Professional Documents

Culture Documents

Bharti Airtel Vodafone Idea: Basic Introductions About The Company

Uploaded by

vipul tuteja0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

BHARTI AIRTEL

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesBharti Airtel Vodafone Idea: Basic Introductions About The Company

Uploaded by

vipul tutejaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

BHARTI AIRTEL vs VODAFONE IDEA

BASIC INTRODUCTIONS ABOUT THE COMPANY

BHARTI AIRTEL

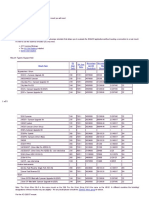

Bharti Airtel is the largest mobile telephony operator in the GSM space (2G) with 19.8% share

of the Indian wireless market (as at the end of FY18). The company, apart from being the largest

player in the mobile segment with subscribers in all the 22-telecom circles of the country, also

provides varied services like fixed line, broadband and retail internet access. During the period

FY12 to FY17, the company grew its sales and profits at average annual rates of 31% and 12%

respectively.

VODAFONE IDEA

Idea Cellular is the third largest operator in the GSM space with 12.3% share of the Indian

wireless telecom market (as at the end of FY12) and having a subscriber base of over 112.7 m.

The company provides services in all the 22 telecom circles. Idea has received 3G spectrum in

11 of its 22 circles. These circles contribute nearly 80% of Idea's total revenues and puts it in a

position of advantage over its peers. During the period FY06 to FY12, the company grew its

sales and profits at compounded annual rates of 37% and 23% respectively.

DIFFERENTIATING BETWEEN THE EQUITY SHARE

DEFFERENTIATING ABOUT THE AREA CIRCLE AND THE QUALITY

In terms of network, it is a fact that Vodafone has 4G in far lesser circles when compared to

Airtel. Quality of Vodafone networks used to be extremely good until last year. In research it

was founded that Vodafone is much more reliable than Airtel. The voice quality, data transfer

rates and connectivity met highest standards. However, on account of spectrum sharing recently,

it has degraded. As someone else answered, it may also be on account of subscriber overload.

Whatever the cause, as of today, you are going to be unhappy with both the networks. Airtel has

massive call drops and connectivity issues. Also, Airtel has a reputation for undisclosed charges

and unethical billing practices - be it prepaid or postpaid.

The focus is already shifting further towards service quality, with both Airtel and Vodafone

Idea talking up their 4G network improvement plans, while Jio has gone one step further with a

pledge to bring 5G to India before its rivals. And as mobile Video Experience gradually

improves, many operators are now forging content deals to attract subscribers and drive data use.

High levels of competition have put a lot of price pressure on India's operators. But this should

now abate — and relatively low levels of smartphone penetration and a vast customer base mean

there is still a fair bit of room for organic growth.

Airtel network beats rivals Jio and Vodafone-Idea

Airtel data network has performed better than main rivals Jio, Vodafone and Idea during the

Kumbh Mela in Prayagraj from January 14-March 4, 2019, according to Ookla report released

FUTURE ASPECT IN TELECOMMUNICATION INDUSTRY

India's regulator is planning to auction airwaves for 5G use this year, while the country is set to

get its first 5G-enabled phone before the end of 2019. But both Airtel and Vodafone Idea

are lobbying for a delay in the auction to allow them more time to upgrade existing networks to

4G and raise cash, while Vodafone is objecting to plans for an operator spectrum cap.

A recent report from Deloitte has estimated that the total investment required to cover India with

5G would be a staggering $70 billion — partly because the country lacks widespread fibre

backhaul infrastructure necessary for high-capacity networks. It's possible that India will see

consumer 5G next year. But initial launches are likely to be limited to key urban areas, while the

high cost of 5G devices is likely to make them prohibitive for the majority of Indians. There is

no doubt that 5G is coming — however, the average consumer on the subcontinent is unlikely to

feel the widespread benefits of the new technology for some years yet.

