Professional Documents

Culture Documents

Shriram Multicap Regular Dividend Payout

Uploaded by

Yogi173Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shriram Multicap Regular Dividend Payout

Uploaded by

Yogi173Copyright:

Available Formats

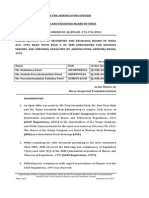

Report as of 22 Aug 2020

Shriram Multicap Regular Dividend payout

Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™

Flexicap S&P BSE 500 India TR INR IISL Nifty 500 TR INR Not Rated

Used throughout report

Investment Objective Performance

The primary investment objective of the scheme is to

12,500

generate long term capital appreciation by investing in

11,250

an actively managed portfolio predominantly consisting

10,000

of Equity & equity related securities diversified over 8,750

various sectors. However, there is no assurance or 7,500

guarantee that the investment objective of the Scheme 6,250

will be achieved. The Scheme does not assure or

guarantee any returns 2015 2016 2017 2018 2019 2020-07

- - - - 6.52 -6.83 Fund

- - - - 8.98 -7.54 Benchmark

- - - - 8.88 -7.64 Category

Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4

3Y Alpha - 3Y Sharpe Ratio - 3 Months 21.54 27.03 23.34 2020 -23.81 15.27 - -

3Y Beta - 3Y Std Dev - 6 Months -4.57 -4.29 -6.10 2019 4.29 1.28 -2.91 3.88

3Y R-Squared - 3Y Risk - 1 Year 6.48 7.81 7.79 2018 - - - 1.63

3Y Info Ratio - 5Y Risk - 3 Years Annualised - - - 2017 - - - -

3Y Tracking Error - 10Y Risk - 5 Years Annualised - - - 2016 - - - -

Calculations use S&P BSE 500 India TR INR (where applicable)

Portfolio 31/07/2020

Asset Allocation % Net Equity Style Box™ Mkt Cap % Fund America Europe Asia

Stocks 81.87 Giant 41.63

Large Mid

Size

Bonds 0.00 Large 33.34

Cash 18.13 Medium 24.31

Other 0.00 Small 0.71

Small

Value Blend Growth Micro 0.01

Style

Average Mkt Cap Fund

(Mil)

Ave Mkt Cap INR 1,025,44 <25 25-50 50-75 >75

6.03

Top Holdings Stock Sector Weightings % Fund World Regions % Fund

Holding Name Sector %

h Cyclical 46.73 Americas 0.00

Reliance Industries Ltd o 6.67 r Basic Materials 10.66 United States 0.00

HDFC Bank Ltd y 4.79 t Consumer Cyclical 2.28 Canada 0.00

ICICI Bank Ltd y 4.47 y Financial Services 33.79 Latin America 0.00

HDFC Asset Management... y 4.25 u Real Estate - Greater Europe 0.00

Sanofi India Ltd d 3.20

j Sensitive 27.05 United Kingdom 0.00

HDFC Life Insurance Co Ltd y 3.13 i Communication Services 3.46 Eurozone 0.00

Hindustan Unilever Ltd s 2.95 o Energy 10.71 Europe - ex Euro 0.00

ICICI Lombard General... y 2.88 p Industrials 5.15 Europe - Emerging 0.00

Abbott India Ltd d 2.82 a Technology 7.73 Africa 0.00

Bharti Airtel Ltd i 2.82 Middle East 0.00

k Defensive 26.22

Assets in Top 10 Holdings % 37.99 s Consumer Defensive 8.89 Greater Asia 100.00

Total Number of Equity Holdings 56 d Healthcare 15.66 Japan 0.00

Total Number of Bond Holdings 0 f Utilities 1.68 Australasia 0.00

Asia - Developed 0.00

Asia - Emerging 100.00

Operations

Fund Company Shriram Asset Share Class Size (mil) - Minimum Initial Purchase 5,000 INR

Management Co Ltd Domicile India Minimum Additional Purchase 1,000 INR

Phone +91 33 23373012 Currency INR Exit Load 1.00% - 0-365 days

Website www.shriramamc.com UCITS - 0.00% - >365 days

Inception Date 21/09/2018 Inc/Acc Inc Expense Ratio 2.55%

Manager Name Gargi Banerjee ISIN INF680P01083

Manager Start Date 21/11/2019

NAV (21/08/2020) INR 10.45

Total Net Assets (mil) 576.14 INR

(31/07/2020)

