Professional Documents

Culture Documents

Cambridge O Level: Economics 2281/21 May/June 2020

Uploaded by

Jack KowmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cambridge O Level: Economics 2281/21 May/June 2020

Uploaded by

Jack KowmanCopyright:

Available Formats

Cambridge O Level

ECONOMICS 2281/21

Paper 2 Structured Questions May/June 2020

MARK SCHEME

Maximum Mark: 90

Published

Students did not sit exam papers in the June 2020 series due to the Covid-19 global pandemic.

This mark scheme is published to support teachers and students and should be read together with the

question paper. It shows the requirements of the exam. The answer column of the mark scheme shows the

proposed basis on which Examiners would award marks for this exam. Where appropriate, this column also

provides the most likely acceptable alternative responses expected from students. Examiners usually review

the mark scheme after they have seen student responses and update the mark scheme if appropriate. In the

June series, Examiners were unable to consider the acceptability of alternative responses, as there were no

student responses to consider.

Mark schemes should usually be read together with the Principal Examiner Report for Teachers. However,

because students did not sit exam papers, there is no Principal Examiner Report for Teachers for the June

2020 series.

Cambridge International will not enter into discussions about these mark schemes.

Cambridge International is publishing the mark schemes for the June 2020 series for most Cambridge

IGCSE™ and Cambridge International A & AS Level components, and some Cambridge O Level

components.

This document consists of 15 printed pages.

© UCLES 2020 [Turn over

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Generic Marking Principles

These general marking principles must be applied by all examiners when marking candidate answers.

They should be applied alongside the specific content of the mark scheme or generic level descriptors

for a question. Each question paper and mark scheme will also comply with these marking principles.

GENERIC MARKING PRINCIPLE 1:

Marks must be awarded in line with:

• the specific content of the mark scheme or the generic level descriptors for the question

• the specific skills defined in the mark scheme or in the generic level descriptors for the question

• the standard of response required by a candidate as exemplified by the standardisation scripts.

GENERIC MARKING PRINCIPLE 2:

Marks awarded are always whole marks (not half marks, or other fractions).

GENERIC MARKING PRINCIPLE 3:

Marks must be awarded positively:

• marks are awarded for correct/valid answers, as defined in the mark scheme. However, credit

is given for valid answers which go beyond the scope of the syllabus and mark scheme,

referring to your Team Leader as appropriate

• marks are awarded when candidates clearly demonstrate what they know and can do

• marks are not deducted for errors

• marks are not deducted for omissions

• answers should only be judged on the quality of spelling, punctuation and grammar when these

features are specifically assessed by the question as indicated by the mark scheme. The

meaning, however, should be unambiguous.

GENERIC MARKING PRINCIPLE 4:

Rules must be applied consistently e.g. in situations where candidates have not followed

instructions or in the application of generic level descriptors.

GENERIC MARKING PRINCIPLE 5:

Marks should be awarded using the full range of marks defined in the mark scheme for the question

(however; the use of the full mark range may be limited according to the quality of the candidate

responses seen).

GENERIC MARKING PRINCIPLE 6:

Marks awarded are based solely on the requirements as defined in the mark scheme. Marks should

not be awarded with grade thresholds or grade descriptors in mind.

© UCLES 2020 Page 2 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

1 Components using point-based marking:

Point marking is often used to reward knowledge, understanding and application of skills. We

give credit where the candidate’s answer shows relevant knowledge, understanding and

application of skills in answering the question. We do not give credit where the answer shows

confusion. From this it follows that we:

a credit answers which are worded differently from the mark scheme if they clearly convey the

same meaning (unless the mark scheme requires a specific term)

b credit alternative answers/examples which are not written in the mark scheme if they are

correct

c credit answers where candidates give more than one correct answer in one

prompt/numbered/scaffolded space, where extended writing is required rather than list-type

answers. For example, questions that require n reasons (e.g. State two reasons…).

d DO NOT credit answers simply for using a ‘key term’ unless that is all that is required. (Check

for evidence it is understood and not used wrongly.)

e DO NOT credit answers which are obviously self-contradicting or trying to cover all

possibilities, e.g. a scattergun approach to a question asking for n items

f DO NOT give further credit for what is effectively repetition of a correct point already credited

unless the language itself is being tested. This applies equally to ‘mirror statements’ (i.e.

polluted/not polluted).

g DO NOT require spellings to be correct, unless this is part of the test. However spellings of

syllabus terms must allow for clear and unambiguous separation from other syllabus terms

with which they may be confused (e.g. erosion/corrosion).

2 Presentation of mark scheme:

• Slashes (/) or the word ‘or’ separate alternative ways of making the same point.

• Semi colons (;) bullet points (•) or figures in brackets (1) separate different points.

• Content in the answer column in brackets is for examiner information / context to clarify the

marking but is not required to earn the mark

3 Calculation questions:

• The mark scheme will show the steps in the most likely correct method(s), the mark for each

step, the correct answer(s) and the mark for each answer.

• If working/explanation is considered essential for full credit, this will be indicated in the

question paper and in the mark scheme. In all other instances, the correct answer to a

calculation should be given full credit, even if no supporting working is shown.