You might also like

- Age of Mobile Data: The Wireless Journey To All Data 4G NetworksFrom EverandAge of Mobile Data: The Wireless Journey To All Data 4G NetworksRating: 4.5 out of 5 stars4.5/5 (5)

- Strategic Issue of Reliance Jio - Sunit & RishiDocument7 pagesStrategic Issue of Reliance Jio - Sunit & RishiManju Philip100% (1)

- How Do You Think Adani's Entry in The Telecom Sector Will Impact The Telecom IndustryDocument4 pagesHow Do You Think Adani's Entry in The Telecom Sector Will Impact The Telecom IndustryANIKET KUMARNo ratings yet

- Is India Ready For 5GDocument6 pagesIs India Ready For 5GcoolNo ratings yet

- Airtel's Business Portfolio and Impact of 5G on Telecom SectorDocument12 pagesAirtel's Business Portfolio and Impact of 5G on Telecom SectorHimanshu Tandon100% (1)

- Services Marketing: Reliance JIO Infocomm LTDDocument18 pagesServices Marketing: Reliance JIO Infocomm LTDSibadittya BaidyaNo ratings yet

- BRM Interim ReportDocument11 pagesBRM Interim ReportVijeta BaruaNo ratings yet

- Company IdeaDocument8 pagesCompany IdeaishanNo ratings yet

- AnswerDocument6 pagesAnswerParagNo ratings yet

- Project Report: ON Comparative Analysis of Marketing Strategies of Reliance Jio & Bharti AirtelDocument23 pagesProject Report: ON Comparative Analysis of Marketing Strategies of Reliance Jio & Bharti AirtelSwapnil MohiteNo ratings yet

- 5G ReadyDocument6 pages5G ReadyRoshan JamesNo ratings yet

- Telecom Industry Research Paper OverviewDocument10 pagesTelecom Industry Research Paper Overviewvaishnav reddyNo ratings yet

- ReviewDocument26 pagesReviewakshaya akshayaNo ratings yet

- INTRO TO INDIAN TELECOMDocument21 pagesINTRO TO INDIAN TELECOMvineet tiwariNo ratings yet

- Chapter - 1: (Type Text)Document21 pagesChapter - 1: (Type Text)vineet tiwariNo ratings yet

- Jio Infocomm 5GDocument2 pagesJio Infocomm 5GPRUTHIBI PATTANAIKNo ratings yet

- Can Vodafone - CompetitionDocument8 pagesCan Vodafone - Competitiontinup333No ratings yet

- Safari - 21-Mar-2019 at 2:39 PMDocument1 pageSafari - 21-Mar-2019 at 2:39 PMRashmita GowdaNo ratings yet

- Swot Analysis of Bharti Airtel Mobile ServicesDocument6 pagesSwot Analysis of Bharti Airtel Mobile ServicesAnusree RavikumarNo ratings yet

- Strategic Marketing ManagementDocument4 pagesStrategic Marketing ManagementajayNo ratings yet

- Bharti Airtel, Idea Cellular Ratings Cut to Hold on Jio Launch ImpactDocument9 pagesBharti Airtel, Idea Cellular Ratings Cut to Hold on Jio Launch Impactarun_algoNo ratings yet

- Individual Assignment - Facebook-Jio DealDocument6 pagesIndividual Assignment - Facebook-Jio DealParagNo ratings yet

- Research On Consumer Preference On India's Best Network AIRTEL & JIODocument33 pagesResearch On Consumer Preference On India's Best Network AIRTEL & JIOmirajNo ratings yet

- Vodafone's plans for 5G data servicesDocument2 pagesVodafone's plans for 5G data servicesPokemon EpisodesNo ratings yet

- India Wired Broadband Market Report 2023 AdoptionDocument3 pagesIndia Wired Broadband Market Report 2023 Adoptionjeelpadsumbiya709No ratings yet

- Analysis of Airtel's Sales & Distribution in IndiaDocument13 pagesAnalysis of Airtel's Sales & Distribution in IndiaRadhika SinhaNo ratings yet

- Executive Summary VodafoneDocument2 pagesExecutive Summary VodafoneShah Suzane100% (1)

- Casestudy:-Indian Telecom War: Startup Reliance Takes On Leader Airtel in 4G ServicesDocument7 pagesCasestudy:-Indian Telecom War: Startup Reliance Takes On Leader Airtel in 4G ServicesPunith Kumar ReddyNo ratings yet

- 1.1.1 Indian Telecom Market OverviewDocument7 pages1.1.1 Indian Telecom Market Overviewmaharshi patelNo ratings yet

- Telecom IndustryDocument15 pagesTelecom Industrymanish panwarNo ratings yet

- Role of Government and Impact of Jio on India's Growing Telecom SectorDocument20 pagesRole of Government and Impact of Jio on India's Growing Telecom Sectorshubham tikekarNo ratings yet

