Professional Documents

Culture Documents

Depreciation Sum-Pg1

Uploaded by

Dip KunduOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Sum-Pg1

Uploaded by

Dip KunduCopyright:

Available Formats

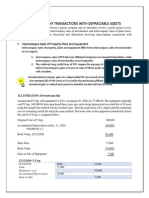

DEPRECIATION, PBOV]SIONS AND RESERVES

9.21

Difference between Straight Line Method and Diminishing

Barance Method

tten Down l As per straight Line Method, the written-down

value of the asset over its useful life becomes

Llue at the b't,':99'Diminishing Balance Method, there must have been nil,

losing some written-down value over its

c useful life since the amount of depreciation graduaily

Rs.

a".**", yuar after year.

However, the points of distinction between the two

are:

80,000 Straight Line Method Diminishing Balance Method

1. Under this method amount of depre- l, Under this method amount

64,000 ciation remains fixed vear after year of depre_

ciation varies from year to year since it is

which is written-off calculated on written-down value.

51 ,200 2. Depreciation is calculated on the original 2. Depreciation is calculated on the

cost of the asset. down value of the assets.

40,960 3. The written-down value of the asset over 3. The written-down value of the asset can

its useful life becomes nil since equal never be nil over its useful life.

32,768 amount of depreclation is written_off for a

fixed period.

re (WDV) o1 4. The effect of depreciation on profit The effect of depreciation on profit varies

10,000, Ioss remains same year after year since the from year to year since the amount is

amount is fixed. variable.

'the asset as 5. ln case of addition to assets, deprbciation ln case of addition, depreciation is not

is ca lculated separately. separately calculated since it is computed

on total written-down value of the assets.

decrease in This method is mostly suitable for less This method is suitable for costlv assets

costly assets, e.g. Furniture and Fixture viz., Plant and Machinery.

and which depreciates due to effluxion of

lenefit more

time e.g. Patent, Trade-Marks, etc.

rould reflect

ortion of the 7. Usually a lower rate of percentage is to be Usually a higher rate of depreciation

'iods than in taken into consideration for cllculating taken into consideration since it

the amount of depreciation. calculated on W.D.V.

tion are not

lllustration 9.5

* on .l.1.2000,

a machine was purchased for Rs. 1,00,000. on 30.9.2002,

was purchased for Rs. 20,000, installation expenses being Rs.

a new machine

re impact ol 5,000.

Show the Machinery Account up to 3lst Dec.2003, assuming that the rate of depreciation

was 107o on Reducing Balance Method.

Solution

rless the rate

ln the books of ........

Machinery Account

:e the cost oi

t of reduceo

Date

Cr.

Amount

2000 Rs. 2000

s impossible -l-o Rs.

Jan. i Bank A,/c 1,00,000 Dec. 31 By Depreciation

o the written Nc 10,000

Balance c/d 90,000

1"00"000

ilggm

Contd.

You might also like

- An Overview On Venture Capital FinancingDocument4 pagesAn Overview On Venture Capital FinancingJoysree 1111No ratings yet

- AC216 Unit 3 Assignment 4 - Depreciation Methods MorganDocument2 pagesAC216 Unit 3 Assignment 4 - Depreciation Methods MorganEliana MorganNo ratings yet

- Pdf. Mira Report 2 PDFDocument40 pagesPdf. Mira Report 2 PDFNurul AfifahNo ratings yet

- CE22 13 DepreciationDocument59 pagesCE22 13 DepreciationHahns Anthony GenatoNo ratings yet

- INTEREST RATES DETERMINATION AND STRUCTURE-finalDocument12 pagesINTEREST RATES DETERMINATION AND STRUCTURE-finalPaula Rodalyn MateoNo ratings yet

- RAMON P. JACINTO and JAIME J. COLAYCO, Petitioners, vs. FIRST WOMENS CREDIT CORPORATION, Represented in This Derivative Suit by SHIG KATAYAMA, RespondentsDocument6 pagesRAMON P. JACINTO and JAIME J. COLAYCO, Petitioners, vs. FIRST WOMENS CREDIT CORPORATION, Represented in This Derivative Suit by SHIG KATAYAMA, RespondentsVic Cajurao0% (1)

