Professional Documents

Culture Documents

Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)

Uploaded by

May Grethel Joy PeranteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)

Uploaded by

May Grethel Joy PeranteCopyright:

Available Formats

Excel_Professional Services Inc.

Management Firm of Professional Review and Training Center (PRTC)

(LUZON) Manila 7339344 * Santiago City,Isabela(0918)2807130

Calamba City, Laguna * Dasmariñas City, Cavite * Lipa City, Batangas (0917) 8852769

(VISAYAS) Bacolod City (034) 434-6214 * Cebu City (032) 253-7900 Loc. 218

(MINDANAO) Cagayan de Oro City (0917) 708-1465 * Davao City (082) 225-0049

AP.2809 - Simulated Examination

Suggested answers/solutions by OCAMPO/CABARLES/SOLIMAN/OCAMPO

PROBLEM NO. 1 - Caloocan Corporation

Question No. 1 - B

Cash balance, 12/31/18 706,600

Add back credits to Cash account:

Cash paid for operating expenses 440,000

Cash paid on accounts payable 943,400 1,383,400

Total 2,090,000

Less other debits to Cash account:

Cash balance, 12/31/17 200,000

Collection of note receivable 50,000 250,000

Cash sales 1,840,000

Divide by selling price per unit 100

Units sold 18,400

Question No. 2 - A

Accounts payable, 12/31/17 150,000

Add purchases:

Month Unit cost Quantity Total cost

January 65.20 1,500 97,800

February 65.40 1,500 98,100

March 65.60 1,500 98,400

April 65.80 1,500 98,700

May 66.00 1,500 99,000

June 66.20 1,500 99,300

July 66.40 1,500 99,600

August 66.60 1,500 99,900

September 66.80 1,500 100,200

October 67.00 1,500 100,500

November 67.20 1,500 100,800

December 67.40 1,500 101,100 1,193,400

Total 18,000 1,343,400

Less cash paid on accounts payable 943,400

Accounts payable, 12/31/18 400,000

Question No. 3 - A

Inventory quantity, 12/31/17 (P399,750/P65.00) 6,150

Add purchases (see no. 2) 18,000

Units available for sale 24,150

Less units sold (see no. 1) 18,400

Inventory quantity, 12/31/18 5,750

Month of purchase Quantity Unit cost Total cost

December 1,500 67.40 101,100

November 1,500 67.20 100,800

October 1,500 67.00 100,500

September (balance) 1,250 66.80 83,500

5,750 385,900

Question No. 4 - D

Question No. 5 - C

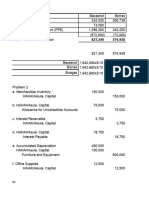

PROBLEM NO. 2 - Olive Corporation

12/31/17 Addition Disposal 12/31/18 CA, 12/31/18

Cost

Land 450,000 200,000 650,000 650,000 (7-A)

Land improvements - 100,000 100,000 95,000

Buildings 2,400,000 730,000 3,130,000 1,816,250 (6-C)

Machinery and equipment 2,770,000 960,000 1,810,000 1,394,500

5,620,000 1,030,000 960,000 5,690,000 3,955,750 (8-C)

Accumulated depreciation

Land improvements - 5,000 5,000

Buildings 1,200,000 113,750 1,313,750

Machinery and equipment 546,500 253,000 384,000 415,500

1,746,500 371,750 384,000 1,734,250

Page 1 of 5 www.prtc.com.ph AP.2809sol

Computation of depreciation:

Land improvements (P100,000/10 x 6/12) 5,000

Buildings:

Old (P2.4M/25) 96,000

New - constructed (P330,000/12 x 6/12) 13,750

Donated (P400,000/25 x 3/12) 4,000 113,750

Machinery and equipment

Remaining (P1,810,000/10) 181,000

Sold (P960,000/10 x 9/12) 72,000 253,000

Question No. 9 - A

Sales proceeds 520,000

Carrying amount (P960,000 - P384,000) 576,000

Gain (Loss) on sale (56,000)

Question No. 10 - D

PROBLEM NO. 3 - GDL, Inc.

