Professional Documents

Culture Documents

Valuation of Bank (Part-2) - Task-20

Uploaded by

snithisha chandran0 ratings0% found this document useful (0 votes)

14 views6 pagesThis document discusses valuation metrics for two banks - State Bank of India and Indian Bank - for the fiscal year 2021. It provides growth rates for deposits, advances, and net interest income for both banks based on prior year data and expected economic conditions due to the pandemic. It also forecasts cash reserve ratios, statutory liquidity ratios, other income, net interest income, and costs for both banks for FY2021. The economy is expected to struggle with lower funds and deposits, leading to modest growth rates across most metrics for both banks.

Original Description:

Original Title

Valuation of Bank{Part-2}-Task-20.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses valuation metrics for two banks - State Bank of India and Indian Bank - for the fiscal year 2021. It provides growth rates for deposits, advances, and net interest income for both banks based on prior year data and expected economic conditions due to the pandemic. It also forecasts cash reserve ratios, statutory liquidity ratios, other income, net interest income, and costs for both banks for FY2021. The economy is expected to struggle with lower funds and deposits, leading to modest growth rates across most metrics for both banks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views6 pagesValuation of Bank (Part-2) - Task-20

Uploaded by

snithisha chandranThis document discusses valuation metrics for two banks - State Bank of India and Indian Bank - for the fiscal year 2021. It provides growth rates for deposits, advances, and net interest income for both banks based on prior year data and expected economic conditions due to the pandemic. It also forecasts cash reserve ratios, statutory liquidity ratios, other income, net interest income, and costs for both banks for FY2021. The economy is expected to struggle with lower funds and deposits, leading to modest growth rates across most metrics for both banks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

VALUATION

OF BANKS {PART-2}

DONE BY: ANNET

SARA ROY

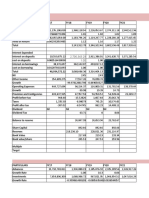

STATE BANK OF INDIA

GROWTH RATE OF DEPOSITS

Growth rate of deposits = {Deposits in the current

year – deposits in the previous year}/ Deposits in the

previous year

={3,241,620.73-2,911,386.01}/2,911,386.01

=0.11%

Expected Growth Rate

0.05%

Due to this pandemic situation, the economy

is facing a struggle with funds. They don’t

have enough funds. So, the amount of

deposits will be less.

Cash Reserve Ratio: 3%

Statutory Liquidity Ratio: 18.00%

3-0.05=2.95%

18.00-0.05=17.95%

Other Income Forecasted

In FY20, Advances=2,325,289.56.The growth

rate is 0.06%.

So, in FY21, Advances might be around

0.8%.

Due to this current situation, the economy

is facing a large crisis .So, for the next

financial year, we can expect that there might

be a slight increase in growth rate.

Net Interest Income

Net Interest Income=Total Interest earned-

Total Interest expended

=3,602,595.46-3,556,276.38

=46,319.08

Forecasted Net Interest Income

Foe FY21, the net interest income might be

2.32.

Cost Forecasted

In FY20, the total amount of cost incurred

from deposits and borrowings as interest by

bank is 3,556,276.38.

So, in FY21, the cost incurred by bank

might be around 8,223,344.87.

INDIAN BANK

GROWTH RATE OF DEPOSITS

Growth rate of deposits = {Deposits in the current

year – deposits in the previous year}/ Deposits in the

previous year

={260,225.90-242,075.95}/242,075.95

=0.07%

Expected Growth Rate

0.04%

Here also the reason arises, due to this

pandemic situation, the economy is facing a

struggle with funds. They don’t have enough

funds. So, the amount of deposits will be less.

Cash Reserve Ratio: 3%

Statutory Liquidity Ratio: 18.00%

3-0.04=2.96%

18.00-0.04=17.96%

Other Income Forecasted

In FY20, Advances=197,887.01.The growth

rate is 0.09%.

So, in FY21, Advances might be around

1.50%.

Here also, due to this current situation, the

economy is facing a large crisis .So, for the

next financial year, we can expect that there

might be a slight increase in growth rate.

Net Interest Income

Net Interest Income=Total Interest earned-

Total Interest expended

=21,211.86-10,850.09

=10,361.77

Forecasted Net Interest Income

Foe FY21, the net interest income might be

3.22.

Cost Forecasted

In FY20, the total amount of cost incurred

from deposits and borrowings as interest by

bank is10, 850.09.

So, in FY21, the cost incurred by bank might

be around 2,665.53.

