Professional Documents

Culture Documents

Assignment

Uploaded by

Md. Alif HossainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment

Uploaded by

Md. Alif HossainCopyright:

Available Formats

Assignment

Corse Title: Taxation, Course Code: BBA321

Date of soft copy submission: September 06, 2020

Date of hard copy submission: after opening university

Instructions: i. write your name and id on the top of each page

ii. use white color clean page or fresh white color khata

iii. Keep it safely for the final submission of the hard copy after opening the campus

iv. You have to participate on line viva voce on this assignment and viva schedule will be

given later on.

Problem-1

On June 2019, Mr. Jarif’s basic salary falls on Tk. 10,200 in the scale of 9,600-200*12-

12,000. His date of yearly increment is on 21st March. He received two bonuses equivalent to

one month’s B.S, one received before the date of increment and another after increment. He

contributes 10% of B.S to recognized provident fund (RPF) from which he has also received

an interest of Tk. 1,500 @ 10% interest. He received technical allowance Tk. 8,000 per

month and medical allowance Tk. 3,500 per month. He has been provided a quarter with a

concessional rate for which Tk. 1,000 per month is deducted from his salary. However, the

annual rental value of that house is Tk. 75,000. He has been provided with a car for both

office and private use. In additional to it, he is also provided with Tk. 6,000 per month as

conveyance allowance. Driver’s salary of the full-time car Tk. 10,000 per month paid to his

driver’s bank account directly. The maintenance cost of the car during the year was Tk.

10,000 paid by him.

Company gave him international Air ticket for a tour as a part of his service contract for

which the company spent Tk. 35,000. He has received compensation for the termination of

Tk. 250,000. Bill paid for the membership of an international club by the company Tk.

25,000. He received Tk. 4,000 per month as a pension and gratuity for Tk. 120,000. Due to

family problem he received two month’s B.S as an advanced. He has been provided a special

allowance Tk. 6,000 for conducting office assignment but his actual expenses were Tk. 4,500.

He has been given Tk. 250,000 as a travel passage to Maldives with his spouse as per the

terms of employment. Company provides Tk. 10,000 to him during the year being the

reimbursement of various utilities bills of his house. His taxation income from other sources

was Tk. 230,000 during the income year. He was paid personal mobile phone bill paid by the

company @ Tk. 600 per month. His investments during the year were as follows:

a. Purchase of share of a private limited company Tk. 10,000

b. Purchase of share of a partnership firm Tk. 25,000

c. Donation to Dhaka university and Dhaka hospital Tk. 120,000

d. Payment of owns and his wife’s insurance policy Tk. 1,200

e. Purchase of a laptop Tk. 56,000

f. Purchase of books and magazine Tk. 2,500

Required: Compute total taxable income of Mr. Jarif under the head of “Income from

Salary” Sec-21

Problem-2: From the following information compute the chargeable income under the head

of “income from interest on securities” for Mr. Maulif for the income year 2018-2019

I. Income from interest on tax free government securities Tk.30,000

II. 15% tax -exempt govt. securities to the extent of Tk.80,000

III. Income from interest on taxable govt. securities Tk. 20,000

IV. 12% less tax government securities to the extent of Tk. 60,000

V. Income from zero coupon bond Tk. 15,000

VI. Income from interest on debentures Tk. 16,000

VII. 13% taxable government securities to the extent of Tk.180,000 which were purchased

on 01/010/2016.

VIII. 12.5% approved commercial securities to the extent of Tk. 270,000 which were

purchased on 01/010/2018.

IX. The DCT identified that he has transferred 14% debenture of Tk. 240,000 to his close

friend on 15th June 2019(interest is paid on 30 th June on an annul basis) and bought it

back n 3rd July 2019 a Tk. 105,000. The DCT has identified the matter as Bond

washing.

The Bank has deducted Tk. 600 as commission for collecting interest on above government

securities. In addition to this, approved commercial securities were purchased by taking a

bank loan of Tk. 150,000@ 10% interest.