Question No. 11 - A

Patent amortization (P1,680,000/6) 280,000

Trademark -

Noncompetition agreement (P2,000,000/5) 400,000

Total amortization 680,000

Question No. 12 - D

Patent (P1,680,000 - P280,000) 1,400,000

Trademark (P8,000,000 x 3/4) 6,000,000

Noncompetition agreement (P2,000,000 - P400,000) 1,600,000

Carrying amount of intangible assets, 12/31/18 9,000,000

Question No. 13 - A

Deferred tax asset, 12/31/17 360,000

Decrease in deferred tax asset:

Decrease in unearned rent (P200,000 x 35%) (70,000)

Increase in warranty liability (P150,000 x 35%) 52,500 (17,500)

Deferred tax asset, 12/31/18 342,500

Question No. 14 - B

Question No. 15 - A

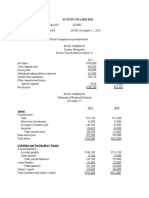

PROBLEM NO. 4 - Syria Company

December

Nov. 30 Receipts Disb Dec. 31

Unadjusted bank balances 480,000 240,000 300,000 420,000

Undeposited collections:

November 30 100,000 (100,000)

December 31 140,000 140,000

Outstanding checks:

November 30 (150,000) (150,000)

December 31 120,000 (120,000)

Erroneous bank debit (90,000) 90,000

Deposits with loan payment (P725,000 x 80%) 580,000 580,000

NSF checks:

Returned in Nov., recorded in Dec. 10,000 (10,000)

Returned and recorded in Dec. (25,000) (25,000)

Returned in Dec., recorded in Jan. (29,000) 29,000

Unrecorded bank collection in Dec. (106,000) (106,000)

Anticipated loan proceeds from AR hypothecation

Nov. 30 sales (P180,000 x 80%) 144,000 (144,000)

Dec. 31 sales (P200,000 x 80%) 160,000 160,000

Anticipated loan payment from undeposited collections

Nov. 30 (P100,000 x 80%) (80,000) (80,000)

Dec. 31 (P140,000 x 80%) 112,000 (112,000)

Interest charge for bank loan in Dec. (38,000) 38,000

Unadjusted book balances 504,000 735,000 700,000 539,000

(16 - A) (17 - C) (18 - B) (19 - D)

Question No. 20 - B

Page 2 of 5 www.prtc.com.ph AP.2809sol

PROBLEM NO. 5 - Austronesian Corporation

Question No. 21 - B

Cash-Allied Bank, 12/31/17 450,000

Add (deduct) transactions during 2018:

(b) Collections on accounts receivable 5,765,000

(d) Payment on dishonored discounted NR (30,900)

(e) Proceeds from NR discounted 585,000

(g) Recoveries of bad debts written off 20,200

(h) Collections on notes receivable 270,000

(h) Collections on interest receivable 24,500

(j) Loan proceeds from Allied Bank 350,000

(j) Loan repayment - interest and principal (195,000)

(k) Replenishment of petty cash fund (4,500)

(l) Transfer to bond retirement fund (30,000)

(m) Decrease in cash on hand [P160,000 - P120,000] 40,000

(n) Payment for expenses (6,800,000)

Cash-Allied Bank, 12/31/18 444,300

Cash on hand, 12/31/18 120,000

Petty cash fund, 12/31/18 10,000

Total cash, 12/31/18 574,300

Question No. 22 - A

Accounts receivable, 12/31/17 856,000

Add (deduct) transactions during 2018:

(a) Sales on account 7,670,000

(b) Collections on accounts receivable

[(P5,765,000 + (P930,000x.02)] (5,783,600)

(c) Notes received in settlement of accounts (825,000)

