Professional Documents

Culture Documents

IPR Tariff Classification Questionnaire IPR001 v1

Uploaded by

donhan910 ratings0% found this document useful (0 votes)

9 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageIPR Tariff Classification Questionnaire IPR001 v1

Uploaded by

donhan91Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

UK Inward Processing Tariff Classification

Doc : IPR001 v1

UK Inward Processing Tariff Classification Questionnaire

(One form required for each product)

Until approval has been given by Bodycote, please do not ship your product to the UK for processing. Where the

product is new to Bodycote, it can take up to six weeks to obtain approval from the UK tax authorities

Please complete the following:

Required information Details

Customer Name PIONEER DRILLING CO., LTD

Country of Origin of Product (i.e. where manufactured/built) Vietnam

Country of Export of Product

(where different from Country of Origin) Vietnam

Harmonised Tariff System Code/Commodity

Code (i.e. code to be used for export of product to the UK) hỏi XNK

Name of Product (layman’s terms)

Technical Name of Product

Base Material(s) of Product Nickel Alloy

(for example, if metal, is it steel, iron, aluminium)

Function of Product

(What is the product used for, how does it work?)

List of photographs/technical drawings attached

(useful for the classification process) Drawing# D01119620 RevB

Is the product industry specific? Yes/No Yes. Oil & Gas

(For example, agricultural, farming, aerospace, medical)

If Yes, which industry:

Name Le Van Thang

Signature

Date 7th Aug, 2019

Position President cum CEO

For Bodycote Tax Dept. Use Only

HTS Code (approved for use)

Internal Approval Number

Name

Signature

Date

You might also like

- Form For Registration of New Firm Centeral Police CanteenDocument24 pagesForm For Registration of New Firm Centeral Police Canteenanon_38851431173% (15)

- SMETA ReportDocument61 pagesSMETA ReportAnonymous cmF4vJicMXNo ratings yet

- LAN Module (INTG-996018PCB K) #Pcoc#certiDocument4 pagesLAN Module (INTG-996018PCB K) #Pcoc#certiSiddiq KhanNo ratings yet

- CGO - Proforma Step 1, 2, 3 & 5, UpdatedDocument4 pagesCGO - Proforma Step 1, 2, 3 & 5, UpdatedFareed KhanNo ratings yet

- QUESTIONNAIRE KVSPDocument7 pagesQUESTIONNAIRE KVSPDeepak DasNo ratings yet

- Material Requisition Cum Indent FormDocument2 pagesMaterial Requisition Cum Indent FormprasannaNo ratings yet

- TIEP Application TemplatesDocument6 pagesTIEP Application TemplatesactivatedcarbonsolutionsNo ratings yet

- Bid DocumentDocument3 pagesBid DocumentHussain ShaikhNo ratings yet

- Preferred Manufacturers List (PML) Registration Form: Registration Reference No: Date: Manufacturing Plant DetailsDocument2 pagesPreferred Manufacturers List (PML) Registration Form: Registration Reference No: Date: Manufacturing Plant DetailsRoshanNo ratings yet

- 740411Document10 pages740411Augustin MacmacNo ratings yet

- O-01.A Core Questionnaire General April 2018 (02-06-19)Document4 pagesO-01.A Core Questionnaire General April 2018 (02-06-19)Mohamed HabibNo ratings yet

- Certification FormsDocument4 pagesCertification FormsRaoul SeveNo ratings yet

- Roadmap For BIS Product Certification PDFDocument2 pagesRoadmap For BIS Product Certification PDFAnkurNo ratings yet

- ONGC OES Vendor Checklist Rev 5 06 11 2013 2 2 PDFDocument6 pagesONGC OES Vendor Checklist Rev 5 06 11 2013 2 2 PDFPillai S KumarNo ratings yet

