Professional Documents

Culture Documents

AutoRecovery Save of Document1.asd

Uploaded by

Gabriel CarumbaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AutoRecovery Save of Document1.asd

Uploaded by

Gabriel CarumbaCopyright:

Available Formats

Hi Ma,am Gez,

Here is my write ups for the task you’ve given.

=========

1. There is no provision under the law prohibits the investment of real property only to the company, but in

actual practice, all corporation are investing cash for its daily operations and transactions. Cash are

considered lifeblood of the business to fund day-to-day business operations and to pay the ongoing

operating expenses. The real properties as non- current assets are the company’s long-term investments

for which the full value will not be realized within the accounting year while the cash are realized on a

regular basis.

2.

Transfer of Real Properties from a natural person to juridical person in exchange of share is not considered a contract of

sale and not subject to payment of Capital Gain Tax.

may transfer of ownership don from a certain person -individual to anothet person -juridical. it is not considered as a

contract of sale basically walang CGT don kasi magkakagain kung may exchange transaction. The proof of transfer

will be provided through certificate of stock equivalent ng market value ng property to share of stocks

kasi pag Contract of Sale mag kakatax yun basically may profit

but investment itself does not guarantee profit

in the event that there is indeed a profit, board resolution also is required in order to distribute dividends and yun

ang income considered for the stock of ownership mo

the question first is the intent

pag ang intent ay to make the buyer an investor that is not a contract of sale

but to acquire it as a capital asset or ordinary asset of company

that's the time it can considered a sale

Thus, may share equivalent kung ang intent ay si buyer is considered an investor

You might also like

- Sec Registration of Representative Office: Basic Requirements To HaveDocument8 pagesSec Registration of Representative Office: Basic Requirements To HaveGabriel CarumbaNo ratings yet

- Managing Financial Resources and Decisions of Finance Finance Essay (WEB)Document28 pagesManaging Financial Resources and Decisions of Finance Finance Essay (WEB)johnNo ratings yet

- 200 Problems For Alcohol ProductsDocument51 pages200 Problems For Alcohol ProductsGabriel CarumbaNo ratings yet

- Sec Registration of Representative Office: Basic Requirements To HaveDocument8 pagesSec Registration of Representative Office: Basic Requirements To HaveGabriel CarumbaNo ratings yet

- UNIT 5 Working Capital FinancingDocument24 pagesUNIT 5 Working Capital FinancingParul varshneyNo ratings yet

- CasesDocument14 pagesCasesGabriel CarumbaNo ratings yet

- Sources of Finance DefinitionDocument6 pagesSources of Finance Definitionpallavi4846100% (1)

- Basic Accounting Terminology: Tangible AssetsDocument4 pagesBasic Accounting Terminology: Tangible Assetskavya guptaNo ratings yet

- Basic Accounting TerminologiesDocument3 pagesBasic Accounting TerminologiesSIVARAM E MBA (HOSPITAL & HEALTH SYSTEMS MANAGEMENT)No ratings yet

- Basic Accounting TermsDocument8 pagesBasic Accounting Termsjosephinemusopelo1No ratings yet

- Financial Terms Glossary LMDocument15 pagesFinancial Terms Glossary LMphilipsdNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsSk KhatibNo ratings yet

- IBC & Debt RRecoveryDocument3 pagesIBC & Debt RRecoverySoorya ShrinivasNo ratings yet

- Study Note 2Document3 pagesStudy Note 2Keerthana Raghu RamanNo ratings yet

- FINANCEDocument12 pagesFINANCEJasnoor MatharuNo ratings yet

- Financial and Management Accounting Frequently Asked Questions - Unit 1 Financial Accounting - An IntroductionDocument5 pagesFinancial and Management Accounting Frequently Asked Questions - Unit 1 Financial Accounting - An Introductionrkl.satishNo ratings yet

- Working Capital Management at Shriram ChitsDocument43 pagesWorking Capital Management at Shriram ChitsVeeresh PeddipathiNo ratings yet

- 1.what Is Debenture?: AnswersDocument16 pages1.what Is Debenture?: Answerssirisha222No ratings yet

- Fa Module3Document10 pagesFa Module3cheskaNo ratings yet

- Fra Notes Unit1&2Document21 pagesFra Notes Unit1&2mohdsahil2438No ratings yet

- Fundamental of Financial Markets & Institutions: Preston University IslamabadDocument4 pagesFundamental of Financial Markets & Institutions: Preston University Islamabadjuni26287No ratings yet

- 2assets, Liabilities and CapitalDocument5 pages2assets, Liabilities and Capitaldilhani sheharaNo ratings yet

- Taxation LawDocument124 pagesTaxation Lawakshay yadavNo ratings yet

- Asset VS LiabilitiesDocument10 pagesAsset VS LiabilitiesSuhas Salehittal100% (1)

- CORPORATEDocument15 pagesCORPORATEKomal SharmaNo ratings yet

- Reviewer - IntaccDocument36 pagesReviewer - IntaccPixie CanaveralNo ratings yet

- FRA NotesDocument10 pagesFRA NotesHimanshu JoshiNo ratings yet

- Tugas MK 1 (RETNO NOVIA MALLISA)Document5 pagesTugas MK 1 (RETNO NOVIA MALLISA)Vania OlivineNo ratings yet

- Intacc Ass 1Document5 pagesIntacc Ass 1Pixie CanaveralNo ratings yet

- Partnership 2Document3 pagesPartnership 2darwin polidoNo ratings yet

- NOTES On Statement of Financial PositionDocument13 pagesNOTES On Statement of Financial PositionJenevic D. MariscalNo ratings yet

