Professional Documents

Culture Documents

Update On State Government Borrowings - 25 August 2020

Uploaded by

aniket guptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Update On State Government Borrowings - 25 August 2020

Uploaded by

aniket guptaCopyright:

Available Formats

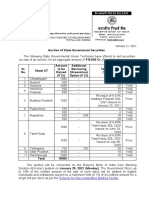

Update on State 10 states raised a total of Rs.

ed a total of Rs.13,850 crores at the auction of state government securities or state development loans (SDLs) held today, which

Government was Rs.1,000 crores more than the notified amount of the auction as 2 states –Tamil Nadu and Gujarat exercised the over-allotment (green –

shoe) option and accepted Rs.500 crores each more than the auction amount.

Borrowings –

25 August’20 So far in the current fiscal year (7 April – 25 August’20), 26 states and 1 UT have cumulatively raised Rs.2.70 lakhs crores via market borrowings,

which is a 53% increase from the borrowings in the corresponding period of 2019-20 (Rs. 1.76 lakh crores from 9 April- 27 Aug’19). As per the

Contact: proposed market borrowings calendar, the state government borrowings in H1 2020-21 at Rs. 3.45 lakh crores is likely to be 53% more than that

Madan Sabnavis in H1 2019-20.

Chief Economist

madan.sabnavis@careratings.com

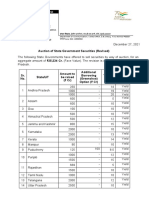

Table 1: Auction of State Development Loans of State Governments: 25 August’20

91-22-68374 433

Notified Amount (Rs Amount Cut Off Yield

State Tenure (Yrs)

Crs) Raised (Rs Crs) (%)

Author

Andhra Pradesh 250 250 6.77 20

Kavita Chacko

Bihar 2000 2000 5.1 3

Senior Economist

Goa 100 100 6.68 10

kavita.chacko@careratings.com

Gujarat 1500 2000 6.65 10

91-22-68374 426 1000 1000 6.63 10

Karnataka

1000 1000 6.77 13

500 500 5.05 3

Kerala

500 500 6.04 5

500 500 5.89 5

Rajasthan

500 500 6.64 10

1000 1250 5.09 3

Tamil Nadu

1000 1250 6.66 10

Uttar Pradesh 1000 1000 6.67 10

West Bengal 2000 2000 6.68 10

Source : RBI

State-wise market borrowings so far in 2020-21

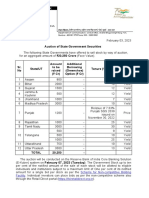

The lockdown of the past 5 months has resulted in the state government witnessing a sharp fall in their revenues while at the time registering

an increase in their expenditure towards health and relief measures. This has led state government to increasing meet their funding shortfalls

through market borrowings via issue of SDLs. Of the 26 states that have issued SDLs so far in the financial year, 11 states have seen their market

borrowings increase by 50% and above when compared with the corresponding period of year ago. At the same time, the borrowings of 8

states has been lower than year ago. These states are Uttar Pradesh, Punjab, Manipur, Uttrakhand, Assam, Meghlaya, Arunachal Pradesh and

Himachal Pradesh. Jharkhand and Tripura have not raised funds via market borrowings so far in 2020-21.

Tamil Nadu, Maharashtra, Andhra Pradesh, Rajasthan, Karnataka, Telangana, West Bengal, Gujarat, Haryana and Kerala are amongst the largest

borrowers so far in 2020-21 and these 9 states have together accounted for 83% of total state government borrowings. There has been a

marked increase in the borrowings of Karnataka (375%), Maharashtra (176%) and Tamil Nadu (128%) in the current fiscal year from that in the

first 5 months of 2019-20.

Table 2: State-wise market borrowings

FY 20 (9 April- 27 Aug FY 21 (7 April- 18 Aug '20)

