Professional Documents

Culture Documents

HUL - Snippet Analysis 2 PDF

Uploaded by

snithisha chandranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HUL - Snippet Analysis 2 PDF

Uploaded by

snithisha chandranCopyright:

Available Formats

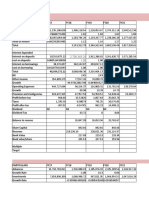

VALUATION

FY 17 FY 18 FY 19 FY 20

EPS 21.29 26.53 30.93 34.78

PE 32.00 55.00 50.00 57.00

TGT 681.43 1459.21 1546.55 1982.36

Current Fair value 659.01 1342.15 1422.48 1982.36

MOS @

0.20 549.18 1118.46 1185.401271 1651.97049

Assumptions from FY 19 FY 18 FY 19 FY 20

Sales- Breakup

Home care 33% 33% 33%

Beauty & Personal Care 47% 47% 47%

Food & Refreshment 18% 18% 18%

Others 2% 2% 2%

Revenue Growth 11% 11%

Total Revenue Growth

Expense Breakup as a % of sales

Raw material expense 46% 46% 45%

Employee Benefit Expenses 5% 5% 5%

Advertising & Promotion 12% 13% 12%

Other operating expenses 13% 14% 13%

Operating margins 24.00% 23.00% 24.38%

Depreciation 1% 1% 1%

Finance cost 0.11% 0.11% 0.11%

Taxes 28% 28% 28%

STATEMENT FORECASTING FY 18 FY 19 FY 20

Revenue Breakup

Home care 11629 12874 14826.93

Beauty & Personal Care 16464 17800 21117.15

Food & Refreshment 6487 7131 8087.418

Others 624 1505 898.602

TOTAL OPERATING REVENUE 34511 39310 44930.1

Other revenue 1168 0 0

TOTAL REVENUE 35679 39310.00 44930.1

Expenses

Raw material expense 16303 17948 20272.46

Employee Benefit Expenses 1745 1747 2291.435

Advertising & Promotion 4105 4552 5391.612

Other operating expenses 5167 5328 6020.633

TOTA EXPENSE 27320 29575 33976.14

OPERATING PROFIT 8359 9735.00 10953.96

Depreciation 345.11 393.1 449.301

EBIT 8013.89 9341.9 10504.66

Finance Cost 37.9621 43.241 49.42311

EBT 7975.9279 9298.659 10455.23

Taxes 2233.2598 2603.6245 2927.466

EAT/PAT 5742.6681 6695.0345 7527.769

No Of Shares 216.45 216.45 216.45

EPS 26.531153 30.93109 34.77833

HUL Quarterly Numbers

Q1FY19 Q2FY19 Q3FY19 Q4FY19

SALES BREAKUP

Home care 3146.00 3080.00 3148.00 2.21%

% of Total revenue 33.16% 33.35%

Beauty & Personal Care 4407.00 4316.00 4539.00 5.2%

% of Total revenue 46.5% 46.7%

Food & Refreshment 1785.00 1704.00 1728.00 1.4%

% of Total revenue 19% 18%

Others 149.00 134.00 143.00 6.72%

% of Total revenue 1.6% 1.5%

Revenues 9487.00 9234.00 9558.00 0.00

Segment EBT

Home care 602.00 492.00 404.00

% of Total revenue 6% 5%

Beauty & Personal Care 1162.00 1115.00 1162.00

% of Total revenue 12% 12%

Food & Refreshment 334.00 288.00 244.00

% of Total revenue 3.5% 3.1%

Others -2.00 2.00 -3.00

% of Total revenue -0.02% 0.02%

Total EBT 2096.22 1897.21 1807.00

EBITDA 1230.00 2324.00 2152.00

25.17% 22.52%

Depreciation 35.00 130.00 133.00

EBIT 1195.00 2194.00 2019.00

Interest 9.49 6.28 7.00

PBT 1291.51 2187.72 2012.00

Tax 276.00 627.00 506.00

PAT 1015.51 1560.72 1506.00

No of shares 216.45 216.45 216.45

EPS 4.69 7.21 6.96 #DIV/0!

