Professional Documents

Culture Documents

Economic Performance of The Airline Industry: Key Points

Uploaded by

NguyenThanhDatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Performance of The Airline Industry: Key Points

Uploaded by

NguyenThanhDatCopyright:

Available Formats

Economic Per formance of the Airline Industr y

This semi-annual report takes a broad look at how the airline industry is adding value for its consumers, the wider economy and

governments, as well as for its investors.

Key Points

• The impact of COVID-19 on the global economy will be severe. Global GDP growth is expected to contract by 5.0% in 2020.

• COVID-19 will have a significant impact on international trade (13% decline) which has been suffering from the US-China trade war.

• 2020 will be the worst year in history for airlines (net loss of $84.3bn) and losses will continue in 2021, albeit to a lesser extent.

• Airlines in all regions are expected to record negative operating income in 2020.

• Revenues are expected to fall by more than demand as airlines are significantly discounting ticket prices to help stimulate travel.

• The sharp fall in revenue led to high cash burn due to fixed and semi fixed costs. Airlines face pressure to reduce operating costs.

• 32 million jobs supported by aviation (including tourism) are at risk.

• Restoring air transport connectivity will be critical in the post-COVID period to support the recovery in economic development.

Consumers

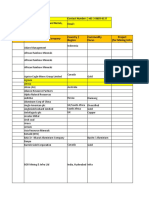

In the near-term, consumers will face lower real travel costs as Worldwide airline Industry 2019 2020F 2021F

airlines are significantly discounting ticket prices to stimulate Spend on air transport*, $billion 876 434 598

demand. The average return fare (before surcharges and tax) % change over year 3.6% -50.4% 37.7%

of $254 in 2020 is forecast to be 68% lower than in 1998, after % global GDP 1.0% 0.5% 0.6%

adjusting for inflation. We expect the share of world GDP

Return fare, $/pax. (2018$) 317 254 257

spent on air transport to be halved in 2020, totaling $434

Compared to 1998 -61% -68% -68%

billion (0.5% of GDP) amidst widespread lockdowns. RPKs are

Freight rate, $/kg (2018$) 1.82 2.31 2.26

estimated to plummet by 55% in 2020 compared to last year.

Compared to 1998 -64% -54% -55%

The recovery in the second half of 2020 is predicted to come

initially from domestic markets and then via a gradual opening Passenger departures, million 4,543 2,246 3,384

of international markets. However, the global recession and % change over year 3.8% -50.6% 50.6%

weak consumer confidence will put pressure on the recovery RPKs, billion 8680 3929 6099

in air travel demand. World trade is also forecast to fall by 13% % change over year 4.2% -54.7% 55.2%

in 2020 indicating a steep decline in air cargo volumes. CTKs, billion 254 211 263

However, trade is expected to rebound strongly next year, % change over year -3.2% -16.8% 24.6%

which will be supportive for air cargo volumes in 2021.

World GDP growth, % 2.5% -5.0% 7.1%

IATA survey of airline CFOs and heads of cargo

World trade growth, % 0.9% -12.9% 21.3%

100 Passenger services growth

expected in the next 12 months Note: RPK = Revenue Passenger Km, CTK = Cargo & mail Tonne Km

90 GVA = Gross Valued Added (firm-level GDP). *Airline revenue + indirect taxes.

80 Sources : IATA, ICAO, OE, CPB, PaxIS, CargoIS, WTO

50 = no change

70

Industry sentiment regarding the prospects for both

60 Cargo services growth passenger travel and cargo declined abruptly in April. The

expected in the next 12 months

50 impact of the pandemic on the passenger side is more severe

40 and volumes are not expected to be fully restored within a year.

30 Even though current demand is more resilient on the cargo

20 side with the support of shipments of necessities, such as

10 medical supplies, expectations for air cargo also turned

2008 2010 2012 2014 2016 2018 2020

negative for the first time since April 2009.

Source: IATA

www.iata.org/economics │ 2020 Mid-year report 1

Wider Economy

Worldwide airline Industry 2019 2020F 2021F

Air transport is key to global economic development. This

Unique city pairs 21187 16102

wider economic benefit is underpinned by both the direct

Compared to 1998 107% 57%

connections between cities - enabling the flow of goods,

Transport cost, US$/RTK (2018$) 78.4 70.5 68.0

people, capital, technology and ideas - and falling air

Compared to 1998 -55% -59% -61%

transport costs. However, COVID-19 has caused a

Value of trade carried, $billion 6,504 5,543 6,234

significant loss in city-pair connectivity. As of the end of % change over year -2.5% -14.8% 12.5%

April, the number of unique city-pairs was 67% lower than its Value of tourism spend, $billion 902 457 706

level of a year ago. % change over year 7.1% -49.3% 54.5%

For 2020 overall, unique city-pair connectivity is expected to

Note: RTK = Revenue Tonne Kilometers, GVA = Gross Value Added. The total

decline for the first time since the global financial crisis. number of ‘routes’ or airport pairs is much higher due to multiple airports in

Moreover, there is a risk that the number of unique city-pair some cities and connections are counted both ways. City-pairs: jets + turbo-

props larger than 19 seats, at least 1 flight a week from SRS Analyser. Supply

connections is not fully recovered, which would undo some chain jobs and GVA from ATAG ABBB 2018 report appendix.

of the gains of recent years.

