Professional Documents

Culture Documents

Istiak

Uploaded by

ArponOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Istiak

Uploaded by

ArponCopyright:

Available Formats

2.

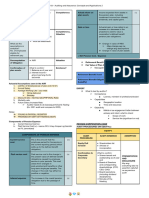

Based on the calculation above number (1) The Liquidity and Profitability condition of the

company for both years are given below:

Liquidity Condition of the Company: Here, two ratios can explain the liquidity condition. These

are Account receivable turnover and acid-test-ratio.

These ratios can measure the short-term ability of the company to pay its maturing obligations

and to meet unexpected needs for cash.

2019 2018

Accounts Receivable turnover =

5.45׿ ¿ 7.28׿ ¿

365 365

Average collection period in terms of days = =

5.45 7.28

= 66.97 days = 50.14 days

In 2019 the company on average receive or collects Accounts receivable in 66.97 days, in 2018 it

takes 50.14 days. Shorter collection period is good for the company. In 2018, the company’s

Accounts receivable turnover is quite good rather than 2019.

2019 2018

Acid-test ratio =

1.57 1.27

This ratio measures immediate liquidity. In 2019 this ratio provides good return rather than year

2018. Means quick current assets raises in terms of liability in years 2019 rather than 2018.

So, the liquidity condition of the company is quite good for year 2019 than tear 2018 as cash

generation ability is quite high for the year 2019 than previous year.

Profitability Condition of the company: Here, two ratios can explain the profitability condition of

the company which are given below.

2019 2018

Net Profit margin =

31.777 41.197

Asset turnover ratio = 0.57 times 0.59 times

Profit margin measures the percentage of each dollar sales that results in net income. Higher

profit margin is preferable. On the other hand Asset turnover ratio measures how efficiently

assets are used to generate sales and therefore revenue. So, both of these ratios which is higher is

preferable.

In 2018, the company’s profit margin and Asset turnover ratios are relatively higher than the year

2019. Which indicates that in 2018 the company more efficiently used its assets to generate sakes

and greater income reflects on this rather than year 2019.

So, in terms of profitability, the condition of the company in year 2018 is better than year 2019.

In conclusion we can say that, this company was doing good in year 2018 rather than year 2019

based on its liquidity and profitability condition.

You might also like

- Task 2 Strategic Financial Management (20800) Financial AnalysisDocument7 pagesTask 2 Strategic Financial Management (20800) Financial AnalysisperelapelNo ratings yet

- Asset ManagementDocument4 pagesAsset ManagementNur Jihad AntaoNo ratings yet

- Business Report - Myer Holdings LTDDocument9 pagesBusiness Report - Myer Holdings LTDSimon100% (1)

- Senior High SchoolDocument9 pagesSenior High SchoolCharlyn CastroNo ratings yet

- Financial Statement AnalysisDocument11 pagesFinancial Statement AnalysisAbdul RehmanNo ratings yet

- BF Nishant Rana (1875405) Buisiness Finance AssignmentDocument16 pagesBF Nishant Rana (1875405) Buisiness Finance AssignmentNishant RanaNo ratings yet

- FABM Week 6 - Financial RatioDocument35 pagesFABM Week 6 - Financial Ratiovmin친구No ratings yet

- Fundamental Ratio Analysis of Almari: Your NameDocument8 pagesFundamental Ratio Analysis of Almari: Your Nameabdulla mohammadNo ratings yet

- Measurement LevelsDocument67 pagesMeasurement LevelsEllixander LanuzoNo ratings yet

- The Balance Sheet: Task 1Document12 pagesThe Balance Sheet: Task 1Mahmoud EsmaeilNo ratings yet

- MJ PLCDocument16 pagesMJ PLCRichard Osahon EseleNo ratings yet

- FABM2 - Q1 - V2a Page 80 93Document14 pagesFABM2 - Q1 - V2a Page 80 93Kate thilyNo ratings yet

- Financial AnalysisDocument34 pagesFinancial AnalysisElaijah D. SacroNo ratings yet