(f) Accounts written off (87,200)

Accounts receivable, 12/31/18 1,830,200

Allowance for doubtful accounts, 12/31/18 (P1,830,200 x 5%) 91,510

(f) Accounts written off 87,200

(g) Recoveries of bad debts written off (20,200)

Allowance for doubtful accounts, 12/31/17 (41,500)

Doubtful accounts expense for 2018 117,010

Question No. 23 - C

Accounts receivable, 12/31/18 1,830,200

Less allowance for doubtful accounts, 12/31/18 91,510

Accounts receivable, net 1,738,690

Question No. 24 - D

Accounts receivable, net (see no. 23) 1,738,690

Notes receivable (see below) 285,000

Notes receivable - dishonored (d) 30,900

Interest receivable (i) 6,300

Trade and other receivables, net 2,060,890

Notes receivable, 12/31/17 365,000

Add (deduct) transactions during 2018:

(c) Notes received in settlement of accounts 825,000

(d) Collections and dishonor of discounted notes (155,000)

(e) Collections of discounted notes (480,000)

(h) Collections of notes receivable (270,000)

Accounts receivable, 12/31/18 285,000

Question No. 25 - D

PROBLEM NO. 6 - Bahrain Bank

Question No. 26 - B

Question No. 27 - C

Principal 10,000,000

Direct origination cost 130,900

Origination fee received from borrower (P10M x .05) (500,000)

Carrying amount, 1/1/17 9,630,900

Amortization schedule - partial

Date EI (11%) NI (10%) Disc. Amort. C.A.

1/1/17 9,630,900

12/31/17 1,059,399 1,000,000 59,399 9,690,299

12/31/18 1,065,933 1,000,000 65,933 9,756,232

Page 3 of 5 www.prtc.com.ph AP.2809sol

Question No. 28 - A

Carrying amount, 12/31/18 (see schedule) 9,756,232

Less PV of expected cash flows:

12/31/20 (P4M x 0.8116) 3,246,400

12/31/22 (P4M x 0.6587) 2,634,800 5,881,200

Loan impairment (bad debt expense) 3,875,032

Question No. 29 - A

Question No. 30 - B

PROBLEM NO. 7 - La Cost Company

Question no. 31 - C

Selling price (4,000 shares x P69) 276,000

Less CA of shares sold (P528,250 x 4/8) 264,125

Gain on sale of Totoy Bibo shares 11,875

Question no. 32 - A

Selling price (4,000 shares x P62) 248,000

Less CA of shares sold (P630,000 x 4/10) 252,000

Loss on sale of Bulaklak shares (4,000)

Realized gain on shares sold (P40,000 x 4/10) 16,000

Gain on sale of Bulaklak shares 12,000

Question no. 33 - C

Yeye Bonel [(10,000+ 3,000) x P76.60] 995,800

Totoy Bibo [(8,000 - 4,000) x P68.50] 274,000

Pasaway (15,000 x P55.25) 828,750

Mayniladlad 205,550

Total fair value - TS 2,304,100

Question no. 34 - C

Bulaklak Inc. [(10,000 - 4,000) x P61] 366,000

Jumbo Hotdog (20,000 x P27) 540,000

Total fair value - AFS 906,000

Question no. 35 - A

Trading securites, 12/31/17 1,477,500

Cost of 3,000 additional Yeye Bonel shares, 3/1 229,500

CA of 4,000 Totoy Bibo shares sold, 4/15 (264,125)

Cost of 15,000 Pasaway shares purchased, 10/30 832,500

Trading securites, 12/31/18 before mark-to-market 2,275,375

Trading securites at market 2,304,100

Unrealized gain on TS - P/L 28,725

Fair value of AFS, 12/31/18 906,000

Total cost of AFS, 12/31/18 [(P590Tx6/10)+P490T] 844,000

Unrealized gain-AFS, 12/31/18 (Equity component) 62,000

PROBLEM NO. 8 - Lakers, Inc.

