0% found this document useful (0 votes)

73 views2 pagesCash Flow and Loan Amortization Analysis

The document contains accounting information for a bank including:

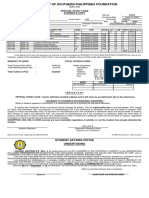

1) Monthly unadjusted and adjusted cash balance sheets showing receipts, disbursements, and balances for June 30 through July 31.

2) Monthly unadjusted bank balance sheets and adjusted cash balances for November 30 through December 31 including deposit and check information.

3) An amortization schedule for a $10 million loan and calculation of loan impairment at December 31, 2012 based on present value of expected cash flows.

Uploaded by

Quijano GpokskieCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

73 views2 pagesCash Flow and Loan Amortization Analysis

The document contains accounting information for a bank including:

1) Monthly unadjusted and adjusted cash balance sheets showing receipts, disbursements, and balances for June 30 through July 31.

2) Monthly unadjusted bank balance sheets and adjusted cash balances for November 30 through December 31 including deposit and check information.

3) An amortization schedule for a $10 million loan and calculation of loan impairment at December 31, 2012 based on present value of expected cash flows.

Uploaded by

Quijano GpokskieCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd