Professional Documents

Culture Documents

Paper2 PDF

Paper2 PDF

Uploaded by

Jaswanth Sunkara0 ratings0% found this document useful (0 votes)

48 views12 pagesOriginal Title

Paper2(3).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views12 pagesPaper2 PDF

Paper2 PDF

Uploaded by

Jaswanth SunkaraCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 12

FOUNDATION COURSE EXAMINATION

December 2017 P-2(FOA)

Syllabus 2016

Fundamentals of Accounting

Time Allowed: 3 Hours Full Marks: 100

The figures in the margin on the right side indicate full marks.

This question paper has two parts. Both the sections are to be answered

subject to instructions given against each.

SECTION - A

(a) Choose the correct answer from the given four alternatives: 1%30=30

(Which one of the following character is not related to Financial Accounting?

(A) Evaluates the financial strength of the whole business.

(B) Based on monetary transactions of the enterprise.

(C) Reports are always subject to statutory audit,

(D) Reports are as per requirement of management.

(ii) Which one of the following equation is correct?

(A) Owner's Equity = Liability + Asset

(B) Owner's Equity = Asset ~ Liability

(©) Liability = Owner's Equity + Asset

(D) Asset = Owner's Equity — Liability

Gii) Identify the ‘Personal Account’ from the following.

(A) Salary Payable Account

(B) Taxes Paid Account

(©) Investment Account

(D) Trademark Account

(iv) Which of the following is a transaction of contra entry?

(A) Sale goods to Y 12,500.

(B) Godown rent & 7,000 paid by cheque.

(C) Received & 12,000 in full settlement of € 12,500.

(D) Cash deposited to bank & 9,000.

() When Trial Balance will not tally/mismatch?

(A) Two errors those are compensating each other,

(B) A transaction recorded twice.

(C) Taking balance to the wrong side in the Trial Balance.

(D) If an entry is totally missed.

Please Turn Over

P-2(FOA)

Syllabus-2016

(vi)

(vii)

(viii)

(x)

@

Gi)

Q)

An entry of & 1,560 has been debited to a Debtor's Personal Account at € 1,650. It is

an error of

(A) Omission

(B) Commission

(© Principle

(D) Compensating

Amount set apart to meet loss due to bad debt is a

(A) Provision

(B) Appropriation

(© Reserve

(D) Commission

Reduction in value of asset due to its continuous use is treated as

(A) Appreciation

(B) Depreciation

(© Loss

(D) Profit

What happens when a bad debt is recovered?

(A) Current asset decreases

(B) Debtor's balance decreases

(© Profit increases

(D) Owner's fund decreases

Which balance is not considered for closing entries on the basis of trial balance

for transferring to Trading and Profit & Loss Account?

(A) Salary and Wages

(B) Discount Received

(©) Commission Paid

(D) Cash in Hand

Select correct journal entry to rectify an error “An amount of & 10,000, withdrawn

by owner for personal use debited to Trade Expenses Account”.

Debit Credit

(A) Drawing Account Trade Expenses A/c.

(B) Trade Expenses A/c. Drawing Account

(©) Drawing Account Cash Account

(D) Trade Expenses A/c, Cash Account

G) P-2(FOA)

Syllabus-2016

(xii) M/s. A.B. Enterprises has bank balance & 8,800 as per cash book and the

followings were found:

(a) Three cheques deposited in bank for 5,800 but only one cheque for ® 2,000

was cleared.

(b) Dividend collected by bank % 1,250 was wrongly entered in cash book as

& 1,520. What is balance as per pass book?

(A) 3,480

B) & 4,730

(© %2,730

(D) © 3,750

(xiii) House Building Advance of € 2.00 lakh paid to employees. It is a

(A) Asset

(B) Revenue Expenditure

(©) Capital Expenditure

(D) Deferred Revenue Expenditure

(xiv) Claims against company pending in court case. It is a

(A) Current Liability

(B) Current Asset

(©) Contingent Liability

(D) Un-secured Loan

(xv) Which one of the following is not a negotiable instrument?