SENSITIVITY SALES AND MARGINS

1982.36 8% 9% 10% 11% 12% 13% 14% 15% 16%

18% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

19% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

20% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

21% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

22% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

23% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

24% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

25% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

26% 1930.3326 1947.6766 1965.021 1982.364585 1999.70858 2017.0526 2034.39658 2051.7406 2069.0846

Q3 FY 19 Q2 FY19 Q3 FY17 % Change % Change

Revenue 9357 9138 8323 2.40% 12.42%

Other operating revenue 201 96 267 109.38% -24.72%

Other Income 106 305 152 -65.25% -30.26%

Total 9664 9539 8742 1.31% 10.55%

Cost of raw material 3199 3343 3188 -4.31% 0.35%

Change in Inventory -118 -90 -51 31.11% 131.37%

Purchase of stock in trade 1337 1182 768 13.11% 74.09%

Employee Benefit 465 438 491 6.16% -5.30%

Advertising 1186 1106 1107 7.23% 7.14%

Other Expense 1443 1236 1407 16.75% 2.56%

Excise duty

Total Expense 7512 7215 6910 4.12% 8.71%

EBITDA 2152 2324 1832

Margin 22.27% 24.36% 20.96% -2.09% 1.31%

Depreciation 133 130 121 2%

EBIT 2019 2194 1711

Finance Cost 7 7 5

EBT 2012 2187 1706

20.82% 22.93% 19.51%

Taxes 506 627 359

Net Profit 1506 1560 1347 12%

Margin 15.58% 16.35% 15.41% 0.18%

Er(e) 10.80%

Cost of capital 10.56%

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Long-Quiz CFASDocument20 pagesLong-Quiz CFASAya AlayonNo ratings yet

- Financial Statement AnalysisDocument80 pagesFinancial Statement AnalysisSujatha SusannaNo ratings yet

- Financial AnalysisDocument53 pagesFinancial AnalysisDhaouz Ismail100% (1)

- HUL - Snippet Analysis 2Document7 pagesHUL - Snippet Analysis 2snithisha chandranNo ratings yet

- Bank ValuationDocument88 pagesBank Valuationsnithisha chandranNo ratings yet

- Banking - (Pages 1 To 25)Document25 pagesBanking - (Pages 1 To 25)snithisha chandranNo ratings yet

- 89029art of QuestioningDocument6 pages89029art of Questioningsnithisha chandranNo ratings yet

- TASK-20 Valuation of Banks Part-2Document4 pagesTASK-20 Valuation of Banks Part-2snithisha chandranNo ratings yet

- Valuation of Bank (Part-3) - Task 21Document10 pagesValuation of Bank (Part-3) - Task 21snithisha chandranNo ratings yet

- Task 17: Analysis of Non Performing Assets of Bank Non Performing AssetDocument8 pagesTask 17: Analysis of Non Performing Assets of Bank Non Performing Assetsnithisha chandranNo ratings yet

- Valuation of Bank (Part-2) - Task-20Document6 pagesValuation of Bank (Part-2) - Task-20snithisha chandranNo ratings yet

- Interest Earned: Valuation Sheet of State Bank of India Income StatementDocument9 pagesInterest Earned: Valuation Sheet of State Bank of India Income Statementsnithisha chandranNo ratings yet

- Hedge Your Weatlh: Life ParametersDocument3 pagesHedge Your Weatlh: Life Parameterssnithisha chandranNo ratings yet

- 110620-Top Management Org Structure, SBI Corporate CentreDocument1 page110620-Top Management Org Structure, SBI Corporate Centresnithisha chandranNo ratings yet

- Task-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing CompaniesDocument17 pagesTask-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing Companiessnithisha chandranNo ratings yet

- Getting Things DoneDocument20 pagesGetting Things Donesnithisha chandranNo ratings yet

