Professional Documents

Culture Documents

12 Accountancy Lyp 2012 Set1

Uploaded by

SeasonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Accountancy Lyp 2012 Set1

Uploaded by

SeasonCopyright:

Available Formats

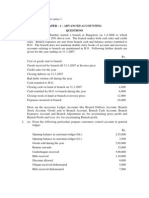

Question

Paper 2012 Delhi set 1

CBSE Class 12 ACCOUNTANCY

General Instruction:

(i) This question paper contains three parts A, B and C.

(ii) Part A is compulsory for all candidates.

(iii) Candidates can attempt only one part of the remaining part B and C.

(iv) All parts of the questions should be attempted at one place.

Part A

(Accounting for Not-For-Profit Organisations, Partnership Firms and Companies)

1. For what share of Goodwill a partner is entitled at the time of his retirement? (1)

2. Name the financial statement prepared by a Not-For-Profit Organisation on accrual basis.

(1)

3. Give any one advantage for the redemption of debentures by purchase in the open

market? (1)

4. State the provisions of Indian Partnership Act regarding the payments of remuneration to

a partner for the service rendered. (1)

5. State any two occasions on which a firm can be reconstituted. (1)

6. Jain ltd. purchased Building Rs. 10,00,000 from Gupta Ltd. 10% of the payable amount was

paid by a cheque drawn in favour of Gupta Ltd. The balance was paid by issue of Equity

shares of Rs. 10 each at a discount of 10%.

Pass necessary Journal Entries in the books of Jain Ltd. (3)

7. Narain Laxmi Ltd. invited applications for issuing 7500, 12% Debentures of Rs 100 each at

a premium of Rs. 35 per Debentures. The full amount was payable on application.

Applications were received for 10,000 Debentures. Applications for 2500 Debentures were

rejected and the application money was refunded. Debentures were allotted to the

Material downloaded from myCBSEguide.com. 1 / 9

remaining applicants.

Pass necessary Journal Entries for the above transactions in the books of Narain Laxmi Ltd.

(3)

8. From the following information, calculate the amount of income from subscriptions to be

shown in the Income and Expenditure Account for the year ended 13.3.2011: (3)

Subscriptions received during the year 2010 – 2011 Rs. 3,40,000

Subscriptions outstanding as on 31.3.2011 RS. 47,000

Subscription received in advance as on 31.3.2011 Rs. 35,000

Subscriptions outstanding as on 1.4.2010 Rs. 28,000

Subscription received in advance as on 1.4.2010 Rs. 25,000

9. Arjun, Bhim and Nakul are partners sharing profits & losses in the ratio of 14 : 5 : 6

respectively. Bhim retries and surrenders his 5/25th share in favour of Arjun. The goodwill of

the firm is valued at 2 year purchase of super profits based on average profits of last 3 years.

The profit for the 3 years are Rs. 50,000, Rs. 55,000 & Rs. 60,000 respectively. The normal

profits for the similar firm are Rs. 30,000. Goodwill already appears in the books of the firm

at Rs. 75,000. The profit for the first year after Bhim’s retirement was Rs. 1,00,000. Give the

necessary Journal Entries to adjust Goodwill and distribute profits showing your workings.

(4)

10. Shakti ltd. decided to redeem its 750, 12% Debentures of Rs. 100 each. The Company

purchased 500 debentures at Rs. 94 per Debenture from the open market. The remaining

debentures were redeemed out of profit. The company has already made a provision for

Debentures redemption Reserve in its books.

Pass necessary journal Entries in the books of the company for the above transaction. (4)

11. Arun and Arora were partners in a firm sharing profits in the ratio of 5 : 3. Their fixed

capitals on 1.4.2010 were: Rs. 60,000 and Arora Rs. 80,000. They agreed to allow interest on

capital @ 12% p.a. and to charge on drawing @ 15% p.a. The profit of the firm for the year

ended 31.3.2011 before all above adjustments were Rs. 12,600. The drawing made by Arun

Material downloaded from myCBSEguide.com. 2 / 9

were Rs. 2000 and by Arora Rs. 4,000 during the year. Prepare Profit and Loss Appropriation

Account of Arun and Arora. Show your calculations clearly. The interest on capital will be

allowed even if the firm incurs loss. (4)

12. Pass necessary Journal Entries for the following transactions in the books of N.R. Ltd: (6)

(i) Redeemed 1,200, 9% Debentures of Rs. 175 each by converting into New 10% Debentures

of Rs. 100 each issued at a premium of 5%.

(ii) Redeemed 19,000, 6% Debentures of Rs. 50 each by converting them into Equity shares of

Rs. 100 each. The Equity shares were issued at a discount of 5%.

