Professional Documents

Culture Documents

Tax Reviewer - All About Taxation Tax Reviewer - All About Taxation

Tax Reviewer - All About Taxation Tax Reviewer - All About Taxation

Uploaded by

Jason LazaroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Reviewer - All About Taxation Tax Reviewer - All About Taxation

Tax Reviewer - All About Taxation Tax Reviewer - All About Taxation

Uploaded by

Jason LazaroCopyright:

Available Formats

lOMoARcPSD|5484049

Tax reviewer - All about Taxation

Bachelor of Science in Accountancy (Polytechnic University of the Philippines)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

lOMoARcPSD|5484049

Ch.4 taxable net income, rules on taxable net income, tax base, source rate, due, classes of individual:

Special individual taxpayer—taxed at the preferential single/flat tax rate of 0%, 15% or 25% based only in the gross from within the

Philippines.

- not required to file ITR

- income already net of final tax withheld

-not entitled to claim of deduction

Ordinary income taxpayer—file their ITR

-tax at progressive income tax rates of 5% to 32% based on taxable net income

-entitled to claim the ff. deduction:

bus. Expenses

allowed personal exemption

health hospitalization insurance premium

Summarized rules on individual income taxation

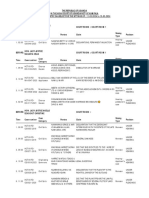

Classes of individual Tax base Tax source Tax rate

1. Resident citizen

a. basic income tax Taxable net income world 5% to 32%

b. final income tax Taxable gross income In philippines Single rates

c. income exempt Income not subject to

income tax

2. Resident Alien,

Non-resident Citizen,

Non-resident Alien

engage in business in

Philippines

a. basic income tax Taxable net income In philippines 5 to 32%

b. final income tax Taxable gross income In philippines Single rates

c. income exempts Income not subject to

income tax

3. Non-resident alien not

engage in bus. In

Philippines

a. basic income tax Taxable gross income In Philippines 25%

b. final income tax Taxable gross income In Philippines Single rates

c. income exempt Income not subject to

income tax

4. Special Alien, Filipino

Employee Gross compensation

a. basic income tax income In philippines 15%

b. final income tax Special income In philippines Various rates

c. income exempt Income not subject to

income tax

Rule I: Income tax for resident citizen

A. basic income tax for resident citizen

1. Resident citizen—taxed at graduated basic income tax rate of 5% to 32%.

(taxable net income world)(5% to 32%) = basic income tax

2. Taxable net income world* = gross income (-) allowable deduction/bus. Expense (-) allowance and exemption incurred/paid within

and without Philippines[allowed personal exemption, health hospitalization insurance premium]

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

lOMoARcPSD|5484049

*taxable net income world or

*net loss world—non taxable nor refundable

Disregarded/excluded in computation of taxable net income world:

items exempt from income tax

income subject to final income tax

non-deductible bus. Expense

Format1: Standard Formula/Pattern:

Compensation income in Philippines

(+) compensation income in foreign country (abroad)

(+)Bus. Income in Philippines

(+)bus. Inc. in foreign country

(+)other income in Philippines

(+)other income in foreign country

Gross income world

(-)allowed deduction world

(-)bus. Expenses in Phil.

(-)bus. Expenses in foreign country

Net income World

(-) allowance and exemption world

(-) APE(single) & HHIP (0)

Taxable net income world

basic income tax due (5% to 32%)

*allowed deduction—refers only to bus. Expenses of sole proprietorship bus.

-excluding the amount of allowed personal exemption and HHIP

Format 2: Alternative Formula/Pattern

Gross income world

(-) Allowed deduction world

(-)bus. Expenses

(-)HHIP world

(-) APE

Taxable net income world

*allowed deduction—refers to deductible bus. Exp.

-already include the amounts of APE & HHIP

*gross income—already includes compensation, bus. &other inc.

