Professional Documents

Culture Documents

Period of Protection Is Temporary - Renewable - Convertible - Lifetime Protection

Period of Protection Is Temporary - Renewable - Convertible - Lifetime Protection

Uploaded by

ayoob naderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Period of Protection Is Temporary - Renewable - Convertible - Lifetime Protection

Period of Protection Is Temporary - Renewable - Convertible - Lifetime Protection

Uploaded by

ayoob naderCopyright:

Available Formats

Term insurance

Life Whole life insurance

• Lifetime protection

• Period of protection is temporary

• Renewable • Generic name for a cash-value policy

• Called ordinary life insurance if premiums are payable

• Convertible throughout the lifetime of the insured and limited

payment life insurance if the premium period is less

than the insured’s lifetime

Yearly ble

renewa ghjhhh Variable Life Insurance

• Issued for a one-year period .

•The policyholder can renew for successive one-year periods and • Similar to a mutual fund maintained by the insurer.

convert to a cash-value تالالتنتنتنwith no evidence of insurability. • The death benefit and cash surrender values will increase or decrease

with the investment experience of the separate account.

5-,10-,15-,20-,25-,or 30-year term

Universal Life Insurance

• The premiums paid during the term period are level, but they increase

when the policy is renewed. • Unbundling of protection and saving component

• Two forms of universal life insurance

Term to age 65 • Considerable flexibility

• Provides protection to age 65, at which time the policyexpires • Cash withdrawals permitted

can converted to a permanent plan of insurance, but the decision to convert • Favorable income-tax treatment

must be exercised before age 65.

Indexed universal life insurance

Decreasing term • Minimum interest rate guarantee.

• The face amount gradually declines each year. • Additional interest may be credited to the policy and there is a formula

Reentry term for determining it.

• Renewal premiums are based on select (lower) mortality rates if the • Provide more complete disclosure than policies not federally regulated.

insured can periodically demonstrate acceptable evidence of insurability. Current assumption whole

Return of premium term insurance Variable Universal Life Insurance life insurance

• Product that returns the premiums at the end of the term period, • Sold as investments or tax shelters.

Endowment insurance

provided the insurance is still in force.

You might also like

- Life Insurance Basics EbookDocument11 pagesLife Insurance Basics Ebooknoexam1100% (3)

- Transmamerica FFIUL Client BrochureDocument24 pagesTransmamerica FFIUL Client BrochuredjdazedNo ratings yet

- Lloyds Solvency II Tutorial - and - CertificateDocument9 pagesLloyds Solvency II Tutorial - and - Certificatescribd4anoop100% (1)

- Period of Protection Is Temporary - Renewable - Convertible - Lifetime ProtectionDocument1 pagePeriod of Protection Is Temporary - Renewable - Convertible - Lifetime Protectionayoob naderNo ratings yet

- تااؤلؤلبلؤاؤلراتاتلاDocument1 pageتااؤلؤلبلؤاؤلراتاتلاayoob naderNo ratings yet

- - Period of protection is temporary - تااتانة Convertible - Lifetime protection -Document1 page- Period of protection is temporary - تااتانة Convertible - Lifetime protection -ayoob naderNo ratings yet

- - ىتلاتابؤلءبؤؤاعاات - تااتانة Convertible - Lifetime protection -Document1 page- ىتلاتابؤلءبؤؤاعاات - تااتانة Convertible - Lifetime protection -ayoob naderNo ratings yet

- Week 10 - Contracts Permanent InsuranceDocument28 pagesWeek 10 - Contracts Permanent InsuranceAayushi NaikNo ratings yet

- Chapter 5 & 6 - Risk Management & InsuranceDocument64 pagesChapter 5 & 6 - Risk Management & InsuranceLencho MusaNo ratings yet

- Life Insu Class-14Document23 pagesLife Insu Class-14saroj aashmanfoundationNo ratings yet

- Life Insurance ProductsDocument7 pagesLife Insurance ProductsalaguNo ratings yet

- Classification of Insurance - Life and NonDocument11 pagesClassification of Insurance - Life and NonbapparoyNo ratings yet