Question No. 36 - B

Total proceeds 4,000,000

Less liability component:

PV of the principal (P4,000,000 x 0.6830) 2,732,000

PV of the interest [(P4,000,000 x 8% x 3.1699) 1,014,368 3,746,368

Equity component 253,632

Question no. 37 - D

Carrying amount, 1/1/17 (see no. 36) 3,746,368

Add discount amortization for 2017:

Effective interest (P3,746,368 x 10%) 374,637

Nominal interest (P4,000,000 x 8%) 320,000 54,637

Carrying amount, 12/31/17 3,801,005

Question no. 38 - D

Effective interest - 2018 (P3,801,005 x 10%) 380,101

Question no. 39 - A

Carrying amount, 12/31/17 (see no. 38) 3,801,005

Add discount amortization for 2018:

Effective interest (P3,801,005 x 10%) 380,101

Nominal interest (P4,000,000 x 8%) 320,000 60,101

Carrying amount, 12/31/18 3,861,106 *

CA of bonds converted (P3,861,106* x 1/2) 1,930,553

Par value of shares issued (P2,000,000/P1,000 x 6 x P100) 1,200,000

Net increase in share premium 730,553

Page 4 of 5 www.prtc.com.ph AP.2809sol

Question no. 40 - C

Reacquisiton price (P1,000,000 x 110%) 1,100,000

CA of bonds reacquired (P3,861,106 x 1/4) 965,276

Loss on bond reacquisition 134,724

PROBLEM NO. 9 - Perseverance Corporation

Retained Treasury

Share capital Share premium earnings shares

Balances, 12/31/16 3,000,000 300,000 450,000 -

Issuance of CS, 6/15/17 5,000,000 1,000,000

Stock dividend, 9/30/17 400,000 40,000 (440,000)

Profit - 2017 475,000

Balances, 12/31/17 8,400,000 1,340,000 485,000 -

Acquisition of TS, 3/1/18 285,000

Sale of TS, 5/31/18 37,500 (142,500)

Exercise of 25,000 share rights, 9/15/18 5,000,000 1,250,000

Exercise of 40,000 share rights, 10/31/18 8,000,000 2,000,000

Declared cash dividend, 12/10/18 (425,000)

Retired 1,000 TS, 12/20/18 (100,000) 5,000 (95,000)

Profit - 2018 500,000

Balances, 12/31/18 21,300,000 4,632,500 560,000 47,500

41 - B 42 - C 43 - D

Question no. 44 - D

Question no. 45 - D

PROBLEM NO. 10 - Bryant Corporation

Question No. 46 - A

Unadjusted income before taxes 560,000

Add (deduct) adjustments:

a) Unrealized loss on short term marketable securities (P55,000 - P60,000) (5,000)

b) Decrease in allowance for doubtful accounts (P59,000 - P36,000) 23,000

c) Understatement of ending inventories 12,000

d) Prepaid insurance charged to expense 3,000

e) Accrual of pension cost (P45,000/2) (22,500)

f) Production machine charged to expense 24,000

f) Depreciation of production machine (P24,000/5 x 6/12) (2,400)

g) Write off of R & D expense (P150,000 - P30,000) (120,000)

h) Provision for loss from lawsuit (50,000)

Adjusted income before taxes 422,100

Less income tax expense (40%) 168,840

Net income 253,260

Question No. 47 - C

Cash 150,000

Marketable securities, at fair value 55,000

Accounts receivable 450,000

Allowance for doubtful accounts (36,000)

Inventories (P430,000 + P12,000) 442,000

Prepaid insurance (P15,000 + P3,000) 18,000

Total current assets 1,079,000

Question No. 48 - B

Property, plant and equipment (P426,000 + P24,000) 450,000

Accumulated depreciation (P40,000 + P2,400) (42,400)

Property, plant and equipment, net 407,600

Current assets (see no. 47) 1,079,000

Total assets 1,486,600

Question No. 49 - A

Accounts payable and accrued expenses 592,000

Income taxes payable (see no. 46) 168,840

Accrued pension expense 22,500

Provision for loss from lawsuit 50,000

Total liabilities 833,340

Question No. 50 - D

Share capital 400,000

Retained earnings (see no. 46) 253,260

Total equity 653,260

Page 5 of 5 www.prtc.com.ph AP.2809sol

You might also like

- NP Performance Appraisal Sample PDFDocument2 pagesNP Performance Appraisal Sample PDFHamss Ahmed80% (5)

- List of 400 English Synonyms & Antonyms - Practice To Beat Competition PDFDocument18 pagesList of 400 English Synonyms & Antonyms - Practice To Beat Competition PDFSaket SaxenaNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument20 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument16 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy Perante100% (1)

- Chapter 32 - Stockholders Equity Part 1Document23 pagesChapter 32 - Stockholders Equity Part 1May Grethel Joy PeranteNo ratings yet

- DECA RolePlayDocument6 pagesDECA RolePlayAftab MohammedNo ratings yet

- Converse Rubber Vs Jacinto RubberDocument15 pagesConverse Rubber Vs Jacinto RubberClaudine Christine A VicenteNo ratings yet

- Hampton Machine Tool CaseDocument7 pagesHampton Machine Tool CaseChaitanya80% (10)

- Chapter 2-Meaning and Scope of Public FinanceDocument21 pagesChapter 2-Meaning and Scope of Public FinanceyebegashetNo ratings yet

- Zaha Hadid's Revolutionary Architecture and PhilosophyDocument4 pagesZaha Hadid's Revolutionary Architecture and PhilosophyLetu OlanaNo ratings yet

- MIDTERM QUIZ 2 - Attempt ReviewDocument5 pagesMIDTERM QUIZ 2 - Attempt ReviewAshnesh YadavNo ratings yet

- Qdoc - Tips HR Bangalore HR DBDocument27 pagesQdoc - Tips HR Bangalore HR DBHarshitNo ratings yet

- QSP Qad 08Document2 pagesQSP Qad 08prabha_1No ratings yet

- Question No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamDocument6 pagesQuestion No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamBernadette PanicanNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- Duty To Bargain - ReportDocument10 pagesDuty To Bargain - ReportMc BagualNo ratings yet

- Clinical-Chemistry-MB-Reviewer 2Document14 pagesClinical-Chemistry-MB-Reviewer 2Aubrey Jane TagolinoNo ratings yet

- Introduction To MASDocument10 pagesIntroduction To MASxorelli100% (8)

- (02D) Inventories Assignment 02 ANSWER KEYDocument9 pages(02D) Inventories Assignment 02 ANSWER KEYGabriel Adrian ObungenNo ratings yet

- The Financial ExpertDocument16 pagesThe Financial ExpertVinay Vishwakarma0% (1)

- AP 5905Q InventoriesDocument3 pagesAP 5905Q Inventoriesaldrin elsisuraNo ratings yet

- Pangakun UAS 2018 - JawabanDocument16 pagesPangakun UAS 2018 - Jawabansepuluh 10No ratings yet

- 4 5845855793034823827Document4 pages4 5845855793034823827Gena HamdaNo ratings yet

- Sales Budget Jan Feb Mar April May TotalDocument2 pagesSales Budget Jan Feb Mar April May Totalwhat everNo ratings yet

- Mas ReviewerDocument14 pagesMas ReviewerMichelle AvilesNo ratings yet

- Managing Inventory Levels for a Bicycle Parts ManufacturerDocument2 pagesManaging Inventory Levels for a Bicycle Parts ManufacturerLunaNo ratings yet

