Professional Documents

Culture Documents

Chapter 31 - Income Taxes

Uploaded by

May Grethel Joy Perante0 ratings0% found this document useful (0 votes)

247 views11 pagesOriginal Title

CHAPTER-31_INCOME-TAXES

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

247 views11 pagesChapter 31 - Income Taxes

Uploaded by

May Grethel Joy PeranteCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 11

(Financial Accounting &

Reporting 2)

LECTURE AID

2017

ZEUS VERNON B. MILLAN

FAR PART 2: Zeus Vernon B. Millan

Chapter 31 Income Taxes

Related standard: PAS 12 Income Taxes

Learning Competencies

• Explain why the profit presented in the financial

statements may be different from the taxable profit.

• Determine the tax base of assets and liabilities.

• Compute for income tax expense and current tax

expense.

• Compute for deferred tax assets and deferred tax

liabilities.

FAR PART 2: Zeus Vernon B. Millan

FAR PART 2: Zeus Vernon B. Millan

FAR PART 2: Zeus Vernon B. Millan

FAR PART 2: Zeus Vernon B. Millan

Deferred tax expense (benefit)

FAR PART 2: Zeus Vernon B. Millan

FAR PART 2: Zeus Vernon B. Millan

Interperiod and intraperiod tax allocation

• Interperiod tax allocation relates to the recognition of deferred tax assets

and deferred tax liabilities. It is concerned with the accounting for

temporary differences.

• Intraperiod tax allocation relates to the allocation of income tax expense

during the period to various items of income or other sources that brought

about the tax. This is based on the notion – “the tax follows the income.”

Income tax is allocated to the following:

a. Profit or loss from continuing operations

b. Profit or loss from discontinued operations

c. Components of other comprehensive income

d. Items recognized directly in retained earnings

FAR PART 2: Zeus Vernon B. Millan

CLASSROOM

DISCUSSIONS &

COMPUTATIONS

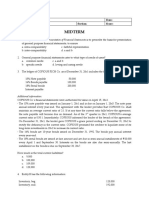

PROBLEM 31-2: THEORY & COMPUTATIONAL

FAR PART 2: Zeus Vernon B. Millan

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

FAR PART 2: Zeus Vernon B. Millan

SEATWORK

(PROBLEM 31-4: CLASSROOM ACTIVITY)

FAR PART 2: Zeus Vernon B. Millan

You might also like

- Introduction To MASDocument10 pagesIntroduction To MASxorelli100% (8)

- (Intermediate Accounting 3) : Lecture AidDocument17 pages(Intermediate Accounting 3) : Lecture AidClint Agustin M. RoblesNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument19 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- (Intermediate Accounting 3) : Lecture AidDocument28 pages(Intermediate Accounting 3) : Lecture AidFrost Garison100% (1)

- Discontinued Operations ProblemsDocument4 pagesDiscontinued Operations ProblemsJeane Mae BooNo ratings yet

- Chapter 6 - Statement of Cash FlowsDocument14 pagesChapter 6 - Statement of Cash Flowsarlynajero.ckc100% (1)

- Financial Reporting Objectives and ConceptsDocument14 pagesFinancial Reporting Objectives and ConceptsDarlyn Dalida San PedroNo ratings yet

- The Common Forms of Debt Restructuring: Asset SwapDocument5 pagesThe Common Forms of Debt Restructuring: Asset SwapJonathan VidarNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- IA3 Prelims With No AnswerDocument6 pagesIA3 Prelims With No Answercarl fuerzasNo ratings yet

- Quiz 2 Ncahs/ Discontinued Operation: FeedbackDocument67 pagesQuiz 2 Ncahs/ Discontinued Operation: FeedbackAngela Miles DizonNo ratings yet

- Installment Sales ConceptsDocument61 pagesInstallment Sales ConceptsRanne BalanaNo ratings yet

- Conceptual Framework and Accounting Standards: C F A SDocument34 pagesConceptual Framework and Accounting Standards: C F A SG & E ApparelNo ratings yet

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNo ratings yet

- ILLUSTRATIONS - Government AccountingDocument10 pagesILLUSTRATIONS - Government AccountingKathleenNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFEstiloNo ratings yet