% change

'19) Rs crs Rs crs

Andhra Pradesh 16,078 24,250 51

Arunachal Pradesh 472 428 -9

Assam 1700 1,000 -41

Bihar 7,600 8,000 5

Chhattisgarh 1,000 1,300 30

Goa 900 1,100 22

Gujarat 13,300 14,280 7

Haryana 8,501 14,000 65

Himachal Pradesh 1,600 500 -69

Jammu & Kashmir 2,749 3,300 20

Jharkhand 1,500 NA

Karnataka 4,000 19,000 375

Kerala 11,682 13,930 19

Madhya Pradesh 6,000 9,000 50

Maharashtra 12,500 34,500 176

Manipur 803 700 -13

Meghalaya 350 200 -43

Mizoram 258 310 20

Nagaland 100 350 250

Odisha 2,000 3,000 50

Punjab 10,820 7,700 -29

Rajasthan 15,882 23,950 51

Sikkim 213 467 119

Tamil Nadu 19,615 44,750 128

Telangana 12,800 18,461 44

Tripura 450 NA

Uttar Pradesh 11,000 7,500 -32

Uttarakhand 1,300 1,000 -23

West Bengal 11,510 17,500 52

Source: RBI and CARE Ratings

Tenure and Interest Rate of State Government Dated Securities

The borrowings of state’s is mainly through the issues of securities carrying a tenure of 10 years. 37% of the SDL’s issuances in the first 5

months of 2020-21 have a tenure of 10 years.

The 3 year tenure SDLs have the second highest share of issuances (11% of total) followed by the 30 year SDLs (8%).

The weighted average interest rate of state government dated securities (across states and tenures) auctioned on 25 August’20 at 6.19%

was 13 bps lower than week ago (18 August’20).

The (weighted average) yields of the 10 year and 3 year SDLs in today’s auction hardened by 16 bps each from week ago. The 10 year

SDL yields have risen by 24 bps to 6.66% during August’20 and that of 3 years have increased by 35 bps to 5.09% in this month.

Chart 1: Market Borrowings and Yield

Chart 2 : Yield Movement of 10 year SDLs

9

35,000 7.74 9 7.90

Weighted Average Yield (%)

Weighted Average Yield: %

6.82 6.51 8 8

30,000 6.79 6.60

5.90

6.12 6.43

6.33 6.197 7 6.44 6.50 6.66

25,000 5.97 5.85 6 6

Rs. Crs

20,000 5

4 5

15,000

3 4

10,000

2 3

5,000 1

2

0 0

1

07-Apr-20

21-Apr-20

05-May-20

19-May-20

02-Jun-20

16-Jun-20

30-Jun-20

11-Aug-20

25-Aug-20

14-Jul-20

28-Jul-20

0

02-Jun-20

16-Jun-20

30-Jun-20

07-Apr-20

21-Apr-20

05-May-20

19-May-20

11-Aug-20

25-Aug-20

14-Jul-20

28-Jul-20

Amount Raised : Rs Crs Weighted Average Yield

Disclaimer: This report is prepared by Credit

Analysis & Research Limited [CARE Ratings]. CARE

Ratings has taken utmost care to ensure accuracy

and objectivity while developing this report based

on information available in public domain. However,

neither the accuracy nor completeness of

information contained in this report is guaranteed.

CARE Ratings is not responsible for any errors or

omissions in analysis / inferences / views or for

results obtained from the use of information

contained in this report and especially states that

CARE Ratings has no financial liability whatsoever to

the user of this report

www.careratings.com CORPORATE OFFICE:

CARE Ratings Limited

Follow us on /company/CARE Ratings Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022.

/company/CARE Ratings Tel: +91-22-6754 3456 I Fax: +91-22-6754 3457 I E-mail: care@careratings.com

You might also like

- Starting A Nonprofit Organization GuideDocument38 pagesStarting A Nonprofit Organization GuideJon Gollogly100% (3)

- Commercial Lien StrategyDocument8 pagesCommercial Lien Strategykinfromsa92% (12)

- Mutation and PartitionDocument5 pagesMutation and PartitionRAMSINGH CHAUHANNo ratings yet

- G.R No. 173252 July 17, 2009 DIGESTDocument2 pagesG.R No. 173252 July 17, 2009 DIGESTChristine Jane Rodriguez100% (1)

- 576 People vs. Maraorao, G.R. No. 174369, June 18, 2012Document1 page576 People vs. Maraorao, G.R. No. 174369, June 18, 2012JUNGCO, Jericho A.No ratings yet

- New Golden Builders & Development Corp Vs CA DigestDocument2 pagesNew Golden Builders & Development Corp Vs CA DigestEl G. Se ChengNo ratings yet

- Forma or Not "Exceptionally Meritorious," The Argument of Petitioner Would Still Be Untenable. It Is SettledDocument1 pageForma or Not "Exceptionally Meritorious," The Argument of Petitioner Would Still Be Untenable. It Is SettledArlene DurbanNo ratings yet