- HUL - Snippet Analysis 2Document7 pagesHUL - Snippet Analysis 2snithisha chandranNo ratings yet

- Summary Notes MainDocument208 pagesSummary Notes MainNikitaa SanghviNo ratings yet

- The Double Entry System For Expenses and RevenuesDocument2 pagesThe Double Entry System For Expenses and RevenuesAung Zaw HtweNo ratings yet

- FA ModuleDocument84 pagesFA ModulesdhrubuNo ratings yet

- Hilton7e SM Ch06 Final RevisedDocument82 pagesHilton7e SM Ch06 Final RevisedJohn100% (4)

- Accounting Fundamentals in Society ACCY111: DR Sanja PupovacDocument24 pagesAccounting Fundamentals in Society ACCY111: DR Sanja PupovacStephanie BuiNo ratings yet

- Homework Chapter 5Document5 pagesHomework Chapter 5Trung Kiên NguyễnNo ratings yet

- Junior High School Second Monthly Examination in Tle 8: I. MULTIPLE CHOICE QUESTIONS: Encircle The Correct AnswerDocument3 pagesJunior High School Second Monthly Examination in Tle 8: I. MULTIPLE CHOICE QUESTIONS: Encircle The Correct AnswerRolly PeraltaNo ratings yet

- Financial Accounting and Reporting 5Document82 pagesFinancial Accounting and Reporting 5Jehan CodanteNo ratings yet

- Balance Sheet Vs Fund Flow StatementDocument19 pagesBalance Sheet Vs Fund Flow StatementsuasiveNo ratings yet

- Modern Auditing Chapter 16Document13 pagesModern Auditing Chapter 16Charis SubiantoNo ratings yet

- Introduction To Financial Planning Unit 1Document57 pagesIntroduction To Financial Planning Unit 1Joshua GeddamNo ratings yet

- Instruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedDocument2 pagesInstruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedPalak MendirattaNo ratings yet

- EmpBen TheoriesDocument8 pagesEmpBen TheoriesCarl Dhaniel Garcia SalenNo ratings yet

- Ita Uk 2007Document773 pagesIta Uk 2007Nabilah ShahidanNo ratings yet

- Kertas Kerja PT SENTOSADocument13 pagesKertas Kerja PT SENTOSAnovita dwi letariNo ratings yet

- Rapides Parish Police Jury AuditDocument151 pagesRapides Parish Police Jury AuditThe Town TalkNo ratings yet

- What Is The Difference Between P & L Ac and Income & Expenditure Statement?Document22 pagesWhat Is The Difference Between P & L Ac and Income & Expenditure Statement?pranjali shindeNo ratings yet

- Publication 529Document22 pagesPublication 529robert marleyNo ratings yet

- Accounting For Income TaxDocument21 pagesAccounting For Income Taxkara mNo ratings yet

- Acct Project Question 4Document15 pagesAcct Project Question 4graceNo ratings yet

- Business Plan For Smart BoutiqueDocument25 pagesBusiness Plan For Smart BoutiqueAnonymous NM7hmMfNo ratings yet

- Vai Final Excel Cashbook With Links 2010Document24 pagesVai Final Excel Cashbook With Links 2010sreekanthNo ratings yet

- BankScope Stata Version 2015Document43 pagesBankScope Stata Version 2015AliNo ratings yet

- 20 Regional Mid-Year Convention - Academic League Advanced Financial Accounting and Reporting CupDocument20 pages20 Regional Mid-Year Convention - Academic League Advanced Financial Accounting and Reporting CupAshNor RandyNo ratings yet

- Acca f6 Taxation Vietnam 2012 Dec QuestionDocument13 pagesAcca f6 Taxation Vietnam 2012 Dec QuestionNguyễn GiangNo ratings yet

- Crazy Eddie, Inc: Case 1.6Document34 pagesCrazy Eddie, Inc: Case 1.6Yukimi SugitaNo ratings yet

- Week 1 Review of Accounting BasicsDocument34 pagesWeek 1 Review of Accounting BasicsGokul KumarNo ratings yet