(A) Currency Note

(B) Promissory Note

© Bill of Exchange

) Crossed Cheque

(xvi) Which one of the following is not the feature of a joint venture business?

(A) Co-venture may or may not contribute initial capital,

B) Ithas limited duration.

(© Itis done for specific purpose.

(D) Profit o loss on joint venture is shared as per their capital ratio.

(xvii) Del Credere Commission in consignment business is generally payable on

(A) total sales.

@) only on credit sales.

© other than credit sales.

() % on recovery of bad debt.

Please Turn Over

P-2(FOA)

Syllabus-2016

(xviii)

(xix)

(x)

(xxi)

(xii)

(xxiii)

(4)

Subscription received in advance is shown in

(A) Liability side of the Balance Sheet.

(B) Asset side of the Balance Sheet.

(© Income & Expenditure Account as expenditure,

(D) Income & Expenditure Account as income.

There are 250 members in the Srikrishna Club where annual subscription is

% 500. During 2016-17, subscription received % 97,500 and subscription receivable

is % 47,500. What amount of subscription received in advance during 2016-17?

(A) & 20,000

(B) 25,000

(© € 27,500

(D) % 50,000

When goods are purchased for the joint venture, the account to be debited is

(A) purchase account.

@®) joint venture account

(© venture's capital account

(©) either Purchase account or Joint venture account

The abnormal loss on consignment is credited to:

(A) Profit and Loss Account

B) Consignee's Account

(©) Consignment Account

(D) Insurance Company Account

Fixed Assets and Current Assets are categorized as per concept of

(A) Separate Entity

(B) Going Concem

(©) Consistency

(D) Time period

An expenditure is in capital nature when

(A) the receiver of the amount is going to treat it for the purchase of fixed

assets.

(B) it increase the quantity of fixed assets.

(©) itis paid as interests on loans for the business.

(D) it maintains a fixed assets.

(xxiv)

(xv)

(xvi)

(xxvii)

(xxviii)

(xxix)

() P-2(FOA)

Syllabus-2016

Cash book is a

(A) Subsidiary book

(B) Subsidiary book and a Ledger account

(C) Ledger account

(D) None of the above

‘The periodical total of the Sales Return Book is posted to the

(A) Debit side of Sales Account.

(B) Debit side of Sales Return Account.

(C) Credit side of Sales Return Account,

(D) Debit side of Debtors Return,

The debts written off as bad, if recovered subsequently are

(A) Credited to Bad Debts recovered A/c

(B) Credited to Trade receivables Account

(©) Debited to Profit and Loss Account

(D) None of the above

If bill drawn on 3rd July, 2017 for 40 days, payment must be made on

(A) 16th August, 2017

(B) 15th August, 2017

(C) 12th August, 2017

(D) 14th August, 2017

Goods sent on consignment account is of the nature of,

(A) Personal account

(B) Nominal account

(©) Real account

(D) Sales account

What is the nature of “joint venture with co-venture account”?

(A) Nominal account

(B) Real account

(C) Personal account

(D) None of the above

Please Turn Over

P-2(FOA)

Syllabus-2016

(xxx)

(6)

Which of the following items are shown in the income and expenditure account?

(A) Only items of capital nature.

(B) Only items of revenue nature which are received during the period of

accounts.

(C) Only items of revenue nature pertaining to the period of accounts.

(D) Both the items of capital and revenue nature.

(b) State whether the following statements are True or False: 1x12=12

@

(i)

Gii)

Gv)

@)

(vi)

wii)

(viii)

(i)

@

(xi)

(xii)

Profit and Loss A/c covers a period and not the position on a particular day.

The surplus of a non-profit organisation is distributed amongst the members.

Current assets + Current liabilities = Working capital.

Discount on Bill of exchange is a loss for the drawer and gain for the drawee.

‘The owner of the consignment stock is consignee.

Certificate of protest is issued by a Notary Public.