- Gaso Transport Services V Obene Ealr 1990-1994 Ea 88Document12 pagesGaso Transport Services V Obene Ealr 1990-1994 Ea 88Tumuhaise Anthony Ferdinand100% (1)

- Update On State Government Borrowings-18 Aug20Document3 pagesUpdate On State Government Borrowings-18 Aug20Santosh HiredesaiNo ratings yet

- Auction of State Government Securities 10,930 Cr. (Face Value)Document2 pagesAuction of State Government Securities 10,930 Cr. (Face Value)A-Series OfficialNo ratings yet

- Year of FPO2014Document2 pagesYear of FPO2014mkNo ratings yet

- Telecom Sector: BWA Auctions - Week 1Document3 pagesTelecom Sector: BWA Auctions - Week 1vishi.segalNo ratings yet

- PPP in IndiaDocument8 pagesPPP in IndiaPRATIM MAJUMDERNo ratings yet

- Sri Ramadhootha 16.03.2023Document1 pageSri Ramadhootha 16.03.2023Sridhar GandikotaNo ratings yet

- January 5, 2018: Accord Advertising Pvt. LTDDocument2 pagesJanuary 5, 2018: Accord Advertising Pvt. LTDDibyojyoti SahaNo ratings yet

- VVVHHFFDocument2 pagesVVVHHFFVasu Ram JayanthNo ratings yet

- Account Ledger Inquiry: Menu Show Memo Pad Background Menu CCY ConverterDocument2 pagesAccount Ledger Inquiry: Menu Show Memo Pad Background Menu CCY Convertersarwan kumarNo ratings yet

- PR1667ASGDocument2 pagesPR1667ASGBhupinder PawarNo ratings yet

- Nfo Deck HSBC Consumption FundDocument50 pagesNfo Deck HSBC Consumption FundGautam MehtaNo ratings yet

- PR1577ED6DAD7FABB8454E8A5C237372EDocument3 pagesPR1577ED6DAD7FABB8454E8A5C237372EAayush GuptaNo ratings yet

- Srivinayaka 28.02.2023Document1 pageSrivinayaka 28.02.2023Sridhar GandikotaNo ratings yet

- Tcs (Lat Tilot Fetct T : :qarr (Ljllftul" LF"'Document2 pagesTcs (Lat Tilot Fetct T : :qarr (Ljllftul" LF"'Khalid PandithNo ratings yet

- Sai Proteins 16.03.2023Document1 pageSai Proteins 16.03.2023Sridhar GandikotaNo ratings yet

- 2024 03 11 10 24 56jun 23 - 110086Document3 pages2024 03 11 10 24 56jun 23 - 110086aslamkhan110084No ratings yet

- R P Coatings (P) Ltd. (11-12) - (From 1-Apr-2015) - (From 1-Apr-20Document12 pagesR P Coatings (P) Ltd. (11-12) - (From 1-Apr-2015) - (From 1-Apr-20rishabhNo ratings yet

- Pmswa Nidhi DataDocument6 pagesPmswa Nidhi DataManish VermaNo ratings yet

- EESL SOlar Pump Tender ALl INDIADocument220 pagesEESL SOlar Pump Tender ALl INDIAakshay upadhyayNo ratings yet

- Brief Tractor 07-11-2023Document4 pagesBrief Tractor 07-11-2023Hafiz Saddique MalikNo ratings yet

- Venvet 16.03.2023Document1 pageVenvet 16.03.2023Sridhar GandikotaNo ratings yet

- Biomass Power: Chapter - VIDocument13 pagesBiomass Power: Chapter - VIYAFASNo ratings yet

- Quotation Quotation: Macula HealthcareDocument1 pageQuotation Quotation: Macula Healthcarevishaljames PadharNo ratings yet

- Eastern Province: Funds Allocations To The ProvinceDocument3 pagesEastern Province: Funds Allocations To The ProvinceTharindu PriyanathNo ratings yet

- Facebook Telegram: Institutes Bond Seat Leaving Penalty/ Course Discontinuation Penalty StipendDocument4 pagesFacebook Telegram: Institutes Bond Seat Leaving Penalty/ Course Discontinuation Penalty StipendSidharth KNo ratings yet

- A3 Appendix 0000Document2 pagesA3 Appendix 0000Parth VoraNo ratings yet

- Agenda Item No. Vii DRDA Administration SchemeDocument16 pagesAgenda Item No. Vii DRDA Administration Schemeajay_vasaiNo ratings yet