- PC 8137Document17 pagesPC 8137janakaNo ratings yet

- F-Ids-Perd-010 Application For Boi Registration (Boi Form 501)Document5 pagesF-Ids-Perd-010 Application For Boi Registration (Boi Form 501)Aj IVNo ratings yet

- EvaluationDocument2 pagesEvaluationBilal_Yunus_1784No ratings yet

- Applicant Details: Department of Imports and Exports ControlDocument3 pagesApplicant Details: Department of Imports and Exports ControlShami MudunkotuwaNo ratings yet

- Vendor_RegistrationFormDocument3 pagesVendor_RegistrationFormskghoshNo ratings yet

- 25uw04l3 lzd8894728Document21 pages25uw04l3 lzd8894728Faiz RasoolNo ratings yet

- Notice of Installation of A Boiler or Pressure VESSEL (An "Object")Document1 pageNotice of Installation of A Boiler or Pressure VESSEL (An "Object")Mohammed YcfssNo ratings yet

- Sub Section VIDocument9 pagesSub Section VIdvnambNo ratings yet

- Quote This Reference Number For All Correspondence With OILDocument38 pagesQuote This Reference Number For All Correspondence With OILMKTG THE SALEM AEROPARKNo ratings yet

- ONGC OES - Vendor Checklist - Rev 5 - 06 11 2013 PDFDocument6 pagesONGC OES - Vendor Checklist - Rev 5 - 06 11 2013 PDFsac84hinNo ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- India Localization & VAT With Respect To SD: Kumar ArmugamDocument47 pagesIndia Localization & VAT With Respect To SD: Kumar ArmugamjkanoongoNo ratings yet

- SupplierSelfAssessmenttemplate Ver 3.0Document43 pagesSupplierSelfAssessmenttemplate Ver 3.0jackNo ratings yet

- Saudi Aramco Manufacturing Plant Evaluation Questionnaire (RV0)Document16 pagesSaudi Aramco Manufacturing Plant Evaluation Questionnaire (RV0)شیخ صادقNo ratings yet

- Smeta 6.0 Report Publicly Available (25326)Document71 pagesSmeta 6.0 Report Publicly Available (25326)Kingsmen ForceNo ratings yet

- Cin 2Document77 pagesCin 2fharooksNo ratings yet

- GeM Bidding 4045892Document5 pagesGeM Bidding 4045892Kartik RajputNo ratings yet

- Application Form For Advance Authorisation (Including AdvanceDocument6 pagesApplication Form For Advance Authorisation (Including Advanceakashaggarwal88No ratings yet

- Pre Test Takko - TUV Rheinland India Textile Testing 2046567-00Document3 pagesPre Test Takko - TUV Rheinland India Textile Testing 2046567-00Sabeeh Ul HassanNo ratings yet

- Questionnaire 637027722257034154Document13 pagesQuestionnaire 637027722257034154Santosh Kumar KurellaNo ratings yet

- Technip - IVR - 8116970849 - Sr. No.01 - R00 - 077015C002-PO-1310-0012-02-O9833 PDFDocument18 pagesTechnip - IVR - 8116970849 - Sr. No.01 - R00 - 077015C002-PO-1310-0012-02-O9833 PDFAbhay KarandeNo ratings yet

- SMETA ReportDocument61 pagesSMETA ReportANKUSHNo ratings yet

- SMR Entresibling 2023 2QDocument9 pagesSMR Entresibling 2023 2QLowell SalvadorNo ratings yet

- BHEL Bid Document for HDPE TarpsDocument5 pagesBHEL Bid Document for HDPE TarpsWhite GraphicsNo ratings yet

- Omnibus Investment Code of 1987 (EO 226) Fiscal IncentivesDocument5 pagesOmnibus Investment Code of 1987 (EO 226) Fiscal IncentivesCrizryshel Loreen P. DeramaNo ratings yet

- App. Form SPRS Form 3.8.2018-1Document20 pagesApp. Form SPRS Form 3.8.2018-1Harshit BaheriaNo ratings yet