Capital Account is a liability of the business.

Overcasting of purchase book would affect purchase account.

In case of mineral resources, depreciation is not provided but depletion is charged.

‘The discount column of the cash book is not posted is an example of error of

omission,

Retirement of bill means sending the bill for collection.

Cost of the goods include all expenses incurred till the goods reach the premises of

the consignee’s godown,

(©) Match the following: 1x6=6

‘Column A’ ‘Column B

Pre-receipt of income

Current Liability

1.

2. | Return Inward

Capital Expenditure

3, | Wages paid of installation of

+ | machine

Real Account

4. | Goodwill Account AS-10

5. | Fixed Assets Current Assets

6. | Rent Prepaid Sales |

a|=|=]5] 2 |p]>

Nominal Account

(2) P-2(FOA)

Syllabus-2016

Answer any four questions out of six questions: 8xd=32

2. On the basis of following information, prepare Three Column Cash Book in the books of

Makkhan:

2017

November, 1 _ | Opening cash balance was & 13,800 and bank balance was % 2,75,000.

November, 4 _| Wages paid in cash € 15,000.

November, 5 | Received cheque of % 49,800 from L K Enterprise after allowing discount of

& 1,200. It was deposited into bank

November,7 _| Paid electricity charges by cheque of € 17,500,

November, 10 | Cash of € 12,500 withdrawn from bank.

November, 12 | Received a cheque for & 49,500 in full settlement of the account of

Badhu & Co. at a discount of 10% and deposited the same into bank.

November, 15. | Badhu & Co.'s cheque dishonoured and returned by the bank.

3. On Ist January, 2015 the K C Transport Company purchased a truck for 8,00,000. On Ist July,

2016 this truck was involved in an accident and was completely destroyed and & 6,50,000 were

received from the Insurance Company in full settlement. On the same date another truck was

purchased by the company for & 10,00,000.

The company writes off 15% depreciation per annum on written down value method. Prepare the

Truck Account and Depreciation Account for the years ended 31st March, 2015, 2016 and 2017.

4. From the following information, prepare a Bank Reconciliation Statement as on 31st March,

2017:

(The Bank column of the Cash Book showed overdraft of € 1,15,000 on 31st March, 2017.

(ii) Cheques of € 42,400 issued but not encashed by the customers.

(iii) Cheques deposited but not cleared € 21,500.

(iv) Collection charges debited by the Bank not recorded in the Cash Book & 185.

(vy) Bank interest charged by the Bank not recorded in the Cash Book & 4,350.

(vi) Cheques dishonoured debited by the Bank not recorded in the Cash Book & 45,000.

(vii) Interest directly received by the Bank not entered in the Cash Book & 11,200.

Please Turn Over

P-2(FOA)

Syllabus-2016

5. The Trial Balance of a concern has agreed but the following mistakes were detected after the

preparation of final accounts.

(@) No adjustment entry was passed for an amount of & 4,000 relating to outstanding rent.

(6) Purchase book was overcast by & 3,000.

(©) An amount of & 4,000 as depreciation on furniture has been omitted to be recorded in the

book.

(a) An amount of & 5,000 received from a customer has been credited to Sales A/c.

State the effect of the above errors in Profit & Loss Account and Balance Sheet.

6. Following is the Trial Balance of M/s. Chandu Traders as on 31st March, 2017. Prepare Trading

and Profit & Loss Account for the year ended 31st March, 2017 and a Balance Sheet on that

date:

A Particulars Debit Credit

®@ ®)

Capital 9,00,000

Buildings 3,15,000

Drawings 1,18,000

Furniture & Fittings 17,500

Motor Van 1,25,000

Loan from Hari @12% interest 1,50,000

Interest paid on above 9,000

Sales 10,00,000

Purchases 750,000

Opening Stock 2,50,000

Establishment expenses 1,15,000

Wages 12,000

Insurance 11,000

Commission received 24,500

Sundry debtors 3,28,100

Bank balance 2,46,900

Sundry creditors 2,10,000

Interest 13,000

2,97,500 22,97,500

[Total

(9) P.2(FOA)

Syllabus-2016

Adjustments:

(a)

(b)

©

@

©

oO

(8)

)

The value of stock on 31-03-2017 was & 3,20,000.

