Professional Documents

Culture Documents

Difference Between Fixed Cost and Variable Cost

Uploaded by

Ghalib HussainOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDifference Between Fixed Cost and Variable Cost

Uploaded by

Ghalib HussainDifference Between Fixed Cost And Variable Cost

BASIS FOR

FIXED COST VARIABLE COST

COMPARISON

Meaning The cost which remains same, regardless The cost which changes with the

of the volume produced, is known as change in output is considered as a

fixed cost. variable cost.

Nature It is related to time. It is related to volume.

Fixed costs are definite, they are incurred Variable costs are incurred only

Incurred when whether the units are produced or not. when the units are produced.

Fixed cost changes in unit, i.e. as the units Variable cost remains same, per

produced increases, fixed cost per unit unit.

Unit Cost decreases and vice versa, so the fixed cost

per unit is inversely proportional to the

number of output produced.

Behavior It remains constant for a given period of It changes with the change in the

time. output level.

Fixed Production Overhead, Fixed Direct Material, Direct Labor,

Administration Overhead and Fixed Direct Expenses, Variable

Combination of Selling and Distribution Overhead. Production Overhead, Variable

Selling and Distribution Overhead.

Examples Depreciation, Rent, Salary, Insurance, Material Consumed, Wages,

Tax etc. Commission on Sales, Packing

Expenses, etc.

Explicit And Implicit Costs

Explicit Cost

➢ Explicit Costs are the costs which involve an immediate outlay of cash from the business.

The cost is incurred when any production process is going on or an activity is conducted in

the normal course of business.

➢ The cost is a charge for the use of factors of production like land, labor, capital and so on.

They are in the form of rent, salary, material, wages, and other expenses like electricity,

stationery, postage etc.

➢ Explicit Costs show that payment has been made to outsiders, while business is carried on.

The recognition and reporting of explicit cost is very easy, because they are recorded when

they arise.

➢ Recording of explicit cost is very important because it helps in the calculation of profit as

well as it fulfills purposes like decision making, cost control, reporting, etc.

Implicit Cost

➢ Implicit Cost, also known as economic cost, is the cost which the company had foregone

while employing alternative course of action.

➢ They do not involve any outflow of cash from the business. It is the value of sacrifice made

by the entity at the time of exercising some other action. The cost occurs when an asset is

used as a factor of production by the entity instead of renting it out.

➢ As they are not actually incurred they cannot be easily measured, but they can be estimated.

They are not recorded in the books of accounts as well as these are not reported.

➢ The purpose of ascertaining the implicit cost is that it helps in decision making regarding

the replacement of any asset and many more.

➢ Implicit costs have a direct impact on the profitability and performance of the company.

You might also like

- Internship ReportDocument10 pagesInternship ReportRaziya ShresthaNo ratings yet

- Cookie Ch2Document5 pagesCookie Ch2Charmaine Bernados Brucal100% (3)

- CH 12Document31 pagesCH 12Mochammad RidwanNo ratings yet

- CH 01Document57 pagesCH 01junjjangieNo ratings yet

- Standard Costs and Variance AnalysisDocument33 pagesStandard Costs and Variance AnalysisSay the name Pentastic100% (1)

- Differentiation and Brand PositioningDocument22 pagesDifferentiation and Brand PositioningkarolinNo ratings yet

- Assignment of Time Value of MoneyDocument3 pagesAssignment of Time Value of MoneyMuxammil IqbalNo ratings yet

- The Investment Setting: Answers To QuestionsDocument11 pagesThe Investment Setting: Answers To Questions12jd100% (1)

- 04 Marginal CostingDocument67 pages04 Marginal CostingAyushNo ratings yet

- MGT705 - Advanced Cost and Management Accounting Midterm 2013Document1 pageMGT705 - Advanced Cost and Management Accounting Midterm 2013sweet haniaNo ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document12 pagesIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNo ratings yet

- Elements, Nature & Scope of Cost AccountingDocument20 pagesElements, Nature & Scope of Cost AccountingAnusha_Sahukara0% (1)

- IIM B GMITE-Course Contents PDFDocument8 pagesIIM B GMITE-Course Contents PDFananndNo ratings yet

- The Delphi Technique A Case StudyDocument3 pagesThe Delphi Technique A Case StudyFeisal Ramadhan MaulanaNo ratings yet

- Reconciliation of Cost and Financial AccountsDocument18 pagesReconciliation of Cost and Financial AccountsHari RamNo ratings yet

- Break Even AnalysisDocument3 pagesBreak Even AnalysisShiv MalhotraNo ratings yet

- Financial Management - DefinitionDocument13 pagesFinancial Management - DefinitionAmol AgarwalNo ratings yet

- Project Analysis Chapter SixDocument6 pagesProject Analysis Chapter Sixzewdie100% (1)