• Where the candidate uses a valid method which is not covered by the mark scheme, award

equivalent marks for reaching equivalent stages.

• Where an answer makes use of a candidate’s own incorrect figure from previous working,

the ‘own figure rule’ (OFR) applies: full marks will be given if a correct and complete method

is used. Further guidance will be included in the mark scheme where necessary and any

exceptions to this general principle will be noted.

4 Annotation:

• For point marking, ticks are used to indicate correct answers and crosses to indicate wrong

answers. There is a direct relationship between ticks and marks.

• Other annotations will be used by examiners as agreed during standardisation, and the

meaning will be understood by all examiners who mark that paper.

• For levels of response marking, each level awarded should be clearly annotated on the script

the first time it is achieved.

© UCLES 2020 Page 3 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

PREPARATION FOR MARKING

1 Make sure that you have completed the relevant training and have access to the RM Assessor

Guide.

2 Make sure that you have read and understand the question paper, which you can download from

https://support.rm.com/ca

3 Log in to RM Assessor then mark and submit the required number of practice and standardisation

scripts. You will need to mark the standardisation scripts to the required accuracy in order to be

approved for marking live scripts. You may be asked to re-mark them, or to mark a second

sample, if you do not meet the required accuracy on your first attempt.

MARKING PROCESS

1 Mark strictly to the FINAL mark scheme, applying the criteria consistently and the general

marking principles outlined on the previous page.

2 If you are in doubt about applying the mark scheme, consult your Team Leader.

3 Mark at a steady rate through the marking period. Do not rush, and do not leave too much until

the end. If you anticipate a problem in meeting the deadline, contact your Team Leader

immediately and the Examiners’ Helpdesk.

4 Examiners will prepare a brief report on the performance of candidates to send to their Team

Leader via email by the end of the marking period. The Examiner should note strengths seen in

answers and common errors or weaknesses. Constructive comments on the question paper,

mark scheme or procedures are also appreciated.

MARKING SPECIFICS

Crossed out work

1 All a candidate’s answers, crossed out or not, optional or not, must be marked.

2 The only response not to be marked is one that has been crossed out and replaced by another

response for that exact same question.

3 Consequently, if a candidate has crossed out their response to an optional question and gone on

to answer a different optional question then both attempts must be marked. The higher mark will

be awarded by the system according to the rubric.

0 (zero) marks or NR (no response)

1 Award NR if there is nothing at all written in answer to that question (often the case for optional

questions).

2 Award NR if there is a comment which is not an attempt at the question (e.g. ‘can’t do it’ or ‘don’t

know’ etc.)

3 Award NR if there is a symbol which is not an attempt at the question, such as a dash or question

mark.

4 Award 0 (zero) if there is any attempt at the question which does not score marks. This includes

copying the question onto an Answer Booklet.

Annotation

1 Every question must have at least one annotation e.g. <NAQ> if it is an NR and <X> or <seen> if

0 marks are awarded.

2 Every mark awarded for a question (as shown in the mark input box to the right of the

screen) must be indicated by a correctly positioned tick on the script. The number in the

box below the tick annotation must be equal to the mark awarded in the input box.

3 Every page of a script must have at least one annotation e.g. <BP> for a blank page

© UCLES 2020 Page 4 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

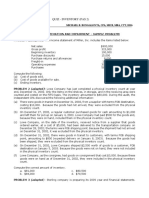

Question Answer Marks

1(a) Calculate Vietnam’s GDP per head in 2017. 1

$6900 (1).

1(b) Identify two rewards to factors of production. 2

Wages (1) profits (1).

1(c) Explain what happened to Vietnam’s foreign exchange rate between 2

2010 and 2017.

Logical explanation which might include:

It fell/depreciated (1) more dong had to be given to buy one dollar (1).

1(d) Explain two benefits an economy may gain from having a young 4

labour force.

Logical explanation which might include:

May be more flexible (1) switch from doing different tasks (1).

May be more mobile (1) able to switch from one job to another or from one

place to another place (1).

May be more up to date with advances in technology (1) more

productive/able to use advanced technology (1).

1(e) Analyse why Vietnam’s budget deficit may decline in the future. 4

Coherent analysis which might include:

High economic growth will raise incomes/wages rising (1) higher profits (1)

more revenue from direct taxes (1) higher incomes is likely to result in more

spending (1) more revenue from indirect taxes (1).

Tax rates may be increased (1) reducing the gap between tax revenue and

government spending (1).

Deregulation / privatisation may increase profits (1) resulting in higher

revenue from direct taxes /corporation tax (1).

1(f) Analyse the relationship between government spending on education 5

and the percentage of the labour force employed in the tertiary sector.

Coherent analysis which might include:

Generally the countries with the highest % spending on education have the

highest percentage employed in the tertiary sector and vice versa (1) up to

two examples e.g. Norway has the highest % spending and the highest %

employed in the tertiary sector, Bangladesh has the lowest % spending and

the lowest % employed in the tertiary sector (2) the main exception is

Vietnam – second highest % spending but lowest % employed in the tertiary

sector (1) there may be a time lag in this case (1).

It is the expected relationship as some tertiary jobs require high skills (1)

countries that can afford to devote a high percentage of resources to

education may have achieved a relatively high level of development (1) a

higher percent spent will create jobs in education (1).