13. A and B were partners in a firm sharing profits in the ratio of 3 : 2. On 31.3.2011 Balance

Sheet of the firm was as follow: (6)

Balance Sheet of A&B as on 31.3.2011

Liabilities Rs. Assets Rs.

2,40,000

Building

Capitals: 1,75,000

Furniture

A 3,00,000 5,00,000 80,000

Debtors

B 2,00,000 1,17,000 75,000

Stock

Sundry Creditors 47,000

Cash

6,17,000 6,17,000

The firm was dissolved on 1.4.2011 and the assets and liabilities were settled as follows:

(i) Building was taken over by the creditors as their full & final payment.

(ii) Furniture was taken over by B for cash payment at 5% less than the book value.

(iii) Debtors were collected by a debt collection agency at a cost of Rs. 5,000.

(iv) Stock realized Rs. 70,500

(v) ‘B’ agreed to bear all realization expenses. For this service B is paid Rs. 500.

Actual expenses on realization amounted to Rs. 1,000.

Pass necessary Journal Entries for dissolution of the firm.

14. Following is the ‘Receipt and Payments Account’ of ‘New Club’ for the year ended

31.3.2011: (6)

Material downloaded from myCBSEguide.com. 3 / 9

Receipts Rs. Payments Rs.

By Salaries (paid for 8 months 24,000

To Balance b/d

3,400 only)

To Subscriptions

21,000 By Rent 3,000

To Entrance fee

5,750 By Electricity 2,750

To donations (includes Rs.

2,100 By Honorarium 5,000

1,000 for building)

By Books 7,500

To Hall rent

7,550 By 9% Fixed Deposits (on 10,000

To sale of Investments (Book

15,400 30.6.2010)

value Rs. 16,000)

By Balance c/d 2,950

55,200 55,200

From the above ‘Receipts and Payments Account’, Prepare an ‘Income and Expenditure

Account’ of ‘New Club’ for the year ended 31.3.2011.

15. ‘B’ and ‘C’ were partners sharing profits in the ratio of 3 : 2. Their Balance Sheet as on

31.3.2011 was as follows: (8)

Balance Sheet of B and C as on 31.3.2011

Liabilities Amount Rs. Assets Amount Rs.

Capitals: Land & Building 80,000

B 60,000 Machinery 20,000

C 40,000 1,00,000 Furniture 10,000

Provision for bad 1,000 Debtors 25,000

debts Cash 16,000

Creditors 60,000 Profit & Loss Account 10,000

1,61,000 1,61,000

‘D’ was admitted to the partnership for 1/5th share in the profits on the following terms:

(i) The new profit sharing ratio was decided as 2 : 2 : 1.

(ii) D will bring Rs. 30,000 as his capital and Rs. 15,000 for his share of goodwill.

(iii) Half of goodwill amount was withdrawn by the partner who sacrificed his share of profit

Material downloaded from myCBSEguide.com. 4 / 9

in favour of ‘D’.

(iv) A provision of 5% for bad and doubtful debts was to be maintained.

(v) an item of Rs. 500 included in Sundry Creditors was not likely to be paid,

(vi) A provision of Rs. 800 was to be made for claims for damage against the firm.

After making the above adjustments the capital Accounts of ‘B’ and ‘C’ were to be adjusted on

the basis of D’s capital actual cash was to be brought in or to be paid off as the case may be.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the New firm.

OR

‘G’, ‘E’ and ‘F’ were partners in a firm sharing profit in the ration of 7 : 2 : 1. The Balance

Sheet of the firm as on 31st March 2011 was as follows:

Balance Sheet of ‘G’, ‘E’ and ‘F’ as on 31 March 2011

Liabilities Amount Rs. Assets Amount Rs.

Capitals: Goodwill

40,000

G 70,000 Land & Building

60,000

E 20,000 Machinery

40,000

F 10,000 1,00,000 Stock

7,000

General Reserve 20,000 Debtors

12,000

Loan from ‘E’ 30,000 Cash

5,000

Creditors 14,000

1,64,000 1,64,000

‘E’ died on 24th August 2011. Partnership deed provided for the settlement of claims on the

death of a partner in addition to his capital as under:

(i) The share of profit of deceased partner to be because upto the date death on the basis of

average profits of the past three years which was Rs. 80,000.

(ii) His share in profit/loss in revaluation of assets and re-assessment of liabilities which was

as follows:

Land and Building were revalued at Rs. 94,000, Machinery at Rs. 38,000 and Stock at Rs.

5,000. A Provision of 2 1/2% was to be created on debtors for bad and doubtful debts.