- SWOT JioDocument3 pagesSWOT JioAmal Raj SinghNo ratings yet

- SWOT Analysis On Jio: StrengthDocument3 pagesSWOT Analysis On Jio: StrengthAmal Raj SinghNo ratings yet

- 5G Newsletter India's Growth ModifiedDocument7 pages5G Newsletter India's Growth ModifiedAshish ShakyaNo ratings yet

- ME TERM 1 ReportDocument5 pagesME TERM 1 ReportDeep GhoshNo ratings yet

- Indian Telecom Industry Report on 5G Readiness and Spectrum CostsDocument12 pagesIndian Telecom Industry Report on 5G Readiness and Spectrum CostsHEM BANSALNo ratings yet

- Review of LiteratureDocument3 pagesReview of LiteratureMehul ThakkarNo ratings yet

- Airtel-Overview of India's 2nd Largest Telecom OperatorDocument3 pagesAirtel-Overview of India's 2nd Largest Telecom OperatorAditya ChitaliyaNo ratings yet

- Marketing Strategies of TelecommunicationDocument55 pagesMarketing Strategies of TelecommunicationGovind LahotiNo ratings yet

- Vodafone Idea LimitedDocument5 pagesVodafone Idea LimitedPriya ParmarNo ratings yet

- Customer Perception Analysis of Jio & Airtel 4G Services in KolkataDocument18 pagesCustomer Perception Analysis of Jio & Airtel 4G Services in KolkataABHISEKH SARKARNo ratings yet

- Jio SM ReportDocument9 pagesJio SM ReportANUSHKANo ratings yet

- Wimax: India Broadband & Wimax Market AnalysisDocument7 pagesWimax: India Broadband & Wimax Market AnalysisMaansi BhasinNo ratings yet

- BRM1Document12 pagesBRM1Dhruv YadavNo ratings yet

- Bharti Airtel: India's Leading Telecom ProviderDocument6 pagesBharti Airtel: India's Leading Telecom ProviderTata Pavan KumarNo ratings yet

- Swot Analysis of Bharti AirtelDocument4 pagesSwot Analysis of Bharti AirtelvinothNo ratings yet

- JIO Vs AirtelDocument8 pagesJIO Vs AirtelAnurag ChaudharyNo ratings yet

- FAS47A2 - Vodafone Idea - MRDocument8 pagesFAS47A2 - Vodafone Idea - MRShivangi AroraNo ratings yet

- CONSUMER, FIRMS AND BHARTI AIRTELDocument12 pagesCONSUMER, FIRMS AND BHARTI AIRTEL202022030 imtnagNo ratings yet

- Bharti Airtel EPS to Double by 2014 on Improving ProfitabilityDocument7 pagesBharti Airtel EPS to Double by 2014 on Improving ProfitabilitySubhankar BarikNo ratings yet

- Case Study On Business Policy & Strategy Adopted by AirtelDocument14 pagesCase Study On Business Policy & Strategy Adopted by Airtelbhumika nagiNo ratings yet

- Case study on Airtel's business strategies for growth and competitivenessDocument14 pagesCase study on Airtel's business strategies for growth and competitivenessbhumika nagiNo ratings yet

- I O R J O T I I I: Mpact F Eliance IO N Elecom Ndustry N NdiaDocument3 pagesI O R J O T I I I: Mpact F Eliance IO N Elecom Ndustry N NdiamitNo ratings yet

- Reliance JIO - OpportunityDocument19 pagesReliance JIO - OpportunitysumitNo ratings yet

- RISE AND FALL OF VODAFONE INDIADocument20 pagesRISE AND FALL OF VODAFONE INDIATharunNo ratings yet

- 5G, The World of PossibilitiesDocument3 pages5G, The World of PossibilitiesrajeevNo ratings yet

- Airtel Company ProfileDocument4 pagesAirtel Company ProfilemanojNo ratings yet

- Recruitment Selection in Bharti Airtel Services LTD FinalDocument69 pagesRecruitment Selection in Bharti Airtel Services LTD Finalshalucoolgirl_girl09No ratings yet

- Alhad 504-AirtelDocument11 pagesAlhad 504-AirtelAlhad PosamNo ratings yet

- Pgma1947 - Vipul - PM - Indivi3.docx - VIPUL TUTEJADocument12 pagesPgma1947 - Vipul - PM - Indivi3.docx - VIPUL TUTEJAvipul tutejaNo ratings yet

