Professional Documents

Culture Documents

Income Statment With Cost Bifurcation

Income Statment With Cost Bifurcation

Uploaded by

sajal0 ratings0% found this document useful (0 votes)

16 views3 pagesOriginal Title

Income statment with cost bifurcation.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views3 pagesIncome Statment With Cost Bifurcation

Income Statment With Cost Bifurcation

Uploaded by

sajalCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

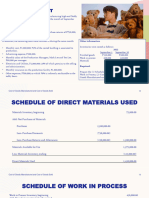

Schedule of cost of goods sold for a manufactruing company Income Statement

Beginning raw material 5000 Sales

Add: Raw material purchased 20000 Less: Cost of goods sold

Raw material available for use 25000 Gross margin

Deduct: Ending raw material 2500 Less: Selling and administrative expenses

Raw material consumed in production 22500 Net operating income

Beginning Work-in-progress 7500

Add: Raw material consumed in production 22500

Add: Manufacturing expenses 75000

Deduct: Ending work-in-progress 10000

Cost of goods manufactured 95000

Add: Beginning finished goods inventory 15000

Add: Cost of goods manufactured 95000

Goods available for sale 110000

Deduct: Ending finished goods inventory 2500

Cost of goods sold 107500

nt Income Statement

250000 Sales 250000

107500 RM Consumed 22500

142500 Change in inventory WIP -2500

87500 Change in inventory FG 12500

55000 Manufacturing expenses 75000

COGS 107500

Gross margin 142500

Less: Selling and administrative expenses 87500

Net operating income 55000

Beginning Work-in-progress 7500

Add: Beginning finished goods inventory 15000

Add: Raw material consumed in production 22500

Add: Manufacturing expenses 75000

Deduct: Ending work-in-progress -10000

Deduct: Ending finished goods inventory -2500

Cost of goods sold 107500

You might also like

- Top Business Books of All TimeDocument5 pagesTop Business Books of All Timechandel08No ratings yet

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- Manufacturing Account Worked Example Question 13Document6 pagesManufacturing Account Worked Example Question 13Roshan Ramkhalawon100% (1)

- Sensitivity Problems - ExerciseDocument17 pagesSensitivity Problems - Exercisechandel08No ratings yet

- Schedule of Cost of Goods Manufactured: Direct MaterialsDocument2 pagesSchedule of Cost of Goods Manufactured: Direct MaterialsLan Tran HoangNo ratings yet

- Cost SheetDocument13 pagesCost SheetsvermaupesNo ratings yet

- Flow of Sequence of All Costs Including Work in ProgressDocument7 pagesFlow of Sequence of All Costs Including Work in ProgressUmesh AroraNo ratings yet

- Cost Concepts - Cost SheetDocument24 pagesCost Concepts - Cost SheetFaraz SiddiquiNo ratings yet

- Adm Excel EtDocument168 pagesAdm Excel EtShashank PullelaNo ratings yet

- Cost Sheet 1Document6 pagesCost Sheet 1Tamilselvi ANo ratings yet

- Cost Lectures DR - Mohiy SamyDocument10 pagesCost Lectures DR - Mohiy SamyEiad WaleedNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Marginal and AbsorptionDocument11 pagesMarginal and AbsorptionMURREE YTNo ratings yet

- Ridgely Manufacturing Company Production Report Jul-92 Quantity of ProductionDocument3 pagesRidgely Manufacturing Company Production Report Jul-92 Quantity of ProductionJessa BasadreNo ratings yet

- Activity 1 AnswersDocument5 pagesActivity 1 AnswersClyn CFNo ratings yet

- Book 1Document3 pagesBook 1Ridhi JainNo ratings yet

- Sno Description Cost in Rs Cost in RsDocument8 pagesSno Description Cost in Rs Cost in RsCH NAIRNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Financial Cost Sheet Unit 2Document6 pagesFinancial Cost Sheet Unit 2Julls ApouakoneNo ratings yet

- Cost Sheet DetailedDocument5 pagesCost Sheet DetailedSimran JainNo ratings yet

- Chapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inDocument20 pagesChapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inPratyush GoelNo ratings yet

- ASSIGNMENT N01 mgt402Document1 pageASSIGNMENT N01 mgt402armaghank1218No ratings yet

- COGS Practise Questions 2 SolutionDocument13 pagesCOGS Practise Questions 2 SolutionBisma ShahabNo ratings yet

- Soal Cash Flow Untuk Di Kelas-1Document7 pagesSoal Cash Flow Untuk Di Kelas-1Nathanael ChristianNo ratings yet

- Gayatri Reddy - Section A - 21WU0201200.PDF 2Document4 pagesGayatri Reddy - Section A - 21WU0201200.PDF 2gayatri reddyNo ratings yet

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- Cost SheetDocument4 pagesCost Sheetpravinmore1589No ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingValérie CamangueNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Mô HìnhDocument7 pagesMô HìnhThanh Tâm Lê ThịNo ratings yet