© 2020 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may ®

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

ß

and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

You might also like

- Netball Whole Sport PlanDocument2 pagesNetball Whole Sport PlanLiamAlfordNo ratings yet

- Shriram Long Term Equity Fund Direct GrowthDocument1 pageShriram Long Term Equity Fund Direct GrowthYogi173No ratings yet

- Axis Capital Builder Fund Series 4 (1582 Days) Direct Dividend PayoutDocument1 pageAxis Capital Builder Fund Series 4 (1582 Days) Direct Dividend PayoutChankyaNo ratings yet

- Morningstarreport20190906085207 PDFDocument1 pageMorningstarreport20190906085207 PDFChankyaNo ratings yet

- Morning Star Report 20190906085149Document1 pageMorning Star Report 20190906085149ChankyaNo ratings yet

- Morningstarreport20190906085149 PDFDocument1 pageMorningstarreport20190906085149 PDFChankyaNo ratings yet

- Shriram Balanced Advantage FundDocument1 pageShriram Balanced Advantage FundYogi173No ratings yet

- Morningstarreport20190906085214 PDFDocument1 pageMorningstarreport20190906085214 PDFChankyaNo ratings yet

- Morning Star Report 20190906085214Document1 pageMorning Star Report 20190906085214ChankyaNo ratings yet

- Axis Capital Builder Fund Series 4 (1582 Days) Regular Dividend PayoutDocument1 pageAxis Capital Builder Fund Series 4 (1582 Days) Regular Dividend PayoutChankyaNo ratings yet

- Morning Star Report 20190726102821Document1 pageMorning Star Report 20190726102821YumyumNo ratings yet

- Axis Capital Builder Fund Series 4 (1582 Days) Regular GrowthDocument1 pageAxis Capital Builder Fund Series 4 (1582 Days) Regular GrowthChankyaNo ratings yet

- Morning Star Report 20190906085226Document1 pageMorning Star Report 20190906085226ChankyaNo ratings yet

- Morning Star Report 20190726102748Document1 pageMorning Star Report 20190726102748YumyumNo ratings yet

- Morning Star Report 20190725103314Document1 pageMorning Star Report 20190725103314SunNo ratings yet

- Morning Star Report 20190725103254Document1 pageMorning Star Report 20190725103254SunNo ratings yet

- MAMCF Factsheet MorningstarDocument1 pageMAMCF Factsheet Morningstarveerenbabu69No ratings yet

- Morning Star Report 20190726102711Document1 pageMorning Star Report 20190726102711YumyumNo ratings yet

- Morning Star Report 20190906085421Document1 pageMorning Star Report 20190906085421ChankyaNo ratings yet

- Morning Star Report 20190906085330Document1 pageMorning Star Report 20190906085330ChankyaNo ratings yet

- Quant Focused Fund Growth Option Direct Plan: H R T y UDocument1 pageQuant Focused Fund Growth Option Direct Plan: H R T y UYogi173No ratings yet

- Parag Parikh Tax Saver FundDocument1 pageParag Parikh Tax Saver FundYogi173No ratings yet

- Morning Star Report 20190906085356Document1 pageMorning Star Report 20190906085356ChankyaNo ratings yet

- Morningstarreport20190906085333 PDFDocument1 pageMorningstarreport20190906085333 PDFChankyaNo ratings yet

- Morningstarreport20190906085331 PDFDocument1 pageMorningstarreport20190906085331 PDFChankyaNo ratings yet

- Axis Growth Opportunities Fund Direct Dividend Pay-Out: H R T y UDocument1 pageAxis Growth Opportunities Fund Direct Dividend Pay-Out: H R T y UChankyaNo ratings yet

- Morning Star Report 20190726102554Document1 pageMorning Star Report 20190726102554YumyumNo ratings yet

- Morning Star Report 20190906085305Document1 pageMorning Star Report 20190906085305ChankyaNo ratings yet

