Professional Documents

Culture Documents

Financial Management Youtube Review

Financial Management Youtube Review

Uploaded by

Erin Chelsea Llobrera0 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

Financial Management Youtube review.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageFinancial Management Youtube Review

Financial Management Youtube Review

Uploaded by

Erin Chelsea LlobreraCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

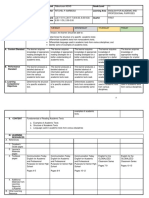

I.

Top 10 Financial Ratios to use Before Buying a Stock 1

The video listed down the different kinds of financial ratios an aspiring

investor could possibly need before opting to purchase any kind of stock in the

market. Since ratios paint a quick snapshot of the quantitative health of a

company, an investor should supplement this with a qualitative scan.

The first ratio that the video discussed was the operating margin ratio,

which can be calculated by dividing operating income by sales. This ratio tells an

investor how much brand power and efficiency a company has. The video

compared the operating margin of Apple and Walmart, citing that Apple had a

higher operating margin with 27% as compared to Walmart’s 4.2%. However,

having a low margin does not necessarily mean that the business isn’t doing well.

But investors need to understand that the lower one’s ratio is, the more easily a

company can drop into operating losses. The next ratio discussed was the

Interest coverage/ Times Interest ratio, which can be calculated by dividing EBIT

by interest expense. This is a good ratio to check for a company’s level of

financial distress or risk of bankruptcy. Since a higher ratio means that you have

more power of paying off your debts. Another financial distress ratio is the debt-

to-equity ratio. The higher the leverage of liabilities to equity, the higher the risk a

company is taking, which can mean bad news in the long run. The best ratio to

use for beginning investors is the PE ratio as this tells us how much earnings a

shareholder earned during the year and how many years it would take to be paid

back assuming there’s no growth. It gives investors a snapshot as to whether

they need to dig for more information about the company. The Earnings per

Share ratio is an important ratio as well since it gives the shareholder a realistic

view as to how well the company is doing in terms of how much their investment

is worth. Finally, the most important ratio for investors would be the Return on

Invested Capital ratio, which is operating income after taxes divided by what

shareholders and debt owners put up. This ratio is important since as someone

buying the business would like to see what they could earn irrespective of how

much debt a company uses.

The video clearly laid out the different ratios one can use in analyzing a

company’s performance, what they are, and what they mean. The ratios

discussed were in line with the lessons discussed in class. The video gave a

clear example of how to apply the concepts I learned in class in real-life practice.

1Video source: https://www.youtube.com/watch?v=5ELXFBCpJp0

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Applied Mathematics 10 (Zambak) - Zambak Publishing (2008) PDFDocument200 pagesApplied Mathematics 10 (Zambak) - Zambak Publishing (2008) PDFdata100% (1)

- Maverick Men: The True Story Behind The Videos (FREE TEASER)Document25 pagesMaverick Men: The True Story Behind The Videos (FREE TEASER)Anthony DiFiore100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Doyle, Kant, Liberal LegaciesDocument32 pagesDoyle, Kant, Liberal LegaciesMatheus LamahNo ratings yet

- Bsim3v3 3.3 Manual PDFDocument200 pagesBsim3v3 3.3 Manual PDFfabbNo ratings yet

- How To Calculate ForceDocument3 pagesHow To Calculate ForceJohn MalonesNo ratings yet

- Delta Dentists Near Nyc ApartmentDocument50 pagesDelta Dentists Near Nyc ApartmentSteve YarnallNo ratings yet

- LBP - Dr. Dessy Sp.sDocument77 pagesLBP - Dr. Dessy Sp.srahmadsyahNo ratings yet

- Diagnostic Imagining Technique. (Osce)Document17 pagesDiagnostic Imagining Technique. (Osce)Rabah IrfanNo ratings yet

- Selections of Arbitration A Judicial ReviewDocument16 pagesSelections of Arbitration A Judicial ReviewArham RezaNo ratings yet

- Chapter - 1: Introduction of Financial AccountingDocument21 pagesChapter - 1: Introduction of Financial AccountingMuhammad AdnanNo ratings yet

- Di V V: Cardiomath Equations InfoDocument35 pagesDi V V: Cardiomath Equations InfoMd. ashfaque Ahemmed khanNo ratings yet

- SAIMC-2019 Keystage-3 Individual Final.x17381Document7 pagesSAIMC-2019 Keystage-3 Individual Final.x17381Darma YasaNo ratings yet

- Official History of Improved Order of RedmenDocument672 pagesOfficial History of Improved Order of RedmenGiniti Harcum El BeyNo ratings yet

- Seven Chakras and Its CharacteristicsDocument1 pageSeven Chakras and Its Characteristicsapi-3722436No ratings yet

- Preparing Chocolate CakeDocument14 pagesPreparing Chocolate CakegayNo ratings yet

- Course Schedule CAES9820 Sem 2 MonThuDocument4 pagesCourse Schedule CAES9820 Sem 2 MonThuyip90No ratings yet

- IJRAR22B1253Document20 pagesIJRAR22B1253Rumaan ToonsNo ratings yet

- DR Shamsul BaharDocument31 pagesDR Shamsul Bahardenesh11No ratings yet

- DLL - Mathematics 5 - Q3 - W2Document10 pagesDLL - Mathematics 5 - Q3 - W2Noemi LazaroNo ratings yet

- A Report On: Bachelor of Technology IN Civil EngineeringDocument31 pagesA Report On: Bachelor of Technology IN Civil EngineeringKalyan Reddy AnuguNo ratings yet

- Oriya Language Press: Status, Problems and ProspectsDocument9 pagesOriya Language Press: Status, Problems and ProspectsMrinal Chatterjee95% (20)

- English in Use - Verbs - Wikibooks, Open Books For An Open World PDFDocument86 pagesEnglish in Use - Verbs - Wikibooks, Open Books For An Open World PDFRamedanNo ratings yet

- Teaching NotesDocument13 pagesTeaching NotesmaxventoNo ratings yet

- Buddhist Film Collection 270Document34 pagesBuddhist Film Collection 270Kev0192No ratings yet

- School Nabunturan NCHS Grade Level Teacher Ritchel P. Barbosa Learning Area English For Academic andDocument9 pagesSchool Nabunturan NCHS Grade Level Teacher Ritchel P. Barbosa Learning Area English For Academic andChenie BawisanNo ratings yet

- Jency Dalphy: in Partial Fulfillment of The Requirements For The Degree ofDocument25 pagesJency Dalphy: in Partial Fulfillment of The Requirements For The Degree ofjency dalfyNo ratings yet

- ROC Graphs: Notes and Practical Considerations For Data Mining ResearchersDocument28 pagesROC Graphs: Notes and Practical Considerations For Data Mining ResearchersJan ShumwayNo ratings yet

- Blocki 2007Document5 pagesBlocki 2007Abdellah LAHDILINo ratings yet

- Stat 132 SyllabusDocument3 pagesStat 132 SyllabusPCCPatronNo ratings yet

- How Project Leaders Can Overcome The Crisis of SilenceDocument12 pagesHow Project Leaders Can Overcome The Crisis of SilenceKrunal DattaniNo ratings yet