Professional Documents

Culture Documents

Financial Cost Sheet Unit 2

Uploaded by

Julls ApouakoneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Cost Sheet Unit 2

Uploaded by

Julls ApouakoneCopyright:

Available Formats

Problems on Cost Sheet:

1. From the following particulars, prepare a cost sheet showing – materials consumed, prime

cost, factory cost, cost of production and profit.

$

Opening stock of raw materials 20,000

Opening stock of work in progress 10,000

Opening stock of finished goods 50,000

Raw materials purchased 5,00,000

Direct wages 3,80,000

Sales for the year 12,00,000

Closing stock of raw materials 75,000

Closing stock of work in progress 15,000

Factory overhead 80,000

Direct expenses 50,000

Office and administrative overhead 60,000

Selling and distribution expenses 30,000

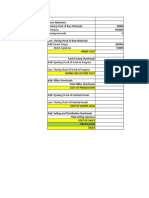

Solution:

Cost sheet for the year……………….

Particulars Amount ($) Amount ($)

Opening stock of raw materials 20000

Purchases 500000

520000

Less: Closing stock of raw materials 75000

Cost of raw materials consumed 445000

Add: Direct wages 380000

Add: Direct expenses 50000 430000

Prime Cost 875000

Add: Factory overheads 80000

Add: Opening stock of work in

progress 10000

90000

Less: Closing stock of workin

progress 15000 75000

Works or Factory cost 950000

Add: Office & administrative

overhead 60000

Cost of Production 1010000

Add: Opening stock of finished goods 50000

1060000

Less: Closing stock of finished goods 50000

Cost of goods sold 1010000

Add: Selling & distribution overhead 30000

Cost of sales 1040000

Profit 160000

Sales for the year 1200000

2. From the following particulars calculate prime cost, works cost, cost of production, cost of

sales and profit

Prime Industries manufacture a product A. on 1st January 2020 finished goods in stock

$50000. Other stocks such as:

Work in progress (1.1.2020) $40000

Raw materials (1.1.2020) $100000

The information available from cost records for the year ended 31st December 2020 was as

follows:

Direct materials 800000

Direct wages 300000

Carriage inwards 40000

Indirect wages 90000

factory overhead 275000

Stock of raw materials (31.12.2020) 80000

Work in progress (31.12.2020) 70000

Sales (120000 units) 2500000

Indirect materials 175000

Office and administrative overhead 80000

Selling and Distribution overhead 100000

Stock on finished goods (31.12.2020) 60000

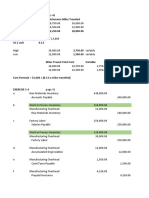

Solution:

Cost Sheet for the year ended 31st December 2020

Particulars Amount ($) Amount ($)

Opening Stock of raw materials 100000

Add: Direct materials 800000

Add: Carriage inwards 40000

940000

Less: Closing stock of raw materials 80000

Raw materials consumed 860000

Add: Direct wages 300000

Prime cost 1160000

Add: Factory overhead 275000

Add: Opeining work in progress 40000

315000

Less: Closing work in progresss 70000 245000

Works or Factory cost 1405000

Add: Office & administrative

overhead 80000

Cost of production 1485000

Add: Opening stock of finished goods 50000

1535000

Less: Closing stock of finished goods 60000

Cost of goods sold 1475000

Add: Selling & distribution expenses 100000

Cost of sales 1575000

Profit 925000

Sales 2500000

3. From the following information of Procta & Co. Ltd., for the year 2003 you are required to

prepare: (a) Prime Cost (b) Work Cost (c) Cost of Production (d) Cost of goods sold and (e)

Net Profit

$

Stock of raw materials (1.1.2003) 50,000

Purchase of raw materials 1,70,000

Stock of raw materials (31.12.2003) 80,000

Carriage Inward 10,000

Direct Wages 1,50,000

Indirect Wages 20,000

Other Direct Charges 30,000

Office rent and rates 1,000

Factory rent and rates 10,000

Indirect consumption of materials 1,000

Depreciation on plant 3,000

Depreciation on office furniture 200

Salesmen salary 4,000

Salary to office supervisor 5,000

Other factory expenses 11,400

Other office expenses 1,800

General Manager's remunerations:

Office Rs. 4,000

Factory Rs. 8,000

SeIling Dept. 12,000

Other seIling expenses 2,000

Traveling expenses of salesmen 2,200

Carriage & Freight outward 2,000

Sales 5,00,000

Advertisement 4,000

Solution:

Particulars Amount ($) Amount ($)