- Morning Star Report 20190906085304Document1 pageMorning Star Report 20190906085304ChankyaNo ratings yet

- Morning Star Report 20190726102129Document1 pageMorning Star Report 20190726102129YumyumNo ratings yet

- DSP Smallcap Closed Morningstarreport20180402100029Document1 pageDSP Smallcap Closed Morningstarreport20180402100029shareonline2010No ratings yet

- Morning Star Report 20190906085300Document1 pageMorning Star Report 20190906085300ChankyaNo ratings yet

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumNo ratings yet

- Mahindra Manulife Credit Risk FundDocument1 pageMahindra Manulife Credit Risk FundYogi173No ratings yet

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumNo ratings yet

- Motilal Oswal Nifty Smallcap 250 Index Fund PDFDocument1 pageMotilal Oswal Nifty Smallcap 250 Index Fund PDFYogi173No ratings yet

- Morning Star Report 20190726102131Document1 pageMorning Star Report 20190726102131YumyumNo ratings yet

- Morning Star Report 20190726102102Document1 pageMorning Star Report 20190726102102YumyumNo ratings yet

- Morning Star Report 20190916052827Document1 pageMorning Star Report 20190916052827ChankyaNo ratings yet

- BHARAT Bond FOF April 2023Document1 pageBHARAT Bond FOF April 2023Yogi173No ratings yet

- Reliance Arbitrage Advantage FundDocument1 pageReliance Arbitrage Advantage FundYogi173No ratings yet

- Morning Star Report 20190916052840Document1 pageMorning Star Report 20190916052840ChankyaNo ratings yet

- Morningstarreport20190906085035 PDFDocument1 pageMorningstarreport20190906085035 PDFChankyaNo ratings yet

- Axis Fixed Term Plan Series 100 1172 Days Direct Growth: Interest Rate SensitivityDocument1 pageAxis Fixed Term Plan Series 100 1172 Days Direct Growth: Interest Rate SensitivityChankyaNo ratings yet

- Morning Star Report 20190906084941Document1 pageMorning Star Report 20190906084941ChankyaNo ratings yet

- Morning Star Report 20190906085132Document1 pageMorning Star Report 20190906085132ChankyaNo ratings yet

- Morning Star Report 20190906085131Document1 pageMorning Star Report 20190906085131ChankyaNo ratings yet

- Edelweiss Overnight FundDocument1 pageEdelweiss Overnight FundYogi173No ratings yet

- Morning Star Report 20190916052348Document1 pageMorning Star Report 20190916052348ChankyaNo ratings yet

- Morningstarreport20190916052307 PDFDocument1 pageMorningstarreport20190916052307 PDFChankyaNo ratings yet

- Morning Star Report 20190906084901Document1 pageMorning Star Report 20190906084901ChankyaNo ratings yet

- Morningstarreport20190906084843 PDFDocument1 pageMorningstarreport20190906084843 PDFChankyaNo ratings yet

- Morning Star Report 20190916052357Document1 pageMorning Star Report 20190916052357ChankyaNo ratings yet

- Morning Star Report 20190916052339Document1 pageMorning Star Report 20190916052339ChankyaNo ratings yet

- Axis Fixed Term Plan Series 104 1112 Days Direct Dividend PayoutDocument1 pageAxis Fixed Term Plan Series 104 1112 Days Direct Dividend PayoutChankyaNo ratings yet

- Axis Fixed Term Plan Series 104 1112 Days Direct Half Yearly Dividend PayoutDocument1 pageAxis Fixed Term Plan Series 104 1112 Days Direct Half Yearly Dividend PayoutChankyaNo ratings yet

- Morning Star Report 20190916052258Document1 pageMorning Star Report 20190916052258ChankyaNo ratings yet

- Morning Star Report 20190916052248Document1 pageMorning Star Report 20190916052248ChankyaNo ratings yet

- Morning Star Report 20190726101827Document1 pageMorning Star Report 20190726101827SunNo ratings yet

- Axis Fixed Term Plan Series 101 1154 Days Regular Dividend PayoutDocument1 pageAxis Fixed Term Plan Series 101 1154 Days Regular Dividend PayoutChankyaNo ratings yet