(iii) The net amount payable to ‘E’s executors was transferred to his Loan Accounts, to be

Material downloaded from myCBSEguide.com. 5 / 9

paid later on.

Prepare Revaluation Account, partner’s Capitals Accounts, E’s Executor A/c. and Balance

sheet of ‘G’ and ‘F’ who decided to continue the business keeping their capitals balance in

their new profit sharing ratio. Any surplus or deficit to be transferred to current accounts of

the partners.

16. Shyam Ltd invited application for issuing 80,000 Equity Shares of Rs. 10 each at a

premium of Rs, 40 per share. The amount was payable as follows: (8)

On Application Rs. 35 per share (including Rs. 30 premium)

On Allotment Rs. 8 per share (including Rs. 4 premium)

On first and Final Call – Balance

Application for 77,000 shares were received. Share were allotted to all the applicants.

Sundram to whom 7,000 shares were allotted failed to pay the allotment money. His shares

were forfeited immediately after allotment. Afterwards the first and final call was made.

Satyam the holder of 500 shares failed to pay the first and final call. His shares were also

forfeited out of the forfeited shares 1,000 were re-issued at Rs. 50 per share fully paid up. The

re-issued shares included all the shares of satyam.

Pass necessary Journal Entries for the above transactions in the books shyam Ltd.

OR

Jain Ltd invited applications for issuing 35,000 Equity Shares of Rs. 10 each at a discount of

10%. The amount was payable as follows:

On Application Rs. 5 per share.

On Allotment Rs. 3 per share

On first and final call – Balance

Applications for 50,000 shares were received. Applications for 8,000 shares were rejected and

the application money of the applicants was refunded. Shares were allotted on pro-rata basis

to the remaining applicants and the excess money received with applications form these

applicants was adjusted towards sums due on allotment. Jeevan who has applied for 600

shares failed to pay allotment and first and final call money. Naveen the holder of 400 shares

failed to pay first and final call money. Shares of Jeevan and Naveen were forfeited. Of the

forfeited 800 shares were re-issued at Rs. 15 per share fully paid up. The re-issued shares

included all the shares of Naveen.

Pass necessary Journal Entries for the above transactions in the books of Jain Ltd.

Material downloaded from myCBSEguide.com. 6 / 9

Part B

(Financial Statement Analysis)

17. State the purpose of preparing a ‘Cash Flow Statement’. (1)

18. While preparing Cash Flow Statement what type of activity is, ‘Payment of Cash to

acquire Debentures by an Investment company’? (1)

19. State the significance of Analysis of Financial statement to the ‘Lenders’. (1)

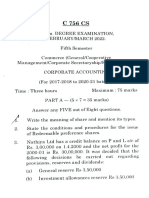

20. O.M. Ltd has a Current Ratio of 3.5 : 1 and Quick Ratio of 2 : 1. If the excess of Current

Assets over Quick Assets as represented by stock is Rs. 1,50,000, calculate Current Assets and

Current Liabilities. (3)

21. From the following information, calculate any two of the following ratios: (4)

(a) Debt-Equity Ratio

(b) Working Capital Turnover Ratio and

(c) Return of Investment

Information: Equity share Capital Rs. 50,000, General Reserve Rs. 5,000; Profit and Loss

Account after tax and interest Rs. 15,000; 9% Debentures Rs. 20,000; creditors Rs. 15,000;

Land and Building Rs. 65,000; Equipment Rs. 15,000; Debtors Rs. 14,500 and Cash Rs. 5,500.

Discount on issue of shares Rs. 5,000.

Sales for the year ended 31.3.2011 was Rs. 1,50,000. Tax rate 50%.

22. Following is the Income Statement of Raj Ltd. for the year ended 31.3.2011: (4)

Particular Amount Rs.

Income:

Sale 2,00,000

Other incomes 15,000

Total Income 2,15,000

Expenses:

Cost of goods sold 1,10,000

Operating expenses 5,000

Material downloaded from myCBSEguide.com. 7 / 9

Total Expenses 1,15,000

Tax 40,000

Prepare a common size Income Statement of Raj Ltd. for the year ended 31.3.2011.

23. From the following Balance Sheet of C.P. Ltd. as on 31.3.2010 and 31.3.2011 prepare a

Cash Flow Statement. (4)

31.3.2010 31.3.2011

Liabilities Assets 31.3.210 Rs. 31.3.2011 Rs.

Rs. Rs.