© UCLES 2020 Page 5 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

1(g) Discuss whether or not an increase in competition is likely to benefit 6

Vietnamese consumers.

Apply this example to all questions with the command word DISCUSS

(1g, 1h, 2d, 3d, 4d and 5d)

Each point may be credited only once, on either side of an argument, but separate

development as to how/why the outcome may differ is rewarded.

Generic example mark

Tax revenue may decrease… 1

...because of reason e.g. incomes may be lower. 1

Tax revenue may increase because incomes may be higher i.e.

0

reverse of a previous argument.

Tax revenue may increase because of a different reason i.e. not

the reverse of a previous argument e.g. government spending on

1

subsidies may stimulate the economy more than spending on

education.

Award up to 4 marks for logical reasons why it might, which may include:

• prices may be reduced to attract more consumers (1) making them

more affordable to consumers (1)

• choice will be increased in terms of sellers (1) and possibly in terms of a

greater range of products (1)

• quality may rise (1) with pressure being put on producers to produce

good products to attract consumers (1)

• producers may respond more fully to changes in consumer demand (1)

Award up to 4 marks for logical reasons why it might not, which may include:

• firms may be smaller (1), less able to take advantage of economies of

scale (1), so prices may be higher (1)

• firms may have less profit (1) and so spend less improving the quality of

the product (1)

• some firms may be MNCs (1), less concerned about causing external

costs (1)

© UCLES 2020 Page 6 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

1(h) Discuss whether or not the increase in borrowing is likely to have 6

caused inflation in Vietnam in 2017.

Award up to 4 marks for logical reasons why it might, which may include:

• higher consumer demand (1) and investment (1) will increase total

(aggregate) demand (1)

• higher total demand may cause demand-pull inflation/cause producers

to raise prices (1)

• government spending may rise, further adding to total (aggregate)

demand (1)

• the economy has very low unemployment/full employment (1) making it

difficult for supply to respond to higher demand (1)

• tax rates may rise (1) which may increase costs of production (1)

causing cost-push inflation (1)

Award up to 4 marks for logical reasons why it might not, which may include:

• higher investment may reduce costs of production (1) lowering cost-

push inflation (1)

• higher consumer spending may enable firms to grow (1) and take

greater advantage of economies of scale (1)

• increased education (1) may raise labour productivity (1), reduce costs

of production (1) and lower cost-push inflation (1)

• privatised firms may be more efficient (1)

• more competition may reduce price rises (1)

© UCLES 2020 Page 7 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

2(a) State two benefits a country may gain from immigration. 2

One mark each for two from:

larger labour force, reduced dependency rate, higher demand, higher tax

revenue, more skilled workers, greater utilisation of resources.

2(b) Explain two consequences of deflation. 4

Logical explanation which might include:

Output may fall (1) if due to lower demand firms will cut back production (1).

Unemployment may rise (1) fewer workers will be needed to produce fewer

goods and services (1).

Economic growth may decline / a recession may occur (1) due to lower total

(aggregate) demand (1).

Output may rise (1) if due to lower costs of production / advances in

technology (1).

Exports may increase (1) if domestic products have become more price-

competitive (1).

2(c) Analyse why children from low-income families may have low incomes 6

as adults.

Coherent analysis which might include:

Likely to receive less education (1) likely to have lower quality healthcare (1)

nutrition is likely to be poor (1) likely to gain fewer qualifications/skills (1) be

less productive (1) have fewer employment opportunities (1) may be in low

paid jobs (1) may be unemployed (1).

© UCLES 2020 Page 8 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

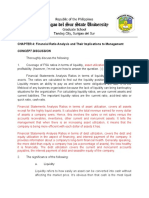

2(d) Discuss whether or not a national minimum wage will reduce poverty. 8

In assessing each answer, use the table below.

Level Description Marks

3 A reasoned discussion which accurately examines both 6–8

sides of the economic argument, making use of

economic information and clear and logical analysis to

evaluate economic issues and situations. One side of

the argument may have more depth than the other but,

overall, both sides of the argument are considered and

developed. There is thoughtful evaluation of economic

concepts, terminology, information and/or data

appropriate to the question. The discussion may also

point out the possible uncertainties of alternative

decisions and outcomes.

2 A reasoned discussion which makes use of economic 3–5

information and clear analysis to evaluate economic

issues and situations. The answer may lack some

depth and development may be one-sided. There is

relevant use of economic concepts, terminology,

information and data appropriate to the question.

1 There is a simple attempt at using economic definitions 1–2

and terminology. Some reference may be made to

economic theory, with occasional understanding.

0 A mark of zero should be awarded for no creditable 0

content.

Why it might:

• is set above the equilibrium level, will raise the pay of the low-paid

• may reduce relative poverty by reducing the gap between high and low-

income earners

• may reduce absolute poverty by enabling low paid workers greater

access to basic necessities

• may raise employment, if it motivates workers and raises productivity

• may raise employment if it increases total (aggregate) demand.

Why it might not:

• may not have any impact if set below the equilibrium level

• unemployment may rise as it may increase firms’ costs of production

• will not help the poor who are unable to work

• may not reduce relative poverty if it results in other workers pressing

for, and getting, wage rises to maintain their wage differentials

• some receiving it may not be in poor households.