- Morningstarreport 20220317032219Document1 pageMorningstarreport 20220317032219Yogi173No ratings yet

- Aditya Birla Sun Life Silver ETF Fund of Fund Direct GrowthDocument1 pageAditya Birla Sun Life Silver ETF Fund of Fund Direct GrowthYogi173No ratings yet

- Nippon India Silver ETF Fund of Fund (FOF) Direct GrowthDocument1 pageNippon India Silver ETF Fund of Fund (FOF) Direct GrowthYogi173No ratings yet

- Anchor Intimation-LetterDocument6 pagesAnchor Intimation-LetterManthan PatelNo ratings yet

- Morningstarreport 20220317034204Document1 pageMorningstarreport 20220317034204Yogi173No ratings yet

- ICICI Prudential NASDAQ 100 Index Fund Direct Growth: H R T y UDocument1 pageICICI Prudential NASDAQ 100 Index Fund Direct Growth: H R T y UYogi173No ratings yet

- Shipham Special Alloy ValvesDocument62 pagesShipham Special Alloy ValvesYogi173No ratings yet

- Morningstarreport 20220317030236Document1 pageMorningstarreport 20220317030236Yogi173No ratings yet

- Morningstarreport 20220317034508Document1 pageMorningstarreport 20220317034508Yogi173No ratings yet

- Morningstarreport 20220317031934Document1 pageMorningstarreport 20220317031934Yogi173No ratings yet

- Red Herring ProspectusDocument351 pagesRed Herring ProspectusYogi173No ratings yet

- Kotak Global Innovation Fund of Fund Direct Growth: H R T y UDocument2 pagesKotak Global Innovation Fund of Fund Direct Growth: H R T y UYogi173No ratings yet

- Climate Change and Extreme Weather Events - Implications For FoodDocument16 pagesClimate Change and Extreme Weather Events - Implications For FoodYogi173No ratings yet

- Jyothy Labs Limited: Rating Reaffirmed: Summary of Rating ActionDocument7 pagesJyothy Labs Limited: Rating Reaffirmed: Summary of Rating ActionYogi173No ratings yet

- Aries Agro Ratings Reaffirmed and Withdrawn at RequestDocument4 pagesAries Agro Ratings Reaffirmed and Withdrawn at RequestYogi173No ratings yet

- Alkali Metals Limited: Instrument Amount in Rs. Crore Rating ActionDocument3 pagesAlkali Metals Limited: Instrument Amount in Rs. Crore Rating ActionYogi173No ratings yet

- Piston ValvesDocument20 pagesPiston ValvesYogi173No ratings yet

- V-Guard Industries - R - 10052019Document8 pagesV-Guard Industries - R - 10052019Yogi173No ratings yet

- ERIS LIFESCIENCES Q1 EARNINGS REVIEWDocument6 pagesERIS LIFESCIENCES Q1 EARNINGS REVIEWYogi173No ratings yet

- ASM Technologies Limited-R-30082019Document7 pagesASM Technologies Limited-R-30082019Yogi173No ratings yet

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- Corporate Banking TipsDocument1 pageCorporate Banking TipsYogi173No ratings yet

- Covid-19 Related Item - : - Inj. Itolizumab (100mg)Document50 pagesCovid-19 Related Item - : - Inj. Itolizumab (100mg)Yogi173No ratings yet

- Citizen Registration and Appointment For Vaccination User ManualDocument14 pagesCitizen Registration and Appointment For Vaccination User ManualSahilNo ratings yet

- 1 PDFDocument9 pages1 PDFYogi173No ratings yet

- PermenPUPR27 2016 Penyelenggraan SPAMDocument3 pagesPermenPUPR27 2016 Penyelenggraan SPAMferry ferdiansyah pradanaNo ratings yet

- Press Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Yogi173No ratings yet

- Toothbrushes - Covid 19 April 2020Document2 pagesToothbrushes - Covid 19 April 2020Yogi173No ratings yet

- Axis Special Situations Fund Direct GrowthDocument1 pageAxis Special Situations Fund Direct GrowthYogi173No ratings yet

- Yoga Class PrayerDocument1 pageYoga Class PrayerChandu KanthNo ratings yet

- Chap13 Exercise 56Document4 pagesChap13 Exercise 56John Lester C Alag0% (1)