B. Final Income Tax for Resident Citizen

*Capital gains from sale of property classified as capital assets and

*income from passive investment—subject to different final income tax rates

-excluded from above gross income computation

C. Income Exempt from Income Tax for Resident Citizen

*winning/ prizes from sweepstakes office

*statutory minimum wage items of non-taxable minimum wage earner—that are expressly exempt from income tax

-excluded from above gross income computation

Rule II. Income taxation for:

Resident Alien (RA), Non-Resident Citizen(NRC), Non-Resident Alien Engage in Business in Philippines (NRAEBP)

A. Basic Income tax for resident alien, non resident citizen, non resident alien engage in bus. In Phil.

1. (Taxable net income Philippines) X (5 to 32%)=Basic Income Tax

2. taxable net income in phil—determined by gross income earned w/in phil. Only

-allowed deduction(bus. Exp.) and allowance and exemption paid in the Philippines(APE & HHIP)

*taxable net in come phil

*net loss phil—neither taxable nor refundable

Format 1: standard formula/pattern:

Compensation income in Philippines

(+)bus. Income in Philippines

(+)other income in Philippines

Gross income in Phil.

(-) Allowed deduction Phil.

(-)Bus. Expense in Phil.

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

lOMoARcPSD|5484049

Net Income in Phil.

(-)Allowance and Exemption Phil.

(-)APE(married) and HHIP(0)

Taxable net income Phil.

Basic income tax due(5% to 32%)

Format2: alternative Formula Pattern

Gross income Phil.

(-)Bus. Expenses

(-) HHIP

(-) APE

Taxable Net income Phil.

B. Final income tax for residentaliens, non resident citizens, non-resident aliens engage in bus. In Philippines.

(-do-)

C. Income exempt for RA, NRC,NRAEBP

(-do-)

Formula : for employee only (fixed earner or pure compensation income earner)

Gross compensation income P210,000

(-)APE (single) P50,000

(-)HHIP 2,400 (52,400)

Taxable net income or taxable compensation income P157,600

Self-employed only (variable earner; pure bus. Income earner)

bus. Income (gross profit from sales) P210,000

(+)other income if any 40,000

Gross income 250,000

(-)bus. Expense (140,000)

Net income 110,000

(-)APE P50,000

(-)HHIP 2,400 (52,400)

Taxable Net income 57,600

For Mixed Earner

Compensation Income

(+)Bus. Inc. (gross profit from sales)

(+) other inc.

Gross income

(-)bus. Expense

Net income

(-) APE

(-)HHIP

Taxable income

*resident citizen—source w/in and w/out Phil.

*resident alien, non resident citizen, NRAEBP—only w/in Phil.

Rule III. Income taxation for

non-resident alien not engage in business in Phil, (NRANEBP)

A. Basic income tax for NRANEBP

(Gross income in Phil) x (25%) = Income tax due and withheld

Illustration: taxable gross income and income tax due of NRANEBP

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

lOMoARcPSD|5484049

Basic Salary in Phil

(+)allowances in Phil.

(+)Other Compensation in Phil.

(+)Dividends income from domestic corp. in Phil.

(+)Other profits or gain in Phil.

Gross income in Phil

Income tax due and withheld 25%

B. Final income tax for NRANEBP

(-do-)

C. Income Exempt from income tax for NRANEBP

(-do-)

Rule IV. Income tax for:

Special/ Alien/ Filipino Employees (SAFE)

A. Basic income tax for SAFE

(Gross compensation income Phil) x (15%) = Income tax due and withheld

Illustration:

Basic Salary in Phil.

(+) Allowance in Phil.

(+)Other Compensation in Phil.

Gross Compensation income, in Phil.

Income tax due and withheld (at 15%)

B. Final Income tax for SAFE

(-do-)

C. Income exempt from income tax for SAFE

(-do-)

Special Alien or Filipino Employee—refer to foreigner or counterpart Filipino

-who is holding a managerial and/or technical position,

-employe by certain specified bus. Org. in the Phil.