Reward, but do not expect, a national minimum wage diagram which shows

the effect on pay and employment.

© UCLES 2020 Page 9 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

3(a) Define a capital good. 2

Human-made good (1) used in production/used to produce other goods and

services (1).

3(b) Explain two challenges facing small firms. 4

Logical explanation which might include:

Lack of finance/difficulty raising finance (1) banks may be more reluctant to

lend to small firms (1).

May not be able to take advantage of economies of scale (1) may have

higher average cost (1).

Not well known (1) difficult to attract consumers (1).

May face fierce competition from large firms (1) which may lower their

prices/spend more on advertising (1).

Risk of failure (1) due to inexperience of owners (1).

3(c) Analyse, using a demand and supply diagram, how a rise in income 6

may affect the market for gold.

Up to 4 marks for the diagram:

Axes correctly labelled – price and quantity or p and q (1).

Demand and supply curves correctly labelled (1).

Demand curve shifted to the right (1).

Equilibriums – shown by lines P1, P2/Q1, Q2 or marking the equilibrium

points E1 and E2 (1).

Up to 2 marks for logical analysis:

An increase in income will increase people’s ability to buy gold/raise

purchasing power (1).

Price will rise/quantity traded will rise (1).

© UCLES 2020 Page 10 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

3(d) Discuss whether or not MNCs increase production and productivity in 8

their host countries.

In assessing each answer, use the table below.

Level Description Marks

3 A reasoned discussion which accurately examines both 6–8

sides of the economic argument, making use of

economic information and clear and logical analysis to

evaluate economic issues and situations. One side of

the argument may have more depth than the other but,

overall, both sides of the argument are considered and

developed. There is thoughtful evaluation of economic

concepts, terminology, information and/or data

appropriate to the question. The discussion may also

point out the possible uncertainties of alternative

decisions and outcomes.

2 A reasoned discussion which makes use of economic 3–5

information and clear analysis to evaluate economic

issues and situations. The answer may lack some

depth and development may be one-sided. There is

relevant use of economic concepts, terminology,

information and data appropriate to the question.

1 There is a simple attempt at using economic definitions 1–2

and terminology. Some reference may be made to

economic theory, with occasional understanding.

0 A mark of zero should be awarded for no creditable 0

content.

Why they might:

• may have high demand for their products

• may create demand for raw materials from domestic firms

• may bring new technology and working practices into the countries

• may train workers

• may pay higher wages which may motivate workers.

Why it might not:

• may drive some domestic firms of business

• may deplete natural resources, reducing output in the future

• may have long/unsociable working hours

• may generate external costs including pollution which may reduce the

health of workers.

Limit to level 2 if only production or productivity is considered.

© UCLES 2020 Page 11 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

4(a) Define macroeconomics. 2

The study of the whole economy (2).

Example of a macroeconomic topic e.g. unemployment/study of economics

on a large scale (1).

4(b) Explain two consequences to firms of unemployment. 4

Logical explanation which might include:

Lower demand (1) lower revenue (1).

Lower ability to take advantage of economies of scale (1) due to lower

output (1).

Lower average costs (1) lower wages (1).

Less risk of industrial action (1) workers afraid of losing their jobs (1).

Greater ease of recruiting workers (1) reducing recruitment costs (1).

4(c) Analyse how tax cuts could increase exports. 6

Coherent analysis which might include:

Lower indirect taxes could reduce costs of production (1) could encourage

investment (1) use of more advanced technology/more efficient methods of

production (1) which could lower prices / make prices more internationally

competitive (1).

Lower income tax could motivate workers (1) raise productivity (1) lower

price of exports (1) raise quality of exports (1).

Lower taxes in other countries (1) e.g. a lower tariff will encourage

foreigners to purchase more exports (1).

© UCLES 2020 Page 12 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

4(d) Discuss whether or not a current account deficit on its balance of 8

payments harms an economy.

In assessing each answer, use the table below.

Level Description Marks

3 A reasoned discussion which accurately examines both 6–8

sides of the economic argument, making use of

economic information and clear and logical analysis to

evaluate economic issues and situations. One side of

the argument may have more depth than the other but,

overall, both sides of the argument are considered and

developed. There is thoughtful evaluation of economic

concepts, terminology, information and/or data

appropriate to the question. The discussion may also

point out the possible uncertainties of alternative

decisions and outcomes.

2 A reasoned discussion which makes use of economic 3–5

information and clear analysis to evaluate economic

issues and situations. The answer may lack some

depth and development may be one-sided. There is

relevant use of economic concepts, terminology,

information and data appropriate to the question.

1 There is a simple attempt at using economic definitions 1–2

and terminology. Some reference may be made to

economic theory, with occasional understanding.

0 A mark of zero should be awarded for no creditable 0

content.

Why it might:

• income/demand is leaving the economy

• employment will be lower than it could be

• it may put downward pressure on the exchange rate

• the country will get into debt

• other countries may not be willing to lend to it / invest in the country.

Why it might not:

• deficit may be low / short term

• enables the country to consume more than it produces

• imports of raw materials and capital goods will increase output in the

future.