Problem-3

Transparent Company provides the following information about its production & sales:

Purchase of Raw materials Tk. 20,00,000 and Direct wages Tk.2,50,000

Administrative expenses Tk. 70,000 and Selling expenses Tk. 20,000

Depreciation of Machinery Tk. 30,000

The Company sells its products by adding 25% margin on cost. The opening and closing

stock of raw materials recorded at Tk. 50,000 and Tk. 40,000 respectively. Determine VAT if

the rate is 15% assuming that opening and closing stock of finished goods were Tk. 30,000

and Tk. 20,000 respectively.

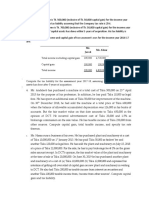

Problem -4

Ms. Samiha is working as an assistant professor of a private university in Bangladesh. For

the assessment, her income of the year 2018-2019 is given bellow:

Income from Salary: On July, 2018, basic salary Tk. 35,400 in the scale of 30,000-1800*10-

61,800. Her date of yearly salary increment is on 25th January. She received Dearness

Allowance @ 15% of B.S. and Medical Allowance of Tk. 800 per month. She received two

business equivalents to one month’s basic salary –one received before and another after

increment. She contributes 10% of her basic salary to recognized provident fund. Her

employer also contributes the same. She has been provided with a quarter for which 10% B.S.

is deducted. She received interest on provident fund Tk. 6,400 at an interest rate of 16%. She

has been provided with a car for office and private use.

Income from securities: 8% tax free government securities Tk. 25,000; Interest on taxable

government securities Tk. 3,800; interest on zero coupon bond Tk. 22,000 and interest on

approved debenture Tk. 20,000.

Income from House Property: She has a six storied building. Each floor has two flats. All

flats of the house are let out at Tk. 20,000 per month except one where she is using it for her

residence. The Municipal value of the house is Tk. 28,00,000. Expenses of the house for the

year were as follows: Repair Tk. 350,000; Interest on H.B.F.C. Loan Tk. 45,000; city

corporation tax Tk. 24,000; caretaker & night guard salary Tk. 19,500; rent collection charges

of Tk. 4,500; legal expense Tk. 13,250; insurance premium for this year of the building Tk.

14,500; whitewash and painting of the building maintenance for water pump, etc. Tk. 6,000

and municipal taxes Tk. 5,400. The house remained vacant for two months during the year.

Uncollectible rent for one month. However, owner’s expense paid by the tenants Tk. 7,800.

Agriculture Income: Sale of Rice 240 maunds @ Tk. 950 per maund. Income from tea Tk.

100,000, income from lease of agricultural land Tk. 28,000 and Sale of Agri-products Tk.

400,000. She purchased a tractor by Tk. 250,000; paid land development tax Tk. 4,000 and

crops insurance Tk. 12,000. Income from sale of fish from pond Tk.68,000. Income from

ferry ghat Tk. 10,000. Income from sale of honey Tk. 4,500 and income from sale of Palm

juice Tk. 3,200. Allowable depreciation for this year Tk.12,000. Maintenance costs of

irrigation plant Tk. 4,500. Other costs of production: cost of seeds and fertilizer Tk. 55,000,

watering and & maintenance cost Tk. 22,000, Labor, other production costs Tk. 140,000 and

ordinary processing costs Tk. 13,200. However, she maintained proper books of accounts for

the agricultural income of this year.

Business Income: Income from sole-trader ship business Tk. 260,000; last year loss carried

forward Tk. 20,000 and loss on speculative business Tk. 25,000 for this year. Sale of machine

Tk. 24,000 and cost was Tk. 20,000 and book value was Tk. 16,000. Moreover, she has

speculative income in this year Tk. 12,000 from another source.

Partnership income: Share of profit of an unregistered partnership firm Tk. 120,000.

Income from husband’s and minor son’s property (they do not submit tax return):

Income from her husband’s property Tk. 80,000 and income from her minor son’s property

Tk. 35,000.

Capital gain: Capital gain Tk. 85,000.

Other income: Interest on Bank Deposit Tk. 18,000; Dividend income from public limited

company Tk. 9,000; Profit from Islami Bank Bangladesh Limited Tk. 9,000. Interest on bank

fixed deposit account Tk. 18,350, dividend received from private limited company Tk.

22,800, Prize of lottery Tk. 50,000. Interest on postal savings account Tk. 27,000. Income

from writing book Tk. 35,000. Income from sale of forest timber Tk. 12,000. Dividend

received from private limited company Tk. 72,000.