-describe as follows:

1. Regional Area Headquarters of Municipal Companies

2. Regional Operating Headquarters of Multinational Companies

3. Offshore Banking Units

4. Foreign Petroleum Service Contractor or Subcontractor engaged in Petroleum Operation in the Philippines

-shall have options to be taxed either:

1. 15% of gross compensation income in Phil

2. Basic income tax rates 5% to 32% on his taxable net income in Phil.

V. Income taxation For: Minimum Wage Earner (MWE)

1. MWE—worker in private sector; paid w/ minimum wage

- work in public sector with compensation income of not more than the statutory minimum wage in the non-agricultural sector where

he/she is assigned

2. statutory Minimum Wage—shall refer to the rate fixed by the regional tripartite wage and Productivity board

- defined by bureau of labor and employment statistics (BLES)

3. compensation income of MWE workprivate sectorexempt from income taxation

4. compensation income of MWEworkpublic sector exempt from income taxation

5. basic salary of public MWEequated to SMW in the non-agricultural sector applicable to the place where he/she is

assignedsame with private MWE

6. *basic pay *holiday pay *overtime pay *nightshift pay *hazard pay likewise be covered by above exemptions

*in excess of the allowable statutory amount of 30,000 not exempt from income tax and withholding tax

7. MWEs receiving other income are not exempted from income tax on their entire income earned during the taxable year.

8. hazard pay—paid by employer toemployee assigned to danger or strife-torn area

-if not satisfy criteria above subject to income tax

9. offenders may be criminally prosecuted existing laws

10 summary of current regional daily minimum wage rate

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

lOMoARcPSD|5484049

*456non-agricultural sector

*419 other sectors

*30COLA increase

Simplified rules on Income taxation for MWE

1. Income taxation for Non-Taxable Minimum Wage Earner

-If minimum wage earner earned income consisting of only 5 statutory minimum wage items, whether with or without income exempt

from income tax and/or income subject to final income tax MWE is classified as Non-taxable MWE.

2. Income taxation for taxable minimum wage earner

-if the minimum wage earner, earned other income subject to the basic income tax rate of 5% to 32% MWE is classified as a

taxable MWE

Statutory minimum wage item include the ff.

1. Statutory/ Daily MW or basic pay including the COLA cost of living allowance

2. Holiday pay

3. Hazard Pay

4. Overtime pay

5. Night shift differential pay

RULE VI. Income tax for married couples ( provision of section 51 D of NIRC)

a. Married individual—shall file only one income tax return for the taxable year

b. Spouse –may pass separate ITR; but must be consolidated by BIR

c. In one ITR—taxable net income and income tax due of each spouse shall be separately computed

-identify income and expense directly or wholly

Format 1: standard formula

Husband wife Combined

Compensation income 150000 230000 380,000

Bus. Inc. 700,000 500,000 1,200,000

Share in unspecified 50,000 50,000 100,000

income (50% each)

Gross income 900,000 780,000 1,680,000

Less: Bus. Exp. (600,000) (460,000) (1,060,000)

Unspecified bus. (20,000) (20,000) (40,000)

Expense

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

lOMoARcPSD|5484049

Total deduction (620,000) (480,000) (1,100,000)

Net Income 280,000 300,000 580,000

Less: APE & HHIP (150,000) (50,000) (200,000)

Taxable net income 130,000 250,000 380,000

Basic income tax due

(5% to 32%)

Format 2: Alternative formula:

Gross income

(-)bus. Exp

(-)APE

(-)HHIP

taxable net income

Rule VII. Income tax for parent and children

1. Minor children who are gainfully employed are mandated by law to file their own ITR thru their gardian or parent

2. Income of unmarried minor gratuitously from parent shall be included and declared as part of the parent donor’s gross income

3. Donation is recorded in part of the child –donee’s gross income in his/her income tax return

a. When related donor’s tax has been paid on such property

b. When the transfer of such property is exempt from donor’s tax.