Stock of raw materials (1.1.2003) 50,000

Add: Purchases 1,70,000

Carriage Inwards 10,000

2,30,000

Less: Stock of raw materials (31.12.2003) 80,000

Raw Materials Consumed 1,50,000

Wages 1,50,000

Other Direct Charges 30,000

Prime Cost 3,30,000

Add: Factory Overhead:

Indirect Charges 20,000

Factory rent and rates 10,000

Indirect Materials 1,000

Depreciation of Plant 3,000

Other factory Expenses 11,400

General Manager's remuneration 8,000 53,400

Factory Cost 3,83,400

Add: Office & Administrative Overheads:

Office rent and rates 1,000

Depreciation on office furniture 200

Salary to Office Supervisor 5,000

Other Office Expenses 1,800

General Managers remuneration 4,000 12,000

Cost of Production: 3,95,400

Add: SeIling & Distribution Overheads:

Salary to Salesmen 4,000

General Manager's Salary 12,000

Other Selling Expenses 2,000

Advertisement 4,000

Traveling expenses 2,200

Carriage and freight overhead 2,000 26,200

Cost of Goods Sold 4,21,600

Profit 78,400

Sales 5,00,000

Problems on Overhead Apportionment:

1. PQR Ltd. has two production departments A, B and one service department S. The actual

costs for a period are as follows:

$

Power 1750

Lighting 1600

Rent and rates 6000

Indirect wages 4000

Sundry Expenses 1600

Depreciation on Machinery 6000

Production Departments Service Department

A B S

Working Hours 4000 3000 2000

Direct wages ($) 3000 2000 3000

Cost of Machinery 75000 50000 25000

H.P. of Machinery 60 30 10

Light points 18 12 10

Floor Area (Sq. ft.) 1000 1200 800

Apportions the costs of the various departments on most equitable basis.

Solution:

Primary Distribution Summary

Items Basis of Apportionment Total Production Service

($) Departments Department

A B S

Power Horse power * Hours (24:9:2) 1750 1200 450 100

Lighting Light points (9:6:5) 1600 720 480 400

Rent and rates Area occupied (5:6:4) 6000 2000 2400 1600

Indirect wages Direct wages (3:2:3) 4000 1500 1000 1500

Sundry Expenses Direct wages (3:2:3) 1600 600 400 600

Depreciation Cost of Machinery (3:2:1) 6000 3000 2000 1000

20950 9020 6730 5200

2. Finex Co. Ltd has three production departments and four service departments.

The expenses of these departments as per primary distribution summary were as follows:

Production Departments $

X 90000

Y 117000

Z 72000

Total 279000

Service Departments

Stores 9000

Time-keeping and accounts 13500

Power 5400

Canteen 6000

Total 33900

The following information is also available in respect of production departments:

X Y Z

H.P. of machines 1200 900 600

No. of workers 120 80 40

Value of store requisitioned ($) 7500 6000 4500

Apportion the cost of various service departments to the production departments.

Solution:

Secondary Distribution Summary

Item Basis of Apportionment Total Production Departments

X Y Z

$ $ $

Cost as per primary - 279000 90000 117000 72000

distribution

Stores Value of stores (5:4:3) 9000 3750 3000 2250

Time-Keeping No. of workers (3:2:1) 13500 6750 4500 2250

Power H.P of machines (4:3:2) 5400 2400 1800 1200

Canteen No. of workers (3:2:1) 6000 3000 2000 1000

312900 105900 128300 78700

You might also like

- Direct Materials, Labour, Expenses Cost CalculationDocument2 pagesDirect Materials, Labour, Expenses Cost CalculationEchizen RyomaNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Cost Sheet 1Document6 pagesCost Sheet 1Tamilselvi ANo ratings yet

- Cost Sheet ProblemsDocument5 pagesCost Sheet ProblemsshamilaNo ratings yet

- Costsheet (Subham)Document3 pagesCostsheet (Subham)amijit93No ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- Cost Concepts - Cost SheetDocument24 pagesCost Concepts - Cost SheetFaraz SiddiquiNo ratings yet

- Cost Sheet 1Document4 pagesCost Sheet 1Bhavya GroverNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Term Paper On Managerial AccountingDocument27 pagesTerm Paper On Managerial AccountingrezwanrahimNo ratings yet

- Cost of Production StatementDocument1 pageCost of Production StatementDhruv Ratan DeyNo ratings yet

- Statement of Cost of Goods SoldDocument3 pagesStatement of Cost of Goods SoldMARIA67% (3)

- Ronald Company 2019 Costs, Sales, IncomeDocument3 pagesRonald Company 2019 Costs, Sales, IncomeKean Brean GallosNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Assignment 1Document2 pagesAssignment 1mkmanish1No ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Schedule of Cost of Goods Manufactured: Direct MaterialsDocument2 pagesSchedule of Cost of Goods Manufactured: Direct MaterialsLan Tran HoangNo ratings yet