- Chapter 34Document17 pagesChapter 34Mike SerafinoNo ratings yet

- Accounting for Income Tax DifferencesDocument42 pagesAccounting for Income Tax DifferencesAngela Miles DizonNo ratings yet

- Cost Concept, Terminologies and BehaviorDocument8 pagesCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONNo ratings yet

- Accounting For Governmental / Chapter 4Document9 pagesAccounting For Governmental / Chapter 4Kenneth BunnarkNo ratings yet

- CH07 Gross EstateDocument9 pagesCH07 Gross EstateRenelyn FiloteoNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Pas 28Document6 pagesPas 28AnneNo ratings yet

- AC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsDocument78 pagesAC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsmerryNo ratings yet

- Accounting For Special TransactionsDocument11 pagesAccounting For Special Transactionsjohn carloNo ratings yet

- Quiz - Chapter 5 - Statement of Changes in EquityDocument1 pageQuiz - Chapter 5 - Statement of Changes in Equityarlynajero.ckcNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Chapter 10 - Shareholders' Equity Part 1Document20 pagesChapter 10 - Shareholders' Equity Part 1Camille GarciaNo ratings yet

- Borrowing CostsDocument17 pagesBorrowing CostsAngelica PagaduanNo ratings yet

- Tax 321 Prelim Quiz 1 Key PDFDocument13 pagesTax 321 Prelim Quiz 1 Key PDFJeda UsonNo ratings yet

- Chapter 40 - Teacher's ManualDocument8 pagesChapter 40 - Teacher's ManualHohohoNo ratings yet

- Audit of LiabilitiesDocument12 pagesAudit of LiabilitiesAcier KozukiNo ratings yet

- Exempt Sale of Goods Properties and Services NotesDocument2 pagesExempt Sale of Goods Properties and Services NotesSelene DimlaNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Responsibility Accounting and Transfer PricingDocument13 pagesResponsibility Accounting and Transfer PricingNicole Andrea TuazonNo ratings yet

- Calculating Impairment Loss and Discontinued OperationsDocument7 pagesCalculating Impairment Loss and Discontinued OperationsRUNEL J. PACOTNo ratings yet

- Financial Accounting and ReportingDocument15 pagesFinancial Accounting and Reportingjoyce KimNo ratings yet

- Audit of PPE Comprehensive QuizzerDocument9 pagesAudit of PPE Comprehensive QuizzerAlice WuNo ratings yet

- CHAPTER 6 PPE Zeus Milan Lecture AidDocument39 pagesCHAPTER 6 PPE Zeus Milan Lecture AidJerome Regalario EspinaNo ratings yet

- Estate Tax Guide for PhilippinesDocument50 pagesEstate Tax Guide for PhilippinesLea JoaquinNo ratings yet

- Toaz - Info Quiz 3 PRDocument25 pagesToaz - Info Quiz 3 PRAprille Xay TupasNo ratings yet

- Chapter 6 - Joint ArrangementsDocument16 pagesChapter 6 - Joint ArrangementsMikael James VillanuevaNo ratings yet

- Warranty Liability: Start of DiscussionDocument2 pagesWarranty Liability: Start of DiscussionclarizaNo ratings yet

- Investing ActivitiesDocument7 pagesInvesting ActivitiesMs. ArianaNo ratings yet

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument3 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- Actg 216 Reviwer Part 2 Without AnswerDocument5 pagesActg 216 Reviwer Part 2 Without Answercute meNo ratings yet

- AFAR-07 (Home-Office & Branch Accounting)Document7 pagesAFAR-07 (Home-Office & Branch Accounting)mysweet surrenderNo ratings yet

- 02 Conceptual Framework - RevisedDocument13 pages02 Conceptual Framework - RevisedRazel MhinNo ratings yet

- Ia2 Prob 1-32 & 33Document1 pageIa2 Prob 1-32 & 33maryaniNo ratings yet

- Regulation of Financial SystemDocument39 pagesRegulation of Financial SystemRamil ElambayoNo ratings yet

- Consolidated Financial Statements Under Purchase AccountingDocument18 pagesConsolidated Financial Statements Under Purchase AccountingtemedebereNo ratings yet

- Subsequent To Acquisition Quiz 3Document1 pageSubsequent To Acquisition Quiz 3John BalanquitNo ratings yet