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

lOMoARcPSD|5484049

Downloaded by Jason Lazaro (rajasonlzr@gmail.com)

You might also like

- Advanced Financial Accounting & Reporting Business CombinationDocument12 pagesAdvanced Financial Accounting & Reporting Business CombinationJunel PlanosNo ratings yet

- Tax Set A With Ans PDFDocument6 pagesTax Set A With Ans PDFXyza JabiliNo ratings yet

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 pagesAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseeNo ratings yet

- 20 Finance Project ExamplesDocument5 pages20 Finance Project ExamplesGustavoMontoyaNo ratings yet

- Records Management VendorsDocument308 pagesRecords Management VendorsRazvan Porojan100% (1)

- Income TaxDocument20 pagesIncome Taxjuliaysabellepepitoaguilar100% (1)

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- Quiz 1Document11 pagesQuiz 1VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- RawDocument5 pagesRawJenny MendozaNo ratings yet

- (Tax) CPAR PreweekDocument4 pages(Tax) CPAR PreweekNor-janisah PundaodayaNo ratings yet

- MasDocument12 pagesMasKenneth RobledoNo ratings yet

- Prac 2Document10 pagesPrac 2Fery AnnNo ratings yet

- Tax Quiz 4Document61 pagesTax Quiz 4Seri CrisologoNo ratings yet

- Sol Chap 5-7Document56 pagesSol Chap 5-7Anonymous QEcQfTeHl100% (1)

- Quiz 9 A6Document20 pagesQuiz 9 A6Lara FloresNo ratings yet

- As 12 - Full Notes For Accounting For Government GrantDocument6 pagesAs 12 - Full Notes For Accounting For Government GrantShrey KunjNo ratings yet

- xP04 Value Added Tax Booklet PDFDocument70 pagesxP04 Value Added Tax Booklet PDFmae KuanNo ratings yet

- KEY Level 2 QuestionsDocument5 pagesKEY Level 2 QuestionsDarelle Hannah MarquezNo ratings yet

- CL Cup 2018 (AUD, TAX, RFBT)Document4 pagesCL Cup 2018 (AUD, TAX, RFBT)sophiaNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- Taxation May Board ExamDocument20 pagesTaxation May Board ExamjaysonNo ratings yet

- DRAFT1Level 3Document130 pagesDRAFT1Level 3Mark Paul RamosNo ratings yet

- Taxation Sia/Tabag TAX.2812-Accounting Methods MAY 2020: Lecture NotesDocument2 pagesTaxation Sia/Tabag TAX.2812-Accounting Methods MAY 2020: Lecture NotesMay Grethel Joy PeranteNo ratings yet

- Hwhwwjwjwjwjwjwiwiwiwkke Cpa Review School of The Philippines Manila Corporations Dela Cruz / de Vera / Lopez / LlamadoDocument9 pagesHwhwwjwjwjwjwjwiwiwiwkke Cpa Review School of The Philippines Manila Corporations Dela Cruz / de Vera / Lopez / LlamadoSophia PerezNo ratings yet

- Midterm Exam Palapuz, John Mark Bsac 3a 1Document6 pagesMidterm Exam Palapuz, John Mark Bsac 3a 1John Mark PalapuzNo ratings yet

- Individual TaxpayersDocument4 pagesIndividual TaxpayersJane TuazonNo ratings yet

- AFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Document24 pagesAFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Prances ObiasNo ratings yet

- Income Tax Compliance, Schemes of Income Taxation and Final Income TaxationDocument45 pagesIncome Tax Compliance, Schemes of Income Taxation and Final Income TaxationMonica MonicaNo ratings yet

- LEAD BATCH 2 - ERG-TAX 1 Estate Tax - George James Comprehensive Problem-AnsDocument2 pagesLEAD BATCH 2 - ERG-TAX 1 Estate Tax - George James Comprehensive Problem-AnsJims Leñar CezarNo ratings yet

- MAS ReviewerDocument22 pagesMAS ReviewerBeverly HeliNo ratings yet

- PSW2 Tax1 SetbDocument1 pagePSW2 Tax1 Setb'Bhandamme ParagasNo ratings yet

- Gains or Losses in Dealings in PropertyDocument6 pagesGains or Losses in Dealings in PropertyRussel RuizNo ratings yet

