Professional Documents

Culture Documents

Tax 5301 Mid 2

Uploaded by

Sabuj BhowmikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax 5301 Mid 2

Uploaded by

Sabuj BhowmikCopyright:

Available Formats

Department of Accounting and Information Systems

EMBA 3rd Semester 2nd Midterm Exam

Course: AIS 5301 Taxation Practices

Time: 1 (one) Hour: Marks: 20

Question 1:

What is grossing up of interest? Explain the taxability of income from interest on different securities. 5.0

Question 2:

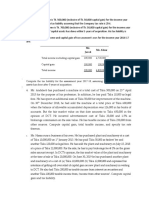

Mr. Abdullah has the following income for the current income year:

Income from Salary: Total Taxable Income Tk.30,00,000

Income from Securities:

8% tax exempt government securities Tk.25,000; Interest on taxable government securities Tk.3,325; and

Interest on debenture Tk.19,000. Bank charge Tk.800 to collect interest from tax exempt government

securities.

Income from House Property:

He has a house. Half of the house is let out at Tk.12,000 per month and other half is used for his residence.

The municipal value of the house is Tk.3,00,000. The let-out part of the house remained vacant for two

months during the year. Expenses of the house for the year were as follows:

Land development tax Tk.1,000;

Repair Tk.38,000;

Interest on HBFC Loan Tk.45,000;

Maintenance of water pump, etc. Tk.6,000 and

Municipal taxes Tk.5,400

Investment:

During the year he spent for:

Insurance Premium paid Tk.20,000 (policy value Tk.3,00,000);

Purchase of primary share of a listed company Tk.20,000;

Purchased academic boos Tk.5,000;

Contributed to Deposit Pension Scheme per month Tk.1,000;

Paid to Government Zakat Fund Tk.5,000 and

Purchase of savings certificate Tk.20,000.

Required:

1. Calculate total taxable income of Mr. Abdullah 9.0

2. Calculate net tax liability of Mr. Abdullah for the current assessment year. 6.0

You might also like

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- Tax Laws in Tanzania: Taxation Questions & AnswersDocument11 pagesTax Laws in Tanzania: Taxation Questions & AnswersKessy Juma90% (119)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Accumt PDFDocument3 pagesAccumt PDFFatema HossainNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Taxable Income Calculation for Professor SamihaDocument5 pagesTaxable Income Calculation for Professor SamihaMd. Alif HossainNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Uj 35520+SOURCE1+SOURCE1.1Document14 pagesUj 35520+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- R2.TAXML Question CMA January 2022 ExaminationDocument7 pagesR2.TAXML Question CMA January 2022 ExaminationPavel DhakaNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- House PropertyDocument36 pagesHouse PropertyRahul Tanver0% (1)

- Calculating Tax LiabilityDocument3 pagesCalculating Tax LiabilityRafia TasnimNo ratings yet

- Malawi Taxation Exam QuestionsDocument15 pagesMalawi Taxation Exam QuestionsCean Mhango100% (1)

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- TaxDocument3 pagesTaxLet it beNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Income Tax - I 2020Document3 pagesIncome Tax - I 2020nimalpes21No ratings yet

- CFM 100-Introduction To Taxation DAYDocument4 pagesCFM 100-Introduction To Taxation DAYDan StephenNo ratings yet

- TXCHN 2022 Dec QDocument18 pagesTXCHN 2022 Dec Qshaunzacharia007No ratings yet

- Mock Exam Paper: Time AllowedDocument9 pagesMock Exam Paper: Time AllowedVannak2015No ratings yet

- Acct 2005 Practice Exam 1Document16 pagesAcct 2005 Practice Exam 1laujenny64No ratings yet

- 2018 - Test 2 - QuestionsDocument8 pages2018 - Test 2 - QuestionsmolemothekaNo ratings yet

- Audit of Other Income Statement ComponentsDocument6 pagesAudit of Other Income Statement ComponentsVip BigbangNo ratings yet

- Easy Method Institute: Adjusting EntriesDocument6 pagesEasy Method Institute: Adjusting EntriesKader Jewel100% (1)

- (Answer Any Two Questions), Question-01:: RequiredDocument2 pages(Answer Any Two Questions), Question-01:: RequiredChowdhury Mobarrat Haider Adnan0% (1)

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- Class 4 QuestionsDocument5 pagesClass 4 Questionsbaqarnaqvi6204No ratings yet

- Tutorial 10-2021-PIT2 ProblemsDocument8 pagesTutorial 10-2021-PIT2 ProblemsHien Bach Thi Tra QTKD-3KT-18No ratings yet

- Old Question Practice2Document3 pagesOld Question Practice2Anuska JayswalNo ratings yet

- Quiz 2Document2 pagesQuiz 2gabie stgNo ratings yet

- AC2101 Seminar 7-8 Deferred Tax OutlineDocument33 pagesAC2101 Seminar 7-8 Deferred Tax OutlinelynnNo ratings yet

- N13 IPCC Tax Guideline Answers WebDocument12 pagesN13 IPCC Tax Guideline Answers WebGeorge MooneyNo ratings yet

- Tax Planning and ComplianceDocument5 pagesTax Planning and ComplianceSrikrishna DharNo ratings yet

- Taxation GuideDocument6 pagesTaxation GuideMff DeadsparkNo ratings yet

- Management Accounting SundayDocument5 pagesManagement Accounting SundayAhsan MaqboolNo ratings yet

- F1 May 2010 For Print. 23.3Document20 pagesF1 May 2010 For Print. 23.3mavkaziNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Kenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationDocument5 pagesKenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationJoe 254No ratings yet

- R2.TAXM .L December 2020Document6 pagesR2.TAXM .L December 2020Pavel DhakaNo ratings yet

- TMQ3 PCDocument2 pagesTMQ3 PCxabfaelynuxielynNo ratings yet

- Audit of Other Income Statement ComponentsDocument7 pagesAudit of Other Income Statement ComponentsIbratama Sukses PratamaNo ratings yet

- CBE June 22 - QDocument8 pagesCBE June 22 - QNguyễn Hồng NgọcNo ratings yet

- "An Individual Assesse Is Allowed To Get Tax Rebate On Certain Investment"-Explain. 4Document3 pages"An Individual Assesse Is Allowed To Get Tax Rebate On Certain Investment"-Explain. 4Shawon SarkerNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- CA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelDocument18 pagesCA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelMan Ish K DasNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- Calculating Income Tax for COVID CompanyDocument2 pagesCalculating Income Tax for COVID CompanyRico, Jalaica B.No ratings yet

- Presidency University Accounting ExamDocument3 pagesPresidency University Accounting ExamMd Ahad MiahNo ratings yet

- CAF-2-TAX-Spring-2021Document6 pagesCAF-2-TAX-Spring-2021duocarecoNo ratings yet

- All Level Two Coc QuestionsDocument15 pagesAll Level Two Coc Questionsabelu habite neriNo ratings yet

- Mock E Exam Pap ERDocument19 pagesMock E Exam Pap ERtim_rattanaNo ratings yet

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Document5 pagesRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharNo ratings yet

- KL Taxtaion I May June 2012Document2 pagesKL Taxtaion I May June 2012asdfghjkl007No ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Theory Type Questions - For Reference OnlyDocument13 pagesTheory Type Questions - For Reference OnlyHaseeb Ahmed ShaikhNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument6 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationSuman UroojNo ratings yet

- Assignment TwoDocument3 pagesAssignment Twososina eseyewNo ratings yet