CommissionsDocument9 pagesNorthwest Berry Foundation's: Oda Recruiting For 12 Open Commissioner Positions On 3 Berry CommissionsnwberryfoundationNo ratings yet

- PEANUT MARKETING NEWS - July 20, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 20, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Market: International Grains CouncilDocument9 pagesMarket: International Grains CouncilZerohedgeNo ratings yet

- Milling and Grain Magazine - September 2016 - FULL EDITIONDocument116 pagesMilling and Grain Magazine - September 2016 - FULL EDITIONMilling and Grain magazineNo ratings yet

- Global Feed Markets: November - December 2013Document8 pagesGlobal Feed Markets: November - December 2013Milling and Grain magazineNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Commodities - MARKETS OUTLOOK 1508Document6 pagesCommodities - MARKETS OUTLOOK 1508Milling and Grain magazineNo ratings yet

- 30 Sfu 07 24 19Document8 pages30 Sfu 07 24 19nwberryfoundationNo ratings yet

- Milling & Baking News - 2012-01-10Document52 pagesMilling & Baking News - 2012-01-10jumanleeNo ratings yet

- Highlights: World EstimatesDocument9 pagesHighlights: World EstimatesKhrystyna MatsopaNo ratings yet

- Commodities - MARKETS OUTLOOKDocument6 pagesCommodities - MARKETS OUTLOOKMilling and Grain magazineNo ratings yet

- Commodities - MARKETS OUTLOOK 1506Document6 pagesCommodities - MARKETS OUTLOOK 1506Milling and Grain magazineNo ratings yet

- The Outlook For Grass-Based Farming Is 'Extremely Good': The 'China Effect' On World CommoditiesDocument1 pageThe Outlook For Grass-Based Farming Is 'Extremely Good': The 'China Effect' On World CommoditiesblwardNo ratings yet

- "Everygreen" CIA Owned Airline: Dropping Poison On You and Your FamilyDocument6 pages"Everygreen" CIA Owned Airline: Dropping Poison On You and Your Familyapi-127658921No ratings yet

- Week 20: Julie PondDocument13 pagesWeek 20: Julie PondnwberryfoundationNo ratings yet

- Small Fruit Update 5-15-19Document10 pagesSmall Fruit Update 5-15-19nwberryfoundationNo ratings yet

- Focus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionDocument2 pagesFocus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionFluenceMediaNo ratings yet

- PEANUT MARKETING NEWS - July 19, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 19, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Julie Pond: What'S InsideDocument11 pagesJulie Pond: What'S InsidenwberryfoundationNo ratings yet

- Global Feed Markets: November - December 2014Document9 pagesGlobal Feed Markets: November - December 2014Milling and Grain magazineNo ratings yet

- 1-Farmers ProblemDocument7 pages1-Farmers ProblemApple Ermida BanuelosNo ratings yet

- Small Fruit Update 5-22-19Document10 pagesSmall Fruit Update 5-22-19nwberryfoundationNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Focus v16 n7 FNLDocument10 pagesFocus v16 n7 FNLrichardck61No ratings yet

- Yield: Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageYield: Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- Climate Variability, SCF, and Corn Farming in Isabela, Philippines: A Farm and Household Level AnalysisDocument66 pagesClimate Variability, SCF, and Corn Farming in Isabela, Philippines: A Farm and Household Level AnalysisAce Gerson GamboaNo ratings yet

- Agricultural Land Investment: Ag Lands - A Bright Spot in The 2009 Investment LandscapeDocument5 pagesAgricultural Land Investment: Ag Lands - A Bright Spot in The 2009 Investment LandscapeSb TyagiNo ratings yet

- Commodities - MARKETS OUTLOOK 1504Document6 pagesCommodities - MARKETS OUTLOOK 1504Milling and Grain magazineNo ratings yet

- Focus On Ag (7-22-19)Document2 pagesFocus On Ag (7-22-19)FluenceMediaNo ratings yet

- Global Feed Markets: January - Febrauary 2014Document8 pagesGlobal Feed Markets: January - Febrauary 2014Milling and Grain magazineNo ratings yet

- Focus On Ag (9-23-19)Document2 pagesFocus On Ag (9-23-19)FluenceMediaNo ratings yet

- Commodities - MARKETS OUTLOOKDocument8 pagesCommodities - MARKETS OUTLOOKMilling and Grain magazineNo ratings yet

- Small Fruit Update 5-8-19Document12 pagesSmall Fruit Update 5-8-19nwberryfoundationNo ratings yet

- Redefining Security: in An Age of Falling Water Tables and Rising Temperatures (NY: W.W. NortonDocument10 pagesRedefining Security: in An Age of Falling Water Tables and Rising Temperatures (NY: W.W. NortonDaisyNo ratings yet

- Questions & Flour ProblemsDocument28 pagesQuestions & Flour ProblemsHaider AliNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Julie Pond: What'S InsideDocument10 pagesJulie Pond: What'S InsidenwberryfoundationNo ratings yet

- Covid 19 and AntifragilityDocument3 pagesCovid 19 and Antifragilitypriyanka jhaNo ratings yet

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDocument1 page2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeNo ratings yet

- Prelim Performance Task 1 Problems of Philippines AgricultureDocument12 pagesPrelim Performance Task 1 Problems of Philippines AgriculturePrince CaratorNo ratings yet

- Northwest Berry Foundation's: Strawberry Nutrient Management Guide For Oregon and WashingtonDocument12 pagesNorthwest Berry Foundation's: Strawberry Nutrient Management Guide For Oregon and WashingtonnwberryfoundationNo ratings yet

- Small Fruit Update 4-10-19Document9 pagesSmall Fruit Update 4-10-19nwberryfoundationNo ratings yet

- How To Stop A Looming Food CrisisDocument8 pagesHow To Stop A Looming Food CrisisHaoJun SeeNo ratings yet

- Pistachio Strategic PlanDocument27 pagesPistachio Strategic Planbig johnNo ratings yet

- Focus On Ag (8-12-19)Document2 pagesFocus On Ag (8-12-19)FluenceMediaNo ratings yet

- RT Vol. 8, No. 2 Rice FactsDocument2 pagesRT Vol. 8, No. 2 Rice FactsRice TodayNo ratings yet

- 12 159 21Document1 page12 159 21Brittany EtheridgeNo ratings yet

- CLICK HERE To Register!Document1 pageCLICK HERE To Register!Brittany EtheridgeNo ratings yet

- Said Jeremy Mayes, General Manager For American Peanut Growers IngredientsDocument1 pageSaid Jeremy Mayes, General Manager For American Peanut Growers IngredientsBrittany EtheridgeNo ratings yet

- One Broker Reported ThatDocument1 pageOne Broker Reported ThatBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Breakfast Luncheon: Peanut Marketing News - November 8, 2021 - Tyron Spearman, Editor (144) Post Harvest Meeting Kick OffDocument1 pageBreakfast Luncheon: Peanut Marketing News - November 8, 2021 - Tyron Spearman, Editor (144) Post Harvest Meeting Kick OffBrittany EtheridgeNo ratings yet

- October 24, 2021Document1 pageOctober 24, 2021Brittany Etheridge100% (1)

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Part of Our Local Economy With Peanuts and PecansDocument1 pagePart of Our Local Economy With Peanuts and PecansBrittany EtheridgeNo ratings yet

- 2021 USW Crop Quality Report EnglishDocument68 pages2021 USW Crop Quality Report EnglishBrittany EtheridgeNo ratings yet

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Document1 pageU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeNo ratings yet

- October 17, 2021Document1 pageOctober 17, 2021Brittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsBrittany EtheridgeNo ratings yet

- October 10, 2021Document1 pageOctober 10, 2021Brittany EtheridgeNo ratings yet

- Sept. 26, 2021Document1 pageSept. 26, 2021Brittany EtheridgeNo ratings yet

- Winter-Conference - HTML: Shelled MKT Price Weekly PricesDocument1 pageWinter-Conference - HTML: Shelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- 10 127 21Document1 page10 127 21Brittany EtheridgeNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- 10 128 21Document1 page10 128 21Brittany EtheridgeNo ratings yet

- October 3, 2021Document1 pageOctober 3, 2021Brittany EtheridgeNo ratings yet

- Dairy Market Report - September 2021Document5 pagesDairy Market Report - September 2021Brittany EtheridgeNo ratings yet

- NicholasDocument1 pageNicholasBrittany EtheridgeNo ratings yet

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDocument1 page2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- Sept. 19, 2021Document1 pageSept. 19, 2021Brittany EtheridgeNo ratings yet

- Sept. 12, 2021Document1 pageSept. 12, 2021Brittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- YieldDocument1 pageYieldBrittany EtheridgeNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeNo ratings yet

- Sekolah Methodist Wesley Klang Class List Year 2011 Teacher: Ms Anitha A/P Balakrishan Class: Form 1MDocument9 pagesSekolah Methodist Wesley Klang Class List Year 2011 Teacher: Ms Anitha A/P Balakrishan Class: Form 1Mina87No ratings yet

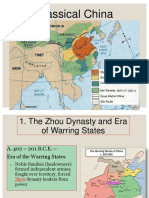

- 6 Ap Classical China NotesDocument20 pages6 Ap Classical China NotesHalle FransenNo ratings yet

- Martial Arts Discussions by Huang Yuanxiu: Brennan TranslationDocument127 pagesMartial Arts Discussions by Huang Yuanxiu: Brennan TranslationPavelNo ratings yet

- 1980 - Paul D. Buell - KALMYK TANGGACI PEOPLE THOUGHTS ON THE MECHANICS AND IMPACT OF MONGOL EXPANSIONDocument20 pages1980 - Paul D. Buell - KALMYK TANGGACI PEOPLE THOUGHTS ON THE MECHANICS AND IMPACT OF MONGOL EXPANSIONfatih çiftçiNo ratings yet

- SuAn Shu ShuDocument151 pagesSuAn Shu ShuabuzaiNo ratings yet

- Paper - 2 Second HalfDocument226 pagesPaper - 2 Second HalfKANCHIVIVEKGUPTANo ratings yet

- List of Acupuncture PointsDocument55 pagesList of Acupuncture PointsGheyda LaboratoryNo ratings yet

- Name Sex: 100m 200m 800m 1500m 5000m Long Jump High Jump Triple JumpDocument3 pagesName Sex: 100m 200m 800m 1500m 5000m Long Jump High Jump Triple JumpIlyas HassanNo ratings yet

- The South China Sea: ASEAN's Security Concerns About China: University of Aarhus, DenmarkDocument14 pagesThe South China Sea: ASEAN's Security Concerns About China: University of Aarhus, DenmarkNovella LerianNo ratings yet

- Presentation ConfuciusDocument14 pagesPresentation Confuciusdanilo pernitoNo ratings yet

- Iwbrs LessonDocument11 pagesIwbrs LessonMaAtellahMendozaPagcaliwaganNo ratings yet

- Chinese Dragon - WikipediaDocument19 pagesChinese Dragon - Wikipediajorge solieseNo ratings yet

- Medical Devices Industry in IndiaDocument39 pagesMedical Devices Industry in IndiaAnurag Rawat100% (2)

- DatsuaronDocument2 pagesDatsuaronQin WangNo ratings yet

- China and The New Silk Road 2020Document219 pagesChina and The New Silk Road 2020YUDHA PAMUNGKAS 201923179No ratings yet

- Non-Wood Forest Products in 15 Countries of Tropical AsiaDocument202 pagesNon-Wood Forest Products in 15 Countries of Tropical AsiaSaravorn100% (1)

- Book of Changes - The Original Core of The I Ching (PDFDrive)Document435 pagesBook of Changes - The Original Core of The I Ching (PDFDrive)jaime_g100% (5)

- ButtersDocument17 pagesButtersCaleb_R_DillmanNo ratings yet

- Cheng Man Ch'IngDocument7 pagesCheng Man Ch'Ingfalungongboy6587No ratings yet

- Travels of A Tshirt Summary4Document3 pagesTravels of A Tshirt Summary4sreedealsNo ratings yet

- On Comparison of Philippine Education Vis A Vis Chinese Education - JASON (HUI SONG)Document17 pagesOn Comparison of Philippine Education Vis A Vis Chinese Education - JASON (HUI SONG)HUI SONGNo ratings yet

- "Analysis of Financial Performance of Cement Industry": Master of Business AdministrationDocument137 pages"Analysis of Financial Performance of Cement Industry": Master of Business AdministrationSushank AgrawalNo ratings yet

- Information Sharing, Coordination and Supply Chain Performance - The Moderating Effect of Demand UncertaintyDocument26 pagesInformation Sharing, Coordination and Supply Chain Performance - The Moderating Effect of Demand Uncertaintysara TALBINo ratings yet

- Catalogo Formulas FitoformulaDocument12 pagesCatalogo Formulas FitoformulaLeNo ratings yet