- Ast TX 801 Items of Gross Income (Batch 22)Document5 pagesAst TX 801 Items of Gross Income (Batch 22)Elijah MontefalcoNo ratings yet

- Review MaterialsDocument1 pageReview MaterialsChristine Jacinto100% (2)

- Accounting Methods And: Installment Reporting of IncomeDocument15 pagesAccounting Methods And: Installment Reporting of IncomeRoronoa ZoroNo ratings yet

- Finals Handout TaxDocument3 pagesFinals Handout TaxFlorenz AmbasNo ratings yet

- For Sir Red - 20 MCQs - TAXATIONDocument5 pagesFor Sir Red - 20 MCQs - TAXATIONRed Christian PalustreNo ratings yet

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- AP 5905Q InventoriesDocument3 pagesAP 5905Q Inventoriesaldrin elsisuraNo ratings yet

- Mas 0 Basic ConsiderationsDocument10 pagesMas 0 Basic ConsiderationsRefinej WickerNo ratings yet

- Chapter 6 To Chapter 8Document4 pagesChapter 6 To Chapter 8Jarren BasilanNo ratings yet

- Theory of Accounts On Business CombinationDocument2 pagesTheory of Accounts On Business CombinationheyNo ratings yet

- ExerciseonEstateTaxDocument1 pageExerciseonEstateTaxJohn Carlo CruzNo ratings yet

- T 2Document3 pagesT 2Corazon Lim LeeNo ratings yet

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Fischer - Pship LiquiDocument7 pagesFischer - Pship LiquiShawn Michael DoluntapNo ratings yet

- TX12 - Estate TaxDocument14 pagesTX12 - Estate TaxPatrick Kyle AgraviadorNo ratings yet

- Review of The Accounting ProcessDocument10 pagesReview of The Accounting ProcessJulz0% (1)

- Laws On Bouncing ChecksDocument15 pagesLaws On Bouncing ChecksGraceNo ratings yet

- Tax CPAR Final Pre Board2Document5 pagesTax CPAR Final Pre Board2Floyd delMundo100% (1)

- DeductionsDocument10 pagesDeductionsceline marasiganNo ratings yet

- 2402 Corporate LiquidationDocument7 pages2402 Corporate LiquidationFernando III PerezNo ratings yet

- How To Tax An Individual 1Document25 pagesHow To Tax An Individual 1Lianna Xenia EspirituNo ratings yet

- TAX.2814 Community-Taxes AnswersDocument1 pageTAX.2814 Community-Taxes AnswersCams DlunaNo ratings yet

- Ap 9401-1 SheDocument4 pagesAp 9401-1 SheLuzviminda SaspaNo ratings yet

- Chapter 3 Auditing Theory 15 16 RoqueDocument34 pagesChapter 3 Auditing Theory 15 16 RoqueDarlene Ventura0% (1)

- Income Tax PresentationDocument22 pagesIncome Tax PresentationItchigo KorusakiNo ratings yet

- HQ04 - Final Income TaxationDocument5 pagesHQ04 - Final Income TaxationJimmyChaoNo ratings yet

- Corporate Income Tax - 1Document22 pagesCorporate Income Tax - 1Katrina Vianca DecapiaNo ratings yet

- Chapter8 TaxationonindividualsDocument12 pagesChapter8 TaxationonindividualsChristine Joy Rapi MarsoNo ratings yet

- Ass&Sa Claro Bac07-18Document28 pagesAss&Sa Claro Bac07-18Steffi Anne D. ClaroNo ratings yet

- SIM7X00 Series UART Application Note V1.00Document15 pagesSIM7X00 Series UART Application Note V1.00Javier GuevaraNo ratings yet

- Christian LawDocument7 pagesChristian LawSandeshNo ratings yet

- Cara Rintala Vs StateDocument2 pagesCara Rintala Vs StateLarry KelleyNo ratings yet

- K - 43402169 - 03 - CA PK33 Deco CeilingDocument4 pagesK - 43402169 - 03 - CA PK33 Deco CeilingMostafa MatarNo ratings yet