- FAFVPL-FAFVOCI IARev RLPDocument2 pagesFAFVPL-FAFVOCI IARev RLPBrian Daniel BayotNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Legal DD Checklist PDFDocument9 pagesLegal DD Checklist PDFbestdealsNo ratings yet

- Business Combination ExerciseDocument5 pagesBusiness Combination Exercise수지No ratings yet

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- Chapter Six Depreciations and Corporate TaxesDocument43 pagesChapter Six Depreciations and Corporate TaxesRoman AliNo ratings yet

- Lower of Cost and Net Realizable ValueDocument3 pagesLower of Cost and Net Realizable ValueMae Loto100% (1)

- IAS 36 MCQ AnswersDocument3 pagesIAS 36 MCQ AnswersUmar bin AsfarNo ratings yet

- Notes DepreciationDocument6 pagesNotes DepreciationFranshwa SalcedoNo ratings yet

- Adobe Scan 09-Mar-2023Document2 pagesAdobe Scan 09-Mar-2023Shagun KumarNo ratings yet

- This Study Resource Was: Question 3. Blindfold Technologies Inc. (BTI) Is Considering Whether To Introduce A NewDocument2 pagesThis Study Resource Was: Question 3. Blindfold Technologies Inc. (BTI) Is Considering Whether To Introduce A NewFaradibaNo ratings yet

- Accounting Standard 2Document18 pagesAccounting Standard 2Tushar Gauba0% (1)

- Depreciation MethodDocument3 pagesDepreciation MethoddreaammmNo ratings yet

- Solution Aassignments CH 9Document10 pagesSolution Aassignments CH 9RuturajPatilNo ratings yet

- 03 Reconstitution of Partnership Admission of Partner PDFDocument24 pages03 Reconstitution of Partnership Admission of Partner PDFBrawler Stars100% (3)

- Depreciation AccountingDocument11 pagesDepreciation AccountingSwati KhandelwalNo ratings yet

- Lecture-7 Cost of EqptDocument35 pagesLecture-7 Cost of EqpthayelomNo ratings yet

- Depreciation AccountingDocument11 pagesDepreciation Accountingmanimeraj506iNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument12 pages© The Institute of Chartered Accountants of IndiaMiku JainNo ratings yet

- MODULE 6 - Chapter 8 - ANSWERSDocument3 pagesMODULE 6 - Chapter 8 - ANSWERSArmer MacalintalNo ratings yet

- Depreciation AccountingbyPraveenSirDocument11 pagesDepreciation AccountingbyPraveenSiruptec kprNo ratings yet

- Depreciation: Part - A: Theory SectionDocument19 pagesDepreciation: Part - A: Theory SectionDivya Punjabi0% (1)

- Chap 12,13, and 14Document6 pagesChap 12,13, and 14Mary Claudette UnabiaNo ratings yet

- Cost Cost Model or Revaluation ModelDocument7 pagesCost Cost Model or Revaluation ModelANo ratings yet

- Accounting (Depreciation)Document15 pagesAccounting (Depreciation)heynuhh gNo ratings yet

- Depreciation of Non-Current AssetsDocument3 pagesDepreciation of Non-Current AssetsMahediNo ratings yet

- DepreciationDocument11 pagesDepreciationLuis HuangNo ratings yet

- Topic 10Document15 pagesTopic 10SUREINTHARAAN A/L NATHAN / UPMNo ratings yet

- CH 10Document24 pagesCH 10Jannatul FerdousNo ratings yet

- Accounting Treatment of DepreciationDocument19 pagesAccounting Treatment of Depreciationraj shahNo ratings yet

- Chapter 6Document40 pagesChapter 6vukicevic.ivan5No ratings yet

- CA-Inter-Accounts Iqtdar-MalikDocument31 pagesCA-Inter-Accounts Iqtdar-MalikSUMANTO BARMANNo ratings yet

- Property Plant and Equipment - RevaluationDocument4 pagesProperty Plant and Equipment - RevaluationpolxrixNo ratings yet

- Kasus PPAK 1 (Kel 1) Jawaban AgusDocument6 pagesKasus PPAK 1 (Kel 1) Jawaban AgusagusriantoNo ratings yet

- DepreciationDocument1 pageDepreciationKaylee JoosteNo ratings yet

- GRADE 11 Lesson Notes On Other Adjustments To Final Accounts ACCRUALS AND PREPAYMENTS SEPT 2023Document11 pagesGRADE 11 Lesson Notes On Other Adjustments To Final Accounts ACCRUALS AND PREPAYMENTS SEPT 2023kxngdawkinz20No ratings yet

- Nov-Dec 2012Document11 pagesNov-Dec 2012Usuf JabedNo ratings yet

- Adjusting Entries NotesDocument5 pagesAdjusting Entries NoteswingNo ratings yet

- Financial ManagementDocument13 pagesFinancial Managementco.harshii.agrawalNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts ReceivableJocel CaoNo ratings yet

- Accounting For Long Term Assets Property Plant and Equipment (Ias 16)Document7 pagesAccounting For Long Term Assets Property Plant and Equipment (Ias 16)ZAKAYO NJONYNo ratings yet

- Depreciation: Definitions of ValueDocument5 pagesDepreciation: Definitions of ValueRonald Renon QuiranteNo ratings yet

- Declining Balance Method of Depreciation: - Sajan Mahat Roll No.: 30Document13 pagesDeclining Balance Method of Depreciation: - Sajan Mahat Roll No.: 30Python SMNo ratings yet

- Tax Planning PapersDocument14 pagesTax Planning PapersPrem ManiNo ratings yet

- Latihan Jurnal Khusus Praktika Akuntansi Per. DagangDocument14 pagesLatihan Jurnal Khusus Praktika Akuntansi Per. DagangAzka Yasfa UgaNo ratings yet

- Vessels Value Methodology Discounted Cash Flow Model 2016Document4 pagesVessels Value Methodology Discounted Cash Flow Model 2016Omaid TariqNo ratings yet

- Investment Outlays: Long-Term AssetsDocument12 pagesInvestment Outlays: Long-Term AssetsRimpy SondhNo ratings yet

- Depreciation Accounting & Methods: Dr. Pallavi IngaleDocument37 pagesDepreciation Accounting & Methods: Dr. Pallavi IngalePallavi IngaleNo ratings yet

- TC Lecture 04 Fixed AssetsDocument4 pagesTC Lecture 04 Fixed AssetsmhrizwanNo ratings yet

- Chapter 8Document38 pagesChapter 8Taurai Mamire100% (2)

- 11th Accountancy EM Half Yearly Exam 2023 Question Paper With Answer Keys Madurai District English Medium PDF DownloadDocument13 pages11th Accountancy EM Half Yearly Exam 2023 Question Paper With Answer Keys Madurai District English Medium PDF DownloadDr.ManogaranNo ratings yet

- Adjustments - The Last Passenger's On The Plane.: The Journey To The Final AccountsDocument35 pagesAdjustments - The Last Passenger's On The Plane.: The Journey To The Final AccountsAreeb IqbalNo ratings yet

- MTP 12 14 Answers 1696416138Document13 pagesMTP 12 14 Answers 1696416138harshallahotNo ratings yet

- Partnership Final Accounts: Tar EtDocument40 pagesPartnership Final Accounts: Tar EtVenkatesh Ramchandra100% (3)

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaSanjay SahuNo ratings yet

- #22 Revaluation & Impairment (Notes For 6206)Document5 pages#22 Revaluation & Impairment (Notes For 6206)Claudine DuhapaNo ratings yet

- Finnncial AnalysisDocument8 pagesFinnncial Analysisharish chandraNo ratings yet

- 73264bos59105 Inter P1aDocument12 pages73264bos59105 Inter P1aRaish QURESHINo ratings yet

- Adobe Scan 11-Nov-2022Document2 pagesAdobe Scan 11-Nov-2022Suthersan SoundarrajNo ratings yet

- Depreciation: Historical MethodsDocument19 pagesDepreciation: Historical MethodsKiran PatilNo ratings yet

- 3 Addition: One MoreDocument10 pages3 Addition: One MoreDip KunduNo ratings yet

- Numbers From One To Nine 2: As Many AsDocument30 pagesNumbers From One To Nine 2: As Many AsDip KunduNo ratings yet

- 4 Subtraction: Take AwayDocument8 pages4 Subtraction: Take AwayDip KunduNo ratings yet

- 1 Shapes and Space: Inside - OutsideDocument20 pages1 Shapes and Space: Inside - OutsideDip KunduNo ratings yet

- Theories of Costing & Cost AccountingDocument5 pagesTheories of Costing & Cost AccountingDip KunduNo ratings yet