Unique city-pairs and real transport costs

24000 4.00

Air transport is vital for international trade in manufactured

22000 goods, particularly for the components industry which

Unique city-pairs 3.50

20000 accounts for a major part of cross border trade today. We

Number of unique city-pairs

18000

US$/RTK in 2014US$

3.00 forecast that the value of international trade shipped by air this

16000

14000 year will be $5.5 trillion, around 15% lower compared to 2019.

2.50

12000 Tourists travelling by air in 2020 are forecast to spend $457

10000 2.00

billion, 49% less than the previous year.

8000 Real transport costs

1.50 Another adverse impact of the crisis will be on jobs. Total

6000

4000 1.00 employment supported (directly and indirectly) by the air

2000 transport sector is expected to decline to 38.4 million in 2020;

0 0.50

a 45% reduction relative to the estimated 70.4 million jobs

1995 2000 2005 2010 2015 2020

supported by aviation in 2019.

Government

Over the past decade, governments benefited from the solid

performance of the airline industry with airlines and their

customers generating $111 billion per year on average in tax

revenues. During the COVID-19 crisis, airlines sought support

from governments to help survive and overcome this period of

unprecedented turmoil. As of mid-May, airlines worldwide are

estimated to have received $123bn of government aid.

Government aid has been unevenly distributed across regions.

Airlines in North America and Europe have received aid

equivalent to 25% and 15% of their revenues, respectively. On

the other hand, the support received by airlines in Latin

America, the Middle East and Africa has been only about 1% of

their revenues.

Support from governments has taken a variety of forms,

including capital injections, the provision of loans, deferring the

payment of taxes and reducing tax liabilities. Some

governments have also provided wage subsidies to preserve

Sources: IATA, ATAG, Oxford Economics, ICAO, UNWTO, WTO, public infor-

jobs. We estimate that governments have subsidized the

mation and data from SRS Analyser, DDS, FlightRadar 24, TTBS, ACIC, Platts,

salaries of more than 800 thousand airline employees so far. Airline Analyst, annual reports. In the gvt. aid chart, measures included up to 15

May 2020.

www.iata.org/economics │2020 Mid-year report 2

Capital Providers

Historically, debt providers to the airline industry have been Worldwide airline Industry 2018 2019 2020F

rewarded for their capital, usually invested with the security of a Industry ROIC, % invested capital 6.5% 5.8% -16.9%

very mobile aircraft asset to back it. On average during previous North America 9.0% 9.9% -10.5%

business cycles, the airline industry has been able to generate Europe 8.8% 7.0% -14.3%

enough revenue to pay its suppliers’ bills and service its debt. Asia Pacific 4.3% 3.5% -12.7%

Latin America 5.0% 3.9% -16.6%

On the other hand, even prior to the COVID-19 crisis, equity

EBIT margin, % revenue 5.7% 5.2% -23.4%

owners had not been rewarded adequately for risking their

Net post-tax profits, $billion 27.3 26.4 -84.3

capital in all regions. In normal times, investors should expect to % revenues 3.4% 3.1% -20.1%

earn at least the return generated by assets of a similar risk $ per passenger 6.22 5.80 -37.54

profile; the weighted average cost of capital (WACC). Such has Adjusted net debt/EBITDAR 4.50 4.60 -7.13

been the intensity of competition, and the challenges to doing Note: ROIC = Return on Invested Capital, EBIT = Earnings Before Interest and Tax.

Debt adjusted for operating leases. Current year or forward-looking industry

business, that average airline returns have rarely been as high financial assessments should not be taken as reflecting the performance of

as the industry’s cost of capital. individual airlines, which can differ significantly.