- Colorado Office of State Planning & Budgeting May Forecast Slide ShowDocument16 pagesColorado Office of State Planning & Budgeting May Forecast Slide ShowMichael_Roberts2019No ratings yet

- Notice: Reports and Guidance Documents Availability, Etc.: Child Restraint Systems Child Restraint Labels Research ReportDocument2 pagesNotice: Reports and Guidance Documents Availability, Etc.: Child Restraint Systems Child Restraint Labels Research ReportJustia.comNo ratings yet

- Evergreen Park Arrests Nov. 2-Nov. 9, 2016Document12 pagesEvergreen Park Arrests Nov. 2-Nov. 9, 2016Lorraine SwansonNo ratings yet

- Verb Noun Adjective Noun: Trung Tâm Anh NG Nhung PH M 27N7A KĐT Trung Hòa Nhân Chính - 0946 530 486 - 0964 177 322Document5 pagesVerb Noun Adjective Noun: Trung Tâm Anh NG Nhung PH M 27N7A KĐT Trung Hòa Nhân Chính - 0946 530 486 - 0964 177 322Trung PhamNo ratings yet

- Plaquette Master Comptabilite Controle Audit DauphineDocument2 pagesPlaquette Master Comptabilite Controle Audit DauphineMathivanan NatarajNo ratings yet

- List of Telugu Movies in LAN 1. 10 ClassDocument30 pagesList of Telugu Movies in LAN 1. 10 ClassGirls TiktokNo ratings yet

- Americans: The Nine Major Sources of RevenueDocument6 pagesAmericans: The Nine Major Sources of RevenueGonzales, Alethea I.No ratings yet

- Chapter 3. Advanced Discounted Cash Flow TechniquesDocument16 pagesChapter 3. Advanced Discounted Cash Flow TechniquesHastings KapalaNo ratings yet

- Investment Proof Submission Form - 2017-18Document5 pagesInvestment Proof Submission Form - 2017-18vishalkavi18No ratings yet

- Motor Vehicle ACT, 1988 Important Judgments: Compiled by Hanif. S. MuliaDocument118 pagesMotor Vehicle ACT, 1988 Important Judgments: Compiled by Hanif. S. MuliaAbhijit TripathiNo ratings yet

- 41 Lim Et Al, V. BarcelonaDocument10 pages41 Lim Et Al, V. BarcelonaRae Angela GarciaNo ratings yet

- New BFP Citizen Charter FSICDocument5 pagesNew BFP Citizen Charter FSICWadwad KingNo ratings yet

- Tolentino Vs SOFDocument1 pageTolentino Vs SOFBechay PallasigueNo ratings yet

- NanduDocument43 pagesNanduNandu BhoiteNo ratings yet

- Tibetan Range WarsDocument25 pagesTibetan Range Warsmleyeh2443No ratings yet

- Family Division Court Cause List Monday March 11 - Friday March 15 2024Document27 pagesFamily Division Court Cause List Monday March 11 - Friday March 15 2024samurai.stewart.hamiltonNo ratings yet

- Indemnity BondDocument42 pagesIndemnity BondDipakMitraNo ratings yet

- Law of Criminal Revisions: S.S. UpadhyayDocument60 pagesLaw of Criminal Revisions: S.S. UpadhyayChaitanya KumarNo ratings yet

- Curso Mhawk4Document109 pagesCurso Mhawk4Omar Antonio Araque100% (1)

- 5 RCBC Savings V Odrada DigestDocument1 page5 RCBC Savings V Odrada DigestDamienNo ratings yet

- Lady Evelyn Zainab Cobbold HadDocument3 pagesLady Evelyn Zainab Cobbold HadAiman NaimNo ratings yet

- MSDS 43310Document2 pagesMSDS 43310Elias100% (1)

- Versatile Notes PHYSICS XII Chapter 01Document36 pagesVersatile Notes PHYSICS XII Chapter 01ShaheerNo ratings yet

- 19 Skunac Corp V Sylianteng PDF FreeDocument1 page19 Skunac Corp V Sylianteng PDF FreeAngel EiliseNo ratings yet