Outstanding wages & 1,500.

Prepaid Insurance & 3,000.

Commission received in advance & 13,000.

Allow interest on capital @ 10%.

Depreciate building 10%; Furniture & Fitting 10%; & Motor van 15%.

Charge interest on drawings & 5,000.

Accrued Interest & 2,500.

7. Guddu sent goods costing @ 15,10,000 on consignment basis to Sukku on Ist April, 2017 @ 5%

commission, Guddu spent & 1,65,000 on transportation and Sukku spent & 1,05,000 on for

unloading charges. Sukku sold 88% of the goods for & 18,00,000. 10% of the goods for

% 2,00,000 and the balance are taken over by Suku at 10% below the cost price and sent a

cheque to Guddu for the amount due after deducting commission.

Show Consignment to Sukku A/c and Sukku’s A/c in the books of Guddu.

SECTION - B

8. Choose the correct answer: Ix12=12

(i) When re-ordering level is 200 units, minimum usage is 20 units, minimum lead

time is 5 days, maximum stock is 400 units then re-ordering quantity will be:

(A) 400 units

(B) 200 units

(©) 300 units

(D) 100 units

(ii) _ In the situation of increasing prices, the valuation of closing stock is more under:

(A) Simple average

(B) Weighted average

(©) FIFO

() LIFO

Please Turn Over

P-2(FOA) (0)

Syllabus-2016

(iii) Payment of Royalties

(A) Direct Expenses.

(B) Administrative Cost.

(C) Charged to Profit & Loss A/c

(D) Factory Overheads.

(iv) Which one of the following statement is true?

(A) Abnormal cost is not controllable.

(B) Financial Expenses are included in Cost Sheet.

(©) Alll overheads changes with the change in volume and in the same

proportion.

(D) Primary packing is an item of prime cost.

(v) Costing is a technique of

(A) Recording of Cost transactions

(B) Ascertaining Cost

(C) Preparation of final accounts

(D) Decision making

(vi) Which of following is appropriate Cost Unit for timber industry?

(A) Per tonne

(B) Per article

(©) Per Kg.

(D) Per foot

(vii) Which of the following is a Cost Control Technique?

(A) Marginal Costing

(B) Uniform Costing

(C) Standard Costing

(D) Absorption Costing

vii)

(ix)

(x)

(xi)

(xii)

qa) P-2(FOA)

Syllabus-2016

Which of the following is differentiated between Fixed and Variable Costs?

(A) Uniform Costing

(B) Marginal Costing

(C) Standard Costing

(D) Direct Costing

Cost of free samples and gifts are included in

(A) Prime Cost

(B) Factory Overhead

(©) Office and Administrative Overheads

(D) Selling & Distribution Overheads

Which method of costing is used for determination of costs for printing industry?

(A) Process costing

(B) Operating costing

(©) Batch costing

(D) Job costing

In behavioral analysis, costs are divided into

(A) Production and Non-Production costs

(B) Controllable and non-controllable costs

(©) Direct and indirect costs

(D) Fixed and variable costs

Which of the following is a part of both Prime cost and Conversion cost?