- SSM117 Trends and Issues in Social Studies OBTLP and ModuleDocument13 pagesSSM117 Trends and Issues in Social Studies OBTLP and ModulealexNo ratings yet

- 7th Methanol Markets & Tech - About Event - About ConferenceDocument3 pages7th Methanol Markets & Tech - About Event - About ConferenceidownloadbooksforstuNo ratings yet

- Shaolin Chin NaDocument1 pageShaolin Chin NaWongHcNo ratings yet

- Book ChinaReport2014Document304 pagesBook ChinaReport2014sheetal kumarNo ratings yet

- Libro 1Document6 pagesLibro 1mthyeremyNo ratings yet

- Basic Principles of GlobalizationDocument10 pagesBasic Principles of GlobalizationBarbara Zuñiga EscalanteNo ratings yet

- Age of Revolutions: Progress and Backlash from 1600 to the PresentFrom EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentRating: 4.5 out of 5 stars4.5/5 (6)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)

- Son of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesFrom EverandSon of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesRating: 4.5 out of 5 stars4.5/5 (497)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldFrom EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldRating: 4.5 out of 5 stars4.5/5 (1145)

- How States Think: The Rationality of Foreign PolicyFrom EverandHow States Think: The Rationality of Foreign PolicyRating: 5 out of 5 stars5/5 (7)

- Reagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarFrom EverandReagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarRating: 4 out of 5 stars4/5 (4)

- Never Give an Inch: Fighting for the America I LoveFrom EverandNever Give an Inch: Fighting for the America I LoveRating: 4 out of 5 stars4/5 (10)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- The Tragic Mind: Fear, Fate, and the Burden of PowerFrom EverandThe Tragic Mind: Fear, Fate, and the Burden of PowerRating: 4 out of 5 stars4/5 (14)

- International Relations: An IntroductionFrom EverandInternational Relations: An IntroductionRating: 4 out of 5 stars4/5 (2)

- The Future of Geography: How the Competition in Space Will Change Our WorldFrom EverandThe Future of Geography: How the Competition in Space Will Change Our WorldRating: 4.5 out of 5 stars4.5/5 (4)

- Advanced Modelling Techniques in Structural DesignFrom EverandAdvanced Modelling Techniques in Structural DesignRating: 5 out of 5 stars5/5 (3)

- To Engineer Is Human: The Role of Failure in Successful DesignFrom EverandTo Engineer Is Human: The Role of Failure in Successful DesignRating: 4 out of 5 stars4/5 (137)

- The Economic Weapon: The Rise of Sanctions as a Tool of Modern WarFrom EverandThe Economic Weapon: The Rise of Sanctions as a Tool of Modern WarRating: 4.5 out of 5 stars4.5/5 (4)

- How Everything Became War and the Military Became Everything: Tales from the PentagonFrom EverandHow Everything Became War and the Military Became Everything: Tales from the PentagonRating: 4 out of 5 stars4/5 (18)

- Pitfall: The Race to Mine the World’s Most Vulnerable PlacesFrom EverandPitfall: The Race to Mine the World’s Most Vulnerable PlacesNo ratings yet

- Unholy Alliance: The Agenda Iran, Russia, and Jihadists Share for Conquering the WorldFrom EverandUnholy Alliance: The Agenda Iran, Russia, and Jihadists Share for Conquering the WorldRating: 3.5 out of 5 stars3.5/5 (15)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceFrom EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceRating: 5 out of 5 stars5/5 (4)

- The Miracle of the Kurds: A Remarkable Story of Hope Reborn In Northern IraqFrom EverandThe Miracle of the Kurds: A Remarkable Story of Hope Reborn In Northern IraqRating: 4 out of 5 stars4/5 (12)

- Marine Structural Design CalculationsFrom EverandMarine Structural Design CalculationsRating: 4.5 out of 5 stars4.5/5 (13)

- Freedom is a Constant Struggle: Ferguson, Palestine, and the Foundations of a MovementFrom EverandFreedom is a Constant Struggle: Ferguson, Palestine, and the Foundations of a MovementRating: 4.5 out of 5 stars4.5/5 (566)

- Shadow State: Murder, Mayhem, and Russia's Remaking of the WestFrom EverandShadow State: Murder, Mayhem, and Russia's Remaking of the WestRating: 4 out of 5 stars4/5 (32)

- The Great Reset: And the War for the WorldFrom EverandThe Great Reset: And the War for the WorldRating: 3.5 out of 5 stars3.5/5 (33)