- Cash Flow Statement & Replacement Analysis PDFDocument7 pagesCash Flow Statement & Replacement Analysis PDFDip KunduNo ratings yet

- Capital Budgeting TechniquesDocument11 pagesCapital Budgeting TechniquesDip KunduNo ratings yet

- Cost Accounting TheoriesDocument2 pagesCost Accounting TheoriesDip KunduNo ratings yet

- Final Accounts Theory and Structures PDFDocument1 pageFinal Accounts Theory and Structures PDFDip KunduNo ratings yet

- SUR G: Story by Diptesh KunduDocument7 pagesSUR G: Story by Diptesh KunduDip KunduNo ratings yet

- Stone Ridge 2020 Shareholder LetterDocument16 pagesStone Ridge 2020 Shareholder LetterLuis Felipe MartinsNo ratings yet

- Solutions For Non-Constant Growth Stock ValuationsDocument2 pagesSolutions For Non-Constant Growth Stock ValuationsNguyễn Bá Khánh TùngNo ratings yet

- Introducción A Las Finanzas Corporativas: Tarea Capítulos 10, 11 y 13Document15 pagesIntroducción A Las Finanzas Corporativas: Tarea Capítulos 10, 11 y 13gerardoNo ratings yet

- SC - Terms and ConditionsDocument12 pagesSC - Terms and ConditionsAbdul AlimNo ratings yet

- An Analysis On Systematic Investment Plan of Motilal Oswal: AT Karvy Stock Broking LimitedDocument91 pagesAn Analysis On Systematic Investment Plan of Motilal Oswal: AT Karvy Stock Broking LimitedShiaa namdevNo ratings yet

- Accounting For Financial ManagementDocument54 pagesAccounting For Financial ManagementEric RomeroNo ratings yet

- Tesla Forecasting 2020-3Document19 pagesTesla Forecasting 2020-3Santiago Prada CruzNo ratings yet

- We Fi Annual Report 2022 CompressedDocument94 pagesWe Fi Annual Report 2022 CompressedCariElpídioNo ratings yet

- Impact of Firm Specific Variables On Dividend Payout of Nepalese BanksDocument13 pagesImpact of Firm Specific Variables On Dividend Payout of Nepalese BanksMani ManandharNo ratings yet

- NIFTY: 11073 BANK NIFTY: 21646: 20 Days 50 Days 200 Days 20 Days 50 Days 200 DaysDocument3 pagesNIFTY: 11073 BANK NIFTY: 21646: 20 Days 50 Days 200 Days 20 Days 50 Days 200 DaysKiran KudtarkarNo ratings yet

- A Study On Mutual Funds With Due Reference To Sbi Mutual FundsDocument8 pagesA Study On Mutual Funds With Due Reference To Sbi Mutual FundskomalNo ratings yet

- What Is Diversification?Document4 pagesWhat Is Diversification?Jonhmark AniñonNo ratings yet

- Key - Stocks & Shares (Equities) VocabularyDocument1 pageKey - Stocks & Shares (Equities) VocabularyNguyen HuyenNo ratings yet

- Portfolio Diversification: Building A Passive Portfolio With EtfsDocument5 pagesPortfolio Diversification: Building A Passive Portfolio With EtfsJeremy LoobsNo ratings yet

- ALTIOS: 30 Years Old, An International Success StoryDocument6 pagesALTIOS: 30 Years Old, An International Success StoryMV AltiosNo ratings yet

- SM - HUL FinancialsDocument7 pagesSM - HUL FinancialsAAYUSH SHARMA 1927501No ratings yet

- Market Riask of Ambee PharmaDocument12 pagesMarket Riask of Ambee PharmaSabbir ZamanNo ratings yet

- Project Report On Capital BudgetingDocument9 pagesProject Report On Capital BudgetingLeena SahuNo ratings yet

- EMH FaheemDocument34 pagesEMH FaheemMohammad Faheem HasanNo ratings yet

- MBA CapitalBudgetingDocument34 pagesMBA CapitalBudgetinganvita raoNo ratings yet

- Prospectus QT Fund LTD PDFDocument114 pagesProspectus QT Fund LTD PDFtjjnycNo ratings yet

- BCG MatrixDocument10 pagesBCG MatrixshoaibmirzaNo ratings yet