- Alias Grace Explores Different Types of ImprisonmentDocument7 pagesAlias Grace Explores Different Types of Imprisonmentvipul tutejaNo ratings yet

- AbhiDocument2 pagesAbhivipul tutejaNo ratings yet

- Pgmb1913 Gaurang IndividualDocument6 pagesPgmb1913 Gaurang Individualvipul tutejaNo ratings yet

- Running Head: THE PERT MUSTANG 1Document13 pagesRunning Head: THE PERT MUSTANG 1vipul tutejaNo ratings yet

- Individual Assignment: Does Teamwork Pay?Document4 pagesIndividual Assignment: Does Teamwork Pay?vipul tutejaNo ratings yet

- Project Management: Individual AssignmentDocument4 pagesProject Management: Individual Assignmentvipul tutejaNo ratings yet

- HMS Pinafore Case Study AnalysisDocument5 pagesHMS Pinafore Case Study Analysisvipul tutejaNo ratings yet

- Akul Tuteja Essay 1Document5 pagesAkul Tuteja Essay 1vipul tutejaNo ratings yet

- SEO w17432 PDF EngDocument14 pagesSEO w17432 PDF EngJose Luis HuamánNo ratings yet

- Pharma Sector Profile - Spain's Growing Pharma IndustryDocument1 pagePharma Sector Profile - Spain's Growing Pharma Industryvipul tutejaNo ratings yet

- Case Study-Pert MustangDocument4 pagesCase Study-Pert Mustangvipul tuteja100% (1)

- Case Analysis 1: This Study Resource WasDocument5 pagesCase Analysis 1: This Study Resource Wasvipul tutejaNo ratings yet

- Individual Assignment: Does Teamwork Pay?Document4 pagesIndividual Assignment: Does Teamwork Pay?vipul tutejaNo ratings yet

- Ingot Market - Shankhadeep BanerjeeDocument38 pagesIngot Market - Shankhadeep Banerjeevipul tutejaNo ratings yet

- Spectrum Brands: Situation AnalysisDocument6 pagesSpectrum Brands: Situation Analysisvipul tutejaNo ratings yet

- Case Analysis 1: Spectrum Brands Inc. - The Sales Force DilemmaDocument6 pagesCase Analysis 1: Spectrum Brands Inc. - The Sales Force Dilemmavipul tutejaNo ratings yet

- Time For Team Members To Appreciate Each Other's SkillsDocument3 pagesTime For Team Members To Appreciate Each Other's Skillsvipul tutejaNo ratings yet

- 7 11 Japan Case StudyDocument23 pages7 11 Japan Case Studyvipul tutejaNo ratings yet

- OM ProjectDocument12 pagesOM ProjectKushal Sundar Shrestha86% (7)

- Ingot Market - 6WResearch - VipulDocument41 pagesIngot Market - 6WResearch - Vipulvipul tutejaNo ratings yet

- Seven-Eleven Japan Supply Chain StrategiesDocument6 pagesSeven-Eleven Japan Supply Chain StrategiesUsman Asif78% (9)

- 7-11 JapanDocument17 pages7-11 JapanJoJo ChinNo ratings yet

- "Match Your Sales Force Structure To Your Business Life Cycle"Document3 pages"Match Your Sales Force Structure To Your Business Life Cycle"vipul tutejaNo ratings yet

- RD Ingot MarketDocument1 pageRD Ingot Marketvipul tutejaNo ratings yet

- RD Ingot MarketDocument1 pageRD Ingot Marketvipul tutejaNo ratings yet

- Seven ElevenDocument23 pagesSeven ElevenAnang HartantoNo ratings yet

- Seven Eleven Case StudyDocument3 pagesSeven Eleven Case StudyAshish Shadija100% (2)

- 131 MCQSDocument14 pages131 MCQSSakthi Royalhunter66% (67)

- Marketing Management (MKT 201)Document28 pagesMarketing Management (MKT 201)vipul tutejaNo ratings yet

- Sample - Table - Literature ReviewDocument11 pagesSample - Table - Literature ReviewKeyur KevadiyaNo ratings yet

- Installation of ESRS Virtual Edition (ESRSVE) On VMwareDocument58 pagesInstallation of ESRS Virtual Edition (ESRSVE) On VMwaremummy206No ratings yet