- (201014) BR Shield - Antibacterial Performance Results (1) - 1Document1 page(201014) BR Shield - Antibacterial Performance Results (1) - 1Nikesh ShahNo ratings yet

- Module 1: General Information Reference No.:139631 Year:2022 Quarter: 4 Name of Plant: The Permanente Health Plan Corporation NotesDocument9 pagesModule 1: General Information Reference No.:139631 Year:2022 Quarter: 4 Name of Plant: The Permanente Health Plan Corporation NotesPermanente Health Plan Corporation PHPNo ratings yet

- IRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFDocument3 pagesIRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFsaptarshi jashNo ratings yet

- Technical Submittal - Al Hijaz (Final)Document91 pagesTechnical Submittal - Al Hijaz (Final)Samra MuzaferovicNo ratings yet

- 0929 I P ElectronicsDocument5 pages0929 I P ElectronicsYakshit JainNo ratings yet

- P.O Box, 5464 Abu Dhabi Procurement & Contract/Pos Department Tel:22065700 Email: Cert-Procurement@Hct - Ac.Ae Date: 18-05-2022Document5 pagesP.O Box, 5464 Abu Dhabi Procurement & Contract/Pos Department Tel:22065700 Email: Cert-Procurement@Hct - Ac.Ae Date: 18-05-2022thanuskoditNo ratings yet

- MAT - FRM - 003A - 1 - 4 - OII - Supplier - Packet HRDDocument15 pagesMAT - FRM - 003A - 1 - 4 - OII - Supplier - Packet HRDronal_abangaceNo ratings yet

- TC Form 2 Request For Tariff Classification Dispute Ruling: (To Be Submitted in Duplicate)Document2 pagesTC Form 2 Request For Tariff Classification Dispute Ruling: (To Be Submitted in Duplicate)Mikaella Catapang MorenoNo ratings yet

- ApplicationformDocument5 pagesApplicationformpradeepNo ratings yet

- Door License (INTG-996940) #Pcoc#certi PDFDocument4 pagesDoor License (INTG-996940) #Pcoc#certi PDFSiddiq KhanNo ratings yet

- Business Responsibility Report 2019 20Document9 pagesBusiness Responsibility Report 2019 20johnsongautam43No ratings yet

- GST QuestionnaireDocument2 pagesGST QuestionnaireIshan MehtaNo ratings yet

- QS-F-8.1-4version 1.0Document2 pagesQS-F-8.1-4version 1.0Mohammad AkilNo ratings yet

- Anf 5BDocument3 pagesAnf 5BAkash KediaNo ratings yet

- GEM Bid for 10 Copper Alloy Bathroom TapsDocument3 pagesGEM Bid for 10 Copper Alloy Bathroom TapsSudhanshu GoyalNo ratings yet

- GOTS Chemical ApplicationDocument3 pagesGOTS Chemical ApplicationMadhavkumarNo ratings yet

- Permanent Registration Application Format 19092019Document9 pagesPermanent Registration Application Format 19092019PRASANNA THAKKARNo ratings yet

- Power Supply 3A (INTG-996091PCB and K) #PcocDocument4 pagesPower Supply 3A (INTG-996091PCB and K) #PcocSiddiq KhanNo ratings yet

- EPCG application formDocument6 pagesEPCG application formsrinivasNo ratings yet

- Metal Heat Treating World Summary: Market Values & Financials by CountryFrom EverandMetal Heat Treating World Summary: Market Values & Financials by CountryNo ratings yet

- Como Desenhar Mangá - Básico e ExpressõesDocument7 pagesComo Desenhar Mangá - Básico e Expressõesvinicius0398No ratings yet

- Forming Features and Properties of Titanium AlloyDocument12 pagesForming Features and Properties of Titanium Alloydonhan91No ratings yet