- Chapter 4 InventoriesDocument29 pagesChapter 4 InventoriesTzietel Ann FloresNo ratings yet

- Name: - Section: - Schedule: - Class Number: - DateDocument21 pagesName: - Section: - Schedule: - Class Number: - DateJohn Michael SorianoNo ratings yet

- IA3 Chapter 14 Problem 31Document3 pagesIA3 Chapter 14 Problem 31Bea TumulakNo ratings yet

- AsdasdDocument3 pagesAsdasdMark Domingo MendozaNo ratings yet

- PAS 1 and PFRS 1 Multiple Choice QuestionsDocument4 pagesPAS 1 and PFRS 1 Multiple Choice Questionsjahnhannalei marticioNo ratings yet

- Chapter 13 Share-Based Payments 2Document9 pagesChapter 13 Share-Based Payments 2Thalia Rhine AberteNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument20 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Chapter 17 Consolidated FS - Part 1Document29 pagesChapter 17 Consolidated FS - Part 1Erwin Labayog Medina100% (1)

- Overview of Risk-Based AuditDocument8 pagesOverview of Risk-Based AuditMay Grethel Joy PeranteNo ratings yet

- Overview of Risk-Based AuditDocument8 pagesOverview of Risk-Based AuditMay Grethel Joy PeranteNo ratings yet

- Psa37 4Document1 pagePsa37 4May Grethel Joy PeranteNo ratings yet

- Law PinoyDocument54 pagesLaw PinoyfrustratedlawstudentNo ratings yet

- Financial Accounting & ReportingDocument1 pageFinancial Accounting & ReportingMay Grethel Joy PeranteNo ratings yet

- 9005 - HandoutsDocument5 pages9005 - HandoutsSirNo ratings yet

- RFBT NotesDocument8 pagesRFBT NotesMay Grethel Joy PeranteNo ratings yet

- Financial Accounting & ReportingDocument1 pageFinancial Accounting & ReportingMay Grethel Joy PeranteNo ratings yet

- Easter WorksheetsDocument8 pagesEaster WorksheetsMay Grethel Joy PeranteNo ratings yet

- Financial Accounting & ReportingDocument1 pageFinancial Accounting & ReportingMay Grethel Joy PeranteNo ratings yet

- ONLINE STEP-BY-STEP GUIDE FOR PRC ID RENEWALDocument28 pagesONLINE STEP-BY-STEP GUIDE FOR PRC ID RENEWALmichael gerezNo ratings yet

- Freebie PlannerCardsDocument2 pagesFreebie PlannerCardsMay Grethel Joy PeranteNo ratings yet

- One Chapter A Day Bible Reading PlanDocument9 pagesOne Chapter A Day Bible Reading PlanMay Grethel Joy PeranteNo ratings yet

- AT 8901 PPT Material For UploadDocument62 pagesAT 8901 PPT Material For UploadMay Grethel Joy PeranteNo ratings yet

- 10 Receivable Financing For UploadDocument19 pages10 Receivable Financing For UploadMay Grethel Joy PeranteNo ratings yet

- Financial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesDocument2 pagesFinancial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesMay Grethel Joy PeranteNo ratings yet

- English Grammar and Correct UsageDocument22 pagesEnglish Grammar and Correct UsageMay Grethel Joy PeranteNo ratings yet

- Civil Service Exam Vocabulary ReviewDocument7 pagesCivil Service Exam Vocabulary ReviewMay Grethel Joy PeranteNo ratings yet

- Civil Service ReviewDocument203 pagesCivil Service ReviewGretchen Alunday SuarezNo ratings yet

- Cpa Review School of The Philippines ManilaDocument1 pageCpa Review School of The Philippines ManilaMay Grethel Joy PeranteNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDei FenixNo ratings yet

- 09 Accounts Receivable For UploadDocument15 pages09 Accounts Receivable For UploadMay Grethel Joy PeranteNo ratings yet

- Chapter 32 - Stockholders Equity Part 1Document23 pagesChapter 32 - Stockholders Equity Part 1May Grethel Joy PeranteNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument16 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy Perante100% (1)

- FAR Part 2: Noncurrent LiabilitiesDocument11 pagesFAR Part 2: Noncurrent LiabilitiesMay Grethel Joy PeranteNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument20 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument18 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet