Professional Documents

Culture Documents

(Answer Any Two Questions), Question-01:: Required

Uploaded by

Chowdhury Mobarrat Haider AdnanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Answer Any Two Questions), Question-01:: Required

Uploaded by

Chowdhury Mobarrat Haider AdnanCopyright:

Available Formats

East West University

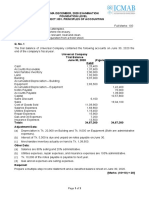

Course: Financial Accounting (MBA501), Section -1

Second Mid Term Examination, Full Marks: 20, Time: 1.00 Hours,

(Answer any two questions),

Question-01: 5+5=10

A) Chittagong Motel opened for business on July 01, 2019. The trail balance as on Dec’ 31 as under:

Name of account Debit Credit

1. Cash 45,000 1. Capital -------------------------- 3, 50,000

2. Supplies 18,000 2. Accounts payable -------- 1, 63,000

3. Prepaid insurance 24,000 3. Unearned Rent ------- ---- 35,000

4. Building ----------- 5, 00,000 4. Mortgage payable ------- 2, 40,000

5. Furniture------- 2, 68,000 5. Rent revenue -------- --- 1, 02,000

6. Advertising expenses 5,000

7. Salary -------- 20,000

8. Utilities expenses ----- 10,000

======== =========

8, 90,000 8,90,000

The following adjusting entries are consists:

1. Insurance expenses TK= 2000 per month. 3. Annual depreciation on furniture TK=24000.

2. Supplies= 5000 as unused on Dec, 2019. 4. Unearned Rent TK=10000 has been earned.

Required: 1. Prepare work sheet showing adjusted Trail Balance on Dec, 31.

2. Prepare income & expenditure account and Balance Sheet on Dec’ 30,

Question: 02

A} what is credit term? Explain the meaning of the following credit terms: 3+7=10

1. 2/10, n/30

2. 2/10, EOM

B) What are the recording entries of given transaction in the books of Alien & co under perpetual inventory

system?

1. On July 2, Alien & co sold TK=55,000 of merchandise to world mate on credit terms 2/10, n/30. Alien

originally paid TK=50,000 for the merchandise.

2. On July 5, world mate returned TK=5000 of defective merchandise to Alien & co for July, 2 sale. The cost for

this merchandise was TK=3,000

3. On July 6, Alien & co sold TK=40,000 of merchandise to world mate on credit with terms of 2/10, n/EOM.

The cost of the merchandiser was TK=35,000

4. On July 15, Alien & co receives the full amount due from world mate from the sale on July 6.

5. On July 20, Alien & co received the full amount due from world mate from the sale of July 2.

6. On July 31, Alien & co counts the inventory. An Inventory shortage of TK=3000 is discovered.

Question-03

A) Write short notes: 5+5=10

1. Inventory shrinkage. 2. FOB. 3. Merchandiser. 4) Inventory systems 5. Sales discount.

B) Rains Supply uses a perpetual inventory system. On the January 1, its account had a beginning balance of

TK=74, 00,000. Rains engaged in the following transaction during the year.

1. Purchase merchandising inventory for TK=1, 05, 00,000.

2. Generated net sales of TK=3, 30, 00,000.

3. Recorded inventory shrinkage of 20,000 after taking a physical inventory at year-end.

4. Reported Gross-profit for the year of 200, 00,000 in its income statement.

Required:

a) At what amount was cost of goods sold reported in the company’s year-end income statement?

b) At what amount was merchandise Inventory reported in the company’s year-end balance sheet?

C) Immediately prior to recording inventory shrinkage at the end of year, what was the balance of the cost of

goods sold account? What was the balance of the merchandising inventory account?

======= =============XX=====================

Question 02. 3+7=10

A) Define the various methods of Inventory valuation? Which method you will suggest considering the liquidity of firm?

B) Calculate value of ending inventory and cost of goods sold under FIFO and LIFO method from the following:

1. July 01: Beginning inventory1800 units @ TK=20.00

2. July 05: Purchased 2000 Units @ TK=25.00

3. July 09: Goods sold 1700 Units

4. July 15: Goods sold 1900 Units

5. July 21: Purchased 2400 units @ TK=35.00

6. July 26: Goods sold 1200 Units

7. July 30: Goods sold 900 Units

Question-03. 5+5 10

Bangla Food limited opened for business on Jan 01, 2019. The trial balance before adjustments as on Dec 31, is as follow:

Serial No Name of account LF debit Credit

1. Cash account 20,000

2. Furniture 33,000

3. Account receivable 50,000

4. Accounts payable 17,000

5. Mortgage payable (1.01.19) 20,000

6. Capital 38,000

7. Rent revenue 45,000

8. Advertising expenses 5,000

9. Salary 10,000

10. Utilities expenses 2,000

-------------- -------------

1,20,000 1,20,000

The following adjusting entries are consists:

a. Annual Insurance expenses TK=2000 which is due but not recorded in the book.

b. Annual depreciation on furniture @ 15%

c. Bad debt TK=1500 against account receivable.

d. Salary TK=900 is accrued but unpaid.

e. Interest on mortgage to be charged @ 9% PA.