- Anees Ahmad (0964) - Ratio AnalysisDocument9 pagesAnees Ahmad (0964) - Ratio AnalysisMR ANo ratings yet

- 5 Remaining RatiosDocument2 pages5 Remaining RatioshariharanpNo ratings yet

- Accounts Ail Activity: Nam E: Yas Hvi Rana Class: Xii-C Roll No.:34Document19 pagesAccounts Ail Activity: Nam E: Yas Hvi Rana Class: Xii-C Roll No.:341464Yashvi RanaNo ratings yet

- Rate of Return oDocument13 pagesRate of Return oHassaan QaziNo ratings yet

- Gross Profit Margin Gross Profit ÷ Net SalesDocument2 pagesGross Profit Margin Gross Profit ÷ Net Salesagavi niggaNo ratings yet

- Financial AssignmentDocument28 pagesFinancial AssignmentChaminda Devan MuthuhettiNo ratings yet

- Analysis of The Various Ratios of The Gulf Hotels (Oman) Liquidity RatiosDocument20 pagesAnalysis of The Various Ratios of The Gulf Hotels (Oman) Liquidity RatiosRajshekhar BoseNo ratings yet

- Analysis of Cement Industry: Assignment No: 01Document6 pagesAnalysis of Cement Industry: Assignment No: 01Sadaf HussainNo ratings yet

- Sedano, Crea Final RequirementDocument6 pagesSedano, Crea Final RequirementCrea Madula SedanoNo ratings yet

- Marico: Current Ratio: This Ratio Explains The Relationship Between The Current Assets and The CurrentDocument4 pagesMarico: Current Ratio: This Ratio Explains The Relationship Between The Current Assets and The CurrentkpilNo ratings yet

- 8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresDocument28 pages8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresNeeraj BhartiNo ratings yet

- Accounting Middle East College 1Document16 pagesAccounting Middle East College 1Rubab KanwalNo ratings yet

- Liquidity Ratios: Current RatioDocument3 pagesLiquidity Ratios: Current RatiojatinNo ratings yet

- Financial Analysis of SpicejetDocument6 pagesFinancial Analysis of SpicejetChandan SaigalNo ratings yet

- Performance Task 4 - Abm 12-2Document15 pagesPerformance Task 4 - Abm 12-2Pauleene AdelinoNo ratings yet

- Accounting For Manager: Name of The Student: Student ID: Name of The UniversityDocument12 pagesAccounting For Manager: Name of The Student: Student ID: Name of The Universitykomal singhNo ratings yet

- Análisis EmpresaDocument20 pagesAnálisis EmpresaJorge GrubeNo ratings yet

- Financial ManagementDocument11 pagesFinancial ManagementEngr AtiqNo ratings yet

- Ratios AnalysisDocument6 pagesRatios Analysisabhishek27panwalaNo ratings yet

- Name: Hammad Ali (180811) Class: BSAF 4A Submitted To: Sir Khalid Subject: Financial Reporting 2Document14 pagesName: Hammad Ali (180811) Class: BSAF 4A Submitted To: Sir Khalid Subject: Financial Reporting 2tech& GamingNo ratings yet

- IV-Financial Measure of Performance: (Mouad Ougazzou) : EBIT in Millions of USD Except Per ShareDocument5 pagesIV-Financial Measure of Performance: (Mouad Ougazzou) : EBIT in Millions of USD Except Per ShareMouad OugazzouNo ratings yet

- Fsa Final InterpretationDocument42 pagesFsa Final InterpretationTakibul HasanNo ratings yet

- Chapter 1: Literature Review On The Financial Ratios AnalysisDocument19 pagesChapter 1: Literature Review On The Financial Ratios AnalysisAnh Hà Thị TrâmNo ratings yet

- Accounting Control Research TaskDocument12 pagesAccounting Control Research TaskAgamdeep SinghNo ratings yet

- Risk AnalysisDocument9 pagesRisk AnalysisBurhan Al MessiNo ratings yet

- Course Project Week 11,12Document5 pagesCourse Project Week 11,12Nae InsaengNo ratings yet