That said, for North America and Europe in the last four years, Return on capital invested in airlines

15

equity investors have received a return above the cost of Cost of capital

10

capital. In North America, structural improvements combined (WACC)

% of invested capital

with low fuel prices boosted the return on invested capital 5

(ROIC) above the cost of capital, creating value for investors. In

0

Europe, although rising competition put pressure on yields,

-5

airlines overall created value for investors by managing their

costs effectively and focusing on ancillaries as an additional -10

source of revenue. On the other hand, airlines in the Asia Pacific Return on capital

-15 (ROIC)

and Latin America regions have consistently generated below-

-20

WACC returns. The highly competitive nature of the market in

2007 2009 2011 2013 2015 2017 2019 2021

Asia Pacific has prevented airlines from fully reflecting the

increase in costs resulting in narrower operating margins. Breakeven and achieved cargo+ passenger load factor

76

74 Achieved load factor

The situation has changed considerably this year. With the

impact of the pandemic, all regions are facing negative ROIC 72

outcomes and we forecast the industry to generate an overall 70

ROIC of –16.9%. Next year, we expect to see a moderate

% ATKs

68

improvement stemming from the gradual recovery in demand 66

conditions. Nonetheless, the return to investors is still expected 64

to remain in negative territory. 62 Breakeven load factor

Aircraf t 60

58

For 2020, commercial airlines currently have around 960 new 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020

aircraft scheduled for delivery. This is approximately 40% lower

Aircraft deliveries and airline industry ROIC

than the number originally planned at the beginning of this year. 1900 10

1800 Airlines ROIC

In light of the very challenging industry outlook, we expect that

1700 5

Number of aircraft delivered

ROIC as % invested capital

airlines will consider further cancellations or postponements 1600

over the second half of the year. As at the end of May, just 235 1500 0

1400

new aircraft had been delivered, well down on the usual level.

1300

-5

1200

Looking further forward, the investment appetite for new 1100

1000 -10

aircraft is likely to remain subdued into 2021. Moreover, airlines

900 Aircraft deliveries

are also expected to consider the sale of their existing assets. 800 -15

700

600 -20

Sources for charts on this page: IATA, ICAO, McKinsey, Ascend.

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020

www.iata.org/economics │ 2020 Mid-year report 3

In 2020 and 2021, new aircraft deliveries will be limited. Airlines Worldwide airline Industry 2019 2020F 2021F

will have less of an incentive to retire old aircraft in the current Aircraft fleet 29,697 20,261

business conditions and with supportive low fuel prices. % change over year 0.7% -31.8%

Nevertheless, airlines will look to retire or put their older Available seats, million 4.5 2.8

aircraft into storage as the demand for air travel remains weak. % change over year 1.5% -36.3%

Overall, this is expected make a positive contribution to Average aircraft size, seats 150 140

improving fleet fuel efficiency, as described below. % change over year 0.9% -6.6%

Scheduled flights, million 38.9 23.1

The in-service fleet is expected to decrease to 20,261 aircraft

% change over year 2.2% -40.7% 30.4%

this year. The average size of aircraft in the fleet will also

ASKs, % change over year 3.4% -40.4% 31.9%

decline as airlines focus on short and medium-haul travel

Passenger load factor, % ASK 82.5% 62.7% 73.8%

initially. Hence, by the end of 2020, we estimate that there will Cargo load factor, % ACTK 54.9% 50.8% 46.2%

be around 2.8 million available seats, more than one-third lower Weight load factor, % ATK 69.5% 59.4% 65.0%

than in 2019. In addition, the passenger load factor is expected Breakeven load factor, % ATK 65.9% 73.3% 67.7%

to ease substantially from 82.5% in 2019 to 62.7%, stemming

Note: ASK = Available Seat Kilometers, AFTK = Available Cargo Tonne Kilometers

from potential regulatory requirements and the decline in ATK = Available Tonne Kilometers. Sources: Ascend, ICAO, IATA.

passenger confidence.

Fuel

This year, we forecast the industry fuel bill to decline to $78 Worldwide airline Industry 2019 2020F 2021F

billion, which will represent around 15% of average operating Fuel spend, $billion 188 78 85

costs. This decline is a reflection of less traffic (kilometers % change over year 4.7% -58.8% 9.1%

flown) given the collapse in demand and the sharp decrease in % operating costs 23.7% 15.0% 13.6%

oil prices. In addition, jet fuel prices have declined more than

Fuel use, billion litres 363 228 297

oil prices following the downfall in demand and the crack

% change over year 1.0% -37.1% 30.3%

spread has turned negative. We base our forecast on an

Fuel efficiency, litre fuel/100atk 22.4 22.1 21.9

average jet price of $36.8/b and $35/b for the Brent crude oil

% change over year -1.9% -1.0% -1.1%

price for 2020. We expect the crack spread will widen next

CO2, million tonnes 914 574 748

year resulting in an estimated fuel price of $51.8/b for 2021 .

% change over year 1.0% -37.1% 30.3%

Fuel price, $/barrel 77.0 36.8 51.8

140 Fuel efficiency and the price of jet fuel 55 % change over year -10.6% -52.3% 40.8%

120 % spread over oil price 18.5% 5.0% 15.0%

Litres fuel used per 100 RTK

50

Note: ATK = Available Tonne Kilometers. Sources: Ascend, ICAO, IATA.

100

45

80

US$ per barrel

We forecast that fuel efficiency, in terms of capacity use i.e. per

60 Jet fuel price ATK, will improve by 1.1% in 2020 as older aircraft will be

40

retired or put into storage. The annual average per RTK fuel

40

35 efficiency improvement from 2009-14 stands at 2.4%, versus

20 the 1.5% industry target. As much of the industry was

Fuel use/100 RTK

0 30 grounded throughout the second quarter of the year, CO2

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 emissions are expected to be 37.1% lower compared to 2019.

Fuel is such a large cost for airlines that it is the focus of intense

effort across the industry to find efficiency improvements. Such

gains can take a variety of forms including replacing fleet with

new aircraft, better operations and efforts to persuade

governments to remove the airspace and airport inefficiencies

that waste around 5% of fuel burn each year.

Sources for charts on this page: IATA, ICAO, Platts.

www.iata.org/economics │2020 Mid-year report 4

Labour

Airlines are facing pressure to limit their rate of cash burn (est. Worldwide airline Industry 2018 2019 2020F

to be $61bn in the second quarter of this year). As air traffic Labour costs, $ billion 174 187 103

halted in the second quarter and is not expected to return to % change over year 2.5% 7.5% -45.1%

pre-crisis levels in a short time, total employment in the airline Employment, million 2.79 2.90 1.87

industry will also come under increasing pressure. % change over year -0.7% 4.2% -35.5%

Productivity, atk/employee 536,079 529,688 521,348

We estimate that total employment by airlines will decline to % change over year 6.8% -1.2% -1.6%

1.9 million in 2020. Productivity is likely to fall with the average Unit labour cost, $/ATK 0.117 0.122 0.105

employee generating 521,348 ATKs a year. Wages will decline % change over year -3.4% 4.4% -13.6%

in the industry but despite declining unit labour costs, the GVA/employee, $ 99,858 98,498 80,289

squeeze on airline profit margins will continue. % change over year 5.1% -1.4% -18.5%

IATA survey of airline CFOs Note: ATK = Available Tonne Kilometers, GVA = Gross Value Added (firm-level

GDP). Sources: IATA, ICAO, ATAG, Oxford Economics

80

Employment change expectations

70 for the next 12 months

60 The jobs being created are not just productive for their airline

50 = no change

50 employers; they are also highly productive for the economies

40 in which they are employed. We estimate that the direct GVA

30 for national economies, generated by the average airline

20 employee will decline year-on-year by 18.5% to $80,289 in

2020.

10

0

2008 2010 2012 2014 2016 2018 2020

Infrastructure

Infrastructure partners play an important role in the service that While the global passenger volume is forecast to contract by

airlines provide to their customers, affecting the experience, the 50.6%, the unit cost of infrastructure use is estimated to fall

timeliness of the journey, and its cost. by a lesser extent (-39.3%) in 2020.

The direct cost paid for using infrastructure has increasingly Airspace inefficiency increased dramatically in Europe prior

been transferred to the airlines and passengers. Overall the to the start of the COVID-19 crisis. Delays, as measured by

cost of using airport and ANSP infrastructure has risen steeply total delay minutes, increased in January and February

over past decades, partly because competitive pressures are compared to the previous year and then fell sharply in March

very weak in this part of the supply chain. This sits in contrast as the number of flights in Europe plunged with the spread of

with the relatively limited rise in non-fuel airline costs. COVID-19 in the region.

EU airspace 2018 2019 Jan Feb Mar

380 Total Cost of Infrastructure & Passenger Numbers

inefficiency 2020 2020 2020

330 Total cost of

Indexed to equal 100 in 2000

Delay minutes, million 25.6 24.2 0.7 1.1 0.7

infrastructure use (1)n

280

% change over year 61.2% -5.7% 14.8% 48.9% -44.4%

230

Operating cost to air-

2,152 2,151

180 lines, US$m

Number of

Passengers (2)

130 Passenger time value

2,487 2,571

Ratio=(1)/(2) loss, US$m

80

Sources for charts on this page: ACI (aeronautical revenues), ICAO (en-route charges), Eurocontrol, IPRB, FAA, ATA.

www.iata.org/economics │ 2020 Mid-year report 5

Regions

The COVID-19 crisis has reached an unprecedented level for Worldwide airline Industry 2018 2019 2020F

airlines in all regions. Airlines in North America, the strongest Africa

Net post-tax profit, $billion -0.1 -0.3 -2.0

performer in the pre–crisis period, are estimated to deliver a net

Per passenger, $ -1.09 -2.67 -42.02

loss of $23.1bn in 2020. That represents a net loss of $38.15 % revenue -0.7% -1.8% -30.5%

per passenger, almost six times the loss per passenger RPK growth, % 8.0% 4.5% -58.5%

recorded in the weakest performing region in the pre-pandemic ASK growth, % 7.5% 4.2% -50.4%

period. The net margin for airlines in North America is estimated Load factor, % ATK 60.7% 59.7% 52.2%

to be –16.8%, which is relatively better than elsewhere and due Breakeven load factor, % ATK 59.8% 59.1% 67.3%

Asia-Pacific

in part to the support received from the US government. As

Net post-tax profit, $billion 6.1 4.9 -29.0

airlines will be lowering prices to bring back demand in the

Per passenger, $ 3.74 2.92 -30.09

recovery period, breakeven load factors are expected to % revenue 2.4% 1.9% -22.5%

increase by 10ppts to 68.0%. RPK growth, % 7.0% 4.8% -53.8%

ASK growth, % 6.8% 4.5% -39.2%

Breakeven load factors in Europe will rise to 75.7%, due to low

Load factor, % ATK 72.5% 71.8% 61.4%

yields. Intra-regional travel in Europe is expected to start in

Breakeven load factor, % ATK 68.5% 68.4% 78.3%

June and markets are expected to open in phases, which has Middle East

the potential to support recovery. However, with the lock-down Net post-tax profit, $billion -1.5 -1.5 -4.8

of air travel in the second quarter, net losses are estimated to Per passenger, $ -6.69 -6.75 -37.03

be $21.5 billion for the region in 2020, representing a loss of % revenue -2.7% -2.7% -14.8%

RPK growth, % 7.0% 2.3% -56.1%

$34.4 per passenger and a negative net margin of 22.1%.

ASK growth, % 4.9% 0.1% -46.1%

Asia-Pacific was the first region exposed to the weakness Load factor, % ATK 65.2% 65.1% 57.1%

coming from the disease outbreak and their losses will be larger Breakeven load factor, % ATK 68.2% 68.5% 69.1%

compared to the other regions as current demand recovery is Latin America

Net post-tax profit, $billion -0.8 -0.7 -4.0

not coming with profitability. The average loss per passenger

Per passenger, $ -2.78 -2.24 -27.83

this year is expected to be $30.1. Overall, net losses in 2020 are

% revenue -2.3% -1.8% -22.8%

forecast to be $29 billion and net margins to be –22.5%. RPK growth, % 8.0% 4.1% -57.4%

ASK growth, % 7.5% 3.0% -43.3%

Middle Eastern airlines faced this crisis while a number were

Load factor, % ATK 67.9% 67.7% 56.9%

transitioning through a restructuring process which included a

Breakeven load factor, % ATK 66.0% 65.7% 69.3%

planned slowdown in capacity growth. Following the impact of

North America

the pandemic, Middle Eastern airlines are expected to see their Net post-tax profit, $billion 14.5 17.4 -23.1

losses rise to $4.8 billion in 2020 (from a loss of $1.5bn in 2019). Per passenger, $ 14.66 16.95 -38.15

% revenue 5.7% 6.6% -16.8%

In Latin America, airline performance was mixed prior to the

RPK growth, % 3.5% 3.9% -52.6%

crisis, with some airlines facing an already difficult economic ASK growth, % 3.4% 2.9% -35.2%

and operating backdrop which has been compounded by the Load factor, % ATK 64.9% 64.8% 56.1%

COVID-19 impact. Overall, the region is expected to post a $4.0 Breakeven load factor, % ATK 59.0% 58.5% 68.0%

billion net loss in 2020. Europe

Net post-tax profit, $billion 9.1 6.5 -21.5

Africa was the weakest region in the pre-crisis period. Few Per passenger, $ 7.94 5.42 -34.39

airlines in the region were able to achieve adequate load factors % revenue 4.5% 3.1% -22.1%

to generate a profitable performance. The pandemic has added RPK growth, % 6.0% 4.3% -56.4%

to an already challenging operating environment and as a result ASK growth, % 5.5% 3.6% -42.9%

Load factor, % ATK 74.8% 74.4% 62.3%

airlines in the region are expected to post a $2.0 billion net loss

Breakeven load factor, % ATK 70.2% 70.8% 75.7%

in 2020.

Note: RPK = Revenue Passenger Kilometers, ASK = Available Seat Kilometers,

ATK = Available Tonne Kilometers. Current year or forward-looking industry

9th June 2020 financial assessments should not be taken as reflecting the performance of

IATA Economics, economics@iata.org individual airlines, which can differ significantly. Sources: ICAO, IATA.