- Group 4Document3 pagesGroup 4Rizma RizwanNo ratings yet

- Module 3 - CVP AnalysisDocument2 pagesModule 3 - CVP AnalysisJoshua CabinasNo ratings yet

- Chapter 7 Asset Investment Decisions and Capital RationingDocument31 pagesChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNo ratings yet

- Benefits of Global Accounting StandardsDocument16 pagesBenefits of Global Accounting StandardsJones EdombingoNo ratings yet

- SU Marketing Management CurriculumDocument130 pagesSU Marketing Management CurriculumkinfeNo ratings yet

- Lesson 4Document747 pagesLesson 4Brintha SubbarajNo ratings yet

- CAPACITY PLANNING, DECISION THEORY, PROCESS SELECTION AND FACILITY LAYOUT and LINEAR PROGRAMMINGDocument14 pagesCAPACITY PLANNING, DECISION THEORY, PROCESS SELECTION AND FACILITY LAYOUT and LINEAR PROGRAMMINGJohn CkNo ratings yet

- MainDocument18 pagesMaini_ahmed_nsuNo ratings yet

- Theoretical FrameworkDocument3 pagesTheoretical Frameworkm_ihamNo ratings yet

- Job Order Costing FINALDocument11 pagesJob Order Costing FINALmannu.abhimanyu3098No ratings yet

- Receivable Management KanchanDocument12 pagesReceivable Management KanchanSanchita NaikNo ratings yet

- P2 November 2014 Question Paper PDFDocument20 pagesP2 November 2014 Question Paper PDFAnu MauryaNo ratings yet

- Chapter 14. The Cost of CapitalDocument15 pagesChapter 14. The Cost of Capitalmy backup1No ratings yet

- Case Study of Capital BudgetingDocument38 pagesCase Study of Capital BudgetingZara Urooj100% (1)

- Chap 03 Data VisualizationDocument61 pagesChap 03 Data VisualizationNevan NovaNo ratings yet

- Tecniques of Project AppraisalDocument3 pagesTecniques of Project Appraisalqari saibNo ratings yet

- This Study Resource Was: Lecture Handout For Chapter 12Document6 pagesThis Study Resource Was: Lecture Handout For Chapter 12rifa hanaNo ratings yet

- Process CostingDocument20 pagesProcess Costingአረጋዊ ሐይለማርያምNo ratings yet

- Republic of The Philippines Tarlac State University College of Business and Accountancy Marketing ManagementDocument1 pageRepublic of The Philippines Tarlac State University College of Business and Accountancy Marketing ManagementAimee Ayson De AsisNo ratings yet

- List Three (3) Products Per Type, and Explain Why You Think Each Product Belongs in That Specific TypeDocument2 pagesList Three (3) Products Per Type, and Explain Why You Think Each Product Belongs in That Specific TypeJennyca Sison100% (1)

- Excel As A Tool in Financial ModellingDocument5 pagesExcel As A Tool in Financial Modellingnikita bajpaiNo ratings yet

- Ratio Analysis Formula Excel TemplateDocument5 pagesRatio Analysis Formula Excel TemplateTarun MittalNo ratings yet

- The Cost of CapitalDocument18 pagesThe Cost of CapitalzewdieNo ratings yet

- Cost - Volume - ProfitDocument52 pagesCost - Volume - ProfitsueernNo ratings yet

- Financial Accounting PDFDocument43 pagesFinancial Accounting PDFJaya SudhakarNo ratings yet

- OutsourcingDocument19 pagesOutsourcingAb RaNo ratings yet

- Evaluating Project Economics and Capital Rationing: Learning ObjectivesDocument53 pagesEvaluating Project Economics and Capital Rationing: Learning ObjectivesShoniqua JohnsonNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- The Influence of Accounting Software in Achieving The Internationalaccounting Standard Boards Qualitative Characteristics of Financial InformationDocument13 pagesThe Influence of Accounting Software in Achieving The Internationalaccounting Standard Boards Qualitative Characteristics of Financial InformationIJAR JOURNALNo ratings yet

- Equivalent Annual AnnuityDocument10 pagesEquivalent Annual Annuitymohsin_ali07428097No ratings yet

- Introduction 3Document24 pagesIntroduction 3Zinashbizu LemmaNo ratings yet

- Chap 002Document21 pagesChap 002mynameSchool100% (12)

- 1.6 Organisational Structure For ZPC Kariba South Power Station.......... 9Document27 pages1.6 Organisational Structure For ZPC Kariba South Power Station.......... 9Praise chari100% (1)

- CH 1-5 OMDocument71 pagesCH 1-5 OMAbu DadiNo ratings yet

- Presentation On Internship Report Rastriya Beema Sansthan: Ayusha Regmi 6 Semester (Action) Apex CollegeDocument9 pagesPresentation On Internship Report Rastriya Beema Sansthan: Ayusha Regmi 6 Semester (Action) Apex CollegeSoo Ceal100% (1)