Foreign income: Income from foreign property Tk. 120,000 received through remittance and

interest on foreign bank’s deposit Tk. 25,000.

During the year she incurred expenses for: Insurance premium paid (Policy value Tk.

300,000) Tk. 35,000; purchased primary share of a listed company Tk. 20,000; Purchased

Law and academic books Tk. 5,000; Donated to Deposit pension Scheme per month Tk.

1,000; Paid to Government Zakat Fund Tk. 5,000; given zakat during Ramadan to the poor

people Tk. 23,750 and Purchased of savings certificate Tk. 40,000. He purchased share of a

company from primary market Tk. 7,500. He also purchases medical books for Tk. 12,000

during the year. He donated Tk. 32,500 to prime minister's relief fund; Tk.12,000 to his

relatives and Tk. 25,000 to Aga khan Development Foundation.

Required: Calculate her total taxable income, gross tax liability and net tax liability. Assume

that during the income year her total net asset amount is Tk. 7 crore.

You might also like

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- Dac 212:principles of Taxation Revision Questions Topics 1-4Document6 pagesDac 212:principles of Taxation Revision Questions Topics 1-4Nickson AkolaNo ratings yet

- "An Individual Assesse Is Allowed To Get Tax Rebate On Certain Investment"-Explain. 4Document3 pages"An Individual Assesse Is Allowed To Get Tax Rebate On Certain Investment"-Explain. 4Shawon SarkerNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- Maths From CH-06 Salary IncomeDocument2 pagesMaths From CH-06 Salary IncomeFozle Rabby 182-11-5893No ratings yet

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Taxation of Individuals QuestionsDocument2 pagesTaxation of Individuals QuestionsPerpetua KamauNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- New Employment Inc QnsDocument13 pagesNew Employment Inc QnsLoveness JoseehNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Summer Holiday Homework Grade Xii CommerceDocument10 pagesSummer Holiday Homework Grade Xii CommerceJéévâNo ratings yet

- UntitledDocument4 pagesUntitledabdallahmachiliNo ratings yet

- Assignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsDocument2 pagesAssignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsWaasfaNo ratings yet

- Caf PracticeDocument2 pagesCaf Practicedavid.ellis1245No ratings yet

- Question CAP III AND CA MEMBERHSIP New OneDocument17 pagesQuestion CAP III AND CA MEMBERHSIP New OneSuraj ThapaNo ratings yet

- Assignment On SalaryDocument4 pagesAssignment On SalarySohel MahmudNo ratings yet

- Employment IncomeDocument2 pagesEmployment IncomeFarhanah AfendiNo ratings yet

- Accumt PDFDocument3 pagesAccumt PDFFatema HossainNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Sunita Sobers QuestionDocument1 pageSunita Sobers Questionzhart1921No ratings yet

- Financial Feasibility: Financial Assumptions of Dry Laundry ExpressDocument3 pagesFinancial Feasibility: Financial Assumptions of Dry Laundry ExpressLosing Sleep100% (1)

- Employt Revision Qns. 2023Document8 pagesEmployt Revision Qns. 2023Mbeiza MariamNo ratings yet

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- Tax 5301 Mid 2Document1 pageTax 5301 Mid 2Sabuj BhowmikNo ratings yet

- Theory Type Questions - For Reference OnlyDocument13 pagesTheory Type Questions - For Reference OnlyHaseeb Ahmed ShaikhNo ratings yet

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- Caf Pac Mock With Solutions Compiled by Saboor AhmadDocument124 pagesCaf Pac Mock With Solutions Compiled by Saboor AhmadkamrankhanlagharisahabNo ratings yet

- Accounting Case StudyDocument1 pageAccounting Case StudyAhmad ZakariaNo ratings yet

- Problems On Income From Other SourcesDocument3 pagesProblems On Income From Other Sourcesgoli pandeyNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- XII Commerce PDFDocument10 pagesXII Commerce PDFNeena BaggaNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- Income Tax - I 2020Document3 pagesIncome Tax - I 2020nimalpes21No ratings yet

- Gross Income ActivityDocument2 pagesGross Income ActivityJester LimNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Tax Laws Letures (13-07-2021 To 17-07-2021)Document28 pagesTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNo ratings yet