Terms and Conditions for the use of this IATA Economics Report and its contents can be found at: www.iata.org/economics-terms

By using this IATA Economics Report and its contents in any manner, you agree that the IATA Economics Report Terms and Conditions apply to you

and agree to abide by them. If you do not accept these Terms and Conditions, do not use this report.

www.iata.org/economics │2020 Mid-year report 6

You might also like

- Iata PDFDocument6 pagesIata PDFTatiana RokouNo ratings yet

- Airline Industry Economic Performance Jun19 Report PDFDocument6 pagesAirline Industry Economic Performance Jun19 Report PDFFahad MohamedNo ratings yet

- Economic Performance of The Airline Industry: Key PointsDocument5 pagesEconomic Performance of The Airline Industry: Key PointsAlex SanchoNo ratings yet

- IATA Economic Performance of The Industry End Year 2015 Report PDFDocument6 pagesIATA Economic Performance of The Industry End Year 2015 Report PDFRafee HossainNo ratings yet

- IATA Forecasts $84 Billion in Airline Losses for 2020Document3 pagesIATA Forecasts $84 Billion in Airline Losses for 2020winsomeNo ratings yet

- KGAL Whitepaper The Corona Virus Outbreak - Impact On The Aviation Market April 2020Document8 pagesKGAL Whitepaper The Corona Virus Outbreak - Impact On The Aviation Market April 2020GrowlerJoeNo ratings yet

- Airline Industry Economic Performance ReportDocument6 pagesAirline Industry Economic Performance ReportMae SampangNo ratings yet

- Effects of Novel Coronavirus On Civil Aviation PDFDocument175 pagesEffects of Novel Coronavirus On Civil Aviation PDFBlogger28No ratings yet

- Outlook of Global Airline Industry 2021Document6 pagesOutlook of Global Airline Industry 2021Raja Churchill DassNo ratings yet

- ICAO Coronavirus Econ ImpactDocument174 pagesICAO Coronavirus Econ ImpactErik John Ruiz PeraltaNo ratings yet

- What COVID-19 Did To European Aviation in 2020, and Outlook 2021Document12 pagesWhat COVID-19 Did To European Aviation in 2020, and Outlook 2021Satrio AditomoNo ratings yet

- Urjith 2022 - PP (Harsha and Jerositta)Document21 pagesUrjith 2022 - PP (Harsha and Jerositta)HARSHAVISALI DNo ratings yet

- Abbb21 Factsheet Covid19-1Document1 pageAbbb21 Factsheet Covid19-1Vi MoNo ratings yet

- KGAL Outlook For Aviation Q1 2021Document6 pagesKGAL Outlook For Aviation Q1 2021GrowlerJoeNo ratings yet

- ICAO Economic Impact 1590669089Document116 pagesICAO Economic Impact 1590669089Navid SolangiNo ratings yet

- Vanuatu: Economic PerformanceDocument3 pagesVanuatu: Economic PerformanceViliame TawanakoroNo ratings yet

- Will COVID-19 Threaten The Survival of The Airline Industry?Document18 pagesWill COVID-19 Threaten The Survival of The Airline Industry?Harish AlubilliNo ratings yet

- COVID-19 Impact on Airports: Traffic Fall & Revenue LossesDocument8 pagesCOVID-19 Impact on Airports: Traffic Fall & Revenue Lossespepe pecasNo ratings yet

- The Impact of COVID-19 On Airports:: An AnalysisDocument6 pagesThe Impact of COVID-19 On Airports:: An AnalysisBruce VillarNo ratings yet

- The Impact of COVID-19 On CAREC Aviation and Tourism Draft, 8 June 2020Document42 pagesThe Impact of COVID-19 On CAREC Aviation and Tourism Draft, 8 June 2020ShawalNo ratings yet

- Covid-19 & Airports: Traffic Forecast & Financial ImpactDocument11 pagesCovid-19 & Airports: Traffic Forecast & Financial ImpactTatiana RokouNo ratings yet

- ICAO Coronavirus Econ ImpactDocument112 pagesICAO Coronavirus Econ ImpactForrestNo ratings yet

- Sector Review Aviation Neutral The Attempt On Long Way 2Document14 pagesSector Review Aviation Neutral The Attempt On Long Way 2PhươngĐỗNo ratings yet

- Cirium Fleet Forecast 2022-2041 SummaryDocument7 pagesCirium Fleet Forecast 2022-2041 SummaryEdwin SinginiNo ratings yet

- Air travel recovery stalled in December 2020Document4 pagesAir travel recovery stalled in December 2020Jorge Ignacio Ramos OlguinNo ratings yet

- ICAO - Coronavirus - Econ - Impact 20210120Document125 pagesICAO - Coronavirus - Econ - Impact 20210120Paola Cemin da SilvaNo ratings yet

- Report Final ECODocument14 pagesReport Final ECOArnav BorthakurNo ratings yet

- IATA June Global OutlookDocument23 pagesIATA June Global OutlookTim MooreNo ratings yet