- Evaluating The Ability To Pay Long-Term DebtDocument3 pagesEvaluating The Ability To Pay Long-Term DebtIntan HidayahNo ratings yet

- Individual Assignment - Ratio AnalysisDocument9 pagesIndividual Assignment - Ratio Analysisyash rathodNo ratings yet

- T2003 Financial Accounting: Name: Moumi Bera Specialization: Division D-Human Resources Roll No.: 45216 PRN: 22020141116Document4 pagesT2003 Financial Accounting: Name: Moumi Bera Specialization: Division D-Human Resources Roll No.: 45216 PRN: 22020141116teen agerNo ratings yet

- Gross Profit Ratio : Cy2018 Cy2017Document5 pagesGross Profit Ratio : Cy2018 Cy2017Eric Glenn CalingaNo ratings yet

- 3.0 Liquidity and Financial StabilityDocument4 pages3.0 Liquidity and Financial StabilityJeThro LockingtonNo ratings yet

- Financial Management: Assignment - 2Document4 pagesFinancial Management: Assignment - 2Aishu KrishnanNo ratings yet

- Financial Analysis For Sapphire Fibres LimitedDocument6 pagesFinancial Analysis For Sapphire Fibres LimitedRashmeen NaeemNo ratings yet

- Financial Ratio Analysis (Final)Document27 pagesFinancial Ratio Analysis (Final)NadaBaajajahNo ratings yet

- Linde Bangladesh LTDDocument4 pagesLinde Bangladesh LTDNabil mahmudNo ratings yet

- Assignment On ANALYSIS OF FINANCIAL STATMENTS of Nishat Mills Limited (Finance Assignment)Document7 pagesAssignment On ANALYSIS OF FINANCIAL STATMENTS of Nishat Mills Limited (Finance Assignment)Mahnoor KamranNo ratings yet

- 2 Cadbury Ratio AnalysisDocument7 pages2 Cadbury Ratio AnalysisMiconNo ratings yet

- Microfinance Ass 1Document15 pagesMicrofinance Ass 1Willard MusengeyiNo ratings yet

- Sig PLC ReportDocument13 pagesSig PLC ReportrashiNo ratings yet

- JSW Ratios by Group No 5Document17 pagesJSW Ratios by Group No 5Priyanka KoliNo ratings yet

- MFA Assessment 1Document6 pagesMFA Assessment 1rajeshkinger_1994No ratings yet

- O.M. Scott & SonsDocument7 pagesO.M. Scott & Sonsstig2lufetNo ratings yet

- BANK 311 SlidesDocument18 pagesBANK 311 SlidesMaha AlanjawiNo ratings yet

- Ratios NoteDocument24 pagesRatios Noteamit singhNo ratings yet

- Political Science AnikDocument2 pagesPolitical Science AnikArponNo ratings yet

- Sugera Shaznin PDFDocument4 pagesSugera Shaznin PDFArponNo ratings yet

- Political Science AnikDocument2 pagesPolitical Science AnikArponNo ratings yet

- Report On Social Media Influences in Politics of BangladeshDocument16 pagesReport On Social Media Influences in Politics of BangladeshArponNo ratings yet

- E e Eeee EstiakDocument4 pagesE e Eeee EstiakArponNo ratings yet

- Eng103 MainDocument2 pagesEng103 MainArponNo ratings yet

- Eng103 FinalDocument2 pagesEng103 FinalArponNo ratings yet

- Submitted To: Tanya Ahmed (Tya)Document24 pagesSubmitted To: Tanya Ahmed (Tya)ArponNo ratings yet

- Dr. Ikramul Hasan: Internship Report On Employee Efficiency Management' ofDocument34 pagesDr. Ikramul Hasan: Internship Report On Employee Efficiency Management' ofArponNo ratings yet

- Submitted To: Md. Saidur Rahman (SR3)Document13 pagesSubmitted To: Md. Saidur Rahman (SR3)ArponNo ratings yet