(A) Direct Material

(B) Indirect Labour

(© Direct Labour

(D) Allof the above

Please Turn Over

P-2(FOA) (12)

Syllabus-2016

Answer any one question out of the following two questions: 8x1=8

9. Distinguish between Cost Accounting and Management Accounting.

10. Rukmani Limited furnishes the following data relating to the year ending 31st March, 2017:

Opening Stock of Raw Material %2,13,500

Closing Stock of Raw Material % 2,81,600

Purchases of Raw Material 15,50,900

Direct Wages % 885,750

Carriage Inwards on Raw Material % 11,200

Machine Hours Worked 4200 hours

Machine Hour Rate Zia

Office and Administrative Overhead 25% of Factory Overhead

Selling and Distribution Overhead @&8 per unit

Units Produced 24000 Units

Units Sold 21500 Units @ & 190 per unit

You are required to prepare a statement of cost showing:

(a) Raw material consumed

(©) Prime cost

(c) Factory cost

(@ Cost of production

(©) Costof sales

(© Total profit and per unit profit 14141414258

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- LOI For RiceDocument1 pageLOI For RiceJaswanth Sunkara100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Letter of Intent For Vehicle Export Port of Savannah, GeorgiaDocument1 pageLetter of Intent For Vehicle Export Port of Savannah, GeorgiaJaswanth SunkaraNo ratings yet

- Reach PDFDocument1 pageReach PDFJaswanth SunkaraNo ratings yet

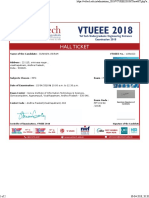

- Controller of Examinations, VTUEEE 2018 Signature of The CandidateDocument2 pagesController of Examinations, VTUEEE 2018 Signature of The CandidateJaswanth SunkaraNo ratings yet

- Board of Intermediate Education Andhra Pradesh::VijayawadaDocument1 pageBoard of Intermediate Education Andhra Pradesh::VijayawadaJaswanth Sunkara100% (1)

- Revision Class 10 Comprehension Passages Read The Passage Given Below and Answer The Questions That FollowDocument4 pagesRevision Class 10 Comprehension Passages Read The Passage Given Below and Answer The Questions That FollowJaswanth SunkaraNo ratings yet

- Small Industries Development Bank of India List of Beneficiaries During 2011-12Document67 pagesSmall Industries Development Bank of India List of Beneficiaries During 2011-12Jaswanth SunkaraNo ratings yet

- Anashi EnterprisesDocument3 pagesAnashi EnterprisesJaswanth SunkaraNo ratings yet

- Rise of The Coal-Based Sponge Iron Sector in India and Some Issues in Conservation of Resources Authors: S. K. Saluja & Suchitra Sengupta (ERU, JPC) 1. A ODocument12 pagesRise of The Coal-Based Sponge Iron Sector in India and Some Issues in Conservation of Resources Authors: S. K. Saluja & Suchitra Sengupta (ERU, JPC) 1. A OJaswanth SunkaraNo ratings yet

- GugujjDocument13 pagesGugujjJaswanth SunkaraNo ratings yet

- A Discussion On Non-Coking Coal Pricing Systems Adopted in Different CountriesDocument12 pagesA Discussion On Non-Coking Coal Pricing Systems Adopted in Different CountriesJaswanth SunkaraNo ratings yet

- 52Document65 pages52Jaswanth SunkaraNo ratings yet

- Your Registration Number Is 18179080 Roll Number Candidate Name College Name Admission Date Type of Service FeeDocument1 pageYour Registration Number Is 18179080 Roll Number Candidate Name College Name Admission Date Type of Service FeeJaswanth SunkaraNo ratings yet

- NIT NO - PUR 8.66.IOF/0029 dtd.25/08/2018Document41 pagesNIT NO - PUR 8.66.IOF/0029 dtd.25/08/2018Jaswanth SunkaraNo ratings yet

- Irrevocable Corporate Purchase Order: Target Price: USD 310/-Per MT, EXWI I, Jabel AliDocument2 pagesIrrevocable Corporate Purchase Order: Target Price: USD 310/-Per MT, EXWI I, Jabel AliJaswanth SunkaraNo ratings yet

- Building ConstructionDocument5 pagesBuilding ConstructionJaswanth SunkaraNo ratings yet

- Steelx - Loi - 1078 - Iron Ore For Tameem Khan - 21062019Document3 pagesSteelx - Loi - 1078 - Iron Ore For Tameem Khan - 21062019Jaswanth Sunkara100% (1)