- Statement On FinanceDocument12 pagesStatement On Financevinayak raoNo ratings yet

- Ramadhootha Farm 28.02.2023Document1 pageRamadhootha Farm 28.02.2023Sridhar GandikotaNo ratings yet

- Turmeric Outlook Report - January To May 2021Document6 pagesTurmeric Outlook Report - January To May 2021Sumit VermaNo ratings yet

- Sagar Cement LTD - 23 January 2021Document11 pagesSagar Cement LTD - 23 January 2021nakilNo ratings yet

- Swastic VillasDocument3 pagesSwastic Villasvinayakconstructiondeveloper02No ratings yet

- 15 Chapter 8Document66 pages15 Chapter 8Prabhu MoorthyNo ratings yet

- Statement of Axis Account No:080010100183918 For The Period (From: 19-10-2020 To: 18-10-2021)Document4 pagesStatement of Axis Account No:080010100183918 For The Period (From: 19-10-2020 To: 18-10-2021)Ketan PatelNo ratings yet

- RBD Discrepancy Updated List - AGDocument5 pagesRBD Discrepancy Updated List - AGMandeep KumarNo ratings yet

- Shiva Saraswat: Portfolio SummaryDocument6 pagesShiva Saraswat: Portfolio SummaryShiva saraswatNo ratings yet

- Statistics Report CIA I PDFDocument8 pagesStatistics Report CIA I PDFVAMIL MAHESHWARI 2234159No ratings yet

- Key Highlight-EDocument29 pagesKey Highlight-ELeena SinhaNo ratings yet

- 2023 08 01 16 27 01jun 23 - 521001Document3 pages2023 08 01 16 27 01jun 23 - 521001vinodaaubbriNo ratings yet

- Fanmes Cash Flow2Document4 pagesFanmes Cash Flow2Justo Caldas PeruNo ratings yet

- Accelerated Irrigation Benefit ProgrammeDocument7 pagesAccelerated Irrigation Benefit ProgrammeAbhinav SinhaNo ratings yet

- Pradhan Mantri Gram Sadak Yojana: State: Himachal Pradesh District: Mandi Block: Chauntra Route: All RoutesDocument1 pagePradhan Mantri Gram Sadak Yojana: State: Himachal Pradesh District: Mandi Block: Chauntra Route: All RoutesAmit KumarNo ratings yet

- UpdateDocument3 pagesUpdateheenaNo ratings yet

- 2023 09 01 19 40 52apr 23 - 495668Document3 pages2023 09 01 19 40 52apr 23 - 495668harsha.tahalaniNo ratings yet

- Government of Rajasthan: Schedule of Income Tax (Budgethead 8658-00-112-00-00)Document5 pagesGovernment of Rajasthan: Schedule of Income Tax (Budgethead 8658-00-112-00-00)shane haiderNo ratings yet

- 1 Guntha Horizontal Green Poly House ProjectDocument1 page1 Guntha Horizontal Green Poly House ProjectRajneeshNo ratings yet

- Unit 6: Preparation of Budgets: 6.0 ObjectivesDocument26 pagesUnit 6: Preparation of Budgets: 6.0 ObjectivesTamerat FikaduNo ratings yet

- NabardDocument13 pagesNabardapi-3833893100% (1)

- Food Corporation of India Regional Office: Haryana PanchkulaDocument8 pagesFood Corporation of India Regional Office: Haryana Panchkularafikul123No ratings yet

- Suco 2018Document7 pagesSuco 2018PUNI67% (3)

- Suco 2018Document7 pagesSuco 2018PUNI100% (1)

- Representation To Textile Commissioner To Include The Matter of Non-Arrival of Cotton Bales As Agenda For The Meeting - 02.02.2022Document3 pagesRepresentation To Textile Commissioner To Include The Matter of Non-Arrival of Cotton Bales As Agenda For The Meeting - 02.02.2022Jai PatelNo ratings yet

- 7th Anniversary BudgetDocument10 pages7th Anniversary BudgetBilal GillaniNo ratings yet

- Entitlement Chart LatestDocument1 pageEntitlement Chart LatestNishant SinhaNo ratings yet

- Recruitment in Clerical Cadre in Associate Banks of State Bank of IndiaDocument5 pagesRecruitment in Clerical Cadre in Associate Banks of State Bank of Indiap4ukumarNo ratings yet