- Calculating weighted average cost and change in fair value of biological assetsDocument7 pagesCalculating weighted average cost and change in fair value of biological assetsSinclair faith galarioNo ratings yet

- Acctg 202Document9 pagesAcctg 202Lore Desa CenizaNo ratings yet

- Chap 12 Inventories CompleteDocument38 pagesChap 12 Inventories CompleteKloie SanoriaNo ratings yet

- AC 100 Aug2006 MSDocument6 pagesAC 100 Aug2006 MSERICK MLINGWANo ratings yet

- Final Accounting (ENG)Document19 pagesFinal Accounting (ENG)lika rukhadzeNo ratings yet

- Answer Key Quiz1Document14 pagesAnswer Key Quiz1JOYCE C ANDADORNo ratings yet

- Monthly Expenditure Report Pt. Tunggal Idaman AbdiDocument4 pagesMonthly Expenditure Report Pt. Tunggal Idaman Abdinofianti ekaputriNo ratings yet

- Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Document7 pagesExcel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Phoeza Espinosa VillanuevaNo ratings yet

- Sales, Costs, Inventory TrackingDocument34 pagesSales, Costs, Inventory TrackingGenie MaeNo ratings yet

- Corporate Finance II Section: 01 Homework No: 02Document5 pagesCorporate Finance II Section: 01 Homework No: 02Sumaiya TithiNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- Total Cash Available (1 + 2) 82,500 124,000 89,275Document6 pagesTotal Cash Available (1 + 2) 82,500 124,000 89,275Nischal LawojuNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- Appendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessDocument14 pagesAppendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessLan Hương Trần ThịNo ratings yet

- Audit of Receivables, Inventories, Property Plant & Equipment and Intangible AssetsDocument5 pagesAudit of Receivables, Inventories, Property Plant & Equipment and Intangible AssetsJoyce Marie SablayanNo ratings yet

- Financial Plan OkDocument7 pagesFinancial Plan OkSYED ARSALANNo ratings yet

- 4.2 Answers and Solutions - Assignment On Materials and LaborDocument8 pages4.2 Answers and Solutions - Assignment On Materials and LaborRoselyn LumbaoNo ratings yet

- 4 y 5Document16 pages4 y 5vanesantvilNo ratings yet

- PT CEMERLANG Unadjusted Trial Balance and Balance Sheet AnalysisDocument61 pagesPT CEMERLANG Unadjusted Trial Balance and Balance Sheet Analysisdevionika avandaNo ratings yet

- Module 6 - Ppe RevalutionDocument4 pagesModule 6 - Ppe RevalutionARISNo ratings yet

- Asset Depreciation and Revaluation ReportDocument10 pagesAsset Depreciation and Revaluation ReportAaliyah ManuelNo ratings yet

- ADV Corp's 1-year sales, expenses, and 3-year projectionsDocument3 pagesADV Corp's 1-year sales, expenses, and 3-year projectionsJersey Ann AlcazarNo ratings yet

- Problem o SolutionDocument3 pagesProblem o SolutionRenz AlconeraNo ratings yet

- Post Test - Answer KeyDocument6 pagesPost Test - Answer KeyLynn A. NuestroNo ratings yet

- Jimbob Co.'s January Income StatementDocument24 pagesJimbob Co.'s January Income StatementAlyannaNo ratings yet

- AK RevaluationDocument6 pagesAK RevaluationClaire Labiste IINo ratings yet

- Assignment On LCNRV and GP MethodDocument6 pagesAssignment On LCNRV and GP MethodAdam CuencaNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Mid Term Review AnswersDocument12 pagesMid Term Review AnswersManasi ChitnisNo ratings yet

- Module Number 6 (Ppe Revalution) Question No. 1Document4 pagesModule Number 6 (Ppe Revalution) Question No. 1ARISNo ratings yet

- Final Preboard Examination On Auditing Problems Suggested Answers/solutionsDocument8 pagesFinal Preboard Examination On Auditing Problems Suggested Answers/solutionsLoren Lordwell MoyaniNo ratings yet