- Ahsanullah University of Science and TechnologyDocument5 pagesAhsanullah University of Science and TechnologyMD Rakib MiaNo ratings yet

- ACC315A JAN 2023 Taxation CAT 1Document2 pagesACC315A JAN 2023 Taxation CAT 1Abuk AyulNo ratings yet

- Acc 305 Supp AssessmentDocument8 pagesAcc 305 Supp AssessmentSharonNo ratings yet

- Xi Acc - Project Ques (1-5) - GDGMTDocument10 pagesXi Acc - Project Ques (1-5) - GDGMTRijakpreet Singh ChughNo ratings yet

- Assignment XI 2023Document3 pagesAssignment XI 2023Vipul AgarwalNo ratings yet

- Midterm Departmental ExaminationDocument6 pagesMidterm Departmental ExaminationCrizzalyn Cruz100% (1)

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- TQ U6 Salaries 4 2019 PDFDocument3 pagesTQ U6 Salaries 4 2019 PDFhelenNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Old Question Practice2Document3 pagesOld Question Practice2Anuska JayswalNo ratings yet

- Assignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionDocument5 pagesAssignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionArjun DonNo ratings yet

- Front Page RiyaDocument19 pagesFront Page RiyaTechboy RahulNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Fred Banks: TAXATION TUTORIAL #2: 18th February, 2021Document2 pagesFred Banks: TAXATION TUTORIAL #2: 18th February, 2021zhart1921No ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Dhaka Ice CreamDocument28 pagesDhaka Ice CreamMd. Alif HossainNo ratings yet

- Welcome To My Presentation: "Study On Rare Agro Sector For The Development Economy in Bangladesh"Document6 pagesWelcome To My Presentation: "Study On Rare Agro Sector For The Development Economy in Bangladesh"Md. Alif HossainNo ratings yet

- Cafe Business PlanDocument31 pagesCafe Business Planatuanaini0% (1)

- Purple Leaf RiceDocument7 pagesPurple Leaf RiceMd. Alif HossainNo ratings yet

- Ahsanullah University of Science and Technology: School of Business Online Learning/E-LearningDocument15 pagesAhsanullah University of Science and Technology: School of Business Online Learning/E-LearningMd. Alif HossainNo ratings yet

- Ahsanullah University of Science and TechnologyDocument2 pagesAhsanullah University of Science and TechnologyMd. Alif HossainNo ratings yet

- Business PlanDocument24 pagesBusiness PlanMd. Alif HossainNo ratings yet

- MD Alif Hossain: 17.01.02.040: 3 Year 2 SemesterDocument15 pagesMD Alif Hossain: 17.01.02.040: 3 Year 2 SemesterMd. Alif HossainNo ratings yet

- Ahsanullah University of Science & TechnologyDocument9 pagesAhsanullah University of Science & TechnologyMd. Alif HossainNo ratings yet

- Topic: ICT Education and It's Outcome Assessment ProcessDocument12 pagesTopic: ICT Education and It's Outcome Assessment ProcessMd. Alif HossainNo ratings yet

- Rice Processing Industry of BangladeshDocument37 pagesRice Processing Industry of BangladeshTanim XubayerNo ratings yet

- Cafe Business PlanDocument31 pagesCafe Business Planatuanaini0% (1)

- A New Business Plan (Fresh Lemon Juice Company LTD.) : By: Group 8 (7 Batch) AIS Department Jagannath UniversityDocument37 pagesA New Business Plan (Fresh Lemon Juice Company LTD.) : By: Group 8 (7 Batch) AIS Department Jagannath UniversityMd. Alif HossainNo ratings yet

- A New Business Plan (Fresh Lemon Juice Company LTD.) : By: Group 8 (7 Batch) AIS Department Jagannath UniversityDocument37 pagesA New Business Plan (Fresh Lemon Juice Company LTD.) : By: Group 8 (7 Batch) AIS Department Jagannath UniversityMd. Alif HossainNo ratings yet

- Ahsanullah University of Science and Technology: School of Business Online Learning/E-LearningDocument15 pagesAhsanullah University of Science and Technology: School of Business Online Learning/E-LearningMd. Alif HossainNo ratings yet