- Capital and Revenue Expenditure and ReceiptsDocument7 pagesCapital and Revenue Expenditure and ReceiptsjamiemangsangNo ratings yet

- Joint Venture Class NoteDocument4 pagesJoint Venture Class NoteAtia IbnatNo ratings yet

- Accounting ConceptsDocument2 pagesAccounting Conceptssoumyasundar720No ratings yet

- Module 1-1Document6 pagesModule 1-1shejal naikNo ratings yet

- Noncurrent AssetsDocument6 pagesNoncurrent AssetsJohn Matthew CallantaNo ratings yet

- CBSE Quick Revision Notes and Chapter Summary: Class-11 Accountancy Chapter 2 - Theory Base of AccountingDocument9 pagesCBSE Quick Revision Notes and Chapter Summary: Class-11 Accountancy Chapter 2 - Theory Base of AccountingPrashant JoshiNo ratings yet

- What Is The Difference Between P & L Ac and Income & Expenditure Statement?Document22 pagesWhat Is The Difference Between P & L Ac and Income & Expenditure Statement?pranjali shindeNo ratings yet

- CLASS XI ACCOUNTANCY NOTES Chapter 2 - Theory Base of AccountingDocument26 pagesCLASS XI ACCOUNTANCY NOTES Chapter 2 - Theory Base of AccountingPradyumna ChoudharyNo ratings yet

- Accounting AssignmentDocument6 pagesAccounting AssignmentOmer NasirNo ratings yet

- STUDY Note 3 Important Accounting TermsDocument10 pagesSTUDY Note 3 Important Accounting TermsKeerthana Raghu RamanNo ratings yet

- Study Material AccountingDocument62 pagesStudy Material Accountingsagar sheralNo ratings yet

- Introduction To Accounting, Journal, Ledger, Trial BalanceDocument74 pagesIntroduction To Accounting, Journal, Ledger, Trial Balanceagustinn agustinNo ratings yet

- Presentation ON Working CapitalDocument17 pagesPresentation ON Working Capitaltamanna13No ratings yet

- TaxationDocument12 pagesTaxationUwuNo ratings yet

- Introduction To Accounting, Journal, Ledger, Trial BalanceDocument74 pagesIntroduction To Accounting, Journal, Ledger, Trial Balancethella deva prasadNo ratings yet

- Working Capital Management: Working Capital Current Assets Net Working Capital Current Assets Current LiabilitiesDocument14 pagesWorking Capital Management: Working Capital Current Assets Net Working Capital Current Assets Current LiabilitiesriyaneerNo ratings yet

- Business Finance Reviewer 1Document12 pagesBusiness Finance Reviewer 1John Delf GabrielNo ratings yet

- Balance Sheets and Its ConceptsDocument34 pagesBalance Sheets and Its ConceptsKamal KantNo ratings yet

- Accounting TerminologyDocument4 pagesAccounting TerminologyIndu GuptaNo ratings yet

- Basics of Accounting: Chapter Two Basic of Accounting Types and Golden Rules of AccountingDocument15 pagesBasics of Accounting: Chapter Two Basic of Accounting Types and Golden Rules of AccountingTausif RazaNo ratings yet

- Sebi Grade A 2020: Accounting and Its Terminology (PART 2)Document10 pagesSebi Grade A 2020: Accounting and Its Terminology (PART 2)Tarun SurjaNo ratings yet

- Finance Viva Final SemesterDocument3 pagesFinance Viva Final SemesterSharfuddin ZishanNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsSwanand DhakeNo ratings yet

- Financial Management DictionaryDocument9 pagesFinancial Management DictionaryRaf QuiazonNo ratings yet

- Ias 7 & 8Document6 pagesIas 7 & 8John Wallace ChanNo ratings yet

- Financial Accounting 1 - Acc 301: Unit One Company AccountsDocument53 pagesFinancial Accounting 1 - Acc 301: Unit One Company AccountsTrishia ReditaNo ratings yet

- Introduction To Accounting, Journal, Ledger, Trial Balance: Module - 1Document64 pagesIntroduction To Accounting, Journal, Ledger, Trial Balance: Module - 1irshan amirNo ratings yet

- Working Capital Management: Presented byDocument32 pagesWorking Capital Management: Presented byazra khanNo ratings yet

- Assignment of Tax Law: Gitarattan International Business School DELHI-110085Document5 pagesAssignment of Tax Law: Gitarattan International Business School DELHI-110085AbhishekNo ratings yet

- Study of Challenges Faced by Small Companies in Adopting Social Media MarketingDocument7 pagesStudy of Challenges Faced by Small Companies in Adopting Social Media MarketingAshish ChandraNo ratings yet

- Unit 2 Principles of TaxationDocument24 pagesUnit 2 Principles of TaxationDeepak SuranaNo ratings yet

- Katie's Bus Corp Outline (Burkhard Spring 2008)Document182 pagesKatie's Bus Corp Outline (Burkhard Spring 2008)Jay MartinNo ratings yet

- WebinarDocument5 pagesWebinarGabriel CarumbaNo ratings yet

- International Tax Affairs DivisionDocument3 pagesInternational Tax Affairs DivisionGabriel CarumbaNo ratings yet

- LIST OF CUSTOMS ISSUANCES July 2019 To July 2020Document3 pagesLIST OF CUSTOMS ISSUANCES July 2019 To July 2020Gabriel CarumbaNo ratings yet

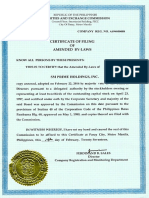

- SM PRIME Holdings INC - Amended by LawsDocument26 pagesSM PRIME Holdings INC - Amended by LawsGabriel CarumbaNo ratings yet