© UCLES 2020 Page 13 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

5(a) State two objectives of firms. 2

One mark each for two from:

survival, social welfare, profit maximisation and growth.

5(b) Explain how a subsidy can correct market failure. 4

Logical explanation which might include:

A payment to increase production (1) and lower price (1) can increase

consumption of merit goods (1) products with positive externalities (1) which

are under-consumed if left to market forces (1) can be paid to private sector

firms to produce public goods (1) would not be produced if left to market

forces (1).

5(c) Analyse, using a production possibility curve (PPC) diagram, the effect 6

of advances in technology on an economy.

Up to 4 marks for the diagram:

Axes correctly drawn (1).

Initial curve drawn as a curve or a downward sloping line to the axes (1).

New curve drawn as a curve or a downward sloping line to the axes (1).

Shift to the right indicated by arrow or lettering (1).

Up to 2 marks for logical analysis:

Advances in technology raise the quality of capital (1) increase productive

capacity (1).

© UCLES 2020 Page 14 of 15

2281/21 Cambridge O Level – Mark Scheme May/June 2020

PUBLISHED

Question Answer Marks

5(d) Discuss whether or not an increase in government spending will 8

reduce unemployment.

In assessing each answer, use the table below.

Level Description Marks

3 A reasoned discussion which accurately examines both 6–8

sides of the economic argument, making use of

economic information and clear and logical analysis to

evaluate economic issues and situations. One side of

the argument may have more depth than the other but,

overall, both sides of the argument are considered and

developed. There is thoughtful evaluation of economic

concepts, terminology, information and/or data

appropriate to the question. The discussion may also

point out the possible uncertainties of alternative

decisions and outcomes.

2 A reasoned discussion which makes use of economic 3–5

information and clear analysis to evaluate economic

issues and situations. The answer may lack some

depth and development may be one-sided. There is

relevant use of economic concepts, terminology,

information and data appropriate to the question.

1 There is a simple attempt at using economic definitions 1–2

and terminology. Some reference may be made to

economic theory, with occasional understanding.

0 A mark of zero should be awarded for no creditable 0

content.

Why it might:

• may raise total (aggregate) demand, encouraging firms to hire more

workers

• may be spent on education which may increase people’s skills

• may be spent on healthcare which may make people fitter and more

employable

• may be spent on subsidies to firms which will encourage them to

increase output and take on more workers.

Why it might not:

• if spent on unemployment benefits, it may encourage some people to

leave their jobs

• if there is full employment, it will just cause inflation

• spending on education may be ineffective e.g. develop the wrong skills

• higher total (aggregate) demand may encourage firms to use more

capital goods rather than labour.

© UCLES 2020 Page 15 of 15

You might also like

- Cambridge O Level: Economics 2281/22 May/June 2020Document14 pagesCambridge O Level: Economics 2281/22 May/June 2020Jack KowmanNo ratings yet

- Cambridge IGCSE™: Economics 0455/21 May/June 2020Document15 pagesCambridge IGCSE™: Economics 0455/21 May/June 2020PhoneHtut KhaungMinNo ratings yet

- Cambridge O Level: Economics 2281/21 May/June 2020Document15 pagesCambridge O Level: Economics 2281/21 May/June 2020saeedaumar1954No ratings yet

- Cambridge International AS & A Level: Business 9609/21 May/June 2022Document22 pagesCambridge International AS & A Level: Business 9609/21 May/June 2022cx9tc54hjvNo ratings yet

- Cambridge International AS & A Level: Business 9609/12 May/June 2022Document20 pagesCambridge International AS & A Level: Business 9609/12 May/June 2022fopabip33No ratings yet

- Cambridge International AS & A Level: Business 9609/32 May/June 2021Document24 pagesCambridge International AS & A Level: Business 9609/32 May/June 2021StarboyNo ratings yet

- Cambridge International AS & A Level: Business 9609/32 May/June 2022Document25 pagesCambridge International AS & A Level: Business 9609/32 May/June 2022btsfan2002007No ratings yet

- Cambridge International AS & A Level: BusinessDocument24 pagesCambridge International AS & A Level: BusinessNipuni PereraNo ratings yet

- Cambridge International AS & A Level: Business 9609/23 May/June 2022Document17 pagesCambridge International AS & A Level: Business 9609/23 May/June 2022Ss EditzNo ratings yet

- 9708_w22_ms_22Document17 pages9708_w22_ms_22kutsofatsoNo ratings yet

- Cambridge International AS & A Level: Business 9609/13 October/November 2022Document19 pagesCambridge International AS & A Level: Business 9609/13 October/November 2022Sasa DzudzevicNo ratings yet

- Cambridge International AS & A Level: Business 9609/32 February/March 2022Document23 pagesCambridge International AS & A Level: Business 9609/32 February/March 2022thabo bhejaneNo ratings yet

- Cambridge International AS & A Level: Sociology 9699/42 March 2021Document18 pagesCambridge International AS & A Level: Sociology 9699/42 March 2021Tamer AhmedNo ratings yet

- Cambridge International AS & A Level: EconomicsDocument15 pagesCambridge International AS & A Level: EconomicsDivya SinghNo ratings yet