Share Capital 3,00,000 4,50,000 37,500 31,250

Profit & Loss 75,000 1,50,000 Patents 4,50,000 4,50,000

Account Building -- 56,250

Bank Loan 1,50,000 75,000 Investment 1,50,000 1,91,250

Proposed 60,000 45,000 Debtors 7,500 11,250

Dividend 30,000 52,500 Stock 15,000 66,250

Provision for tax 45,000 33,750 Cash

Creditors 6,60,000 8,06,250 6,60,000 8,06,250

Additional Information:

During the year building having book value Rs. 1,50,000 was sold at a loss of Rs. 6,000

Depreciation charged on Building was Rs. 16,000.

Part C

(Computerized Accounting)

17. What is meant by the first digit in the ‘code’ allotted to an ‘Account’? (1)

18. What is #Null Error? (1)

19. How does the usage of computers help the business? (1)

20. Explain any three features of Computerized Accounting Software. (3)

21. Write is DBMS? Explain its three advantages. (4)

Material downloaded from myCBSEguide.com. 8 / 9

22. Write the steps of a query of Compute D.A. for employs in Microsoft Access. (4)

23. (a) Calculate the formula from the following information on Excel for computing the

amount of conveyance allowance. Basis salary up to Rs. 45,000 @20%, for more than Rs.

45,000 @25% (Basic salary is projected in C2)

(b) Name and explain the financial function of Excel which is used to calculate cumulative

interest paid between two periods. (2 + 4 = 6)

Material downloaded from myCBSEguide.com. 9 / 9

You might also like

- Blue ApronDocument2 pagesBlue ApronSyed Muhammad Baqir RazaNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Accounts Dissolution Test 3rd SemesterDocument6 pagesAccounts Dissolution Test 3rd SemesterNeha agarwalNo ratings yet

- Article 1825Document11 pagesArticle 1825Alex Buzarang SubradoNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- AccountsDocument5 pagesAccountsvenessaNo ratings yet

- Foundation Practice SumsDocument9 pagesFoundation Practice SumsBRISTI SAHANo ratings yet

- Class 12 Accountancy Sample Paper Term 2Document3 pagesClass 12 Accountancy Sample Paper Term 2Ayaan KhanNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- Chapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oDocument9 pagesChapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oabi100% (1)

- DISSLUTIONDocument3 pagesDISSLUTIONomgarg2714No ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Co 2101Document3 pagesCo 2101PRIYA LAKSHMANNo ratings yet

- Admission of A Partner AssignmentDocument3 pagesAdmission of A Partner AssignmentAishwarya NaikNo ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- 12 2006 Accountancy 2Document5 pages12 2006 Accountancy 2Akash TamuliNo ratings yet

- 12 Accountancy Lyp 2008 Set1Document9 pages12 Accountancy Lyp 2008 Set1Yash VagrechaNo ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- 12 2006 Accountancy 1Document5 pages12 2006 Accountancy 1Akash TamuliNo ratings yet

- Advanced Corporate Accounting Jan - 2024 SupplementaryDocument2 pagesAdvanced Corporate Accounting Jan - 2024 SupplementarysaradhachinnaboyinaNo ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Retierment of PartnerDocument4 pagesRetierment of PartnerSaransh GhoshNo ratings yet

- Untitled FgapqDocument5 pagesUntitled FgapqSusovan SirNo ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- HW 16433Document2 pagesHW 16433Abdullah Khan100% (1)

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- 12 Accountancy t2 sp10Document21 pages12 Accountancy t2 sp1015. FutureNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Paper II Financial Accounting IIDocument7 pagesPaper II Financial Accounting IIPoonam JainNo ratings yet

- Accountancy QP 1 (A) 2023Document5 pagesAccountancy QP 1 (A) 2023mohammedsubhan6651No ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- PQ - Covnersion Partnership To CompanyDocument8 pagesPQ - Covnersion Partnership To CompanyAnshul BiyaniNo ratings yet

- Revision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolDocument3 pagesRevision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolStudy HelpNo ratings yet

- Answer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)Document15 pagesAnswer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)shashank saxenaNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- 11 Accountancy t2 Sp01Document19 pages11 Accountancy t2 Sp01Lakshy BishtNo ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- Worksheet 2Document4 pagesWorksheet 2singhharshu3222No ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Rti Website Updation - 21032020 PDFDocument5,388 pagesRti Website Updation - 21032020 PDFSeasonNo ratings yet

- 01 2020 Inoperative Accounts GBDocument9 pages01 2020 Inoperative Accounts GBSeasonNo ratings yet

- Current Affairs Q&A PDF Free - December 2019 by AffairsCloudDocument32 pagesCurrent Affairs Q&A PDF Free - December 2019 by AffairsCloudNebu NatureNo ratings yet