- Stuxnet: February 2018Document17 pagesStuxnet: February 2018Schubert BalizaNo ratings yet

- RPT InventoryDocument74 pagesRPT InventoryISAM AHMEDNo ratings yet

- A Project Report On Knowledge ManagementDocument6 pagesA Project Report On Knowledge ManagementBharati KudambalNo ratings yet

- Method Taken From Spirax Sarco Technical Guidance: Calculation No.: Sheet: Device Tag: DescriptionDocument9 pagesMethod Taken From Spirax Sarco Technical Guidance: Calculation No.: Sheet: Device Tag: Descriptionfahmi0% (1)

- E-mail Encryption Project ReportDocument15 pagesE-mail Encryption Project Reportishant7890No ratings yet

- Megahertz Internet Network Pvt. LTD.: Retail InvoiceDocument1 pageMegahertz Internet Network Pvt. LTD.: Retail InvoiceAyush ThapliyalNo ratings yet

- Faizan Ur Rehman CVDocument3 pagesFaizan Ur Rehman CVHawabaz AwanNo ratings yet

- Matlab Code For Digital Modulation TechniquesDocument25 pagesMatlab Code For Digital Modulation TechniquesRam Murthy100% (1)

- Name Synopsis Description: Curl (Options) (URL... )Document35 pagesName Synopsis Description: Curl (Options) (URL... )yo goloNo ratings yet

- Structure of A C++Document3 pagesStructure of A C++All TvwnzNo ratings yet

- Saved Copy Internship 1Document1 pageSaved Copy Internship 1Mu Jta BaNo ratings yet

- Week 4 INFS6018 - S1 2023 - WorkshopDocument16 pagesWeek 4 INFS6018 - S1 2023 - Workshop496068808No ratings yet

- ZXUN USPP Load BalancingDocument69 pagesZXUN USPP Load BalancingTawhid AlamNo ratings yet

- FCO560 Users Guide Issue 2aDocument63 pagesFCO560 Users Guide Issue 2aJames Mason100% (1)

- SET UP EQMOD SOFTWARE FOR ASTROPHOTOGRAPHYDocument5 pagesSET UP EQMOD SOFTWARE FOR ASTROPHOTOGRAPHYMechtatel HrenovNo ratings yet

- DS-2CD2083G0-I: 8 MP Outdoor IR Fixed Bullet CameraDocument3 pagesDS-2CD2083G0-I: 8 MP Outdoor IR Fixed Bullet CameraRosemarie JimenezNo ratings yet

- Check-Lists D'inspectionDocument43 pagesCheck-Lists D'inspectionElisee93% (29)

- RG Coaxial Cable Types and SpecsDocument8 pagesRG Coaxial Cable Types and SpecsedgarputongNo ratings yet

- MKT V-5esc Installation GuideDocument31 pagesMKT V-5esc Installation GuidePrudzNo ratings yet

- Lufthansa Technical Training Troubleshooting Fundamentals CourseDocument160 pagesLufthansa Technical Training Troubleshooting Fundamentals CourseBELISARIONo ratings yet

- Civil/Structural Calculation SheetDocument19 pagesCivil/Structural Calculation Sheetfbaxter22No ratings yet

- Control Valves PDFDocument21 pagesControl Valves PDFRiyadh DaoudiNo ratings yet

- Cambridge English Empower B2 Progress Test: Student NameDocument12 pagesCambridge English Empower B2 Progress Test: Student NameCheto CepedaNo ratings yet

- Vb2012me Preview PDFDocument39 pagesVb2012me Preview PDFsomaliyow17No ratings yet

- Agile vs Waterfall: Which Project Methodology is BestDocument29 pagesAgile vs Waterfall: Which Project Methodology is BestAhmad Adeniyi SharafudeenNo ratings yet

- All Motor, &electrical Equipment in StorDocument8 pagesAll Motor, &electrical Equipment in StorMd. Saddam HossainNo ratings yet

- + - OSDI2020-FIRM - An Intelligent Fine-Grained Resource Management Framework For SLO-Oriented MicroservicesDocument22 pages+ - OSDI2020-FIRM - An Intelligent Fine-Grained Resource Management Framework For SLO-Oriented MicroservicesBENKEMCHI OussamaNo ratings yet

- PLC Based Traffic Control System ReportDocument51 pagesPLC Based Traffic Control System ReportAbhijeet Shinde73% (26)