- NAVEO Air Transport Fleet Trends 20211122Document33 pagesNAVEO Air Transport Fleet Trends 20211122Estevão SantoNo ratings yet

- Sectors Impacted Worst by COVID: Indraneel MahantiDocument6 pagesSectors Impacted Worst by COVID: Indraneel MahantidebojyotiNo ratings yet

- ICAO Coronavirus Econ ImpactDocument175 pagesICAO Coronavirus Econ ImpactSneha BasuNo ratings yet

- IATA - IATA Forecast Predicts 8.2 Billion Air Travelers in 2037Document8 pagesIATA - IATA Forecast Predicts 8.2 Billion Air Travelers in 2037Santosh ShivhareNo ratings yet

- MKTG 6650 - Individual AssignmentDocument14 pagesMKTG 6650 - Individual AssignmentShehriyar AhmedNo ratings yet

- AitaDocument2 pagesAitaDhananjay PatilNo ratings yet

- IBEF Aviation PresentationDocument40 pagesIBEF Aviation PresentationIshan ShuklaNo ratings yet

- RetrieveDocument5 pagesRetrieveAdileneNo ratings yet

- ATAG - Blue Print For Green Recovery 2020 - FinalreportDocument12 pagesATAG - Blue Print For Green Recovery 2020 - FinalreportSatrio AditomoNo ratings yet

- Air Passenger Forecast - IATADocument17 pagesAir Passenger Forecast - IATAumeshnihalaniNo ratings yet

- ICAO Coronavirus Econ ImpactDocument125 pagesICAO Coronavirus Econ ImpactRAMADHIAN EKAPUTRANo ratings yet

- IBEF Aviation Feb 2019Document40 pagesIBEF Aviation Feb 2019Amitabh RanjanNo ratings yet

- Research ReportDocument24 pagesResearch Reportkunalsukhija21No ratings yet

- EYK Airlines Quarterly Update 1Q23Document18 pagesEYK Airlines Quarterly Update 1Q23KapilNo ratings yet

- ICAO Coronavirus Econ Impact PDFDocument108 pagesICAO Coronavirus Econ Impact PDFDarwis IdrusNo ratings yet

- 1 Amadeus in The Travel IndustryDocument12 pages1 Amadeus in The Travel IndustryNHUNG NGUYỄN THẢONo ratings yet

- SCSC BẢN TIN NHÀ ĐẦU TƯ Q3-2023 11 Oct 2023 ENDocument8 pagesSCSC BẢN TIN NHÀ ĐẦU TƯ Q3-2023 11 Oct 2023 ENTrường Trường XuânNo ratings yet

- Group Assignment Opm554 Nbo4b Group 5Document24 pagesGroup Assignment Opm554 Nbo4b Group 5Afiq Najmi RosmanNo ratings yet

- ICAO Coronavirus Econ ImpactDocument125 pagesICAO Coronavirus Econ ImpactmasliliksNo ratings yet

- Airlines Financial Monitor: Key PointsDocument4 pagesAirlines Financial Monitor: Key PointsIsaac MarkNo ratings yet

- COVID-19 Effects on Civil Aviation Economic Impact Analysis ReportDocument125 pagesCOVID-19 Effects on Civil Aviation Economic Impact Analysis ReportPhạm PhátNo ratings yet

- Introduction to the Global Airline Industry and Challenges Faced by British Airways (39Document19 pagesIntroduction to the Global Airline Industry and Challenges Faced by British Airways (39Tharindu WeerasingheNo ratings yet

- Aviation Oct 2018Document39 pagesAviation Oct 2018fataposterNo ratings yet

- Global Trends in Maritime and Port Economics: The COVID 19 Pandemic and BeyondDocument12 pagesGlobal Trends in Maritime and Port Economics: The COVID 19 Pandemic and BeyondHbiba HabboubaNo ratings yet

- Country Summaries and Key Indicators: Cambodia Economic OutlookDocument52 pagesCountry Summaries and Key Indicators: Cambodia Economic OutlookThiện TâmNo ratings yet

- The Future of Civil Aviation PDFDocument57 pagesThe Future of Civil Aviation PDFSantiago HidalgoNo ratings yet

- ACI Project May, 09Document14 pagesACI Project May, 09aryan295No ratings yet

- Afjal Sir Assignment.Document9 pagesAfjal Sir Assignment.221 Khairul IslamNo ratings yet

- MKTG 6650 - Individual AssignmentDocument14 pagesMKTG 6650 - Individual AssignmentShehriyar AhmedNo ratings yet

- Flight Attendant CVDocument11 pagesFlight Attendant CVLinh PhanNo ratings yet

- 2019 Marine Insurance Facts & FiguresDocument5 pages2019 Marine Insurance Facts & FiguresAkash MishraNo ratings yet