- Cambridge International AS & A Level: Business 9609/11 May/June 2022Document18 pagesCambridge International AS & A Level: Business 9609/11 May/June 2022Tawanda BlackwatchNo ratings yet

- 9609 m22 Ms 12 PDFDocument18 pages9609 m22 Ms 12 PDFthabo bhejaneNo ratings yet

- Cambridge O Level: Global Perspectives 2069/02Document8 pagesCambridge O Level: Global Perspectives 2069/02hafak27227No ratings yet

- Cambridge O Level: Global Perspectives 2069/12Document21 pagesCambridge O Level: Global Perspectives 2069/12hafak27227No ratings yet

- Cambridge International AS & A Level: Sociology 9699/11 May/June 2022Document17 pagesCambridge International AS & A Level: Sociology 9699/11 May/June 2022katsandeNo ratings yet

- Commerce 04Document20 pagesCommerce 04Abu IbrahimNo ratings yet

- Cambridge International AS & A Level: Sociology 9699/12Document15 pagesCambridge International AS & A Level: Sociology 9699/12Rida ShariqNo ratings yet

- 9693 s22 Ms 11 Test 2022 Answerkey PDFDocument14 pages9693 s22 Ms 11 Test 2022 Answerkey PDFBeatriz ColioNo ratings yet

- Cambridge International AS & A Level: Economics 9708/42 October/November 2022Document15 pagesCambridge International AS & A Level: Economics 9708/42 October/November 2022Poh CarineNo ratings yet

- Cambridge International AS & A Level: Business 9609/12 May/June 2021Document19 pagesCambridge International AS & A Level: Business 9609/12 May/June 2021RizwanSial100% (1)

- 0457_m23_ms_12Document20 pages0457_m23_ms_12David ThydetNo ratings yet

- 9699_s23_ms_21Document17 pages9699_s23_ms_21Tomisin KoladeNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/22 February/March 2022Document21 pagesCambridge IGCSE™: Business Studies 0450/22 February/March 2022Ineza LindaNo ratings yet

- Cambridge International AS & A Level: Business 9609/12 March 2021Document16 pagesCambridge International AS & A Level: Business 9609/12 March 2021LisaNo ratings yet

- Cambridge International AS & A Level: Economics 9708/43 October/November 2022Document22 pagesCambridge International AS & A Level: Economics 9708/43 October/November 2022Poh CarineNo ratings yet

- Psychology p4Document24 pagesPsychology p4EmaanNo ratings yet

- 0457_m21_ms_12Document19 pages0457_m21_ms_12David ThydetNo ratings yet

- Cambridge IGCSE™: Global Perspectives 0457/13 May/June 2022Document20 pagesCambridge IGCSE™: Global Perspectives 0457/13 May/June 2022Akoh Nixon AkohNo ratings yet

- 03 0455 22 2023 MS Prov Rma 24022023030336Document26 pages03 0455 22 2023 MS Prov Rma 24022023030336abin alexanderNo ratings yet

- Cambridge International AS & A Level: Global Perspectives and Research 9239/11 May/June 2021Document21 pagesCambridge International AS & A Level: Global Perspectives and Research 9239/11 May/June 2021Hassan AsadullahNo ratings yet

- Cambridge IGCSE™: Global Perspectives 0457/11 May/June 2022Document20 pagesCambridge IGCSE™: Global Perspectives 0457/11 May/June 2022Akoh Nixon AkohNo ratings yet

- Cambridge International AS & A Level: SociologyDocument18 pagesCambridge International AS & A Level: Sociologyshwetarameshiyer7No ratings yet

- Cambridge International AS & A Level: AccountingDocument16 pagesCambridge International AS & A Level: AccountingFarrukhsgNo ratings yet

- Cambridge IGCSE™: Economics 0455/22 February/March 2022Document30 pagesCambridge IGCSE™: Economics 0455/22 February/March 2022Angel XxNo ratings yet

- Cambridge International AS & A Level: Economics 9708/23 October/November 2022Document15 pagesCambridge International AS & A Level: Economics 9708/23 October/November 2022Andrew BadgerNo ratings yet

- Cambridge IGCSE™: Physics 0625/41 October/November 2020Document17 pagesCambridge IGCSE™: Physics 0625/41 October/November 2020Nisha zehraNo ratings yet

- 0457_s23_ms_13Document22 pages0457_s23_ms_13Yakshrajsinh JadejaNo ratings yet

- 5054 s20 Ms 22 PDFDocument13 pages5054 s20 Ms 22 PDFJack KowmanNo ratings yet

- Cambridge International AS & A Level: Sociology 9699/11Document15 pagesCambridge International AS & A Level: Sociology 9699/11Anindita DeeyaNo ratings yet

- 9699_s23_ms_32Document10 pages9699_s23_ms_32Tomisin KoladeNo ratings yet

- 0457_w23_ms_13Document20 pages0457_w23_ms_13David ThydetNo ratings yet

- Post0455/22 Mark Scheme March 2021Document20 pagesPost0455/22 Mark Scheme March 2021Rabab KashifNo ratings yet

- Cambridge International AS & A Level: BusinessDocument29 pagesCambridge International AS & A Level: BusinessTrần Đức TàiNo ratings yet