You might also like

- Time Value of MoneyDocument76 pagesTime Value of Moneyrhea agnesNo ratings yet

- Kota FibresDocument10 pagesKota FibresShishirNo ratings yet

- TASK-20 Valuation of Banks Part-2Document4 pagesTASK-20 Valuation of Banks Part-2snithisha chandranNo ratings yet

- Financial Management FM 1: Introduction & Time Value of MoneyDocument20 pagesFinancial Management FM 1: Introduction & Time Value of MoneyharryworldNo ratings yet

- TDS On SalaryDocument5 pagesTDS On SalaryAato AatoNo ratings yet

- Payment of Tax, PAYE and Employment IncomeDocument20 pagesPayment of Tax, PAYE and Employment IncomeRavihara D.G.KNo ratings yet

- Running Head: Financial Management 1Document12 pagesRunning Head: Financial Management 1Faith BedonNo ratings yet

- RD FD Growth Calculator 1.0Document18 pagesRD FD Growth Calculator 1.0dantroliyaNo ratings yet

- Task 2 Strategic Financial Management (20800) Financial AnalysisDocument7 pagesTask 2 Strategic Financial Management (20800) Financial AnalysisperelapelNo ratings yet

- Chapter 5Document10 pagesChapter 5Ali KazmiNo ratings yet

- Nishat Submission 3Document10 pagesNishat Submission 3Saeed MahmoodNo ratings yet

- Scenario 1# You Do Not Have Outstanding Tax LiabilityDocument7 pagesScenario 1# You Do Not Have Outstanding Tax LiabilityBhupendra SharmaNo ratings yet

- 21.6 D D T (DDT: लाभाश वतरण कर) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 119Document3 pages21.6 D D T (DDT: लाभाश वतरण कर) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 119Washim Alam50CNo ratings yet

- Credit and CommoditiesDocument3 pagesCredit and CommoditiesSubG 08No ratings yet

- Fiscal Deficit and Its Impact On GDPDocument15 pagesFiscal Deficit and Its Impact On GDPFlorosia StarshineNo ratings yet

- Allahabad Bank Equity Research ReportDocument18 pagesAllahabad Bank Equity Research ReportkushagraNo ratings yet

- Impacts On Banking and Financial SectorsDocument2 pagesImpacts On Banking and Financial Sectorssuman AryalNo ratings yet

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- Afi 2015 Exam Answer and Grade DistributionDocument6 pagesAfi 2015 Exam Answer and Grade DistributionStephanie NgNo ratings yet

- Income Tax SlabsDocument2 pagesIncome Tax SlabsGhulam AwaisNo ratings yet

- Allahabad Bank Equity Research Report - CorrectedDocument20 pagesAllahabad Bank Equity Research Report - CorrectedkushagraNo ratings yet

- Budget Speech: Pu Zoramthanga Hon'Ble Chief Minister & Finance MinisterDocument16 pagesBudget Speech: Pu Zoramthanga Hon'Ble Chief Minister & Finance MinisterLalsangmawia LalsangmawiaNo ratings yet

- JKala Associates Overview BudgetDocument60 pagesJKala Associates Overview Budget1krishnagopalNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Recommendarion: Findings About Gross Profit RatioDocument1 pageRecommendarion: Findings About Gross Profit RatioSudip BaruaNo ratings yet

- Lecture 05 Financial For Casting and PanningDocument7 pagesLecture 05 Financial For Casting and Panningimranam_pk992100% (1)

- Financial Institutions and Market: Nabin ShiwakotiDocument3 pagesFinancial Institutions and Market: Nabin Shiwakotimunna tamangNo ratings yet

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Document5 pagesTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaNo ratings yet

- Assignment-2 (New) PDFDocument12 pagesAssignment-2 (New) PDFminnie908No ratings yet

- An Examination of The Determinants of inDocument39 pagesAn Examination of The Determinants of inSk nabilaNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Patanjali Case StudyDocument6 pagesPatanjali Case StudysukhvindertaakNo ratings yet

- From: Sandile Memela, SARS SpokespersonDocument6 pagesFrom: Sandile Memela, SARS SpokespersonhoimirNo ratings yet

- Accounting Under Ideal ConditionDocument53 pagesAccounting Under Ideal ConditionHideoYoshidaNo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- Tathya Ashish Isb HyderabadDocument4 pagesTathya Ashish Isb HyderabadAshish KumarNo ratings yet

- Star Incentive-Policy 1.0Document8 pagesStar Incentive-Policy 1.0appanraj.rNo ratings yet

- Bank: FAYSAL BANK LIMITED - Analysis of Financial Statements Financial Year 2005 - Financial Year 2009Document8 pagesBank: FAYSAL BANK LIMITED - Analysis of Financial Statements Financial Year 2005 - Financial Year 2009Asad KhanNo ratings yet