- Selected State-Wise Area, Production and Productivity of Jute in India (2019-2020)Document1 pageSelected State-Wise Area, Production and Productivity of Jute in India (2019-2020)Sourav GhoshNo ratings yet

- 6a MTP Oct 2020Document13 pages6a MTP Oct 2020Bijay AgrawalNo ratings yet

- Received With Thanks ' 6,000.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 6,000.00 Through Payment Gateway Over The Internet Fromprakharmishra902No ratings yet

- JV LedgerDocument31 pagesJV LedgerSandesh HegisteNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Bsebond - Operating Guidelines PDFDocument11 pagesBsebond - Operating Guidelines PDFaniket guptaNo ratings yet

- Detailed Procedure For Listing of Privately Placed DebenturesDocument11 pagesDetailed Procedure For Listing of Privately Placed Debenturesaniket guptaNo ratings yet

- NSE Circular 14072020 1Document1 pageNSE Circular 14072020 1aniket guptaNo ratings yet

- To The Brink and Back Indias 1991 Story by Jairam Ramesh B015dy9idm PDFDocument5 pagesTo The Brink and Back Indias 1991 Story by Jairam Ramesh B015dy9idm PDFaniket guptaNo ratings yet

- List of Intl DelegatesDocument3 pagesList of Intl DelegatesAhsan Mohiuddin100% (1)

- Supreme Court: Jesus S. Anonat For Petitioner. Arturo M. Alinio For Private RespondentDocument5 pagesSupreme Court: Jesus S. Anonat For Petitioner. Arturo M. Alinio For Private RespondentShella Hannah SalihNo ratings yet

- Brown and White Scrapbook Elegant Company Profile PresentationDocument9 pagesBrown and White Scrapbook Elegant Company Profile PresentationJenny BayengNo ratings yet

- People v. SolidumDocument2 pagesPeople v. SolidumJames Amiel VergaraNo ratings yet

- Manalo vs. SistozaDocument6 pagesManalo vs. SistozaerforNo ratings yet

- M Maridoss V State Represented by The Inspector of Police Anr 405990Document21 pagesM Maridoss V State Represented by The Inspector of Police Anr 405990Abinaya KumarNo ratings yet

- Internation Police Organization Member CountriesDocument128 pagesInternation Police Organization Member CountriesReincar Angel Ruiz GarciaNo ratings yet

- Cervantes V FajardoDocument1 pageCervantes V Fajardogel94No ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument2 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledAbegail LeriosNo ratings yet

- Hon. Sto. Tomas v. Salac November 13 2012Document9 pagesHon. Sto. Tomas v. Salac November 13 2012bentley CobyNo ratings yet

- G.R. No. 139794: February 27, 2002 Martin S. Emin,,: Petitioner v. RespondentsDocument8 pagesG.R. No. 139794: February 27, 2002 Martin S. Emin,,: Petitioner v. Respondentschristopher d. balubayanNo ratings yet

- Congo V Belgium PDFDocument30 pagesCongo V Belgium PDFipmanaseNo ratings yet

- Astudillo Vs People 2Document17 pagesAstudillo Vs People 2Charm Divina LascotaNo ratings yet

- 2021 SCMR PDF File1 by AAMIR KhanDocument66 pages2021 SCMR PDF File1 by AAMIR KhanSamerNo ratings yet

- Admission and ConfessionDocument9 pagesAdmission and ConfessionAmmirul AimanNo ratings yet

- Types of LeasingDocument7 pagesTypes of LeasingsanjuNo ratings yet

- 4 Gujarat Prohibition Act, 1949Document29 pages4 Gujarat Prohibition Act, 1949Stannis SinghNo ratings yet

- RTI - Hydraulic Engineer - 03 - E04Document3 pagesRTI - Hydraulic Engineer - 03 - E04akash narNo ratings yet

- Court Documents: Dr. Jeffrey KamletDocument28 pagesCourt Documents: Dr. Jeffrey KamletPhil AmmannNo ratings yet

- Annexure GLDocument38 pagesAnnexure GLamit_mak72260% (2)

- SenatorsDirectory PDFDocument200 pagesSenatorsDirectory PDFSajhad HussainNo ratings yet

- History GabrielaDocument10 pagesHistory Gabrielaredbutterfly_766No ratings yet