- Riskman 1Document23 pagesRiskman 1Jayvee M FelipeNo ratings yet

- Personal Finance-Types of Life InsuranceDocument12 pagesPersonal Finance-Types of Life InsurancePriyaNo ratings yet

- Session 3 Life Insurance Products: Conventional Plans - Non Participating PlansDocument30 pagesSession 3 Life Insurance Products: Conventional Plans - Non Participating Plansm_dattaiasNo ratings yet

- Chapter 7 (Annuities)Document11 pagesChapter 7 (Annuities)Khan AbdullahNo ratings yet

- Warren 09 14 12Document1 pageWarren 09 14 121hope819No ratings yet

- Finance For EveryoneDocument5 pagesFinance For Everyones.c.wangmo10No ratings yet

- 8-Life InsuranceDocument51 pages8-Life InsuranceKartik BhartiaNo ratings yet

- #14 Aesthetic MintDocument37 pages#14 Aesthetic MintPahilangco, ErikaNo ratings yet

- Life Insurance PolicyDocument8 pagesLife Insurance PolicyharshitaNo ratings yet

- TemplateDocument36 pagesTemplateSubhan Imran100% (1)

- Presentation1 SKDocument80 pagesPresentation1 SKSimran KhuranaNo ratings yet

- Chapter Five. Life InsuranceDocument51 pagesChapter Five. Life InsuranceDonald CrumpNo ratings yet

- Chapter 5 Insurance Companies635905675665434363Document37 pagesChapter 5 Insurance Companies635905675665434363Aastha RokkaNo ratings yet

- Unit 3 Life Insurance Products: ObjectivesDocument24 pagesUnit 3 Life Insurance Products: ObjectivesPriya ShindeNo ratings yet

- Topic 9 - Product Knowledge & Entreprenuer EmploybilityDocument63 pagesTopic 9 - Product Knowledge & Entreprenuer EmploybilityMUHAMMAD ZIKRI ZAINUDINNo ratings yet

- IV. Life InsuranceDocument3 pagesIV. Life InsurancelauraoldkwNo ratings yet

- Life InsuranceDocument15 pagesLife InsuranceJayme BainsNo ratings yet

- Learning Objective Life Insurance ProductsDocument25 pagesLearning Objective Life Insurance ProductsHelpdeskNo ratings yet

- Life Insu Class-13Document14 pagesLife Insu Class-13saroj aashmanfoundationNo ratings yet

- Chapter 5Document33 pagesChapter 5Yebegashet AlemayehuNo ratings yet

- Day 2-Participating PlansDocument19 pagesDay 2-Participating Plansm_dattaiasNo ratings yet

- Unit 3Document16 pagesUnit 3HimangshuNo ratings yet

- Chapter 6 (Classification of Policies)Document38 pagesChapter 6 (Classification of Policies)Khan AbdullahNo ratings yet

- Term Life InsuranceDocument3 pagesTerm Life InsuranceAbhishek TendulkarNo ratings yet

- HDFC Life Group Credit Protect Plus Insurance PlanDocument8 pagesHDFC Life Group Credit Protect Plus Insurance PlanManas Jain MJNo ratings yet

- Insurance: Source: WWW - Licindia.inDocument23 pagesInsurance: Source: WWW - Licindia.inRavi KumarNo ratings yet

- Insurance: Source: WWW - Licindia.inDocument23 pagesInsurance: Source: WWW - Licindia.inRavi KumarNo ratings yet

- Waheed Ali Siyal 174Document25 pagesWaheed Ali Siyal 174Waheed AliNo ratings yet

- Unit 5 - Types of InsuranceDocument56 pagesUnit 5 - Types of Insurancetptp1801No ratings yet

- IndiaFirst Smart Save Plan BrochureDocument16 pagesIndiaFirst Smart Save Plan BrochureVishal SharmaNo ratings yet

- All About Life ProtectionDocument37 pagesAll About Life ProtectionNilesh Shahji100% (1)