- Cost Sheet for Keraniganj Manufacturing Company 2021Document1 pageCost Sheet for Keraniganj Manufacturing Company 2021muhsinNo ratings yet

- Cost ManufacturingDocument10 pagesCost ManufacturingCarlNo ratings yet

- Manufacturing Costs and COGSDocument4 pagesManufacturing Costs and COGSNia BranzuelaNo ratings yet

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisAdityasai Gudimalla75% (4)

- Hasan Yaseen 9990Document3 pagesHasan Yaseen 9990Haris KhanNo ratings yet

- Cost Sheet Project AcknowledgementDocument3 pagesCost Sheet Project AcknowledgementAnil PokharelNo ratings yet

- Unit - Ii Cost and Management AccountingDocument17 pagesUnit - Ii Cost and Management AccountingRamakrishna RoshanNo ratings yet

- Solution Cost AccountingDocument3 pagesSolution Cost AccountingHaris KhanNo ratings yet

- COGS F2F Practise Questions With SolutionsDocument5 pagesCOGS F2F Practise Questions With Solutionsak8ballpool111No ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Cost Accounting QuestionsDocument3 pagesCost Accounting Questionshumzasadiq52No ratings yet

- BSA 2B Roco, Xyriene Von Briel MDocument8 pagesBSA 2B Roco, Xyriene Von Briel MXyriene RocoNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Income Statement AnalysisDocument6 pagesIncome Statement AnalysisLove IslamNo ratings yet

- Cost accounting introductionDocument5 pagesCost accounting introductionDaniel Jackson100% (1)

- Auto PPDocument9 pagesAuto PPHariom YadavNo ratings yet

- Chapter 3 Cost AccountingDocument2 pagesChapter 3 Cost AccountingJacob DiazNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- Unit Cost Direct Costing Absorption CostingDocument11 pagesUnit Cost Direct Costing Absorption CostingMURREE YTNo ratings yet

- Submitted by Nisar Ahmed Registration# 44150: Visic Corporation Cost of Goods Manufactured StatementDocument4 pagesSubmitted by Nisar Ahmed Registration# 44150: Visic Corporation Cost of Goods Manufactured StatementHaris KhanNo ratings yet

- Freak Food PVT - LTD: Presented by (Group-8) Siddhanta Chatterjee. Shadhra BhutraDocument15 pagesFreak Food PVT - LTD: Presented by (Group-8) Siddhanta Chatterjee. Shadhra BhutraShradha BhutraNo ratings yet

- Cost Accounting MidDocument7 pagesCost Accounting MidHuma NadeemNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Activity 1 AnswersDocument5 pagesActivity 1 AnswersClyn CFNo ratings yet

- COST SHEET ANALYSISDocument5 pagesCOST SHEET ANALYSISVasudev ANo ratings yet

- Illustration Questions 7Document3 pagesIllustration Questions 7mohammedahalys100% (1)

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- Lecture 5.2-General Cost Classifications (Problem 2)Document2 pagesLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon75% (4)

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Manufacturing Account Worked Example Question 8Document7 pagesManufacturing Account Worked Example Question 8Roshan RamkhalawonNo ratings yet

- Homework No.2Document14 pagesHomework No.2Danna ClaireNo ratings yet

- Cost Accounting TutorialDocument49 pagesCost Accounting TutorialpreciousegualanNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- Cost Sheet PDF - 20210623 - 142101Document10 pagesCost Sheet PDF - 20210623 - 142101Raju Lal100% (1)

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- QUIZ 2-PART 2Document1 pageQUIZ 2-PART 2Jaypee BignoNo ratings yet

- PrelimQuiz1 AnswerKeyDocument3 pagesPrelimQuiz1 AnswerKeyAnnabelle RafolsNo ratings yet

- Cost Sheet, ABC CostingDocument29 pagesCost Sheet, ABC CostingRajshri SaranNo ratings yet

- Normal Costing ProblemsDocument3 pagesNormal Costing Problemsrose llar67% (3)

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- Pediatirc Medical ErrorDocument7 pagesPediatirc Medical ErrorJulls ApouakoneNo ratings yet

- Current Trends in Preservation RhinoplastyDocument43 pagesCurrent Trends in Preservation RhinoplastyJulls ApouakoneNo ratings yet

- Patient Safety and CommunicationDocument11 pagesPatient Safety and CommunicationJulls ApouakoneNo ratings yet

- Financial Unit 2 Cost AccountingDocument29 pagesFinancial Unit 2 Cost AccountingJulls ApouakoneNo ratings yet