- 100 Banking Awareness Questions For Ibps Clerk Mains 2019 27Document112 pages100 Banking Awareness Questions For Ibps Clerk Mains 2019 27SeasonNo ratings yet

- Rti Website Updation - 21032020 PDFDocument5,388 pagesRti Website Updation - 21032020 PDFSeasonNo ratings yet

- Reading Comprehension PDF Set 1 PDFDocument50 pagesReading Comprehension PDF Set 1 PDFHanuman PoteNo ratings yet

- 2020 SBI Clerk NotificationDocument7 pages2020 SBI Clerk NotificationSwarna LathaNo ratings yet

- Uco Bank - Statewise List of Holidays - 2019Document1 pageUco Bank - Statewise List of Holidays - 2019Anwesha SinghNo ratings yet

- State Bank of India: Recruitment of Circle Based OfficersDocument3 pagesState Bank of India: Recruitment of Circle Based OfficerskundanlaNo ratings yet

- An Open LetterDocument3 pagesAn Open LetterSeasonNo ratings yet

- Pre8 - FinalsDocument4 pagesPre8 - FinalsJalyn Jalando-onNo ratings yet

- RM48,000 X 9% X 90/365Document4 pagesRM48,000 X 9% X 90/365Nurul SyakirinNo ratings yet

- Events After The Reporting PeriodDocument18 pagesEvents After The Reporting PeriodShara Mae SameloNo ratings yet

- Welcome To Presentation On Discharge of SuretyDocument18 pagesWelcome To Presentation On Discharge of SuretyAmit Gurav94% (16)

- 37 Sps Celones Vs MetroBankDocument2 pages37 Sps Celones Vs MetroBankJem100% (1)

- 2021 Nov QP 4ac1 1 PDFDocument20 pages2021 Nov QP 4ac1 1 PDFDilrukshi CooràyNo ratings yet

- Accounting Standards Full INCLUSING ANSWERSDocument235 pagesAccounting Standards Full INCLUSING ANSWERSAnsari Salman100% (1)

- Company Law Final ExaminationDocument5 pagesCompany Law Final ExaminationTemwaniNo ratings yet

- 50 Q AuditingDocument45 pages50 Q Auditingnickle kanthNo ratings yet

- Lifting The Veil of IncorporationDocument29 pagesLifting The Veil of IncorporationNur ZaqirahNo ratings yet

- Liamvs - unitedCoconutPlantersBank, 793 SCRA 383, G.R. No. 194664 June 15, 2016Document13 pagesLiamvs - unitedCoconutPlantersBank, 793 SCRA 383, G.R. No. 194664 June 15, 2016Arriane P. BagaresNo ratings yet

- Carbon Microfinance BankDocument8 pagesCarbon Microfinance BankAbdullahi AdamuNo ratings yet

- 1Document13 pages1DesireeNo ratings yet

- CCASBCM128Document56 pagesCCASBCM128GAJANAN MULTISERVICESNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- Paper - 8A: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument33 pagesPaper - 8A: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio Analysisrohith shivakumarNo ratings yet

- Wells Fargo Bank StatementDocument6 pagesWells Fargo Bank Statementiimoadi333No ratings yet

- Printmelaw1156 1160Document4 pagesPrintmelaw1156 1160Danica Del CastilloNo ratings yet

- Managing Transaction ExposureDocument29 pagesManaging Transaction ExposuresyilaNo ratings yet

- Dissolution of Partnership FirmDocument35 pagesDissolution of Partnership FirmRanjit SinghNo ratings yet

- The Civil Code of The PhilippinesDocument5 pagesThe Civil Code of The Philippinesgillian CalalasNo ratings yet

- CH 14Document40 pagesCH 14Cris Ann Marie ESPAnOLANo ratings yet

- (Math) Mel K2Document35 pages(Math) Mel K2Teacher MawaddahNo ratings yet

- Ncert Solutions Class 12 Business Studies Chapter 10Document28 pagesNcert Solutions Class 12 Business Studies Chapter 10Rounak BasuNo ratings yet

- PBI - Unit 3-Loans and AdvancesDocument59 pagesPBI - Unit 3-Loans and AdvancesAmit PatelNo ratings yet

- CIMB Islamic Bank BHD V LCL Corp BHD & Anor (2012) 3 MLJ869Document7 pagesCIMB Islamic Bank BHD V LCL Corp BHD & Anor (2012) 3 MLJ869muhammad amriNo ratings yet

- Securities Operations PDFDocument7 pagesSecurities Operations PDFVenu MadhavNo ratings yet

- Banking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Document7 pagesBanking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Ashraf AliNo ratings yet