- Sunrise resource constraintsDocument3 pagesSunrise resource constraintsHIRA MAZHAR IQBALNo ratings yet

- Latihan Statement of Financial PositionDocument7 pagesLatihan Statement of Financial PositionWindy Fartika100% (1)

- Presentation On NAFTADocument11 pagesPresentation On NAFTAagrawalkrunalNo ratings yet

- CH 11 HW SolutionsDocument9 pagesCH 11 HW SolutionsAriefka Sari DewiNo ratings yet

- Macquarie - India Consumer Sector - Shifting To Higher Orbit of Growth - Aug 2018Document37 pagesMacquarie - India Consumer Sector - Shifting To Higher Orbit of Growth - Aug 2018Raghav BhatnagarNo ratings yet

- Buy High and Sell Higher - Momentum - TradingDocument34 pagesBuy High and Sell Higher - Momentum - TradingkosurugNo ratings yet

- Long-Term Construction Contracts and FranchisingDocument7 pagesLong-Term Construction Contracts and FranchisingEpal AkoNo ratings yet

- Narasimham Committee On Banking Sector ReformsDocument4 pagesNarasimham Committee On Banking Sector ReformsZameer Pasha ShaikNo ratings yet

- Kohlberg Kravis Roberts (KKR)Document20 pagesKohlberg Kravis Roberts (KKR)jim1234uNo ratings yet

- Percentage Fractions Ratio Word ProblemsDocument66 pagesPercentage Fractions Ratio Word ProblemsJaved AnwarNo ratings yet

- Piramal Enterprises Consolidated Results For The Third Quarter and Nine Months EndedDocument5 pagesPiramal Enterprises Consolidated Results For The Third Quarter and Nine Months EndedakanshapradhanNo ratings yet

- How To Work Word Problems in Algebra Part IDocument4 pagesHow To Work Word Problems in Algebra Part IimanolkioNo ratings yet

- Bharti Axa ProjectDocument62 pagesBharti Axa ProjectKishan Chauhan RajputNo ratings yet

- Rabin A Monetary Theory 66 70Document5 pagesRabin A Monetary Theory 66 70Anonymous T2LhplUNo ratings yet

- Form CSRF Subscriber Registration FormDocument7 pagesForm CSRF Subscriber Registration FormPranab Kumar DasNo ratings yet

- CPA REVIEW SCHOOL FINANCIAL RATIO ANALYSISDocument16 pagesCPA REVIEW SCHOOL FINANCIAL RATIO ANALYSISZein SkyNo ratings yet

- Valuation-Methods and ParametersDocument15 pagesValuation-Methods and ParametersPranav Chaudhari100% (2)

- International Finance JUNE 2022Document9 pagesInternational Finance JUNE 2022Rajni KumariNo ratings yet

- Costs. QuizezDocument2 pagesCosts. QuizezSanda ZahariaNo ratings yet

- 7110 s05 QP 1Document12 pages7110 s05 QP 1kaviraj1006No ratings yet

- Adani Group StrategiesDocument21 pagesAdani Group StrategiesBhanwar Singh NathawatNo ratings yet

- Brought To You by Http://Stockviz - BizDocument8 pagesBrought To You by Http://Stockviz - BizShyam SunderNo ratings yet

- About GBMDocument53 pagesAbout GBMAnjali Kumari60% (5)

- Accounting Principles True or False IdentificationDocument51 pagesAccounting Principles True or False IdentificationPedro MarcoNo ratings yet

- Insurance Company in BD Term PaperDocument19 pagesInsurance Company in BD Term PaperHabibur RahmanNo ratings yet

- Life &personal Financial Management: Presentation To New Employees of Bank of GhanaDocument36 pagesLife &personal Financial Management: Presentation To New Employees of Bank of GhanaKwasi Osei-YeboahNo ratings yet

- Behavioural Finance MCom (H) 2020 PDFDocument5 pagesBehavioural Finance MCom (H) 2020 PDFVishal MalikNo ratings yet

- Monitary PolicyDocument24 pagesMonitary PolicyManindra SinhaNo ratings yet