- Chapter-1: HRM Functions and StrategyDocument11 pagesChapter-1: HRM Functions and StrategyMd. Alif HossainNo ratings yet

- School of Business: Assignment OnDocument16 pagesSchool of Business: Assignment OnMd. Alif HossainNo ratings yet

- Chapter 5 Pad104Document6 pagesChapter 5 Pad1042022460928No ratings yet

- Securities For AdvancesDocument3 pagesSecurities For AdvancesWaqas TariqNo ratings yet

- Elija Andjelich LUKOIL PetrochemicalDocument15 pagesElija Andjelich LUKOIL Petrochemicalfdfddf dfsdfNo ratings yet

- Student Entrepreneurship in The Social Knowledge EconomyDocument156 pagesStudent Entrepreneurship in The Social Knowledge EconomyKharisma Sofiana SiregarNo ratings yet

- Macroeconomics Course Outline and SyllabusDocument13 pagesMacroeconomics Course Outline and Syllabussana zaighamNo ratings yet

- Week 2 LectureDocument46 pagesWeek 2 LectureJesslyn WongNo ratings yet

- Entrepreneurship Development Notes 2022FDocument44 pagesEntrepreneurship Development Notes 2022FAlvin MoraraNo ratings yet

- 2008 Unit 2 Paper 2 JulyDocument7 pages2008 Unit 2 Paper 2 JulyMia ColemanNo ratings yet

- Akmpr7229l Partb 2022-23Document3 pagesAkmpr7229l Partb 2022-23BB StudioNo ratings yet

- Cost AccountingDocument26 pagesCost AccountingdivinamariageorgeNo ratings yet

- FillnaasweelDocument1 pageFillnaasweeladamNo ratings yet

- Bussiness Case Nabati MTDocument12 pagesBussiness Case Nabati MTFi Fiyunda50% (2)

- Rfox DC Apc CJHX 58 NDocument14 pagesRfox DC Apc CJHX 58 NAnuj AnujNo ratings yet

- MAPI - Annual Report 2019 PDFDocument373 pagesMAPI - Annual Report 2019 PDFAshfina HardianaNo ratings yet

- Bain Packaging CaseDocument8 pagesBain Packaging CaseThanh Phu TranNo ratings yet

- PMM Doc 3Document15 pagesPMM Doc 3satexNo ratings yet

- Economics Ss1 3Document11 pagesEconomics Ss1 3tjahmed87No ratings yet

- Ruchi Soya Industries LTD.: Growing With Improving Strength in FMCG SpaceDocument3 pagesRuchi Soya Industries LTD.: Growing With Improving Strength in FMCG SpaceYakshit NangiaNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Ultra HNI 21Document2 pagesUltra HNI 21Rafi AzamNo ratings yet

- Final Group 2Document17 pagesFinal Group 2Asnia Fuentabella ImamNo ratings yet

- Snapshot Checklist - Vendor - SPA Without TitleDocument7 pagesSnapshot Checklist - Vendor - SPA Without TitleAdhariahNo ratings yet

- 3.7.2.1 C - Details of Linkages 1Document207 pages3.7.2.1 C - Details of Linkages 1Rai Media TechnologiesNo ratings yet

- Nielsen India FMCG Snapshot - Q2'20 - DeckDocument23 pagesNielsen India FMCG Snapshot - Q2'20 - DeckAshish GandhiNo ratings yet

- DSInnovate MSME Empowerment Report 2021Document51 pagesDSInnovate MSME Empowerment Report 2021juniarNo ratings yet

- E TicketDocument1 pageE TicketKamal Raj MohanNo ratings yet

- Evolution of Indian BankingDocument5 pagesEvolution of Indian BankingManu SainiNo ratings yet

- Chapter 1 IntroductionDocument8 pagesChapter 1 IntroductionSachin MohalNo ratings yet

- Fruit and Horticulture ProcessingDocument16 pagesFruit and Horticulture ProcessingDavid BernardNo ratings yet

- 9/32 Dhurki", Situated At:-Devisarai, Thana: - Lehari, Thana No. - 127, Khata No.Document2 pages9/32 Dhurki", Situated At:-Devisarai, Thana: - Lehari, Thana No. - 127, Khata No.amit dipankarNo ratings yet