- Financial Position and Income Statement Analysis of Simple CompanyDocument2 pagesFinancial Position and Income Statement Analysis of Simple CompanyAndrea Monique AlejagaNo ratings yet

- Merchandise Worksheet SolutionDocument1 pageMerchandise Worksheet SolutionSiam FarhanNo ratings yet

- Merchandise Worksheet SolutionDocument1 pageMerchandise Worksheet SolutionSiam FarhanNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Exercise 1: Schedule of Expected Cash CollectionDocument7 pagesExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNo ratings yet

- Ponderosa-IncDocument6 pagesPonderosa-IncpompomNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Prob1 Afar QuizDocument7 pagesProb1 Afar Quizryan rosalesNo ratings yet

- Republic Central Colleges Angeles City Prelim QuizDocument3 pagesRepublic Central Colleges Angeles City Prelim QuizPaupauNo ratings yet

- Hampton Machine Tool CaseDocument7 pagesHampton Machine Tool Casegunjan19834u100% (1)

- ACTY04 s.2020 2021Document3 pagesACTY04 s.2020 2021Gelay MagatNo ratings yet

- Advance Acc, Individual Assignment Two AnswerDocument13 pagesAdvance Acc, Individual Assignment Two Answerchalachew mekonnenNo ratings yet

- 4th Assessment STUDENTDocument5 pages4th Assessment STUDENTJOHANNA TORRESNo ratings yet

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- #2. IT Doesnt MatterDocument40 pages#2. IT Doesnt Matterciptapanjiutama 1021No ratings yet

- Aging Accounts Receivable and Calculating Doubtful Accounts ExpenseDocument7 pagesAging Accounts Receivable and Calculating Doubtful Accounts Expenselala gasNo ratings yet

- Accounting calculations and journal entriesDocument6 pagesAccounting calculations and journal entriesZatsumono YamamotoNo ratings yet

- 9005 - HandoutsDocument5 pages9005 - HandoutsSirNo ratings yet

- Overview of Risk-Based AuditDocument8 pagesOverview of Risk-Based AuditMay Grethel Joy PeranteNo ratings yet

- Overview of Risk-Based AuditDocument8 pagesOverview of Risk-Based AuditMay Grethel Joy PeranteNo ratings yet

- Law PinoyDocument54 pagesLaw PinoyfrustratedlawstudentNo ratings yet

- Easter WorksheetsDocument8 pagesEaster WorksheetsMay Grethel Joy PeranteNo ratings yet

- Financial Accounting & ReportingDocument1 pageFinancial Accounting & ReportingMay Grethel Joy PeranteNo ratings yet

- AT 8901 PPT Material For UploadDocument62 pagesAT 8901 PPT Material For UploadMay Grethel Joy PeranteNo ratings yet

- RFBT NotesDocument8 pagesRFBT NotesMay Grethel Joy PeranteNo ratings yet

- One Chapter A Day Bible Reading PlanDocument9 pagesOne Chapter A Day Bible Reading PlanMay Grethel Joy PeranteNo ratings yet

- Financial Accounting & ReportingDocument1 pageFinancial Accounting & ReportingMay Grethel Joy PeranteNo ratings yet

- Psa37 4Document1 pagePsa37 4May Grethel Joy PeranteNo ratings yet

- 10 Receivable Financing For UploadDocument19 pages10 Receivable Financing For UploadMay Grethel Joy PeranteNo ratings yet

- Financial Accounting & ReportingDocument1 pageFinancial Accounting & ReportingMay Grethel Joy PeranteNo ratings yet

- Financial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesDocument2 pagesFinancial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesMay Grethel Joy PeranteNo ratings yet

- Civil Service ReviewDocument203 pagesCivil Service ReviewGretchen Alunday SuarezNo ratings yet