- Cambridge IGCSE™: Physics 0625/43 October/November 2020Document16 pagesCambridge IGCSE™: Physics 0625/43 October/November 2020Nisha zehraNo ratings yet

- gp ir mark scheme 0457 igcseDocument8 pagesgp ir mark scheme 0457 igcsewaihon.pang2011No ratings yet

- Cambridge IGCSE ™: Global Perspectives 0457/12Document19 pagesCambridge IGCSE ™: Global Perspectives 0457/12Franco CardozoNo ratings yet

- Cambridge International AS & A Level: Physics 9702/21 October/November 2020Document12 pagesCambridge International AS & A Level: Physics 9702/21 October/November 2020Kamran KhanNo ratings yet

- Bus P1Document105 pagesBus P1saharnoor996No ratings yet

- 9609_m23_ms_12_2Document27 pages9609_m23_ms_12_2kutsofatsoNo ratings yet

- Cambridge International AS & A Level: Physics 9702/42 May/June 2021Document19 pagesCambridge International AS & A Level: Physics 9702/42 May/June 2021Mahebul MazidNo ratings yet

- 0457_s23_ms_11Document21 pages0457_s23_ms_11David ThydetNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/22 February/March 2022Document21 pagesCambridge IGCSE™: Business Studies 0450/22 February/March 2022سعدیNo ratings yet

- Cambridge IGCSE™: Physics 0625/42 October/November 2020Document19 pagesCambridge IGCSE™: Physics 0625/42 October/November 2020Nisha zehraNo ratings yet

- Cambridge IGCSE™: Physics 0625/32 February/March 2022Document15 pagesCambridge IGCSE™: Physics 0625/32 February/March 2022Freddy BotrosNo ratings yet

- 0457_w23_ms_11Document19 pages0457_w23_ms_11David ThydetNo ratings yet

- Cambridge O Level: PHYSICS 5054/21Document20 pagesCambridge O Level: PHYSICS 5054/21Jack KowmanNo ratings yet

- Cambridge O Level: Physics 5054/12Document16 pagesCambridge O Level: Physics 5054/12Jack KowmanNo ratings yet

- Cambridge O Level: Physics 5054/11 October/November 2020Document3 pagesCambridge O Level: Physics 5054/11 October/November 2020Jack KowmanNo ratings yet

- Cambridge O Level: Physics 5054/11 October/November 2020Document3 pagesCambridge O Level: Physics 5054/11 October/November 2020Jack KowmanNo ratings yet

- Cambridge O Level: Physics 5054/11Document16 pagesCambridge O Level: Physics 5054/11Jack KowmanNo ratings yet

- Cambridge O Level: Marine Science 5180/03 October/November 2020Document11 pagesCambridge O Level: Marine Science 5180/03 October/November 2020Jack KowmanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationJack KowmanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International General Certificate of Secondary EducationJack KowmanNo ratings yet

- Cambridge O Level: Marine Science 5180/01Document16 pagesCambridge O Level: Marine Science 5180/01Jack KowmanNo ratings yet

- Cambridge Assessment International Education: Fashion and Textiles 6130/01 October/November 2019Document23 pagesCambridge Assessment International Education: Fashion and Textiles 6130/01 October/November 2019Jack Kowman100% (1)

- Grade Thresholds - November 2018: Cambridge O Level Second Language Urdu (3248)Document1 pageGrade Thresholds - November 2018: Cambridge O Level Second Language Urdu (3248)Uzair KhanNo ratings yet

- Cambridge O Level: Marine Science 5180/01 October/November 2020Document12 pagesCambridge O Level: Marine Science 5180/01 October/November 2020Jack KowmanNo ratings yet

- Cambridge O Level: Literature in English 2010/12 May/June 2020Document4 pagesCambridge O Level: Literature in English 2010/12 May/June 2020Jack KowmanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument24 pagesCambridge International General Certificate of Secondary EducationJack KowmanNo ratings yet

- 0510 s19 QP 21 PDFDocument16 pages0510 s19 QP 21 PDFJack KowmanNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument20 pagesCambridge Ordinary Level: Cambridge Assessment International EducationJack KowmanNo ratings yet

- 0510 s19 QP 21 PDFDocument16 pages0510 s19 QP 21 PDFJack KowmanNo ratings yet

- Cambridge O Level: Arabic 3180/02 May/June 2020Document13 pagesCambridge O Level: Arabic 3180/02 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level: Literature in English 2010/22 May/June 2020Document4 pagesCambridge O Level: Literature in English 2010/22 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level: Arabic 3180/02 May/June 2020Document13 pagesCambridge O Level: Arabic 3180/02 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level Fashion and Textiles Grade Thresholds Nov 2019Document1 pageCambridge O Level Fashion and Textiles Grade Thresholds Nov 2019Jack KowmanNo ratings yet

- Cambridge O Level: Global Perspectives 2069/12Document4 pagesCambridge O Level: Global Perspectives 2069/12Jack KowmanNo ratings yet

- Cambridge O Level Cambridge O Level: Literature in English 2010/12Document28 pagesCambridge O Level Cambridge O Level: Literature in English 2010/12Jack KowmanNo ratings yet