- HDFC Life Group Credit Protect Plus Insurance Plan20161128 093336 PDFDocument8 pagesHDFC Life Group Credit Protect Plus Insurance Plan20161128 093336 PDFSara LopezNo ratings yet

- MC0620179970 HDFC Life Group Credit Protect PlusDocument8 pagesMC0620179970 HDFC Life Group Credit Protect PlusAditya RajNo ratings yet

- Insurance ServiceDocument31 pagesInsurance Servicepjsv12345No ratings yet

- Principles of Insurance - NotesDocument4 pagesPrinciples of Insurance - NotesTarang SuriNo ratings yet

- Life Asia Insurance TrainingDocument81 pagesLife Asia Insurance TrainingCM100% (2)

- AnnutiesDocument6 pagesAnnutiesJyoshna NagothiNo ratings yet

- Types of Life InsuranceDocument65 pagesTypes of Life InsuranceLalit AyerNo ratings yet

- Managing Organization Risks of Death and Disability: - As A Part of The Organization's Own RiskDocument50 pagesManaging Organization Risks of Death and Disability: - As A Part of The Organization's Own RiskmohdsolahuddinNo ratings yet

- 13 - Life Insurance ContractsDocument3 pages13 - Life Insurance ContractsLevy LubindaNo ratings yet

- Risk CH 5 PDFDocument14 pagesRisk CH 5 PDFWonde BiruNo ratings yet

- Insurance Swot: Types of Insurance PoliciesDocument15 pagesInsurance Swot: Types of Insurance Policiespranav253No ratings yet

- Rashdullah Shah 133Document14 pagesRashdullah Shah 133Rashdullah Shah 133No ratings yet

- SinglifeSavvyInvest PrdtSumm Oct23Document19 pagesSinglifeSavvyInvest PrdtSumm Oct23NeoNo ratings yet

- LOMA 281 Module 2 Lesson 2 Cash Value Life Insurance Summary of Key PointsDocument1 pageLOMA 281 Module 2 Lesson 2 Cash Value Life Insurance Summary of Key PointslehunglhNo ratings yet

- Classes of Insurance: Learning ObjectivesDocument66 pagesClasses of Insurance: Learning ObjectivesIzzaty NurdiNo ratings yet

- GE1202 Managing Your Personal Finance: InsuranceDocument41 pagesGE1202 Managing Your Personal Finance: InsuranceAiden LANNo ratings yet

- Life Insurance Products & Terms PDFDocument16 pagesLife Insurance Products & Terms PDFSuman SinhaNo ratings yet

- 10 Insurance Lesson Factsheet 1Document7 pages10 Insurance Lesson Factsheet 1hlmd.blogNo ratings yet

- The Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1From EverandThe Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1No ratings yet

- - Period of protection is temporary - تااتانة Convertible - Lifetime protection -Document1 page- Period of protection is temporary - تااتانة Convertible - Lifetime protection -ayoob naderNo ratings yet

- تااؤلؤلبلؤاؤلراتاتلاDocument1 pageتااؤلؤلبلؤاؤلراتاتلاayoob naderNo ratings yet

- Period of Protection Is Temporary - Renewable - Convertible - Lifetime ProtectionDocument1 pagePeriod of Protection Is Temporary - Renewable - Convertible - Lifetime Protectionayoob naderNo ratings yet

- - ىتلاتابؤلءبؤؤاعاات - تااتانة Convertible - Lifetime protection -Document1 page- ىتلاتابؤلءبؤؤاعاات - تااتانة Convertible - Lifetime protection -ayoob naderNo ratings yet

- Chapter 0: Economics: The Core Issues: Multiple Choice QuestionsDocument107 pagesChapter 0: Economics: The Core Issues: Multiple Choice Questionsayoob naderNo ratings yet

- Chapter 5: The Competitive Firm: Multiple Choice QuestionsDocument98 pagesChapter 5: The Competitive Firm: Multiple Choice Questionsayoob naderNo ratings yet

- The Response of Life Insurance Pricing To Life SettlementsDocument24 pagesThe Response of Life Insurance Pricing To Life SettlementsNoura ShamseddineNo ratings yet