- Freebie PlannerCardsDocument2 pagesFreebie PlannerCardsMay Grethel Joy PeranteNo ratings yet

- Civil Service Exam Vocabulary ReviewDocument7 pagesCivil Service Exam Vocabulary ReviewMay Grethel Joy PeranteNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDei FenixNo ratings yet

- 09 Accounts Receivable For UploadDocument15 pages09 Accounts Receivable For UploadMay Grethel Joy PeranteNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument19 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- ONLINE STEP-BY-STEP GUIDE FOR PRC ID RENEWALDocument28 pagesONLINE STEP-BY-STEP GUIDE FOR PRC ID RENEWALmichael gerezNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument18 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- FAR Part 2: Noncurrent LiabilitiesDocument11 pagesFAR Part 2: Noncurrent LiabilitiesMay Grethel Joy PeranteNo ratings yet

- Cpa Review School of The Philippines ManilaDocument1 pageCpa Review School of The Philippines ManilaMay Grethel Joy PeranteNo ratings yet

- English Grammar and Correct UsageDocument22 pagesEnglish Grammar and Correct UsageMay Grethel Joy PeranteNo ratings yet

- Chapter 31 - Income TaxesDocument11 pagesChapter 31 - Income TaxesMay Grethel Joy PeranteNo ratings yet

- Scientific Theological Aspects of GeocentricityDocument222 pagesScientific Theological Aspects of GeocentricityAdi Dumitru100% (1)

- Enterprise Resource Planning ERPDocument16 pagesEnterprise Resource Planning ERPsaifNo ratings yet

- NCC - Binding The Nation Together - National Integration - NDocument4 pagesNCC - Binding The Nation Together - National Integration - Nselva_raj215414No ratings yet

- Amul SpssDocument41 pagesAmul Spssshikhahota2012No ratings yet

- English M.philcomplte Tehsis-5Document98 pagesEnglish M.philcomplte Tehsis-5Bushra Siddiqui100% (1)

- Cash Flow StatementDocument2 pagesCash Flow StatementEvy Nonita AnggusNo ratings yet

- 2013 SAMPLE BAR EXAM QUESTIONSDocument11 pages2013 SAMPLE BAR EXAM QUESTIONShellojdeyNo ratings yet

- Client Request FormDocument1 pageClient Request FormDenald Paz100% (1)

- CiviljointpdfDocument8 pagesCiviljointpdfAyashu PandeyNo ratings yet

- Flexible Budgets and Variance AnalysisDocument50 pagesFlexible Budgets and Variance AnalysisRanjini SettyNo ratings yet

- Budak Historia Salonitana and Historia Salonitana Maior Compatibility ModeDocument17 pagesBudak Historia Salonitana and Historia Salonitana Maior Compatibility Modeprofa92No ratings yet

- University of Ljubljana: International FinanceDocument20 pagesUniversity of Ljubljana: International FinanceShruti VadherNo ratings yet

- 2021 BTCI FASTING PREPARATION (Part 1) - 2Document2 pages2021 BTCI FASTING PREPARATION (Part 1) - 2Andrew HunterNo ratings yet

- HEKKERT Surprise and Humor in Product Design - Designing Sensory Metaphors in Multiple ModalitiesDocument26 pagesHEKKERT Surprise and Humor in Product Design - Designing Sensory Metaphors in Multiple ModalitiesxyzNo ratings yet

- Pasan Ko Ang DaigdigDocument1 pagePasan Ko Ang DaigdigJermaine Rae Arpia Dimayacyac0% (1)

- Lal Bahadur ShastriDocument17 pagesLal Bahadur Shastribhaskar124970No ratings yet

- 3 Point ProblemDocument8 pages3 Point ProblemDhana Strata NNo ratings yet

- Group 1 Math 100L Hqt2 HWDocument5 pagesGroup 1 Math 100L Hqt2 HWAmelie HernandezNo ratings yet