- Why Plan Human Resources For Health?: Round TableDocument22 pagesWhy Plan Human Resources For Health?: Round TableIonelia PașaNo ratings yet

- DiagramDocument2 pagesDiagramJulls ApouakoneNo ratings yet

- Quality GurusDocument18 pagesQuality GurusrajeeevaNo ratings yet

- The Diagram: (S) He Received False Laboratory Report. Place The Problem Statement On TheDocument2 pagesThe Diagram: (S) He Received False Laboratory Report. Place The Problem Statement On TheJulls ApouakoneNo ratings yet

- Data Et Tabulation Statistic LinkDocument29 pagesData Et Tabulation Statistic LinkJulls ApouakoneNo ratings yet

- Health Informatics BasicsDocument29 pagesHealth Informatics BasicsJulls ApouakoneNo ratings yet

- U03 Cost Management Terminology and ConceptsDocument15 pagesU03 Cost Management Terminology and ConceptsHamada Mahmoud100% (1)

- Multiple Choice Questions on Consumer and Producer SurplusDocument6 pagesMultiple Choice Questions on Consumer and Producer SurpluskhaleeluddinshaikNo ratings yet

- Digital Journey MapDocument11 pagesDigital Journey MapTahnee TsenNo ratings yet

- Promotional Strategies at Maihar CementDocument71 pagesPromotional Strategies at Maihar CementAbhay JainNo ratings yet

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksDocument240 pagesAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY71% (7)

- BK Saudiarabia Dbi2016 Jan17Document16 pagesBK Saudiarabia Dbi2016 Jan17Vinodh PaleriNo ratings yet

- PR PaperDocument41 pagesPR PaperyukiNo ratings yet

- Intercompany Transfers of Services and Noncurrent Assets: AnswerDocument34 pagesIntercompany Transfers of Services and Noncurrent Assets: AnswerIzzy B100% (1)

- Chapter Seven Decentralisation, Transfer Pricing and Responsibility Centers DecentralizationDocument9 pagesChapter Seven Decentralisation, Transfer Pricing and Responsibility Centers DecentralizationEid AwilNo ratings yet

- MGT1036 Principles-Of-Marketing Eth 1.0 40 MGT1036Document2 pagesMGT1036 Principles-Of-Marketing Eth 1.0 40 MGT1036STYXNo ratings yet

- Case Study - FoxyDocument4 pagesCase Study - FoxyANo ratings yet

- BT12203 Revision TipsDocument10 pagesBT12203 Revision TipsChelsea RoseNo ratings yet

- What Is MarketingDocument5 pagesWhat Is MarketingAmalil InsyirahNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- CHAPTER 4 5 Sustainable Strategies of Micro Food Businesses 1Document23 pagesCHAPTER 4 5 Sustainable Strategies of Micro Food Businesses 1Queen Jhanica TrespeciosNo ratings yet

- Business Plan PDFDocument86 pagesBusiness Plan PDFNicholas SalisNo ratings yet

- Management of Logistics For E-Commerce CompaniesDocument38 pagesManagement of Logistics For E-Commerce CompaniesJasonFernandes50% (2)

- Basic: Problem SetsDocument4 pagesBasic: Problem SetspinoNo ratings yet

- MDRA Interim SIP Report on University Ranking ResearchDocument7 pagesMDRA Interim SIP Report on University Ranking Researchvarun kumar VermaNo ratings yet

- PR ResumeDocument2 pagesPR Resumeapi-269630796No ratings yet

- 395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMDocument13 pages395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMblazeweaver67% (3)

- Prospectus of Simtex Industries LimitedDocument172 pagesProspectus of Simtex Industries LimitedMostafa Noman DeepNo ratings yet

- Bean Counter's Essential Accounting Cheat SheetDocument7 pagesBean Counter's Essential Accounting Cheat SheetdbistaNo ratings yet

- Bai Tap Ias36Document25 pagesBai Tap Ias36Thiện PhátNo ratings yet

- AppleDocument2 pagesAppleSULEIMANNo ratings yet

- Fortinet NSE 2 SlidesDocument16 pagesFortinet NSE 2 Slidesyifu ye100% (1)

- BSBFIM601 Assessment Task 2 v2.1Document3 pagesBSBFIM601 Assessment Task 2 v2.1Cindy HuangNo ratings yet

- Marketing Plan For A Cosmetic Giant - The OrdinaryDocument5 pagesMarketing Plan For A Cosmetic Giant - The OrdinaryKunal SainiNo ratings yet

- Migrate Classic GL to NewGLDocument8 pagesMigrate Classic GL to NewGLtifossi6665No ratings yet

- International Journal of Bank MarketingDocument43 pagesInternational Journal of Bank MarketingThương HoàiNo ratings yet