Prepare: 1. Profit & loss account for the year ended Dec 31, 2019

2. Balance sheet as on Dec, 31, 2019

====================0====================

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- CA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelDocument18 pagesCA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelMan Ish K DasNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- 2020-06 Icmab FL 001 Pac Year Question June 2020Document3 pages2020-06 Icmab FL 001 Pac Year Question June 2020Mohammad ShahidNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- CMA Cost and Management Accountants Bangladesh Exam Principles of AccountingDocument50 pagesCMA Cost and Management Accountants Bangladesh Exam Principles of Accountingzia4000No ratings yet

- Thrift Corp. Prepaid Expenses QuizDocument9 pagesThrift Corp. Prepaid Expenses QuizKristine VertucioNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- CMA Exam Principles of AccountingDocument4 pagesCMA Exam Principles of AccountingMohammad ShahidNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- 2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Document3 pages2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Mohammad ShahidNo ratings yet

- 3b79070f9fdf9cd3f1dc5d6aeda6e1c3Document3 pages3b79070f9fdf9cd3f1dc5d6aeda6e1c3Vivian TamerayNo ratings yet

- XI ACCOUNTING SET 4Document8 pagesXI ACCOUNTING SET 4aashirwad2076No ratings yet

- QuestionPaperDec 2010Document50 pagesQuestionPaperDec 2010Md.Reza HussainNo ratings yet

- T1-June 2014Document21 pagesT1-June 2014Biplob K. SannyasiNo ratings yet

- Q 1 3Document9 pagesQ 1 3Ahasanul AlamNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- Long Quiz FAR Review -STUDENTDocument3 pagesLong Quiz FAR Review -STUDENTjaytoo202020No ratings yet

- Accounts Accounts Cash + Receivable + Supplies + Equipment Payable +Document4 pagesAccounts Accounts Cash + Receivable + Supplies + Equipment Payable +greysonNo ratings yet

- ABM 123 MPBA 1st Sem 2020 2021Document2 pagesABM 123 MPBA 1st Sem 2020 2021Ciana SacdalanNo ratings yet

- ACCOUNT- 2Document6 pagesACCOUNT- 2kakajumaNo ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- Financial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYDocument23 pagesFinancial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYJaquelyn ClataNo ratings yet

- AC5021 2015-16 Resit Exam Questions ASPDocument8 pagesAC5021 2015-16 Resit Exam Questions ASPyinlengNo ratings yet

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- Student financial accounts portfolioDocument5 pagesStudent financial accounts portfolioKevin PhạmNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- Adjust allowance for doubtful accounts, calculate income tax expense, and determine accounts receivable days sales outstandingDocument11 pagesAdjust allowance for doubtful accounts, calculate income tax expense, and determine accounts receivable days sales outstandingrahul ambatiNo ratings yet

- Financial Accounting Test1Document5 pagesFinancial Accounting Test1musa mosesNo ratings yet

- Sevilla - Unit 3 - IA3Document22 pagesSevilla - Unit 3 - IA3Hensel SevillaNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- FOUNDATION ACCOUNTING TESTDocument6 pagesFOUNDATION ACCOUNTING TESTalokkulkarni14No ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Accounting PDFDocument8 pagesAccounting PDFOwen Hambulo Sr.No ratings yet

- 2 Accounting PDFDocument3 pages2 Accounting PDFibrahimbdNo ratings yet

- Accounting Problem SetDocument22 pagesAccounting Problem SetJill SolisNo ratings yet

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- Assignment Accounting For BusinessDocument5 pagesAssignment Accounting For BusinessValencia CarolNo ratings yet

- Thirty Questions For Thirty Minutes Only. Maintain The TimeDocument3 pagesThirty Questions For Thirty Minutes Only. Maintain The TimeANo ratings yet

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- CH 3 HomeworkDocument6 pagesCH 3 HomeworkAxel OngNo ratings yet