- Problems On Cash Management Baumol ModelsDocument1 pageProblems On Cash Management Baumol ModelsDeepak100% (1)

- MB 0023 Assingment Set1 Set2Document17 pagesMB 0023 Assingment Set1 Set2dannykpNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Financial Anaysis of ProjectDocument48 pagesFinancial Anaysis of ProjectalemayehuNo ratings yet

- Product: 1.1. Background of The StudyDocument24 pagesProduct: 1.1. Background of The StudyFiteh K100% (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Difference Between Fixed Cost and Variable CostDocument3 pagesDifference Between Fixed Cost and Variable CostCRISTIAN MAURICIO LEITON VALENCIANo ratings yet

- Cost Accounting PPT FinalDocument47 pagesCost Accounting PPT FinalAkanksha GuptaNo ratings yet

- Classification of CostDocument33 pagesClassification of CostGeet SharmaNo ratings yet

- Checkpoint Activity 1:: Term/ConceptDocument2 pagesCheckpoint Activity 1:: Term/ConceptlalalalaNo ratings yet

- Chapter - 3 Agricultural Development: Measures To Remove These ProblemsDocument1 pageChapter - 3 Agricultural Development: Measures To Remove These ProblemsGhalib HussainNo ratings yet

- Cost & MGT AccountingDocument3 pagesCost & MGT AccountingGhalib HussainNo ratings yet

- Differenfce Between Various Types of AuditDocument3 pagesDifferenfce Between Various Types of AuditGhalib HussainNo ratings yet

- Chapter - 4 Audit Programme By: Ghalib Hussain: 2. ObjectivesDocument3 pagesChapter - 4 Audit Programme By: Ghalib Hussain: 2. ObjectivesGhalib Hussain100% (1)

- Income Tax Law DefinitionsDocument17 pagesIncome Tax Law DefinitionsGhalib HussainNo ratings yet

- Cottage/ Small Scale Industries: Chapter - 4 Industrial DevelopmentDocument2 pagesCottage/ Small Scale Industries: Chapter - 4 Industrial DevelopmentGhalib HussainNo ratings yet

- Principles of Accounting: Section - B By: Ghalib Hussain Class - XIDocument7 pagesPrinciples of Accounting: Section - B By: Ghalib Hussain Class - XIGhalib HussainNo ratings yet

- Sources of Agricultural CreditDocument4 pagesSources of Agricultural CreditGhalib HussainNo ratings yet

- Chapter - 6 Audit & InvestigationDocument2 pagesChapter - 6 Audit & InvestigationGhalib HussainNo ratings yet

- Introduction To Economics: The Economic Problem Opportunity Cost Production Possibility FrontiersDocument8 pagesIntroduction To Economics: The Economic Problem Opportunity Cost Production Possibility FrontiersSaad AhmedNo ratings yet

- Appointment of AuditorDocument16 pagesAppointment of Auditorshahnawaz243No ratings yet

- Iron and Steel IndustryDocument17 pagesIron and Steel IndustryEMJAY100% (1)

- Chapter - 3 Agricultural Development By: Ghaib Hussain (GH)Document2 pagesChapter - 3 Agricultural Development By: Ghaib Hussain (GH)Ghalib HussainNo ratings yet

- A Typical Business Organisation May Consist of The Following Main Departments or FunctionsDocument5 pagesA Typical Business Organisation May Consist of The Following Main Departments or FunctionsGhalib HussainNo ratings yet

- Definition of Joint Stock CompanyDocument2 pagesDefinition of Joint Stock CompanyGhalib HussainNo ratings yet

- Preparation of Financial Statements Under The COVID 19 Circumstances PDFDocument67 pagesPreparation of Financial Statements Under The COVID 19 Circumstances PDFFraz AyoubNo ratings yet

- Breakdown of The Public Sector Development ProgrammeDocument2 pagesBreakdown of The Public Sector Development ProgrammeGhalib HussainNo ratings yet

- Cash EmbezzelementDocument1 pageCash EmbezzelementGhalib HussainNo ratings yet

- 85MoreProbabilityQuestions SolutionsDocument16 pages85MoreProbabilityQuestions SolutionsRam YadavNo ratings yet

- ElasticityDocument36 pagesElasticityMiCan CHaiNo ratings yet

- EconomicImpact of COVID19 On PakistantDocument32 pagesEconomicImpact of COVID19 On PakistantGhalib HussainNo ratings yet

- (Alan Crawford, Samuel R. Mathews, Jim MakinsterDocument252 pages(Alan Crawford, Samuel R. Mathews, Jim Makinstermohammed.habib6259No ratings yet