- ACT201 AssignmentDocument27 pagesACT201 AssignmentArponNo ratings yet

- Fins QuizDocument5 pagesFins QuizAyWestNo ratings yet

- FAtDocument6 pagesFAtCassandra AnneNo ratings yet

- Activity 5 Non Current Assets Held For Sale and Discontinued OperationsDocument3 pagesActivity 5 Non Current Assets Held For Sale and Discontinued Operationsnglc srzNo ratings yet

- A Pragmatist's Guide To Leveraged Finance NotesDocument36 pagesA Pragmatist's Guide To Leveraged Finance Notesvan07075% (4)

- Global Perspectives of Regulatory Reform For Shadow Banking: Impact On Their Business ModelsDocument78 pagesGlobal Perspectives of Regulatory Reform For Shadow Banking: Impact On Their Business ModelscasammyNo ratings yet

- Bull Call SpreadDocument6 pagesBull Call SpreadSrini Vasan100% (1)

- Test Eks - с Переводом - исправленноеDocument9 pagesTest Eks - с Переводом - исправленноеAleksandra AbramovaNo ratings yet

- EICHERMOT Share Price Target - Eicher Motors Limited NSE INDIA Chart AnalysisDocument4 pagesEICHERMOT Share Price Target - Eicher Motors Limited NSE INDIA Chart AnalysisumashankarsinghNo ratings yet

- Inv PLNGDocument78 pagesInv PLNGapi-38145570% (1)

- Business Valuation1Document288 pagesBusiness Valuation1Kapil Bhopatkar100% (1)

- EtradeDocument29 pagesEtradeRangga Try PutraNo ratings yet

- Aec64 Audit 2 Notes-22-24Document3 pagesAec64 Audit 2 Notes-22-24Althea RubinNo ratings yet

- Etisalat Bond Prospectus PDFDocument2 pagesEtisalat Bond Prospectus PDFLisaNo ratings yet

- L 7 Portfolio-Construction-Guide - Vanguard PDFDocument36 pagesL 7 Portfolio-Construction-Guide - Vanguard PDFRajesh AroraNo ratings yet

- Bom Unit-3Document89 pagesBom Unit-3Mr. animeweedNo ratings yet

- Exercise in Manaco 2Document2 pagesExercise in Manaco 2Gracelle Mae Oraller100% (1)

- Market Analysis Feb 2024Document17 pagesMarket Analysis Feb 2024Subba TNo ratings yet

- FINANCE FOR EXECUTIVES (AutoRecovered)Document5 pagesFINANCE FOR EXECUTIVES (AutoRecovered)suruchi singhNo ratings yet

- Financial Derivatives Assignment - MridulDocument8 pagesFinancial Derivatives Assignment - MridulsahilNo ratings yet

- GST 231 Pq&a IiiDocument4 pagesGST 231 Pq&a IiiMuhammad Ibrahim SugunNo ratings yet

- Berkshire's Corporate Performance vs. The S&P 500Document25 pagesBerkshire's Corporate Performance vs. The S&P 500cooljoe9No ratings yet

- Week 10 12. ULO B. Substantive Test of InvestmentsDocument13 pagesWeek 10 12. ULO B. Substantive Test of InvestmentskrizmyrelatadoNo ratings yet

- Certified Financial Services AuditorDocument8 pagesCertified Financial Services AuditorMa. Kathleen ReyesNo ratings yet

- Fixed Vs Flexible Exchange RatesDocument63 pagesFixed Vs Flexible Exchange Ratesramya4smilesNo ratings yet

- Money Supply: Economics ProjectDocument9 pagesMoney Supply: Economics ProjectabhimussoorieNo ratings yet

- 7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesDocument9 pages7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesTarekegnNo ratings yet

- Investment Analysis and Portfolio Management OutlineDocument6 pagesInvestment Analysis and Portfolio Management OutlineHuan EnNo ratings yet

- Week 10 Ch12 Excel ProblemsDocument10 pagesWeek 10 Ch12 Excel ProblemsMarcus R Urquhart0% (1)

- Walter Wurster, Et Al. v. Deloitte Et Al.Document63 pagesWalter Wurster, Et Al. v. Deloitte Et Al.Matthew Kish100% (1)