- Sample Final Exam - Intermediate Accounting I - Fall 2023Document4 pagesSample Final Exam - Intermediate Accounting I - Fall 2023Айбар КарабековNo ratings yet

- Quiz 1Document1 pageQuiz 1Chowdhury Mobarrat Haider AdnanNo ratings yet

- Business Math AssignmentDocument3 pagesBusiness Math AssignmentChowdhury Mobarrat Haider AdnanNo ratings yet

- MBA-502 Business Mathematics Course OutlineDocument2 pagesMBA-502 Business Mathematics Course OutlineChowdhury Mobarrat Haider AdnanNo ratings yet

- Quiz 1Document1 pageQuiz 1Chowdhury Mobarrat Haider AdnanNo ratings yet

- Quiz 2Document1 pageQuiz 2Chowdhury Mobarrat Haider AdnanNo ratings yet

- Question 1 - 12: Find The DerivativesDocument2 pagesQuestion 1 - 12: Find The DerivativesChowdhury Mobarrat Haider AdnanNo ratings yet

- Assignment CoverDocument1 pageAssignment CoverChowdhury Mobarrat Haider AdnanNo ratings yet

- Ayman Sadiq's Journey to Build Bangladesh's Largest Online Education PlatformDocument12 pagesAyman Sadiq's Journey to Build Bangladesh's Largest Online Education PlatformChowdhury Mobarrat Haider AdnanNo ratings yet

- East West University Managerial Economics, Section-2: Mid-Term II, Marks 40, Time 90 Minutes Answer All QuestionsDocument3 pagesEast West University Managerial Economics, Section-2: Mid-Term II, Marks 40, Time 90 Minutes Answer All QuestionsronylolNo ratings yet

- MBA-502 Business Mathematics Course OutlineDocument2 pagesMBA-502 Business Mathematics Course OutlineChowdhury Mobarrat Haider AdnanNo ratings yet

- East West University Managerial Economics Final Exam ReviewDocument4 pagesEast West University Managerial Economics Final Exam ReviewChowdhury Mobarrat Haider AdnanNo ratings yet

- MBA-502 Business Mathematics Course OutlineDocument2 pagesMBA-502 Business Mathematics Course OutlineChowdhury Mobarrat Haider AdnanNo ratings yet

- Assignment CoverDocument1 pageAssignment CoverChowdhury Mobarrat Haider AdnanNo ratings yet

- Perception Test 1 - Understanding Your Beliefs About Successful EntrepreneursDocument1 pagePerception Test 1 - Understanding Your Beliefs About Successful EntrepreneursChowdhury Mobarrat Haider AdnanNo ratings yet

- Kuratko9eCh01 - Entrepreneurship - Evolutionary Development and Revolutionary Impact - ClassDocument36 pagesKuratko9eCh01 - Entrepreneurship - Evolutionary Development and Revolutionary Impact - ClassChowdhury Mobarrat Haider AdnanNo ratings yet

- Ewu Mba Summer 2020 FinalDocument3 pagesEwu Mba Summer 2020 FinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Kuratko9eCh02 - The Entrepreneurial Mind-Set in Individuals - Cognition and Ethics - Class3Document34 pagesKuratko9eCh02 - The Entrepreneurial Mind-Set in Individuals - Cognition and Ethics - Class3Chowdhury Mobarrat Haider AdnanNo ratings yet

- Kuratko 9 e CH 05Document27 pagesKuratko 9 e CH 05lobna_qassem7176No ratings yet

- Accounting EquationfinalDocument40 pagesAccounting EquationfinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Kuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - Class 10Document41 pagesKuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - Class 10Chowdhury Mobarrat Haider AdnanNo ratings yet

- Kuratko 9 e CH 05Document27 pagesKuratko 9 e CH 05lobna_qassem7176No ratings yet

- Preparation of Final AccountsDocument31 pagesPreparation of Final AccountsChowdhury Mobarrat Haider AdnanNo ratings yet

- Adjusting AccountsDocument43 pagesAdjusting AccountsChowdhury Mobarrat Haider Adnan100% (1)

- Ex 7Document2 pagesEx 7Chowdhury Mobarrat Haider AdnanNo ratings yet

- 04.recording Process Journal - TB FinalDocument49 pages04.recording Process Journal - TB FinalChowdhury Mobarrat Haider Adnan100% (1)

- Inventory Valuation Methods: FIFO, LIFO & Weighted AverageDocument27 pagesInventory Valuation Methods: FIFO, LIFO & Weighted AverageChowdhury Mobarrat Haider AdnanNo ratings yet