- 100 Đề Luyện Thi Vào Lớp 10 Chuyên Anh Có Đáp ÁnDocument684 pages100 Đề Luyện Thi Vào Lớp 10 Chuyên Anh Có Đáp ÁnLe QuocNo ratings yet

- User Manual: For Windows and Macintosh OSDocument16 pagesUser Manual: For Windows and Macintosh OSAin NadhirahNo ratings yet

- Location and MapDocument2 pagesLocation and Mapdonhan91No ratings yet

- Technical Specification for GO2 Supply System with 6,000L HP Storage TankDocument8 pagesTechnical Specification for GO2 Supply System with 6,000L HP Storage Tankdonhan91No ratings yet

- Bro-0008.7 Hvofsolutions enDocument16 pagesBro-0008.7 Hvofsolutions enIzziNo ratings yet

- ID CoolFlowDocument4 pagesID CoolFlowycwbycwbNo ratings yet

- Demco Gate Valves BrochureDocument56 pagesDemco Gate Valves BrochureVictor100% (1)

- Study of Void Closure in Hot Rolling of Stainless Steel SlabsDocument6 pagesStudy of Void Closure in Hot Rolling of Stainless Steel Slabsdonhan91No ratings yet

- Option 1 - LGCDocument9 pagesOption 1 - LGCdonhan91No ratings yet

- ID CoolFlowDocument4 pagesID CoolFlowycwbycwbNo ratings yet

- Payments To Governments On Oil and Gas Exploration and Production Activities - tcm14-147662Document24 pagesPayments To Governments On Oil and Gas Exploration and Production Activities - tcm14-147662donhan91No ratings yet

- ID Code Handbook 2-D Code Basic Guide PDFDocument27 pagesID Code Handbook 2-D Code Basic Guide PDFddsatttrreNo ratings yet

- TenarisHydrilPH6 PDFDocument1 pageTenarisHydrilPH6 PDFRifqi AbdillahNo ratings yet

- MSC - Call For Applications 2018 FinalDocument6 pagesMSC - Call For Applications 2018 Finaldonhan91No ratings yet

- Telefusion Flyer - July 2016Document2 pagesTelefusion Flyer - July 2016donhan91No ratings yet

- SD 095Document2 pagesSD 095donhan91No ratings yet

- Requirements of Raw Materials For Steel Industry Reflections On MMDR Bill 2011Document17 pagesRequirements of Raw Materials For Steel Industry Reflections On MMDR Bill 2011donhan91No ratings yet

- Website Eliminating Hydrogen Embrittlement Per ASTM B633 PDFDocument6 pagesWebsite Eliminating Hydrogen Embrittlement Per ASTM B633 PDFdonhan91No ratings yet

- RECI Fiber Software InstructionsDocument122 pagesRECI Fiber Software Instructionsdonhan91100% (1)

- Profile PDFDocument1 pageProfile PDFdonhan91No ratings yet

- Conversion: Nozzle KitDocument2 pagesConversion: Nozzle Kitdonhan91No ratings yet

- Powerscan Pm9500 Models and KitsDocument6 pagesPowerscan Pm9500 Models and Kitsdonhan91No ratings yet

- Auxiliary Side Connectors: Installation InstructionsDocument2 pagesAuxiliary Side Connectors: Installation Instructionsdonhan91No ratings yet

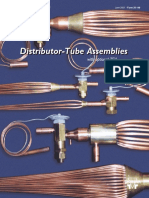

- Distributor-Tube AssembliesDocument2 pagesDistributor-Tube Assembliesdonhan91No ratings yet

- Catalogo Distribuidores Sporlan PDFDocument28 pagesCatalogo Distribuidores Sporlan PDFhugoNo ratings yet

- Co2 PDFDocument29 pagesCo2 PDFdonhan91No ratings yet

- Solenoid Valves For Secondary Coolant CO: XSP SeriesDocument8 pagesSolenoid Valves For Secondary Coolant CO: XSP Seriesdonhan91No ratings yet