- Cambridge O Level: Accounting 7707/11 May/June 2020Document3 pagesCambridge O Level: Accounting 7707/11 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level: Arabic 3180/01 May/June 2020Document6 pagesCambridge O Level: Arabic 3180/01 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level: ARABIC 3180/01Document8 pagesCambridge O Level: ARABIC 3180/01Muhammad Raza HayatNo ratings yet

- Cambridge O Level: Accounting 7707/21 May/June 2020Document18 pagesCambridge O Level: Accounting 7707/21 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level: Global Perspectives 2069/12 May/June 2020Document15 pagesCambridge O Level: Global Perspectives 2069/12 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level: Global Perspectives 2069/02 May/June 2020Document6 pagesCambridge O Level: Global Perspectives 2069/02 May/June 2020Jack KowmanNo ratings yet

- Cambridge O Level: Accounting 7707/11 May/June 2020Document3 pagesCambridge O Level: Accounting 7707/11 May/June 2020Jack KowmanNo ratings yet

- EVA Challenge Book SummaryDocument9 pagesEVA Challenge Book SummaryRahilHakimNo ratings yet

- Income Taxation Taxation of CorporationsDocument52 pagesIncome Taxation Taxation of CorporationsBianca Denise AbadNo ratings yet

- Icaew Accounting Mock (Pilot Test) : 1. EmailDocument13 pagesIcaew Accounting Mock (Pilot Test) : 1. EmailSteve IdnNo ratings yet

- Far670 Solution Jul 2020Document4 pagesFar670 Solution Jul 2020siti hazwaniNo ratings yet

- 01 Capitalstructure Lecture ADocument76 pages01 Capitalstructure Lecture AKatarina SusaNo ratings yet

- Inventory Quiz ProblemsDocument9 pagesInventory Quiz Problemspenny coronado100% (1)

- SEBI Grade A EXAM Mock Test Questions with SolutionsDocument31 pagesSEBI Grade A EXAM Mock Test Questions with SolutionsSnehashree SahooNo ratings yet

- Tugas Manajemen Keuangan PT. Hotel Sahid JayaDocument2 pagesTugas Manajemen Keuangan PT. Hotel Sahid JayaDadra Are PutraNo ratings yet

- Tutorial 2 Manufacturing Account 2 AnswerDocument15 pagesTutorial 2 Manufacturing Account 2 AnswerNG JIA LUNGNo ratings yet

- Vivendi 20230308 VIV Pres FY-2022 ENGDocument46 pagesVivendi 20230308 VIV Pres FY-2022 ENGMiguel RamosNo ratings yet

- 1st Semester Account GKJDocument89 pages1st Semester Account GKJGkjNo ratings yet

- Prozone by StockupdatesDocument181 pagesProzone by Stockupdatesstockupdates2012No ratings yet

- Income From Business-ProblemsDocument20 pagesIncome From Business-Problems24.7upskill Lakshmi V100% (1)

- Chap - Test - CH4 - Financial Ratio Analysis and Their Implications To ManagementDocument10 pagesChap - Test - CH4 - Financial Ratio Analysis and Their Implications To Managementroyette ladicaNo ratings yet

- This Study Resource Was: Philippine School of Business AdministrationDocument6 pagesThis Study Resource Was: Philippine School of Business AdministrationGab IgnacioNo ratings yet

- Accounting For Government and Not-For-Profit OrganizationsDocument30 pagesAccounting For Government and Not-For-Profit OrganizationsPatricia ReyesNo ratings yet

- BADVAC1X - MOD 6 TemplatesDocument16 pagesBADVAC1X - MOD 6 TemplatesDarius DelacruzNo ratings yet

- Tunisia Tax Guide - 2019 - 0Document10 pagesTunisia Tax Guide - 2019 - 0Sofiene CharfiNo ratings yet

- Payslip Mar 2023Document1 pagePayslip Mar 2023Hitesh ChauhanNo ratings yet

- 2.KEL Blue PrintDocument80 pages2.KEL Blue Printanand chawanNo ratings yet

- MDI Gurgaon PGPM20-21 Term II Management Accounting II Mid-term-examDocument2 pagesMDI Gurgaon PGPM20-21 Term II Management Accounting II Mid-term-exampgpm20 SANCHIT GARGNo ratings yet

- Barangay Tax Code SampleDocument3 pagesBarangay Tax Code SampleReese Oguis96% (26)

- Module 34 Share Based Compensation TheoryDocument2 pagesModule 34 Share Based Compensation TheoryThalia UyNo ratings yet

- Accounting For Special Transactions and Business CombinationsDocument3 pagesAccounting For Special Transactions and Business CombinationsJustine Reine CornicoNo ratings yet

- Read The Following Excerpt From A Complaint Filed by TheDocument1 pageRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- A Report On WIndow DressingDocument6 pagesA Report On WIndow DressingsaumyabratadasNo ratings yet

- p4 6Document2 pagesp4 6Santika Ayu PalupiNo ratings yet

- Taxation 1Document54 pagesTaxation 1JaylordPataotaoNo ratings yet

- Capital StructureDocument28 pagesCapital Structureyaatin dawarNo ratings yet

- Strategic Tax Management (Final Period Assignment Quiz)Document4 pagesStrategic Tax Management (Final Period Assignment Quiz)Nelia AbellanoNo ratings yet