- 06.marchandising Operation-FinalDocument53 pages06.marchandising Operation-FinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Cashflows From Operating Activities: Net Increase in Cash 5,000.00 Opening Balance (01.01.2019) 20,000.00Document1 pageCashflows From Operating Activities: Net Increase in Cash 5,000.00 Opening Balance (01.01.2019) 20,000.00Chowdhury Mobarrat Haider AdnanNo ratings yet

- Learn2Earn - Business ModelDocument14 pagesLearn2Earn - Business ModelChowdhury Mobarrat Haider AdnanNo ratings yet

- CH 07Document29 pagesCH 07varunragav85No ratings yet

- Landed Cost ProcessDocument17 pagesLanded Cost Processvedavyas4funNo ratings yet

- Definition of LogisticsDocument31 pagesDefinition of LogisticsArun Narayanan100% (1)

- Caso MBC - C ParcialDocument3 pagesCaso MBC - C ParcialCindy Gineth Barrera BarreraNo ratings yet

- Principles of Accounting II PDFDocument212 pagesPrinciples of Accounting II PDFMekonnen TarikuNo ratings yet

- O M Concepts, Systems & Emerging TrendsDocument62 pagesO M Concepts, Systems & Emerging TrendsShveta HastirNo ratings yet

- Risk Management: Risk Identification and Risk AssesmentDocument6 pagesRisk Management: Risk Identification and Risk AssesmentRidz KhanNo ratings yet

- AckmidtocDocument9 pagesAckmidtocraakesh_rrNo ratings yet

- StramaDocument59 pagesStramaFranco JavierNo ratings yet

- Heizer - 01 Operations and ProductivityDocument37 pagesHeizer - 01 Operations and ProductivityDawood HusainNo ratings yet

- SS 08 Quiz 1 - AnswersDocument82 pagesSS 08 Quiz 1 - AnswersVan Le Ha100% (3)

- Audit of Cash and ReceivablesDocument23 pagesAudit of Cash and ReceivablesjaseyNo ratings yet

- Winning in A Value Driven WorldDocument8 pagesWinning in A Value Driven WorldRohit BaggaNo ratings yet

- Financial Case Study On Return On InvestmentDocument23 pagesFinancial Case Study On Return On InvestmentSheel HansNo ratings yet

- SM Assignment 2Document3 pagesSM Assignment 2GunjanNo ratings yet

- ACS Code of Ethics Case StudiesDocument43 pagesACS Code of Ethics Case Studiesdmizza125333% (9)

- The Perfect Order SEBDocument7 pagesThe Perfect Order SEBEduardo El Khouri BuzatoNo ratings yet

- MIS ReportDocument25 pagesMIS ReportMilan PatelNo ratings yet

- IT Asset Management (PDFDrive)Document172 pagesIT Asset Management (PDFDrive)Ahmed AlyNo ratings yet

- Accounting for Inventories ChapterDocument14 pagesAccounting for Inventories Chapterseneshaw tibebuNo ratings yet

- A Compilation of Case Studies in Financial AccountingDocument75 pagesA Compilation of Case Studies in Financial AccountingShrinivasan ShriNo ratings yet

- Executive Summary of Teer Soya Bean Oil Supply ChainDocument29 pagesExecutive Summary of Teer Soya Bean Oil Supply ChainAshif Uz ZamanNo ratings yet

- How To Account For Spare Parts Under IFRS - IFRSbox - Making IFRS EasyDocument20 pagesHow To Account For Spare Parts Under IFRS - IFRSbox - Making IFRS EasyLinkon PeterNo ratings yet

- Copper Physical Trading and Supply Chile and Perú JLCDocument57 pagesCopper Physical Trading and Supply Chile and Perú JLCJosé Luis Cuevas67% (3)

- SSM - Group 3Document13 pagesSSM - Group 3aishwarya anandNo ratings yet

- Ma2 - A201-Assignment 2 - Budgeting InstructionDocument2 pagesMa2 - A201-Assignment 2 - Budgeting Instructionateen rizalmanNo ratings yet

- TOA - Theory of Accounts ReviewDocument7 pagesTOA - Theory of Accounts ReviewAnne Lorrheine CasanosNo ratings yet

- Accounting For Manufacturing ConcernDocument2 pagesAccounting For Manufacturing ConcernAhmed MemonNo ratings yet

- Textile Management System Final ReviewDocument40 pagesTextile Management System Final Reviewabhishek asgolaNo ratings yet

- Project Report On Times of IndiaDocument50 pagesProject Report On Times of IndiaPradeep Astropy BhuvaNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)