Professional Documents

Culture Documents

True or False. Partnership Formation

Uploaded by

촏교새벼Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

True or False. Partnership Formation

Uploaded by

촏교새벼Copyright:

Available Formats

Partnership Formation True or False

False 1. An industrial partner is exempted from liability to third persons for the debts of

the partnership.

False 2. A partnership is an incorporated association of two or more persons that

contribute money, property, or industry to a common fund, with the intention of dividing

the profits among themselves.

True 3. A partnership has a limited life because any change in the relationship of the

partners dissolves the partnership.

True 4. When partners introduce cash or any other asset, cash or the other asset

account is debited at the value agreed by the partners and the corresponding partner's

capital account is credited by the same amount.

True 5. Each partner is personally liable for all debts of the partnership.

True 6. Income earned by the partnership is usually viewed as income to the “entity”

with partner entitled to a distributive share of the income.

False 7. In the creation of the initial capital account balances on a partnership's financial

records, each partner's capital account must have a non-zero value assigned to it.

False 8. The newly formed partnership must have a new set of books for accounting

records and should not use the books of one of the sole proprietors.

True 9. If a partner's capital balance is credited for an amount greater than or less than

the fair value of his net contribution, the excess or deficiency is called BONUS.

You might also like

- Chapter 16 Test Bank Dissolution and Liquidation of A PartnershipDocument23 pagesChapter 16 Test Bank Dissolution and Liquidation of A Partnershipjosh lunarNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- 4 - Lecture Notes - Partnership DissolutionDocument18 pages4 - Lecture Notes - Partnership DissolutionNikko Bowie PascualNo ratings yet

- Qa PartnershipDocument9 pagesQa PartnershipFaker MejiaNo ratings yet

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- Chapter 1 Partnership Formation, Operations, Dissolution-PROFE01Document7 pagesChapter 1 Partnership Formation, Operations, Dissolution-PROFE01Steffany RoqueNo ratings yet

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyDocument19 pagesSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyJomar RabiaNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Prelim Exercises Pretest Partnership OperationDocument2 pagesPrelim Exercises Pretest Partnership OperationGarp BarrocaNo ratings yet

- Partnership OperationDocument71 pagesPartnership Operationglenn langcuyanNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Partnership OperationDocument21 pagesPartnership OperationDonise Ronadel SantosNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- Chapter 1 Partnership Basic Considerations and FormationDocument20 pagesChapter 1 Partnership Basic Considerations and FormationMIKASANo ratings yet

- Partnership DissolutionDocument5 pagesPartnership DissolutionKathleenNo ratings yet

- Chapter 17 and 18 - Investment in Associates What Is An Associate? Accounting Procedures of Investment in AssociateDocument2 pagesChapter 17 and 18 - Investment in Associates What Is An Associate? Accounting Procedures of Investment in AssociateRanee DeeNo ratings yet

- Partnership Formation QuizDocument5 pagesPartnership Formation QuizMJ NuarinNo ratings yet

- StalasaDocument23 pagesStalasajessa mae zerdaNo ratings yet

- Intro To Partnership Corporation Accounting PDFDocument11 pagesIntro To Partnership Corporation Accounting PDFMyMy Margallo100% (1)

- Partneship Handout Without Answer KeyDocument10 pagesPartneship Handout Without Answer KeyAirah Manalastas0% (1)

- FAR 2 Q2 - Sample Problems With Solutions - FOR EMAILDocument11 pagesFAR 2 Q2 - Sample Problems With Solutions - FOR EMAILJoyce Anne GarduqueNo ratings yet

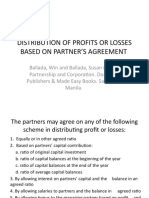

- Distribution of Profits or Losses Based On Partner'sDocument20 pagesDistribution of Profits or Losses Based On Partner'sJOANNA ROSE MANALONo ratings yet

- Module 3 - Partnership DissolutionDocument54 pagesModule 3 - Partnership DissolutionMaluDyNo ratings yet

- AFAR 01 Partnership FormationDocument9 pagesAFAR 01 Partnership FormationJohn Rey BallesterosNo ratings yet

- Partnership Accounting ReviewerDocument10 pagesPartnership Accounting ReviewerJEFFERSON CUTENo ratings yet

- Answer Key 16-30Document27 pagesAnswer Key 16-30Isabela QuitcoNo ratings yet

- Partnership 2021 - Long ProblemsDocument5 pagesPartnership 2021 - Long ProblemsMichael MagdaogNo ratings yet

- Home Quiz Partnership AccountingDocument3 pagesHome Quiz Partnership AccountingKeith Anthony AmorNo ratings yet

- Chapter 2 - Partnership Liquidation-PROFE01Document4 pagesChapter 2 - Partnership Liquidation-PROFE01Steffany RoqueNo ratings yet

- Reviewer in FAR Operations and FormationDocument9 pagesReviewer in FAR Operations and FormationALMA MORENANo ratings yet

- Accounting For Partnership: I. TheoriesDocument10 pagesAccounting For Partnership: I. TheoriesyowatdafrickNo ratings yet

- Partnership LiquidationDocument5 pagesPartnership LiquidationChristian PaulNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- SHAREHOLDERSDocument6 pagesSHAREHOLDERSJoana MarieNo ratings yet

- PAS 10 Events After The Reporting PeriodDocument2 pagesPAS 10 Events After The Reporting Periodpanda 1No ratings yet

- AFAR Partnership FormationDocument4 pagesAFAR Partnership FormationCleofe Mae Piñero AseñasNo ratings yet

- Partnership Liquidation: Multiple ChoiceDocument23 pagesPartnership Liquidation: Multiple ChoiceIvhy Cruz EstrellaNo ratings yet

- Afar 2 Quizzes Acgsbdjxjcudhdh - CompressDocument26 pagesAfar 2 Quizzes Acgsbdjxjcudhdh - CompressWishNo ratings yet

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- AccountingDocument10 pagesAccountingCacjungoyNo ratings yet

- Quiz - Chapter 2 - Partnership OperationsDocument5 pagesQuiz - Chapter 2 - Partnership OperationsChristian Arnel Jumpay LopezNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- Assets: Pedro Castro Statement of Financial Position October 1, 2016Document2 pagesAssets: Pedro Castro Statement of Financial Position October 1, 2016Mandy Bloom0% (1)

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- Acp 101 MexamDocument5 pagesAcp 101 MexamLyca SorianoNo ratings yet

- Partnership - Chapter 1 Test BankDocument8 pagesPartnership - Chapter 1 Test BankCaile SalcedoNo ratings yet

- AFAR - Partnership OperationsDocument3 pagesAFAR - Partnership OperationsCleofe Mae Piñero AseñasNo ratings yet

- Chapter 16 Dissolution and Liquidation of PartnershipDocument14 pagesChapter 16 Dissolution and Liquidation of Partnershipkp_popinjNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- Accounting For Business Organization: Partnership FormationDocument14 pagesAccounting For Business Organization: Partnership FormationKate Jezel SantoniaNo ratings yet

- Partnership FormationDocument1 pagePartnership FormationIskaNo ratings yet

- PARTNERSHIPDocument4 pagesPARTNERSHIPPrincess Mae HernandezNo ratings yet

- ch12 True or FalseDocument4 pagesch12 True or FalseSusan CornelNo ratings yet

- MinggoyDocument12 pagesMinggoychantrealuna0No ratings yet

- Advancedaccounti 00 RittrichDocument112 pagesAdvancedaccounti 00 RittrichBabar Shahzad Anjum100% (1)

- Test Bank Accounting 25th Editon Warren Chapter 12 Accounting For PDFDocument103 pagesTest Bank Accounting 25th Editon Warren Chapter 12 Accounting For PDFKristine Vertucio100% (1)

- Chapter 14 IMSMDocument43 pagesChapter 14 IMSMjthemansmith1No ratings yet

- Introduction To Partnership Accounting Partnership DefinedDocument33 pagesIntroduction To Partnership Accounting Partnership DefinedMarcus MonocayNo ratings yet

- Week 7 LD Video LinksDocument2 pagesWeek 7 LD Video Links촏교새벼No ratings yet

- Comprehensive Adult Eye and Vision QRGDocument7 pagesComprehensive Adult Eye and Vision QRG촏교새벼No ratings yet

- The Choice Between Audit and CDocument85 pagesThe Choice Between Audit and C촏교새벼No ratings yet

- Perspectives On Audit Quality: An Analysis: Noor Adwa Sulaiman, Fatimah Mat Yasin and Rusnah MuhamadDocument27 pagesPerspectives On Audit Quality: An Analysis: Noor Adwa Sulaiman, Fatimah Mat Yasin and Rusnah Muhamad촏교새벼0% (1)

- Advanced Statistics Day 1Document61 pagesAdvanced Statistics Day 1촏교새벼No ratings yet

- Aseptic Technique: Tomasz Bykowski and Brian StevensonDocument11 pagesAseptic Technique: Tomasz Bykowski and Brian StevensonNear JunearNo ratings yet

- Quiz 1 AccountancyDocument1 pageQuiz 1 Accountancy촏교새벼No ratings yet

- Part. AccountingDocument3 pagesPart. Accounting촏교새벼No ratings yet

- ACC 322 Practice 1Document1 pageACC 322 Practice 1촏교새벼No ratings yet

- CPAT Reviewer - Law On SalesDocument27 pagesCPAT Reviewer - Law On SalesZaaavnn Vannnnn100% (2)

- PADocument1 pagePA촏교새벼No ratings yet

- Results For True/False QuizDocument2 pagesResults For True/False Quiz촏교새벼No ratings yet

- Math 100 Book V2point5finalDocument363 pagesMath 100 Book V2point5final촏교새벼No ratings yet

- Fil BrochureDocument3 pagesFil Brochure촏교새벼No ratings yet

- Saint CyprianDocument1 pageSaint Cyprian촏교새벼No ratings yet