- 20220912-TEM-Tong's PortfolioDocument8 pages20220912-TEM-Tong's PortfolioMohd FadzilNo ratings yet

- Union Budget (2016-17) : FM Finally Gets It Right!Document12 pagesUnion Budget (2016-17) : FM Finally Gets It Right!Muralidharan KrishnamoorthyNo ratings yet

- Chapter-5 Conclusions and Suggestions 5.1 ConclusionsDocument2 pagesChapter-5 Conclusions and Suggestions 5.1 ConclusionsGracious TiggaNo ratings yet

- SMC 2021 Budget FinalDocument39 pagesSMC 2021 Budget Finalprassna_kamat1573No ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- HDFC Budget 2019 20 July2019Document10 pagesHDFC Budget 2019 20 July2019sohanNo ratings yet

- FY 2022-23 (AY 2023-24) - Taxguru - inDocument3 pagesFY 2022-23 (AY 2023-24) - Taxguru - inHarshilNo ratings yet

- Macro Scenario Brazil Special: Damage ControlDocument3 pagesMacro Scenario Brazil Special: Damage ControlMatheus AmaralNo ratings yet

- Accouting TermpaperDocument14 pagesAccouting TermpaperSadia NoorNo ratings yet

- Other Than Senior and Super Senior CitizenDocument6 pagesOther Than Senior and Super Senior CitizenKishan PatelNo ratings yet

- Tarangini: From ZM's DeskDocument5 pagesTarangini: From ZM's DeskBoinzb TNo ratings yet

- Recommendation of Debt To Capital Structure For Hill Country Snackfoods: Problems Without Debt in Capital StructureDocument1 pageRecommendation of Debt To Capital Structure For Hill Country Snackfoods: Problems Without Debt in Capital Structurejorgoca2No ratings yet

- NewcrestDocument10 pagesNewcrestJosh LimNo ratings yet

- Final Report BFDocument22 pagesFinal Report BFAdil IqbalNo ratings yet

- Presentation On CGTMSE and Upcoming OpportunitiesDocument16 pagesPresentation On CGTMSE and Upcoming OpportunitiesAkshay JainNo ratings yet

- IstiakDocument1 pageIstiakArponNo ratings yet

- Thabat Fund Fact Sheet - January 2021Document4 pagesThabat Fund Fact Sheet - January 2021ResourcesNo ratings yet

- Normal Tax Rates For Individual & HUFDocument14 pagesNormal Tax Rates For Individual & HUFAdarsh PandeyNo ratings yet

- FSA MBA06071 Jaswinder SinghDocument6 pagesFSA MBA06071 Jaswinder SinghJaswinder SinghNo ratings yet

- Budget 21Document17 pagesBudget 21Raja17No ratings yet

- Asian Development Outlook 2015: Financing Asia’s Future GrowthFrom EverandAsian Development Outlook 2015: Financing Asia’s Future GrowthNo ratings yet

- HUL - Snippet Analysis 2Document7 pagesHUL - Snippet Analysis 2snithisha chandranNo ratings yet

- Bank ValuationDocument88 pagesBank Valuationsnithisha chandranNo ratings yet

- Banking - (Pages 1 To 25)Document25 pagesBanking - (Pages 1 To 25)snithisha chandranNo ratings yet

- 89029art of QuestioningDocument6 pages89029art of Questioningsnithisha chandranNo ratings yet

- Valuation of Bank (Part-3) - Task 21Document10 pagesValuation of Bank (Part-3) - Task 21snithisha chandranNo ratings yet

- Hedge Your Weatlh: Life ParametersDocument3 pagesHedge Your Weatlh: Life Parameterssnithisha chandranNo ratings yet

- Task 17: Analysis of Non Performing Assets of Bank Non Performing AssetDocument8 pagesTask 17: Analysis of Non Performing Assets of Bank Non Performing Assetsnithisha chandranNo ratings yet

- Interest Earned: Valuation Sheet of State Bank of India Income StatementDocument9 pagesInterest Earned: Valuation Sheet of State Bank of India Income Statementsnithisha chandranNo ratings yet

- 110620-Top Management Org Structure, SBI Corporate CentreDocument1 page110620-Top Management Org Structure, SBI Corporate Centresnithisha chandranNo ratings yet

- Task-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing CompaniesDocument17 pagesTask-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing Companiessnithisha chandranNo ratings yet

- Getting Things DoneDocument20 pagesGetting Things Donesnithisha chandranNo ratings yet

- HUL - Snippet Analysis 2Document7 pagesHUL - Snippet Analysis 2snithisha chandranNo ratings yet