- The Past and The Future of The Russian Milling Industry 2020Document3 pagesThe Past and The Future of The Russian Milling Industry 2020Muhammet Ali VELİOĞLUNo ratings yet

- Brewed Coffee Routine (Clover) - Quick Reference GuideDocument1 pageBrewed Coffee Routine (Clover) - Quick Reference GuideMr. KhanNo ratings yet

- Rice and Vegetable Value Chain Affecting Small Scale Farmers in The Philippines PDFDocument61 pagesRice and Vegetable Value Chain Affecting Small Scale Farmers in The Philippines PDFPaula Marie De GraciaNo ratings yet

- Bhubaneswar and Puri Trip ItineraryDocument6 pagesBhubaneswar and Puri Trip ItineraryKumarNo ratings yet

- Road Design & Construction GuideDocument19 pagesRoad Design & Construction GuideMonishaNo ratings yet

- ID Pengadaan Bahan Olahan Makanan Di Purchasing Section Grand Jatra Hotel Pekanbaru PDFDocument15 pagesID Pengadaan Bahan Olahan Makanan Di Purchasing Section Grand Jatra Hotel Pekanbaru PDFGuntur FepriadiNo ratings yet

- 12 - 13 - Bus Terminal Survey QuestionnaireDocument2 pages12 - 13 - Bus Terminal Survey QuestionnairehariNo ratings yet

- Mastic Asphalt DesignDocument42 pagesMastic Asphalt DesignSoundar Pachiappan100% (1)

- AP Human Geography Chapter 12 NotesDocument17 pagesAP Human Geography Chapter 12 NotesSeth Adler86% (72)

- Technology and Livelihood Education Quarter 1, Wk.2 - Module 2 Afa-Agri Crop Production-Sharpening ToolsDocument12 pagesTechnology and Livelihood Education Quarter 1, Wk.2 - Module 2 Afa-Agri Crop Production-Sharpening Toolsjose ariel barroa jrNo ratings yet

- Rabobank Global Animal Protein Outlook 2020Document28 pagesRabobank Global Animal Protein Outlook 2020Ol VirNo ratings yet

- Manifest b07.20 (PKG Sri) 01Document1 pageManifest b07.20 (PKG Sri) 01Vicktor Nur HanafiNo ratings yet

- 9116 - วิจัยบท1 5 1Document65 pages9116 - วิจัยบท1 5 1Ning NichakornNo ratings yet

- Activity 7 International FinancesDocument4 pagesActivity 7 International FinancesJesus DavidNo ratings yet

- Jora RaiseDocument11 pagesJora RaiseANSHUL YADAVNo ratings yet

- Importance of Industry in The Economy of BangladeshDocument3 pagesImportance of Industry in The Economy of BangladeshFardus Mahmud86% (7)

- Sabre GDS AssessmentDocument6 pagesSabre GDS Assessmentbibhash3335No ratings yet

- The Cebu Bus Rapid Transit BRT ExperienceDocument7 pagesThe Cebu Bus Rapid Transit BRT Experiencewierdo.nerdNo ratings yet

- Mr. Jock O’Callaghan Global Mining Leader Contact Details and Mining Company ProfilesDocument21 pagesMr. Jock O’Callaghan Global Mining Leader Contact Details and Mining Company Profilesramesh50% (2)

- The School For Practical AgricultureDocument5 pagesThe School For Practical AgricultureMichael V. MagallanoNo ratings yet

- VIA Bus Schedule 522 BabcockDocument2 pagesVIA Bus Schedule 522 BabcockMiguel Alejandro BarreraNo ratings yet

- Assertion Reason Questions For Chapter - 1, 2 and 3 of Indian Economy DevelopmentDocument41 pagesAssertion Reason Questions For Chapter - 1, 2 and 3 of Indian Economy DevelopmentGauravNo ratings yet

- D2 Itibaev KairatDocument22 pagesD2 Itibaev KairatIvana WijayaNo ratings yet

- Chapter-III Production and Employment: Fill in The BlanksDocument3 pagesChapter-III Production and Employment: Fill in The Blanksrai venugopalNo ratings yet

- Improve Rural Livelihoods with LEAPDocument10 pagesImprove Rural Livelihoods with LEAPHardikRajayguruNo ratings yet

- Accredited ConsultantsDocument195 pagesAccredited ConsultantsRaja Mani100% (1)

- Rock reinforcement solutions case studyDocument15 pagesRock reinforcement solutions case studySEDIMNo ratings yet

- Iron and Steel IndustryDocument15 pagesIron and Steel IndustryKRNo ratings yet

- XII - Geography Study Material - I D Soni PDFDocument94 pagesXII - Geography Study Material - I D Soni PDFShivam JainNo ratings yet