- Convention On Civil Liability Tor Damage Caused During Carriage of Dangerous Goods by Road, Rail and Inland Navigation Vessels (CRTD)Document23 pagesConvention On Civil Liability Tor Damage Caused During Carriage of Dangerous Goods by Road, Rail and Inland Navigation Vessels (CRTD)dipublicoNo ratings yet

- NMSC HandbookDocument11 pagesNMSC HandbookMay-an FernandezNo ratings yet

- Insurance and Wagering AgreementDocument3 pagesInsurance and Wagering AgreementPrasen Gundavaram100% (1)

- Insurance Regulatory Framework: Main Reasons For Insurance Regulation IrdaiDocument12 pagesInsurance Regulatory Framework: Main Reasons For Insurance Regulation IrdaiIndeevar SarkarNo ratings yet

- Fin263 Chapter 7-RemittanceDocument22 pagesFin263 Chapter 7-RemittanceMohamad Khairul100% (1)

- Project On Real EstateDocument15 pagesProject On Real EstateMahesh Satapathy100% (1)

- Brokers' Voice Survey Results - January 29th, 2021Document17 pagesBrokers' Voice Survey Results - January 29th, 2021Avishek JaiswalNo ratings yet

- 2018 DPRI Booklet Nov-19-18Document23 pages2018 DPRI Booklet Nov-19-18Maria Lourdes MahusayNo ratings yet

- A Report On Concurrence & Preference of CreditsDocument14 pagesA Report On Concurrence & Preference of CreditsHanna Mapandi80% (5)

- Malayan Insurance Co. Vs ArnaldoDocument2 pagesMalayan Insurance Co. Vs ArnaldoRenz AmonNo ratings yet

- Solutions Manual Chapter Fifteen: Answers To Chapter 15 QuestionsDocument6 pagesSolutions Manual Chapter Fifteen: Answers To Chapter 15 QuestionsBiloni KadakiaNo ratings yet

- MBA Project Report On Kotak Life InsuranceDocument61 pagesMBA Project Report On Kotak Life InsuranceCyberfunNo ratings yet

- Liability Only Policy - Private Bike: Policy Details Vehicle DetailsDocument1 pageLiability Only Policy - Private Bike: Policy Details Vehicle DetailsBhagya BeheraNo ratings yet

- May 24, 2013 Strathmore TimesDocument36 pagesMay 24, 2013 Strathmore TimesStrathmore TimesNo ratings yet

- Offer LetterDocument6 pagesOffer LetterKennet AlphyNo ratings yet

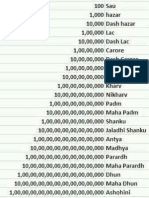

- Count On ZerosDocument3 pagesCount On Zerosmahendrasing2No ratings yet

- Isinwise 10.04.19Document3,498 pagesIsinwise 10.04.19AmanNo ratings yet

- Joint Living Trust Funding WorksheetDocument14 pagesJoint Living Trust Funding WorksheetRocketLawyerNo ratings yet

- Bankruptcy QuestionnaireDocument7 pagesBankruptcy QuestionnaireArasto FarsadNo ratings yet

- What Is Title Forensics?Document6 pagesWhat Is Title Forensics?daveafxNo ratings yet

- MORFXTDocument99 pagesMORFXTMilesNo ratings yet

- Nigerian Letter or "419" Fraud: Local FBI Office Federal Trade Commission's Complaint AssistantDocument7 pagesNigerian Letter or "419" Fraud: Local FBI Office Federal Trade Commission's Complaint AssistantHaiz LyneNo ratings yet

- TaxDocument43 pagesTaxSuman MehtaNo ratings yet

- ExpressPay DetailsDocument5 pagesExpressPay DetailsSai PastranaNo ratings yet

- Sanjay PandeyDocument153 pagesSanjay PandeySimon RileyNo ratings yet

- Applicable Laws On Retirement in The PhilippinesDocument26 pagesApplicable Laws On Retirement in The Philippinesbash021No ratings yet

- Practical Accounting 1Document14 pagesPractical Accounting 1Anonymous Lih1laaxNo ratings yet