- Practice QuestionDocument1 pagePractice QuestionGhalib HussainNo ratings yet

- Chapter - 5 Audit Working Papers By: Ghalib HussainDocument3 pagesChapter - 5 Audit Working Papers By: Ghalib HussainGhalib HussainNo ratings yet

- Discus The Procedure To Investigate in Case of Suspected FraudDocument1 pageDiscus The Procedure To Investigate in Case of Suspected FraudGhalib HussainNo ratings yet

- Accounting Equation SummaryDocument4 pagesAccounting Equation SummaryGhalib HussainNo ratings yet

- Financial AccountingDocument217 pagesFinancial AccountingGhalib HussainNo ratings yet

- A Brief On The Companies Act, 2017Document78 pagesA Brief On The Companies Act, 2017Adeel KhanNo ratings yet

- Chapter - 4 Industrial Development: Merits of PrivatizationDocument2 pagesChapter - 4 Industrial Development: Merits of PrivatizationGhalib HussainNo ratings yet

- Imc Of: Coca ColaDocument31 pagesImc Of: Coca ColaJaanvi GoyalNo ratings yet

- UntitledDocument234 pagesUntitleddinesh kumarNo ratings yet

- Chapter Far-10......Document36 pagesChapter Far-10......ClaNo ratings yet

- RevCorporate Governance Risk and Internal ControlsDocument87 pagesRevCorporate Governance Risk and Internal ControlsKrisha Mabel TabijeNo ratings yet

- Price DiscriminationDocument3 pagesPrice DiscriminationAng Mei GuiNo ratings yet

- Auditing and Assurance Services 15Th Edition Arens Solutions Manual Full Chapter PDFDocument44 pagesAuditing and Assurance Services 15Th Edition Arens Solutions Manual Full Chapter PDFstephenthanh1huo100% (11)

- MKT 337 Final Assignment-1632395030Document16 pagesMKT 337 Final Assignment-1632395030Samiul TashbirNo ratings yet

- Analyzing Investing Activities:: Special TopicsDocument40 pagesAnalyzing Investing Activities:: Special TopicsAbhishek PandaNo ratings yet

- MGT 319Document6 pagesMGT 319Ali Akbar MalikNo ratings yet

- 2012 Sales and Operations PlanningDocument14 pages2012 Sales and Operations PlanningSachin BansalNo ratings yet

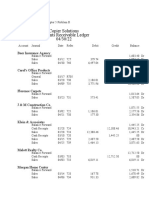

- Copier Solutions Accounts Receivable Ledger 04/30/22: Baer Insurance AgencyDocument2 pagesCopier Solutions Accounts Receivable Ledger 04/30/22: Baer Insurance AgencyCzarhiena SantiagoNo ratings yet

- Branches of AccountingDocument2 pagesBranches of AccountingCher NaNo ratings yet

- WebinarDocument13 pagesWebinarAnirudh SrikantNo ratings yet

- Cambridge IGCSE: 0450/11 Business StudiesDocument12 pagesCambridge IGCSE: 0450/11 Business StudiesAurpa RahmanNo ratings yet

- The Breadfast House: June 28,2021Document31 pagesThe Breadfast House: June 28,2021Avitaj NyxNo ratings yet

- Week 1: What To Make of B2B Marketing? Part 1: How Is It Different From B2CDocument25 pagesWeek 1: What To Make of B2B Marketing? Part 1: How Is It Different From B2Cbanana lalaNo ratings yet

- Supply Chain Management: Supply Chain Performance: Achieving Strategic Fit and ScopeDocument27 pagesSupply Chain Management: Supply Chain Performance: Achieving Strategic Fit and ScopeAsadNo ratings yet

- 1.1. Sem - Solution SolutionsDocument3 pages1.1. Sem - Solution SolutionsSabrinaNo ratings yet

- CH 01Document36 pagesCH 01Lim KeakruyNo ratings yet

- Loan Application Form - FA05112021Document2 pagesLoan Application Form - FA05112021goc.mayumiNo ratings yet

- CHAPTER 11 Inventory ModelDocument24 pagesCHAPTER 11 Inventory ModelmulunehNo ratings yet

- How To Answer DCV ExamDocument11 pagesHow To Answer DCV Examحازم صبحىNo ratings yet

- 6Document9 pages6abadi gebru100% (1)

- 920 Article - Text 1957 1 10 20230118Document7 pages920 Article - Text 1957 1 10 20230118Wrangler De JesusNo ratings yet

- Media Studies Jury Assignment-Ankita KumariDocument14 pagesMedia Studies Jury Assignment-Ankita KumariAnkita SinhaNo ratings yet

- Morning Star Fund Rating MethodologyDocument35 pagesMorning Star Fund Rating MethodologyfoliveiraNo ratings yet