- Absorption CostingDocument1 pageAbsorption CostingMuhammad Bin AshrafNo ratings yet

- FFMA Lecture 8 AttemptDocument1 pageFFMA Lecture 8 Attemptyohan.mathew132No ratings yet

- Cost of Raw Material Available For Use 125,000 Cost of Raw Material Used 110,000Document14 pagesCost of Raw Material Available For Use 125,000 Cost of Raw Material Used 110,000NIMRAH RAISNo ratings yet

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- Assignment Solution MGT402: Answer-1Document3 pagesAssignment Solution MGT402: Answer-1Saad UllahNo ratings yet

- Solution To Compiled QuestionsDocument7 pagesSolution To Compiled Questionslovia mensahNo ratings yet

- ASsignemts SCIDocument25 pagesASsignemts SCIPedro PelaezNo ratings yet

- Manufacturing Account Worked Example Question 7Document4 pagesManufacturing Account Worked Example Question 7Roshan Ramkhalawon100% (1)

- Cost & Management Accounting Assignment 2023Document6 pagesCost & Management Accounting Assignment 2023riya.shah2701No ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- ExamDocument1 pageExamHarshNo ratings yet

- Cost Sheet 2Document2 pagesCost Sheet 2Junaid SiddiquiNo ratings yet

- Accounts Debit Credit: TotalDocument8 pagesAccounts Debit Credit: TotaljangjangNo ratings yet

- XYZ Ice Cream CompanyDocument2 pagesXYZ Ice Cream CompanyTanjib Rahman NiloyNo ratings yet

- Book 1Document2 pagesBook 1kd7ea99m5No ratings yet

- Dorrit and Dorrbie Maufacturig AccountDocument5 pagesDorrit and Dorrbie Maufacturig AccountToniann GordonNo ratings yet

- CGS - Cost of Goods StatementDocument4 pagesCGS - Cost of Goods StatementVix100% (1)

- Manufacturing Account Worked Example Question 8Document7 pagesManufacturing Account Worked Example Question 8Roshan RamkhalawonNo ratings yet

- Income Statement 100 EntriesDocument1 pageIncome Statement 100 EntriesHaseeb AhsanNo ratings yet

- Solution Cost AccountingDocument3 pagesSolution Cost AccountingHaris KhanNo ratings yet

- MALAKAS Manufacturing Cor1Document2 pagesMALAKAS Manufacturing Cor1Agent348No ratings yet

- mc180202711 Assignment Sol. MGT402Document3 pagesmc180202711 Assignment Sol. MGT402Fari BaniNo ratings yet

- Cost Sheet ProblemsDocument5 pagesCost Sheet ProblemsshamilaNo ratings yet

- MA Hasnain Ginwala PGP-21-025Document18 pagesMA Hasnain Ginwala PGP-21-025Shashank AgarwalaNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Cost SheetDocument20 pagesCost SheetVannoj AbhinavNo ratings yet

- Term VI ElectiveDocument121 pagesTerm VI Electivechandel08No ratings yet

- Case: Kay Sunderland - Session 2: Discussion QuestionsDocument2 pagesCase: Kay Sunderland - Session 2: Discussion Questionschandel08No ratings yet

- Exercises On Dummy VariableDocument2 pagesExercises On Dummy Variablechandel08No ratings yet

- Imc-10.10.18 SPDocument18 pagesImc-10.10.18 SPchandel08No ratings yet

- FINAL & UPDATED-MK 612 IMC-Course Structure - September - December 2014Document8 pagesFINAL & UPDATED-MK 612 IMC-Course Structure - September - December 2014chandel08No ratings yet

- Section A-PGDM-MC-II (Sept-Dec-2016) : Name Group NumberDocument2 pagesSection A-PGDM-MC-II (Sept-Dec-2016) : Name Group Numberchandel08No ratings yet

- PGDM B&FS 2015 16 (Groups)Document2 pagesPGDM B&FS 2015 16 (Groups)chandel08No ratings yet

- Section BDocument2 pagesSection Bchandel08No ratings yet

- PGDM Sec D 2015 16 (Groups)Document2 pagesPGDM Sec D 2015 16 (Groups)chandel08No ratings yet

- LM - Optimization - Sensitivity Analysis - Problem 1Document2 pagesLM - Optimization - Sensitivity Analysis - Problem 1chandel08No ratings yet

- Understanding Company's Business & Strategy : Managing Key Business Accounts & The Challenges AheadDocument15 pagesUnderstanding Company's Business & Strategy : Managing Key Business Accounts & The Challenges Aheadchandel08No ratings yet

- Dividend Policy: FM, PGDM 2019-21Document27 pagesDividend Policy: FM, PGDM 2019-21chandel08No ratings yet

- Dividend Policy - Problems For Class DiscussionDocument5 pagesDividend Policy - Problems For Class Discussionchandel08No ratings yet